다이빙 장비 시장 크기 - 분석

USD 기준 시장 규모 Bn

CAGR7.5%

| 연구 기간 | 2024 - 2031 |

| 추정 기준 연도 | 2023 |

| CAGR | 7.5% |

| 시장 집중도 | Medium |

| 주요 플레이어 | Aqua Lung 국제, 카테고리, Cressi 서브 S.P.A., 미국 수중 제품, Inc., Poseidon 다이빙 시스템 AB 및 기타 |

저희에게 알려주세요!

다이빙 장비 시장 트렌드

시장 드라이버 - 성장 관광 및 모험 스포츠 붐

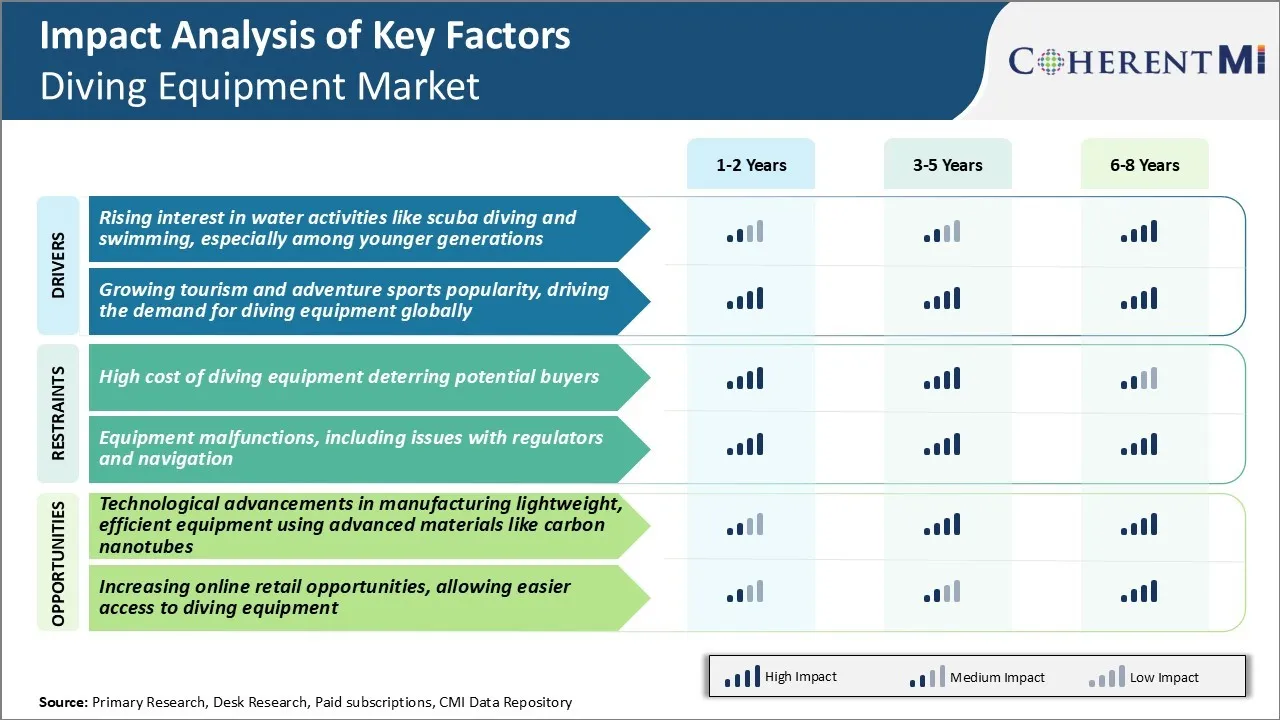

관광 산업은 최근 몇 년 동안 강력한 성장을 보였습니다. 더 많은 여행자는 지금 일반적인 관광 보다는 오히려 주문을 받아서 만들어진 경험을 원합니다. 이 수요를 만족시키는 모험 스포츠는 상당한 붐을 목격했습니다. 물 스포츠 관련 활동은 전 세계 관광 목적지로 인기를 끌고있다. 특히 열대 섬 국가는 지역 다이빙 장비 시장을 강하게 성장한 최고 스쿠버 다이빙 명소로 출현했습니다.

더 적은 알려진 위치에 대한 인식으로 아시아, 아프리카, 라틴 아메리카 및 남태평양의 목적지는 수중 제품을 홍보하고 있습니다. 다이빙 패키지는 이제 많은 여행사 및 온라인 여행 포털에서 선보입니다. 휴가는 장비 임대 및 구입을 위해 번역 된 동안 독특한 수상 스포츠를 시도하는 욕망.

