包装機械市場 サイズ - 分析

市場規模(米ドル) Bn

CAGR4.6%

| 調査期間 | 2024 - 2031 |

| 推定の基準年 | 2023 |

| CAGR | 4.6% |

| 市場集中度 | High |

| 主要プレーヤー | Langley ホールディング plc, メーリスグループ, Rovema GmbH, ドイツ, テトラ・ラヴァル国際S.A., クロネスAG その他 |

お知らせください!

包装機械市場 トレンド

市場ドライバー - 急速な都市化 包装された食糧および飲料のための増加の要求

世界各地の都市センターは、経済と雇用機会のために、過去10年間に途上国に住んでいます。 新鮮な食材を頼りにし、パッケージ化または保存された代替品は都市で共通になります。

オンザ・ゴー・スナックとすぐに使えるオプションは、大きな需要が見られます。

従って包装された食糧製造業者はさまざまな準備の異なったレベルを要求するさまざまな提供の便利のために要求するために食料調達します。 包装機械によって自動化された生産、分裂、シーリングおよび包装は重要な役割を担います。

包装機械市場でのプレイヤーは、革新的な製品、魅力的なデザイン、およびサイズで、ワウ消費者に競争します。 柔軟で高出力のパッケージングラインが不要で、新しいSKUを素早く起動できます。 食品安全、トレーサビリティ、リサイクル性に関する厳格な規制も、高度なパッケージング技術コンプライアンスが必要です。

包装機械メーカーは、包装フォーマット、材料、自動ソリューションを都市消費パターンに向けて革新する機会を持っています。 包装機械市場の成長は、進化する都市のライフスタイルを理解し、パッケージングを通じて今日の都市の消費者の複数のニーズを満たします。

市場機会 - AI、ロボティクス、ブロックチェーンなどの技術支援は、パッケージングの効率性と信頼性を改善しています

包装機械産業のボーンは、包装業務を強化する技術の普及です。 人工知能、ロボティクス、ブロックチェーンは次世代のパッケージソリューションを開発する機会をもたらします。 検査精度を向上し、スループットを増加させ、廃棄物を最小限に抑えるAIと機械学習が自動化されています。

予測分析と組み合わせたロボットシステムは、パッケージングラインの稼働時間を最大化します。 一方、ブロックチェーンは、供給の透明性を可能にし、ソースから棚まで製品の実績を追跡します。 これらの技術は、より高い機械利用率、より少ない欠陥に翻訳され、エンドユーザーの総所有コストを削減します。

機器ビルダーは、高度な制御とコネクティビティを備えた新しいシステムの設計も恩恵を受けています。 包装の機械類の市場は企業を渡る苦痛ポイントを解決するために最も最近の技術を統合し続けなければなりません。 それはハイテクで、非常に自動化された包装の機械類の解決のためのquantifiable利点および増強の要求を提供します。

主要プレーヤーが採用した主な勝利戦略 包装機械市場

オートメーションおよび先端技術に焦点を合わせて下さい: Tetra Pak、Bosch、Kronesなどのリーダーは、ロボティクス、IoT、AIなどと統合した高度自動包装機械ソリューションの開発に注力しています。 たとえば、Tetra Pak は、IoT 接続と予測保守機能を使用する新しい世代の A3 ラインを立ち上げました。

製品ポートフォリオの拡大: 企業は、製品ポートフォリオを継続的に拡大し、多様で進化する顧客ニーズに応えます。 たとえば、2015年、KronesはEyermannの買収により無菌充填技術に拡大し、飲料の包括的なポートフォリオを提供できるようにしました。

新興市場への注力: : : 大手選手は、グリーンフィールド投資、買収、現地製造およびサポートインフラの確立を通じて、過去10年間にこれらの地域に積極的に展開しています。 例えば、Tetra Pakは2020年にインドの新しい工場を現地で包装材料を生産しました。

サービスおよび顧客サポート: プレーヤーは訓練、維持、予備品管理等のような付加価値サービスが付いている機械類の販売を補います。 ボッシュパッケージングは、予測メンテナンスと稼働時間を最大化するためのプラントパフォーマンスサービスプログラムを提供しています。

セグメント分析 包装機械市場

エンドユース業界によるインサイト:業界横断の自動化を強化

エンドユース業界、食品、飲料業界は2024年の市場シェア35.7%を保有する予定です。 主に産業縦横のオートメーションの増加によって運転されます。 人件費を成長させ、高速生産の必要性は、食品や飲料メーカーがますますます充填、ラベリング、梱包などのアプリケーションのための自動化包装機械ソリューションを採用しています。

