Clear Cell Ovarian Cancer Market Size - Analysis

Market Size in USD Bn

CAGR7.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 7.3% |

| Market Concentration | High |

| Major Players | Genentech, GlaxoSmithKline, Clovis Oncology, AstraZeneca, Bristol-Myers Squibb and Among Others |

please let us know !

Clear Cell Ovarian Cancer Market Trends

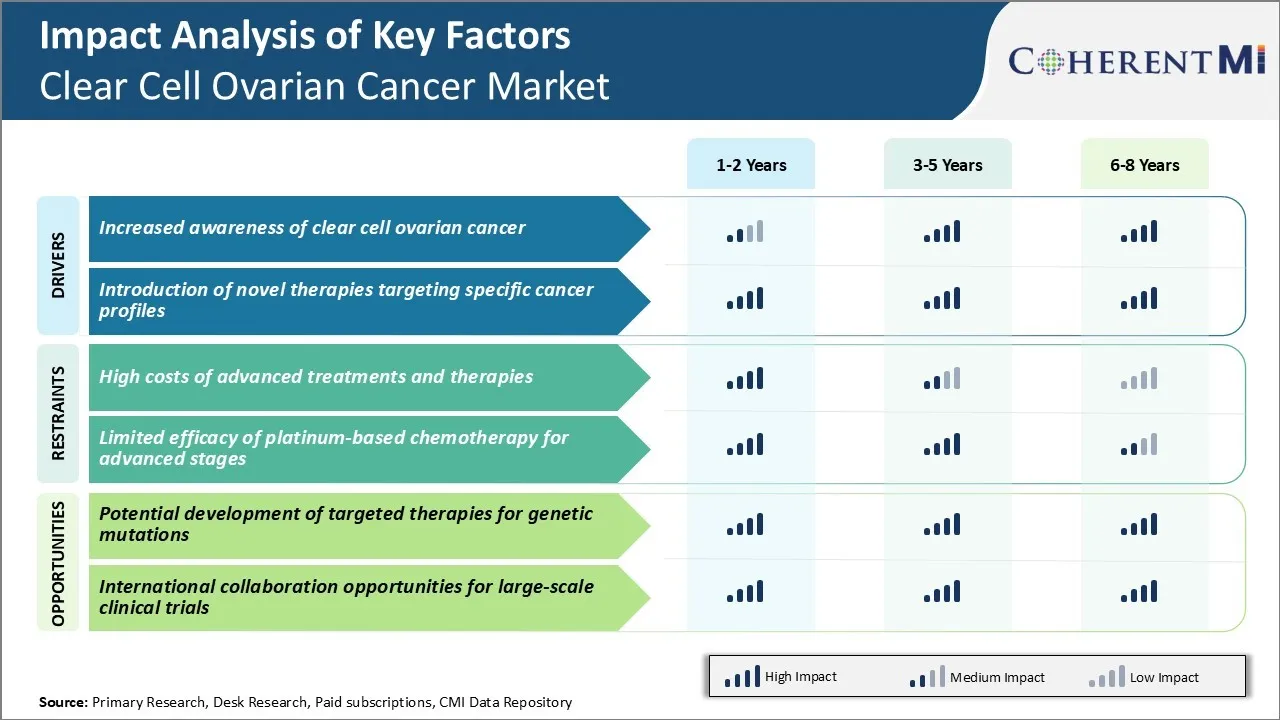

Clear cell ovarian cancer is one of the rarer types of ovarian cancer. Its symptoms are often less defined which leads to delayed diagnosis. However, in recent years awareness about this particular type of cancer has increased tremendously. Several advocacy groups and non-profits have come forward to spread knowledge about clear cell ovarian cancer, its signs and importance of early detection. They organize various seminars and workshops to educate women as well as healthcare providers.

Screening guidelines specifically for clear cell ovarian cancer are also emerging which promotes awareness. While yearly gynaecological exams continue to be recommended for general ovarian cancer screening, some organizations now additionally suggest transvaginal ultrasound screening for women with high risk factors of developing clear cell ovarian cancer. This targets population that can benefit the most from early detection and intervention.

Market Driver - Introduction of Novel Therapies Targeting Specific Cancer Profiles

Biopharmaceutical companies are leveraging these insights and developing therapies that precisely hit the identified targets and pathways. Drugs belonging to newer classes like PARP inhibitors, angiogenesis inhibitors are in clinical trials after showing promise against clear cell ovarian cancer in pre-clinical research and early phase studies.

Personalized medicine using a patient’s genomic profile to recommend the best suitable targeted regimen is gaining feasibility. This allows choosing treatments with highest likelihood of success based on a woman’s individual tumor characteristics and genetics. It presents an opportunity to optimize outcomes for clear cell ovarian cancer like never before.

