Electric Vehicle Battery Coolant Market Size - Analysis

Market Size in USD Bn

CAGR4.00%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 4.00% |

| Market Concentration | Medium |

| Major Players | BASF SE, Valvoline Inc., Exxon Mobil Corporation, Shell Group, GS Caltexa and Among Others |

please let us know !

Electric Vehicle Battery Coolant Market Trends

Transportation sector is recognized as a major contributor to carbon emissions today. This has put the spotlight on electric vehicles that have zero direct emissions. Countries have set ambitious targets to transition to electric mobility to reduce dependence on oil imports and curb greenhouse gas emissions from vehicles.

This burgeoning electric mobility revolution will likely drive strong demand for more sophisticated and efficient battery cooling systems for electric vehicles. Advance cooling solutions will play a vital role in encouraging continued uptake of battery-powered vehicles and faster energy transition globally. Consequently, this is expected to drive growth of the electric vehicle battery coolant market in the coming years.

Market Driver - Government Initiatives Promoting the Use of Electric Vehicles for Environmental Benefits

Policy driven adoption aligns with national goals to diversify energy sources, boost energy security and transition to a greener transport system. Developed nations are leading the push for electric mobility while emerging countries are catching up through supportive policy ecosystems. A robust policy framework has accelerated the push towards low or zero emission vehicles in nations committed to curbing environmental impact of transportation.

Market Challenge - Compatibility Issues with Different Battery Materials that Impact Efficiency

Finding a universal coolant that can efficiently manage heat transfer across all these different battery materials has been difficult. Incompatibility can cause issues like increased impedance between electrodes, decay of active materials and premature capacity loss over battery cycling.

One of the major opportunities for players in the electric vehicle battery coolant market lies in advances being made in solid-state battery technologies. Solid-state batteries offer higher energy densities and better safety compared to traditional lithium-ion batteries. However, they also generate more heat during operation due to characteristics like higher electron and ion conductivity.

With existing thermal solutions, manufacturers in the electric vehicle battery coolant market have an opportunity to engineer products customized for emerging solid state battery chemistries and requirements.

Key winning strategies adopted by key players of Electric Vehicle Battery Coolant Market

Tesla recognized early on that effective thermal management of battery packs is critical for improving EV range and performance. In 2012, Tesla acquired a Canadian company called Hatteras to gain expertise in temperature control technologies. It invested heavily in R&D to develop advanced liquid cooling systems for its batteries.

Total's focus on next-gen coolants:

German auto parts maker Continental followed an acquisition-led strategy to consolidate its presence in the EV battery thermal management space. In 2017, it acquired Priamus System Technology, a specialist in thermal management for lithium-ion batteries. In 2021, it acquired Argus Cyber Security, strengthening its monitoring and cybersecurity capabilities for connected vehicle systems.