高度の自動包装機械は生産の効率を改善し、プロダクト質および安全を保障し、無駄を最小にし、一貫した高速操作を可能にするのを助けます。 食品や飲料業界からのこの増加した自動化需要は、全体的な包装機械市場の成長に著しく貢献します。

追加の洞察 包装機械市場

- アジアパシフィック ドミナンス:アジア太平洋地域は、迅速な産業化とパッケージされた商品の消費増加による包装機械市場の重要なシェアを保持しています。

- 食糧および飲料のセクターは導きます: 包装機械の市場シェアの35%以上のための会計、食糧および飲料の企業は包装の機械類の最も大きいエンド ユーザーです。

- オートメーションの傾向: 新しい包装機械の設置の約60%は自動化されたシステムであり、産業のシフトを効率性に反映しています。

- インダストリアル 4.0 技術の統合は、包装機械に標準になってきており、予測的なメンテナンスとリアルタイム監視を可能にします。

- 柔軟性を提供するモジュラー包装の機械類への成長した傾向があり、カスタマイズされた消費者要求に食料調達する異なった包装の条件のために容易に合わせることができます。

競合の概要 包装機械市場

包装機械市場で動作する主要なプレーヤーは、Langley Holding plc、Maillis Group、Rovema GmbH、Tetra Laval International S.A.、Krones AG、I.M.A.を含む。 Industria Macchine Autohe S.p.A., Syntegon Technology GmbH, ProMach Inc., GEA Group Aktiengesellschaf, Sacmi, Coesia S.p.A., Duravant, Douglas Machine Inc., KHS Group, SIG Group AG, Robert Bosch GmbH, Barry-Wehmiller Companies Inc., FUJIRY MACHINERY Co., Ltd., Multivac Group, Marchesini S.p.A.A., Inc., KHS Group, KHS Group, SIG Group, SIG Group, SIG Group AG, ロバート・ボッシュバーリー・ウェイマーチャージャー・カンパニー株式会社

包装機械市場 リーダー

- Langley ホールディング plc

- メーリスグループ

- Rovema GmbH, ドイツ

- テトラ・ラヴァル国際S.A.

- クロネスAG

包装機械市場 - 競合関係

包装機械市場

(大手プレーヤーが支配)

(多くのプレーヤーが参入し、競争が激しい。)

最近の動向 包装機械市場

- 2024年6月、Camaグループでは、生産性の向上とマルチパック食品市場でのフットプリント削減を目指した新しいトップローディング包装機械を開始しました。 機械の高度のロボティクスおよびモジュラー設計はエネルギー消費および無駄を最小限にしている間、包装プロセスを非常に能率的、適用範囲が広い作ります。

- 2024年5月、マッキーのスコットランドは、生産能力を増加させ、環境への影響を削減することを目的とした新しい氷包装機械で£300,000を投資しました。 この最先端の包装機械は、毎分30枚の氷を充填でき、年間で最大3万枚の袋を増やすことが期待されています。 Mackieの持続可能性目標と投資は、機械が天然冷媒ガスやバイオマス電力を使用する低炭素冷凍システムと統合しているためです。

- 2024年4月、シーメンスPLCは、AIとデジタルツイン技術で包装機械を強化し、スループットと品質を33%向上しました。

- 2024年2月、IMA 包装機械の効率化を目指した先進的なAIソリューションを導入。 これらのソリューションは、IMA SandboxとIMA AlgoMarketの産業AIの使用とアルゴリズム開発を強化するように設計されています。 IMA Sandboxは、共同開発およびテストのアルゴリズムを安全な環境で提供し、実装前に複雑なシナリオをシミュレートする協調的でクラウドベースのプラットフォームを提供しています。

包装機械市場 セグメンテーション

- 機械タイプ別

- 充填機

- ラベリングマシン

- フォームフィールシール機

- カートン機械

- ラッピングマシン

- パレタイジングマシン

- その他

- エンドユース業界別

- 食品・飲料

- 医薬品

- 化学品

- パーソナルケア

- その他

- テクノロジー

- 自動制御

- セミオート

- マニュアル

購入オプションを検討しますか?このレポートの個々のセクション?

Shivam Bhutani は、市場調査と戦略コンサルティングで 6 年の経験があります。彼は、強力な分析のバックグラウンドを持つ市場調査コンサルタントです。彼は、市場予測、競合情報 (競合ベンチマークとプロファイリング)、価格戦略、および一次調査に優れています。彼は、大規模なデータセットを分析して正確な洞察を提供し、クライアントが効果的な市場参入と成長戦略を開発するのを支援することに長けています。

よくある質問 :

包装機械市場はどれくらいの大きさですか?