GoPro 카메라와 같은 특징은 관광객이 수중 경험을 쉽게 캡처하고 공유 할 수 있습니다. 이 호텔은 더 많은 여행객들에게 열대 해변에 스쿠버 다이빙을 시도하도록 영감을줍니다. 붐비는 관광 및 모험 스포츠 산업은 전 세계적으로 다이빙 장비 시장을 주도하고 있습니다.

Market Opportunity - 경량 제조 기술 발전, 효율적인 장비

다이빙 장비 시장의 가장 큰 기회 중 하나는 첨단 새로운 재료를 사용하여 더 가벼운, 더 튼튼한 기어를 제조하는 기술 발전을 활용하고 있습니다. 탄소 나노 튜브와 같은 재료 탱크, 레귤레이터 및 잠수복은 크게 표준 스쿠버 설정의 무게와 부피를 줄일 것을 약속합니다.

더 가벼운 다이빙 장비는 다이버만 착용하고 수중을 운반할 수 있을 뿐만 아니라, 또한 전통적인 무거운 장비를 가진 잠수의 육체적인 수요에 의해 결정된 개인에게서 더 중대한 참여를 격려할 수 있었습니다. BCD와 날개 같은 특정 장비를 완전히 제거 할 수 있습니다.

탄소 나노 튜브 복합물과 같은 기술을 성공적으로 채택하는 제조업체는 경쟁력있는 가격 지점에서 다양한 고성능, 차세대 제품을 제공 할 수 있습니다. 이 브랜드 충성도를 강화하고 업계 리더들의 최신 혁신적인 솔루션을 기대하는 레크리에이션 다이버의 새로운 세대를 유치하는 데 도움이 될 수 있습니다.

전체적으로 재료 과학은 다이빙 장비 시장에 대한 성장의 미래에 대한 다이빙 기어 디자인과 드라이브를 혁명 할 수있는 주요 기회를 제공합니다.

주요 플레이어가 채택한 주요 승리 전략 다이빙 장비 시장

제품 혁신에 초점 - 다이빙 장비 회사는 R & D에 지속적으로 투자하여 다이빙 경험을 향상시키는 혁신적인 신제품을 개발합니다. 예를 들어 2016 년 Scubapro는 최첨단 밝은 컬러 디스플레이와 터치 스크린 인터페이스를 활용한 혁신적인 Luna diving 컴퓨터를 출시했습니다. 그것은 unprecedented 명확성 및 사용의 용이에 있는 근본적인 다이빙 자료로 다이버를 제공할 수 있었습니다.

마스크 및 핀 포트폴리오 확장 - Mares와 Cressi와 같은 주요 플레이어는 모든 기술 수준과 필요를 다각화하기 위해 마스크와 핀의 범위를 확장에 초점을 맞추고 있습니다. 2018 년 Mares는 인기있는 X-Vision 범위와 4 개의 새로운 핀 모델을 출시했습니다.

Sponsor 경쟁력있는 다이버 - Sponsoring pro-divers 및 경쟁 수상자는 스포츠에 관심을 끌. 2019 년 Cressi는 유럽 전역의 여러 국가 다이빙 팀과 챔피언을 후원했습니다.

전자 상거래 및 디지털 마케팅에 초점 - 플레이어는 온라인 판매 채널을 embraced하고 소셜 플랫폼, 블로그, 영향력 마케팅을 효과적으로 활용했습니다. 2020 년 Scubapro는 웹 사이트를 개정하고 교육 내용으로 Facebook / Instagram 존재를 올렸습니다. 온라인 판매에서 35 % YoY 성장을 얻는다.

