Netherlands Bitumen Market Size - Analysis

The Netherlands Bitumen Market is estimated to be valued at USD 14.47 Bn in 2025 and is expected to reach USD 20.09 Bn by 2032, growing at a CAGR of 4.8% from 2025 to 2032.

Market Size in USD Bn

CAGR4.8%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 4.8% |

| Market Concentration | Medium |

| Major Players | Royal Dutch Shell, Koninklijke Wegenbouw Stevin B.V., Ooms Producten B.V., Latexfalt B.V., Bitufa Bitumen B.V. and Among Others |

please let us know !

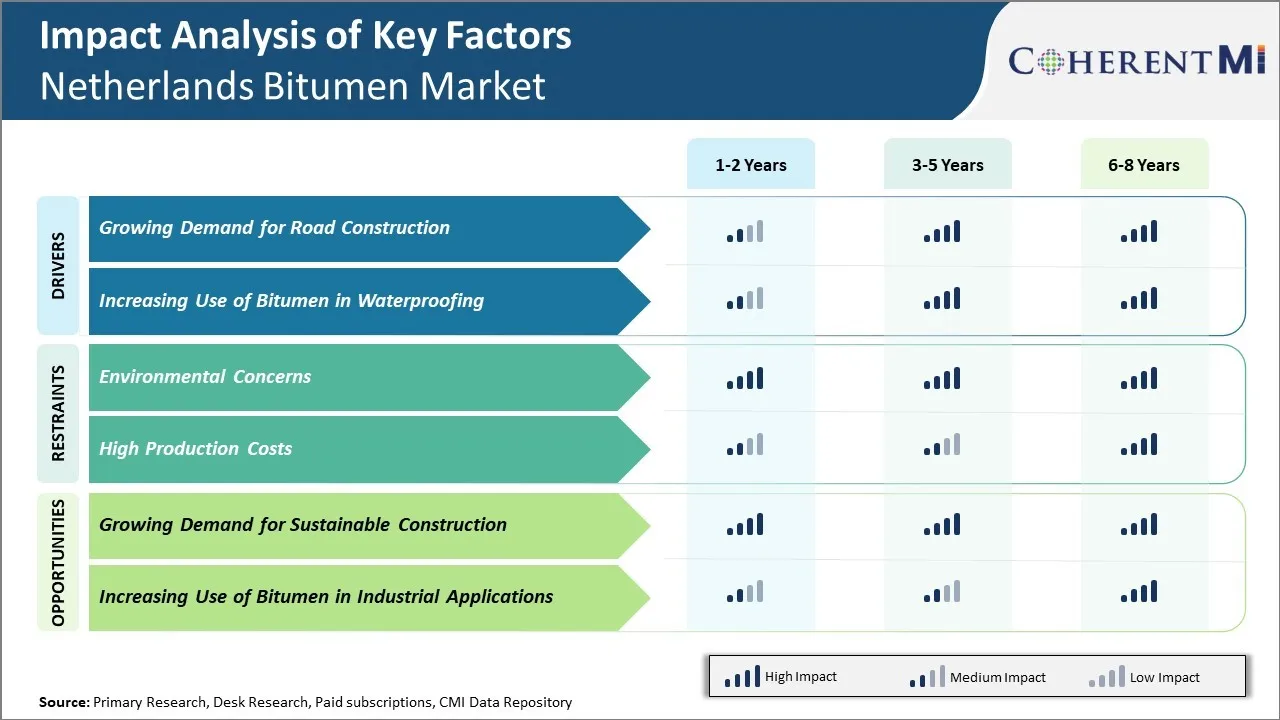

Netherlands Bitumen Market Trends

The Netherlands has witnessed significant growth in road construction activities over the past few years which has driven the demand for bitumen in the country. With increasing urbanization and industrialization, the need for better road infrastructure to support the growing transportation needs has risen steadily. The government has recognized the need to expand and upgrade the road networks and has allocated sizable funds towards various road construction projects.

