足下垂治療機器市場 サイズ - 分析

フットドロップ処理装置市場は、 2024年のUSD 2.59 Bn そして到達する予定 2031年のUSD 4.5 Bn、混合の年次成長率で育つ (CAGR) 2024年~2031年 神経障害および傷害の増加の発生はこれらの装置のための要求を運転しています。 機能性電気刺激や3Dプリントブレースなどの装置における技術的進歩は、さらなる需要を燃料化しています。

市場規模(米ドル) Bn

CAGR8.4%

| 調査期間 | 2025-2032 |

| 推定の基準年 | 2024 |

| CAGR | 8.4% |

| 市場集中度 | Medium |

| 主要プレーヤー | オットボック, バイオネス株式会社, アクシオビオニクス, 加速ケアプラス株式会社, サエボ株式会社 その他 |

お知らせください!

足下垂治療機器市場 トレンド

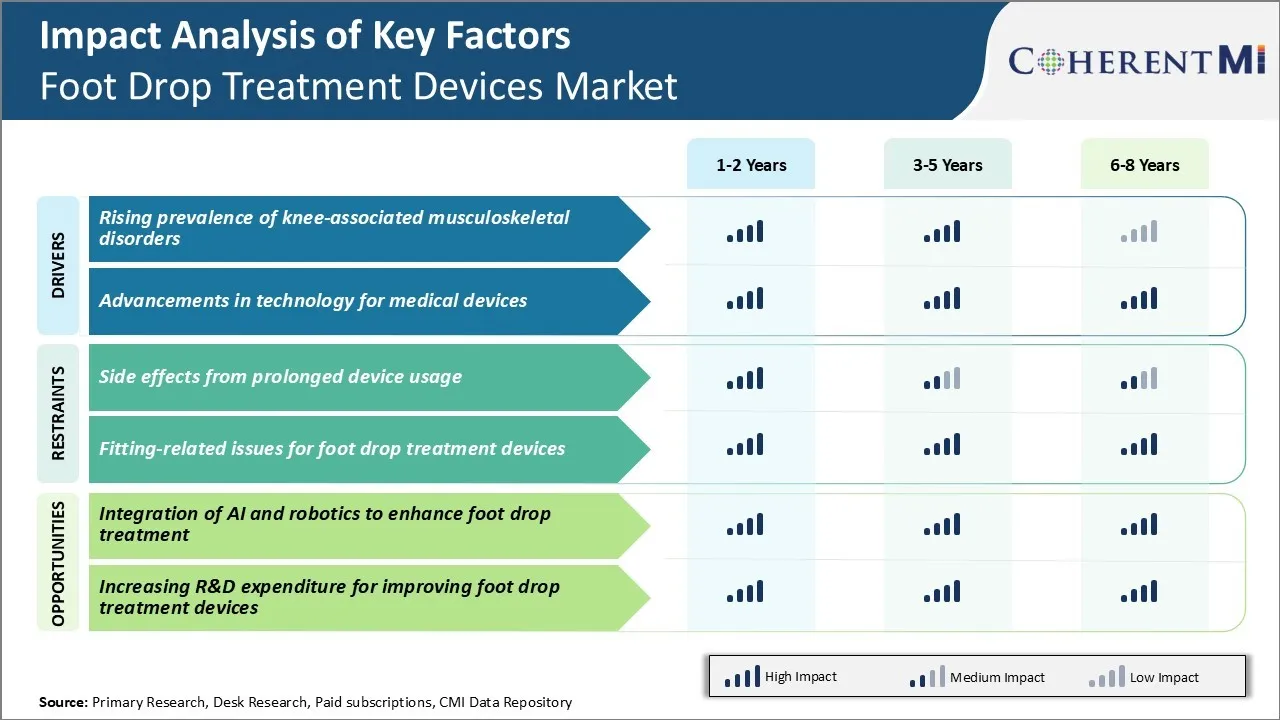

市場ドライバ - ニー・アソシエーション・ムスカルロスケレタールの有利な存在 障害物

過去10年間に膝関連のmusculoskeletal障害の蔓延に連続的な上昇がありました。 一般的な膝の障害のいくつかは、骨関節炎、膝腱炎、靭帯の怪我や足の低下を引き起こす神経疾患です。 都市化と身体活動の欠如のために、より多くの人々が座りやすいライフスタイルを導きます, 膝骨関節炎のような障害が上昇しています.

