The orthostatic hypotension market is estimated to be valued at USD 2.07 Bn in 2025 and is expected to reach USD 3.41 Bn by 2032, growing at a compound annual growth rate (CAGR) of 7.4% from 2025 to 2032. The orthostatic hypotension market is witnessing positive growth owing to factors such as increasing incidences of Parkinson's disease, diabetes and hypertension. These conditions make high risk population prone to orthostatic hypotension.

Market Size in USD Bn

CAGR7.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 7.4% |

| Market Concentration | High |

| Major Players | Lundbeck A/S, Theravance Biopharma, Brain Neurotherapy Bio, Inc., Ionis Pharmaceuticals, Inc., Alterity Therapeutics and Among Others |

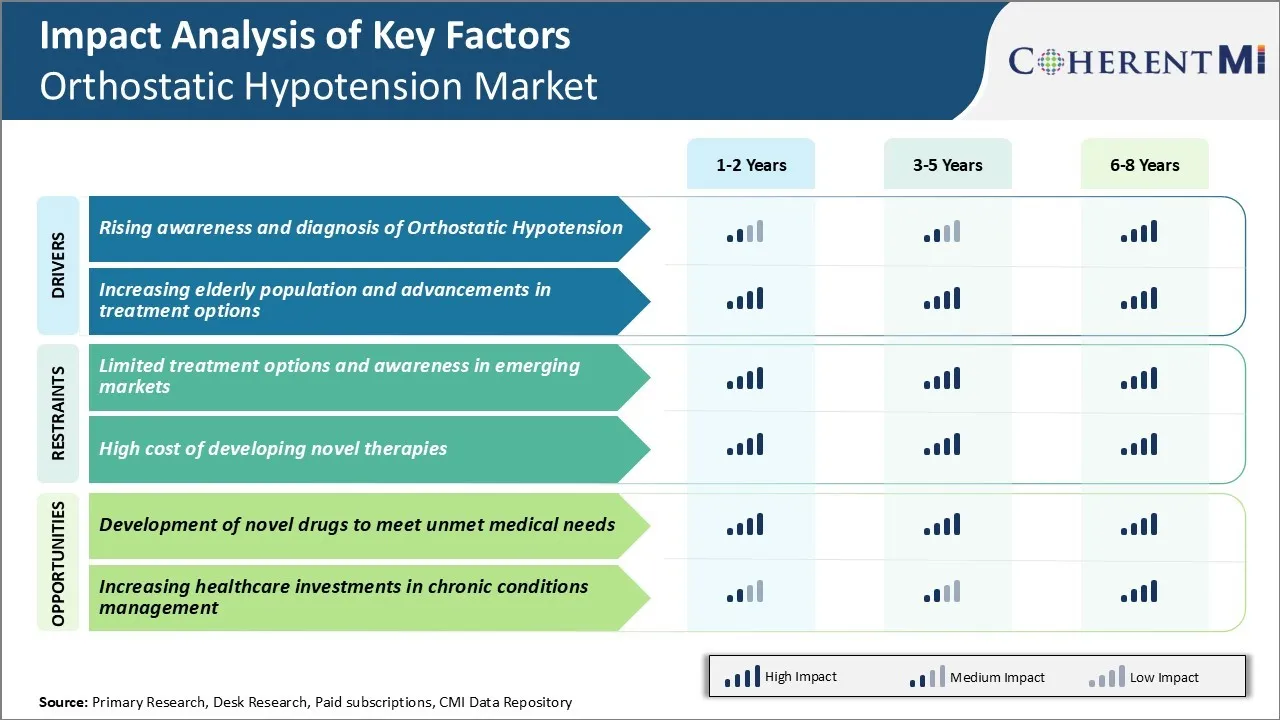

Market Driver - Rising Awareness and Diagnosis of Orthostatic Hypotension

Orthostatic hypotension can often go undiagnosed because people attribute symptoms like dizziness or fainting to other causes like low blood sugar. With improved knowledge, people are now more likely to consult doctors if they face recurrent symptoms.

Furthermore, routine tests done as part of regular health checkups now include checking vitals like blood pressure in both lying and standing positions which makes it simpler to detect fluctuations indicative of orthostatic hypotension. The adoption of mobile health technologies has augmented traditional diagnosis methods. Smartwatches and health apps can unobtrusively monitor heart rate and blood pressure round the clock including during changes in posture.

