Inclusion Body Myositis Market Size - Analysis

Market Size in USD Mn

CAGR5.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.7% |

| Market Concentration | High |

| Major Players | Pfizer Inc., GlaxoSmithKline plc, Eli Lilly and Company, AbbVie Inc., Novartis AG and Among Others |

please let us know !

Inclusion Body Myositis Market Trends

As the condition is progressive and debilitating, awareness about its symptoms and the available diagnostic methods is crucial. Various non-profit patient advocacy groups and clinical communities have intensified their efforts towards educating the general population as well as healthcare providers. Several awareness campaigns are being run through multiple channels including social media, print media and community outreach activities. This is helping more individuals recognize the warning signs at an early stage and seek medical advice promptly. The number of patients approaching doctors with suspected symptoms of IBM has seen a steady rise over the last few years.

As the inflammatory condition leads to progressive weakening of muscles over time, patients often require long-term medical management and rehabilitative support. This translates to increased healthcare resource utilization and a rising economic burden on patients as well as national healthcare budgets.

At the same time, major pharmaceutical vendors and clinical research organizations are investing heavily in immunotherapy and gene therapy research for IBM.

Some of the agents in the pipeline may even be able to modify the disease course if approved. This ongoing R&D focus on new drug development and alternative remedies is financed through growing industry investments and government grants for rare disease programs.

Inclusion body myositis is a rare muscle disease with no approved treatments available. Currently, the only options for patients are off-label corticosteroids or immunomodulatory drugs which have limited effectiveness. Developing new drugs specifically for IBM is challenging due to the rarity and heterogeneity of the disease.

Many patients struggle to afford expensive medications, which can exacerbate the condition due to lack of proper treatment. Out-of-pocket costs also place a huge financial burden. To expand patient access, new drug development needs to be incentivized while also ensuring affordability and availability to those most in need. Alternative pricing and reimbursement strategies may need to be explored.

Market Opportunity - Technological Advancements in Diagnostic Methods for Market

As diagnostic certainty and predictability increase, the IBM market is likely to expand. Pharmaceutical companies may feel more confident investing in drug development knowing the target patient population can be identified with greater accuracy.

Prescribers preferences of Inclusion Body Myositis Market

Inclusion Body Myositis (IBM) is a progressive muscle disorder typically treated in a stepwise manner. For early stage IBM with mild symptoms, prescribers often recommend physical/occupational therapy and over-the-counter pain relievers.

For patients with significant functional impairment in late stages, intravenous immunoglobulin (IVIg) treatments are commonly used. IVIg products prescribed include Gamunex-C, Gammagard, and Octagam. While IVIg provides symptom relief for some, it requires monthly infusions and is very expensive. As a result, cost is a major factor influencing prescribers' preferences here.

Treatment Option Analysis of Inclusion Body Myositis Market

Inclusion Body Myositis (IBM) is a progressive muscle disorder characterized by muscle inflammation and weakness. It is divided into three stages based on severity of symptoms:

Intermediate stage (moderate symptoms): As muscle weakness increases, immunotherapy may be considered. Low-dose corticosteroids (prednisone) or steroid-sparing immunosuppressants (azathioprine, methotrexate) are most commonly used, either alone or in combination. These aim to reduce muscle inflammation and slow disease progression.

In summary, IBM treatment focuses on symptom management and controlling immune system overactivity. Treatment progresses from mild therapies to stronger immunotherapy as the disease advances from early to intermediate to advanced stages. Goals shift from maintaining strength to preserving function and quality of life.

Key winning strategies adopted by key players of Inclusion Body Myositis Market

- Companies like BioMarin, KPI Therapeutics and Anthropic have focused on advancing their clinical pipeline of drugs to treat IBM. For example, BioMarin started two late-stage clinical trials (Pivot-IB-1 and Pivot-IB-2) in 2018 to evaluate the effectiveness and safety of BMN-250 in slowing disease progression in people with IBM. These Phase 3 trials are still ongoing.

License/acquire promising programs from smaller biotechs:

- Anthropic partnered with Toleranz Therapeutics in 2020 to leverage each other's capabilities in AI and drug development. This partnership will apply AI/machine learning tools to analyze molecular dynamics simulations and multi-omic datasets to identify potential drug targets for IBM. Successful collaborations help optimize resources and capabilities for productive R&D.