研究によると、膝骨関節炎は世界中で300万人以上の人々に影響を及ぼし、2040年までに60歳以上の人口の25%以上がこの条件で生活されることが推定されています。

肥満レベルを上げると、膝の障害にも大きく貢献します。 過剰な体重を運ぶと、自分の軟骨や骨を傷つける時間をかけて膝に追加の圧力をかけます。 さらに、警報率で成長している糖尿病などの疾患は、足の低下を引き起こす神経疾患に寄与しています。

パーオーナルな神経のpalsyの経験のフィートの低下のような条件に苦しんでいる人々は歩く間フィートをきちんと持ち上がることができません。 これは、異常な歩行と落下のリスクの増加につながる. 世界的な成長するgeriatric人口で、そのような筋骨格の病気により多くの傾向があります、足の低下の処置装置のための忍耐強いプールは急速に拡大し続けます。

市場ドライバー - 医療機器のテクノロジーの進歩

過去数年間に、フットドロップ処理技術において有意義なイノベーションが誕生しました。 足首の足首の接合箇所に安定性を提供するために足首のフィートのオースズに主に焦点を合わせる早期装置。 しかし、新時代のデバイスは、材料科学、ナノテクノロジー、デジタルテクノロジーを活用して、優れた治療結果を提供します。

高度のマイクロプロセッサ制御足首の足の矯正は自然な歩行の機械化を感じ、それに応じてセンサー、プロセッサおよびアクチュエータを通して足首の動きを制御することができます。 これらのスマートなortoses にプログラム可能な振動およびスタンスの段階制御があり、忍耐強い必要性に基づいてカスタム化を可能にします。

3Dプリンティング技術は、デバイスメーカーがカスタム設計したフットプレートとブレースを開発するために、ますます使用されています。 患者の足と歩行の3Dスキャンは、自分の解剖学に合わせてインプラントを作成するのに役立ちます。 快適性と性能を向上します。

一部のスタートアップは、効率的なリチウムイオン電池を搭載したウェアラブルドロップフット刺激剤などの代替ソリューションを開発しています。 そのようなデバイスは、神経筋電気刺激を使用して、ドーサールの屈曲を誘発し、機械的な矯正を必要としない歩行を改善します。 AIの継続的なデジタル化と使用により、将来のフットドロップソリューションがより効果的であり、使いやすくなる可能性があります。

マーケットチャレンジ - 延長された装置の使用からの側面の効果

フットドロップ処理装置市場で直面する重要な課題の1つは、これらのデバイスの長期使用から生じる潜在的な副作用です。 足首フィートのオース(AFO)および機能電気刺激(FES)装置のようなフィートの低下の処置装置は効果的にフィートの低下の状態を扱うために毎日数時間のために身に着けなければなりません。

しかし、長時間連続した装置の使用は、皮膚の刺激、痛み、および患者の足や足の上に不快感につながることがあります。 これはより柔らかい代わりと比較してより少ない柔軟性を提供する堅いプラスチック AFOs のために特に本当です。 デバイス構造によって引き起こされる皮膚や圧力点に対する擦り傷は、多くの時間のためにそれらを使用している患者の赤み、発疹または痛みを引き起こす可能性があります。

デバイスメーカーは、より柔らかい素材、使用中の定期的な壊れ目、および人間工学に基づいたデザインを処方することに焦点を合わせる必要があります。 不審な不快感または皮膚の問題は、患者のコンプライアンスを時間以上減らし、足の低下治療装置市場の可能性に悪影響を及ぼす可能性があります。

市場機会 - AIとロボティクスの統合により、フットドロップ処理を強化

人工知能(AI)やロボティクスなどの高度な技術の統合により、フットドロップ処理オプションを強化し、フットドロップ処理装置市場を前進させるための大きな機会を提示します。 たとえば、AI搭載センサーとアルゴリズムにより、将来のフットドロップデバイスを適切に監視し、関節角度、剛性、足首の位置をリアルタイムに調整できます。 これにより、修正レベルを最適化し、動的、必要に応じてサポートすることができます。

同様に、足首足のオースズとエクスカレトンのロボット要素は、スイングフェーズ活動中に電力援助を提供できます。 AI、センサー、アクチュエータを組み合わせることで、パッシブデバイスよりも効果的にフットドロップの症状を減らすことができます。 それはまた処置の応答および予後の時間上の貴重な忍耐強いデータを集めることができます。

これらの最先端技術の収束は、フットドロップ管理による治療結果と患者体験を大幅に改善することを意味します。 これは、革新的なデバイスメーカーのためのユニークな成長経路を紹介します。

