Keratoconus Market Size - Analysis

Market Size in USD Mn

CAGR4.9%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 4.9% |

| Market Concentration | High |

| Major Players | Glaukos Corporation, Bausch & Lomb Incorporated, Alcon Laboratories, Inc., Carl Zeiss Meditec AG, Topcon Corporation and Among Others |

please let us know !

Keratoconus Market Trends

With growing awareness about keratoconus, more people are getting themselves screened for the condition at an early stage. Previously, keratoconus diagnosis often happened quite late when significant vision deterioration had already set in.

Several outreach campaigns by eye hospitals and NGOs in the last decade have played a big role in educating general public as well as eye care professionals about keratoconus. People are recognizing that certain eye problems or vision issues in younger individuals may not just be due to high myopia but could be an early sign of keratoconus as well. This is encouraging more proactive consultation with specialists.

Technological upgrades have revolutionized the management of keratoconus. Cross-linking which arrests the worsening of the corneal shape by enhancing its biomechanical strength using riboflavin and UV light, is now an established standard of care worldwide.

Bravelle continuum contact lenses have opened up new possibilities for fitting problematic keratoconic eyes. Availability of scleral lenses provide superior visual outcomes for those not fitted by other modalities. Newer specialized intraocular lenses tailored for keratoconus are being explored. Tissue engineering approaches hold promise for developing bioengineered corneas.

Market Challenge - High Costs Associated with Treatments, Limiting Accessibility

For many patients with limited or no health insurance, affording such expensive care remains a major challenge. Even in countries with universal healthcare, long wait times for procedures limit timely access. This delay in receiving treatment can allow the disease to progress rapidly in severe cases. The high economic burden restricts access to care especially for low-income groups and in developing nations.

The keratoconus market is poised for growth with ongoing R&D into novel therapeutic approaches. One promising innovation is IVMED-80, an investigational, non-invasive drug delivered through eye drops being developed for keratoconus. If approved, it can potentially transform treatment landscape. Keratoconus management relies heavily on hard contact lenses and rigid gas permeable lenses to improve vision.

With a large patient base and no approved pharmacologic treatments currently available, IVMED-80, if successful, has potential to capture a sizable market share globally. It can expand patient reach and lead to superior outcomes.

Prescribers preferences of Keratoconus Market

Keratoconus is typically treated via a staged approach depending on the severity of the condition. In mild cases, over-the-counter lubricating eye drops may provide relief from discomfort. For moderate Keratoconus, rigid gas-permeable contact lenses are often prescribed to help correct vision and slow progression, such as brands like BostonSight and SynergEyes.

Finally, in advanced cases where vision is greatly impaired, prescription of a corneal transplant is not uncommon. Transplants carry risks but provide the best chance of restoring vision through replacement of the damaged cornea. Prescriber preference here depends on factors like graft rejection risks, availability of donor tissue, and the patient's overall health profile and lifestyle.

Treatment Option Analysis of Keratoconus Market

Keratoconus has been typically classified into four stages based on severity of the condition:

Stage 2 (Moderate): In addition to above, there may be mild or moderate thinning and protrusion of the cornea. This stage often requires contact lenses like BostonSight or Rose K2 lenses for visual rehabilitation. Cross-linking with riboflavin and UV-A rays is also recommended to stop progression.

Stage 4 (Severe): Extreme steepening with corneal Hydrops or scarring render the cornea opaque. The last line of management involves penetrating keratoplasty (corneal transplant) using donor corneal button grafting.

Key winning strategies adopted by key players of Keratoconus Market

Collagen cross-linking has emerged as a very effective strategy for treating mild to moderate Keratoconus. Players like Avedro have developed riboflavin ultraviolet light therapies that employ this technique. When Avedro launched its KXL system in 2013 to perform collagen cross-linking, it helped slow or stop progression in many keratoconus patients by increasing collagen resistance. Clinical studies showed KXL reduced the rate of progression by around 96%, cementing its adoption.

Players are also offering intracorneal ring segments (ICRS) to halt the disease's progression. For instance, in 2008 BostonSight launched the Ferrara ring, claiming it provided 3-5 lines of improved unaided vision in over 90% of patients at 5 years post-surgery. A prospective study of 157 eyes showed the Ferrara ring stabilized 90% of keratoconic corneas after 5 years, allowing it to capture a major segment of the ICRS market.