Segmental Analysis of Inclusion Body Myositis Market

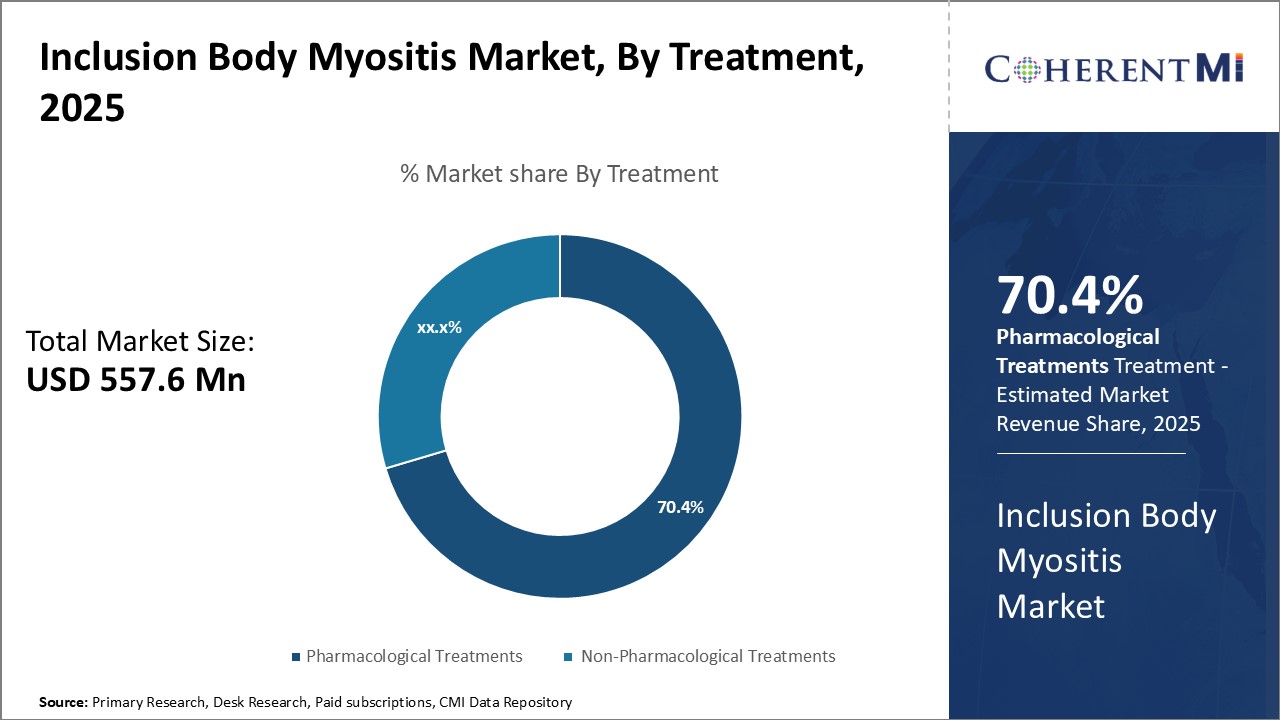

Insights, By Treatment: Pharmacological Treatments High in Demand with Growing Research on Developing Novel Medications

The increasing clinical trials assessing the efficacy of novel molecular entities and biologics for the management of symptoms is a key factor bolstering the adoption of pharmacological treatments. Additionally, the growing awareness among physicians about drug therapies optimizing muscle strength and function is further supporting the demand for medication-based treatment regimens.

