Lewy Body Dementia Market Size - Analysis

The Global Lewy Body Dementia Market is estimated to be valued at USD 1.35 Bn in 2025 and is expected to reach USD 2.27 Bn by 2032, growing at a compound annual growth rate (CAGR) of 7.7% from 2025 to 2032. Lewy body dementia is a common form of progressive dementia that causes a decline in thinking, reasoning and independent function over time. It can vary in its severity and rate of progression.

The market is expected to grow at a steady rate during the forecast period. Rising elderly population worldwide and increasing prevalence of Lewy body dementia are the key factors driving the market. In addition, approval and launch of new drugs and growing number of research activities for developing innovative treatment therapies are further expected to boost the market growth over the coming years.

Market Size in USD Bn

CAGR7.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 7.7% |

| Market Concentration | High |

| Major Players | EIP Pharma Inc., Cognition Therapeutics, Eisai Inc., Eli Lilly and Company, Athira Pharma and Among Others |

please let us know !

Lewy Body Dementia Market Trends

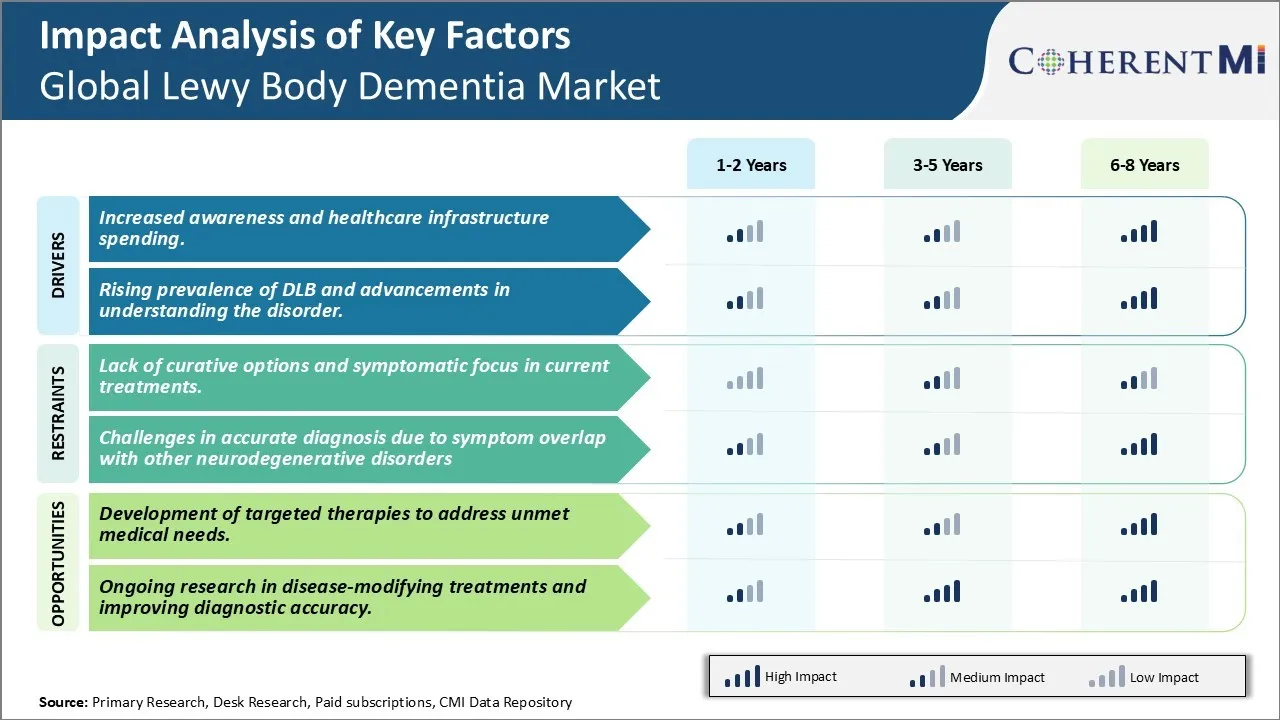

Market Driver - Increased awareness and healthcare infrastructure spending.

Over the past few years, there has been a significant increase in awareness campaigns about Lewy Body dementia organized by various global healthcare NGOs and foundations. Several initiatives have been launched to educate people about signs and symptoms of the disorder and importance of early diagnosis. Support groups for patients and caregivers have also seen rise in number. All these activities have played a crucial role in bringing Lewy Body dementia into spotlight.

