The pediatric growth hormone deficiency market is estimated to be valued at USD 5.00 Bn in 2025 and is expected to reach USD 7.27 Bn by 2032, growing at a compound annual growth rate (CAGR) of 5.5% from 2025 to 2032. The pediatric growth hormone deficiency market has been witnessing steady growth over the past few years and increased awareness regarding treatment of pediatric growth disorders is expected to drive further growth.

Market Size in USD Bn

CAGR5.5%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.5% |

| Market Concentration | High |

| Major Players | Pfizer Inc., Novo Nordisk A/S, Eli Lilly and Company, Merck KGaA (EMD Serono), Sandoz International GmbH and Among Others |

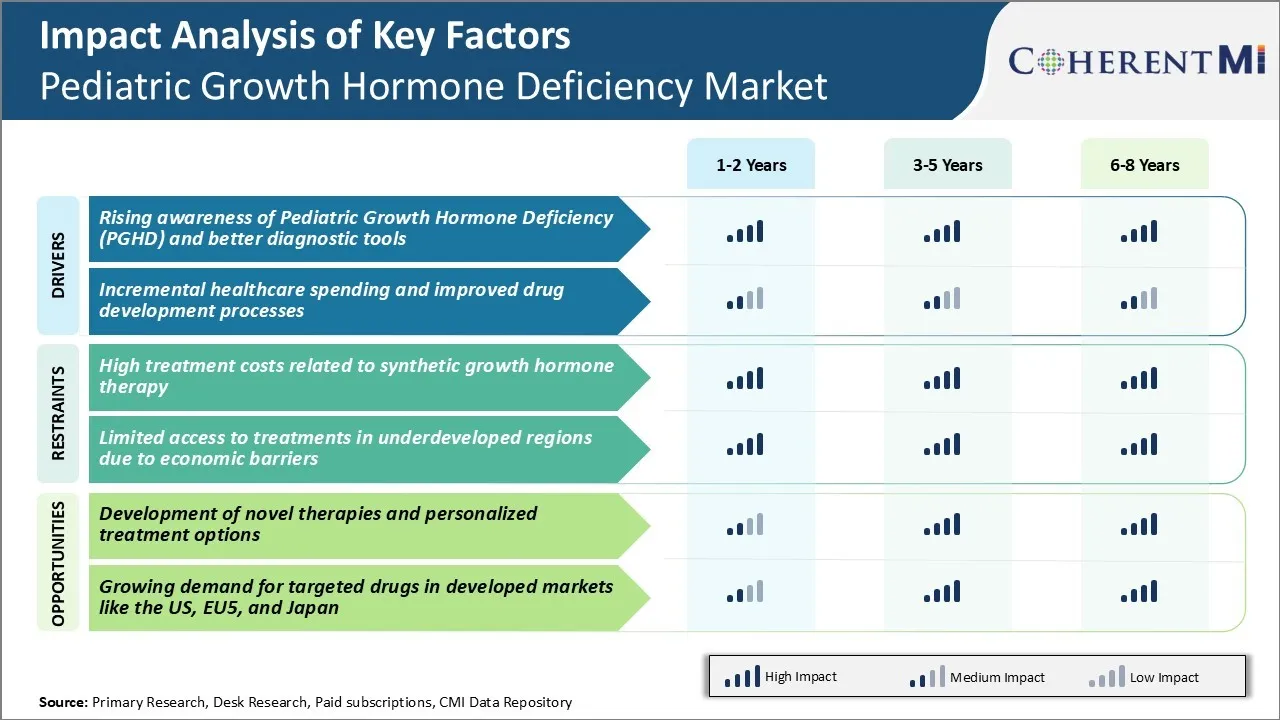

Market Driver - Rising Awareness of Pediatric Growth Hormone Deficiency (PGHD) and Better Diagnostic Tools

Pediatric growth hormone deficiency is a medical condition where children fail to produce sufficient growth hormone required for proper growth and development. In recent years there has been a significant rise in awareness about PGHD among parents and medical practitioners. Various non-profit organizations and patient communities have been actively educating people on signs and symptoms of the condition. This has encouraged more parents to consult doctors if they notice irregularities in their child's growth patterns.

