Hypertrophic Scar Market Size - Analysis

Market Size in USD Bn

CAGR6.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.7% |

| Market Concentration | Medium |

| Major Players | Smith & Nephew plc, 3M Company, Medline Industries, Inc., ConvaTec Group plc, Mölnlycke Health Care AB and Among Others |

please let us know !

Hypertrophic Scar Market Trends

According to data, around 1.35 million people die each year as a result of road traffic crashes. Injuries sustained in such accidents often require extensive wound management and skin grafting procedures subsequently increasing the risk of scarring and hypertrophic scar formation.

On the surgical front, the steadily increasing global healthcare spending has ensured greater access to essential as well as elective surgical procedures for populations worldwide. While surgery plays an important role in improving quality of life, associated risks such as incision site hypertrophic scarring continue to remain high. Even routine surgeries for conditions like appendix, hernia and tonsil often leave behind raised or thickened scars.

Another major factor driving growth in the hypertrophic scar market is the technological advancements and rising adoption of innovative scar management modalities. Companies are continuously investing in R&D to develop more efficacious and safe treatment options for scarring disorders. Laser therapy is gaining widespread acceptance owing to benefits such as minimal invasiveness, faster recovery times and ability to target scars of any shape or size including post-surgical linear hypertrophic scars.

Growing patient awareness about innovative solutions along with supportive clinical research data further amplifies acceptance and uptake of advanced scar management modalities among populace and healthcare providers alike. Their ability to deliver superior cosmetic and functional improvement encourages hypertrophic scar patients to complete prescribed treatment regimens as well as seek early intervention. This augurs well for the revenue prospects of hypertrophic scar market.

One of the key challenges faced by the hypertrophic scar market is the high costs associated with advanced treatments such as laser therapy and corticosteroid injections. These sophisticated treatment modalities often require specialized equipment and medical expertise to administer, driving up the direct costs per treatment significantly. Laser therapy involves the use of precise lasers and complex techniques to target scar tissues, which translates to expensive laser devices and lengthy, multi-session treatments for patients.

This cost barrier could deter patients from undergoing the full recommended course of treatments needed to achieve optimal scar reduction outcomes. It may also limit insurer coverage and reimbursement support for such specialty scar treatments. High therapy expenses could impede stronger market growth if left unaddressed.

Market Opportunity - Emerging Therapies like RNAi-based Treatments and Cryotherapy

Additionally, minimally-invasive cryotherapy using controlled cooling is being explored. Carefully monitored, multiple short freezing cycles may calm inflammation and help scar tissues remodel more naturally over time. These emerging alternatives could address current treatment gaps. If ongoing studies bear fruit, RNAi medicines and cryotherapy present opportunities for novel, effective and relatively affordable therapy options to be commercialized in the future, serving to boost the market prospects.

Prescribers preferences of Hypertrophic Scar Market

Hypertrophic scarring is typically treated through a multi-staged approach. For mild cases in the early proliferative stage, prescribers commonly recommend low-to-mid potency topical corticosteroids such as mometasone furoate (Elocon) cream or lotion applied twice daily. If signs of inflammation persist after 4-6 weeks, a second-line option includes silicone gel sheeting (e.g. ScarAway gel sheets) worn for at least 12 hours per day.

Finally, for severe hypertrophic scarring or keloid lesions that do not respond to other therapies, prescribers often consider surgical excision as a last resort treatment. For recalcitrant cases, adjuvant therapies like postoperative radiotherapy, vitamin E, interferon, or mitomycin C have also shown promise but with limited evidence. Overall treatmentlength varies greatly by individualFactors like scar size, location and degree of inflammation/maturity influence prescribers' treatment selection at each stage.

Treatment Option Analysis of Hypertrophic Scar Market

Hypertrophic scars can be classified into three stages based on their appearance and severity – early, mature and late. The treatment approach differs for each stage.

As the scar matures (1-2 years), it becomes thicker and raised. Intralesional corticosteroid injections directly into the scar tissue using drugs like Kenalog or Triessence are effective. They work by reducing inflammation and hastening scar maturation. Combination therapy using steroid injections along with laser treatments such as Pulsed Dye Laser is preferred as lasers also improve texture and color.

