India Ethanol Market Size - Analysis

India ethanol market is estimated to be valued at US$ 3.28 Bn in 2025, and is expected to reach US$ 9.31 Bn by 2032, exhibiting a compound annual growth rate (CAGR) of 16.1% from 2025 to 2032.

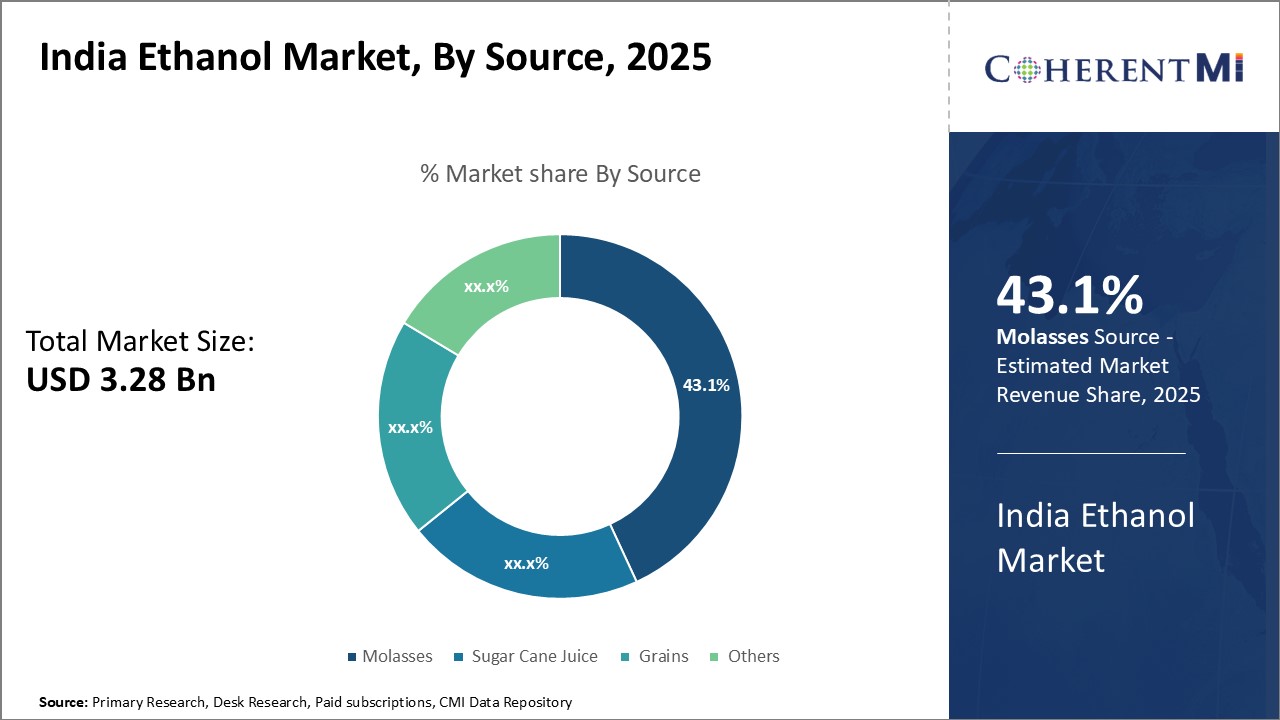

India ethanol market is segmented into by source, end-user, grade, blending, application method, and region. By source, the market is segmented into molasses, sugar cane juice, grains, and others. The molasses segment accounted for the largest share of the market in 2025. Molasses is readily available in India as a by-product of sugar production. The government focus on using sugarcane juice directly to produce ethanol is expected to drive the sugar cane juice segment at the highest CAGR during 2025-2032.

India Ethanol Market- Drivers

- Supportive Government Policies - The Indian government has implemented several supportive policies to boost ethanol production and consumption in the country. Ethanol blending program mandates an increasing blending of ethanol with gasoline. This has given ethanol a steady and expanding market. The government has also provided subsidies, loans and incentives for ethanol projects. The National Policy on Biofuels-2018 aims to triple ethanol production by 2025. Such policies encourage investments and development in the ethanol market.

- Growing Automotive Sector - India is one of the fastest growing automotive markets globally. Vehicle sales have been rising steadily due to rising incomes, increasing urbanization, and infrastructure development and expanding middle class. This expanding automotive sector boosts demand for fuels. Ethanol blending helps to address this fuel demand in a more sustainable manner while reducing oil imports. The government aims to achieve its ethanol blending targets by leveraging this vast growth potential of India's automotive sector.

- Increasing Consumption as Biofuel - Most of the ethanol produced in India is used for EBP blending. But apart from blending, ethanol's use as a biofuel is also rising for transportation applications. Ethanol fuel blends allow existing gasoline-based vehicles to switch to cleaner renewable fuels with minimal or no engine modification. Ethanol has high octane rating and oxygen content, making it an efficient fuel. As environmental concerns grow globally, ethanol is gaining traction as a cleaner burning biofuel alternative. This boosts its consumption in India.

