관개 자동화 시장 크기 - 분석

USD 기준 시장 규모 Bn

CAGR7.00%

| 연구 기간 | 2025-2032 |

| 추정 기준 연도 | 2024 |

| CAGR | 7.00% |

| 시장 집중도 | Medium |

| 주요 플레이어 | 회사 소개, 회사 소개, Valmont 기업 Inc., 레인 버드 Corporation, Jain 관개 시스템 및 기타 |

저희에게 알려주세요!

관개 자동화 시장 트렌드

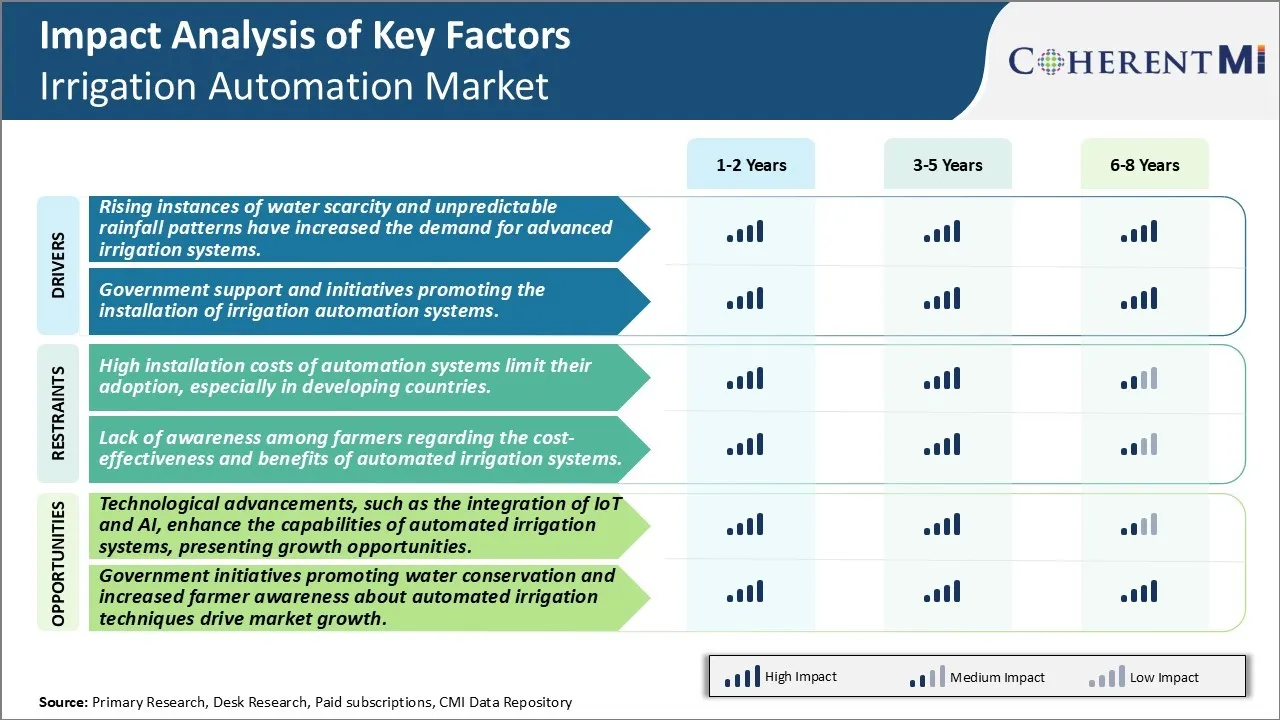

시장 드라이버 - 정부 지원 및 이니셔티브 Irrigation Automation Systems의 설치 촉진

주요 농기구의 정부는 지속 가능한 농업 분야의 효율적인 물 유통 네트워크의 중요성을 인식하기 위해 왔습니다. 전 세계 총 물 소비량의 중요한 부분을위한 전통적인 관개 계정. 물 테이블은 농업 생산 상승의 경보 비율과 물 발자국에 deplete로, 정책 제작자는 정밀도 관개 기술을 채택하기 위하여 농부를 격려하고 있습니다. Subsidies, 금융 계획, 기술 개발 프로그램 및 자동화 시스템을 설정과 관련된 단순화 된 규정은 더 넓은 채택을 촉진하기 위해 모두 활용되었습니다.