Segmental Analysis of Electric Vehicle Battery Coolant Market

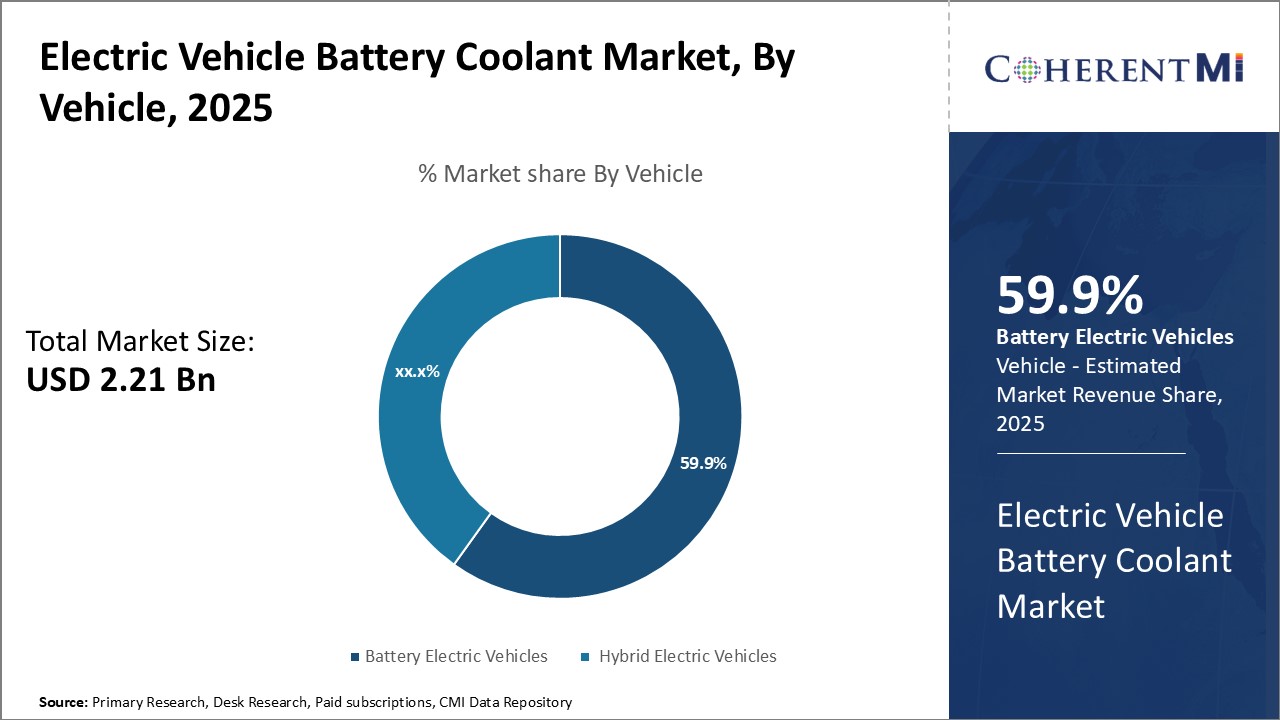

Insights, By Vehicle: Battery Electric Vehicles Driving the EV Battery Coolant Market in Terms of Vehicle Type

Battery electric vehicles only use electric powertrains for propulsion without an internal combustion engine. Therefore, efficient thermal management of high-capacity lithium-ion batteries used in such vehicles is crucial to ensure optimal performance and longer life of the batteries. Battery electric vehicles require sophisticated liquid cooling systems to regulate the temperature of lithium-ion battery packs during charging and discharging cycles. The use of specialized coolants engineered to have high thermal conductivity is witnessing increasing demand from electric vehicle manufacturers.

