Global Rapid Influenza Diagnostic Tests Market Size - Analysis

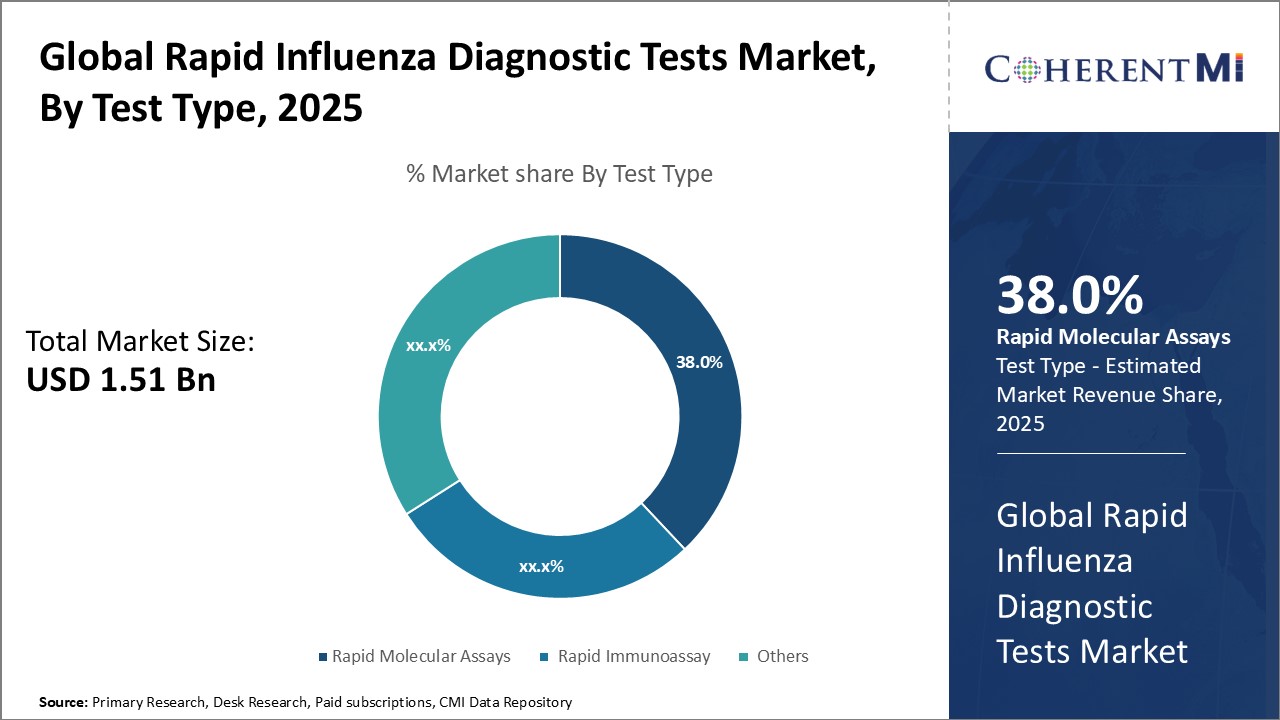

The rapid influenza diagnostic tests market is segmented based on test type, end user, influenza type, specimen type, end user, and region. By test type, the market is segmented into rapid molecular assays, rapid immunoassays, and others. The rapid immunoassays segment accounted for the largest share in 2025. The large share of this segment can be attributed to the easy availability, low cost, and quick turnaround time of rapid immunoassays.

Rapid Influenza Diagnostic Tests Market Drivers:

- Increasing prevalence of seasonal influenza: The rising prevalence of seasonal influenza across the globe is a major factor driving the demand for rapid diagnostic testing. According to World Health Organization (WHO), annual influenza epidemics affect 3-5 million individuals worldwide, resulting in 290,000-650,000 deaths due to respiratory disorders. The increasing incidence of influenza is leading to a growing need for timely diagnosis to facilitate appropriate antiviral treatment and infection control. The use of rapid diagnostic tests allows for the quick identification of influenza cases, within 30 minutes, to aid in prompt clinical management decisions. Additionally, the ability of rapid tests to differentiate between influenza A and B subtypes assists in targeted therapeutic approaches. The growing disease burden of seasonal flu is therefore fueling the greater adoption of rapid influenza diagnostic assays.

- Growing demand for point-of-care influenza testing: The demand for rapid, point-of-care influenza testing has risen significantly over recent years owing to the need for decentralized diagnosis. Rapid influenza diagnostic tests can be performed in close proximity to the patient rather than sending samples to reference labs. The provision of quick results through POC (Point-of-Care) testing allows physicians to prescribe appropriate antiviral drugs during the patient visit. Moreover, the implementation of POC influenza testing in outpatient settings reduces unnecessary antibiotic prescriptions and hospital admissions. The rising demand for POC testing is boosting the use of rapid influenza diagnostic assays in clinical settings.