많은 국가에서, 프로젝트 비용의 50% 가까이에 hefty subsidy 총계는 개인적인 농부 뿐 아니라 그들의 땅에 드립 또는 sprinkler 네트워크를 설치하기를 위한 협력적인 societies에 제안됩니다. 때로는 보조 대출은 농업 은행을 통해 보조금에 배치됩니다. 예를 들어 다양한 미국 국가 정부는 정밀 농업 또는 물 보존 프로그램에 따라 관대 한 보조금을 제공합니다. 인도에서 Pradhan Mantri Krishi Sinchayee Yojana와 같은 계획은 중앙 금융 및 기술 지원을 통해 효율적인 관개 아래 절반 이상의 재배 영역을 커버하는 것을 목표로합니다.

금융 인센티브, 농부의 용량 건물은 행동 변화를 구동하는 것이 중요합니다. 몇몇 선진국은 정밀 관개의 과학과 이익에 관하여 재배자를 교육하기 위하여 광대한 훈련 단위를 소개했습니다. 데모 및 유지 보수 워크샵에서 손은 기술을 향상시킵니다. 브라질의 예를 들어, Irrigation의 'Modernization of Irrigation' 이니셔티브는 60 %의 자본 보조를 제공하지만 최고의 관행에서 수천 명의 소지자를 훈련했습니다.

전력 및 물 연결과 관련된 간소화 된 승인은 자동화 프로젝트의 번거로운 설치를 용이하게했습니다. 일부 지역은 전기 모터 용량 및 파이프 직경에 대한 긴장 된 규범이 표면 드립 방법을 홍보합니다. 전체, 투자와 결합 된 지원 규제 프레임 워크는 필요한 imp를 주었다

시장 기회 - Technological Advancements 역량 강화, 성장 활성화

IoT, AI, 관개 자동화 시스템과 같은 신기술의 통합은 시장 확장을 위한 수익성을 나타내는 역량을 크게 강화하고 있습니다. IoT 연결은 자동화된 시스템을 통해 모바일 앱을 통해 원격으로 모니터링하고 제어할 수 있으며, 탁월한 유연성을 제공합니다. 한편, AI 및 기계 학습 알고리즘은 실시간 환경 조건을 기반으로 물 및 비료 사용을 최적화하는 등 다양한 시스템을 돕고, 작물 수확량을 향상시킵니다. 이러한 스마트 기능 특히 생산성 극대화를 원하는 대규모 상업 농부에 매력. 기술 성숙과 그들의 비용 감소, 심지어 작은 홀더 농부는 그들의 필요에 맞는 저렴한 정밀 농업 솔루션을 통해 혜택을 제공합니다. 원격 농업 관리를위한 향상된 범위는 공유 커뮤니티 농장과 같은 새로운 비즈니스 모델을 가능하게합니다. 전반적으로, 지속적인 기술 발전은 다양한 지형 및 응용 분야에서 자동화의 연료 채택, 강력한 장기 시장 성장 전망 지원.

주요 플레이어가 채택한 주요 승리 전략 관개 자동화 시장

제품 혁신: 혁신적이고 진보 된 관개 자동화 솔루션을 제공하는 것은 핵심 플레이어가 경쟁 업체보다 가장자리를 얻습니다. 예를 들어, 2020년, Lindsay Corporation은 FieldNET® Advisor와 함께 Zimmatic® ZC 시리즈 센터 피벗 및 측면 이동 관개 시스템을 출시했습니다. 일부 주요 기능에는 고해상도 토양 습기 모니터링, 실시간 데이터, 모바일 경고 및 원격 관리 기능을 기반으로 자동화 관개 조정이 포함되어 있습니다. 이 솔루션은 농민들이 수율을 향상시키고 물을 절약하고 비용을 절감합니다. 마찬가지로 Valmont Industries는 2018 년 Valley® Growsmart® irrigation 관리 플랫폼을 도입하여 위성 및 센서 데이터를 통합하여 각 분야에 맞는 사전 교정 권장 사항을 제공합니다. 이러한 혁신적인 솔루션은 판매 및 시장 점유율을 높였습니다.