Simultaneously, government bodies in many developed nations have upgraded healthcare infrastructure and started focusing more on neurological disorders. Heavy investments are being made to set up specialized dementia care centers, memory clinics and recruit trained professionals including neurologists. This is allowing improved diagnostic facilities to be available closer to local population. Some countries have even included LBD in their national dementia plans and made provisions for partial or full medical coverage of approved drug therapies.

The combined effect of these positive developments is that more people are now aware of LBD as a distinct disorder and seeking timely medical advice on experiencing early signs. Diagnosis rates have increased from past whereas underdiagnosis was a major issue earlier. The improved access to quality care pathways and diagnostic/treatment options available is giving patients confidence to visit healthcare providers without delay. It is also encouraging physicians globally to enhance their skills in LBD management through continuous medical education programs.

All such factors related to spreading more knowledge regarding LBD as well as strengthening underlying healthcare infrastructure have created a conducive environment for growth of this particular market in recent times. As diagnosis and treatment-seeking rates increase, overall drug consumption and demand for other supporting products/services is expected to rise substantially. Sustained funding support from major institutes and foundations will be pivotal for the observed positive trends to continue in the forecast period as well.

Rising Prevalence of DLB and Advancements in Understanding the Disorder

Research studies undertaken by medical institutes and clinical trials data are pointing towards an alarming rise in prevalence of Dementia with Lewy Bodies globally. It is now recognized as the second most frequent type of progressive dementia after Alzheimer's disease. Even more concerning is that DLB is under-researched as well as under-diagnosed vis-à-vis other sub-types traditionally.

However, during the last decade extensive efforts by leading experts have improved understanding about characteristics and manifestation of DLB. Biomarker development work has facilitated the process of identifying presence or absence of Lewy Body inclusions in patient's brain. Several guidelines have been published addressing diagnostic criteria, management protocols as well as describing care pathways from primary care to specialist settings. These collectively are working to close gaps which previously resulted in misdiagnosis.

Simultaneously, pharmaceutical companies have accelerated research on DLB therapeutics. Few disease-modifying drugs meant for Parkinson's disease are now being explored for their efficacy against DLB symptoms too. An expanded pipeline of both symptomatic and disease-modifying treatment options exists in development phase which once approved, could strengthen the therapeutics landscape. Ultimately, these advances aim to alleviate suffering of patients and provide much-needed support to their families as well.

As diagnosis of DLB cases gets refined through implementation of updated criteria and guidelines, actual prevalence numbers could surge further from current estimates. This rising disease burden along with efforts to deepen medical understanding are fueling the Lewy Body dementia market demand for accurate diagnostics, effective management approaches and innovative treatment methods among healthcare professionals.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Lack of curative options and symptomatic focus in current treatments.

One of the major challenges faced in the global Lewy body dementia market is the lack of curative options and predominant focus on symptomatic treatments. Lewy body dementia is a progressive and fatal disorder for which there are currently no treatments available that can halt or slow down the degeneration of neurons. All approved therapies till date are only aimed at managing the symptoms of the disease like cognitive decline, psychiatric symptoms, and motor impairments. While these drugs provide some relief from symptoms in the short term, they do not address the underlying pathology or stall the progression of the disease long term. Additionally, most approved drugs are repurposed from other CNS conditions and not specifically developed for Lewy body dementia. The symptomatic focus of current treatment landscape leaves a huge unmet need for disease-modifying therapies that can alter the course of the disease. This lack of curative options poses a major limitation in effectively treating patients suffering from Lewy body dementia.

Development of targeted therapies to address unmet medical needs

One of the major opportunities in the global Lewy body dementia treatment market lies in the development of targeted therapies that can specifically address some of the unmet medical needs in this patient population. With advances in scientific understanding of the molecular pathology and pathogenesis of Lewy body dementia, there is potential to develop novel therapeutic agents directed at underlying disease mechanisms like alpha-synuclein aggregation and spreading, mitochondrial dysfunction, neuroinflammation etc. Several biotech and pharmaceutical companies are investing in Lewy body dementia drug development programs focused on disease modification. Successful research efforts can lead to new therapeutic options like disease-modifying drugs, anti-aggregants, neuroprotective agents that can slow down disease progression and combat symptoms over the long term. This would provide physicians more effective options to treat patients comprehensively rather than just manage symptoms temporarily. The huge unmet need presents a major commercial opportunity for developers of first-in-class targeted therapies for Lewy body dementia.

