PET MRI Systems Market Size - Analysis

Market Size in USD Mn

CAGR9.5%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 9.5% |

| Market Concentration | High |

| Major Players | Siemens Healthineers AG, GE Healthcare, Aspect Imaging Ltd, Bruker Corporation, Mediso Ltd and Among Others |

please let us know !

PET MRI Systems Market Trends

As per estimates, over 50 million people globally suffer from dementia with around 10 million new cases every year. Alzheimer's disease itself is one of the major causes of dementia and its prevalence is expected to triple in the coming years owing to an aging population. PET MRI systems are hugely beneficial in diagnosing such neurological illnesses especially in their early stages. The multi-modality approach allows physicians to get functional as well as anatomical details of the brain.

Several clinical trials are ongoing to evaluate PET MRI for conditions like epilepsy, Parkinson's, Huntington's, etc. Its role in improving early detection rates as well as aiding drug development is being actively explored. The growing mental healthcare needs especially in developing countries will further propel demand.

Rising worldwide incidence of cancer has made it one of the leading causes of mortality. As per estimates, around 19 million new cancer cases and 10 million cancer deaths occurred in 2020 globally.

Cancer types where PET MRI is proving especially valuable include breast cancer and lung cancer. As per some studies, PET MRI may obviate unnecessary biopsies in breast cancer by more accurate lesion characterization compared to conventional imaging.

Overall, multi-parametric imaging holds potential for individualizing cancer care. Role of PET MRI in oncology management continues to expand through ongoing research. Thereby, its adoption rates for leading cancer types are expected to rise in the coming years.

One of the major challenges faced by the PET MRI systems market is the extremely high pricing of these systems. Integrating these complex imaging modalities into a single system leads to a very high manufacturing cost. On average, a PET MRI system can cost between $4-6 million which is significantly higher than conventional PET or MRI scanners individually. This steep pricing puts the technology out of reach for many hospitals and imaging centers, especially those in developing regions.

One key opportunity for the PET MRI Systems market lies in continuous research and development efforts that are leading to better imaging capabilities and newer system versions. PET MRI is an emerging molecular imaging technology that combines the functional imaging power of PET with the high-resolution anatomical imaging of MRI.

In addition, system manufacturers are launching improved hybrid configurations with features like time-of-flight PET detection. Continuous innovation is also expanding clinical applications from brain imaging to whole-body oncological diagnostics.

Key winning strategies adopted by key players of PET MRI Systems Market

Focus on product innovation and technological advancements: Major players like Siemens Healthineers and Philips Healthcare have consistently invested in R&D to develop innovative and advanced PET MRI systems. In 2016, Philips launched the Voyager PET/MR system with latest generation Ingenuity PET and 3.0T MRX-S MRI scanners. This system enhanced throughput, image quality and workflow efficiency.

Strategic partnerships and collaborations: Players have formed key technology partnerships to complement their product portfolios. For example, in 2012 Siemens partnered with Oncovision to develop oncology-specific software for its Biograph mMR. This helped provide a comprehensive oncology solution to customers. Similarly, in 2018 Phillips signed a clinical research collaboration with University Medical Centre Utrecht to validate applications of its PET/MR technology.