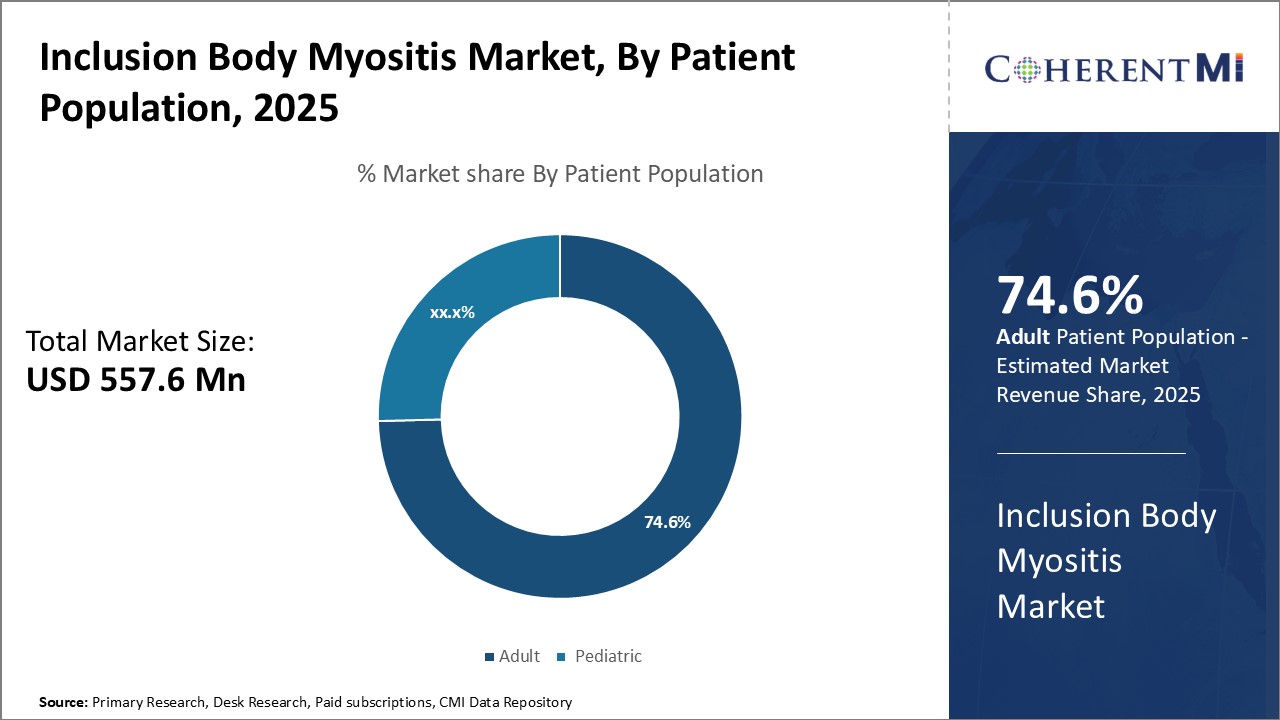

Insights, By Patient Population: Preference for Hospital-based Care

Insights, By Patient Population: Preference for Hospital-based Care

The advanced care delivery capabilities, availability of specialized equipment and expertise, and patient comfort provided at hospitals make them a reliable treatment avenue for adult patients. Furthermore, complex healthcare requirements of adults with co-existing conditions warrant comprehensive treatment approaches commonly available at hospitals. These factors collectively account for the high concentration of adult patients within the hospital end-user segment.

Insights, By End User: Access to Multidisciplinary Teams

The coordinated care approaches that leverage collective expertise deliver well-rounded support addressing medical, therapeutic, and psychosocial aspects of the disease. Therefore, hospitals are often the preferred choice as they offer consolidated treatment from multi-faceted perspectives, driving their attractiveness among end-users.

Additional Insights of Inclusion Body Myositis Market

- Inclusion body myositis is primarily seen in older adults and is characterized by progressive muscle weakness, particularly in the quadriceps and forearm muscles.

- The United States accounts for the highest diagnosed cases of inclusion body myositis in the 7MM (US, EU5, and Japan), and this trend is expected to increase over time due to aging populations.

- Patients with Inclusion Body Myositis often face delays in diagnosis due to the rarity of the disease and its symptom overlap with other conditions such as polymyositis. Awareness campaigns launched by several organizations aim to mitigate this challenge.

- The prevalence of Inclusion Body Myositis is increasing, particularly among the elderly population in North America and Europe. The U.S. alone accounts for nearly 40% of the total diagnosed cases globally.

Competitive overview of Inclusion Body Myositis Market

The major players operating in the Inclusion body myositis market include Pfizer Inc., GlaxoSmithKline plc, Eli Lilly and Company, AbbVie Inc., Novartis AG, Alexion Pharmaceuticals, Orphazyme, Viela Bio, Sanofi, and Amgen.

Inclusion Body Myositis Market Leaders

- Pfizer Inc.

- GlaxoSmithKline plc

- Eli Lilly and Company

- AbbVie Inc.

- Novartis AG

Inclusion Body Myositis Market - Competitive Rivalry

Inclusion Body Myositis Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Inclusion Body Myositis Market

- In June 2024, Pfizer Inc. initiated a clinical trial for a novel drug targeting muscle inflammation in Inclusion Body Myositis, aiming to improve mobility and reduce symptoms.

- In March 2023, GlaxoSmithKline plc announced a strategic partnership with smaller biotech firms to accelerate the development of innovative therapies for rare muscle disorders, including Inclusion Body Myositis. GSK has been active in various research areas related to rare diseases, and Inclusion Body Myositis is recognized as a rare inflammatory muscle disorder that continues to be a focus for potential therapeutic developments.

- In February 2023, Alexion Pharmaceuticals reported positive clinical trial data for a new monoclonal antibody targeting myositis-specific antigens, expected to reduce inflammation significantly. Furthermore, Alexion, a part of AstraZeneca's Rare Disease division, has been actively involved in developing monoclonal antibodies for rare diseases, particularly in complement system biology. Recent developments have focused on treatments for conditions such as paroxysmal nocturnal hemoglobinuria (PNH) and transthyretin-mediated amyloid cardiomyopathy (ATTR-CM).