処方者の好み 足下垂治療機器市場

軽度の症例では、体調療法は通常、脚と足首の筋肉を強化する最初のラインです。 足首のdorsiflexionの伸張のような練習は移動性の改良を助けることができます。

弱さが悪化するにつれて、処方者はしばしば足首足の矯正(AFO)の支柱を選ぶ。 一般的なブランドは、ベッカーのÖssurとDynamic AFOによってAFOを隠されています。 これらの呼出しのプラスチック支柱は足首を支え、歩行の間に中立的な位置でそれを保持します。 より重要な神経損傷の患者のために、機能電気刺激(FES)は導入されるかもしれません。 WalkAide装置は歩くことの間に共通のperoneal神経を刺激し、筋肉収縮を誘発する普及したFESの選択です。

高度なケースでは、より保守的なオプションに反応しない、ボツリン毒素注射が頻繁に使用されます。 例えば、ボトックス(オナボリントキシンA)をガストロキネシス筋肉に注入し、フットドロップを削減します。 最後に、不可逆神経損傷を持つ人のためにしかし、そうでなければ健康な人のために、腱の移動のような外科的選択は筋肉機能を変更し、移動性を改善するために考慮されるかもしれません。

また、禁止性は、処方パターンに影響を及ぼします。 多発性性硬化症のような疾患の若年患者は、その機能上の利点のためにFESを最初に試す可能性が高くなりますが、末梢神経障害を持つ高齢者は、安全のためのAFOを直視する可能性があります。

治療オプション分析 足下垂治療機器市場

フットドロップは、適切な治療経路に影響を与える重症度が変化しています。 マイルド症例は、足や足首をサポートしている足首矯正(AFO)のような括弧デバイスで治療することができます。 適度なフィートの低下のために、注射可能な処置は考慮されるかもしれません。 Botulinumの毒素のタイプA (Botox)の注入は子牛筋肉に一時的にそれらを弱め、3-6か月のための歩くことを改善する異常な調子を減らすことができます。

より先進的なケースでは、バイオネスL300などの神経筋電気刺激(NMES)装置が必要な場合があります。 これらは、歩行中にパーオーナル神経を刺激するために軽度な電気パルスを使用し、筋肉を適切なタイミングで燃焼させます。 NMESは、機能と可動性を著しく高めることができます。 他の選択肢に反応しない重度の足のために、手術は考慮されるかもしれません。 一般的な手順には、この腱を使用して、足首の外側の筋肉を強化し、より良いリフトのために。

最も先進的な治療は、AbbottのInfiniのような周辺神経刺激(PNS)装置です。 これらは、足首によって配置された小さなインプラントを使用して、ガイトを検出し、選択的にスイングフェーズ中に深いperoneal神経を刺激します。

主要プレーヤーが採用した主な勝利戦略 足下垂治療機器市場

プロダクト革新 - 途方もないニーズに対応できる革新的な製品を開発し、プレイヤーがエッジを得るのを助けました。 たとえば、ハンガークリニックは2015年にWalkAideの括弧を発売しました。これは、一般的なパーオーナル神経の機能的な電気刺激を使用して、歩行中の足を持ち上げます。

市場拡大 - プレイヤーは新しい地理的な領域に拡大し、未適用成長の可能性をタップすることに焦点を当てています。 例えば、バイオネスは、2018年のヨーロッパでL300 Plusシステムを立ち上げ、規制当局の承認を得ました。 欧州・アジア・パシフィック市場をターゲットに。

戦略的パートナーシップとコラボレーション - 企業は病院、医院およびリハビリテーションの専門知識を得るためのリハビリテーションおよびまた顧客のための中心と提携しました。 2019年、バイオネスは、臨床研究をサポートし、革新的なソリューションへのアクセスを改善するために、いくつかのEMEAクリニックと提携しました。 これらのパートナーシップは、治療と市場浸透の専門知識を得るのに役立ちます。

デジタル力の強化 - 電子商取引とデジタルヘルスの上昇に伴い、プレイヤーは自分のデジタルプレゼンスを強化することに焦点を当てています。 Össurは2020年に延長保証プログラムを進水させました。これにより、ユーザーはデバイスをオンラインで追加期間登録できます。 それはデジタル保証を選ぶ30%以上の顧客を見ました。 顧客ロイヤルティと利便性の向上

セグメント分析 足下垂治療機器市場

洞察, 製品の種類によって: 神経系障害と筋肉関連の問題の優先順位を成長 ブースト需要

製品の種類に関しては、電気刺激剤は、2024年に54.6%の市場シェアを保持するように計画され、フットドロップ症状を治療する効果を期待しています。 電気刺激器は歩く間フィートおよびより低い足筋肉に穏やかな電気脈拍を、持ち上がることの患者を助けます。 軽度の衝撃は、足の低下を引き起こす条件の影響を対抗します。, 多発性硬化症など, ストローク, 脊髄損傷, 脳の麻痺.