세그먼트 분석 다이빙 장비 시장

Insights, By Application : 레크리에이션 다이빙의 모험 연료 성장을위한 열정

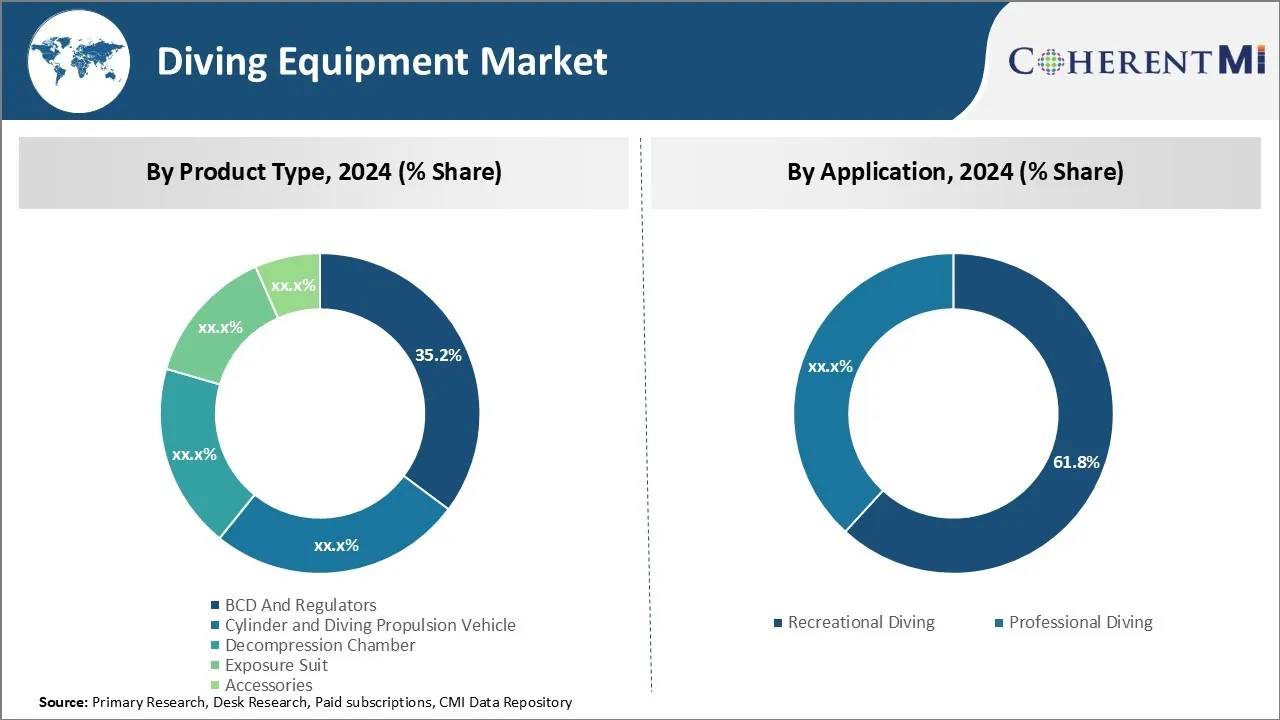

응용 분야의 관점에서 레크리에이션 다이빙은 2024 년 다이빙 장비 시장의 61.8%의 점유율을 차지하는 것으로 예상됩니다. 이것은 주로 모험과 여가 활동을 위해 사람들의 성장하는 열정 때문에. 스쿠버 다이빙의 소개는 주류 레크리에이션 스포츠가 넓은 관객에게 접근 할 수 있도록 만들었습니다. 환경 인식 증가는 암초 설문 조사와 같은 활동을 통해 해양 생태계를 보호하는 다이버를 동기 부여했습니다.

전 세계 지오그래픽의 다양한 지역은 다양한 다이버들에게 다양한 다이빙 사이트를 제공합니다. 처분할 수 있는 소득 및 쉬운 관광은 더 레크리에이션 다이빙 참여를 지원합니다. 현대 라이프 스타일 프롬프트 사람들이 독특한 모험 경험을 추구하기 위해, 레크리에이션 다이빙은 애플리케이션 세그먼트를 운전하는 상당한 인기를 유지할 것입니다.

추가 통찰력 다이빙 장비 시장

- 북미는 2023 년 다이빙 장비 시장을 지배했으며 미국과 캐나다의 광범위한 해안선이 시장 성장에 기여했습니다.

- 아시아 태평양 지역은 태국과 필리핀과 같은 국가의 해안 관광 및 물 스포츠를 확장하여 지역 다이빙 장비 시장에서 중요한 성장을 볼 것으로 예상됩니다.

- 인도 해군의 새로운 다이빙 지원 선박의 출시는 방어 부문에서 다이빙 장비에 대한 수요를 강조합니다.

- 동남아시아의 증가된 관광은 태국과 인도네시아와 같은 국가로 다이빙 장비에 대한 수요를 높입니다.

경쟁 개요 다이빙 장비 시장

다이빙 장비 시장에서 운영되는 주요 플레이어는 Aqua Lung International, Mares S.P.A., Cressi Sub S.P.A., American Underwater Products, Inc., Poseidon Diving System AB, Beuchat International, Dive Rite, H2Odyssey, Johnson Outdoor, Inc., AQUATEC – SUTON INDUSTRY CO., LTD., Johnson Outdoors Inc. 및 Sherwood Scuba가 있습니다.

다이빙 장비 시장 선두

- Aqua Lung 국제

- 카테고리

- Cressi 서브 S.P.A.

- 미국 수중 제품, Inc.