On the diagnostic front as well, advanced technologies have improved the ability to accurately detect growth hormone deficiency at an early stage. Specialized tests like dynamic function tests and MRI scans provide valuable insights into the functional ability of the pituitary gland.

Moreover, many diagnostic centers have started offering these tests at affordable prices. The increased diagnostic capabilities have led to more children being diagnosed formally with PGHD. Early diagnosis is critical because it allows treatment to begin during the period of maximum growth responsiveness, which will drive growth of the pediatric growth hormone deficiency market.

Market Driver - Incremental Healthcare Spending and Improved Drug Development Processes

Over the past decade or so, healthcare budgets of governments as well as individual households have seen a gradual expansion. In case of PGHD, the medicines required for supplemental growth hormone therapy can be quite expensive. Many countries have strengthened public insurance schemes to offer treatment coverage for life-threatening pediatric illnesses.

Parallelly, pharmaceutical players have also stepped up their investments in research and development of next-gen products. Advanced drug delivery methods like daily and long-acting injections now minimize the inconvenience faced by kids during therapy.

Regulatory bodies too have strived to streamline the drug approval process for rare diseases. This has encouraged biotech firms to invest in developing specialized drugs for conditions like PGHD. With streamlined guidelines and faster approvals, companies can recoup development costs and make these medicines available to patients at reduced prices.

At the same time, biosimilar entrants have intensified competition which is working towards bringing down overall therapy costs. This is expected to support growth of the pediatric growth hormone deficiency market.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High Treatment Costs Related to Synthetic Growth Hormone Therapy

One of the major challenges facing the pediatric growth hormone deficiency market is the high costs associated with synthetic growth hormone therapy. Daily injections of recombinant growth hormone drugs can cost families thousands of dollars per month, placing an immense financial burden on patients and their guardians. As these treatments often need to continue for many years during a child's development, the total costs of therapy rapidly accumulate over time.

In developed markets, rising healthcare budgets and economic pressures on public insurance programs have led to tighter controls on reimbursement and funding for growth hormone drugs. This has made therapy unaffordable for some low-income families dealing with growth deficiency. The high resource requirements of lifelong synthetic growth hormone treatment also present challenges for healthcare systems in developing countries with more limited budgets.

These cost barriers negatively impact clinical outcomes and quality of life for pediatric patients who cannot consistently receive prescribed growth hormone dosages. This might hamper growth of the pediatric growth hormone deficiency market in the coming years.

Market Opportunity - Development of Novel Therapies and Personalized Treatment Options

One of the key opportunities for growth in the pediatric growth hormone deficiency market lies in developing more innovative and personalized treatment solutions. Currently, most patients receive standardized recombinant growth hormone therapies through daily subcutaneous injections.

However, there is significant room to improve treatment paradigms and patient outcomes through novel drug delivery technologies. Areas of focus include long-acting sustained release formulations that could replace daily injections with less frequent dosing. This has the potential to greatly enhance compliance while lowering costs of care.

Another promising avenue is working towards more personalized therapies that better mimic the body's natural pulsatile growth hormone secretion patterns. Advances in diagnostic tools also provide opportunities to better identify treatment response biomarkers and customize dosing based on individual patient factors.

With newer entrants, potential of the pediatric growth hormone deficiency market exists for more competition which could further drive down costs over time. Overall, continued research and development towards precision and convenient therapies aligns well with unmet needs and offers possibilities for long-term expansion of the pediatric growth hormore deficiency.

Pediatric growth hormone deficiency is most commonly treated via hormone replacement therapy. The condition is typically managed in three stages, with prescribers adjusting treatment based on patients' growth responses.

In the initial stage of severe deficiency, injectable medications like Genotropin, Humatrope or Norditropin are prescribed to stimulate growth and promote catch-up development. These daily subcutaneous injections contain synthetic versions of human growth hormone (GH) like somatropin.

As patients show signs of growth acceleration, treatment moves to the second maintenance stage. Prescribers continue GH injections but may slightly decrease dosage amounts. Here, multi-dose cartridge/pens like Nutropin AQ or Omnitrope become preferable to parents/caregivers over vials and syringes for their convenience.

In the final stage after near-adult height is reached, GH injections are slowly withdrawn. Prescribers closely monitor patients for any rebound effects before completely stopping treatment. By then, oral medications to promote final maturation like estrogen supplements may be considered.