전략적 파트너쉽 및 인수: Player는 전략적 파트너십 및 인수를 통해 높은 성장 시장에서의 존재를 강화했습니다. 예를 들어, 2021 년, Jain Irrigation은 두 이스라엘 회사에서 대부분의 스테이크를 인수했습니다. - CropX 및 Agrint는 디지털 기능을 확장합니다. Jain은 하드웨어, 소프트웨어 및 서비스를 통해 원스톱 솔루션을 제공합니다. Netafim은 Indigo 농업 및 Anthropic과 같은 클라우드 기반 솔루션 제공 업체와 파트너십을 체결하여 AI / ML 구동 관개 솔루션을 개발했습니다. 이러한 파트너십은 다른 사람들의 보완적인 강점과 기술 전문성을 활용하여 고급 제품을 개발할 수 있는 기회를 제공합니다.

판매 후 서비스에 초점: 관개 시스템은 정비를 요구하고, 강한 판매 후 서비스를 제안하는 선수는 강한 상표 충성도를 얻었습니다. Hunter Industries, Lindsay 및 Valmont와 같은 기업은 지역 기술 지원 및 기차 농부를 제공하기 위해 전 세계적으로 광범위한 유통 및 대리점 네트워크를 설립했습니다. 또한 유지 보수 계약, 소프트웨어 업그레이드 및 컨설팅을 제공 하 고 긴 실행에 고객 만족 수준을 향상.

위 예제는 제품 혁신, 전략적 협업 및 고객 서비스에 초점을 맞추고 관개 자동화 시장에서 핵심 플레이어가 경쟁력 있는 위치와 시장 점유율을 강화하는 데 도움이되었습니다.

