Non-Steroidal Anti-Inflammatory Drugs Market Size - Analysis

Market Size in USD Bn

CAGR5.9%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.9% |

| Market Concentration | High |

| Major Players | Pfizer Inc., Johnson & Johnson Services, Inc., Bayer AG, Sanofi, GSK plc and Among Others |

please let us know !

Non-Steroidal Anti-Inflammatory Drugs Market Trends

Chronic pain has emerged as one of the leading reasons cited by individuals for seeking medical care. According to estimates, arthritis alone afflicts over 300 million people worldwide and given the aging global population, this number is expected to surge substantially in the coming years.

Rising health awareness and expanding access to healthcare have further prompted more people to actively seek treatment options rather than endure regular discomfort. This growing sensitivity towards chronic pain and its implications is a key factor augmenting consumption of over-the-counter as well as prescription NSAID formulations.

Besides the growing disease burden, shifting preferences among patients and prescribers have been further strengthening the NSAIDs market position compared to alternatives. NSAIDs are currently among the world's most widely used pharmaceutical products due to their potent analgesic, antipyretic and anti-inflammatory properties. Their proven record of relieving pain associated with minor illnesses, injuries, dental/surgical procedures or chronic conditions has made them a mainstay therapy worldwide.

Additionally, consumers have also become increasingly disinclined towards prescription drugs with unwanted systemic side effects. This has amplified popularity of NSAIDs available without prescription for self-limiting pain conditions. Their easy over-the-counter availability, affordable prices, and lesser safety risks compared to opioids are strengthening the market position of NSAIDs at the expense of other pain drug categories. As treatment approaches continue prioritizing NSAIDs' superior safety risk profile vis-à-vis alternatives, this drug class will likely maintain its dominant status.

One of the major challenges faced by the players in the Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) market is the high cost associated with drug development and obtaining regulatory approvals. Developing a new drug and getting it approved is an expensive and lengthy process which often spans over a decade at an average cost of over $1 billion. This involves extensive research and testing to establish drug efficacy and safety. Further clinical trials, which often involve thousands of participants, add significantly to the development costs.

One of the major opportunities for players in the NSAIDs market is the rising global geriatric population base over the coming decades. According to estimates, the population aged 65 years and above is projected to double from 703 million today to around 1.5 billion by 2050. This is significant as aging is often associated with degenerative conditions, injuries and disabilities that lead to chronic pain. With advanced age, tissues lose elasticity making the elderly more prone to osteoarthritis, back pain and other musculoskeletal issues requiring long-term treatment.

Leading NSAID manufacturers are well positioned to address this need by expanding their product portfolios with newer formulations catering to elderly patients. Formulations like topicals, liquids and orals that are easy to consume stand to benefit. This growing market base present a major revenue opportunity for players over the coming decades.

Key winning strategies adopted by key players of Non-Steroidal Anti-Inflammatory Drugs Market

Product Innovation: Leading companies like Pfizer, Bayer, and Merck have continuously invested in R&D to develop innovative products with better efficacy and safety profiles. For example, in 2018 Pfizer launched a new type of NSAID called tanezumab, which specifically targets nerve fibers that transmit pain signals.

Life Cycle Management: Companies extend the market exclusivity of blockbuster drugs through techniques like new formulations, indications, and patent layering. For example, in 2015-16 Novartis extended market exclusivity of Voltaren gel, originally approved in 2007, by obtaining approvals for new topical formulations and pediatric arthritis indication extending sales by over $350 million annually.

