Optic Neuritis Treatment Market Size - Analysis

The Global Optic Neuritis Treatment Market is estimated to be valued at USD 265.9 Mn in 2025 and is expected to reach USD 407.8 Mn by 2032, growing at a compound annual growth rate (CAGR) of 6.3% from 2025 to 2032.

Market Size in USD Mn

CAGR6.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.3% |

| Market Concentration | High |

| Major Players | AbbVie Inc., Aerie Pharmaceuticals, Bausch Health, Merck & Co, Pfizer and Among Others |

please let us know !

Optic Neuritis Treatment Market Trends

The increasing prevalence of optic neuritis globally, especially those associated with autoimmune diseases like Multiple Sclerosis (MS) has been a key driver augmenting the growth of optic neuritis treatment market. Optic neuritis is an inflammation of the optic nerve leading to temporal or permanent vision loss and pain in the affected eye. It is highly prevalent in patients affected with multiple sclerosis where it is one of the earliest and most common symptoms presenting in about 25-50% of MS patients.

While optic neuritis attacks associated with MS are usually unilateral, repeated attacks or bilateral involvement can severely hamper vision. Therefore, early diagnosis and timely intervention play a vital role in managing optic neuritis cases, restoring vision and preventing progression to functional blindness. With limited self-recovery possibility in chronic cases, pharmaceutical treatment gains more significance. This has propelled drug manufacturers to invest in developing more efficacious therapies targeting the underlying causes of optic neuritis like neuroinflammation and demyelination.

Market Driver - Advancements in Therapies Targeting Neuroprotection and Remyelination, Such as OCS-05 by Oculis.

In preclinical studies, OCS-05 has demonstrated strong neuroprotective effects through substantial inhibition of axonal degeneration following acute optic nerve damage induced by various stimuli. It was also found to promote remyelination and enhance nerve conduction in mouse models of multiple sclerosis and optic neuritis. Encouraged by these results, Oculis has advanced OCS-05 into clinical trials where it has shown good safety and tolerability profile in healthy volunteers so far. The company is actively recruiting patients for Phase 2a randomized controlled trials in optic neuritis and neuromyelitis optica spectrum disorder.

Market Challenge - High Costs and Long Timelines for Clinical Trials and Drug Approvals.

One of the major opportunities in the optic neuritis treatment market is the development of novel neuroprotective therapies that can potentially prevent long-term optic nerve damage. Currently available treatment options like corticosteroids are focused on reducing inflammation and symptoms in the acute phase. However, there is no approved therapy that provides neuroprotection by preventing nerve cell damage and loss of vision over time. Researchers are exploring pathways like Ocular Compartment Syndrome (OCS) to develop novel therapeutics. For instance, OCS-05 is being evaluated as a potential neuroprotective treatment that aims to maintain optimal eye pressure and prevent compression injury to the optic nerve. Its development is seen as an opportunity to fundamentally change the treatment paradigm by protecting vision long-term rather than just managing symptoms. Such disease-modifying treatments could widen the eligible patient population beyond the acute phase. Their ability to provide lifelong neuroprotection is expected to yield much higher returns on investment compared to conventional therapies.

Prescribers preferences of Optic Neuritis Treatment Market

Optic Neuritis typically follows a stepwise treatment approach based on disease severity and stage. For mild, first-time episodes, prescribers commonly opt for corticosteroid medications such as oral prednisone to reduce inflammation in the optic nerve. Brand names include Deltasone and Medrol. If symptoms fail to improve within 7-10 days, a stronger corticosteroid like intravenous methylprednisolone (Solu-Medrol) may be administered in-clinic.

In addition to medical history and symptom severity, several social factors could impact prescribing decisions. Age and lifestyle of the patient, side effect profiles of the various options, issues of accessibility, cost, and insurance coverage are all considerations for both prescribers and patients in selecting the most appropriate long-term treatment strategy. Close communication is required to develop a mutually agreeable management approach.