세그먼트 분석 관개 자동화 시장

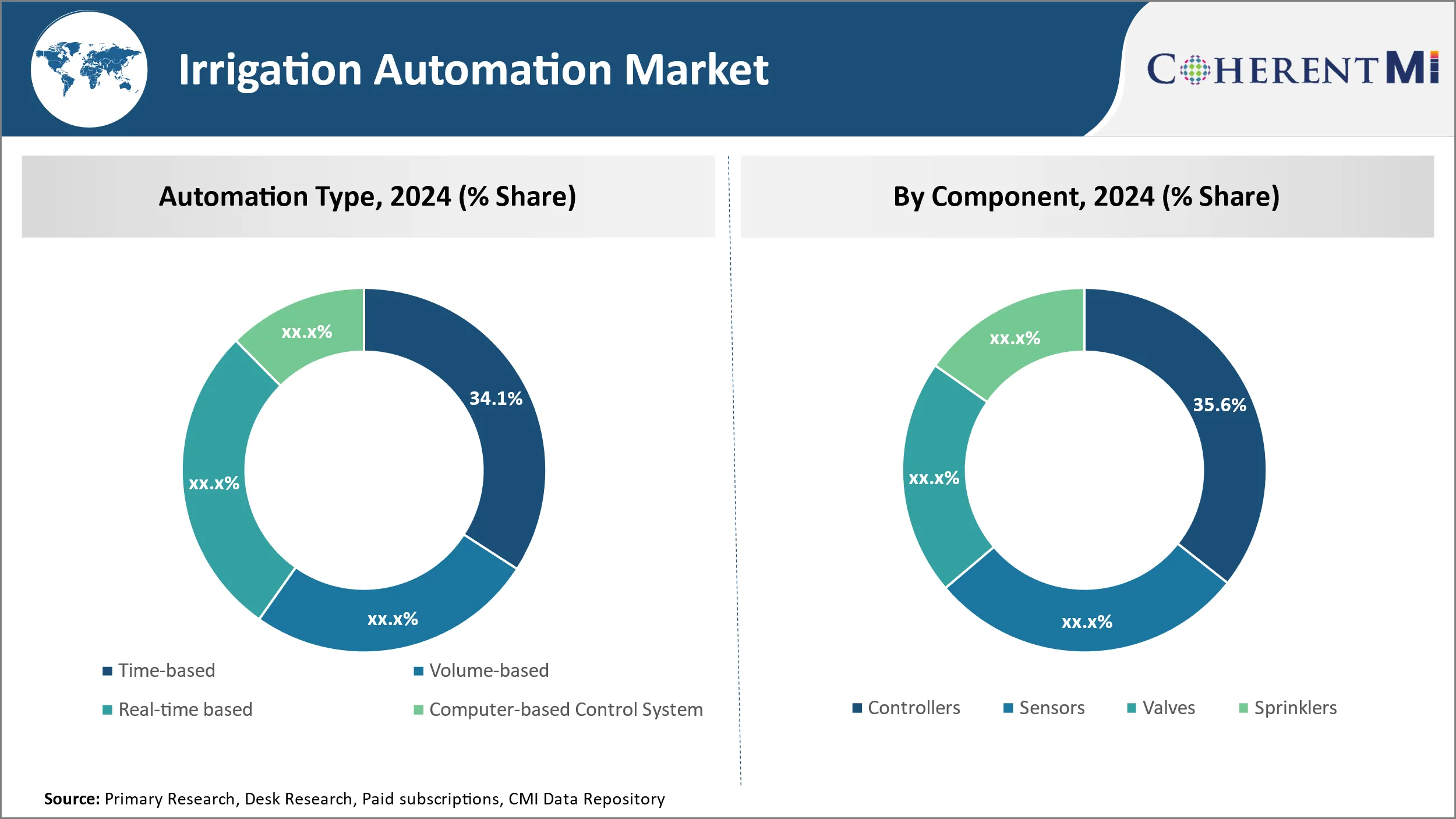

Insights, 구성 요소로, 주거 확장 관제사를 통해서 사용법

관개 자동화 시장의 구성요소에서, 2024년에 35.6%를 위한 관제사 계정은 어떤 자동화한 체계를 위한 핵심 관리 기계설비로 그들의 역할 때문에. 특히 관개 컨트롤러의 주거 채택은 전체 시장의 주요 수요 드라이버 역할을합니다. 상대적으로 낮은 비용과 쉬운 do-it-yourself 임명은 대부분의 homeowners의 도달 안에 풀그릴 관개 통제를 가져옵니다. 관제사는 단추의 강요를 가진 잔디밭과 정원을 위한 편리한 배려를 급수하는 일정의 simplistic 세트를 제안합니다.

물 부족이 전 세계적으로 증가함에 따라, 솔루션의 소비자 수요가 주거용 물 소비량을 늘리고 있습니다. 관제사는 물 사용법을 감사하기 위하여 homeowners를, 식물 유형/조건에 근거를 둔 일정을 주문을 받아서 만들고, 비 사건 도중 suspend 관개 - 수동 관행과 비교된 뜻깊은 저축을 달성하. Water-stressed 지역의 정부는 지속 가능성 노력의 가치를 강조하는 컨트롤러 구매를 더 집중했습니다. Younger demographic 동향은 또한 “똑똑한” 기술로 휴대폰에서 재산 체계의 원격 제어/monitoring를 가능하게 합니다.

전체 환경 인식과 기본 컨트롤러의 접근성을 빠르게 확장하는 주거 고객 세그먼트. 관개 산업의 가장 큰 범주에 발판은 구성 요소 공급 업체의 장기 성장을 구동하는 데 도움이 될 것입니다.

추가 통찰력 관개 자동화 시장

글로벌 관개 자동화 시장은 물 부족의 인스턴스와 더 효율적인 농업 관행에 대한 증가가 필요하여 중요한 성장을 경험하고 있습니다. 시장은 센서, IoT 및 AI를 통합하는 실시간 모니터링 시스템과 같은 고급 관개 기술의 채택으로 빠르게 확장할 것으로 예상됩니다. 이 시스템은 물 관리를 개선하고 노동 비용을 절감하고 관개 프로세스를 최적화하고 지속 가능한 농업에 기여합니다. 아시아 태평양 지역은 광범위한 농업 토지, 물 관리 필요 및 관개 효율성을 개선하기 위해 정부 백업 이니셔티브로 인해 시장을 지배합니다. 북미는 정밀 농업 및 자동화 기술의 발전과 더불어 가장 빠른 속도로 성장할 것으로 예상됩니다. 그러나, 높은 설치 비용 및 일부 지역에서 농부들의 인식 부족은 시장 성장을 방해 할 수 있습니다. 물 보존의 성장 인식과 자동화 관개 시스템의 도입은 확장을위한 중요한 기회를 제공합니다.