Segmental Analysis of PET MRI Systems Market

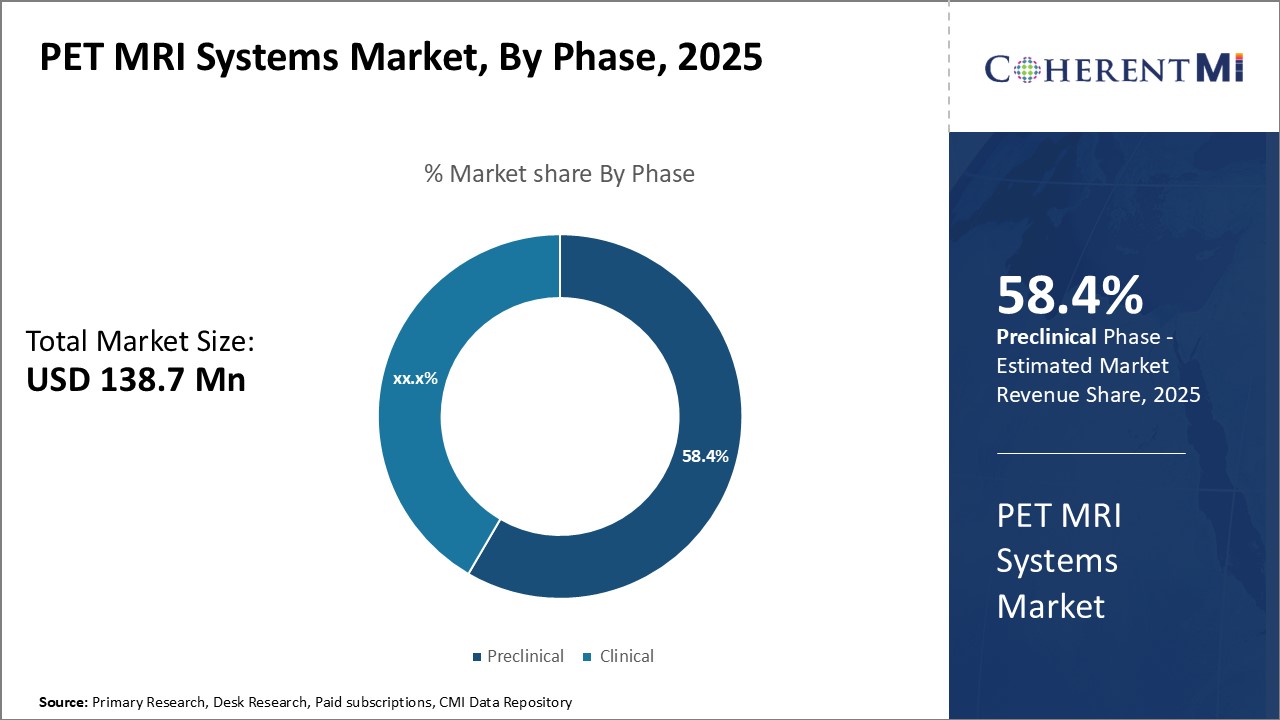

Insights, By Phase: Increased R&D Investments Drive Preclinical PET MRI Systems Market Share

With drug development becoming more complex, risky and lengthy, companies are focusing on improving R&D productivity through advanced preclinical studies. PET MRI systems help provide complementary molecular and anatomical information simultaneously, allowing researchers to better understand disease mechanisms and evaluate new drugs at the preclinical stage.

Government agencies also fund preclinical research through grants aimed at accelerating development of new treatments for conditions like Alzheimer's, Parkinson's and rare genetic disorders. Such funding support has prompted institutions to increasingly adopt multimodal preclinical imaging for grant-funded projects.