このような神経疾患および筋肉の傷害の蔓延が世界中で上昇するにつれて、電気刺激器のような補助装置の必要性は大幅に増加しています。 彼らの非侵襲的な性質および可搬性は電気刺激器を支柱のような他のフィートの低下の処置装置上の好まれた選択させます。

神経質な状態に陥り、外傷の発生率が上昇する、電気刺激剤のような効果的なホームベースのソリューションの需要は、今後数年間生存し続けることが期待されます。

適用による洞察:神経症の患者の意識を高めるBoostsの採用

応用面では、神経症は、主にフットドロップとその治療オプションについての意識を高めるために、2024年にフットドロップ治療装置市場でのシェアの36.9%を消費する可能性があります。 糖尿病、化学療法または他の条件によって引き起こされる神経症は、脚や足の神経を傷つけるので、足の低下に大きな貢献者です。

しかしながら、多くの神経症の患者は診断されていないか、または症状を調べるような症状を関連付けません。 医療団体や患者支援団体によるさまざまな意識キャンペーンは、より多くの神経症例を光に引き上げます。 これは肯定的に足の低下の処置の解決の採用に影響を与えます。

また、医師は電気刺激器や足首の足の矯正などのデバイスを容易に推奨し、神経症に罹患した患者の独立性を高めることができます。

洞察、エンド ユーザーによる: 高い忍耐強い容積のレンダリングの病院ほとんどのLucrativeエンド ユーザー

エンドユーザの観点から、病院はフットドロップ治療装置市場で最も高いシェアに貢献し、主にこれらの施設で処理された大きな患者数に供給しています。 外科を必要とするか、または複雑な神経疾患に苦しんでいる多くの患者は、病院で治療中または治療後にフットドロップ治療装置を受け取ります。 高度なデバイスオプションと医師の専門知識の可用性は、病院の信頼性の高いアクセスポイントになります。

さらに、より高い予算の可用性により、病院は重要な販売チャネルになります。 農民外科センターやクリニックなどの他のエンドユーザーは、いくつかの開発市場で成長していますが、ほとんどの地域で病院は、ターゲット患者の集中と購買決定のために、全体的なフットドロップ治療装置市場での主なシェアをコマンドします。

追加の洞察 足下垂治療機器市場

- 足の低下は打撃のような条件によって一般に引き起こされ、足および頭脳間の神経の経路を弱めるか、または破壊できます。 電気刺激装置のような装置はターゲットを絞られた衝動によって筋肉動きを活動化させることによって患者の回復の可動性を助けます。

- 世界保健機関(WHO)2022報告書によると、世界規模で1,71億人の人々が筋骨格条件に苦しんでいます。 この統計は、特に膝関連の条件を扱う個人の間で、足の低下の処置装置のための上昇の要求を、アンダースコアします。

- 65歳以上のグローバル人口の割合は、2022年から2050年までに10%増加すると予想され、高齢性神経筋障害の治療装置に対する需要が大幅に増加する。

- 重要な傾向は、MedtronicやÖssurなどの非侵襲的治療に重点を置き、患者のモビリティと生活の質を向上させる先進的なデバイスの開発を主導する企業との焦点の増加です。

競合の概要 足下垂治療機器市場

フットドロップ処理装置市場で動作する主要なプレーヤーは、オットボック、バイオネス株式会社、AxioBionics、Acceleated Care Plus Corporation、Saebo、Inc.、ボストンオーソティックス、Turbomed Orthotics、Össur、Thrive Orthopedics、Allard USA Inc.、NextStep Robotics、Finetech Medical、Arthrex、Inc.、Evolution Device、Narang Medical Limited、SCHECK&SIRESS、Alimmed、Spined Prosthetics、S、Spinals、Spinals、Spinals、Inc.、Prosthetics、Inc.、Spetics、Spetics、Inc.

