Global Metagenomic Sequencing Market Size - Analysis

Global metagenomic sequencing market size is expected to reach US$ 6.16 Bn by 2032, from US$ 1.96 Bn in 2025, exhibiting a compound annual growth rate (CAGR) of 17.8% during the forecast period. Metagenomic sequencing refers to the direct genetic analysis of genomes that are contained within an environmental sample. It involves the study of genetic material recovered from environmental samples such as water or soil directly, without the need for culturing individual species. The technique provides a powerful tool to assess the biodiversity of microbial communities and understand their role in ecosystems. Metagenomic sequencing allows researchers to access and study the vast majority of microbes that cannot be cultured in a lab. It helps in identifying novel genes, enzymes, and natural products which have diverse applications in biotechnology, agriculture, medicine, renewable energy, bioremediation and more. The growth of the market is due to the decreasing costs of sequencing, advancements in sequencing technologies, growing genomics research, and rising government and private funding for metagenomics research.

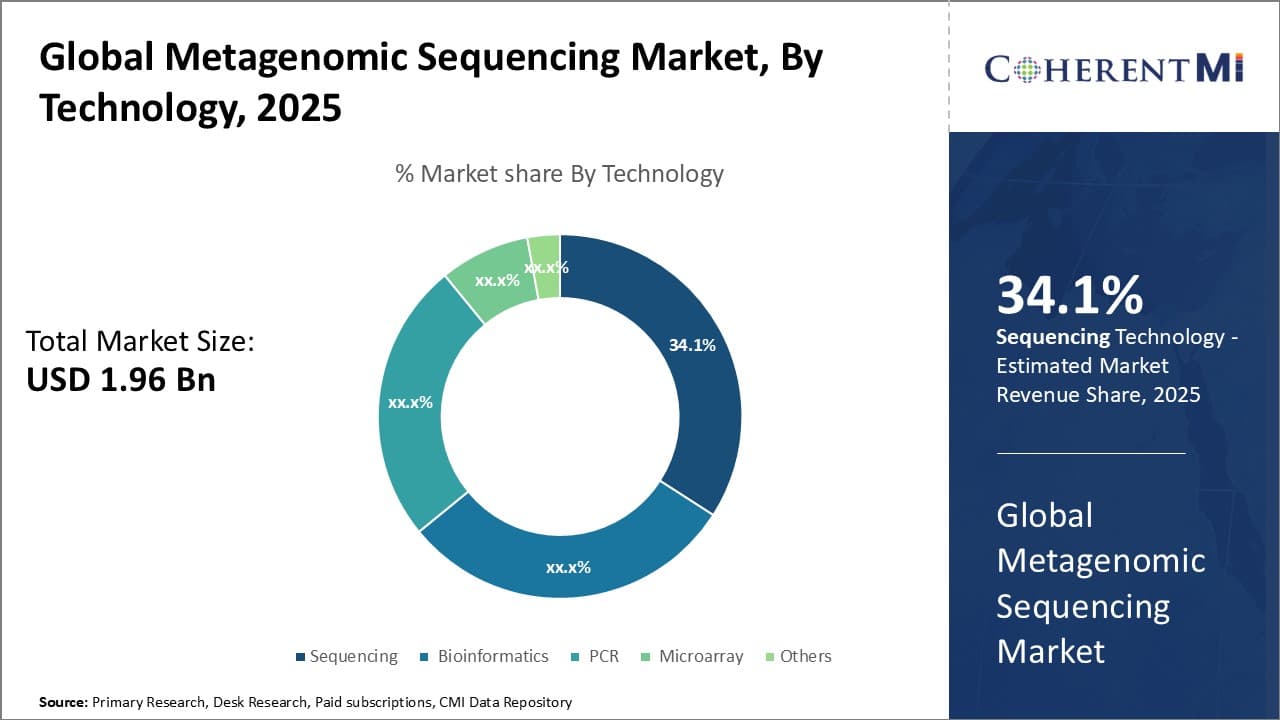

The metagenomic sequencing market is segmented into technology, offerings, application, end user and region. By technology, the market is segmented into sequencing, bioinformatics, PCR, microarray, and others. The sequencing segment accounted for the largest share in 2025. The growth of this segment is due to the continuously declining costs of sequencing and technological improvements in Next-generation Sequencing (NGS) platforms.