One of the major challenges facing the ovarian cancer market is the high costs of advanced treatments and therapies. Clear cell ovarian cancer is an aggressive form of the disease that often requires costly targeted therapies, chemotherapy, or immunotherapy regimens to effectively treat. These specialized treatment options come at a large price tag that many healthcare systems and patients struggle to afford.

For the clear cell ovarian cancer market to continue progressing treatment innovations, solutions must be found to make advanced specialty medications and testing protocols more financially feasible and widely available.

Market Opportunity - Potential Development of Targeted Therapies for Genetic Mutations

Targeted therapies targeted genetic mutations offer the prospect of highly personalized and effective treatment with reduced toxicity compared to traditional chemotherapy. As the molecular landscape of clear cell ovarian cancer is further elucidated, more efficacious targeted drugs could enter the clear cell ovarian cancer market.

Prescribers preferences of Clear Cell Ovarian Cancer Market

Clear cell ovarian cancer (CCOC) is an aggressive form of epithelial ovarian cancer. Treatment approaches are often tailored based on disease stage at diagnosis. For early stage CCOC (Stage I/II), surgery involving a total hysterectomy, bilateral salpingo-oophorectomy and omentectomy is the standard first-line treatment. For more advanced Stage III/IV disease, the preferred approach is a combination of cytoreductive surgery followed by platinum-based chemotherapy.

Other factors influencing treatment decisions include age and co-morbidities. Older patients or those with significant co-morbidities are more likely to receive less aggressive therapies. Genetic profiling may also influence choices, as mutations in genes like ARID1A are associated with CCOC. Novel targeted therapies addressing these molecular subtypes could impact future treatment paradigms.

Treatment Option Analysis of Clear Cell Ovarian Cancer Market

Clear cell ovarian cancer can be treated depending on the stage of the disease. The main treatment options include surgery, chemotherapy and targeted therapy.

For advanced stage (Stage III/IV) disease, the standard treatment is debulking surgery followed by chemotherapy. The goal of surgery is to remove as much of the tumor as possible. Platinum-based chemotherapy using carboplatin and paclitaxel is recommended after surgery to treat any remaining cancer cells. Bevacizumab, a targeted anti-angiogenic therapy, may be added to improve progression-free survival when given along with chemotherapy.

In summary, surgery followed by platinum-based chemotherapy is the standard first-line treatment.

Key winning strategies adopted by key players of Clear Cell Ovarian Cancer Market

Product Innovation: One of the most common strategies adopted by leading players has been continuous innovation in products and treatment options. For example, Clovis Oncology launched Rubraca (rucaparib) in late 2016, which was the first PARP inhibitor approved for certain types of ovarian cancer.

Global Expansion: Large pharma players are leveraging their commercial infrastructure to expand sales of their new drugs globally. For example, after FDA approval in 2016, Clovis rapidly expanded Rubraca's commercial availability in other major markets like Europe and Japan through 2017-18. This helped boost revenues and market share internationally.