- Orphazyme had been conducting a Phase II/III clinical trial of arimoclomol, a drug designed to address protein aggregation, specifically for inclusion body myositis (IBM). This trial was initiated earlier and concluded before 2022. Unfortunately, by March 2021, the company announced that the trial did not meet its primary and secondary endpoints in IBM patients.

Inclusion Body Myositis Market Segmentation

- By Treatment

- Pharmacological Treatments

- Non-Pharmacological Treatments

- By Patient Population

- Adult

- Pediatric

- By End User

- Hospitals

- Clinics

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Frequently Asked Questions :

How big is the inclusion body myositis market?

The inclusion body myositis market is estimated to be valued at USD 557.6 Mn in 2025 and is expected to reach USD 822.0 Mn by 2032.

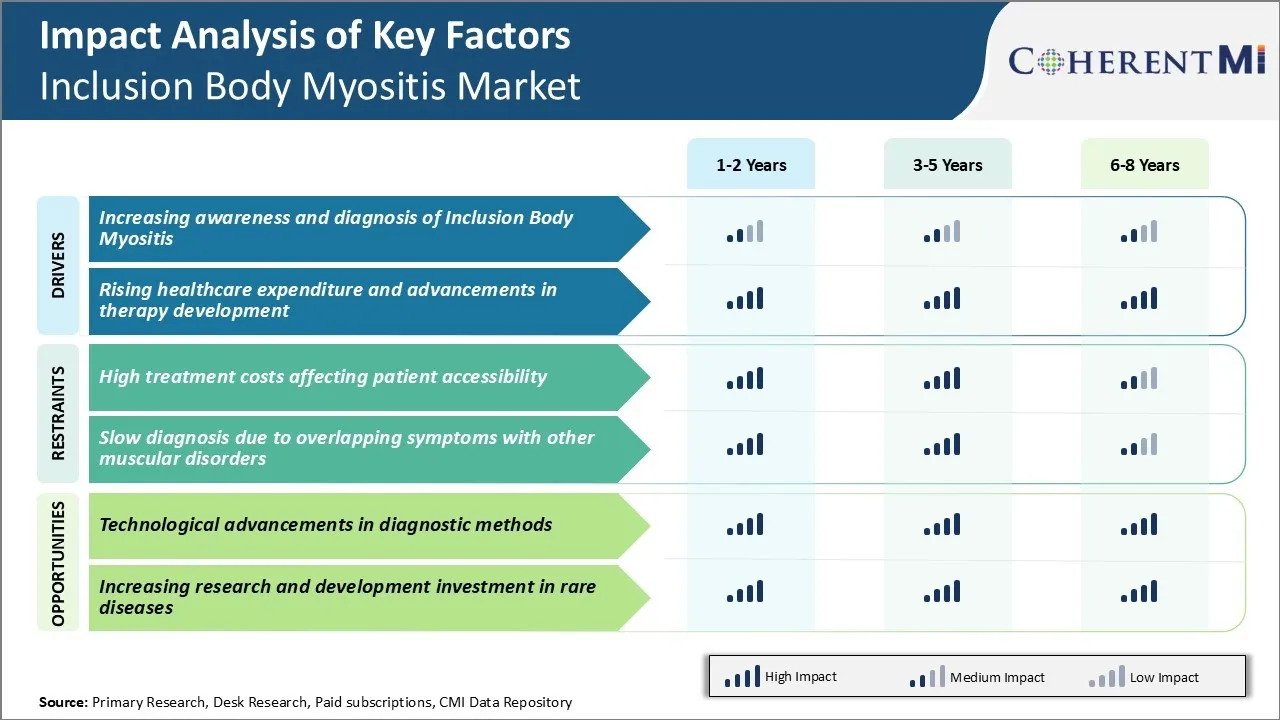

What are the key factors hampering the growth of the inclusion body myositis market?

High treatment costs affecting patient accessibility and slow diagnosis due to overlapping symptoms with other muscular disorders are the major factors hampering the growth of the inclusion body myositis market.

What are the major factors driving the inclusion body myositis market growth?

Increasing awareness and diagnosis of inclusion body myositis and rising healthcare expenditure and advancements in therapy development are the major factors driving the inclusion body myositis market.

Which is the leading treatment in the inclusion body myositis market?

The leading treatment segment is pharmacological treatments.

Which are the major players operating in the inclusion body myositis market?

Pfizer Inc., GlaxoSmithKline plc, Eli Lilly and Company, AbbVie Inc., Novartis AG, Alexion Pharmaceuticals, Orphazyme, Viela Bio, Sanofi, and Amgen are the major players.

What will be the CAGR of the inclusion body myositis market?

The CAGR of the inclusion body myositis market is projected to be 5.7% from 2025-2032.