Segmental Analysis of Keratoconus Market

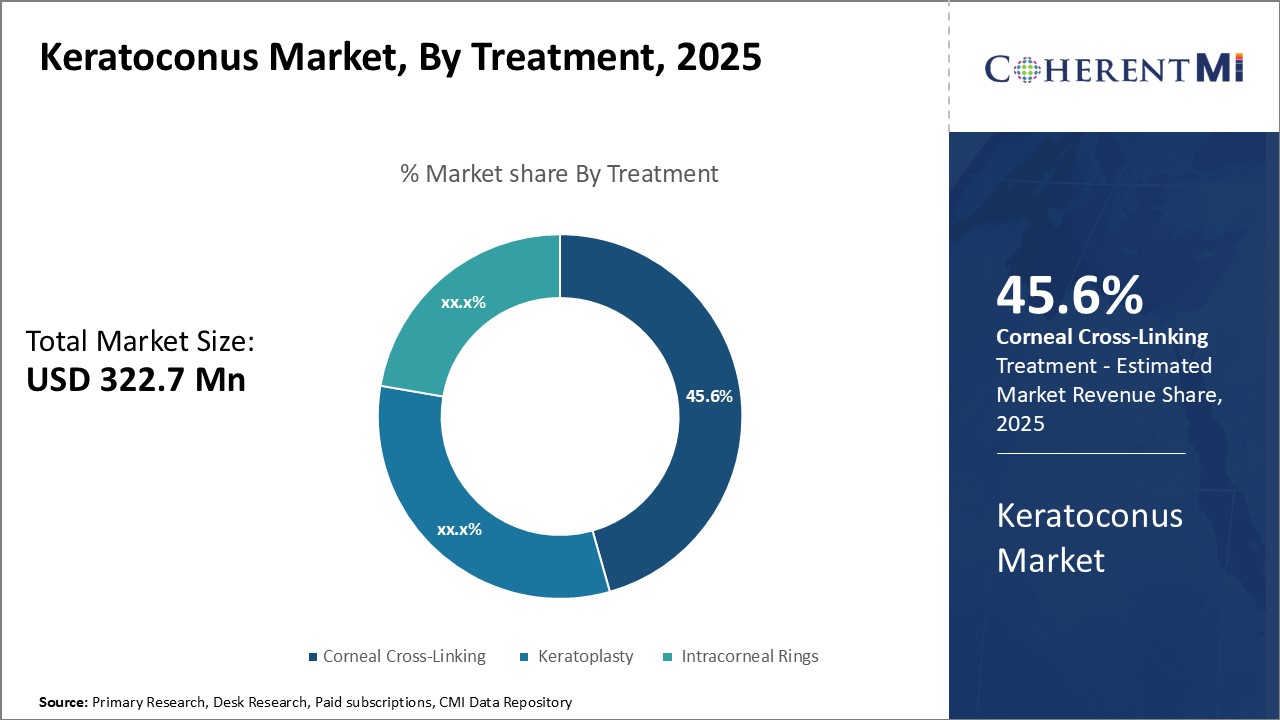

Insights, By Treatment: Corneal Cross-Linking: The Leading Treatment Option

Insights, By Treatment: Corneal Cross-Linking: The Leading Treatment OptionCorneal cross-linking segment is expected to account for 45.6% share of the keratoconus market in 2025, due to its effectiveness in halting the progression of the eye disease. As the gold standard treatment, cross-linking utilizes riboflavin eye drops and ultraviolet A light to form molecular bonds within the corneal collagen, strengthening the tissue and preventing further thinning and steepening. This proven photochemical procedure gives patients hope that their vision will be preserved without needing a cornea transplant.

Due to cross-linking demonstrating concrete evidence that it can stop keratoconus progression in up to 95% of cases, eye care professionals widely recommend it as the first line of defense, especially for moderate to severe keratoconus. Its effectiveness in stabilizing vision makes it appealing to both doctors and their keratoconus patients seeking to delay or avoid keratoplasty. This clinical validity and non-invasiveness sustain corneal cross-linking at the forefront of the treatment landscape.