The first-line treatment is recombinant human growth hormone (rhGH) replacement therapy. RhGH therapy aims to restore normal growth and is initiated once GH deficiency is diagnosed, usually between ages 2-4 years. The most commonly prescribed rhGH drugs are Genotropin, Humatrope, Norditropin, Nutropin, Omnitrope and Saizen which are administered via daily subcutaneous injections. Long-acting formulations like Norditropin SimpleXx which requires less frequent dosing are also available.

For children who show an inadequate response to the starting rhGH dose, the dosage may be increased gradually up to a maximum approved level based on the child's growth response and observed IGF-1 levels. Additional growth can be achieved this way to reach a normal height. In rare cases when rhGH therapy proves ineffective, adjunctive therapies like oxandrolone may be added but require specialist supervision and monitoring.

As growth reaches final adult height, rhGH therapy is gradually tapered off while continuing other monitoring and treatments as advised by the pediatric endocrinologist. Timely treatment using optimal rhGH regimens tailored to the individual patient's requirement helps children with GHD achieve normal growth and reduces long-term adverse impacts on quality of life. Close coordination between families and healthcare providers enables best outcomes.

Product Innovation: Continuous innovation in development and launch of new and improved treatment options has been a key strategy for leaders in the pediatric growth hormone deficiency market like Novo Nordisk and Pfizer. In 2019, Novo Nordisk launched Norditropin FlexPro, an easy-to-use prefilled multi-dose growth hormone pen, which helped improve treatment adherence.

Expanded Access Programs: Companies run expanded access programs or "open label extensions" to allow access to investigational drugs for patients unable to enroll in clinical trials. This helped companies like Pfizer and Merck gain positive exposure and gather real-world evidence for drugs ahead of commercial launches.

Strategic Acquisitions: Companies pursue strategic acquisitions to gain access to new products and technologies or expand geographical footprint. For instance, Novo Nordisk's 2015 acquisition of Calypso Biotech strengthened its clinical pipeline, allowing launch of newer growth hormone formulations. Such deals helped companies deepen their portfolios and enhance leadership in the pediatric growth hormone deficiency market.

Differentiated Pricing: Companies adopt differentiated pricing models based on a country or region's ability to pay. For example, Novo Nordisk offers lower prices in emerging markets like China and Brazil through tiered-pricing programs. This has helped increase accessibility while also driving volume growth in high-growth regions.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

