PCSK9 Inhibitors Market Size - Analysis

Market Size in USD Bn

CAGR16.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 16.4% |

| Market Concentration | High |

| Major Players | Amgen (REPATHA), Sanofi/Regeneron (PRALUENT), Merck (MK-0616), LIB Therapeutics (LIB003), AstraZeneca and Among Others |

please let us know !

PCSK9 Inhibitors Market Trends

The landmark Framingham Heart Study was one of the earliest large-scale investigations that demonstrated individuals with elevated LDL concentrations are twice as likely to develop coronary heart disease compared to those with normal or optimal levels. Further research has reinforced these findings and physicians globally now recognize LDL reduction as a cornerstone of management for both primary and secondary prevention of heart diseases.

However, even with maximally tolerated statins alone many 'high risk' individuals struggle to achieve recommended goals. This has created a clear clinical need for additional lowering therapies to fill the 'treatment gap'. PCSK9 inhibitors have emerged as a promising new class of lipid-lowering agents that act through a distinct and complementary mechanism compared to statins.

The landmark FDA approvals for PCSK9 inhibitors alirocumab and evolocumab in 2015 transformed the management of hypercholesterolemia. This marked a groundbreaking advance as it was the first time a new class of lipid-lowering agents had received regulatory clearance in almost two decades. More importantly, the FOURIER and ODYSSEY outcomes trials demonstrated they significantly lowered rates of heart attacks, strokes and coronary revascularization compared to placebo in high-risk populations.

With proven cardiovascular benefits, they have transformed into a multi-billion dollar market attracting heavy promotion from pharmaceutical companies. While initial uptake was slow due to high list prices, aggressive marketing campaigns, greater accessibility through insurance coverage and expanding clinical indications have succeeded in steadily widening their adoption globally.

Market Challenge - High Cost of Therapy Compared to Traditional Treatments

For example, a year's supply of Praluent or Repatha can cost over $6000, while statins are available for just a few dollars per month. This large price difference means that PCSK9 inhibitors are currently not cost-effective compared to statins for many patients and health plans. Their use tends to be restricted to patients who are unable to tolerate statins or need additional cholesterol lowering.

One significant growth opportunity for the PCSK9 inhibitors market is the potential expansion of therapeutic uses beyond cardiovascular indications. PCSK9 inhibitors are known to significantly lower LDL or "bad" cholesterol levels and emerging research suggests they may provide benefits for additional conditions influenced by cholesterol levels. These include non-alcoholic fatty liver disease (NAFLD), statin-associated muscle pains, and potentially even neurological disorders like Alzheimer's disease where cholesterol plays a role.

Pharmaceutical companies are actively investigating additional therapeutic areas for PCSK9 inhibitors which, if proven successful, could transform the market outlook into one with significant growth potential in the coming decades.

Key winning strategies adopted by key players of PCSK9 Inhibitors Market

Amgen, one of the major players in the market, received FDA approval for Repatha (evolocumab) in 2015, becoming the first PCSK9 inhibitor drug approved. This gave Amgen a first-mover advantage in capturing market share. As of 2020, Repatha accounted for over 60% of the global PCSK9 inhibitor drug market.

Similarly, Sanofi and Regeneron launched Praluent (alirocumab) in 2015 after FDA approval. However, they faced tough competition from the well-entrenched Repatha in the market. To play catch up, Sanofi/Regeneron offered pay-for-performance contracts to pharmacy benefit managers, lowering the net price of Praluent if certain sales thresholds were not met. This risk-sharing strategy helped increase Praluent adoption rates among physicians and patients skeptical of high list prices.

In summary, early FDA approvals, massive promotional spending, and pay-for-performance contracting strategies have been the key factors driving commercial success for major players like Amgen