The future trends also remain positive as the vision of the Dutch government is to develop a robust inter-city transportation grid along with upgrading existing roads to reduce traffic congestion.

Market Driver – Increasing Use of Bitumen in Waterproofing

Some of the key factors driving the higher use of bitumen for waterproofing include growth in construction activities in the country as well as rising awareness about the need for effective waterproofing solutions to protect infrastructure from damage. The Netherlands has witnessed steady growth in new residential and commercial construction post pandemic in 2022 according to the Dutch Central Bureau of Statistics.

Market Challenge – Environmental Concerns

Additionally, the extraction and mining of bitumen poses threat to local biodiversity. The areas surrounding the bitumen mines often contain fragile ecosystems and extraction damages the natural habits. As per the data from Netherlands Environmental Protection Agency published in 2021, over 10,000 hectares of forest land was cleared for bitumen mining in the last decade. This destruction of green cover adversely impacts local flora and fauna. Several environmental groups are protesting against proposed expansion of bitumen mines citing ecological degradation.

Market Opportunity – Growing Demand for Sustainable Construction

This shift towards sustainable construction is driving increased demand for products that can help builders construct greener and more resilient buildings and roads. Bitumen, being a widely used binder in asphalt production and waterproofing, has the potential to play a crucial role in sustainable construction when derived from recycled materials. Using recycled bitumen extracted from existing road surfaces and post-consumer waste reduces the need to mine for new bitumen resources. It also lowers greenhouse gas emissions since less refined bitumen needs processing. As environmental regulations tighten, builders will seek out such climate-friendly bitumen alternatives to remain compliant.