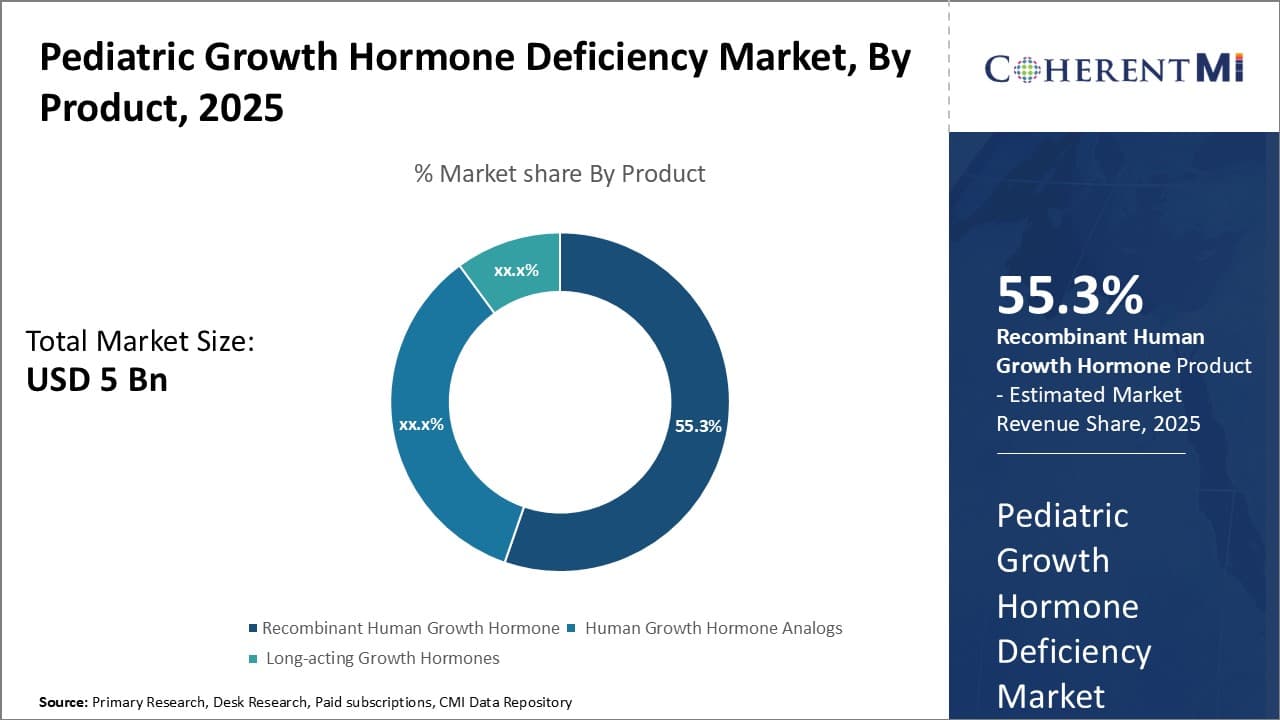

Insights, By Product: Affordability and Efficacy Drives Recombinant Human Growth Hormone (rhGH)

In terms of product, recombinant human growth hormone (rhGH) contributes 55.3% share of the pediatric growth hormone deficiency market in 2025, owning to its affordability and high efficacy rates compared to other growth hormone products. rhGH is recognized as a highly effective treatment for pediatric growth hormone deficiency as it helps children maintain normal growth and development.

Unlike earlier growth hormone extracts developed from human cadavers, rhGH carries no risk of contamination and is qualitatively indistinguishable from natural human growth hormone. Its affordability is a key factor for widespread adoption, as rhGH therapy can be a long-term treatment extending over years.

Overall acceptance among patients and caregivers has been high due to rhGH's reliability in restoring healthy growth without major safety concerns.