Segmental Analysis of PCSK9 Inhibitors Market

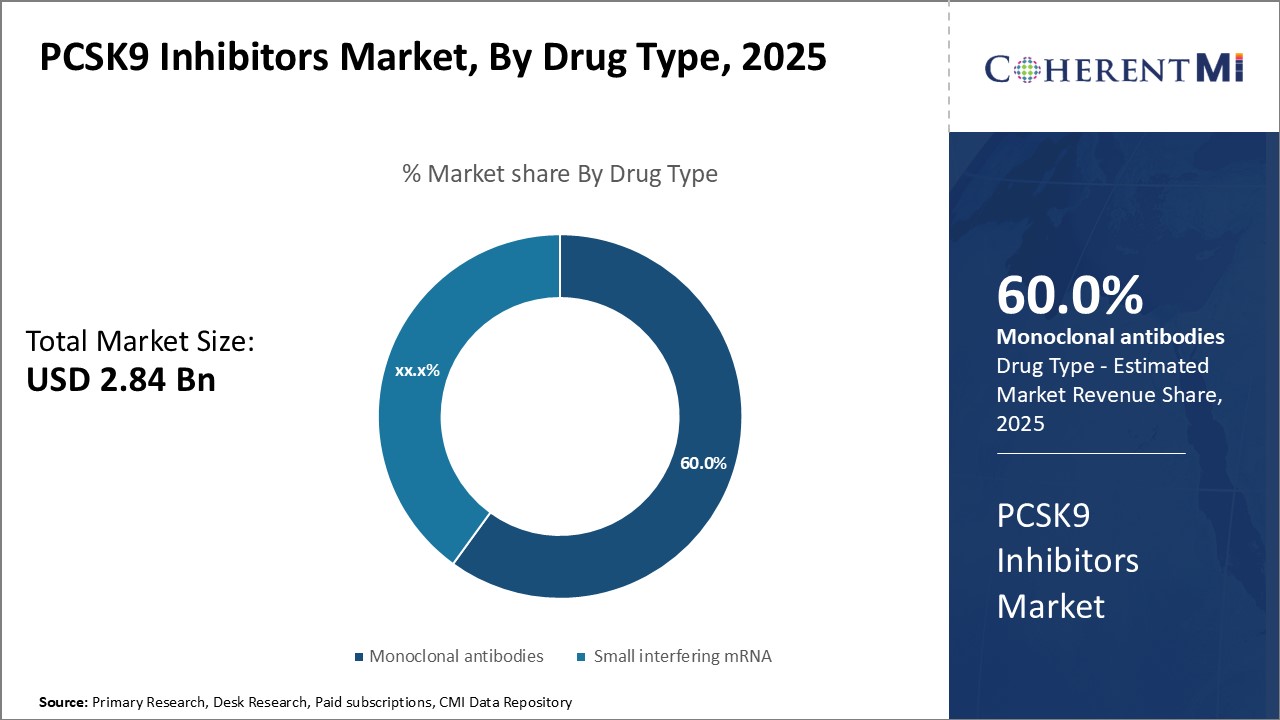

Insights, By Drug Type: Efficacy and Safety Drive Demand for Monoclonal Antibodies in PCSK9 Inhibitors Market

Insights, By Drug Type: Efficacy and Safety Drive Demand for Monoclonal Antibodies in PCSK9 Inhibitors MarketWithin the PCSK9 inhibitors drug type segment, monoclonal antibodies such as PRALUENT and REPATHA dominate the market share due to their proven efficacy and safety profile. Several high-quality clinical trials have demonstrated the antibodies' ability to significantly lower LDL cholesterol levels in patients. For example, trials have shown REPATHA can reduce LDL cholesterol by up to 60% when used in addition to statins. This superior lowering of "bad" cholesterol translates to a reduced risk of cardiovascular events such as heart attacks and strokes.

Looking ahead, clinical development is ongoing to further expand the evidence base and approved indications for monoclonal antibodies. Overall, the monoclonal antibodies' record of proven efficacy and safety will continue driving utilization across indicated high-risk patient populations.

