농장 장비 임대 시장 크기 - 분석

USD 기준 시장 규모 Bn

CAGR6.5%

| 연구 기간 | 2025-2032 |

| 추정 기준 연도 | 2024 |

| CAGR | 6.5% |

| 시장 집중도 | Low |

| 주요 플레이어 | 디어 & 회사, CNH 산업, AGCO 소개 회사 소개, Kubota 법인, 마린드라 & 마린드라 및 기타 |

저희에게 알려주세요!

농장 장비 임대 시장 트렌드

시장 드라이버 - High Upfront Costs Drive Demand for Rental Solutions

높은 상륙 expenditures 행위 특히 농업 신용에 한정된 접근을 가진 작은 홀더 농부에 대 한. 개발된 국가의 일부 중간 또는 대규모 농업 회사는 기계의 수명주기와 페이백 기간을 통해 반환 할 때 가파른 비용을 정당화하는 데 어려움을 발견.

그 사이에, 계절 요구 사항 또한 모든 농부들에게 영구 소유권을 통지하지 않습니다. As-need 기반에 기계 임대는이 시나리오에서 실용적인 대안을 입증했습니다. 그것은 중요한 가동 도중 농부 접근을 보장하는 동안 제3자 함대 소유자를 전문화하는 취득과 정비 비용을 둘 다 이동합니다.

장비 임대 회사는 따라서 다양한 농장 크기의 임시 기계화 필요를 성취하는 적당한 선택권으로 출현했습니다. 그들의 큰 함대는 요구될 때 requisite 실행을 유효합니다 지킵니다. 또한 수리 및 업그레이드, 흡수 장비 수명주기 비용을 처리합니다. 이 임대 모델은 전 세계적으로 수용 할 수 있으며 자본 효율적인 방법으로 전 세계적으로 기계화 된 농업 수준을 높일 수 있습니다. 그것은 또한 작은 홀더 재배자 조차 도달하는 정밀도 서비스 및 최신 기술을 촉진합니다.

Market Opportunity - 시장을위한 Technologically Advanced Rental 트랙터 및 서비스 개발

농업 장비 임대 시장의 주요 기회 중 하나는 기술적으로 고급 임대 트랙터 및 보완 서비스의 개발 고객의 요구에. GPS, Auto-guidance 및 telemetry 시스템과 같은 첨단 기술을 갖춘 최신 모델 트랙터를 소개합니다. 이것은 농장 효율성과 생산성을 개선하는 데 도움이 될 것입니다.

장비 임대 회사는 또한 턴키 맞춤형 농업 솔루션, 정밀 농업 자문 및 장비 유지 보수 패키지와 같은 부가가치 서비스를 제공 할 수 있습니다. 이들은 고객 경험 및 만족을 강화할 수 있습니다.

혁신에 초점을 맞추고, 사용 기반 모델에 대한 트랙터의 급여 당 사용과 같은 새로운 비즈니스 모델은 탐구 될 수있다. 이것은 농부를위한 초기 투자 요구를 줄이고 임대 사업을위한 새로운 수익 흐름을 제공합니다. 전반적으로 신기술을 활용하고 다양한 솔루션을 제공함으로써 lucrative 농장 장비 임대 시장에서 성장을 가속화할 수 있습니다.

주요 플레이어가 채택한 주요 승리 전략 농장 장비 임대 시장

기술 지원:: Player는 고객의 경험을 향상시키기 위해 기술 중심의 솔루션에 중점을 둡니다. 예를 들어, John Deere는 장비 상태 및 성능의 실시간 모니터링을 가능하게 2015년 JDLink telematics 시스템을 출시했습니다. 이것은 함대 활용 및 가동 시간을 개선하는 데 도움이됩니다.