Vast amount of physiological data collected over long periods aids accurate diagnosis of intermittent or mild symptoms. The aggregation of personal health statistics in medical records also facilitates remote consultations and second opinions if required.

Consequently, there is better identification of orthostatic hypotension occurring due to various causes. This is serving to increase recognition of the condition as a major driver for the expansion of the orthostatic hypotension market for its associated treatments.

Markert Driver - Increasing Elderly Population and Advancements in Treatment Options

Age-related physiological changes and widespread conditions like hypertension that frequently affect the elderly weaken the body’s response in maintaining blood pressure levels upon standing up.

Besides the growing senior population base, treatment developments are encouraging more individuals experiencing orthostatic hypotension to actively seek care. Non-pharmacological approaches like lifestyle changes and wearing compression stockings continue to be first-line options.

Newer antihypertensive agents have fewer side effects of hypotension compared to older varieties. Furthermore, certain mineral supplements or vasopressors taken for orthostatic hypotension have been formulated into more convenient delivery methods like orally disintegrating tablets for improved compliance.

Advanced devices supporting treatment are also contributing to the orthostatic hypotension market expansion. Implantable cardiac pacemakers with orthostatic hypotension algorithms can detect and counteract impending pressure drops through automated pacing adjustments.

Likewise, abdominal pressure pumps worn externally minimize blood pooling in the lower body by applying pulsating compression regulated through sensors. Both technologies offer effective treatment delivery without constant user intervention. Their inclusion in clinical practice guidelines has strengthened the orthostatic hypotension market dynamics through recommendations to healthcare practitioners as well.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Limited Treatment Options and Awareness in Emerging Markets

Orthostatic hypotension market currently faces significant challenges due to limited treatment options and low awareness in emerging markets. Patients suffering from various forms of orthostatic hypotension have very few pharmacological and non-pharmacological options to effectively manage their symptoms.

Most available drugs are older antihypertensive medications that are used off-label to boost blood pressure. These often have side effects and provide inadequate relief to patients.

Additionally, emerging markets like Asia, Latin America, Middle East and Africa have very low levels of awareness about orthostatic hypotension as a condition. Many cases continue to remain undiagnosed due to low health literacy and lack of clinical expertise within the medical community in these regions. This ultimately leads to prolonged suffering of patients and delayed access to the few existing treatment alternatives.

Overall, the treatment landscape for orthostatic hypotension remains underdeveloped with no universally effective solution available to address a diverse patient population globally.

Market Opportunity - Development of Novel Drugs to Meet Unmet Medical Needs

The orthostatic hypotension market presents significant opportunities for companies who can successfully develop novel therapies to meet the large unmet needs. Currently, no drugs are approved specifically for the treatment of orthostatic hypotension indicating a clear gap.

Innovation in pharmacology has the potential to transform patient care by offering more effective and safer drugs that work through new mechanisms of action. Drugs targeting autonomic nervous system dysregulation hold promise. Successful research and development of such first-in-class medicines could capture a large share of the orthostatic hypotension market. It will help address an important unmet medical need and improve quality of life for millions globally.

Additionally, companies developing novel drugs have an opportunity to lead awareness initiatives and work with physicians in emerging markets to boost diagnosis and access to newer treatment options. This will aid further market growth prospects over the long term.

Orthostatic hypotension is classified based on stages of severity - mild, moderate, and severe. For mild OH where the drop in systolic blood pressure is 20-29 mmHg upon standing, lifestyle changes such as increasing salt and fluid intake and compression stockings are usually recommended first.

If symptoms persist, pharmacotherapy is initiated. Prescribers commonly choose midodrine as the first-line medication. Brand names like ProAmatine are prescribed 2.5-10mg three times daily to constrict blood vessels and raise blood pressure. For moderate OH with a 30-49 mmHg drop, fludrocortisone - a brand name drug like Florinef - may be added. It works by retaining sodium and fluid levels.

In severe cases with a drop of over 50 mmHg, both midodrine and fludrocortisone are used. If symptoms are still not adequately controlled, pyridostigmine - brand name Mestinon - is added as the third-line treatment. It inhibits the breakdown of acetylcholine to improve blood pressure.

Comorbidities also impact medication choices. For instance, prescribers may prefer midodrine over fludrocortisone in patients with cardiac issues due to its vascular effects without fluid retention.

Orthostatic hypotension can be categorized into three stages - mild, moderate, and severe - based on the severity of symptoms.