Topical agents are preferred early on due to their non-invasive nature. As scars mature, interventional approaches work better due to deeper tissue involvement. Combination therapies give optimal results by targeting scars through different mechanisms of action.

Key winning strategies adopted by key players of Hypertrophic Scar Market

Product Innovation: Developing innovative scar treatment products has helped companies gain an edge in this market. For example, Smith & Nephew launched its Silicone Scar Sheet in 2015, which is an advanced scar management product designed to flatten and soften scars. Clinical studies showed the product helped reduce the height and appearance of scars by over 40% in 4-6 months.

Strategic Partnerships: Companies partner with leading hospitals, scar clinics and researchers to gain credibility and access to patients. For instance, Perrigo partnered with Scar Clinic Netherlands in 2015 to conduct clinical trials for its scar treatment products. Such partnerships provide third-party validation of product efficacy and help expand market reach.

Segmental Analysis of Hypertrophic Scar Market

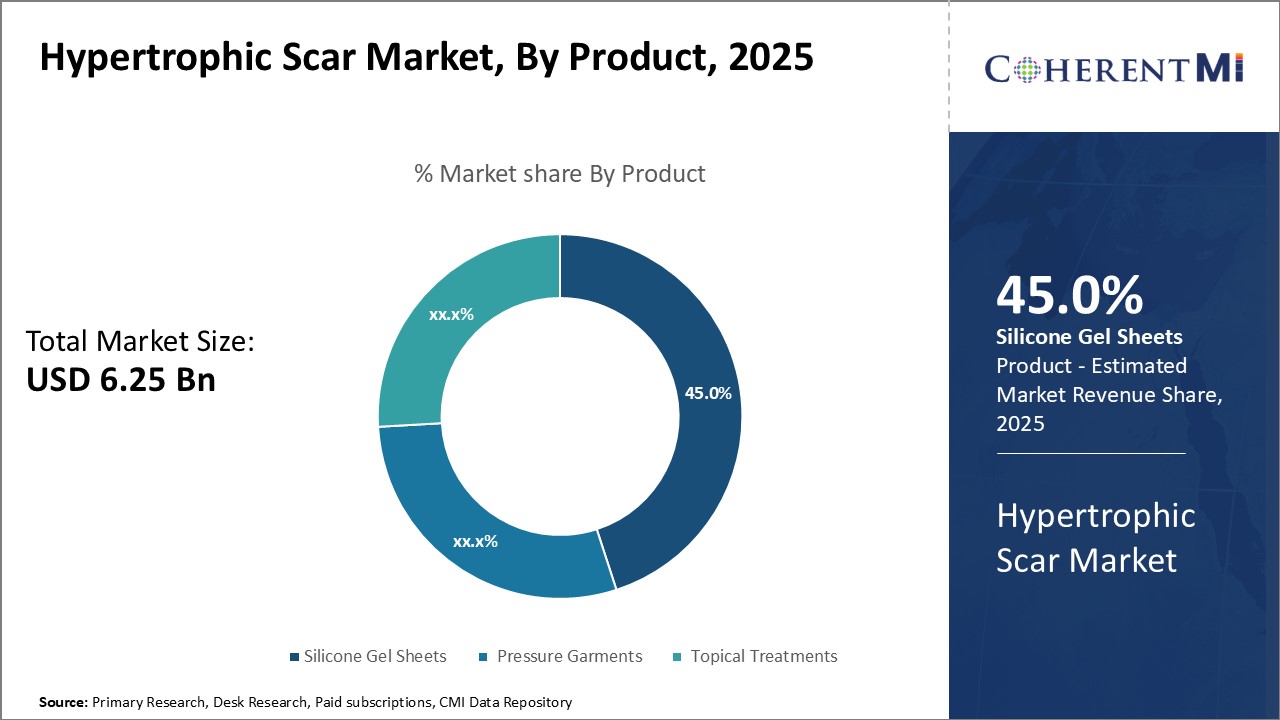

Insights, By Product: Efficacy and Comfort Drive Demand for Silicone Gel Sheets

Unlike other products, silicone gel sheets apply a continuous pressure that mimics the pressure created during massage therapy. This continuous pressure has been demonstrated to inhibit excessive collagen production and promote scar remodeling.