Segmental Analysis of Clear Cell Ovarian Cancer Market

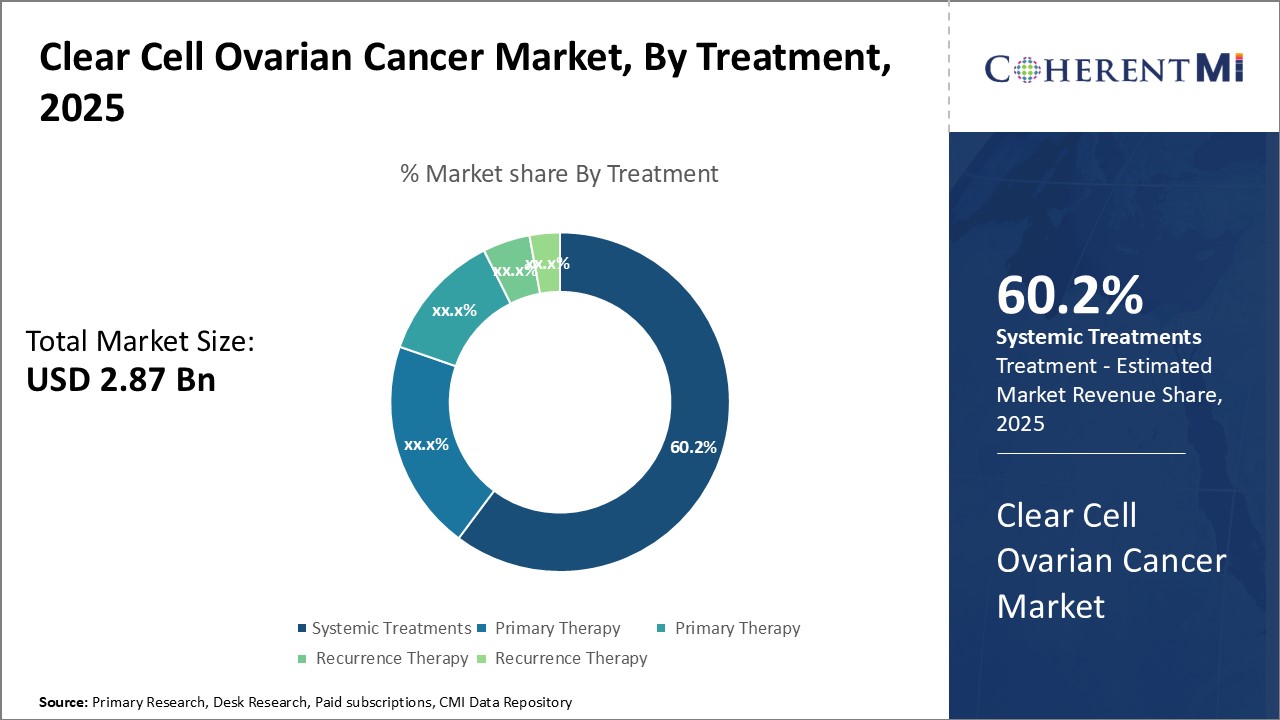

Insights, By Treatment: Systemic Treatments Dominate Due to First-Line Role

Insights, By Treatment: Systemic Treatments Dominate Due to First-Line RoleThe systemic treatments segment is estimated to hold 60.2% share of the clear cell ovarian cancer market in 2025, owing to its prominent first-line role. As the disease is typically detected at an advanced stage, systemic chemotherapy is often the initial therapeutic approach. Platinum-based regimens such as carboplatin and paclitaxel are the standard first-line options due to demonstrated efficacy. Their application as the front-line standard of care ensures this segment captures a sizeable portion of the treatment landscape.

The chemotherapy-based nature of common first-line regimens also presents opportunities. Adverse effects and toxicity concerns continue driving exploration of modified dosing schedules or incorporating targeted agents. Combination strategies melding immunotherapy or PARP inhibitors aim to improve tolerability while maintaining benefit. Such innovative systemic therapy approaches could expand the segment reach going forward.

