생선 가공 시장 크기 - 분석

USD 기준 시장 규모 Bn

CAGR6.1%

| 연구 기간 | 2025-2032 |

| 추정 기준 연도 | 2024 |

| CAGR | 6.1% |

| 시장 집중도 | Medium |

| 주요 플레이어 | 알파 오션 리소스 Berhad, 주식회사 키쿠요, Trident 해산물, 미국 해산물 그룹, LLC, 모위 ASA 및 기타 |

저희에게 알려주세요!

생선 가공 시장 트렌드

시장 드라이버 - 공정한 물고기의 증가 및 공급은 산업 성장을 구동

도시화와 변화하는 라이프 스타일을 통해 소비자는 요리 식사에서 지출 시간 대신 편리한 준비 음식 옵션을 요구하고 있습니다. 가공된 물고기는 즉시 영양이 풍부한 식사 해결책의 이 성장한 필요를 만납니다. 전체 물고기에 비해, 냉동 물고기 손가락 같은 값 추가 된 형태, 빵 물고기 필렛, 물고기 스틱 쉽게 준비 및 소비를 촉진. 가공 방법은 신선한 형태의 냄새와 맛에 대한 구절을 가진 사람들에게 더 담근 물고기를 만드는 맛과 질감을 향상시킵니다. 효과적인 보전 기술은 영양 가치를 비교하지 않고 생선의 유통 기한을 크게 늘릴 수 있도록 냉동, 치료 및 통조림과 같은 단계를 포함합니다. 계절의 무서운을 경험하는 지역에서도 다양한 물고기 품종의 연중 가용성을 가능하게합니다.

더 나은 수송과 찬 사슬 근수에는 가공한 물고기 기업 선수를 위한 공급 사슬 efficiencies가 있습니다. 생산 능력 상승으로, 회사는 지금 소매와 foodservice 수요를 둘 다 회의에 더 큰 가늠자 회의에 가공한 물고기 제품 공급할 수 있습니다. 이 도시 센터의 현대 소매 형식과 전국의 작은 도시뿐만 아니라 전 세계적으로 사용할 수 있습니다. 이전에 특정 물고기는 보전의 부족 때문에 해안선에서 직접 얻어질 수 있었습니다, 진보된 가공은 배급 수로를 통해서 다년생 공급을 지킵니다. 전반적으로 개량된 palatability 및 능률적인 공급 사슬 관리는 그것의 perishable와 계절 본질의 불편을 해결해서 물고기 입구를 증가했습니다. 편리한 옵션에 대한 수요의 성장은 가공 된 물고기 제품에 대한 더 큰 시장 잠재력을 구동.

시장 기회 -Technological Advancements to Boost the Industry Developments in Forecast Period

물고기 가공 시장은 생물성 및 AI와 같은 기술 발전을 가진 다량 기회를 질과 효율성을 개량합니다. 화학 및 바이오 화학적 변화를 모니터링하여 물고기의 신선도를 감지 할 수있는 Biosensors는 품질 보증을 혁신 할 잠재력을 가지고 있습니다. 이 비파괴 검사 기술은 수확에서 최종 소비에 이르기까지 수질의 실시간 모니터링을 가능하게 합니다. 인공 지능과 기계 학습 알고리즘은 플레이어가 grading에서 공장 운영을 최적화하고 자동화 된 처리로 분류하는 데 도움이됩니다. 컴퓨터 비전 및 AI가 지원하는 자동화 된 품질 검사 시스템은 높은 정밀도로 품질 특성을 정확하게 평가 할 수 있습니다. 공급망의 IoT 및 블록 체인 통합은 물고기 제품의 추적을 가능하게하며 수입 및 소비자가 선호하는 품질 및 안전 표준에 대한 준수를 보장합니다. 기술 혁신은 따라서 강화된 음식 안전을 위한 방법을 포장하고, 물고기 가공 시장에 있는 성장을 위한 lucrative 범위를 선물하는 능률적인 자원 이용과 함께 선반 생활을 개량했습니다.