Segmental Analysis of Non-Steroidal Anti-Inflammatory Drugs Market

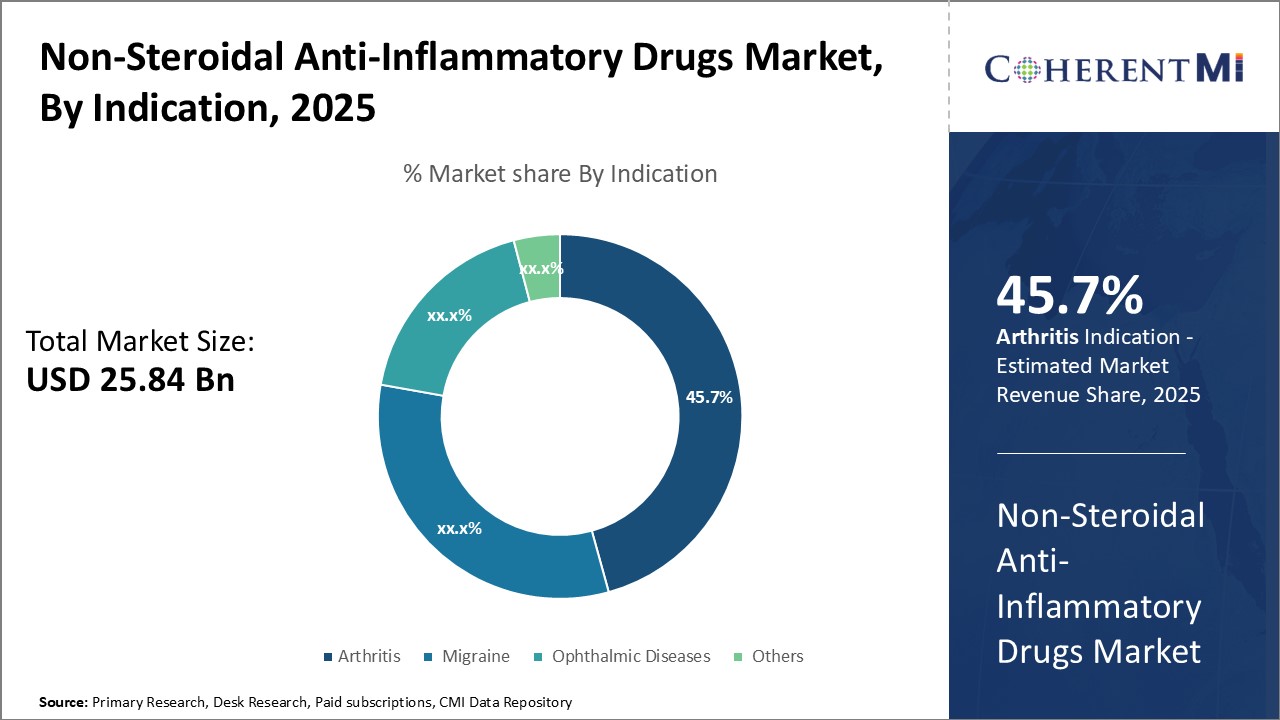

Insights, By Indication: Pain Relief Drives Growth in the Arthritis Segment

Insights, By Indication: Pain Relief Drives Growth in the Arthritis SegmentIn terms of indication, arthritis contributes the highest share of the non-steroidal anti-inflammatory drugs market owning to the large patient pool suffering from chronic joint and muscle pain. Arthritis is a common condition caused by the breakdown and inflammation of the joints.

Non-steroidal anti-inflammatory drugs are extremely effective in relieving arthritis pain and reducing inflammation. The non-addictive nature and over-the-counter availability of many NSAIDs make them a preferred first-line treatment option among doctors as well as patients. As the prevalence of arthritis continues climbing with an aging population, the arthritis segment of the NSAID market is expected to grow steadily in the coming years.

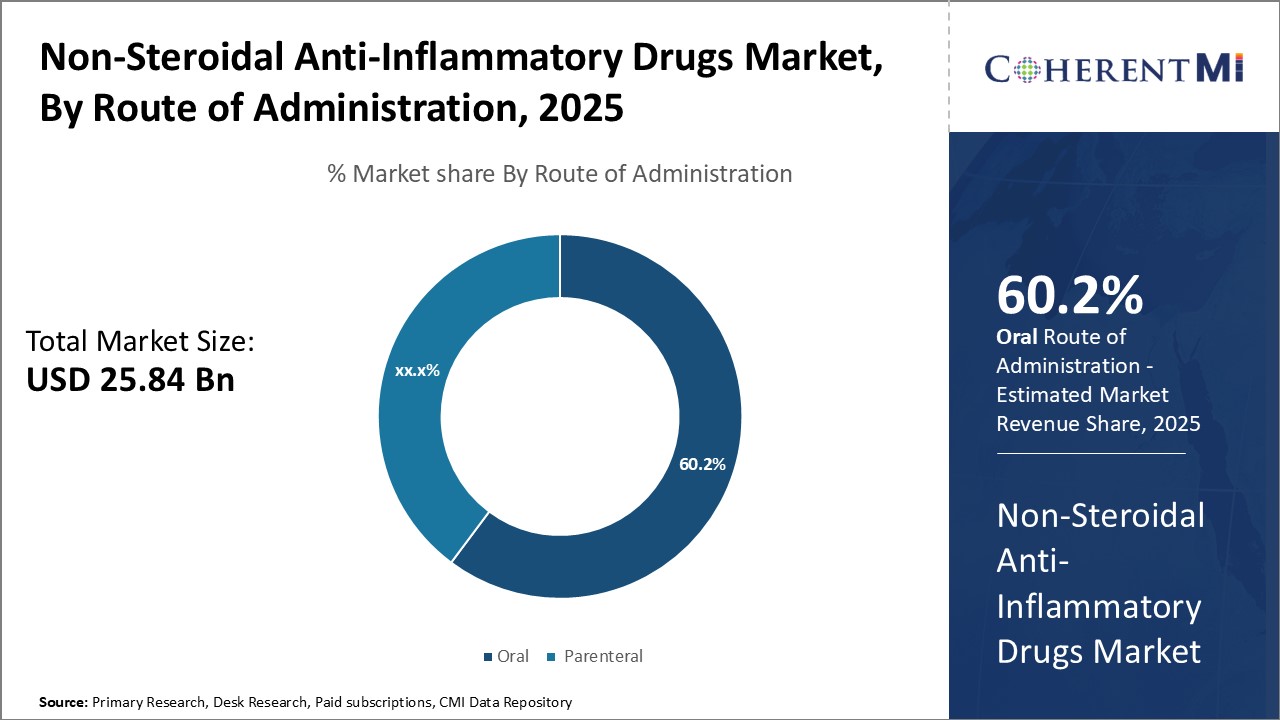

In terms of route of administration, oral contributes the highest share of the non-steroidal anti-inflammatory drugs market owning to the convenience it offers compared to other administration routes. NSAIDs are available in oral formulations like tablets, capsules, suspensions etc. that can be easily taken without any medical supervision. This makes oral NSAIDs very convenient for self-medication and long-term use. They are also generally better tolerated than parenteral forms.