The convenient gel sheet form factor that contours smoothly to any body part has made it popular for scars on all areas of the body. Overall, silicone gel sheets are valued for delivering consistent, non-intrusive scar therapy without sacrificing convenience and comfort, driving their leading market position.

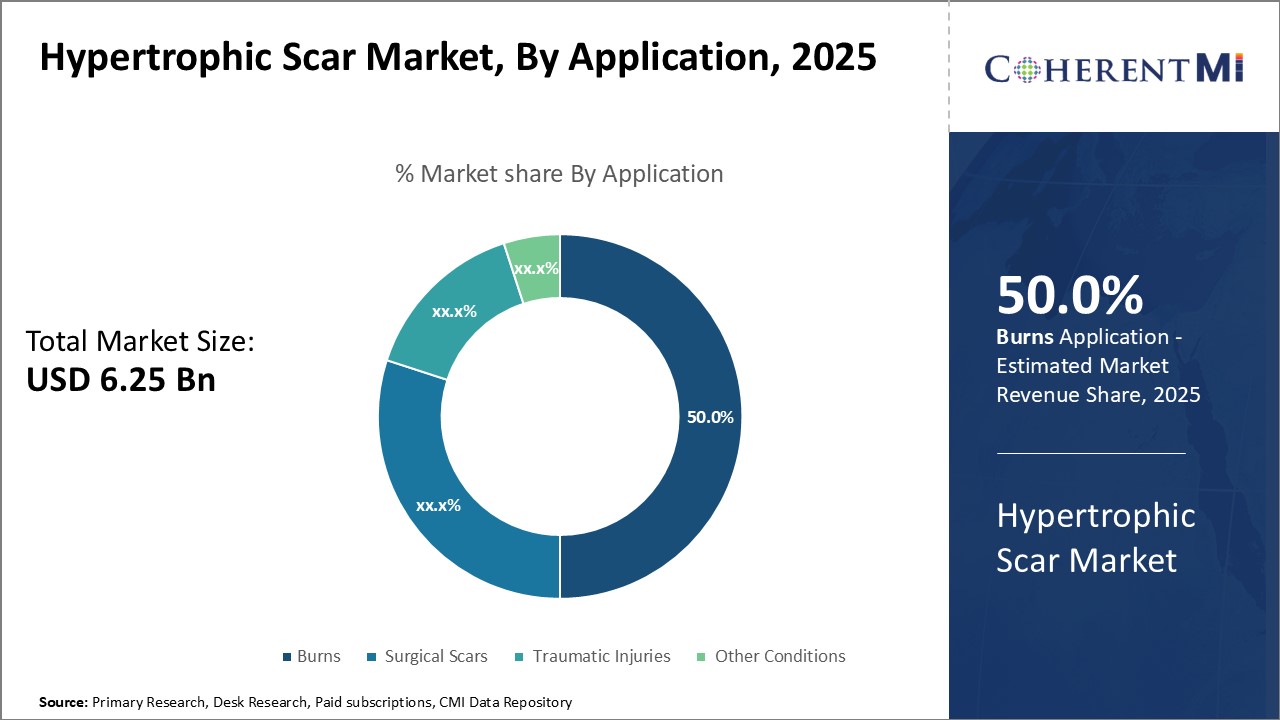

Insights, By Application: Treatment of Burn Injuries Drives Adoption of Compression Products

Insights, By Application: Treatment of Burn Injuries Drives Adoption of Compression Products

Compared to other forms of scarring, burns also have higher needs for scar management from the initial healing stages itself to prevent complications down the line. Compression products like pressure garments, compression bandages and elastic bandages play a vital role in the multidisciplinary treatment of burn scars. These products work to mitigate excessive collagen deposition, control edema, and minimize expansion of scarring.

Hospitals have adopted compression garments as standard post-burn care to optimize outcomes and lower the chance of adverse scarring. This drives the leading demand from burn application.