Global Metagenomic Sequencing Market Drivers

- Decreasing sequencing costs: The cost of sequencing has declined substantially over the past decade, thus making metagenomic sequencing more accessible to a wider range of researchers and end users. The cost of sequencing a human genome was over US$ 100 million in 2001. This has reduced to around US$600-1000 per genome with the advent of next-generation sequencing technologies by companies like Illumina, a biotechnology company, Oxford Nanopore, and others. Similarly, the cost per Mb of microbial sequencing has also fallen exponentially from thousands to just a few dollars. This is expanding the adoption of metagenomic sequencing in research and clinical applications. Continued improvements in sequencing chemistries, instruments, miniaturization, and nanotechnologies will further lower the costs and support the growth of the metagenomic sequencing market.

- Technological advancements in sequencing platforms: New and advanced high-throughput next generation sequencing (NGS) platforms are being developed and launched by companies. These provide higher accuracy, faster turn-around times, longer read lengths, and ability to sequence more samples in a single run. For instance, in September 2020, Oxford Nanopore Technologies, a UK-based company launched the PromethION 2 Solo for nanopore-based long read sequencing. It offers on-demand access to 48 flow cells and increased throughput. Similarly, Illumina launched NovaSeq X Series sequencers that can produce 6Tb of data in less than two days. Such advanced sequencing systems are driving the adoption of metagenomics in various research and clinical fields.

- Growth of metagenomics research: Metagenomics research to analyze microbial communities has gained significant interest over the past decade. The number of metagenomics studies published has grown exponentially from less than 100 in 2007 to over 2000 in 2019 as per the National Center for Biotechnology Information (NCBI) database. Moreover, large-scale metagenomics projects like the Earth BioGenome Project, MetaSUB, and the human microbiome project have been established in recent years. This growing research is supported by declining costs, improved databases and increasing applications across healthcare, biotechnology, agriculture, and other fields.

- Government and private funding: Substantial government and private funding is being provided globally to support metagenomics research initiatives and projects. For instance, the U.S. government announced US$ 515 million funding for the Human Microbiome Project in 2019. Similarly, MetaSUB, an international organization, received US$ 5 million in funding from Genome Canada and Ontario Genomics for microbiome sequencing of global cities. Likewise, private entities like the Gates Foundation, Wellcome Trust, and Simons Foundation provide huge research grants for metagenomics studies. This availability of research funding will propel market growth.

Global Metagenomic Sequencing Market Opportunities

- Synthetic biology and genetic engineering: Metagenomics is uncovering novel enzymes, bioactives, and pathways in microbes that have huge potential for synthetic biology and metabolic engineering applications. The companies are mining metagenomic sequence data to identify novel antimicrobials, biopolymers, biosurfactants, biocatalysts and others which can be heterologously expressed and commercially produced via synthetic biology approaches. For instance, in June 2021, Ginkgo Bioworks, a biotech company, leveraged metagenomics to produce novel cannabinoids. Such applications create significant opportunities for market growth.

- Agri-biotechnology: Metagenomics is enabling identification of plant growth promoting microbes, biocontrol agents, microbial inoculants and others that can transform agricultural productivity in a sustainable manner. The companies like AgBiome, Indigo, and others are leveraging metagenomics for bioprospecting of agricultural microbiomes and developing microbial crop protection and growth enhancement products. The agri-biotech applications of metagenomics will spur its adoption in the near future.

- Bioremediation: Metagenomics allows rapid assessment of microbial communities at contaminated sites and aids in bioaugmentation or biostimulation-based bioremediation approaches. It helps monitor changes during bioremediation and identify novel degrading microbes and catabolic genes. Metagenomics analysis is being widely used for bioremediation of soils that are contaminated with hydrocarbons, heavy metals, dyes, and others. The central role of metagenomics in environmental biotechnology creates significant opportunities.