- Technological advancements in rapid influenza testing: Continuous advancements in rapid diagnostic technologies are supporting the market growth. Companies are focused on developing assays with higher sensitivity, quicker turnaround times and ability to differentiate between influenza A subtypes.

- Increasing initiatives by government health agencies: Various awareness initiatives and recommendations by government health agencies are catalyzing greater uptake of rapid influenza testing. For example, CDC (Centers for Disease Control and Prevention) advises the use of rapid influenza diagnostic tests for clinical decision-making during flu season. Additionally, the availability of reimbursements and insurance coverage for rapid flu testing encourages its adoption in clinical settings. Such guidelines and favorable policies by health authorities are promoting the wider use of rapid assays for timely influenza diagnosis and management.

- Growth opportunities in emerging markets: Emerging markets across Latin America, Asia Pacific, and Middle East represent significant growth opportunities owing to the large target population and rising healthcare expenditure. The epidemiology of influenza is gradually increasing in developing economies due to various factors like urbanization, tourism, and climate change. Moreover, investments in healthcare infrastructure and access to affordable diagnostics are rising in these regions. Key players can focus on entering emerging economies by developing cost-effective and simple rapid influenza tests tailored to regional needs. In March 2025, Virax Biolabs, a biotechnology company announced a distribution agreement for the distribution of Avian Influenza A Virus ("AIV") real-time PCR test kit to CE-marked markets, especially the European Union. The test kit detects and distinguishes ribonucleic acid from AIV and the H5, H7, and H9 subtypes including the H5N1 strain circulating in Europe.

- Increasing adoption of multiplex molecular assays: The adoption of multiplex molecular assays that can simultaneously detect and differentiate between influenza A, influenza B, and other respiratory pathogens in a single test is rising. These syndromic multiplex tests provide faster results and higher accuracy compared to conventional rapid assays. Players operating in the rapid influenza diagnostic tests market can focus on technologically advanced multiplex assays to gain a competitive edge. Additionally, the integration of multiplex technologies with point-of-care testing platforms provides significant growth prospects.

- Growing demand for OTC rapid testing: There is a growing consumer preference for over-the-counter rapid diagnostic testing for influenza monitoring and management. The availability of accurate, easy-to-use OTC influenza tests allows individuals to get timely results in the comfort of home. Leading players are developing advanced OTC rapid assays to cater to rising consumer demand for self-testing. The flourishing rapid influenza diagnostic tests market provides lucrative opportunities for expansion in the rapid influenza diagnostics space. Companies can focus on differentiated OTC products to strengthen their market position.

- Pricing pressure due to intense competition: The rapid influenza diagnostic tests market is highly competitive with the presence of numerous regional and global industry players. The high intensity of competition puts pricing pressure, negatively impacting the profit margins and market share of companies. Small and medium players have to considerably undercut prices to gain the market share. This pricing pressure acts as a major restraint for players in the influenza rapid testing market. Companies are forced to compromise on marketing expenditures amid shrinking profit margins.

- Limitations of rapid antigen testing: Rapid influenza antigen detection tests have lower sensitivity compared to molecular techniques for influenza diagnosis. According to CDC, the sensitivity of rapid influenza tests ranges from 50-70% implying false negative results. Moreover, rapid tests are only qualitative assays, thus do not provide viral load measurements. The limitations around sensitivity and quantification hinder the utility of antigen-based rapid influenza tests. This is restricting widespread adoption among physicians despite benefits such as quick turnaround time.

- Stringent regulatory requirements: Stringent regulations related to diagnostic test approvals across various countries are hampering the growth of the rapid influenza testing market. In the U.S., influenza rapid tests need 510(k) clearance from the U.S. FDA (Food and Drug Administration) which is an expensive and time-consuming process. Additionally, the need for clinical validation data to establish sensitivity and specificity adds to market entry barriers. Similar strict approval regulations are present in Europe and other countries, thereby restricting product commercialization. This negatively impacts player investments and margins.

Market Size in USD Bn

CAGR8.1%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.1% |

| Fastest Growing Market | Asia Pacific |

| Larget Market | North America |

| Market Concentration | High |

| Major Players | Quidel Corporation, Becton Dickinson and Company, Thermo Fisher Scientific, Abbott Laboratories, F.Hoffmann-La Roche Ltd. and Among Others |

please let us know !