Prescribers preferences of Lewy Body Dementia Market

Lewy body dementia (LBD) progresses through mild, moderate, and severe stages. In the mild stage, cholinesterase inhibitors are typically prescribed as first-line treatment to address cognitive symptoms. Donepezil (Aricept) and rivastigmine (Exelon) patches are commonly used drugs in this class. As symptoms intensify in the moderate stage, memantine (Namenda) may be added to augment the cholinesterase inhibitor already in use. Memantine is an NMDA receptor antagonist approved as a monotherapy or adjunctive LBD treatment.

For patients experiencing worsening motor symptoms like Parkinsonism, a dopaminergic agent may be introduced as adjunctive therapy. Common options include the dopamine agonist pramipexole (Mirapex) and levodopa combined with carbidopa (Sinemet). As cognitive and functional impairment progress significantly in the severe stage, treatment shifts to managing comorbidities, minimizing medications, and optimizing comfort. Antipsychotics are generally avoided due to risk of exacerbating symptoms.

Other factors influencing treatment choices include medication side effects, cost, insurance coverage, caregiver preference, and patient quality of life priorities. Cholinesterase inhibitors are usually well-tolerated but can cause gastrointestinal issues. Memantine likewise has a favorable safety profile. Dopaminergic drugs risk side effects like impulse control behaviors.

Treatment Option Analysis of Lewy Body Dementia Market

Lewy body dementia (LBD) can be treated differently depending on the stage of the disease. LBD is typically broken down into 3 stages - early, middle, and late stage.

In early-stage LBD, non-drug therapies are emphasized like cognitive behavioral therapy to address symptoms. Cholinesterase inhibitors are also frequently used as the first line drug treatment option. Donepezil (Aricept) is a commonly prescribed option that works to improve cognitive symptoms.

As the disease progresses to middle stage LBD, symptoms worsen and non-drug therapies alone may not provide enough relief. Combination drug treatments are often utilized like donepezil plus memantine (Namenda). The donepezil helps with cognitive and memory problems while memantine targets psychosis and behavioral issues that emerge at this stage. Rivastigmine patch (Exelon Patch) is another option that provides continuous drug delivery through the skin.

In late stage LBD, care is focused on comfort measures since the brain has significant degeneration. Antipsychotics should generally be avoided due to risk of adverse effects. Non-pharmacological strategies like reassurance, music therapy, and reminiscing continue to be emphasized. Rivastigmine oral solution can still be tried for cognitive and behavioral symptoms though response diminishes significantly at this advanced stage. Palliative care is also introduced to manage pain and other end-of-life issues.

Key winning strategies adopted by key players of Lewy Body Dementia Market

Focus on R&D for new drug development- One of the major strategies adopted by leading players like Novartis, Axovant Sciences, and GE healthcare has been increasing investments in R&D for developing new drugs for treatment of Lewy body dementia. For example, in 2019, Novartis invested over $9 billion in R&D and launched drugs like Piqray and Mayzent which are helping treat symptoms of Lewy body dementia. Axovant Sciences is currently conducting phase 3 clinical trials for its candidate AXO-Lenti-PD which showed positive results in reducing symptoms in phase 2.

Partnering with clinical research organizations - Players are partnering with clinical research organizations to accelerate their drug development programs and clinical trials. For example, in 2021, Axovant partnered with RankClinical to support its global phase 3 study of AXO-Lenti-PD. Such partnerships help companies access specialized expertise and larger patient pools to test potential new treatments faster.

Focus on emerging economies - Due to rising diagnosis rates, players are focusing on markets like China, India and Brazil which are expected to drive higher growth. For example, GE Healthcare has launched lower-cost portable brain PET/CT scanners in India to enable wider diagnostic screening. Their affordable solutions are helping generate increased adoption in emerging markets.

Awareness initiatives and advocacy - Leading players also focus on raising awareness about Lewy body dementia through collaboration with patient advocacy groups. For example, the Lewy Body Dementia Association partners with companies to sponsor educational programs and awareness drives. Novartis supports several advocacy initiatives to spread knowledge about symptoms and caregiving.

Such strategic initiatives by top players focused on R&D, partnerships, emerging markets and advocacy have helped drive increased adoption of available treatment options and diagnostic tools over the past 5 years.