Treatment Option Analysis of Optic Neuritis Treatment Market

Optic neuritis typically follows one of three stages - mild, moderate, or severe. For mild cases, patients often opt for watchful waiting as the body's immune system usually resolves the inflammation on its own. However, corticosteroids are the standard first-line treatment for more advanced stages to quickly reduce inflammation and protect vision loss.

If steroids do not achieve complete resolution, neurologists may add immunomodulator drugs. The most effective is Rebif (interferon beta-1a), a disease-modifying therapy that modifies the immune system over the long run. Given via weekly self-injections, it can help prevent future attacks. For cases with incomplete visual recovery or frequent relapses, Tysabri (natalizumab) - an antibody injected monthly - sees high use as it more powerfully suppresses inflammation.

Key winning strategies adopted by key players of Optic Neuritis Treatment Market

Innovation in Drug Development: Companies are focusing on developing targeted therapies, such as biologics (e.g., monoclonal antibodies), which can better control the immune response involved in optic neuritis. These therapies are particularly effective in treating optic neuritis associated with conditions like multiple sclerosis (MS) and neuromyelitis optica spectrum disorder (NMOSD). For example, Genentech’s ocrelizumab has been used successfully in MS patients with optic neuritis. Research and development into neuroprotective agents are gaining momentum. These agents aim to protect the optic nerve from further damage post-inflammation, thereby improving long-term visual outcomes for patients.

To facilitate early diagnosis, companies are forming partnerships with manufacturers of advanced diagnostic equipment such as optical coherence tomography (OCT) devices. Early detection is crucial in preventing irreversible optic nerve damage, and these collaborations help provide integrated care.

To address the high cost of biologics and other advanced treatments, many companies are offering patient assistance programs. These programs help patients gain access to medications through financial support, especially in underinsured or low-income populations.

Players are investing in physician education and patient awareness programs to ensure early diagnosis and timely intervention, especially for conditions like MS or NMOSD that are closely associated with optic neuritis. This also helps build strong relationships with healthcare providers.

Fast-Track Approvals: To capitalize on unmet medical needs, companies are applying for fast-track or breakthrough therapy designations to accelerate the development and approval process for new treatments.