주요 플레이어가 채택한 주요 승리 전략 생선 가공 시장

부가 가치 제품에 초점: 주요 기업에 의해 채택 된 가장 성공적인 전략 중 하나는 필수 물고기 제품에서 가치 추가 항목에 초점을 맞추고있다. 예를 들어 Marine Harvest는 전 세계적으로 가장 큰 연어 농부 중 하나이며, 2000 년대 후반에 부분 제어 및 포장 연어 절단, 채우기 및 연기 연어 제품의 생산을 가속화했습니다. 이 회사는 더 높은 마진을 명령 할 수. 오늘날 Marine Harvest의 살몬의 50 % 이상이 부가 제품으로 판매됩니다.

Geographic 및 제품 확장:: 대부분의 플레이어는 지리적 및 제품 포트폴리오 확장을 허용하는 인수를 통해 적극적으로 성장했습니다.

자신의 농업 및 수확 가동을 설치하십시오: 수직 integrating 상류는 공급에 약한 경쟁자의 통제를 도왔습니다. Mowi (이전 Marine Harvest)와 같은 회사는 매년 자신의 농장을 통해 연어의 300,000 톤 이상 재배합니다. 이것은 원료와 가격 안정성의 일관된 공급을 지킵니다. 그들은 공급 업체에 따라 더 작은 플레이어와 비교하여 더 낮은 비용으로 연어를 올릴 수있었습니다.

식품 안전 및 지속 가능성에 중점을 둡니다.: 식품 안전 및 지속 가능성 측면에 대한 Emphasis는 최고 브랜드가 소비자의 신뢰를 얻는 데 도움이되었습니다.

고급 콜드 체인 인프라: Iglo Group과 같은 기업은 온도 제어, 최첨단 처리 및 유통 인프라를 갖춘 최고의 제품 품질을 소비자에게 전달합니다.

세그먼트 분석 생선 가공 시장

Insights, By Species, 물고기 세그먼트는 Forecast 시대의 주목할만한 성장에 Poised

종에 따라 물고기는 2024 년에 60.1%에 기여할 것으로 예상되며 내리아 요리 사용. 종에 의해 구분 된 물고기 처리 산업 내에서, 살모, 참치, 공동, pomfret 및 mackerel과 같은 물고기 품종은 가장 큰 공유를위한 공동으로 계정. 바다와 양식 소스뿐만 아니라 다양한 요리 방법을 통해 풍부한 가용성을 지닌 것입니다.

물고기는 세계 요리에서 사용되는 가장 다양한 재료 중 하나입니다. 다른 물고기 품종은 그릴, 베이킹, 튀김, 카레 또는 수프와 스튜와 같은 준비를합니다. 그들의 온화한 맛은 또한 각종 세계 음식 문화에서 각종 조미료로 실험적인 혼합을 허용합니다. 특히 Salmon은 아시아 초밥과 사시미와 함께 퓨전 글로벌 요리의 인기 성분으로 등장했습니다. 저렴한 단백질의 주요 원천이기 때문에 물고기는 건강 의식 소비자로부터 높은 수요에 있습니다. 그 사이에, 해산물 회사는 상쾌한 공급을 지키기 위하여 상업적인 fisheries & 양식 농장에 있는 다른 물고기를 재배합니다. 다양한 컷 및 가공 양식의 가용성으로, 생선 원료는 식품 제조업체, 소매업체 및 식품 서비스 기업에 대한 편의성과 가치를 제공합니다.

이 요리 및 공급 관련 요인에 대한 재해, 물고기 세그먼트는 물고기 가공 산업에 crustaceans 및 molluscs와 같은 다른 해산물 품종에 비해 최고 위치를 유지할 것입니다. 지속적인 혁신과 진화는 이 지배적인 종류의 성장을 더 몰릴 것입니다.

