Glycated Haemoglobin Testing Market Size - Analysis

The glycated haemoglobin testing market is estimated to be valued at USD 260.0 Mn in 2025 and is expected to reach USD 469.2 Mn by 2032, growing at a compound annual growth rate (CAGR) of 8.8% from 2025 to 2032.

The glycated haemoglobin testing market is expected to witness significant growth over the forecast period. The market is driven by rising diabetes prevalence across the globe. As per WHO, the global diabetes cases are expected to double from current 422 million to over 700 million by 2045. Rising obese population is another factor augmenting the risk of diabetes, thereby propelling demand for regular blood sugar monitoring tests such as glycated haemoglobin testing.

Market Size in USD Mn

CAGR8.8%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.8% |

| Market Concentration | High |

| Major Players | Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Tosoh Corporation, Bio-Rad Laboratories and Among Others |

please let us know !

Glycated Haemoglobin Testing Market Trends

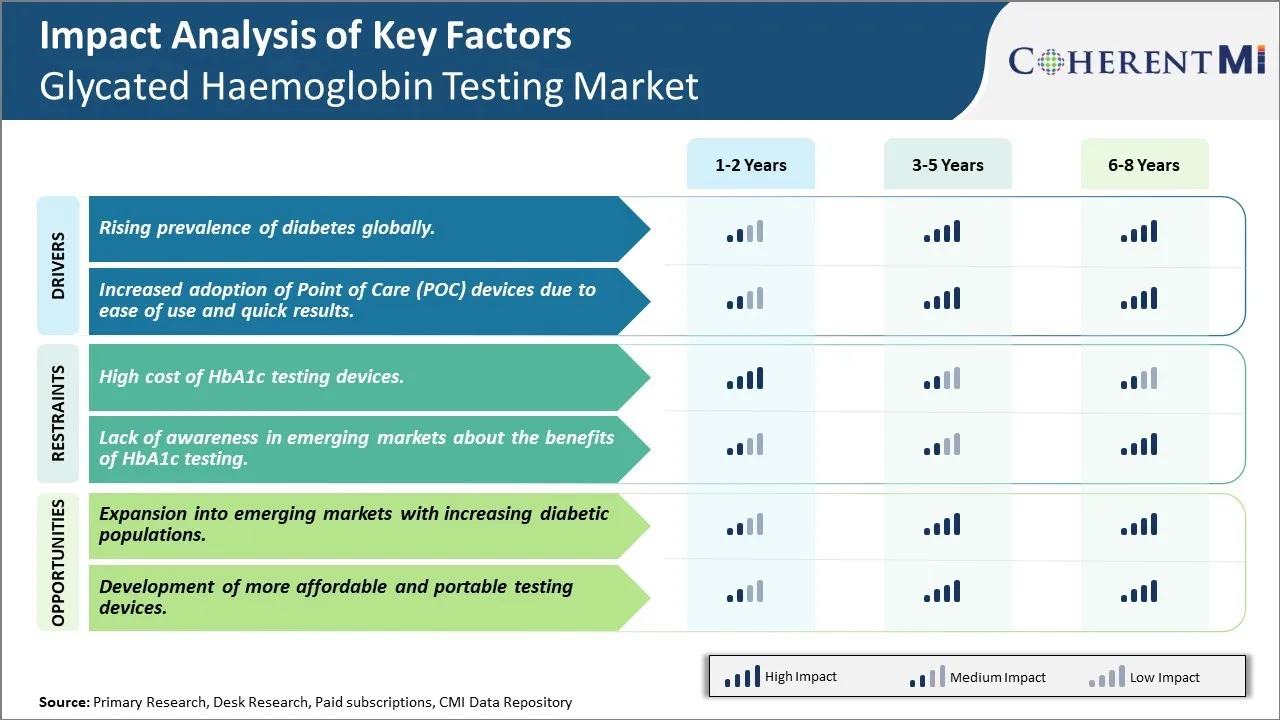

Market Driver - Rising prevalence of diabetes globally

The increasing prevalence of diabetes cases around the globe has been a key growth driver for the glycated haemoglobin testing market. Diabetes is a chronic condition that affects millions worldwide, with numbers continuing to grow each year due to lifestyle changes, urbanization and an aging population. According to estimates by the International Diabetes Federation, over 460 million adults were living with diabetes in 2019, with the figure projected to rise to around 630 million by 2030 and 700 million by 2045.