Segmental Analysis of Optic Neuritis Treatment Market

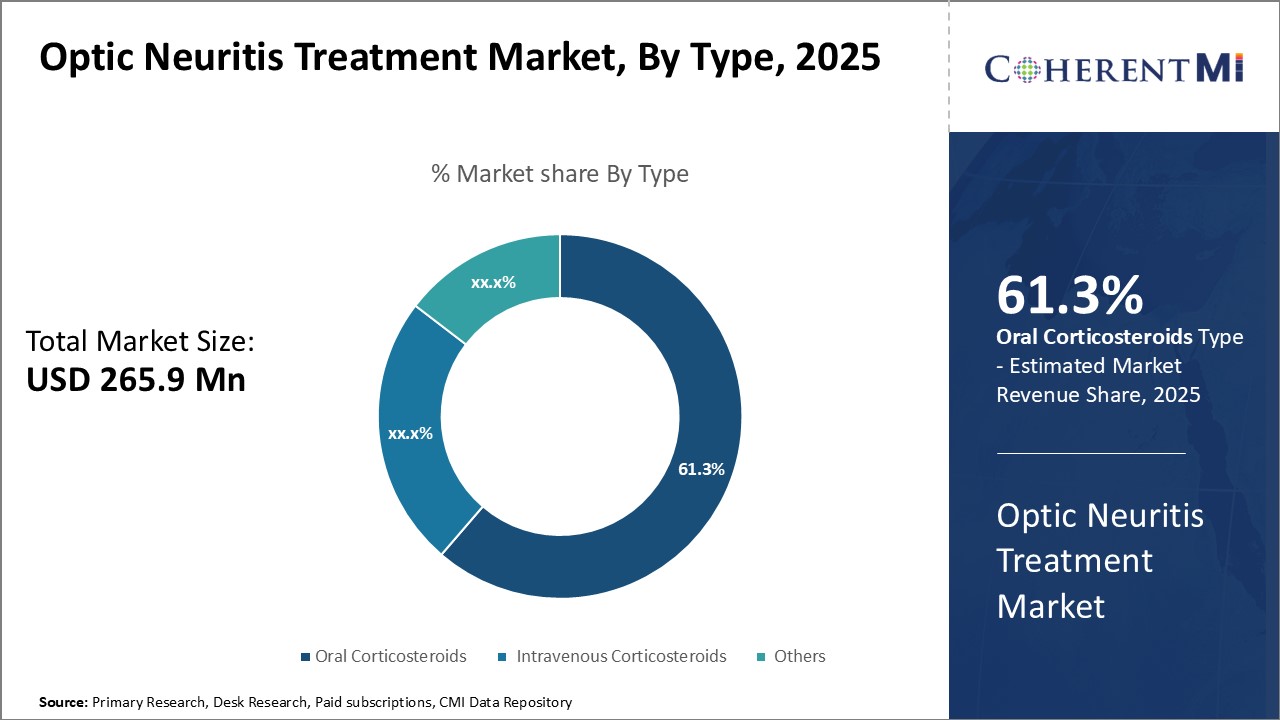

Insights, By Type, Oral Corticosteroids are the Leading Segment in the Forecast Period.

Insights, By Type, Oral Corticosteroids are the Leading Segment in the Forecast Period.By Type, the oral corticosteroids dominate the type segment of the optic neuritis treatment market owing to their convenience of oral administration over intravenous forms. The market share is projected to grow at 61.3% in 2025. As optic neuritis causes sudden vision loss or pain during eye movement, patients prefer treatment options that do not require visiting hospitals or clinics for intravenous injections or infusions. The oral forms can be self-administered at home, saving time and avoiding additional costs related to clinical visits.

The ubiquitous availability of generic oral corticosteroids also makes this segment the most affordable option for patients. Strong demand from the cost-conscious patient population further increases market share for oral forms. Accordingly, oral corticosteroids will continue dominating the type segment as long as they demonstrate safety and convenience benefits over alternatives.