For mild cases, non-pharmacologic strategies like increasing salt and fluid intake and avoiding sudden positional changes are usually sufficient. Compression garments may also provide relief.

In moderate cases where lifestyle changes don't help adequately, medications are needed. The first-line treatment option includes midodrine, a selective alpha-1 agonist available as 2.5mg, 5mg, and 10mg tablets. Midodrine helps constrict blood vessels and maintains blood pressure when standing. Fludrocortisone, a mineralocorticoid steroid that increases salt and water retention, is also commonly used either alone or in combination with midodrine.

For severe cases that do not respond to first-line treatments, second-line options include pyridostigmine, a cholinesterase inhibitor available as 60mg tablets and extended-release 180mg tablets. Pyridostigmine works by increasing concentrations of acetylcholine which constricts blood vessels. For acute episodes, selective serotonin reuptake inhibitor antidepressants like fluoxetine are administered intravenously as they cause venoconstriction.

Product Innovation: Developing innovative and improved products has been a successful strategy for market leaders. In 2018, Novartis launched their new midodrine HCl drug called ProAmatine, which provided a more practical dosing schedule and was better tolerated by patients compared to existing treatment options. This helped Novartis gain a significant market share within a year of launch.

Acquisitions: Making strategic acquisitions has helped companies expand their product portfolio and geographical presence. In 2020, Chelsea Therapeutics was acquired by H. Lundbeck A/S for $337 million. This acquisition strengthened Lundbeck's position in the orthostatic hypotension market by adding Chelsea's investigational drug candidate, CH-3051, to their pipeline.

Clinical Trial Partnerships: Collaborating with institutes and healthcare providers on clinical trials has helped validate new drugs and therapies. In 2015, Anthropic partnered with Kaiser Permanente to test a smartphone-based treatment for Orthostatic Hypotension using an AI assistant. Over 400 patients participated in the trials, demonstrating the therapy's efficacy and safety. This paved the way for its FDA approval.

Awareness Campaigns: Running awareness programs about Orthostatic Hypotension symptoms and management options has helped boost patient identification and diagnosis rates. During 2015-18, Alpha Therapeutic Corp. partnered with patient advocacy groups to conduct seminars, webinars and social media campaigns about orthostatic hypotension.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