包装機械市場は米ドル50.1で評価されると推定されます 2024年のBnと2031年までのUSD 68.66 Bnに達すると予想される。

包装機械市場の成長を妨げる重要な要因は何ですか。

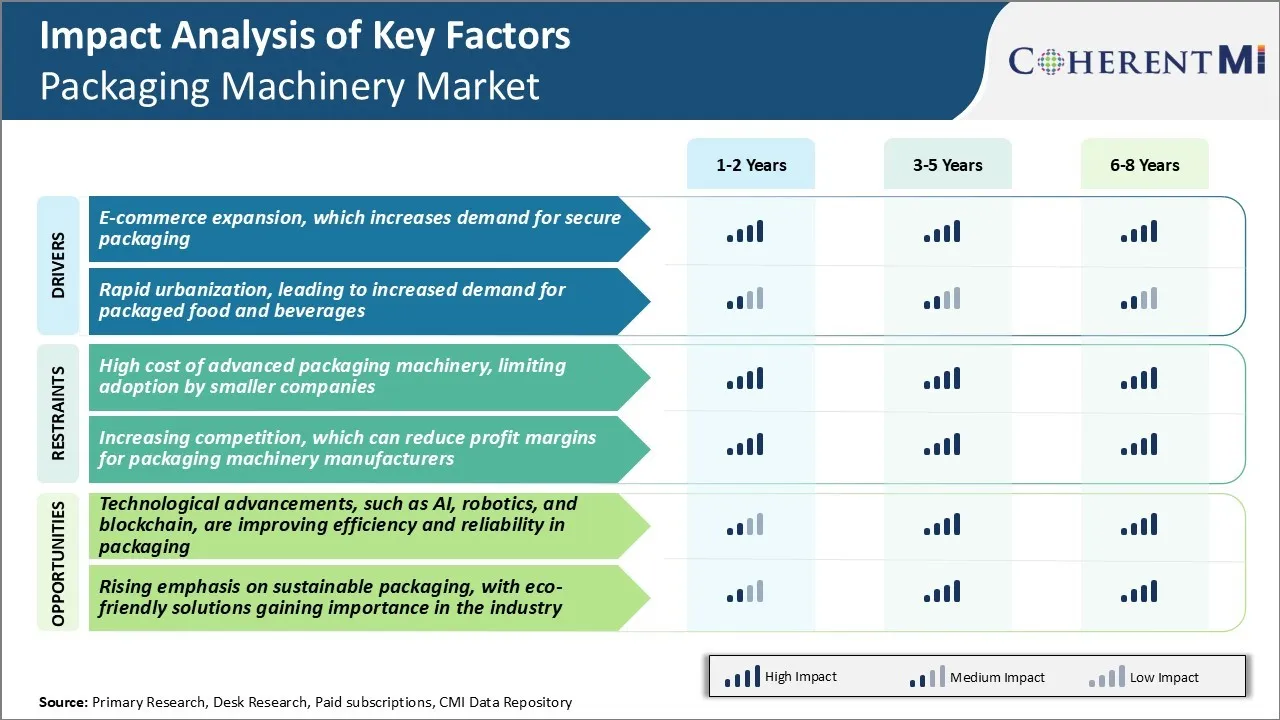

より小さい企業による採用を制限し、包装機械製造業者のための利益率を減らすことができる競争を増加する高度の包装の機械類の高コストは包装の機械類の市場の成長を妨げる主要な要因です。

包装機械市場の成長を運転する主要な要因は何ですか。

安全な包装のための需要を増加させる E コマースの拡大、および包装された食糧および飲料のための増加された要求に導く急速な都市化は包装の機械類の市場を運転する主要な要因です。

包装機械の市場の主要な機械タイプはどれですか。

主要な機械タイプ区分は充填機です。

包装機械市場で動作する主要なプレーヤーはどれですか?

Langley Holding plc, Maillis Group, Rovema GmbH, Tetra Laval International S.A., Krones AG, I.M.A Industria Macchine Autohe S.p.A., Syntegon Technology GmbH, ProMach Inc., GEA Group Aktiengesellschaf, Sacmi, Coesia S.p.A., Duravant, Douglas Machine Inc., KHS Group, SIG Group AG, Robert Bosch GmbH, Barry-Wehmiller Companies Inc., FUJIRY MACHINERY Co., Ltd., Multivac Group, Marchesini S.p.A.A., Ltd. 主要プレイヤーです。

包装機械市場のCATGは何ですか。

包装機械市場のCAGRは、2024-2031年から4.6%であるように計画されています。