Segmental Analysis of Lewy Body Dementia Market

To learn more about this report, Download Free Sample Copy

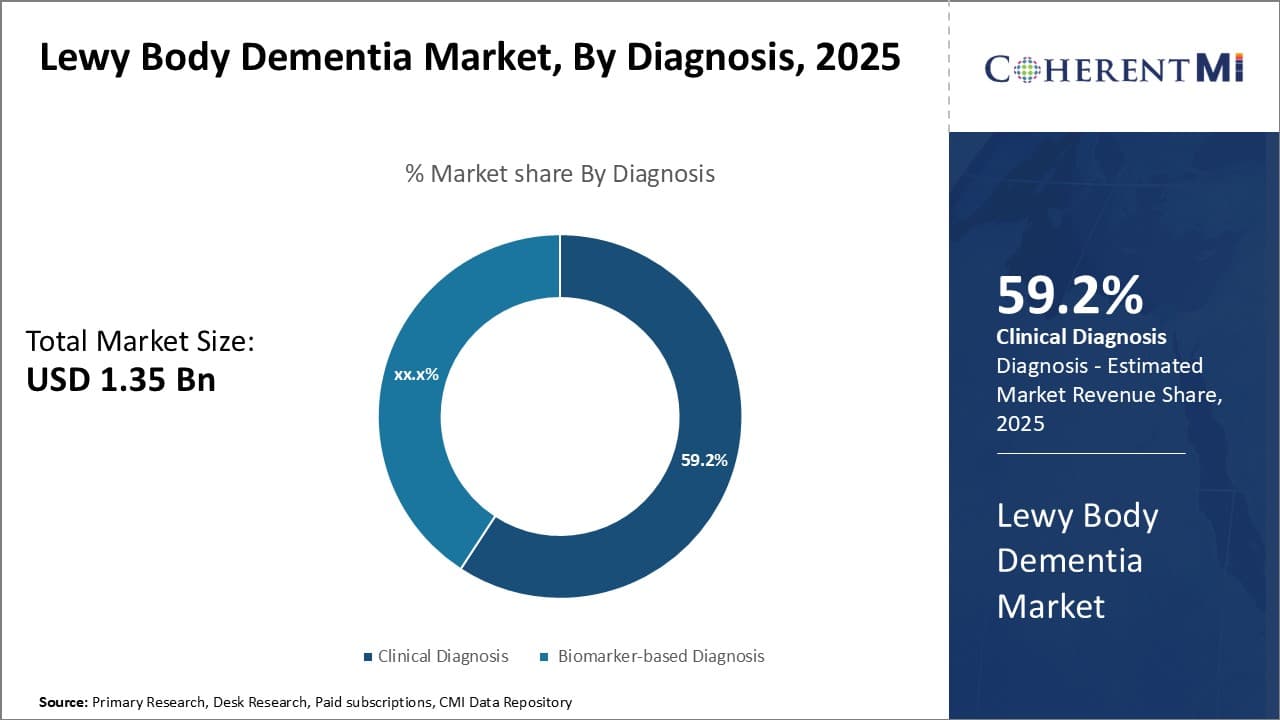

By Diagnosis - Growing Emphasis on Early Detection Drives Clinical Diagnosis Segment

To learn more about this report, Download Free Sample Copy

By Diagnosis - Growing Emphasis on Early Detection Drives Clinical Diagnosis Segment

In terms of By Diagnosis, Clinical Diagnosis contributes the highest share of the market with 59.2% in 2025 owning to the growing emphasis on early detection of Lewy body dementia. Clinicians rely on a detailed medical history and neurological examination to diagnose Lewy body dementia clinically. Some common clinical diagnostic criteria include fluctuating cognition, visual hallucinations, REM sleep behavior disorder, and Parkinsonism features like slowed movements and rigid muscles.

Clinical diagnosis allows doctors to identify symptoms early and delay progression through lifestyle modifications and medication. Early detection is critical since symptoms worsen over time with deterioration in daily functioning. It also helps patients and families plan care arrangements in advance. Researchers are further refining clinical diagnostic criteria to improve accuracy rates. For example, revised consensus criteria now place greater importance on REM sleep behavior disorder which has a high correlation with Lewy body pathology.