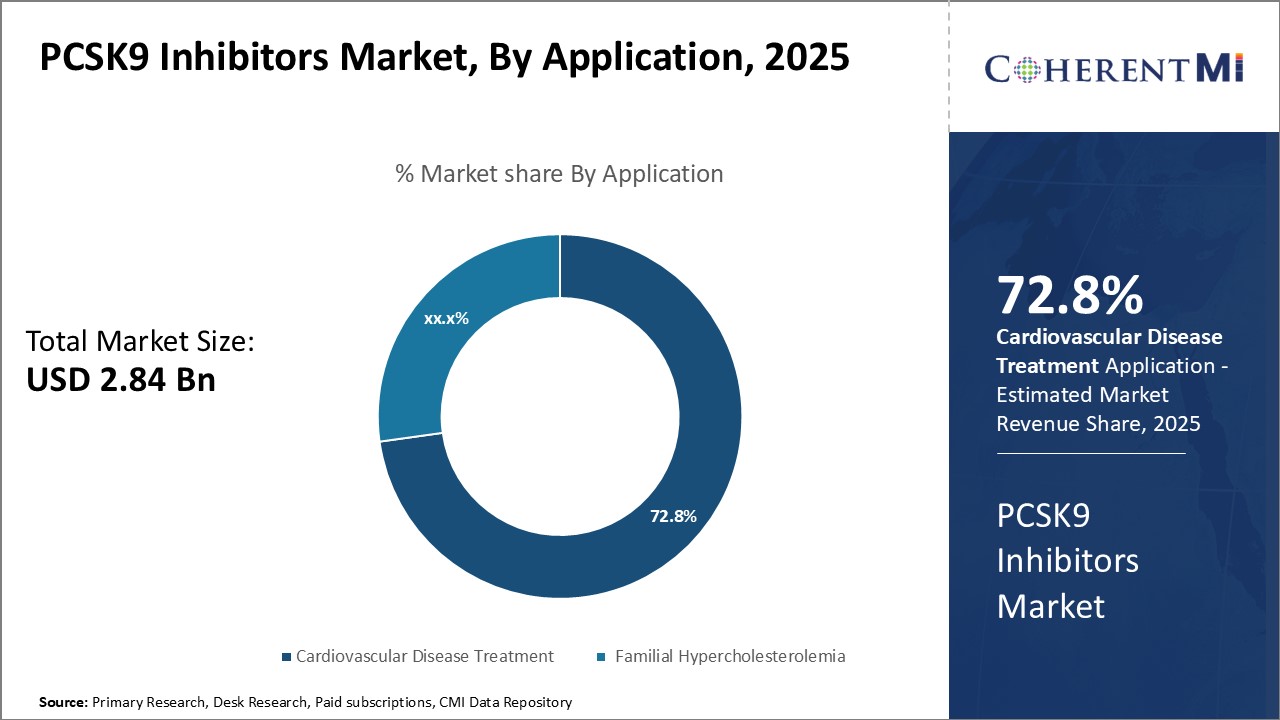

Within the application segment of the PCSK9 inhibitor market, cardiovascular disease treatment accounts for the vast majority of usage. This is due to a combination of epidemiological factors and the clinical benefits demonstrated for patients with established atherosclerotic conditions.

Within the cardiovascular disease scope, PCSK9 inhibitors are predominantly used in patients with manifestations like heart attacks, unstable angina, coronary revascularization procedures and strokes. Later trials are exploring benefits in peripheral artery disease as well. Their cholesterol-lowering benefits translate to reduced plaque progression and vulnerability, lessening atherosclerotic disease burden over the long run. This offers hope of improved survival and quality of life for patients worldwide managing cardiovascular health issues.

Additional Insights of PCSK9 Inhibitors Market

- Prevalence: The prevalence of cardiovascular disease is increasing, further driving the need for cholesterol-lowering therapies like PCSK9 inhibitors

- Familial Hypercholesterolemia: Around 640,000 cases in the 7MM, with homozygous cases being rare.

- Peripheral Artery Disease (PAD): PAD is the largest segment of cases using PCSK9 inhibitors in a prophylactic setting within the 7MM

- Drug Uptake: The pipeline for PCSK9 inhibitors is robust, and LIB003 is expected to dominate the market in the coming years due to better efficiency and once-monthly dosing.

Competitive overview of PCSK9 Inhibitors Market

The major players operating in the PCSK9 Inhibitors Market include Amgen (REPATHA), Sanofi/Regeneron (PRALUENT), Merck (MK-0616), LIB Therapeutics (LIB003), and AstraZeneca.

PCSK9 Inhibitors Market Leaders

- Amgen (REPATHA)

- Sanofi/Regeneron (PRALUENT)

- Merck (MK-0616)

- LIB Therapeutics (LIB003)

- AstraZeneca

PCSK9 Inhibitors Market - Competitive Rivalry

PCSK9 Inhibitors Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in PCSK9 Inhibitors Market

- In August 2023, Merck initiated the Phase III CORALreef trial for MK-0616, a new oral PCSK9 inhibitor targeting cholesterol reduction in adults with hypercholesterolemia. This development could revolutionize the ease of treatment, offering an oral option in a space dominated by injectables.

- LEQVIO (inclisiran) received FDA approval as the first small interfering RNA (siRNA) therapy specifically designed to lower LDL cholesterol (often referred to as "bad" cholesterol). Inclisiran works by silencing the production of PCSK9, a protein that plays a crucial role in cholesterol regulation. By targeting and blocking PCSK9, it helps reduce circulating LDL cholesterol levels in the bloodstream. LEQVIO was initially approved by the FDA in December 2021 for use in adults with atherosclerotic cardiovascular disease (ASCVD) or heterozygous familial hypercholesterolemia (HeFH) who require additional lowering of LDL cholesterol despite maximally tolerated statin therapy.