서비스 및 수리 네트워크:: 딜러와 워크샵의 강력한 네트워크 구축은 플레이어가 빠른 유지 보수 지원 및 수리를 제공합니다. AGCO는 전 세계 3,500개 이상의 대리점을 보유하고 있습니다. 농부들은 최소한의 다운타임에 직면합니다.

유연한 대여 기간: Players는 작물 사이클을 기반으로 몇 시간에서 여러 시즌에 이르기까지 유연한 임대 기간을 제공합니다. 예를 들어, 2008 금융 위기 중, Ritchie Bros는 고정 장기 임대 대신 매일 / 주간 기반을 임대 할 수 있습니다. 이 대여 기간 유연성은 운전 수요를 도왔습니다.

인수 및 파트너쉽: 플레이어는 지역 브랜드를 인수하여 지리적 발자국을 강화합니다. 2018 년, 미국 임대는 캐나다에서 입지를 확장하기 위해 $ 690 백만 달러에 BlueLine Rental을 인수했습니다. ag 입력 회사와 파트너십은 플레이어가 고객에게 더 많은 액세스를 얻을 수 있도록 도와줍니다.

세그먼트 분석 농장 장비 임대 시장

Insights, 전원 출력 : 편리하고 일반적인 HP는 41HP를 100HP 세그먼트로 밀어줍니다.