Advanced diagnostic techniques like dopamine transporter imaging and polysomnography are also assisting clinical diagnoses by objectively confirming presence of Parkinsonism features or REM sleep abnormalities respectively. However, clinical diagnosis can sometimes be difficult given overlapping symptoms with Alzheimer's and Parkinson's diseases. Biomarker tests are evolving but remain limited in availability and cost-effectiveness compared to clinical evaluation, sustaining demand for clinical diagnosis.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

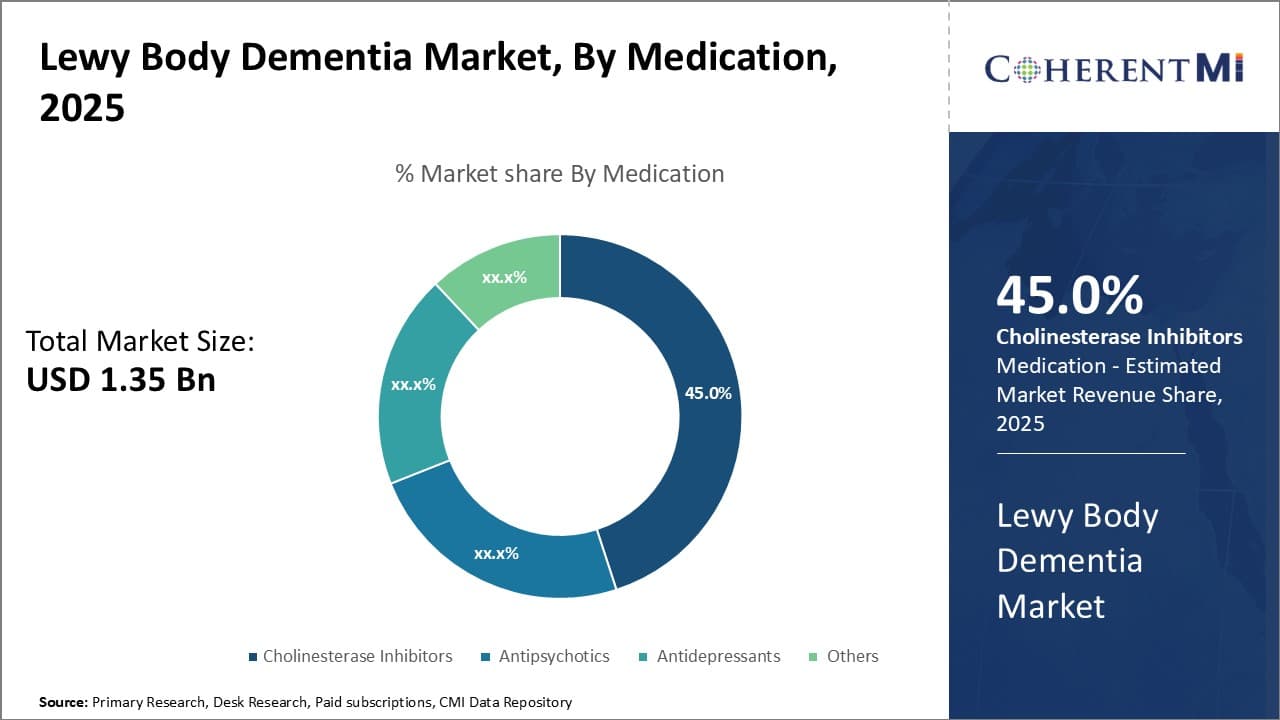

By Medication - Rising Prevalence Increases Demand for Cholinesterase Inhibitors

In terms of By Medication, Cholinesterase Inhibitors contributes the highest share of the market with 45% in 2025 due to the rising prevalence of Lewy body dementia and the efficacy of these drugs. Cholinesterase inhibitors work by increasing levels of acetylcholine, a key neurotransmitter deficient in Lewy body dementia patients. Drugs like rivastigmine, donepezil and galantamine are approved for treatment and effectively provide symptomatic relief from cognitive impairment and behavioral issues.

As more cases are identified through improved diagnosis, the demand for cholinesterase inhibitors is surging. Experts estimate less than half of Lewy body dementia patients currently receive a accurate diagnosis, indicating significant growth potential. Moreover, cholinesterase inhibitors demonstrate clear benefits on attention, executive function and visual hallucinations compared to placebo as evidenced in clinical trials. Their mild side effect profile and once-daily oral dosing also enhance compliance.