- Expanding End-use Applications - Beyond fuel blending, ethanol has diverse end-use applications across industries like personal care, paints & coatings, chemical, pharmaceutical, and others. With rising incomes and growing consumer segments, demand from these sectors is expanding. For instance, ethanol is widely used in cosmetics, perfumes, deodorants, antiseptic products, and others. Its solvent properties create opportunities across industrial domains. Such broad usage potential is fueling the growth of the ethanol industry.

- Cellulosic Ethanol Production - Cellulosic ethanol made from agricultural residues, grasses or wood waste has immense potential in India. The country generates millions of tons of agri-waste annually which could be used to produce cellulosic ethanol. This 2G ethanol does not affect food security like 1G ethanol from grains/sugarcane. Government policy also encourages cellulosic projects. Companies are investing in 2G ethanol production technologies suitable for Indian biomass. Tapping the abundance of agri-residues can drive the market growth.

- Export Potential - India's expanding ethanol production and favorable trade policies have opened up exports opportunities for domestic players. Ethanol exports help to deal with excess supplies as well as generate foreign exchange earnings. The government has allowed exports of surplus ethanol from molasses and non-food feedstock. It has also removed restrictions on export quantity and destinations. Several companies have commenced ethanol exports targeting fuel, potable liquor and industrial demand in overseas markets. Export demand would further propel production of ethanol.

- Emergence of Domestic Market - Historically ethanol production in India has largely depended on ethanol supply obligations for Oil Marketing Companies (OMCs) to meet EBP blending targets. However, new private sector opportunities are now emerging beyond OMC demand with growing usage in non-fuel sectors and specialty chemicals. Beyond the usual OMC demand, rising private consumption would give ethanol producers additional long-term demand certainty.

- Investments in Production Capacity - To meet rising domestic ethanol demand as well as tap export potential, public and private players are investing significantly to enhance production capacities. From molasses-based distilleries to grain/2G ethanol plants, capacity addition plans have been announced. The market has over 150 ethanol producers and additional players are also entering the market. Availability of feedstock, technologies and favorable policies continue to attract large scale investments.

India Ethanol Market- Restraints

- High Feedstock Costs - Feedstock can account for up to 70% of ethanol production costs. Fluctuating availability and elevated prices of feedstocks like corn, broken rice, sugarcane, and others can affect project viability. Excess sugarcane diversion towards ethanol also impacts sugar production. Managing feedstock costs through long-term contracts, using molasses efficiently during surplus sugar seasons is vital.

- Lack of Adequate Storage & Handling Infrastructure - Unlike fossil fuels, ethanol requires Given its propensity for absorbing water, it requires specialized infrastructure for storage and transportation. Lack of adequate tankage facilities at depots, rail tank cars to transport ethanol from production units to OMC depots hampers smooth supply logistics. Developing suitable storage and handling solutions is critical.

- Constraints in Supply Chain Mechanism - Complex sugarcane pricing policies, delays in announcing ethanol procurement tenders and prices affect industry planning. Release of government subsidies/incentives also often gets deferred. Resolving regulatory and procedural hurdles can help to streamline the supply ecosystem.

Market Size in USD Bn

CAGR16.1%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 16.1% |

| Larget Market | India |

| Market Concentration | High |

| Major Players | Praj Industries, Triveni Engineering & Industries Ltd, Shree Renuka Sugars, Balrampur Chini Mills Ltd., Bajaj Hindusthan Sugar Ltd. and Among Others |

please let us know !

India Ethanol Market Trends

- Consolidation Activities - The Indian ethanol industry is witnessing increasing consolidation. Large industry players are entering merger and acquisition deals to augment capacities, expand feedstock options, gain market share and drive growth. For instance, integrated sugar & ethanol producers are acquiring standalone distilleries. Players focused on 1G ethanol are buying stakes in 2G ethanol startups. Such consolidation strengthens supply chain integration and economies of scale.

- Focus on Advanced Biofuels - The ethanol industry is gradually diversifying into advanced biofuels like biobutanol which have higher energy density and can be blended in higher proportions. These drop-in fuels also do not require engine modification. Domestic players are partnering with technology providers to develop projects. The market is also shifting towards specialty value-added ethanol-derivatives used in chemicals, personal care etc. These have higher profit margins.

- Emphasis on Process Efficiency - Players are adopting solutions to enhance productivity and energy efficiency across the ethanol value chain to improve viability. Use of enzymes in fermentation, adopting superior yeast strains, deploying crop yield enhancing technologies, integrating IoT & automation in operations are some ongoing focus areas. Companies are also investing in treating effluents/CO2 recovery to meet sustainability goals.

- Transition towards Integrated RE Ecosystem - Leading energy providers are developing integrated renewable energy complexes housing ethanol facilities along with co/trigeneration plants, wind/solar capacity, and others to meet process energy needs through renewable sources. Some sugar producers are also venturing into ancillary opportunities like compressed biogas production from press mud. Such integration allows leveraging synergies across RE value chain.