The rising diabetes population directly correlates with the increase in demand for glycated haemoglobin testing. HbA1c or glycated haemoglobin is the standardized clinical test for monitoring glycemic control in patients with diabetes. Regular testing helps physicians assess a patient's average blood sugar levels over the past 2-3 months period and determine if their treatment plan requires adjustments. It also has diagnostic value in confirming a diabetes diagnosis. As more people develop diabetes or are diagnosed with the condition, healthcare providers recommend periodic HbA1c testing to closely track the disease and minimize complications through optimal glycemic management.

Another crucial factor is the growing awareness regarding the importance of HbA1c monitoring among both physicians and diabetics. Strict glucose control through medicines, lifestyle changes and HbA1c monitoring has been shown to significantly reduce the risks of diabetes-related complications like heart disease, kidney damage and nerve damage. With rising health education, more patients are willing to undergo regular testing as recommended by clinical guidelines. Doctors too place greater focus on HbA1c levels for enhanced diabetes care. These trends have substantially expanded the customer base for HbA1c testing products and services globally.

Market Driver - Increased adoption of Point of Care (POC) devices due to ease of use and quick results

The glycated haemoglobin testing market has witnessed rising popularity of point-of-care (POC) devices among healthcare providers as well as patients. Traditionally, HbA1c testing involved sending samples to a central laboratory and waiting at least a couple of days to receive reports. However, the emergence of compact, easy-to-use POC analyzers has enabled prompt HbA1c testing at clinics, hospitals and even home settings.

POC HbA1c analyzers deliver lab-accurate results within a short span of 5-15 minutes from a small blood sample, without the need for sample shipment. Their portability and small footprint allow testing to be conveniently performed near the patient. This serves as a major advantage in busy clinical settings as well rural locations where access to central labs may be limited. The rapid availability of HbA1c results assists healthcare practitioners in making timely treatment changes or medication adjustments directly during consultations.

From the patient perspective, POC devices offer convenience as they avoid unnecessary follow-up visits for collecting test reports or dealing with delayed results. The affordable price point of some systems also makes regular self-monitoring viable. Rising diabetes prevalence combined with busy lifestyles has created a strong demand for easy, accessible testing solutions without lengthy turnaround times. All these advantages have accelerated the adoption rate of POC HbA1c analyzers in hospitals, pharmacies, clinics and home settings. Their ease of operation with minimal training requirements is an added bonus. With continued technological advances, POC devices are projected to account for an increasing share of the global HbA1c testing market.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High cost of HbA1c testing devices

One of the major challenges faced by players in the glycated haemoglobin testing market is the high cost of HbA1c testing devices. HbA1c testing requires specialized equipment and reagents which make the devices expensive. The average cost of a basic HbA1c testing kit ranges between $15-$30. This high cost poses affordability issues, especially in developing countries and price-sensitive segments. Many patients in these regions cannot afford regular HbA1c tests due to financial constraints. This negatively impacts compliance to HbA1c monitoring and diabetes management. Device manufacturers face pricing pressures which impact their profit margins. Governments and insurers are also reluctant to pay for expensive testing methods. The high device costs also limit the popularization of home-based HbA1c testing which is more convenient for users. To address this challenge, players must focus on developing low-cost HbA1c testing technologies through innovative product designs, use of affordable materials and mass manufacturing techniques. Partnerships with regional diagnostic kit makers can help localized manufacturing and pricing.