- Single cell metagenomics: Single cell sequencing technologies are enabling metagenomics at the resolution of individual cells, revealing extensive heterogeneity even within the same species. Single cell metagenomics provides finer taxonomic classification, improves detection of rare taxa, and enables genome reconstruction. For instance, in March 2025, 10x Genomics, Biotechnology Company offers single cell metagenomics workflows that can profile thousands of uncultured microbes in parallel. Single cell metagenomics provides new insights and will be a fast-growing opportunity area.

Global Metagenomic Sequencing Market Restraints

- Complexity of data analysis: Metagenomic analysis involves bioinformatically intensive workflows for quality control, taxonomic classification, functional annotation, comparative analysis, and others. Lack of complete reference databases also hampers analysis. Multi-omics integration poses additional challenges. Expertise in microbiology, statistics and computation biology is required for deriving meaningful insights. This complexity limits wider adoption.

Counterbalance: complete reference databases should be made available by the market players to make correct analysis of the same.

- Need for standardized protocols: The lack of standardized protocols for sample collection, metadata recording, DNA/RNA extraction, library prep, and data analysis affects inter-study comparability. Variations in these steps can bias results. Establishing robust experimental and analytical standards is essential for high-quality metagenomics studies and translation into clinical applications.

- Ethical and legal concerns: Metagenomic analysis of human samples raises privacy concerns due to potential extraction of host Deoxyribonucleic Acid (DNA). Accessibility of human microbiome data requires careful handling as per regulations like Health Insurance Portability and Accountability Act (HIPAA). Environmental metagenomic mining for commercial use also raises issues like benefit sharing, prior informed consent, and others Addressing these ethical and legal issues is important for the field.

Analyst’s View on Global Metagenomic Sequencing Market:

Global metagenomic sequencing market is expected to witness steady growth over the forecast period due to increased adoption of workforce management software and cloud-based platforms. It present an opportunity for stakeholders to optimize resource planning and allocation on a real-time basis and the rising demand for nurses caused by aging populations worldwide and increasing prevalence of chronic diseases. Developed markets in North America and Western Europe dominate due to higher allocation of resources to the healthcare sector compared to other regions

Market Size in USD Bn

CAGR17.8%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 17.8% |

| Fastest Growing Market | Asia Pacific |

| Larget Market | North America |

| Market Concentration | High |

| Major Players | Illumina, QIAGEN, Thermo Fisher Scientific, Oxford Nanopore Technologies, BGI Group and Among Others |

please let us know !

Global Metagenomic Sequencing Market Trends

- Focus on metadata collection and standards: There is increasing focus on systematic collection of metadata like sampling location, physicochemical parameters, and others. along with metagenomic sequence data to enable more contextual analysis. Initiatives like the Genomic Standards Consortium provide standards for consistent meta and phenotypic data collection. Moreover, public databases like MG-RAST have enforced minimum metadata standards for all submitted data sets. Complete and standardized metadata aids biological interpretation and trend analysis.

- Long read sequencing: Long read sequencing technologies like nanopore and PacBio allow sequencing of full length 16S rRNA genes and even complete bacterial and archeal genomes from metagenomic samples. This provides finer resolution and accurate taxonomic classification as compared to short reads. Long reads also aid better genome assembly and annotation from complex metagenomes. With improving accuracy and throughput, long read sequencing usage is increasing for metagenomics.

- Bioinformatics solutions: Advances in bioinformatics tools and workflows for metagenomic analysis like metaSPAdes, MEGARes, HUMAnN, and others are improving taxonomic and functional profiling from sequence data. Cloud-based solutions like CosmosID, One Codex, and others provide user-friendly and rapid metagenomic analysis for non-experts. Integrated sample-to-report solutions are enhancing adoption among biologists and clinicians. Automated analysis by AI/ML tools is also an emerging trend.

- Database expansion: Reference genome databases that are required for taxonomic classification and functional annotation are continuously expanding. Initiatives like the Uncultivated Bacteria and Archaea project and Hungate Collection are focused on sequencing type strains of novel microbes to populate databases. Databases like IMG, SILVA, GreenGenes, KEGG are frequently updated with new microbial genomes, functional pathways, and others Richer databases allow more accurate metagenomic analysis.