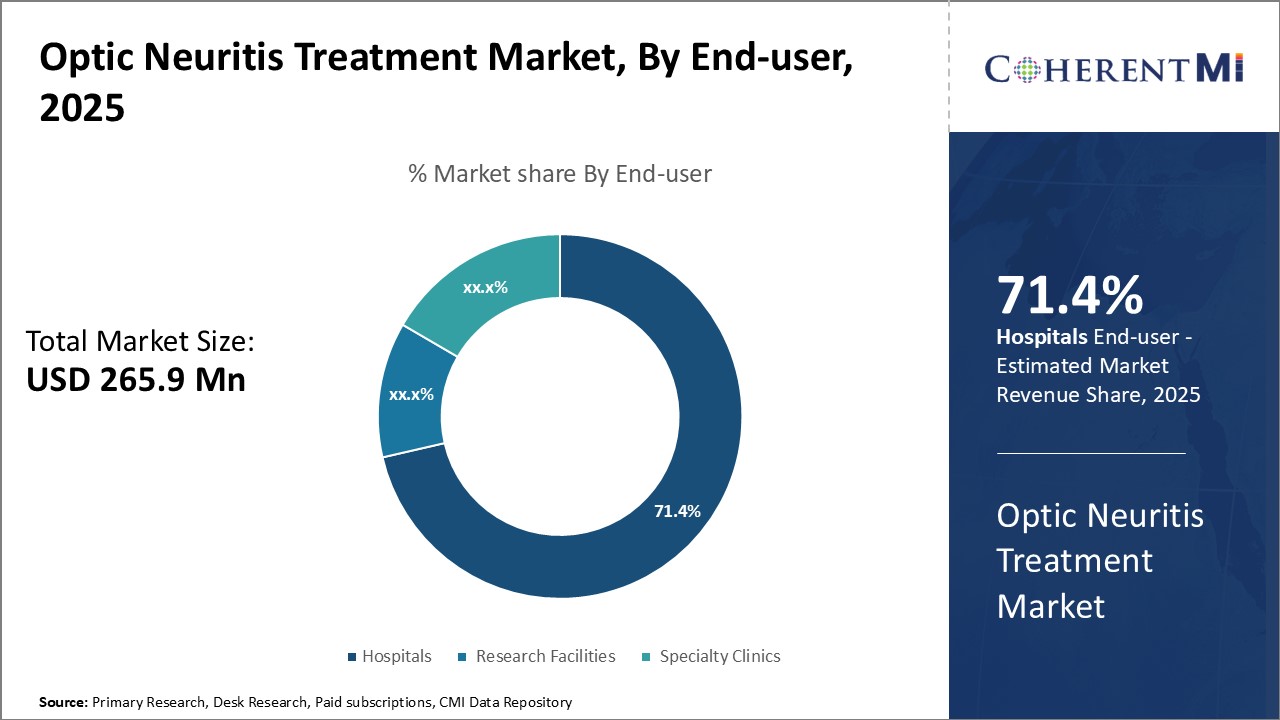

Among the end-user segments, hospitals account for a share of 71.4% in 2025. This is because hospitals have specialized ophthalmology and neurology departments with staff and facilities to conduct tests needed to accurately diagnose optic neuritis. Diagnosis may involve MRI scans, lab tests, lumbar punctures etc. which require sophisticated equipment available only in hospitals.

Hospitals also have the means to manage any potential treatment complications or adverse reactions in a timely manner. With a centralized location, patients also prefer hospitals to get a definitive diagnosis and coordinate any further management of their condition conveniently. These advantages continue attracting majority of the optic neuritis patient pool to hospitals, sustaining their commanding share in the end-user market.

Additional Insights of Optic Neuritis Treatment Market

Immunomodulatory treatments have gained prominence as first-line options for managing optic neuritis, particularly when associated with conditions like multiple sclerosis (MS). Corticosteroids, such as methylprednisolone, remain a standard treatment, as they help reduce inflammation and accelerate recovery. However, the long-term management of underlying conditions like MS is now being increasingly targeted through therapies like interferon-beta and natalizumab, which aim to prevent future relapses and nerve damage. Early diagnosis and treatment are critical for preserving vision in optic neuritis patients. Advances in optical coherence tomography (OCT) and magnetic resonance imaging (MRI) have enhanced the ability of clinicians to diagnose optic neuritis more effectively. This has led to a push for increased awareness among healthcare professionals regarding the importance of early intervention to reduce long-term visual impairment.

Competitive overview of Optic Neuritis Treatment Market

The major players operating in the Optic Neuritis Treatment Market include AbbVie Inc., Aerie Pharmaceuticals, Bausch Health, Merck & Co, Pfizer, Teva Pharmaceuticals, Amorphex Therapeutics, Kubota Vision Inc, Glenmark Pharmaceuticals Inc, Ellex Medical, Astellas Pharma Inc and Acorn Biomedical Inc.

Optic Neuritis Treatment Market Leaders

- AbbVie Inc.

- Aerie Pharmaceuticals

- Bausch Health

- Merck & Co

- Pfizer

Optic Neuritis Treatment Market - Competitive Rivalry

Optic Neuritis Treatment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Optic Neuritis Treatment Market

In 2024, Oculis advanced its OCS-05 drug into Phase II trials. This drug has a novel mechanism of action, targeting SGK-2 pathways to support neuronal development and repair. The clinical trial named ACUITY is testing the drug in patients with acute optic neuritis of demyelinating origin. This development could significantly impact the treatment landscape for optic neuritis.

Optic Neuritis Treatment Market Segmentation

- By Type

- Oral Corticosteroids

- Intravenous Corticosteroids

- Others

- By End-user

- Hospitals

- Research Facilities

- Specialty Clinics

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Frequently Asked Questions :

How Big is the Optic Neuritis Treatment Market?

The Global Optic Neuritis Treatment Market is estimated to be valued at USD 265.9 Mn in 2025 and is expected to reach USD 407.8 Mn by 2032.

What will be the CAGR of the Optic Neuritis Treatment Market?

The CAGR of the Optic Neuritis Market is projected to be 6.10% from 2024 to 2031.