Insights, By Distribution Channel: Hospitals at the Forefront of Hypertrophic Scar Treatment

Hospitals employ trained scar specialists, physiotherapists and nurses who can properly fit, apply and monitor usage of different products. They also offer multi-disciplinary management with inputs from plastic surgeons as needed. This enables tailored, coordinated treatment plans and regular follow-ups essential for achieving optimal scar remodeling outcomes.

Additional Insights of Hypertrophic Scar Market

- Prevalence Rates: Approximately 30% of burn victims develop hypertrophic scars, highlighting the critical need for effective scar management solutions in burn treatment protocols.

- Regional Growth: Asia-Pacific is projected to exhibit the highest growth rate in the Hypertrophic Scar market, driven by increasing incidences of burns and surgical procedures, along with improving healthcare infrastructure.

- 70% of deep burn injuries result in hypertrophic scars, while in Japan, 30% of women undergoing cesarean section develop hypertrophic scars within three months post-operation.

- Treatment Adoption: Silicone gel sheets currently hold the largest market share, accounting for 40% of the total market, due to their non-invasive nature and proven efficacy in scar management.

- Patient Advocacy Programs: Enhanced patient advocacy and support programs have led to greater awareness and proactive management of hypertrophic scars, driving demand for effective treatment solutions.

Competitive overview of Hypertrophic Scar Market

The major players operating in the hypertrophic scar market include Smith & Nephew plc, 3M Company, Medline Industries, Inc., ConvaTec Group plc and Mölnlycke Health Care AB.

Hypertrophic Scar Market Leaders

- Smith & Nephew plc

- 3M Company

- Medline Industries, Inc.

- ConvaTec Group plc

- Mölnlycke Health Care AB

Hypertrophic Scar Market - Competitive Rivalry

Hypertrophic Scar Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Hypertrophic Scar Market

- In November 2023, Medline Industries, Inc. acquired a biotech startup specializing in innovative topical treatments for hypertrophic scars, expanding its product portfolio and strengthening its position in the European market.

- In August 2023, 3M Company entered into a strategic partnership with a leading dermatology clinic network to distribute its advanced silicone-based scar treatment products, enhancing its distribution capabilities in North America.

- In February 2023, Smith & Nephew plc launched a new line of self-adherent silicone gel sheets designed for improved patient comfort and scar reduction efficacy, aiming to capture a larger market share in the burn treatment segment. These silicone gel sheets are designed to reduce scar thickness, itchiness, and discoloration, providing comfort during the healing process.

- In 2023, Sirnaomics introduced STP705, a treatment that leverages RNA interference (RNAi) technology to target and inhibit TGF-ß1 and COX-2. These two proteins play significant roles in the fibrotic and inflammatory processes involved in the formation of hypertrophic scar tissue. STP705 uses small interfering RNA (siRNA) to reduce scar formation by silencing these gene targets, minimizing inflammation, and promoting fibroblast apoptosis.

- In 2023, OliX Pharmaceuticals developed OLX101A, an RNA interference (RNAi)-based therapeutic for the treatment of hypertrophic scars. OLX101A is an intradermal injection designed to inhibit connective tissue growth factor (CTGF) mRNA, which plays a key role in fibrosis. By targeting CTGF, the drug reduces collagen production, thereby preventing or reducing the formation of hypertrophic scars. This compound works through cell-penetrating asymmetric siRNA (cp-asiRNA) technology, which allows it to silence the specific gene responsible for scar tissue formation without needing complex delivery systems.

Hypertrophic Scar Market Segmentation

- By Product

- Silicone Gel Sheets

- Self-Adherent Silicone Sheets

- Non-Adherent Silicone Sheets

- Pressure Garments

- Compression Bandages

- Elastic Bandages

- Topical Treatments

- Creams and Ointments

- Sprays and Gels

- Silicone Gel Sheets

- By Application

- Burns

- Surgical Scars

- Traumatic Injuries

- Other Conditions

- By Distribution Channel

- Hospitals

- Clinics

- Online Pharmacies

- Retail Pharmacies

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Frequently Asked Questions :

How big is the hypertrophic scar market?