PCSK9 Inhibitors Market Segmentation

- By Drug Type

- Monoclonal antibodies (PRALUENT, REPATHA)

- Small interfering mRNA (Inclisiran)

- By Application

- Cardiovascular Disease Treatment

- Familial Hypercholesterolemia

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Frequently Asked Questions :

How big is the PCSK9 inhibitor market?

The PCSK9 inhibitors market is estimated to be valued at USD 2.84 Bn in 2025 and is expected to reach USD 8.22 Bn by 2032.

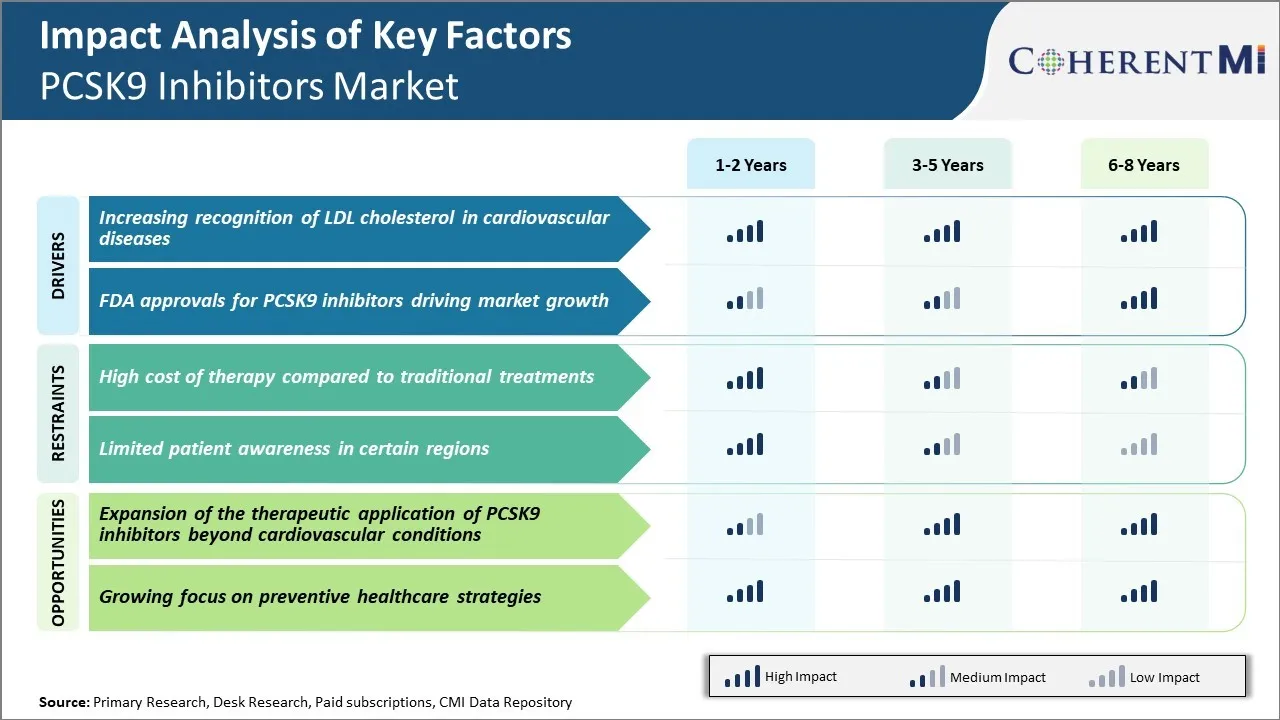

What are the key factors hampering the growth of the PCSK9 inhibitors market?

The high cost of therapy compared to traditional treatments and limited patient awareness in certain regions are the major factor hampering the growth of the PCSK9 inhibitors market.

What are the major factors driving the PCSK9 inhibitors market growth?

The increasing recognition of LDL cholesterol in cardiovascular diseases and FDA approvals for pcsk9 inhibitors driving market growth are the major factor driving the PCSK9 inhibitors market.

Which is the leading Drug Type in the PCSK9 inhibitors market?

The leading drug type segment is monoclonal antibodies (PRALUENT, REPATHA).

Which are the major players operating in the PCSK9 inhibitors market?

Amgen (REPATHA), Sanofi/Regeneron (PRALUENT), Merck (MK-0616), LIB Therapeutics (LIB003), AstraZeneca are the major players.

What will be the CAGR of the PCSK9 inhibitors market?

The CAGR of the PCSK9 inhibitors market is projected to be 16.4% from 2025-2032.