Market Opportunity - Expansion into emerging markets with increasing diabetic populations

The glycated haemoglobin testing market has strong growth opportunities through expansion into emerging markets that have large and growing diabetic patient pools. Countries in Asia Pacific, Latin America, Africa and the Middle East are witnessing rapid economic development along with a rise in obesity and sedentary lifestyles. This has led to increased incidence of diabetes in these regions. According to estimates, over 80% of people with diabetes live in low and middle-income countries. As diabetes management practices advance in emerging nations, demand for regular HbA1c testing will increase significantly. Market players can tap into these regions by setting up local manufacturing, obtaining regulatory approvals, conducting awareness programs and partnering with regional healthcare providers. A focus on affordable product offerings tailored to these price-sensitive markets will be critical. This provides a large untapped market for companies and supports the long term growth prospects of the global glycated haemoglobin testing industry.

Key winning strategies adopted by key players of Glycated Haemoglobin Testing Market

Continuous innovation and development of new products has helped players gain an edge. For example, in 2017 Abbott launched its new Afinion HbA1c Dx assay, an advanced point-of-care test that provides accurate HbA1c results in 2 minutes. This allowed for faster diagnosis and treatment monitoring of diabetes in clinics and physician offices.

Leading players like Roche, Abbott and Siemens have expanded their geographical footprint by establishing manufacturing and distribution facilities globally. For example, in 2016 Roche invested over $100 million to set up a new manufacturing plant in China. This helped them cater to the fast growing Chinese HbA1c testing market and increased their market share in the region.

Strategic acquisitions of smaller companies has helped big players augment their product portfolios and capabilities. For instance, in 2015 Danaher acquired Cepheid for $4 billion, enhancing its molecular diagnostics business. Cepheid owned the Veritor System, a popular rapid HbA1c point-of-care testing platform, boosting Danaher's position in that segment.

Partnerships and Distribution Agreements: Companies partner with physicians, hospitals, pharmacies and diagnostic labs to ensure seamless access and adoption of their HbA1c testing solutions. For example, Abbott ties up with dozens of pharmacy chains in the US like CVS and Walgreens to market and distribute its HbA1c POINT OF CARE product line, driving increased sales.