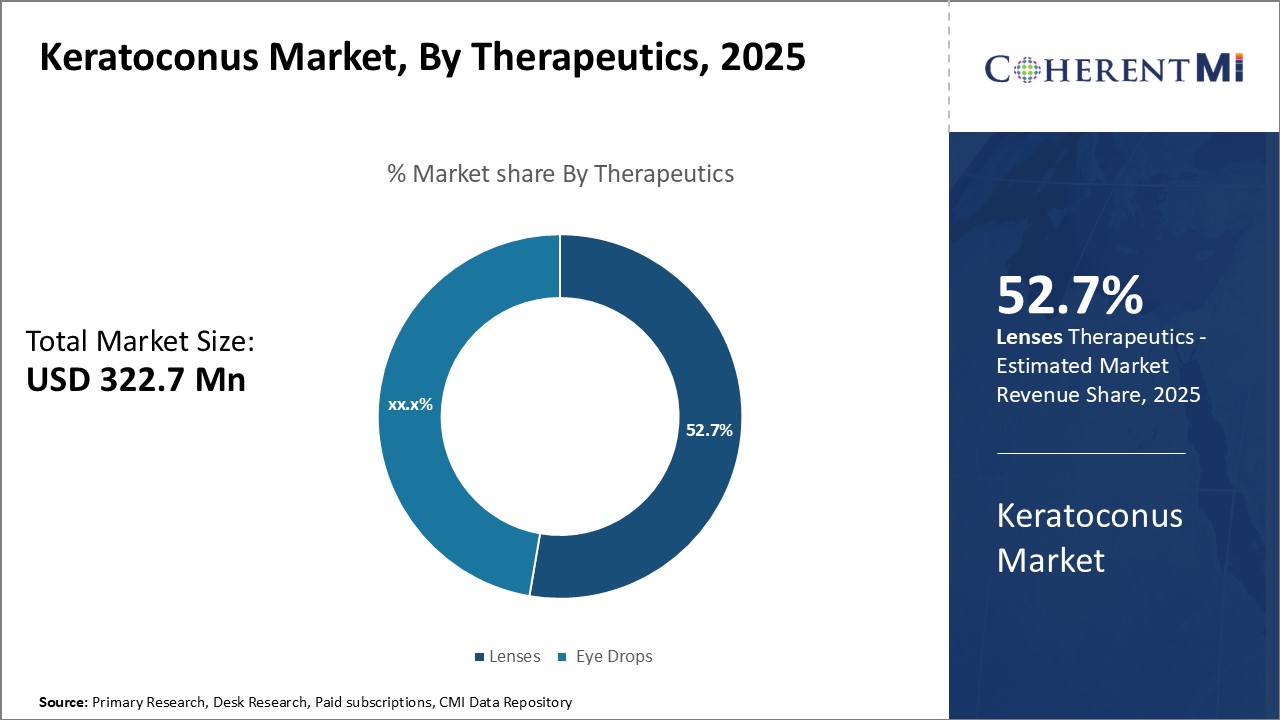

In 2025, the lenses segment is expected to account for 52.7% revenue share of the keratoconus market. Contact lenses play a crucial role in managing keratoconus by optimizing vision and minimizing disability from the condition. As keratoconus causes the cornea to thin and distort, customized gas-permeable rigid contact lenses are able to compensate for this irregular astigmatism and bring clear focus to the eye.

For mild to moderate keratoconus, lenses can regularly provide good to excellent visual acuity without other interventions like cross-linking. They also enable clear vision during the monitoring period prior to cross-linking or determination of whether keratoplasty is needed. Even after corneal transplant, lenses may still be required for fully optimized vision.

This ability of specialty contact lenses to accommodate keratoconus progression and optimize vision at every stage largely attributes to their prominence within the disease's therapeutic landscape.

Additional Insights of Keratoconus Market

- The prevalence of Keratoconus is notably higher in younger demographics, especially in individuals between the ages of 16 and 30. Increased awareness among clinicians has led to earlier diagnosis and intervention in these groups.

- Technological advancements in treatment such as corneal cross-linking are expected to drive significant market growth during the forecast period.

- Patient Pool: In the US, EU5, and Japan, the diagnosed patient pool is increasing, attributed to improved awareness and diagnosis techniques. The report highlights an increasing prevalence in young adults due to enhanced screening.

- Regional Growth: The United States dominates the market, followed by EU5 and Japan, reflecting regional differences in diagnosis and treatment adoption.

Competitive overview of Keratoconus Market

The major players operating in the keratoconus market include Glaukos Corporation, Bausch & Lomb Incorporated, Alcon Laboratories, Inc., Carl Zeiss Meditec AG, Topcon Corporation, Oculus Optikgeräte GmbH, Nidek Co., Ltd., Healon Medical Inc., Mediphacos, and KeraMed, Inc.

Keratoconus Market Leaders

- Glaukos Corporation

- Bausch & Lomb Incorporated

- Alcon Laboratories, Inc.

- Carl Zeiss Meditec AG

- Topcon Corporation

Keratoconus Market - Competitive Rivalry

Keratoconus Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Keratoconus Market

- In August 2023, Iveena Delivery Systems advanced IVMED-80 eye drops into Phase II trials, offering a potential non-surgical option for early-stage keratoconus patients globally.

- In May 2023, Avedro introduced an updated cross-linking device with enhanced UV light control for safer procedures, impacting the US market positively by reducing corneal transplant events. Avedro, a subsidiary of Glaukos Corporation, is a known leader in corneal cross-linking treatments.

- In February 2023, iVeena Delivery Systems entered a collaboration with leading ophthalmologists to work on an innovative therapy aimed at reducing the need for corneal transplants in advanced cases of keratoconus. This development builds on their work with IVMED-80, a pharmacologic treatment designed to address the underlying causes of keratoconus through non-surgical means. This collaboration could significantly improve late-stage disease management, offering new hope to patients who would otherwise require corneal transplants.