Segmental Analysis of Netherlands Bitumen Market

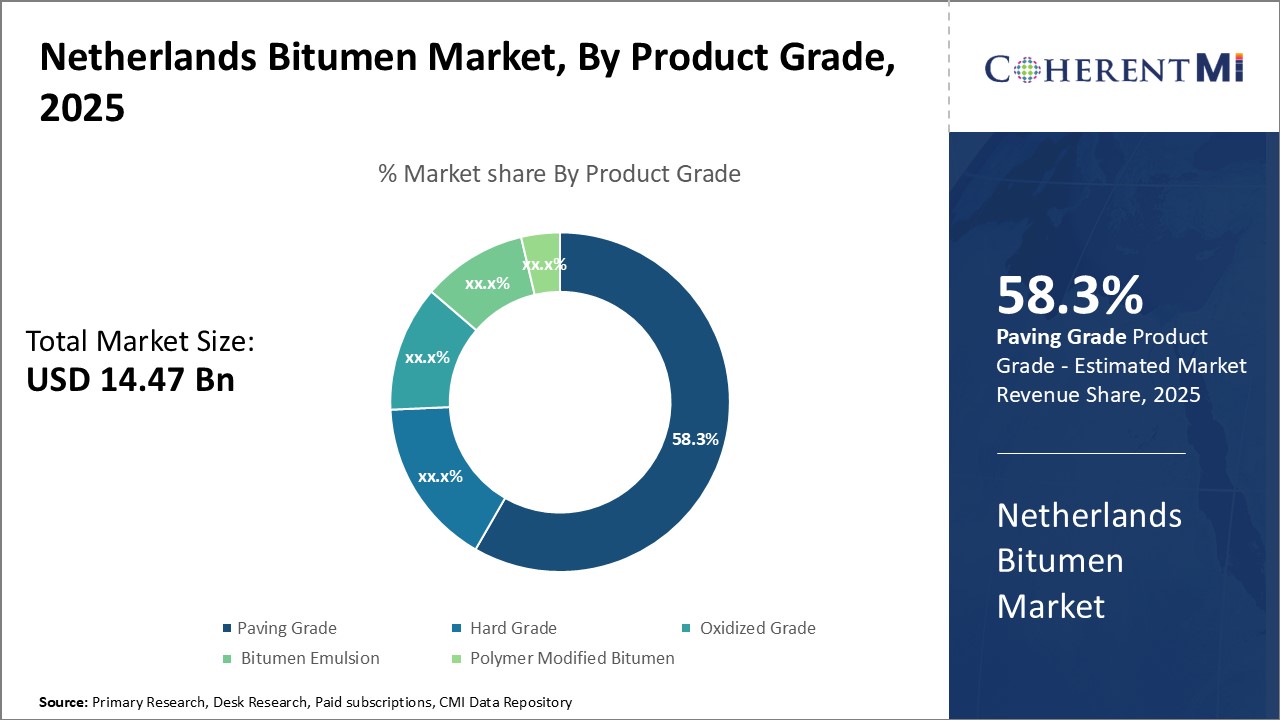

Insights, By Product Grade: Rise in Infrastructure Development Drives Demand for Paving Grade Bitumen

Insights, By Product Grade: Rise in Infrastructure Development Drives Demand for Paving Grade Bitumen The paving grade sub-segment contributes the highest share of 58.3% in the Netherlands bitumen market owing to its widespread applications in road construction activities. Paving grade bitumen serves as a key binder and waterproofing agent in asphalt mixtures used for paving surfaces of highways, streets, and other heavy-duty roads. Rapid infrastructure development across the country in recent years has fueled the demand for paving works.

Furthermore, the large presence of logistics and warehousing facilities near major ports necessitates frequent repairs and resurfacing of heavy-traffic roads. Port cities like Rotterdam and Amsterdam witness intensive movement of heavy cargo vehicles on a daily basis, taking a toll on road quality over time. Paving grade bitumen plays a critical role in maintenance, repair and overlay activities carried out by provincial authorities to extend the lifespan of commercial roads.