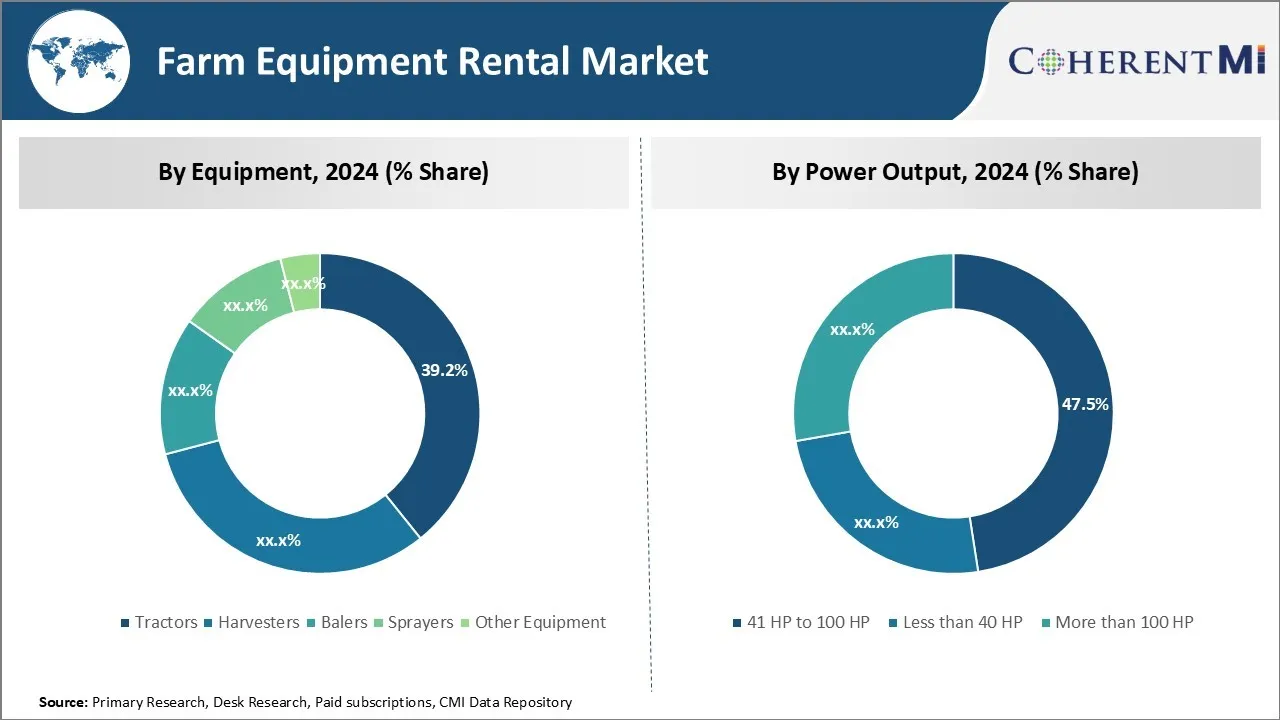

전원 출력 측면에서 41 HP에서 100 HP 세그먼트는 2024 년 농장 장비 임대 시장의 47.5% 점유율을 보유합니다. 이 편리하고 일반적인 힘 필요 41-100HP 농장 장비는 많은 농업 일을 위해 성취합니다. 이 중간 범위 마력 부류에 있는 트랙터에는 표준 fieldwork 및 물자 취급의 넓은 경간을 위한 충분한 힘이 아직도 reasonably 크기와 maneuverable 입니다.

또한, 기본 연산자의 라이센스만 필요로 하는, 41HP에서 100HP 트랙터는 추가 트랙터 전원이 일시적으로 필요할 때 피크 시즌에 유연한 고용 및 고 솔루션을 제공합니다. 더 높은 HP 모델과 비교된 그들의 연료 효율과 낮은 초기 가격 포인트는 또한 비용 의식 농업 작업에 대 한이 세그먼트 매력을 만들.

'goldilocks' 옵션 회의 일상적인 전력 수요로 수많은 농업 기업, 41HP에서 100HP 트랙터의 인기는 농장 장비 임대 시장에서 리더십을 구동한다.

추가 통찰력 농장 장비 임대 시장

- Asia-Pacific Leading Growth: 농업 장비 임대 시장의 약 35.7%의 점유율을 차지하는 아시아 태평양 지역은 저렴한 농장 장비 솔루션을 찾는 소규모 농가에 의해 구동됩니다.

- 농장 장비 임대 시장의 북미 지역은 농업 기술의 발전으로 인해 예측 기간 동안 5.94%의 CAGR에서 성장할 것으로 예상됩니다.

- Precision Farming의 채택 : 농장 장비 임대의 약 42.5%가 더 효율적인 농업 관행을 향한 이동을 나타내는 정밀 농업 기술을 포함합니다.

- Collaborative 농업 모형: 유럽 농장 장비 임대 시장의 농부들은 공동 임대 장비에 협력을 형성하고 개인 비용을 줄이고 공유 자원 활용을 촉진했습니다.

- 임대 함대의 확장 : AGCO Corporation과 같은 농장 장비 임대 시장에서 기업은 고급 농업 기술에 대한 수요를 충족하기 위해 임대 함대를 확장했습니다.

경쟁 개요 농장 장비 임대 시장

농장 장비 임대 시장에서 운영되는 주요 플레이어는 Deere & Company, CNH Industrial, AGCO Corporation, Kubota Corporation, Mahindra & Mahindra, Flaman Group of Companies, Pacific AG Rentals LLC, Messick's, CLAAS KGaA mbH, The Papé Group, Inc, Escorts Limited, J.C. Bamford Excavators Limited (JCB), SDF Group 및 Yanmar Holdings Co., Ltd.를 포함합니다.

농장 장비 임대 시장 선두

- 디어 & 회사

- CNH 산업

- AGCO 소개 회사 소개

- Kubota 법인

- 마린드라 & 마린드라

농장 장비 임대 시장 - 경쟁 경쟁

농장 장비 임대 시장

(주요 플레이어가 지배)

(많은 플레이어가 있는 매우 경쟁적)

최근 개발 농장 장비 임대 시장

- 9 월 2024에서 Kubota North America Corporation은 Bloomfield Robotics를 인수했으며 고급 이미징 및 인공 지능을 사용하여 특수 작물의 건강 및 성능을 모니터링합니다. 이 인수는 예측 유지 보수를 강화하고 장비 사용을 최적화, 스마트 농업에 대한 Kubota의 전략적 비전과 일치.