Generic formulations have made these drugs more affordable and accessible worldwide. While alternative medications like antipsychotics and antidepressants are still prescribed, cholinesterase inhibitors remain first-line pharmacological management owing to proven efficacy and safety established over decades of usage in Alzheimer's patients as well. This large treatment-experienced user base and gold-standard position will sustain cholinesterase inhibitor usage over the forecast period.

By End User - Expanding Diagnostic and Treatment Options Drive Growth in Hospitals

In terms of By End User Hospitals contribute the highest share of the market driven by expanding diagnostic and treatment options available in this setting. Most Lewy body dementia diagnoses occur in specialized memory clinics and movement disorder units located within major urban hospitals. These centers have multidisciplinary teams of neurologists, psychiatrists and nurse practitioners experienced in complex differential diagnoses.

Hospitals are also the preferred location for advanced diagnostic tests like dopamine transporter imaging using SPECT/PET scans and polysomnography studies to objectively confirm clinical findings. Such facilities require specialized equipment and trained technicians only available at hospitals. Additionally, most clinical drug trials are conducted based out of hospital research centers to ensure safety and quality control standards for investigative medications.

Long-term care demand is expected to rise significantly with the aging population globally. While stand-alone elderly homes and assisted living centers may provide custodial care, hospitals have expanded geriatric programs and dementia units offering comprehensive treatment bundled with therapy and case management services. The growing emphasis on non-pharmacological strategies like cognitive stimulation and caregiver training also favors the hospital outpatient setting. Higher reimbursement levels further boost hospital revenues from dementia patients.

Additional Insights of Lewy Body Dementia Market

The Lewy Body Dementia (DLB) market is expected to experience significant growth driven by increased awareness, healthcare infrastructure spending, and advancements in targeted therapies. However, the current treatment landscape is primarily focused on symptomatic management, lacking curative options. The market is dominated by companies like EIP Pharma Inc., Cognition Therapeutics, and Eisai Inc., actively developing treatments. The United States holds the largest market share due to high prevalence and treatment costs, with Japan and the UK following. The market outlook suggests opportunities for innovation and improved treatment outcomes, despite challenges in drug approval and diagnostic accuracy.

Competitive overview of Lewy Body Dementia Market

The major players operating in the Global Lewy Body Dementia Market include EIP Pharma Inc., Cognition Therapeutics, Eisai Inc., Eli Lilly and Company, Athira Pharma, Sun Pharma Advanced Research Company Limited, CuraSen Therapeutics, Inc. and Aptinyx.

Lewy Body Dementia Market Leaders

- EIP Pharma Inc.

- Cognition Therapeutics

- Eisai Inc.

- Eli Lilly and Company

- Athira Pharma

Recent Developments in Lewy Body Dementia Market

- In August 2023, a review of Phase II and III trials underscored the growing interest in developing new drugs for dementia with Lewy bodies (DLB). Despite DLB being linked to more rapid cognitive decline and a greater burden on patients and caregivers compared to Alzheimer's disease (AD), drug development for DLB has lagged behind that for AD. Currently, off-label treatment options for DLB are largely limited to symptomatic agents originally developed for cognitive deficits in AD, motor symptoms in Parkinson's disease, or behavioral issues in psychiatric disorders. However, advancements in the diagnosis of DLB have recently driven renewed efforts to develop disease-modifying agents (DMA) specifically for this condition.

- In October 2022, Pfizer Inc., a global pharmaceutical and biotechnology leader, completed its US$11.6 billion acquisition of Biohaven Pharmaceuticals Inc. This strategic acquisition is intended to enhance Pfizer's capacity to deliver innovative treatment solutions worldwide. Biohaven Pharmaceuticals, focused on developing therapies for Parkinson's disease—a condition associated with Lewy body dementia—aligns with Pfizer's objective to expand its portfolio of treatments in this therapeutic area.

- In November 2020: EIP Pharma Inc. received USFDA approval for investigating Neflamapimod to treat DLB, marking a significant step towards developing new therapies.

Lewy Body Dementia Market Segmentation

- By Diagnosis

- Clinical Diagnosis

- Biomarker-based Diagnosis

- By Medication

- Cholinesterase Inhibitors

- Antipsychotics

- Antidepressants

- Others (e.g., Parkinson's medications,etc.)

- By End User

- Hospitals

- Specialty Clinics

- Long-term Care Facilities

- Others

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.