Global Rapid Influenza Diagnostic Tests Market Trends

- Technological integration with Artificial Intelligence (AI): The integration of AI and machine learning capabilities in rapid diagnostic testing workflows is an emerging trend. AI allows for automated reading and interpretation of assay results, reducing human errors. Players are incorporating AI technology to develop smarter rapid influenza tests that provide more accurate and objective diagnosis.

- Increasing use of smartphone-based fluorescence assays: Smartphone-based fluorescence microscopy is gaining increasing interest for the development of rapid POC diagnostic tests. Fluorescence assays provide greater sensitivity than conventional lateral flow immunoassays. The use of miniaturized fluorescence readers coupled with smartphones allows for portable, accurate testing at POC settings.

- Growing industry focus on multiplex molecular testing: Major market players are increasingly focusing on introducing rapid multiplex molecular assays for combined influenza and respiratory pathogen testing. For instance, in September 2022, Cepheid, molecular diagnostics company launched Xpert Xpress Flu/RSV Plus, a rapid molecular test for detection of flu A, flu B, and RSV from a single nasal swab. The availability of such multiplex tests that provide faster, accurate results in 30-60 minutes is paving the way for multiplex testing to emerge as the new industry standard.

- Shift towards decentralized POC testing models: There is a rising trend towards decentralized diagnostic testing models for influenza and infectious diseases. Key industry players are making investments in advancing POC testing capabilities. Rapid antigen tests are being adapted into portable, easy-to-use formats suitable for POC environments. Decentralized community testing sites, retail clinics, and mobile health clinics provide immense potential for POC deployment of rapid flu tests. This allows for timely influenza diagnosis and reduced burden on hospitals & labs.

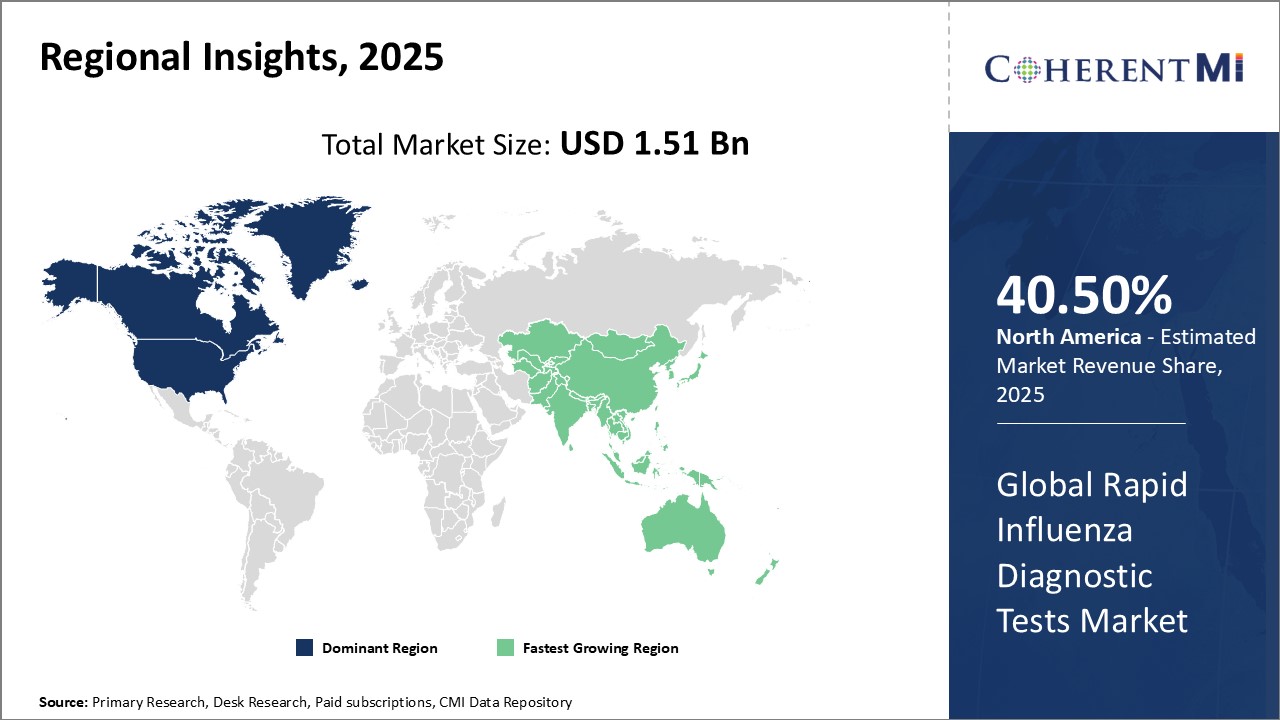

Rapid Influenza Diagnostic Tests Market Regional Insights:

- North America is expected to be the largest market for rapid influenza diagnostic tests during the forecast period, which accounted for over 40.5% of the market share in 2025. The growth of the market in North America is attributed to the high burden of seasonal influenza, favorable reimbursement policies, and the presence of major market players in the region.