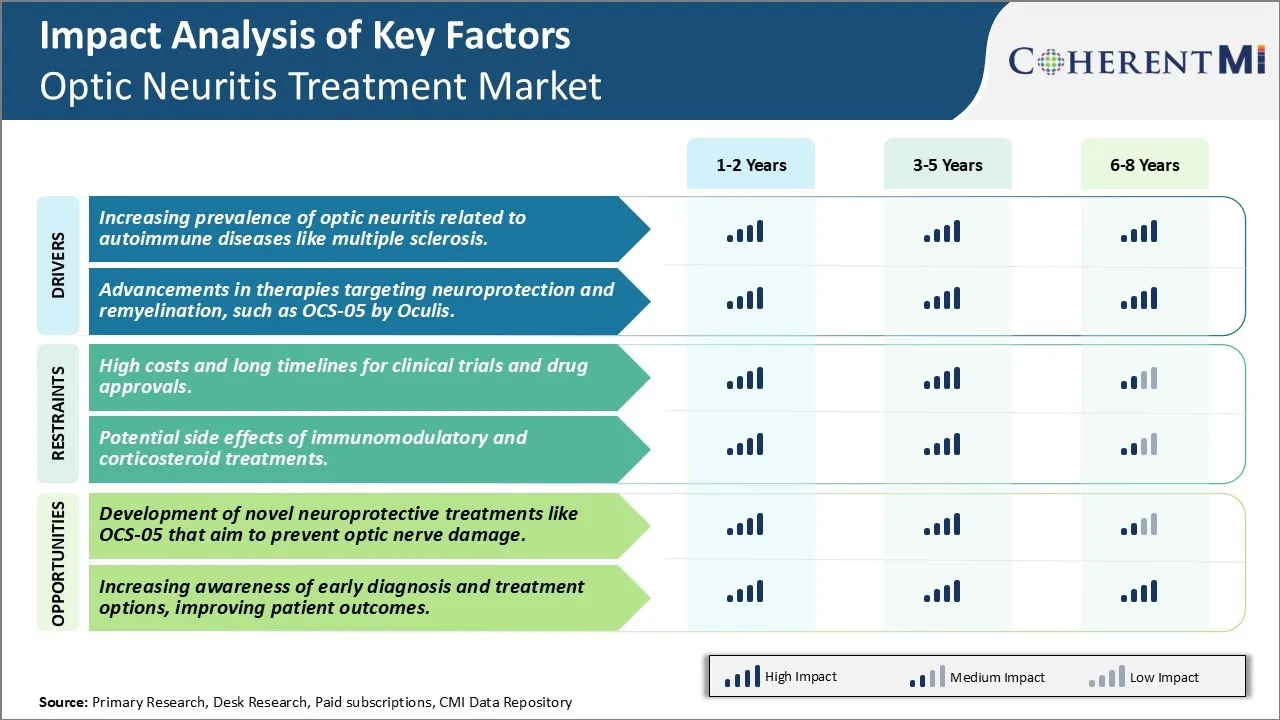

What are the key factors hampering the growth of the Optic Neuritis Treatment Market?

The high costs and long timelines for clinical trials and drug approvals and potential side effects of immunomodulatory and corticosteroid treatments are the major factors hampering the growth of the Optic Neuritis Treatment Market.

What are the major factors driving the Optic Neuritis Treatment Market growth?

The increasing prevalence of optic neuritis related to autoimmune diseases like multiple sclerosis and advancements in therapies targeting neuroprotection and remyelination, such as ocs-05 by Oculis. These are the major factors driving the Optic Neuritis Treatment Market.

Which is the leading Type in the Optic Neuritis Treatment Market?

Oral Corticosteroids is the leading type segment.

Which are the major players operating in the Optic Neuritis Treatment Market?

AbbVie Inc., Aerie Pharmaceuticals, Bausch Health, Merck & Co, Pfizer, Teva Pharmaceuticals, Amorphex Therapeutics, Kubota Vision Inc, Glenmark Pharmaceuticals Inc, Ellex Medical, Astellas Pharma Inc, Acorn Biomedical Inc are the major players.