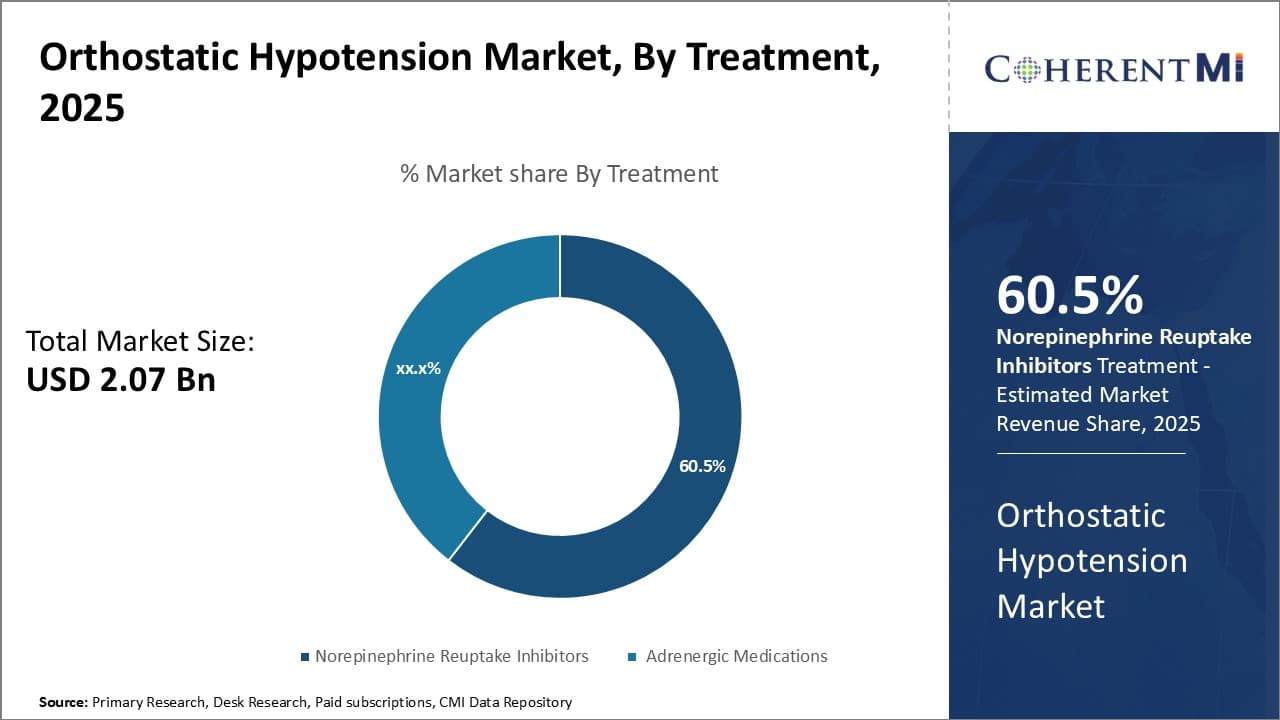

Insights, By Treatment: Efficacy in Managing OH Symptoms Drives Growth of Norepinephrine Reuptake Inhibitors

In terms of treatment, norepinephrine reuptake inhibitors are projected to hold 60.5% share of the orthostatic hypotension market in 2025, owning to its consistent efficacy in managing orthostatic hypotension symptoms. Norepinephrine reuptake inhibitors work by increasing levels of norepinephrine, a neurotransmitter vital for maintaining blood pressure upon standing.

By inhibiting the reabsorption of norepinephrine, these drugs help compensate for the inadequate release of norepinephrine that causes blood pressure to drop in orthostatic hypotension. Clinical studies have demonstrated that norepinephrine reuptake inhibitors like droxidopa can significantly improve dizziness, lightheadedness, and fainting within 3 weeks of treatment in most patients. Their predictable response rate, coupled with favorable safety profiles have made norepinephrine reuptake inhibitors the preferred first-line treatment among physicians.

Additional benefits like ease of oral administration over other injectable treatments have further augmented patient adoption and compliance. These advantages have allowed norepinephrine reuptake inhibitors to emerge as the mainstay solution, sustaining their sizeable market share.

