Continuous Bioprocessing Market Size - Analysis

The continuous bioprocessing market is estimated to be valued at USD 429.0 Mn in 2025 and is expected to reach USD 764.3 Mn by 2032, growing at a compound annual growth rate (CAGR) of 8.6% from 2025 to 2032.

Market Size in USD Mn

CAGR8.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.6% |

| Market Concentration | Medium |

| Major Players | AGC Biologics, Biogen, Bristol-Myers Squibb, Sanofi Genzyme, FUJIFILM Diosynth Biotechnologies and Among Others |

please let us know !

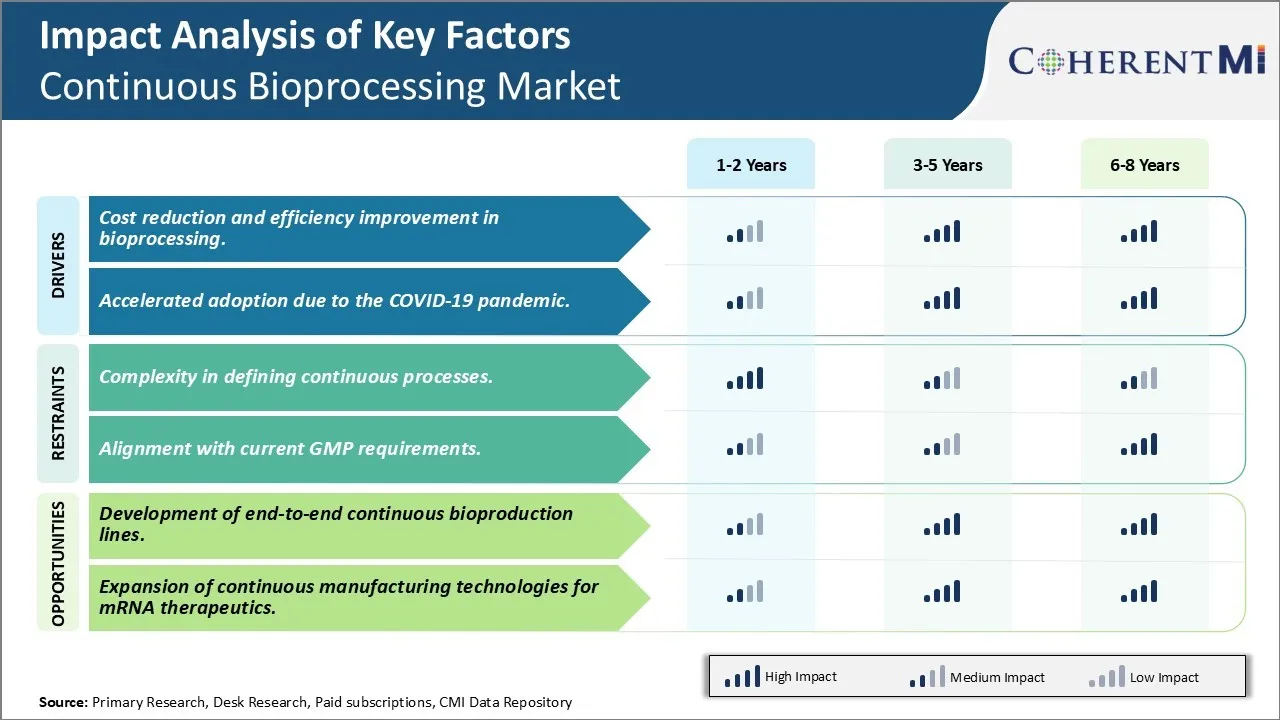

Continuous Bioprocessing Market Trends

One of the major drivers for the adoption of continuous bioprocessing technologies is the potential for significant cost reductions and improvements in efficiency that it offers over traditional batch manufacturing methods. Continuous processing allows for running biological production without interruption 24 hours a day for 7 days a week and eliminates the time-consuming cleaning and start-up cycles between batches. This translates to higher asset utilization and a much more efficient use of production capacity. Manufacturers can continuously harvest and refine their products within a closed system without any batch changes or interruptions. This uninterrupted workflow allows for higher quality consistency and minimizes deviations between batches.

The ongoing COVID-19 pandemic has significantly impacted the biopharmaceutical industry in multiple ways. One notable effect has been an accelerated focus on and adoption of continuous bioprocessing technologies by both biotech firms as well as large biopharma players. The pandemic exposed vulnerabilities in the existing global drug supply chains and dependence on traditional batch manufacturing methods. It highlighted the critical need to improve production flexibility, speed, resilience and capacity surges to address future public health emergencies.