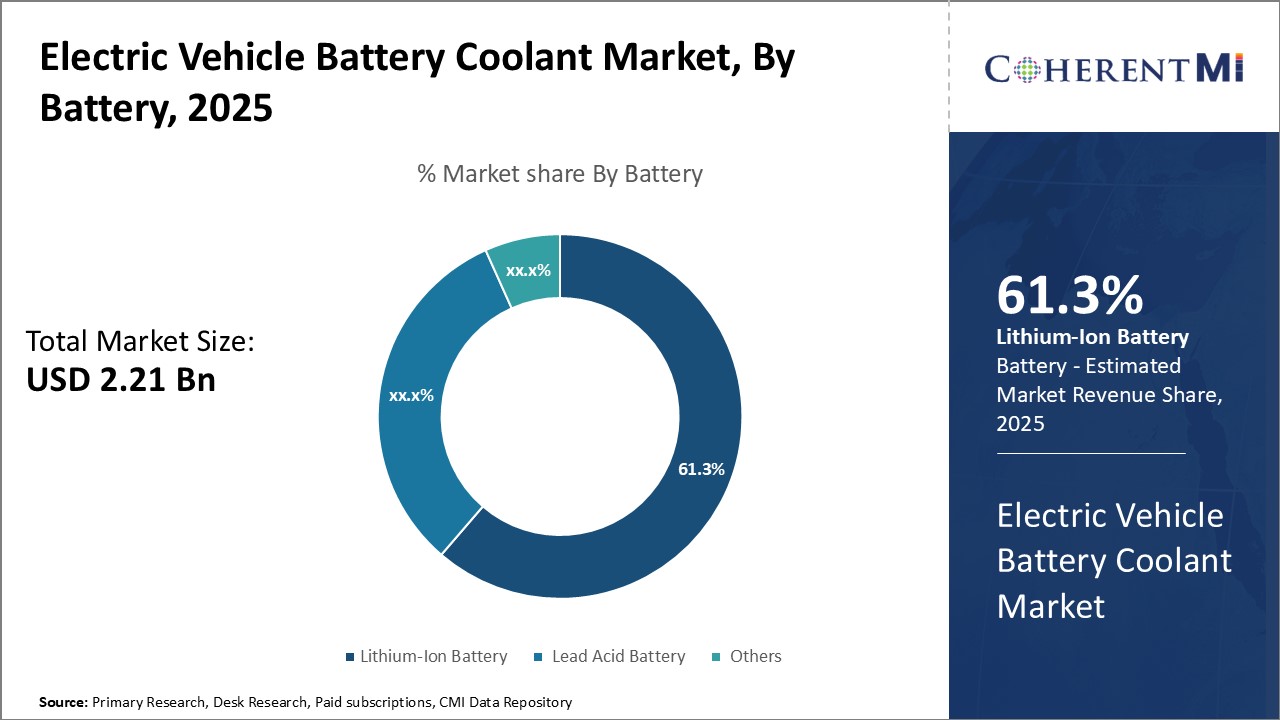

Insights, By Battery Type: Lithium-Ion Batteries Dominate the Battery Type Segment

Insights, By Battery Type: Lithium-Ion Batteries Dominate the Battery Type SegmentAmong the different battery types used in electric vehicles, lithium-ion batteries account for 61.3% revenue share of the electric vehicle battery coolant market. Lithium-ion technology is considered the ideal solution for powering battery electric vehicles and plug-in hybrid electric vehicles. This is due to its higher energy density and better lifecycle compared to other rechargeable battery types.

With lithium-ion emerging as the dominant battery chemistry powering new energy vehicles, its widespread adoption is driving the global demand for specialized electric vehicle battery coolants designed for next-generation high-energy batteries.

Additional Insights of Electric Vehicle Battery Coolant Market

- The Asia-Pacific region led with 46% share in electric vehicle battery coolant market in 2023, mainly due to high EV production in China, Japan, and India.

- North America is expected to grow the fastest in the forecast period due to increasing EV adoption in the U.S. and Canada.

- The lithium-ion battery segment accounted for 61% of the electric vehicle battery coolant market in 2023 due to its efficiency in EV applications.

- The Asia-Pacific electric vehicle battery coolant market is projected to grow from USD 980 million in 2024 to approximately USD 1,430 million by 2034 at a CAGR of 3.88%.

Competitive overview of Electric Vehicle Battery Coolant Market

The major players operating in the electric vehicle battery coolant market include BASF SE, Valvoline Inc., Exxon Mobil Corporation, Shell Group, and GS Caltexa.

Electric Vehicle Battery Coolant Market Leaders

- BASF SE

- Valvoline Inc.

- Exxon Mobil Corporation

- Shell Group

- GS Caltexa

Electric Vehicle Battery Coolant Market - Competitive Rivalry

Electric Vehicle Battery Coolant Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Electric Vehicle Battery Coolant Market

- In February 2024, DuPont introduced the AmberLite™ EV2X resin, a glycol-purification solution designed to extend the lifespan of electric vehicle (EV) coolants. This resin enhances thermal stability, improves system efficiency, and reduces maintenance requirements.

- In October 2023, China's Ministry of Transport proposed a new standard for water glycol-based coolants aimed at enhancing safety in battery electric vehicles (BEVs). This initiative follows tests conducted by the Research Institute on Highway (RIOH), which demonstrated the benefits of using coolants with significantly reduced, though non-zero, electrical conductivity.

Electric Vehicle Battery Coolant Market Segmentation

- By Vehicle

- Battery Electric Vehicles

- Hybrid Electric Vehicles

- By Battery

- Lithium-Ion Battery

- Lead Acid Battery

- Others

Would you like to explore the option of buying individual sections of this report?

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Frequently Asked Questions :

How big is the electric vehicle battery coolant market?