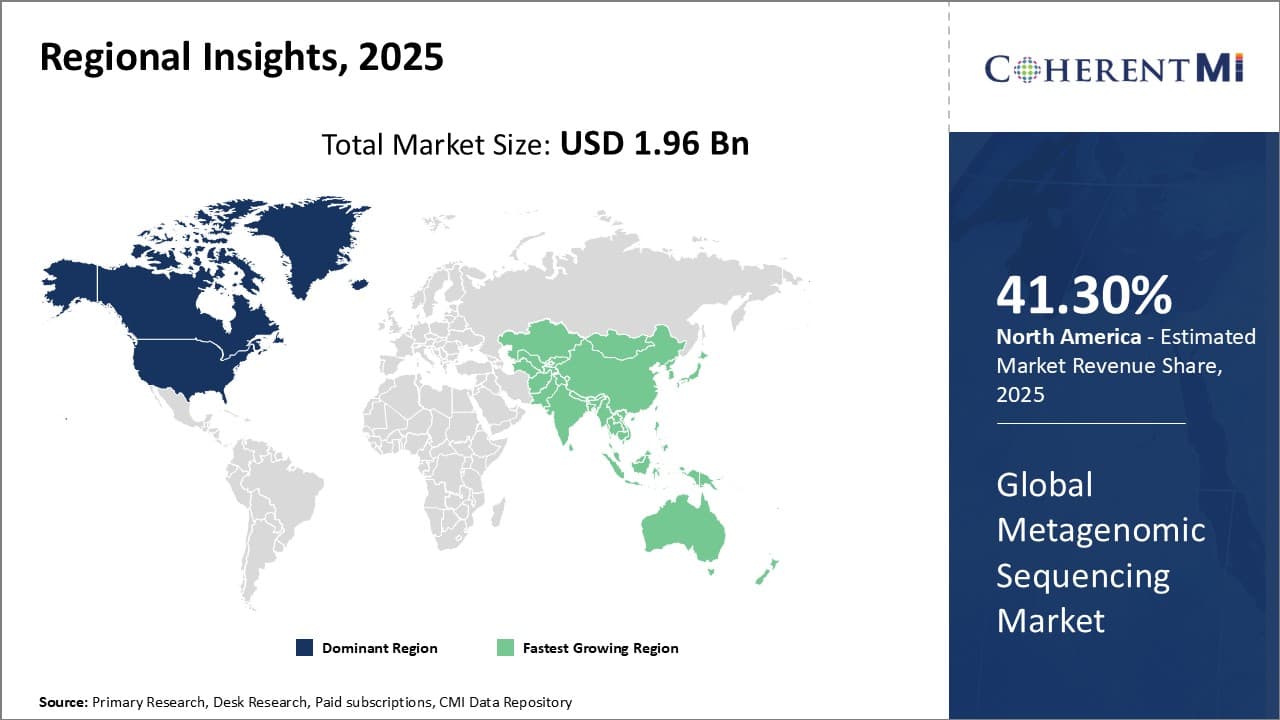

Global Metagenomic Sequencing Market Regional Insights

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy- North America is expected to be the largest market for metagenomic sequencing market during the forecast period, accounting for over 41.3% of the market share in 2025. The growth of the market in North America is due to the high research and development (R&D) expenditure, presence of major companies, and rapid adoption of advanced sequencing technologies in the region.

- The Europe market is expected to be the second-largest market for metagenomic sequencing market, accounting for over 28.7% of the market share in 2025. The growth of the market in Europe is due to the availability of research funding and presence of leading metagenomics research organizations in the region.

- The Asia Pacific market is expected to be the fastest-growing market for metagenomic sequencing market, with a CAGR of over 22.6% during the forecast period. The growth of the market in Asia Pacific is due to the growing genomics research, increasing awareness, and improving healthcare infrastructure in the region.