경쟁 개요 관개 자동화 시장

관개 자동화 시장에서 운영되는 주요 플레이어는 Toro Company, Hunter Industries, Valmont Industries Inc., Rain Bird Corporation, Jain Irrigation Systems, Lindsay Corporation, Netafim, Galcon, Rubicon Water 및 Nelson Irrigation을 포함합니다.

관개 자동화 시장 선두

- 회사 소개

- 회사 소개

- Valmont 기업 Inc.

- 레인 버드 Corporation

- Jain 관개 시스템

관개 자동화 시장 - 경쟁 경쟁

관개 자동화 시장

(주요 플레이어가 지배)

(많은 플레이어가 있는 매우 경쟁적)

최근 개발 관개 자동화 시장

- 에서 2월 2024, 자르기 Reinke Irrigation과 협력하여 현장별 evapotranspiration 측정을 통해 물 관리를 강화하는 신제품을 출시했습니다.

- 6월 2023일, Hunter Industries는 사용자 정의 관개 관리 플랫폼에 대한 두 가지 새로운 필드 서버 (FS-3000 및 FS-1000)를 출시하여 리소스 관리 및 관개 제어를 향상시킵니다.

- 3 월 2023에서 Jain Irrigation은 Rivulis와 국제 관개 사업을 합병하여 2 번째로 큰 글로벌 관개 및 기후 리더를 창출했습니다.

관개 자동화 시장 세분화

- 자동화 유형

- 시간 기반

- 볼륨 기반

- 실시간 기반

- 컴퓨터 기반 제어 시스템

- 제품정보

- 관련 기사

- 센서

- 밸브 밸브

- 스린클러

- 관개 유형

- 스프링클러

- 뚱 베어

- 제품 정보

- 이름 *

- 회사연혁

- 주요사업

- 비수술

구매 옵션을 알아보시겠어요?이 보고서의 개별 섹션?

Yaash Doshi는 상임 경영 컨설턴트입니다. 그는 APAC, EMEA 및 아메리카의 수직적 분야에서 연구를 수행하고 컨설팅 프로젝트를 처리한 경험이 12년 이상 있습니다.

그는 화학 회사가 복잡한 과제를 헤쳐나가고 성장 기회를 파악하도록 돕는 데 강력한 통찰력을 제공합니다. 그는 상품, 특수 및 정밀 화학, 플라스틱 및 폴리머, 석유화학을 포함한 화학 가치 사슬 전반에 걸쳐 심층적인 전문 지식을 보유하고 있습니다. Yash는 업계 컨퍼런스에서 인기 있는 연설자이며 상품, 특수 및 정밀 화학, 플라스틱 및 폴리머, 석유화학과 관련된 주제에 대한 다양한 출판물에 기고합니다.

자주 묻는 질문 :

관개 자동화 시장은 얼마나 큰가?

Global Irrigation Automation Market은 2024년 USD 4.8 Bn에서 평가되고 2031년까지 USD 5.6 Bn에 도달 할 것으로 예상됩니다.

관개 자동화 시장의 CAGR는 무엇입니까?

관개 자동화 시장의 CAGR는 2024년에서 2031년까지 6.8%로 계획됩니다.

Irrigation Automation Market 성장의 주요 요인은 무엇입니까?

물 부족과 예측할 수없는 강우 패턴의 상승 인스턴스는 고급 관개 시스템 및 정부 지원 및 관개 자동화 시스템의 설치를 촉진하는 이니셔티브에 대한 수요를 증가했다. Irrigation Automation Market을 구동하는 주요 요소입니다.

Irrigation Automation Market의 성장에 대한 핵심 요소는 무엇입니까?

자동화 시스템의 높은 설치 비용은 자체 채택을 제한, 특히 개발 국가에서 및 자동화 관개 시스템의 비용 효율성과 이점에 대한 농부의 인식 부족은 관개 자동화 시장의 성장을 추진하는 주요 요인입니다.

Irrigation Automation Market의 주요 자동화 유형은 무엇입니까?

Time-based는 자동화 유형 세그먼트입니다.

Irrigation Automation Market에서 작동하는 주요 플레이어는 무엇입니까?

Toro Company, Hunter Industries, Valmont Industries Inc., Rain Bird Corporation, Jain Irrigation Systems, Lindsay Corporation, Netafim, Galcon, Rubicon Water, Nelson Irrigation는 주요 선수입니다.