The electric vehicle battery coolant market is estimated to be valued at USD 2.21 Bn in 2025 and is expected to reach USD2.91 Bn by 2032.

What are the key factors hampering the growth of the electric vehicle battery coolant market?

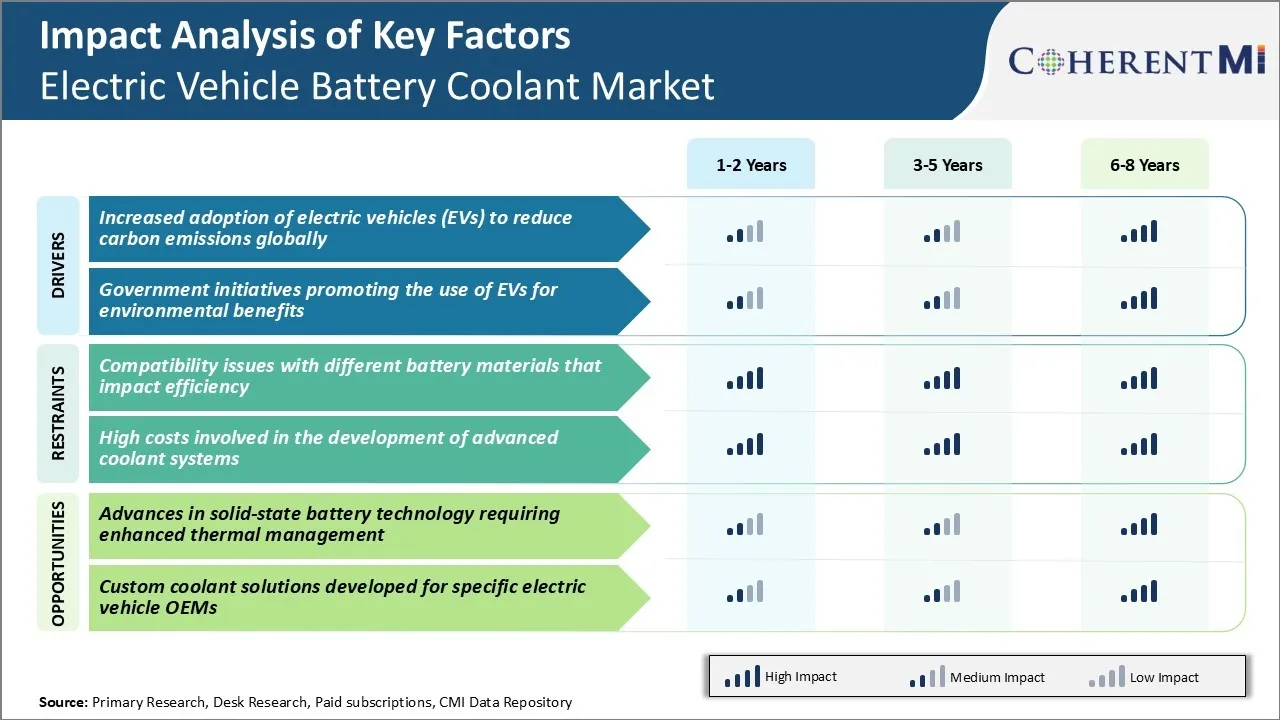

Compatibility issues with different battery materials that impact efficiency and high costs involved in the development of advanced coolant systems are the major factors hampering the growth of the electric vehicle battery coolant market.

What are the major factors driving the electric vehicle battery coolant market growth?

Increased adoption of electric vehicles (EVs) and government initiatives promoting the use of EVs for environmental benefits are the major factors driving the electric vehicle battery coolant market.

Which is the leading vehicle in the electric vehicle battery coolant market?

The leading vehicle segment is battery electric vehicles.

Which are the major players operating in the electric vehicle battery coolant market?

BASF SE, Valvoline Inc., Exxon Mobil Corporation, Shell Group, and GS Caltexa are the major players.

What will be the CAGR of the electric vehicle battery coolant market?

The CAGR of the electric vehicle battery coolant Market is projected to be 4.00% from 2025-2032.