Segmental Analysis of Global Metagenomic Sequencing Market

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Competitive overview of Global Metagenomic Sequencing Market

Illumina, QIAGEN, Thermo Fisher Scientific, Oxford Nanopore Technologies, BGI Group, PerkinElmer, GENEWIZ, Macrogen, Zymo Research, Diversigen, Microsynth AG, BaseClear, MR DNA (Molecular Research), Eurofins Scientific, Novogene Corporation, NuGEN Technologies, Takara Bio, Swift Biosciences, New England Biolabs, and CosmosID

Global Metagenomic Sequencing Market Leaders

- Illumina

- QIAGEN

- Thermo Fisher Scientific

- Oxford Nanopore Technologies

- BGI Group

Recent Developments in Global Metagenomic Sequencing Market

New product launches

- On June 20 2023, Delve Bio, a pioneer in metagenomic next-generation sequencing (mNGS) for infectious diseases, debuts with US$ 35 million in Series A financing led by Perceptive Xontogeny Venture Fund II (PXV Fund II) – and joined by Section 32 and GV. The funds will be used to commercialize the company’s mNGS-based infectious disease test – which was developed by world-renowned infectious disease experts at the University of California San Francisco (UCSF) Center for Next-Gen Precision Diagnostics – and advance a pipeline of next-generation tests.

- In July 2022, Thermo Fisher Scientific, a biotechnology company, launched the Applied Biosystems QuantStudio Absolute Q Digital PCR System, an advanced digital PCR platform to provide ultra-sensitive quantification of nucleic acids.

- In March 2021, Illumina, a biotechnology company, launched the NovaSeq X Series, new ultra-high throughput sequencing platforms, thus enabling researchers to complete the largest sequencing projects in days

- In June 2020, Oxford Nanopore Technologies launched Flongle for rapid, scalable, and low-input metagenomics on nanopore sequencing. It simplifies metagenomic workflows.

Acquisition and partnerships

- On November 02, 2023, QIAGEN, a Netherlands-based holding company, and Element Biosciences, Inc., a multi-disciplinary life science company, announced a strategic partnership to offer comprehensive next-generation sequencing (NGS) workflows for the Element AVITI System, an innovative sequencing platform.

- On January 05, 2023, QIAGEN, a Netherland-based holding company, announced an exclusive strategic partnership with U.S. -based population genomics leader Helix, to advance companion diagnostics for hereditary diseases.

- In November 2022, Ionis Pharmaceuticals, Inc., a biotechnology company, and Metagenomi, a gene editing company, announced that the companies have entered a collaboration that will leverage Ionis Pharmaceuticals', extensive expertise in RNA-targeted therapeutics and Metagenomi's versatile next-generation gene editing systems to pursue a mix of validated and novel genetic targets that have potential to expand therapeutic options for patients. The companies will jointly conduct research which is aimed initially at delivering investigational medicines for up to four genetic targets.

- In October 2022, Illumina acquired Ultima Genomics, a biotechnology company, to integrate its sequencing technology into Illumina's suite of genomic solutions. This acquisition will help accelerate the adoption of Ultima Genomics’s innovative sequencing architecture.

- In June 2021, PerkinElmer, global provider of technology and service solutions, acquired Nexcelom Bioscience, a leading provider of automated cell counting and analysis systems. This acquisition enhances PerkinElmer's biosciences capabilities and enabled it to provide essential workflows for cell-based metagenomics research.

- In September 2020, Thermo Fisher Scientific partnered with the California Institute of Technology (Caltech) to advance metagenomics research. This partnership helped establish Thermo Fisher Scientific's Center of Innovation for emerging and enabling technologies at Caltech.

Global Metagenomic Sequencing Market Segmentation

- By Technology:

-

- Sequencing

- Bioinformatics

- PCR

- Microarray

- Others

- By Offerings:

-

- Instruments

- Reagents & Consumables

- Services

- Analysis Softwares

- By Application:

-

- Drug Discovery

- Disease Diagnosis

- Environmental Remediation

- Gut Microbe Characterization

- Others

- By End User:

-

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Agriculture & Biofuel Companies

- Hospitals & Clinics

- Others

- By Region:

-

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East

- Africa

Would you like to explore the option of buying individual sections of this report?

Abhijeet Kale is a results-driven management consultant with five years of specialized experience in the biotech and clinical diagnostics sectors. With a strong background in scientific research and business strategy, Abhijeet helps organizations identify potential revenue pockets, and in turn helping clients with market entry strategies. He assists clients in developing robust strategies for navigating FDA and EMA requirements.