To learn more about this report, Download Free Sample Copy

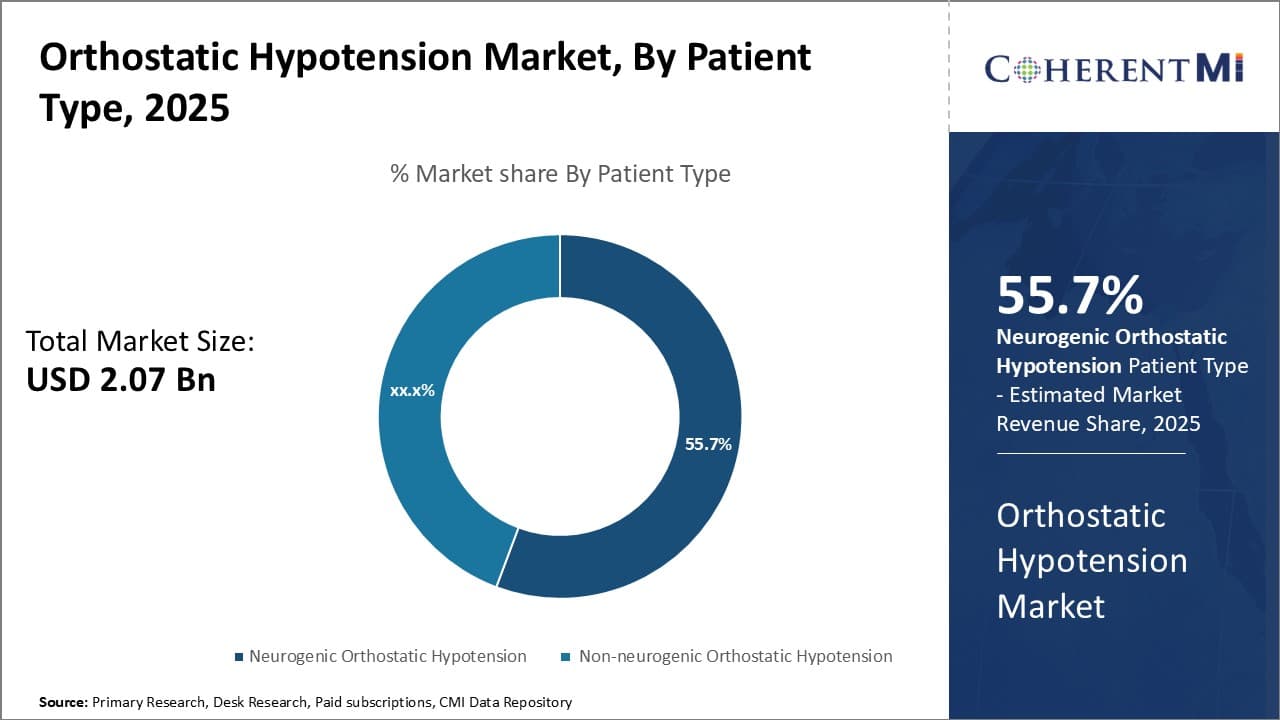

Insights, By Patient Type: Growing Awareness Drives Higher Diagnosis of Neurogenic Orthostatic Hypotension

To learn more about this report, Download Free Sample Copy

Insights, By Patient Type: Growing Awareness Drives Higher Diagnosis of Neurogenic Orthostatic Hypotension

In terms of patient type, neurogenic orthostatic hypotension (nOH) is expected to hold 55.7% share of the orthostatic hypotension market in 2025, owing to raised awareness about its manifestations and ties to underlying neurological disorders. nOH results from failure of the autonomic nervous system to regulate blood pressure appropriately and is frequently seen in patients with Parkinson's disease and multiple system atrophy.

However, its symptoms were often missed or misdiagnosed in the past as postural dizziness. Increased medical education programs have enabled clinicians to recognize nOH and screen high-risk groups proactively. Moreover, patient communities have boosted understanding about nOH’s correlation with neurodegenerative conditions. These efforts have led to growing diagnosis rates of nOH annually.

Screening initiatives by healthcare providers and self-referrals following disease awareness campaigns are expected to further elevate the market penetration of nOH treatment over other forms. Its chronic and debilitating nature also necessitates long-term intervention.

Insights, By Therapeutics: Superior Effectiveness Drives Gene Therapy's Lead in Therapeutics Landscape

In terms of therapeutics, gene therapy contributes the highest share of the market owing to its superior effectiveness over traditional pharmacologic regimens. Gene therapy involves introducing genetic material into patient cells with the aim of replacing faulty genes or augmenting disease-modifying activity.

Breakthroughs in vector engineering have enabled precision delivery of therapeutic genes to specific tissues in OH. Initial gene therapy trials for nOH have demonstrated successful restoration of autonomic function for months after a single intervention. Compared to repetitive drug administration for partial symptom control, gene therapy's curative approach presents an attractive clinical value proposition. Its one-time administration also enhances compliance.

Further clinical evidence is anticipated to fully validate gene therapy's benefits versus other OH therapeutics. Its promising early efficacy and convenience advantages will continue attracting higher patient adoption relative to existing treatment options like dopamine agonists, thereby widening gene therapy's leadership in the therapeutic segment.

The major players operating in the orthostatic hypotension market include Lundbeck A/S, Theravance Biopharma, Brain Neurotherapy Bio, Inc., Ionis Pharmaceuticals, Inc., Alterity Therapeutics, TSH Biopharm Corporation Limited, Chelsea Therapeutics, and Juvantia Pharma Ltd.

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Orthostatic Hypotension Market is segmented By Treatment (Norepinephrine Reuptake Inhibitors, Adrene...

Orthostatic Hypotension Market

How big is the orthostatic hypotension market?

The orthostatic hypotension market is estimated to be valued at USD 2.07 Bn in 2025 and is expected to reach USD 3.41 Bn by 2032.

What are the key factors hampering the growth of the orthostatic hypotension market?

Limited treatment options and awareness in emerging markets and high cost of developing novel therapies are the major factors hampering the growth of the orthostatic hypotension market.

What are the major factors driving the orthostatic hypotension market growth?

Rising awareness and diagnosis of orthostatic hypotension and increasing elderly population and advancements in treatment options are the major factors driving the orthostatic hypotension market.

Which is the leading treatment in the orthostatic hypotension market?

The leading treatment segment is norepinephrine reuptake inhibitors.

Which are the major players operating in the orthostatic hypotension market?

Lundbeck A/S, Theravance Biopharma, Brain Neurotherapy Bio, Inc., Ionis Pharmaceuticals, Inc., Alterity Therapeutics, TSH Biopharm Corporation Limited, Chelsea Therapeutics, and Juvantia Pharma Ltd are the major players.

What will be the CAGR of the orthostatic hypotension market?

The CAGR of the orthostatic hypotension market is projected to be 7.4% from 2025-2032.