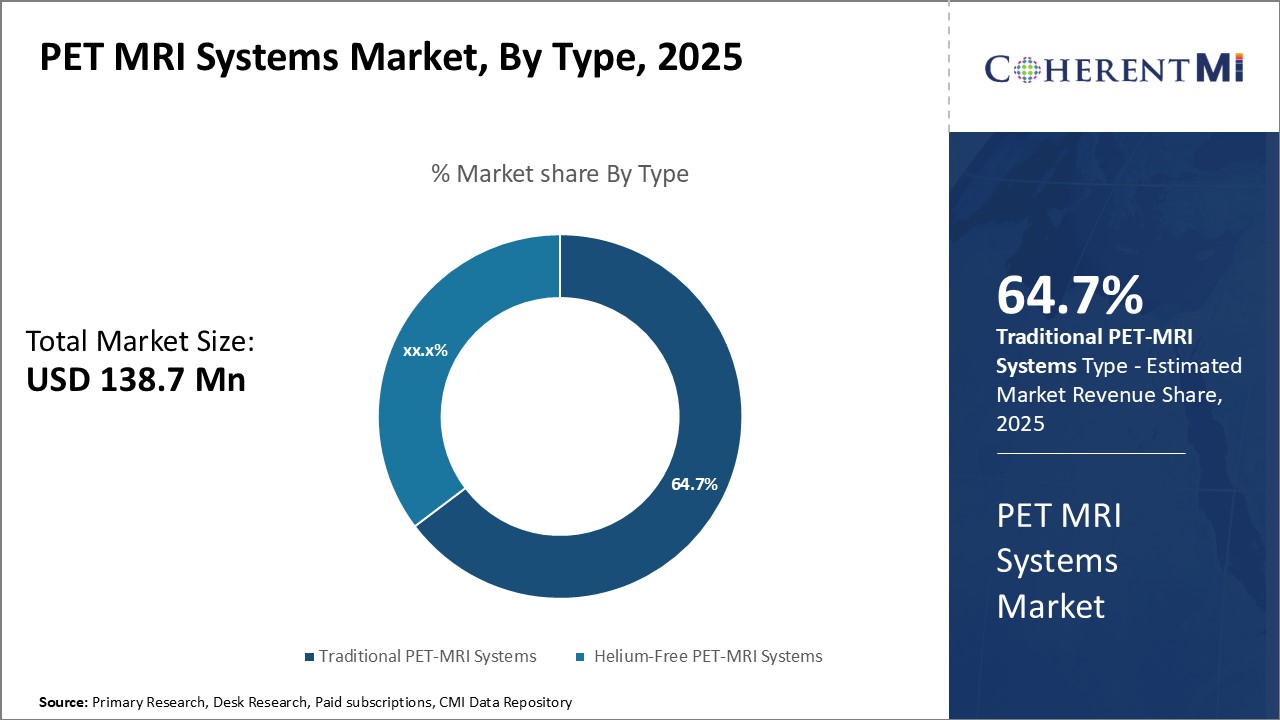

Insights, By Type: Increasing Applications Drive Demand for Traditional PET MRI Systems

Insights, By Type: Increasing Applications Drive Demand for Traditional PET MRI Systems

Some common uses in clinical practice include detecting suspicious lesions, analyzing tumor response after treatment, surveillance scanning for recurrence and radiation therapy planning. As the prevalence of cancers rises worldwide, the volume of associated scans will continue growing steadily. Traditional PET MRIs offer proven clinical utility in staging and characterizing a wide range of tumors.

Given the huge and growing burden of heart conditions globally, especially in developed nations with aging populations, demand is expected to remain robust from diagnostic cardiac imaging centers and hospitals. Furthermore, neurological, musculoskeletal and women's health applications of combined anatomic and molecular imaging are expanding scope for traditional PET MRI market success. With well-established clinical workflows and acceptance, these systems remain the standard bearers.

Insights, By End User: Diagnostic Advantages Drive Hospital Adoption of PET MRI Systems

Compared to standalone machines, PET MRI scanners allow reading physicians to gain a more holistic understanding of pathology from a single study session. This streamlines the diagnostic process and supports treatment planning through improved characterization of lesions, metastases and therapeutic responses.

Additional Insights of PET MRI Systems Market

- According to WHO, nearly 50 million people were living with dementia globally in 2020, and Alzheimer's disease accounts for 60–70% of those cases. This massive prevalence supports the increasing demand for hybrid imaging systems like PET-MRI to aid in diagnosis and research.

- Alzheimer’s Disease Impact: The prevalence of Alzheimer's disease is contributing significantly to the demand for PET-MRI systems, particularly for research and diagnostics.

- R&D and Preclinical Studies: Ongoing research utilizing preclinical PET-MRI systems for neurological and cancer-related studies is helping drive demand for these advanced systems.

- The oncology application accounts for over 50% of the market share due to the high demand for precise cancer imaging.

- North America holds approximately 40% of the global market, attributed to advanced healthcare systems and higher adoption rates of new technologies.

Competitive overview of PET MRI Systems Market

The major players operating in the PET MRI systems market include Siemens Healthineers AG, GE Healthcare, Bruker Corporation, Mediso Ltd, MR Solutions, United Imaging Healthcare Co., Ltd., Koninklijke Philips N.V., Cubresa Inc., Inviscan Imaging Systems, and Canon Medical Systems Corporation.

PET MRI Systems Market Leaders

- Siemens Healthineers AG

- GE Healthcare

- Aspect Imaging Ltd

- Bruker Corporation

- Mediso Ltd

PET MRI Systems Market - Competitive Rivalry

PET MRI Systems Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in PET MRI Systems Market

- In November 2023, Philips Healthcare introduced an upgrade to their PET MRI systems, integrating advanced software for better image reconstruction and reduced patient exposure. Philips also unveiled several AI-driven innovations at RSNA, including upgrades to their MRI technology with solutions like the SmartSpeed, which enhances image reconstruction and efficiency, potentially reducing scan times and improving patient care. Philips also expanded its mobile MRI systems, offering improved accessibility and sustainable operations.

- In July 2023, GE Healthcare partnered with leading research institutions to develop AI-enabled PET MRI solutions, aiming to improve early disease detection. GE Healthcare has been actively advancing AI-enabled solutions, including their AI-driven SIGNA PET/MR systems, which focus on improving the accuracy and speed of scans for complex conditions such as prostate cancer and Alzheimer's disease. These innovations aim to enhance early disease detection and diagnosis through AI-enhanced image reconstruction and workflow improvements.

- In March 2023, Siemens Healthineers launched the Biograph Vision Quadra PET/CT scanner, which is designed for whole-body imaging with an extended axial field of view (106 cm). This system enhances imaging capabilities by enabling clinicians to scan the patient from head to thigh in one position, delivering faster scan times and reduced radiation doses.