Segmental Analysis of India Ethanol Market

Competitive overview of India Ethanol Market

Major players operating in the India ethanol market include Piccadily Sugar & Allied Industries Ltd., Thiru Arooran Sugars Ltd., Ugar Sugar Works Ltd., Dhampure Speciality Sugars Ltd., Praj Industries, Triveni Engineering & Industries Ltd, E.I.D. Parry (India) Ltd., DCM Shriram Ltd., Mawana Sugars Ltd., Uttam Sugar Mills Ltd., Kothari Sugars And Chemicals Ltd., Avadh Sugar & Energy Ltd., The Ugar Sugar Works Ltd., Dwarikesh Sugar Industries Ltd., K.M.Sugar Mills Ltd., Shree Renuka Sugars, Balrampur Chini Mills Ltd., Bajaj Hindusthan Sugar Ltd., Dalmia Bharat Sugar and Industries Ltd., Dhampur Sugar Mills Ltd.

India Ethanol Market Leaders

- Praj Industries

- Triveni Engineering & Industries Ltd

- Shree Renuka Sugars

- Balrampur Chini Mills Ltd.

- Bajaj Hindusthan Sugar Ltd.

India Ethanol Market - Competitive Rivalry

India Ethanol Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in India Ethanol Market

New Product Launches

- In March 2022, Praj Industries (Indian multinational process and project engineering company Indian multinational process and project engineering company) launched Enfinity, an innovative technology to produce ethanol directly from rice straw. This cellulosic ethanol technology enables conversion of rice straw into ethanol, addressing environmental issues.

- In January 2021, IOCL launched E100 pilot fuel, India's first 100% ethanol-blended fuel in Pune. This green fuel alternative will help to combat air pollution and reduce crude imports.

- In December 2020, Praj Industries introduced 2G ETHANOL tech that enables ethanol production from biomass like rice & wheat straw, cotton stalk, bagasse & wood. This provides feedstock flexibility.

Acquisition and Partnerships

- In February 2022, Praj Industries partnered with Ankur Scientific to provide bioenergy solutions using 2G ethanol technology for rice straw feedstock in India

- In June 2021, IOCL signed an agreement with LanzaTech to construct the world's first refinery off-gas to ethanol production facility in India using LanzaTech's gas fermentation technology

- In May 2020, Praj Industries partnered with Gevo, USA, to commercialize renewable isobutanol using sugary-based feedstock. This biofuel has applications in the sustainable aviation fuel.

India Ethanol Market Segmentation

- By Source

-

- Molasses

- Sugar Cane Juice

- Grains

- Others

- By End Use

-

- Fuel

- Industrial Solvents

- Beverages

- Cosmetics

- Pharmaceuticals

- Automotive

- Others

- By Grade:

-

- Denatured Alcohol

- Undenatured Alcohol

- Rectified Spirit

- Specially Denatured Alcohol

- Fuel Ethanol

- By Blending:

-

- E5

- E10

- E15

- E20

- E25

- E70

- E85

- E95

- By Application Method:

-

- Starch-based

- Sugar-based

- Cellulosic

Would you like to explore the option of buying individual sections of this report?

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Frequently Asked Questions :

How big is the India Ethanol Market?

The India Ethanol Market is estimated to be valued at USD 3.3 in 2025 and is expected to reach USD 9.3 Billion by 2032.

What are the major factors driving the India ethanol market growth?

Supportive government policies, rising consumption as biofuel, increasing demand from end-use industries, and environmental benefits are driving the market growth.

Which is the leading component segment in the India ethanol market?

The starch-based segment leads the India ethanol market.

Which are the major players operating in the India ethanol market?

Piccadily Sugar & Allied Industries Ltd., Thiru Arooran Sugars Ltd., Ugar Sugar Works Ltd., Dhampure Speciality Sugars Ltd., Praj Industries, Triveni Engineering & Industries Ltd, E.I.D. Parry (India) Ltd., DCM Shriram Ltd., Mawana Sugars Ltd., Uttam Sugar Mills Ltd., Kothari Sugars And Chemicals Ltd., Avadh Sugar & Energy Ltd., The Ugar Sugar Works Ltd., Dwarikesh Sugar Industries Ltd., K.M.Sugar Mills Ltd., Shree Renuka Sugars, Balrampur Chini Mills Ltd., Bajaj Hindusthan Sugar Ltd., Dalmia Bharat Sugar and Industries Ltd., Dhampur Sugar Mills Ltd.

What will be the CAGR of India ethanol market?

India ethanol market is projected to grow at a CAGR of 16.1% from 2025 to 2032.

What will be the CAGR of India ethanol market?

Supportive government policies, rising environmental concerns, increasing ethanol blending targets, growing automotive sector, expanding end-use applications etc.