- Poseidon 다이빙 시스템 AB

다이빙 장비 시장 - 경쟁 경쟁

다이빙 장비 시장

(주요 플레이어가 지배)

(많은 플레이어가 있는 매우 경쟁적)

최근 개발 다이빙 장비 시장

- 9 월 2024에서 다이빙 장비 및 마케팅 협회 (DEMA)는 캐나다의 다이빙 프로 (Dive Pros of Canada)를 시작하면서 국제 회원, 다이빙 산업 및 지역 사회를 강조하는 이니셔티브를 시작했습니다. 캐나다의 다이빙 전문가 및 지역 사회에 영향을 미치는 지역 동향, 독특한 이야기 및 공공 정책 문제에 중점을 둡니다.

- 6 월 2024에서 Scubapro는 마스크와 스노클의 범위를 위해 새로운 색상의 출시를 발표했습니다. 그들은 3개의 다른 가면 모형 및 snorkel 모형을 위한 색깔 선택권을 확장하고, turquoise와 같은 생생한 색깔을 소개하는, 분홍색, 주황색, 황색 및 파란, 고전적인 검정 및 백색과 함께. 이 이니셔티브는 다이빙 장비의 미학을 강화하는 것을 목표로하고 다이버 및 스노클링과 같은 더 매력을 만듭니다.

- 4월 2024일, EvoLogics는 새로운 Diver Navigation System(DNS)을 도입하여 실시간 위치를 추적하는 데 도움을 줍니다. 이 혁신적인 음향 내비게이션 시스템은 실시간 위치를 추적하는 다이버를 지원하도록 설계되었습니다.

- 인도 해군은 10 월 2023에서 'DSC A 21,'를 출시했습니다. 'DSC A 21'는 Titagarh Rail Systems Limited의 5 개의 선박 건설을 포함하는 다이빙 지원 기술 (DSC) 프로젝트의 두 번째 선박입니다.

다이빙 장비 시장 세분화

- 제품 유형

- 사이트맵 및 규제

- 실린더 및 다이빙 추진 차량

- Decompression 약실

- Exposure 한 벌

- 제품 정보

- 회사연혁

- 다이빙

- 전문 다이빙

- 군 다이빙

- 회사 소개

- 과학 다이빙

- 유통 채널

- 회사 소개

- - 한국어

- 이름 *

구매 옵션을 알아보시겠어요?이 보고서의 개별 섹션?

Sakshi Suryawanshi는 시장 조사 및 컨설팅 분야에서 6년의 광범위한 경험을 가진 연구 컨설턴트입니다. 그녀는 시장 추정, 경쟁 분석 및 특허 분석에 능숙합니다. Sakshi는 시장 동향을 파악하고 경쟁 환경을 평가하여 전략적 의사 결정을 이끌어내는 실행 가능한 통찰력을 제공하는 데 능숙합니다. 그녀의 전문 지식은 기업이 복잡한 시장 역학을 탐색하고 목표를 효과적으로 달성하는 데 도움이 됩니다.

자주 묻는 질문 :

얼마나 큰 다이빙 장비 시장?

다이빙 장비 시장은 2024년 USD 3.83 Bn에서 평가되고 2031년까지 USD 6.36 Bn에 도달할 것으로 예상됩니다.

다이빙 장비 시장의 성장에 대한 핵심 요소는 무엇입니까?

다이빙 장비의 높은 비용 잠재적 구매자 및 장비 기능 장애, 레귤레이터와 네비게이션 문제 포함 하 여 주요 요인 hampering 다이빙 장비 시장의 성장.

다이빙 장비 시장 성장을 구동하는 주요 요인은 무엇입니까?

스쿠버 다이빙 및 수영과 같은 물 활동에 대한 관심, 특히 젊은 세대와 성장 관광 및 모험 스포츠 인기, 다이빙 장비에 대한 수요를 전 세계적으로 다이빙 장비 시장의 주요 요인입니다.

다이빙 장비 시장에서 최고의 제품 유형은 무엇입니까?

주요한 제품 유형 세그먼트는 BCD와 규칙입니다.

어떤 주요 선수는 다이빙 장비 시장에서 운영?

Aqua Lung International, Mares S.P.A., Cressi Sub S.P.A., American Underwater Products, Inc., Poseidon Diving System AB, Beuchat International, Dive Rite, H2Odyssey, Johnson Outdoor, Inc., AQUATEC – SUTON INDUSTRY CO., LTD., Johnson Outdoors Inc. 및 Sherwood Scuba는 주요 선수입니다.

다이빙 장비 시장의 CAGR는 무엇입니까?

다이빙 장비 시장의 CAGR은 2024-2031에서 7.5%로 예상됩니다.