- 2 월 2024에서 Deere & Company는 9RX 시리즈의 일환으로 4 트랙 트랙터의 새로운 라인업을 공개했습니다. 이 시리즈는 830 마력까지 도달하는 엔진 힘을 가진 모형을, 만듭니다 날짜에 회사의 가장 강력한 트랙터를 포함합니다.

- 7 월 2023에서 Pacific AG Rentals LLC는 Burro와 협력하여 농업 부문의 자율 이동성 솔루션을 전문으로하는 필라델피아에 본사를 둔 회사입니다. 이 파트너십은 Burro의 자율 로봇을 Pacific AG Rentals의 농장 장비 임대 함대에 소개하는 것을 목표로 합니다. 협업은 미국 전역의 혁신적인 로봇 기술에 대한 광범위한 액세스를 제공 할 것으로 예상됩니다.

- 6월 2023일, 존 Deere는 농장 장비 임대 서비스를 강화하기위한 새로운 디지털 플랫폼을 출시했습니다. 이 이니셔티브는 농업을 더 쉽게 고급 기계에 액세스 할 수 있도록 설계, 궁극적으로 운영 효율 향상, 생산성. 플랫폼은 농업 장비 임대 서비스를 위한 주문 과정을 단순화하고, 사용자가 필요로 하는 기계장치를 빨리 취득할 수 있다는 것을 보증합니다.

농장 장비 임대 시장 세분화

- 제품정보

- 트랙터

- 유틸리티 트랙터

- 줄 자르기 트랙터

- 산업 트랙터

- 채용 정보

- 콤비네이션

- 포리지 Harvesters

- 채용 정보

- 둥근 포장기

- 광장 Balers

- 회사 소개

- 자동 용접 스프레이어

- 제품 소개

- 기타 장비

- 회사 소개

- 딜러

- 뚱 베어

- 트랙터

- 힘 산출에 의하여

- 41 HP에서 100 HP

- 40 HP 미만

- 100 HP 이상

- 구동방식

- 두 바퀴 드라이브 (2WD)

- 4 바퀴 드라이브 (4WD)

- 기계적인 정면 바퀴 드라이브 (MFWD)

- 분명히 말한 4WD

구매 옵션을 알아보시겠어요?이 보고서의 개별 섹션?

Yaash Doshi는 상임 경영 컨설턴트입니다. 그는 APAC, EMEA 및 아메리카의 수직적 분야에서 연구를 수행하고 컨설팅 프로젝트를 처리한 경험이 12년 이상 있습니다.

그는 화학 회사가 복잡한 과제를 헤쳐나가고 성장 기회를 파악하도록 돕는 데 강력한 통찰력을 제공합니다. 그는 상품, 특수 및 정밀 화학, 플라스틱 및 폴리머, 석유화학을 포함한 화학 가치 사슬 전반에 걸쳐 심층적인 전문 지식을 보유하고 있습니다. Yash는 업계 컨퍼런스에서 인기 있는 연설자이며 상품, 특수 및 정밀 화학, 플라스틱 및 폴리머, 석유화학과 관련된 주제에 대한 다양한 출판물에 기고합니다.

자주 묻는 질문 :

농장 장비 임대 시장은 얼마나 큰?

농장 장비 임대 시장은 2024 년 USD 57.17 Bn에서 평가 될 것으로 예상되며 USD 87.82 Bn 2031에 도달 할 것으로 예상됩니다.

농장 장비 임대 시장의 성장에 대한 주요 요인은 무엇입니까?