추가 통찰력 생선 가공 시장

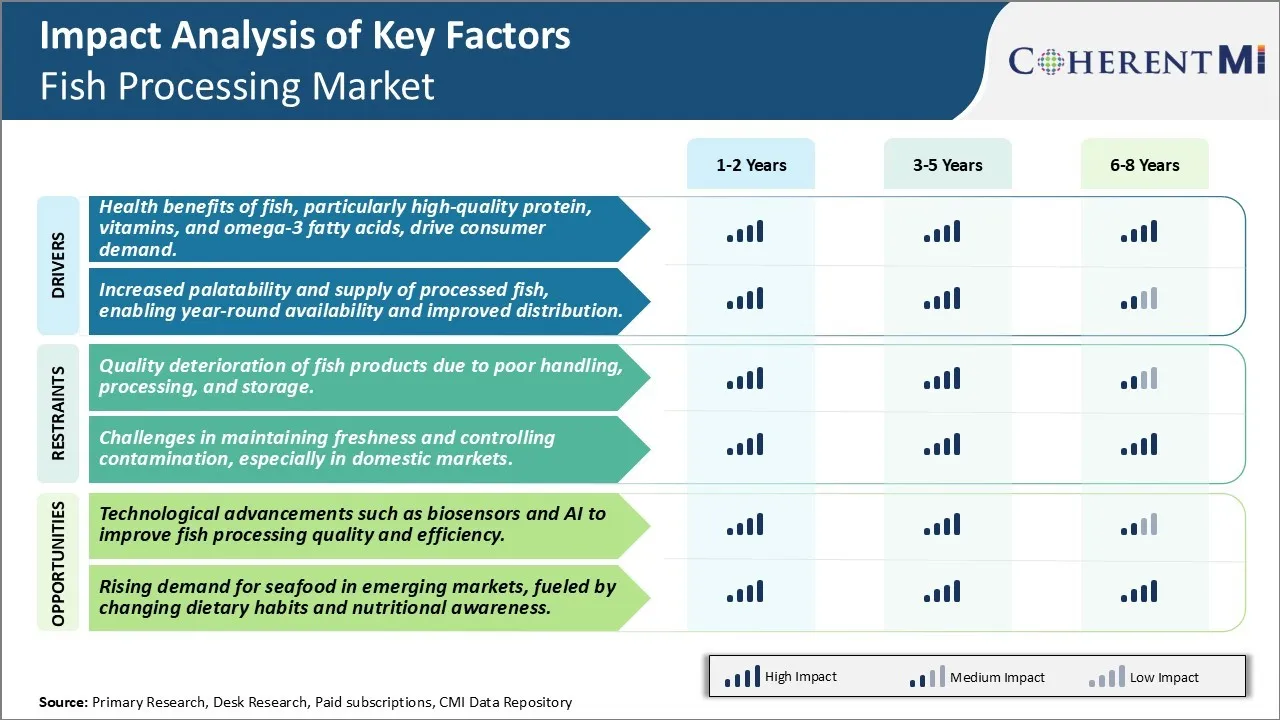

건강 의식 소비자는 점점 높은 품질의 단백질, 비타민 및 오메가-3 지방산에 대한 물고기를 돌리고, 가공 된 물고기에 대한 수요를 운전. 인공지능(AI)과 바이오센서와 같은 기술적인 발전은 더 효율적이고 품질 관리를 개선하기 위해 가공된 물고기를 개발하고 있습니다. 그러나, 도전은, 특히 국내 시장에서 improper 취급과 저장 때문에 질 deterioration를 포함하여 남아 있습니다. 아시아 태평양의 국가, 특히 중국, 시장 지배, 북미는 급작 생산과 강력한 기관 지원 증가로 인해 빠르게 성장할 것으로 예상된다. 전반적으로, 시장은 해물, 기술 혁신을 위한 상승 세계적인 수요에 의해 몰아지고, 주요 지구에 있는 생산 능력을 확장하.