足下垂治療機器市場 リーダー

- オットボック

- バイオネス株式会社

- アクシオビオニクス

- 加速ケアプラス株式会社

- サエボ株式会社

足下垂治療機器市場 - 競合関係

足下垂治療機器市場

(大手プレーヤーが支配)

(多くのプレーヤーが参入し、競争が激しい。)

最近の動向 足下垂治療機器市場

- 2023年10月、Cionicは、シリーズAの資金調達で12万ドルの追加を保証し、合計$ 25百万を調達しました。 資金調達ラウンドは、新しい投資家THVCと既存の投資家から参加して、L Cattertonによって主導されました。 資金は、シオンニューラルスリーブの採用を拡大するために使用される, 複数のスクレア症によって引き起こされる人など、モビリティ障害を個人を支援するために設計されたデバイス, ストローク, 脳パルシー. この資金調達は、より広範なモビリティ課題に対応するため、さらなる製品開発を支援します。

- 2022年11月、MyndTec Inc.は、北米のMyndStep(TM)デバイスを発売し、機能性電気刺激(FES)デバイスのポートフォリオを拡大しました。 MyndStepは、脳卒中、脊髄損傷、および外傷性脳損傷などの上モーターニューロン傷害による足の低下に苦しんでいる患者のための足首のdorsiflexionを提供するように設計されています。 この革新的な製品は、歩行パターンの正規化を支援するために、ガイトイベントや精密な刺激を検出するための組み込みセンサーなどの機能が含まれています。 米国とカナダを横断して利用できます。

- 2022年6月、パラゴン28は、トラウマ、変形補正、リムサルベージを支援するために設計されたモンキーリングTM円形外部固定システムを開始しました。 ソフトティッシュの保存を保障し、調節性および安定性を可能にする間システムが正しい解剖学的位置を維持するのに外的なワイヤーおよびねじを使用して下さい。 この製品は、すでに足と足首の状態のためのソリューションの範囲を含むパラゴン28のポートフォリオを拡大し、整形デバイス市場における会社の成長に貢献します。

- 2022年3月、シオニックはニューラルスリーブのFDAクリアランスを受け取り、モビリティの問題、特に足の低下と足の筋肉の弱さを持つ人々を助けるように設計された足の曲がったデバイスは、複数のスクラブ症、ストローク、および脳のpalsyなどの条件による。 神経スリーブは、機能的な電気刺激(FES)を使用して、分析と予測運動を改善し、ユーザーがより自然にそして自信を持って歩くのを助けるためにリアルタイムの拡張を提供します。

足下垂治療機器市場 セグメンテーション

- 製品タイプ別

- 電気刺激器

- ブレース/スプレンツ

- 用途別

- ネロパシー

- 筋肉障害

- 脳と脊髄障害

- その他

- エンドユーザ

- 病院

- Ambulatory 外科センター

- クリニック

- ホームケア設定

購入オプションを検討しますか?このレポートの個々のセクション?

Manisha Vibhute は、市場調査とコンサルティングで 5 年以上の経験を持つコンサルタントです。市場動向を深く理解している Manisha は、クライアントが効果的な市場アクセス戦略を策定できるよう支援しています。彼女は、医療機器会社が価格設定、償還、規制の経路をうまく利用して、製品の発売を成功に導くお手伝いをしています。

よくある質問 :

フットドロップ処理装置市場はどれくらいの大きさですか?

フットドロップ処理装置市場は2024年にUSD 2.59 Bnで評価され、2031までにUSD 4.5 Bnに達すると予想されます。

フットドロップ治療装置の市場の成長を妨げる重要な要因は何ですか?

フットドロップ処理装置のための長期デバイス使用とフィッティング関連の問題からの副作用は、フットドロップ治療装置の市場の成長を妨げる主要な要因です。

フットドロップ治療装置市場成長を促進する主要な要因は何ですか?

膝筋骨格障害の増大と医療機器の技術の進歩は、フットドロップ治療装置市場を運転する主要な要因です。

フットドロップ処理装置市場における主要な製品タイプは?

主要なプロダクト タイプ区分は電気刺激装置です。

フットドロップ処理装置市場で動作する主要なプレーヤーはどれですか?

Ottobock, Bioness Inc., AxioBionics, Accelerated Care Plus Corporation, Saebo, Inc., Boston Orthotics & Prosthetics, Turbomed Orthotics, Össur, Thrive Orthopedics, Allard USA Inc., NextStep Robotics, Finetech Medical, Arthrex, Inc., Evolution Device, Narang Medical Limited, SCHECK & SIR, AliMed, The London Orthotics Consultancy Ltd, Pros, Spinal Solutions, Spinal Solutions, Spinal Solutions, Spinal Solutions, 主要プレイヤーおよび主要なプレーヤーは、主要なプレーヤーおよびユーザーのニーズに対応いたします。

フットドロップ処理装置市場のCATGは何ですか?

フットドロップ処理装置の市場CAGRは、2024-2031年より8.2%を予定しています。