- Europe is expected to be the second-largest market for rapid influenza diagnostic tests, which accounted for over 27.7% of the market share in 2025. The growth of the market in Europe is attributed to the rising awareness about timely disease diagnosis and increasing healthcare expenditure in the region.

- Asia Pacific market is expected to be the fastest-growing market for rapid influenza diagnostic tests, which is expected to grow at a CAGR of over 9.5% during the forecast period. The growth of the market in Asia Pacific is attributed to the large population base, growing prevalence of influenza, and improving healthcare infrastructure in the region.

Segmental Analysis of Global Rapid Influenza Diagnostic Tests Market

Competitive overview of Global Rapid Influenza Diagnostic Tests Market

Major players operating in the rapid influenza diagnostic tests market include Quidel Corporation, Becton Dickinson, Thermo Fisher Scientific, Abbott Laboratories, F. Hoffmann-La Roche, DiaSorin, Luminex Corporation, Meridian Bioscience, GenMark Diagnostics, Sekisui Diagnostics, and Virax Biolabs are the major players operating in the market.

Global Rapid Influenza Diagnostic Tests Market Leaders

- Quidel Corporation

- Becton Dickinson and Company

- Thermo Fisher Scientific

- Abbott Laboratories

- F.Hoffmann-La Roche Ltd.

Global Rapid Influenza Diagnostic Tests Market - Competitive Rivalry

Global Rapid Influenza Diagnostic Tests Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Global Rapid Influenza Diagnostic Tests Market

New product launches & approvals:

- In February 2023, the U.S. FDA (Food and Drug Administration) issued an emergency use authorization (EUA) for the first over-the-counter (OTC) at-home diagnostic test that can differentiate and detect influenza A and B, commonly known as the flu, and SARS-CoV-2, the virus that causes COVID-19

- In November 2022, Virax Biolabs, a global biotechnology company, announced the availability of an RSV-Influenza-COVID Triple Virus Antigen Rapid Test Kit in regions that recognize the CE mark such as the European Union

- In July 2022, Thermo Fisher Scientific, a global biotechnology company, announced the launch of Applied Biosystems TaqPath Respiratory Viral Select Panel; a CE-IVD-marked molecular assay panel for the detection of five common viruses including those that cause the common cold, bronchiolitis, croup, influenza-like illnesses, and pneumonia

Acquisition and partnerships:

- In February 2023, Virax Biolabs, a global biotechnology company, announced the signing of a purchase order with Cosmos Health, a healthcare company to launch and market COVID-19 and Influenza A+B Antigen Combo Rapid Detection Kits

- In June 2021, PerkinElmer, medical technology company acquired BioLegend, a leading provider of life science antibodies and reagents, for US$ 5.25 Bn to enhance its portfolio of discovery and diagnostics solutions.

Global Rapid Influenza Diagnostic Tests Market Segmentation

- By Test Type

-

- Rapid Molecular Assays

- Rapid Immunoassays

- Others

- By Influenza Type

-

- Influenza type A

- Influenza type B

- Influenza type C

- Others

- By Specimen Type

-

- Nasopharyngeal swab

- Nasal swab

- Throat swab

- Others

- By End User

-

- Diagnostic Laboratories

- Hospitals & Clinics

- Research Institutes

- Others

- By Region

-

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Would you like to explore the option of buying individual sections of this report?

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Frequently Asked Questions :

How big is the Global Rapid Influenza Diagnostic Tests Market?

The Global Rapid Influenza Diagnostic Tests Market is estimated to be valued at USD 1.5 in 2025 and is expected to reach USD 2.6 Billion by 2032.

What are the major factors driving the rapid influenza diagnostic tests market growth?

The factors which are driving the market growth includes Increasing prevalence of influenza, growing awareness about early diagnosis, advancement in testing technologies, favorable government initiatives.

Which is the leading component segment in the rapid influenza diagnostic tests market?

The leading component segment is the rapid immunoassays.

Which are the major players operating in the rapid influenza diagnostic tests market?

Quidel Corporation, Becton Dickinson, Thermo Fisher Scientific, Abbott Laboratories, F. Hoffmann-La Roche, DiaSorin, Luminex Corporation, Meridian Bioscience, GenMark Diagnostics, Sekisui Diagnostics, and Virax Biolabs are the major players operating in the market.

Which region will lead the rapid influenza diagnostic tests market?

North America is expected to lead the rapid influenza diagnostic tests market.

What will be the CAGR of the rapid influenza diagnostic tests market?

The CAGR is 8.1% during 2025-2032.