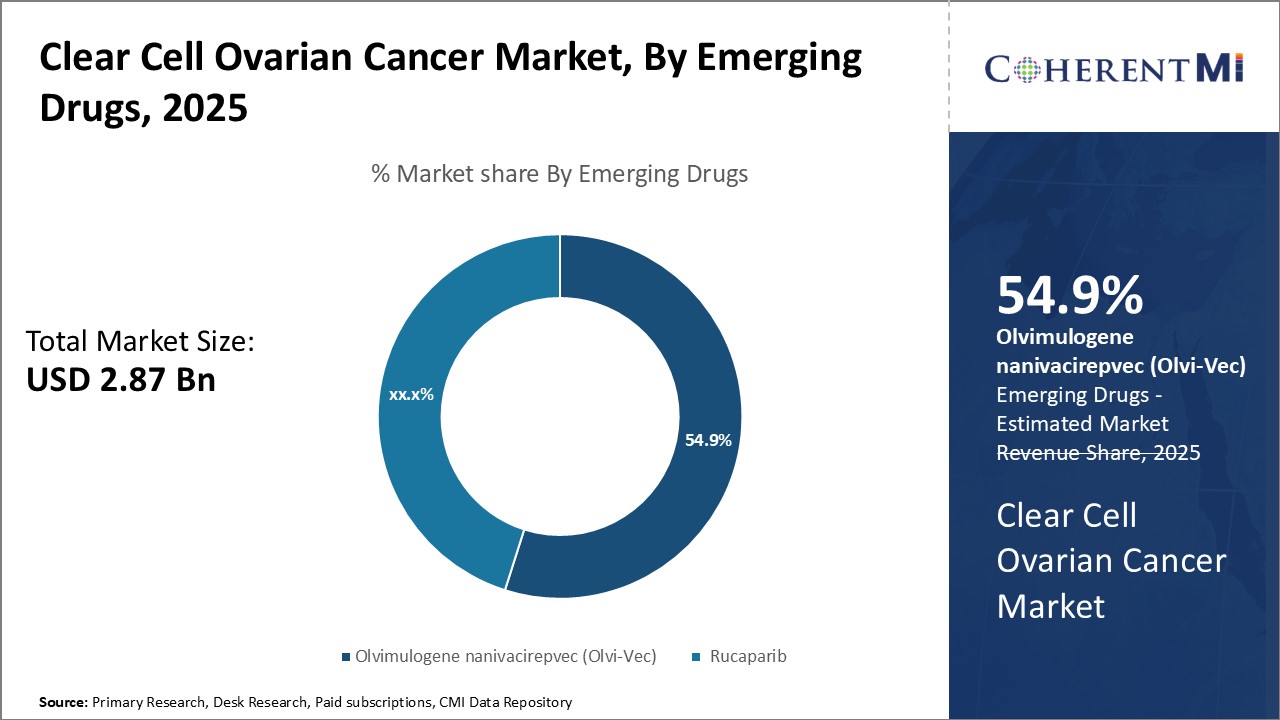

Within emerging drug segments, Olvimulogene nanivacirepvec is projected to account for 54.9% market share in 2025, due to its unique role in addressing an area of high unmet need. As recurrent platinum-resistant ovarian cancer carries a particularly poor prognosis, novel therapies offering new mechanisms of action are attractive. Olvimulogene's oncolytic viral approach helps it gain traction as a therapy for later lines.

Research into new targets and pathways continues apace, but other pipeline agents remain investigational. Olvimulogene alone has completed development and received clearance for marketing. This regulatory head start allows it to dominate the segment as the treatment of choice for platinum-resistant recurrence. Its single-drug status protects share until combination strategies or additional competitors arise.

Additional Insights of Clear Cell Ovarian Cancer Market

- Ovarian cancer incidence rate is 11.2 per 100,000 women per year.

- The 5-year survival rate for localized ovarian cancer is 92.6%.

- Clear cell ovarian cancer is often linked with specific genetic profiles, such as ARID1A mutations.

- International collaboration is critical due to the rarity of clear cell carcinoma.

Competitive overview of Clear Cell Ovarian Cancer Market

The major players operating in the Clear Cell Ovarian Cancer Market include Genentech, GlaxoSmithKline, Clovis Oncology, AstraZeneca, Bristol-Myers Squibb, Novartis, Clinigen Group, and Ortho Biotech.

Clear Cell Ovarian Cancer Market Leaders

- Genentech

- GlaxoSmithKline

- Clovis Oncology

- AstraZeneca

- Bristol-Myers Squibb

Clear Cell Ovarian Cancer Market - Competitive Rivalry

Clear Cell Ovarian Cancer Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Clear Cell Ovarian Cancer Market

- In September 2023, Clovis Oncology announced results from the Phase III ATHENA-MONO trial, which showed that Rucaparib (Rubraca) significantly improved progression-free survival (PFS) in women with advanced ovarian cancer compared to placebo. The trial demonstrated a median PFS of 20.2 months with Rucaparib versus 9.2 months with placebo in the intention-to-treat population, marking a statistically significant improvement. This data supports the use of Rucaparib as a first-line maintenance treatment for ovarian cancer, regardless of biomarker status.

- In June 2023, Genelux Corporation announced the launch of Phase III trials for Olvi-Vec targeting platinum-resistant ovarian cancer, aiming to improve overall survival rates. The trial evaluates the efficacy and safety of Olvi-Vec, a modified oncolytic virus, in combination with platinum-doublet chemotherapy and bevacizumab for platinum-resistant/refractory ovarian cancer. The goal of the trial is to improve overall survival rates among patients with limited treatment options, as announced by the company.

Clear Cell Ovarian Cancer Market Segmentation

- By Treatment

- Systemic Treatments

- Primary Therapy (Stage I)

- Primary Therapy (Stage II-IV)

- Recurrence Therapy (Platinum-sensitive)

- Recurrence Therapy (Platinum-resistant)

- By Emerging Drugs

- Olvimulogene nanivacirepvec (Olvi-Vec)

- Rucaparib

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Frequently Asked Questions :

How big is the clear cell ovarian cancer market?

The clear cell ovarian cancer market is estimated to be valued at USD 2.87 Bn in 2025 and is expected to reach USD 4.70 Bn by 2032.

What are the key factors hampering the growth of the clear cell ovarian cancer market?

The high costs of advanced treatments and therapies and limited efficacy of platinum-based chemotherapy for advanced stages are the major factors hampering the growth of the clear cell ovarian cancer market.

What are the major factors driving the clear cell ovarian cancer market growth?

The increased awareness of clear cell ovarian cancer and introduction of novel therapies targeting specific cancer profiles are the major factors driving the clear cell ovarian cancer market.

Which is the leading treatment in the clear cell ovarian cancer market?

The leading treatment segment is systemic treatments.

Which are the major players operating in the clear cell ovarian cancer market?

Genentech, GlaxoSmithKline, Clovis Oncology, AstraZeneca, Bristol-Myers Squibb, Novartis, Clinigen Group, and Ortho Biotech are the major players.

What will be the CAGR of the clear cell ovarian cancer market?

The CAGR of the clear cell ovarian cancer market is projected to be 7.3% from 2025-2032.