- In January 2023, Glaukos Corporation announced advancements in corneal cross-linking technologies, which aim to enhance patient outcomes by minimizing the invasiveness of treatment. This development is expected to significantly impact treatment approaches in the Keratoconus market, leading to better patient satisfaction and treatment accessibility. These innovations are part of their ongoing work to develop next-generation solutions for eye conditions such as keratoconus. The aim is to make treatments more efficient and patient-friendly, contributing to better clinical results.

Keratoconus Market Segmentation

- By Treatment

- Corneal Cross-Linking

- Epithelium-off Cross-Linking

- Epithelium-on Cross-Linking

- Keratoplasty

- Intracorneal Rings

- Corneal Cross-Linking

- By Therapeutics

- Lenses

- Eye Drops

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Frequently Asked Questions :

How big is the keratoconus market?

The keratoconus market is estimated to be valued at USD 322.7 Mn in 2025 and is expected to reach USD 451.1 Mn by 2032.

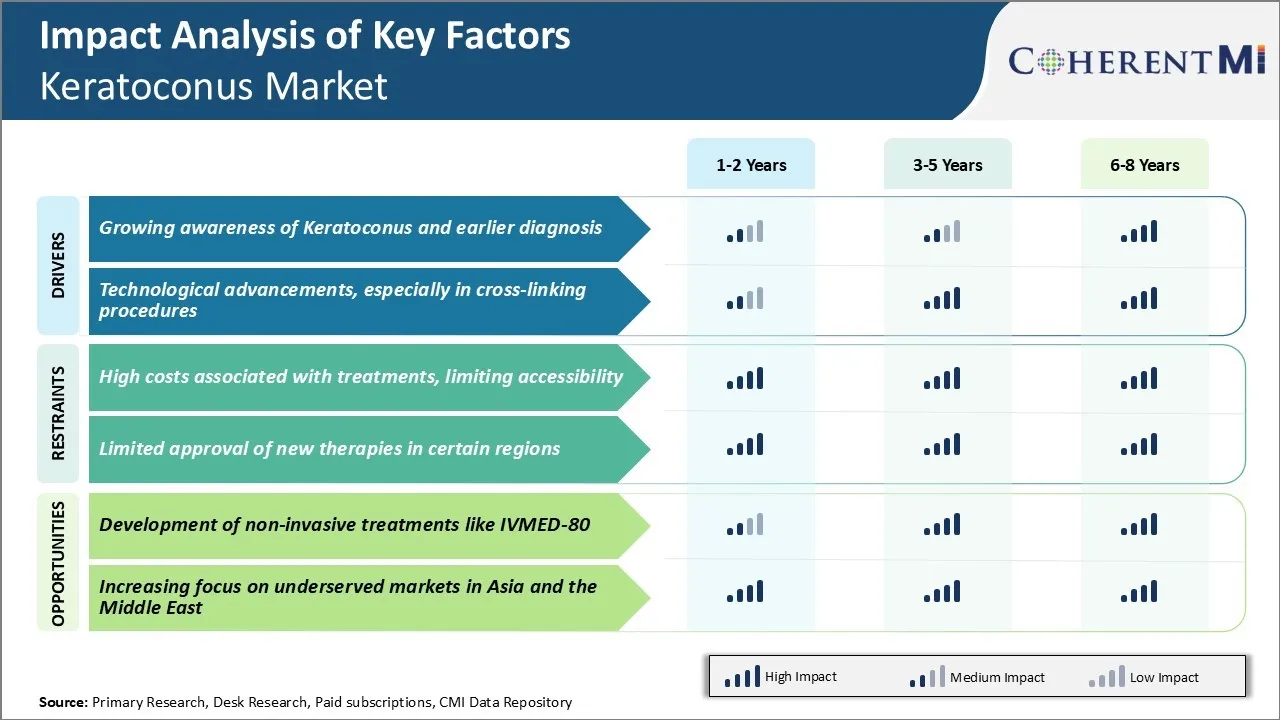

What are the key factors hampering the growth of the keratoconus market?

The high costs associated with treatments, limiting accessibility and limited approval of new therapies in certain regions are the major factors hampering the growth of the keratoconus market.

What are the major factors driving the keratoconus market growth?

The growing awareness of keratoconus and earlier diagnosis and technological advancements, especially in cross-linking procedures, are the major factors driving the keratoconus market.

Which is the leading treatment in the keratoconus market?

The leading treatment segment is corneal cross-linking.

Which are the major players operating in the keratoconus market?

Glaukos Corporation, Bausch & Lomb Incorporated, Alcon Laboratories, Inc., Carl Zeiss Meditec AG, Topcon Corporation, Oculus Optikgeräte GmbH, Nidek Co., Ltd., Healon Medical Inc., and Mediphacos, KeraMed, Inc. are the major players.

What will be the CAGR of the keratoconus market?

The CAGR of the keratoconus market is projected to be 4.9% from 2025-2032.