The hypertrophic scar market is estimated to be valued at USD 6.25 Bn in 2025 and is expected to reach USD 9.84 Bn by 2032.

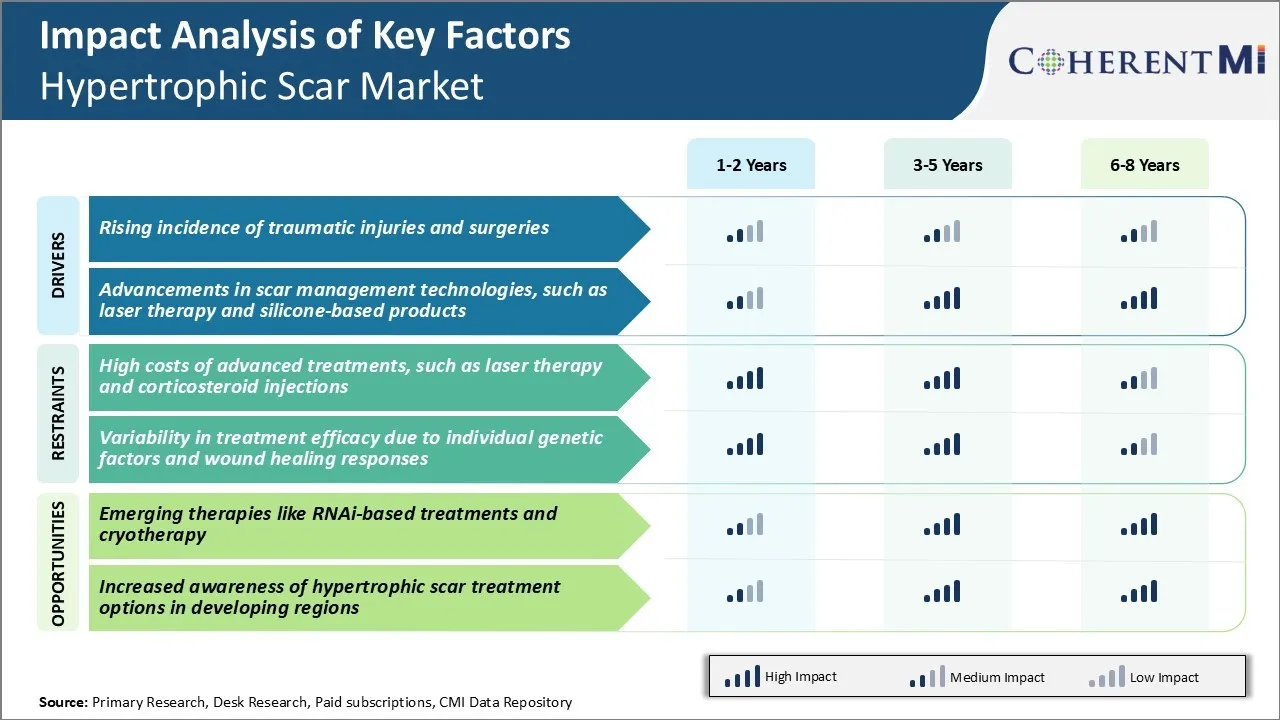

What are the key factors hampering the growth of the hypertrophic scar market?

High costs of advanced treatments, such as laser therapy and corticosteroid injections, and variability in treatment efficacy due to individual genetic factors and wound healing responses, are the major factors hampering the growth of the hypertrophic scar market.

What are the major factors driving the hypertrophic scar market growth?

Rising incidence of traumatic injuries and surgeries and advancements in scar management technologies, such as laser therapy and silicone-based products are the major factors driving the hypertrophic scar market.

Which is the leading product in the hypertrophic scar market?

The leading product segment is silicone gel sheets.

Which are the major players operating in the hypertrophic scar market?

Smith & Nephew plc, 3M Company, Medline Industries, Inc., ConvaTec Group plc, and Mölnlycke Health Care AB are the major players.

What will be the CAGR of the hypertrophic scar market?

The CAGR of the hypertrophic scar market is projected to be 6.7% from 2025-2032.