Segmental Analysis of Glycated Haemoglobin Testing Market

To learn more about this report, Download Free Sample Copy

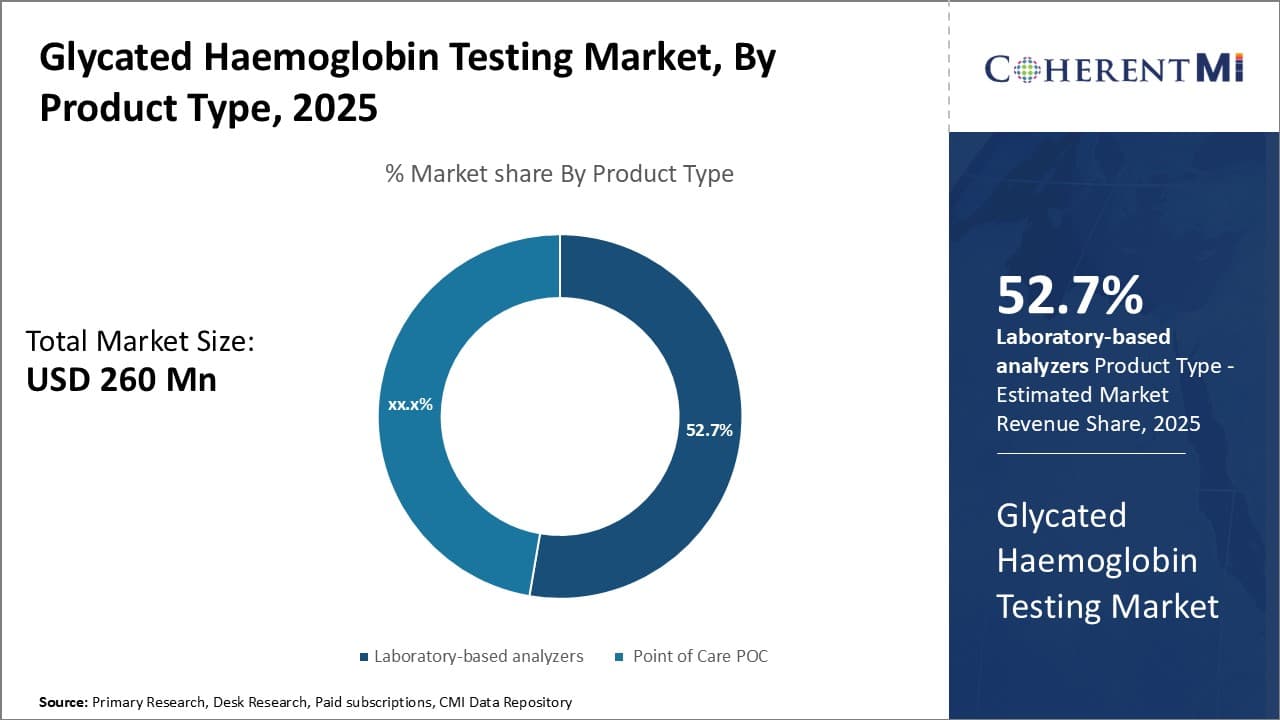

Insights, By Product Type: Growth in central lab testing and automation driving laboratory-based analyzers segment

To learn more about this report, Download Free Sample Copy

Insights, By Product Type: Growth in central lab testing and automation driving laboratory-based analyzers segment

In terms of product type, laboratory-based analyzers sub-segment contributes the highest share of 52.7% in the glycated haemoglobin testing market owing to the growth in central lab testing. Traditional HbA1c testing is increasingly shifting from PoC instruments to centralized clinical labs as they offer accurate and standardized analysis of large sample volumes with minimal manual intervention and error risks. The automation and high-throughput capabilities of Laboratory-based analyzers allow clinical labs to process hundreds of samples within a few hours, with consistent results, thus improving efficiencies. This centralized approach aligned with treatment guidelines recommending HbA1c monitoring for diabetes management at least twice a year. Further, many healthcare providers prefer the accuracy and traceability of lab instruments over PoC devices. Being primarily used in clinical labs with experienced technicians, Laboratory-based analyzers also have lower requirements for operator training and ongoing calibrations compared to PoC instruments. Going forward, the growing preference of healthcare providers for reliable laboratory testing due to legal liability concerns is expected to continue driving the laboratory-based analyzers segment.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