The demand surge during the pandemic also compelled regulatory agencies to adapt new avenues for expediting manufacturing approvals and technology transfers. This created a more facilitative regulatory environment conducive for continuous platforms. Companies now have greater motivation to fast-track their continuous bioprocessing programs in order to build resilient, scalable and flexible infrastructure to effectively address future public health crises. With its agility and surge capabilities, continuous biomanufacturing has moved to the forefront as a strategic priority for both industry and governments in light of the lessons from the COVID-19 experience. This is a major driver propelling greater adoption of these advanced technologies.

One of the key challenges in the continuous bioprocessing market is the complexity in defining continuous processes. Continuous biomanufacturing requires redesigning established batch processes into integrated, continuous train models which involves substantial process development efforts. Compared to batch processes which have clear start and stop points, continuous processes operate in a more complex manner where the different unit operations are interconnected. This makes defining the process parameters, operating conditions and validating the system performance more complicated. Ensuring smooth transition of material between various unit operations while maintaining product quality also poses technical challenges. Additionally, continuous processes deal with significantly larger volumes of material flowing through the system compared to batch. This escalates issues related to process control and streamlining. The non-steady state behavior of such complex, continuously operated trains also makes mathematical modeling and rigorous validation difficult. Overcoming these complexities in designing and developing robust continuous processes requires extensive research and engineering innovations.

Market Opportunity - Development of end-to-end continuous bioproduction lines

Establishing standardized modular platform technologies that can realize scalable, single-use end-to-end solutions will drive the next generation of biomanufacturing. This can open up opportunities for novel business models in contract manufacturing. Continuous bioprocessing allows for on-demand production capabilities matching demand fluctuations. End-to-end integrated platforms thus promise to optimize capacity utilization, make production more demand-driven and accelerate product availability. Their successful realization relies on collaborative efforts across bioprocess engineering, automation, equipment design and supply chain domains.

Key winning strategies adopted by key players of Continuous Bioprocessing Market

Most leading players have shifted their focus towards single-use technologies to enable continuous manufacturing. In 2017, Merck invested $75 million to build a continuous bioprocessing plant in Kenilworth, New Jersey that relies entirely on single-use technologies. This allows for greater flexibility and speed compared to traditional stainless-steel plants.

These early investments have paid off - Merck and GE now have a strong foothold in the growing market for continuous processing. Single-use technologies reduce facility footprints, changeover times and product contamination risks, helping companies manufacture batches continually with quick turnarounds.

Given the significant investment required, partnerships have emerged as a popular strategy. For instance, Merck collaborated with Batavia Biosciences in 2017 to develop automated continuous manufacturing solutions using Batavia’s ChemoFast technologies. Similarly, Boehringer Ingelheim partnered with ABEC in 2019 to speed development of viral vectors through continuous manufacturing processes. Such partnerships help lower risks for large