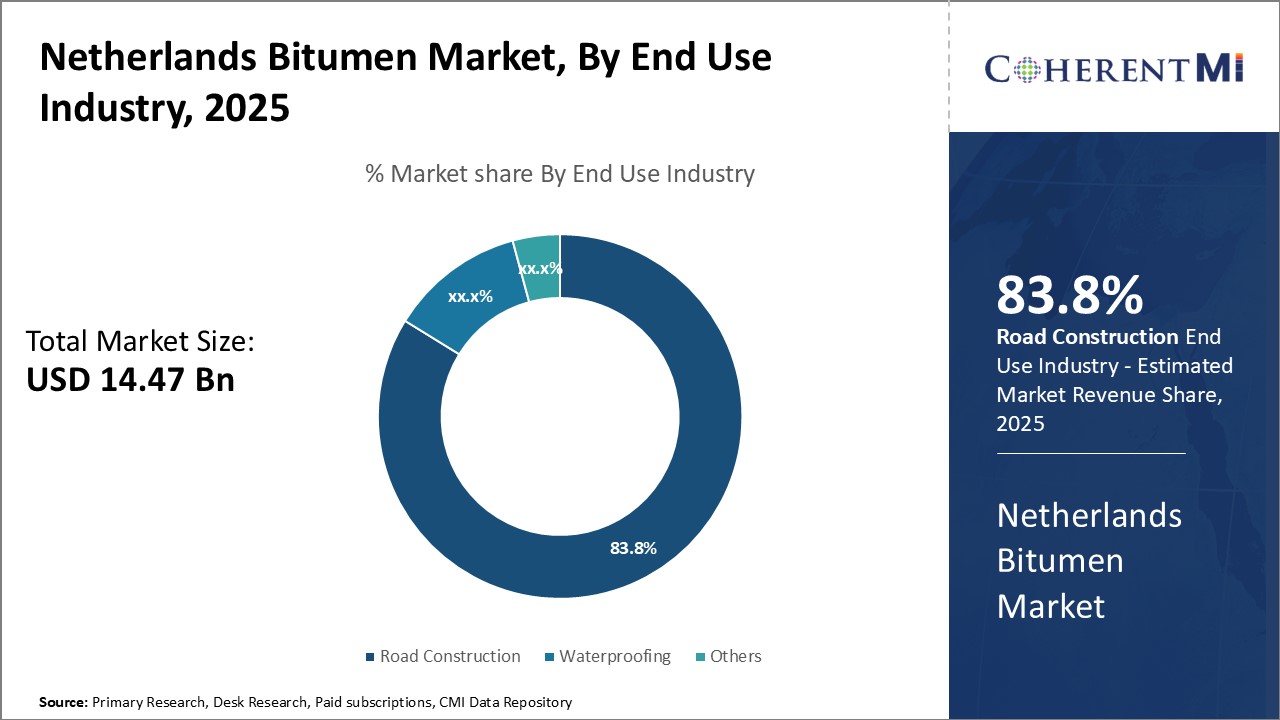

In terms of end use industry, the road construction sub-segment accounts for the major share of 83.8% in terms of bitumen demand. Asphalt mixtures containing bitumen are extensively used in the construction and maintenance of highways, streets and pavements across the Netherlands.

Growing transportation requirements are also propelling roadway developments. Freight movement between the Port of Rotterdam and the hinterland regions relies heavily on an efficient road-based logistics network. Similarly, high private vehicle ownership levels necessitate addition of new lanes as well as rehabilitation projects across existing highways each year.

Competitive overview of Netherlands Bitumen Market

The major players operating in the Netherlands Bitumen Market include Royal Dutch Shell, Koninklijke Wegenbouw Stevin B.V., Ooms Producten B.V., Latexfalt B.V., Bitufa Bitumen B.V., Bitunova B.V., Bitumen Handelsmaatschappij B.V., Bitumen Produkten B.V., Bitumen Specialiteiten B.V., and Bitumen Trading B.V.

Netherlands Bitumen Market Leaders

- Royal Dutch Shell

- Koninklijke Wegenbouw Stevin B.V.

- Ooms Producten B.V.

- Latexfalt B.V.

- Bitufa Bitumen B.V.

Netherlands Bitumen Market - Competitive Rivalry

Netherlands Bitumen Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Netherlands Bitumen Market

- In March 2019, Royal Dutch Shell Introduced a new bitumen solution called Rids Bitumen Fresh Air to reduce the harmful effects of paving and asphalt production on local air quality.

- In November 2022, NYNAS AB Introduced a novel polymer-modified bitumen called Nypol RE. This product contains biogenic elements that enhance service life while having a low environmental impact.

- In March 2022, DL Chemical Co., Ltd acquired Kraton Corporation for $2.5 billion, expanding its presence in the bitumen market.

Netherlands Bitumen Market Segmentation

- By Product Grade

- Paving Grade

- Hard Grade

- Oxidized Grade

- Bitumen Emulsion

- Polymer Modified Bitumen

- By End Use Industry

- Road Construction

- Waterproofing

- Others

Would you like to explore the option of buying individual sections of this report?

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Frequently Asked Questions :

How big is the Netherlands Bitumen Market?

The Netherlands Bitumen Market is estimated to be valued at USD 14.47 in 2025 and is expected to reach USD 20.09 Billion by 2032.

What are the major factors driving the Netherlands Bitumen Market growth?

The growing demand for road construction and increasing use of bitumen in waterproofing are the major factors driving the Netherlands Bitumen Market.

Which is the leading Product Grade in the Netherlands Bitumen Market?

The leading Product Grade segment is Paving Grade.

Which are the major players operating in the Netherlands Bitumen Market?

Royal Dutch Shell, Koninklijke Wegenbouw Stevin B.V., Ooms Producten B.V., Latexfalt B.V., Bitufa Bitumen B.V., Bitunova B.V., Bitumen Handelsmaatschappij B.V., Bitumen Produkten B.V., Bitumen Specialiteiten B.V., and Bitumen Trading B.V. are the major players.

What will be the CAGR of the Netherlands Bitumen Market?

The CAGR of the Netherlands Bitumen Market is projected to be 4.8% from 2025-2032.