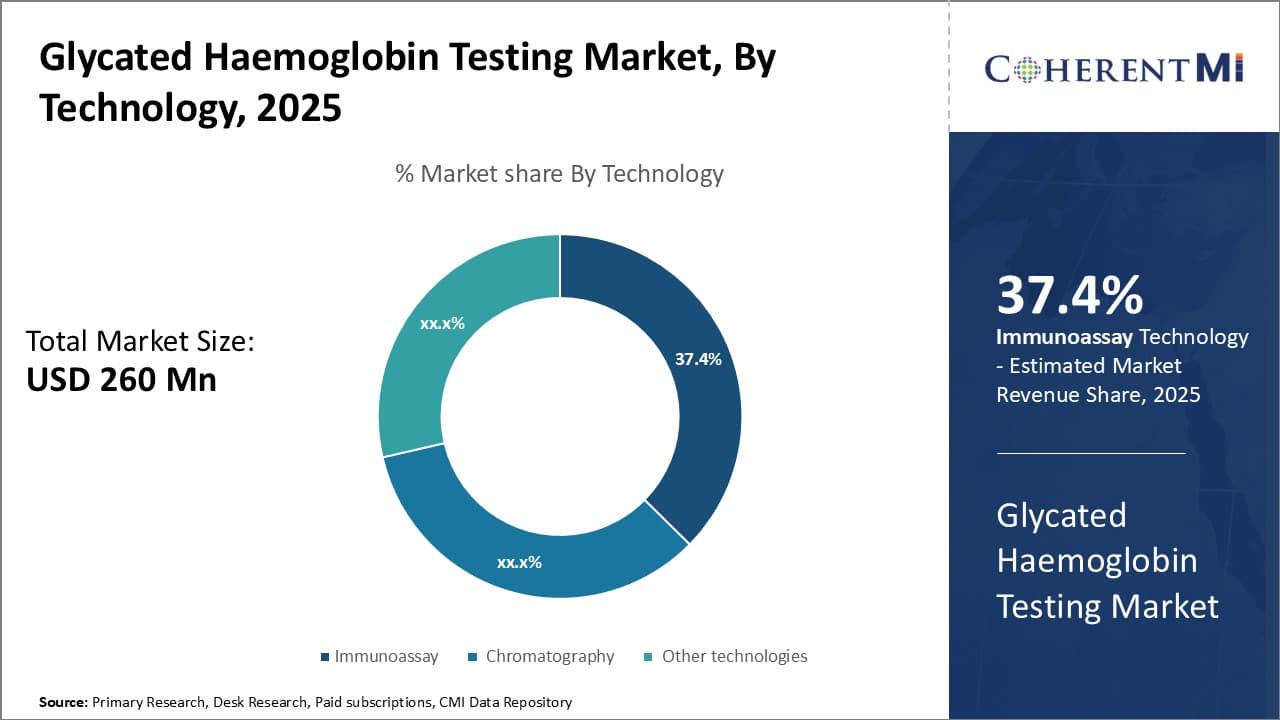

Insights, By Technology: Immunoassay's high accuracy and throughput favored for centralized HbA1c testing

In terms of technology, immunoassay sub-segment contributes the highest share of 37.4% in the glycated haemoglobin testing market owing to its high accuracy and throughput ideal for large-volume centralized testing. Clinically-validated immunoassay techniques such as HPLC, Boronate Affinity Chromatography and Enzymatic Assays are capable of automating the entire glycated hemoglobin testing process from sample preparation to quantitation and result reporting within clinical labs. This end-to-end automation streamlines high-volume HbA1c testing with consistent quality and minimum manual errors. Additionally, immunoassays offer superior accuracy for determining HbA1c levels, which is critical for treatment decisions and monitoring diabetes progression. Their reproducibility and reliability help standardize lab results across multiple samples and instruments in centralized settings. These advantages, along with continuous technology advancements lowering analysis time and costs, have made immunoassay the preferred technology for high-capacity clinical HbA1c testing. Immunoassays' centralized lab focus will allow the segment to grow in parallel with the overall migration of HbA1c testing from point-of-care to labs.

Additional Insights of Glycated Haemoglobin Testing Market

- The market for HbA1c testing is driven by the growing prevalence of diabetes worldwide. As diabetes becomes more common, especially in regions with large populations such as China and India, the demand for accurate and efficient diagnostic tests is increasing. HbA1c tests offer several advantages over traditional glucose monitoring, including no need for fasting, high stability, and less variability.

Competitive overview of Glycated Haemoglobin Testing Market

The major players operating in the glycated haemoglobin testing market include Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Tosoh Corporation, Bio-Rad Laboratories, ARKRAY, Inc., Danaher Corporation, Transasia Bio-Medicals Ltd. and PTS Diagnostics.

Glycated Haemoglobin Testing Market Leaders

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Tosoh Corporation

- Bio-Rad Laboratories

Recent Developments in Glycated Haemoglobin Testing Market

- In January 2024, Roche Diagnostics introduced a new HbA1c testing device aimed at improving accuracy in diabetes diagnosis.

- In May 2023, Siemens Healthineers expanded its laboratory-based HbA1c analyzer line to include more efficient and faster testing capabilities.

Glycated Haemoglobin Testing Market Segmentation

- By Product Type

- Laboratory-based analyzers

- Point of Care (POC) analyzers

- By Technology

- Immunoassay

- Chromatography

- Other technologies

Would you like to explore the option of buying individual sections of this report?

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.