경쟁 개요 생선 가공 시장

Fish Processing Market에서 운영하는 주요 플레이어는 Alpha Ocean Resources Berhad, Kyokuyo Co., Ltd., Trident Seafoods, American Seafoods Group, LLC, Mowi ASA, Beaver Street Fisheries, Grieg Seafood, Associated Seafood Ltd., Aurum Freight International Ltd., Bomar Seafood, Costamar, Sea Pride LLC, Oman Fisheries Co. SAOG 및 Deep Seafood Company가 포함됩니다.

생선 가공 시장 선두

- 알파 오션 리소스 Berhad

- 주식회사 키쿠요

- Trident 해산물

- 미국 해산물 그룹, LLC

- 모위 ASA

생선 가공 시장 - 경쟁 경쟁

생선 가공 시장

(주요 플레이어가 지배)

(많은 플레이어가 있는 매우 경쟁적)

최근 개발 생선 가공 시장

- 9 월 2024 일, Kyokuyo Co., Ltd.는 낚시, 가공, 포장에 걸쳐 유럽 해산물 산업에 종사하는 것을 목표로 북미 해산물 네덜란드의 대다수 지분을 취득하여 유럽으로 확장되었습니다.

- 4월 2024일, Denholm Seafood, The Don Fishing Company 및 Seafood Ecosse는 Trinity Seafoods Ltd.라는 공동 벤처를 형성하여 지속 가능한 백사장 재고를 처리하기 위해 최첨단 장비를 사용합니다.

생선 가공 시장 세분화

- 이름 *

- (주)

- 예약안내

- 이름 *

- 으로 Species

- 뚱 베어

- Crustaceans의 장점

- 구독하기

- 이름 *

구매 옵션을 알아보시겠어요?이 보고서의 개별 섹션?

Sakshi Suryawanshi는 시장 조사 및 컨설팅 분야에서 6년의 광범위한 경험을 가진 연구 컨설턴트입니다. 그녀는 시장 추정, 경쟁 분석 및 특허 분석에 능숙합니다. Sakshi는 시장 동향을 파악하고 경쟁 환경을 평가하여 전략적 의사 결정을 이끌어내는 실행 가능한 통찰력을 제공하는 데 능숙합니다. 그녀의 전문 지식은 기업이 복잡한 시장 역학을 탐색하고 목표를 효과적으로 달성하는 데 도움이 됩니다.

자주 묻는 질문 :

얼마나 큰 물고기 처리 시장?

세계 물고기 처리 시장은 USD 391.1에 가치있을 것으로 예상됩니다. 2024 년 Bn은 USD 690.3에 도달 할 것으로 예상됩니다. 2031년까지 Bn.

물고기 가공 시장의 CAGR는 무엇입니까?

물고기 가공 시장의 CAGR는 2024에서 2031까지 5.9%로 계획됩니다.

Fish Processing Market의 성장은 어떤 핵심 요소입니까?

농산물 및 농산물, 농산물, 농산물, 농산물, 농산물, 농산물, 농산물, 농산물, 농산물, 농산물, 농산물 등

Fish Processing Market 성장의 주요 요인은 무엇입니까?

생선의 건강 혜택, 특히 고품질의 단백질, 비타민 및 오메가-3 지방산, 드라이브 소비자 수요 및 증가 된 palatability 및 처리 된 물고기의 공급, 연중 가용성 및 향상된 배포를 가능하게하는 주요 요인은 물고기 가공 시장 운전.

Fish Processing Market의 주요 유형은 무엇입니까?

언은 주요한 유형 세그먼트입니다.

Fish Processing Market에서 작동하는 주요 선수는 무엇입니까?

Alpha Ocean Resources Berhad, Kyokuyo Co., Ltd., Trident Seafood, American Seafoods Group, LLC, Mowi ASA, Beaver Street Fisheries, Grieg Seafood, Associated Seafood Ltd., Aurum Freight International Ltd., Bomar Seafood, Costamar, Sea Pride LLC, Oman Fisheries Co. SAOG, Deep Seafood Company는 주요 선수입니다.