To learn more about this report, Download Free Sample Copy

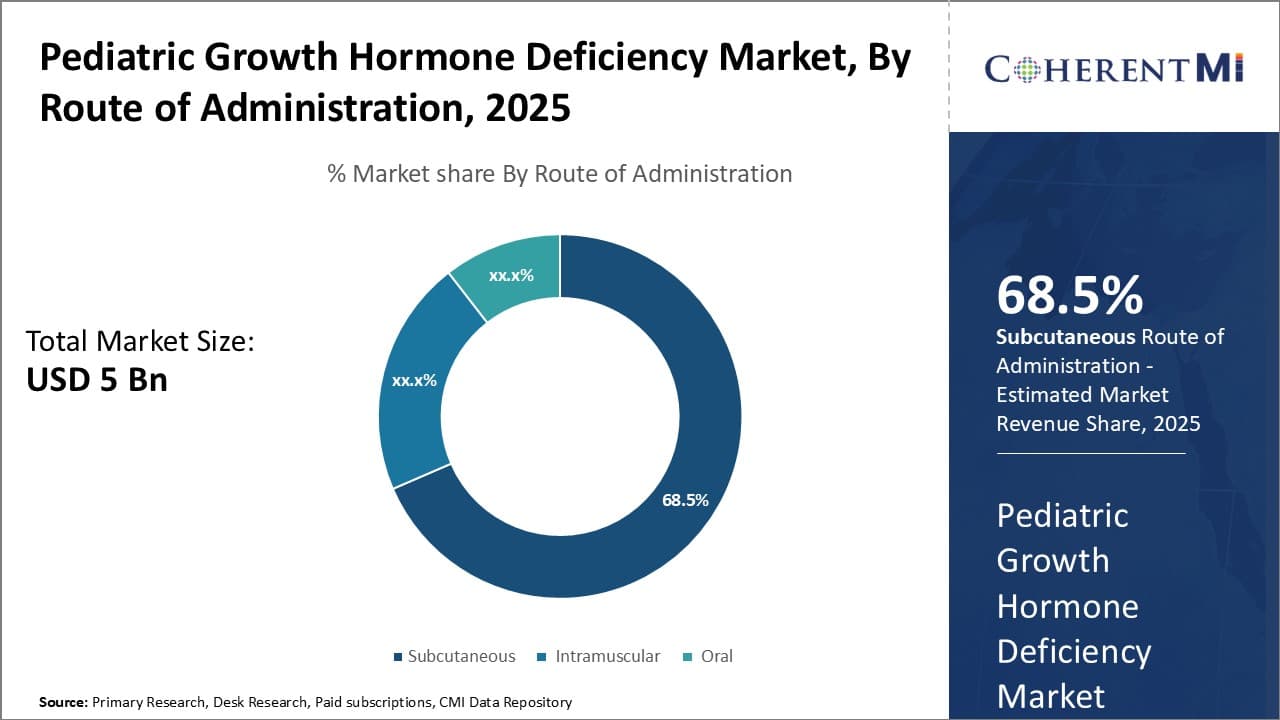

Insights, By Route of Administration: Convenience and Compliance Boosts Subcutaneous Route

To learn more about this report, Download Free Sample Copy

Insights, By Route of Administration: Convenience and Compliance Boosts Subcutaneous Route

In terms of route of administration, subcutaneous segment contributes 68.5% share of the pediatric growth hormone deficiency market in 2025, owing to its convenience and higher patient compliance rates. Subcutaneous rhGH administration allows for self-injection or infusion at home, avoiding the discomfort and inconvenience of intramuscular or intravenous injections at hospitals or clinics.

The minor pain and trauma associated with subcutaneous injections is also better tolerated than other routes. Higher compliance to the prescribed rhGH dosage regimen has been observed with subcutaneous administration, leading to more consistent therapeutic outcomes. These benefits have made subcutaneous the preferred route chosen by the majority of patients and physicians.

Insights, By Distribution Channel: Expertise and Insurance Support Favors Hospitals

In terms of distribution channel, hospital pharmacies contribute the highest share of the pediatric growth hormone deficiency market due to the institutional expertise and insurance support they provide. As pediatric growth hormone deficiency requires long-term management and monitoring by specialized endocrinologists, hospitals are well-equipped to handle such cases.

Hospital pharmacies also have established relationships with pharmaceutical suppliers and the ability to source various rhGH products. Importantly, many public and private health insurance plans cover or subsidize the high costs of rhGH therapy. But it stipulates that patients receive the drug from certain designated facilities like hospital pharmacies within the insurers' network.

This insurance backing and hospitals' credentialed expertise in treating rare conditions like pediatric growth hormone deficiency have made them the main point of rhGH distribution and administration.

The major players operating in the pediatric growth hormone deficiency market include Pfizer Inc., Novo Nordisk A/S, Eli Lilly and Company, Merck KGaA (EMD Serono), Sandoz International GmbH, Ferring Pharmaceuticals, Genentech, Inc. (Roche), Ipsen, Ascendis Pharma A/S, and OPKO Health, Inc.

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Pediatric Growth Hormone Deficiency Market is segmented By Product (Recombinant Human Growth Hormone...

Pediatric Growth Hormone Deficiency Market

How big is the pediatric growth hormone deficiency market?

The pediatric growth hormone deficiency market is estimated to be valued at USD 5.00 Bn in 2025 and is expected to reach USD 7.27 Bn by 2032.

What are the key factors hampering the growth of the pediatric growth hormone deficiency market?

High treatment costs related to synthetic growth hormone therapy and limited access to treatments in underdeveloped regions due to economic barriers are the major factors hampering the growth of the pediatric growth hormone deficiency market.

What are the major factors driving the pediatric growth hormone deficiency market growth?

Rising awareness of pediatric growth hormone deficiency (PGHD) and better diagnostic tools and incremental healthcare spending and improved drug development processes are the major factor driving the pediatric growth hormone deficiency market.

Which is the leading product in the pediatric growth hormone deficiency market?

The leading product segment is recombinant human growth hormone (rhGH).

Which are the major players operating in the pediatric growth hormone deficiency market?

Pfizer Inc., Novo Nordisk A/S, Eli Lilly and Company, Merck KGaA (EMD Serono), Sandoz International GmbH, Ferring Pharmaceuticals, Genentech, Inc. (Roche), Ipsen, Ascendis Pharma A/S, and OPKO Health, Inc. are the major players.

What will be the CAGR of the pediatric growth hormone deficiency market?

The CAGR of the pediatric growth hormone deficiency market is projected to be 5.5% from 2025-2032.