PET MRI Systems Market Segmentation

- By Phase

- Preclinical

- Clinical

- By Type

- Traditional PET-MRI Systems

- Helium-Free PET-MRI Systems

- By End User

- Hospitals

- Diagnostic Centers

- Academic & Research Institutes

- Others

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Frequently Asked Questions :

How big is the PET MRI systems market?

The PET MRI systems market is estimated to be valued at USD 138.7 Mn in 2025 and is expected to reach USD 261.8 Mn by 2032.

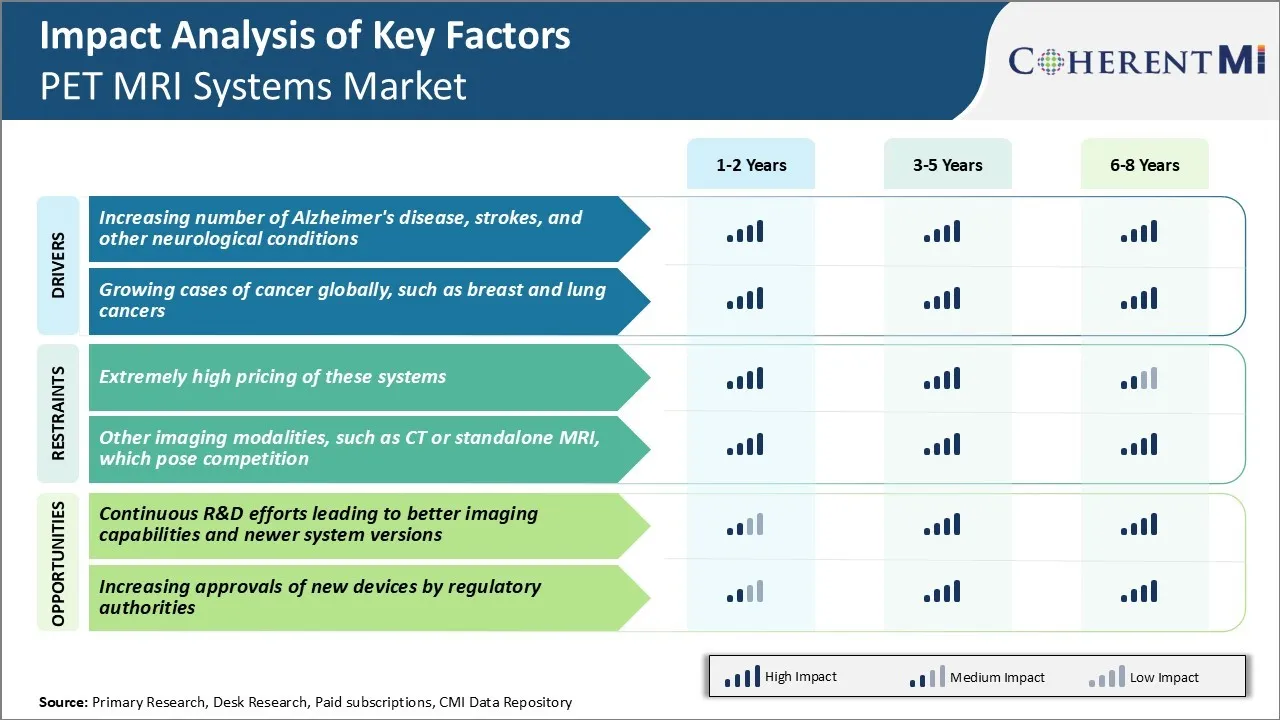

What are the key factors hampering the growth of the PET MRI Systems Market?

Extremely high pricing of these systems and other imaging modalities, such as CT or standalone MRI, which pose competition are the major factors hampering the growth of the PET MRI systems market.

What are the major factors driving the PET MRI systems market growth?

Increasing number of Alzheimer's disease, strokes, and other neurological conditions and growing cases of cancer globally, such as breast and lung cancers, are the major factors driving the PET MRI systems market.

Which is the leading phase in the PET MRI systems market?

The leading phase segment is preclinical.

Which are the major players operating in the PET MRI systems market?

Siemens Healthineers AG, GE Healthcare, Bruker Corporation, Mediso Ltd, MR Solutions, United Imaging Healthcare Co., Ltd., Koninklijke Philips N.V., Cubresa Inc., Inviscan Imaging Systems, and Canon Medical Systems Corporation are the major players.

What will be the CAGR of the PET MRI systems market?

The CAGR of the PET MRI systems market is projected to be 9.5% from 2025-2032.