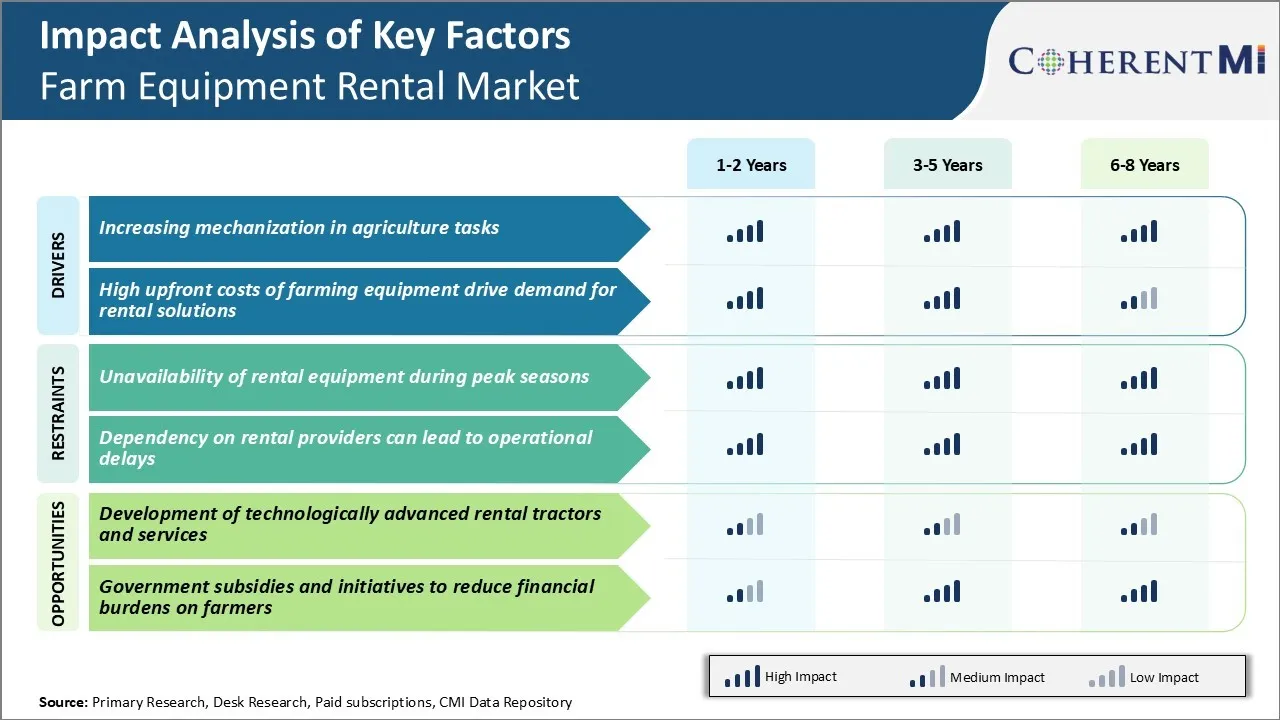

피크 시즌 동안 임대 장비의 가용성 및 임대 제공 업체에 의존도, 운영 지연으로 이어질 수있는 주요 요소는 농장 장비 임대 시장의 성장 hampering.

농장 장비 임대 시장 성장을 구동하는 주요 요인은 무엇입니까?

농업 작업 및 농장 장비의 고급 비용에 기계화가 농업 장비 임대 시장의 주요 요소입니다.

농업 장비 임대 시장에서 선도적 인 장비는 무엇입니까?

주요 장비 세그먼트는 트랙터입니다.

농장 장비 임대 시장에서 운영되는 주요 선수는 무엇입니까?

Deere & Company, CNH Industrial, AGCO Corporation, Kubota Corporation, Mahindra & Mahindra, Flaman Group of Companies, Pacific AG Rentals LLC, Messick's, CLAAS KGaA mbH, The Papé Group, Inc, Escorts Limited, J.C. Bamford Excavators Limited (JCB), SDF Group, Yanmar Holdings Co., Ltd.는 주요 선수입니다.

농장 장비 임대 시장의 CAGR는 무엇입니까?

농장 장비 임대 시장의 CAGR는 2024-2031에서 6.3%로 계획됩니다.