In terms of distribution channel, hospital pharmacy contributes the highest share of the non-steroidal anti-inflammatory drugs market owning to its crucial role in treating complex conditions requiring specialized pain management. While retail pharmacies and e-pharmacies cater mainly to self-limiting pain, hospital pharmacies fulfill a critical need for inpatients experiencing severe acute pain from accidents, surgeries or chronic diseases like cancer.

A reliable supply of different NSAIDs is also necessary to effectively treat the variety of conditions encountered in hospitals. This ensures hospitals remain the primary source for severe, complicated pain treatment requiring NSAIDs.

Additional Insights of Non-Steroidal Anti-Inflammatory Drugs Market

- Research into selective COX-2 inhibitors, such as the ongoing phase 3 trial of CG100649 by Crystal Genomics, is expected to drive the future market for arthritis treatment drugs.

- NSAIDs are currently the most prescribed class of drugs for treating mild to severe pain, with ibuprofen and naproxen recommended as first-line treatments by the American Academy of Family Physicians.

Competitive overview of Non-Steroidal Anti-Inflammatory Drugs Market

The major players operating in the non-steroidal anti-inflammatory drugs market include Pfizer Inc., Johnson & Johnson Services, Inc., Bayer AG, Sanofi, GSK plc, Heron Therapeutics, Inc., Strides Pharma Science Limited, Sun Pharmaceutical Industries Ltd., Reckitt Benckiser Group PLC, and Assertio Holdings, Inc.

Non-Steroidal Anti-Inflammatory Drugs Market Leaders

- Pfizer Inc.

- Johnson & Johnson Services, Inc.

- Bayer AG

- Sanofi

- GSK plc

Non-Steroidal Anti-Inflammatory Drugs Market - Competitive Rivalry

Non-Steroidal Anti-Inflammatory Drugs Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Non-Steroidal Anti-Inflammatory Drugs Market

- in August 2022, Strides Pharma Global Pte Ltd received approval from the U.S. Food and Drug Administration (USFDA) for its generic naproxen sodium softgel capsules. These capsules, at a strength of 220 mg, are used over the counter to treat pain and inflammation. The product is bioequivalent and therapeutically equivalent to the reference-listed drug by Bionpharma Inc. This approval is part of Strides Pharma's strategy to strengthen its presence in the U.S. market, particularly in softgel formulations

- In August 2021, Alkem Laboratories launched Ibuprofen and Famotidine Tablets (800 mg/26.6 mg) in the United States after receiving approval from the U.S. FDA. The product is a generic equivalent of Horizon Medicines' Duexis and is used to relieve symptoms of rheumatoid arthritis and osteoarthritis while reducing the risk of developing gastrointestinal ulcers.

- In February 2021, Strides Pharma Science Limited received approval for Ibuprofen Oral Suspension from the U.S. FDA. The product was approved for over-the-counter use, further strengthening Strides' portfolio in the U.S. market

Non-Steroidal Anti-Inflammatory Drugs Market Segmentation

- By Indication

- Arthritis

- Migraine

- Ophthalmic Diseases

- Others

- By Route of Administration

- Oral

- Parenteral

- By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- E-Commerce

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Frequently Asked Questions :

How big is the non-steroidal anti-inflammatory drugs market?

The non-steroidal anti-inflammatory drugs market is estimated to be valued at USD 25.84 Bn in 2025 and is expected to reach USD 38.60 Bn by 2032.

What are the key factors hampering the growth of the non-steroidal anti-inflammatory drugs market?

The high cost of drug development and the regulatory approval process and side effects associated with NSAIDs are the major factors hampering the growth of the non-steroidal anti-inflammatory drugs market.

What are the major factors driving the non-steroidal anti-inflammatory drugs market growth?

The growing burden of chronic pain-related diseases like arthritis and migraine and increasing preference for NSAIDs over other classes of pain relievers are the major factors driving the non-steroidal anti-inflammatory drugs market.

Which is the leading Indication in the non-steroidal anti-inflammatory drugs market?

In the non-steroidal anti-inflammatory drugs market, the leading Indication segment is arthritis.

Which are the major players operating in the non-steroidal anti-inflammatory drugs market?

Pfizer Inc., Johnson & Johnson Services, Inc., Bayer AG, Sanofi, GSK plc, Heron Therapeutics, Inc., Strides Pharma Science Limited, Sun Pharmaceutical Industries Ltd., Reckitt Benckiser Group PLC, Assertio Holdings, Inc. are the major players in the non-steroidal anti-inflammatory drugs market.

What will be the CAGR of the non-steroidal anti-inflammatory drugs market?

The CAGR of the non-steroidal anti-inflammatory drugs market is projected to be 5.9% from 2025-2032.