Segmental Analysis of Continuous Bioprocessing Market

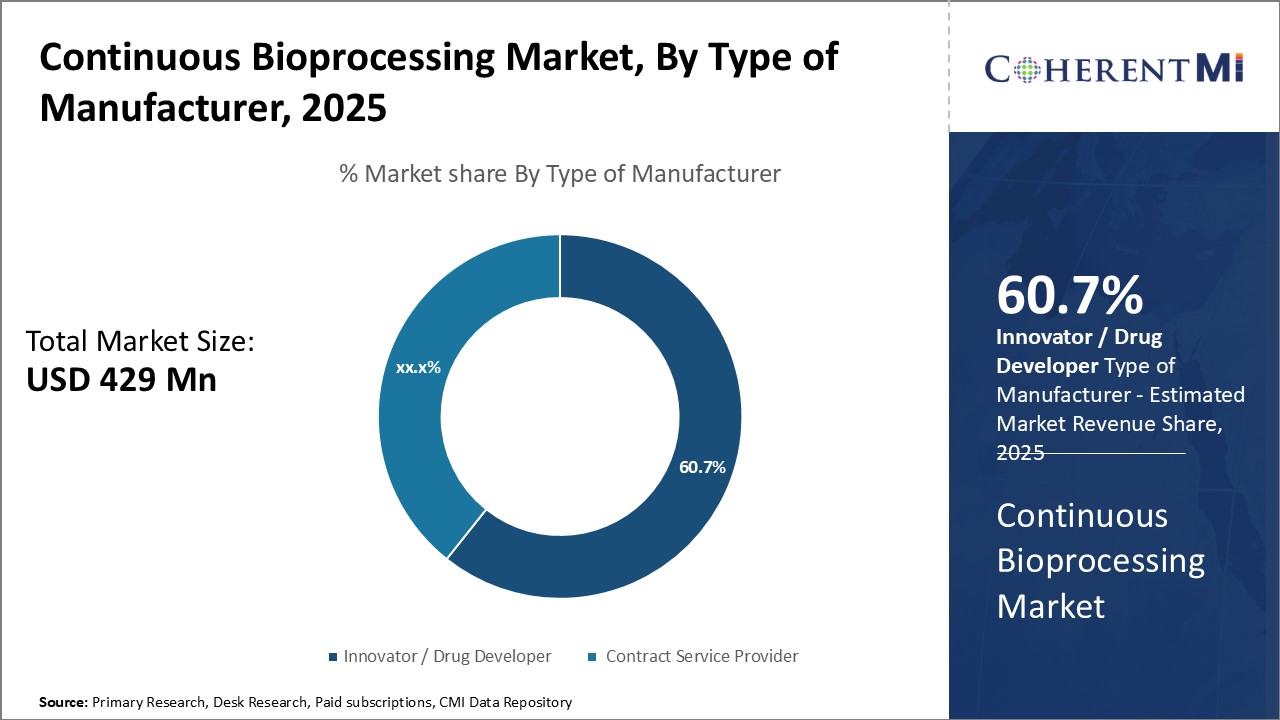

Insights, By Type of Manufacturer: Reliance on continuous innovation

Insights, By Type of Manufacturer: Reliance on continuous innovationIn terms of type of manufacturer, innovator / drug developer sub-segment contributes the highest share of 60.7% in the continuous bioprocessing market owning to their ongoing need for innovation. Drug developers are constantly working to develop new treatments and bring them to patients as quickly as possible. Continuous bioprocessing allows them to accelerate drug development timelines significantly compared to traditional batch manufacturing approaches. By keeping production going continuously with no stop-and-go batches, drug developers save valuable time in getting products from concept to commercialization.

As regulatory expectations rise for demonstrating process understanding, drug developers also turn to continuous bioprocessing for more robust manufacturing. Its ability to continuously monitor and control critical process parameters improves production consistency and quality. This helps drug developers more reliably scale up processes from lab to commercial scale. By choosing flexible continuous platforms, they can more readily meet new regulatory requirements for post-approval changes or additional indications.

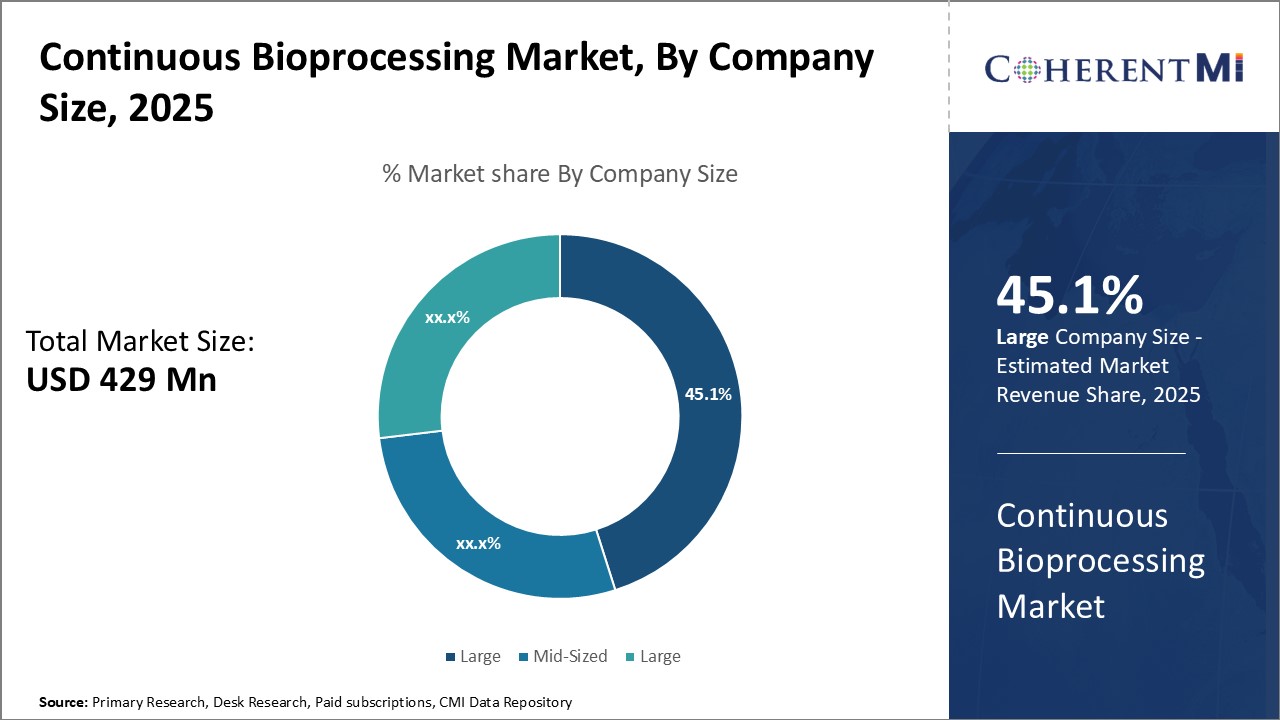

In terms of company size, the large sub-segment contributes the highest share of 45.1% in the continuous bioprocessing market due to economies of scale. Large pharmaceutical manufacturers have vastly greater production needs than mid-sized or small companies. To meet commercial demand for multiple drug products, they require high-capacity manufacturing suitable for mass production.

As continuous bioprocessing entails high upfront capital investment in equipment and facilities, its economies of scale are especially important for large companies to realize full return on investment. Only by taking full advantage of large production capacities do they achieve optimal low unit costs. Furthermore, automation and digital enhancements and increasingly characterized continuous bioprocessing as more "plug and play." This means large companies can readily benefit from standardized equipment designs across their extensive global manufacturing footprints.

Additional Insights of Continuous Bioprocessing Market

- The market is moving towards continuous bioprocessing due to its cost and efficiency benefits. Continuous bioprocessing technologies reduce manufacturing costs, minimize facility footprints, and improve product consistency. The technology's adoption is accelerated by the COVID-19 pandemic. Challenges remain in defining continuous processes and aligning with GMP requirements. However, the opportunity for growth in this domain is significant, with an increasing number of companies exploring continuous bioprocessing lines and upgrading their operations.

Competitive overview of Continuous Bioprocessing Market

The major players operating in the continuous bioprocessing market include AGC Biologics, Biogen, Bristol-Myers Squibb, Sanofi Genzyme, FUJIFILM Diosynth Biotechnologies, Merck KGaA, Novasep, UCB Pharma, Enzene Biosciences, and WuXi Biologics.

Continuous Bioprocessing Market Leaders

- AGC Biologics

- Biogen

- Bristol-Myers Squibb

- Sanofi Genzyme

- FUJIFILM Diosynth Biotechnologies

Continuous Bioprocessing Market - Competitive Rivalry

Continuous Bioprocessing Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Continuous Bioprocessing Market

- In April 2023, Arranta Bio entered into an agreement with MIT to develop continuous manufacturing technology for mRNA therapeutics.

- In April 2023, Exothera inked a deal with Quantoom Biosciences for continuous production platform for RNA.

- In March 2023, Curia collaborated with Corning to expand continuous-flow development for chemical and biopharmaceutical industries.

Continuous Bioprocessing Market Segmentation

- By Type of Manufacturer

- Innovator / Drug Developer

- Contract Service Provider

- By Company Size

- Large

- Mid-Sized

- Small

Would you like to explore the option of buying individual sections of this report?

Nikhilesh Ravindra Patel is a Senior Consultant with over 8 years of consulting experience. He excels in market estimations, market insights, and identifying trends and opportunities. His deep understanding of the market dynamics and ability to pinpoint growth areas make him an invaluable asset in guiding clients toward informed business decisions. He plays a instrumental role in providing market intelligence, business intelligence, and competitive intelligence services through the reports.

Frequently Asked Questions :

How big is the Continuous Bioprocessing Market?

The Continuous Bioprocessing Market is estimated to be valued at USD 429.0 in 2025 and is expected to reach USD 764.3 Million by 2032.

What are the major factors driving the continuous bioprocessing market growth?

The cost reduction and efficiency improvement in bioprocessing and accelerated adoption due to the Covid-19 pandemic are the major factors driving the continuous bioprocessing market.

Which is the leading Type of Manufacturer in the continuous bioprocessing market?

The leading Type of Manufacturer segment is Innovator / Drug Developer.

Which are the major players operating in the continuous bioprocessing market?

AGC Biologics, Biogen, Bristol-Myers Squibb, Sanofi Genzyme, FUJIFILM Diosynth Biotechnologies, Merck KGaA, Novasep, UCB Pharma, Enzene Biosciences, and WuXi Biologics are the major players.

What will be the CAGR of the continuous bioprocessing market?

The CAGR of the continuous bioprocessing market is projected to be 8.6% from 2025-2032.