医薬品キャップおよびクロージャー市場 サイズ - 分析

医薬品キャップおよびクロージャ市場は価値があると推定されます 2024年のUSD 6.4 Bn そして到達する予定 米ドル 10.1 によって 2031、混合の年次成長率で育つ 2024年~2031年(CAGR) 6.7% 大手メーカーによるキャップやクロージャの技術の進歩における医薬品や投資の増大は、予測期間中の市場の成長を促すことが期待されます。

市場は、便利で効率的な投与量の形態の需要が高まっている肯定的な成長を目撃することが期待されます。 更に、反偽造および子供の抵抗力がある包装の技術の導入は市場拡大を支えます。 しかし、代替パッケージのフォーマットの可用性と一般的な薬の好みの増加は、予測年を超える程度の市場進行を妨げる可能性があります。

市場規模(米ドル) Bn

CAGR6.9%

| 調査期間 | 2025-2032 |

| 推定の基準年 | 2024 |

| CAGR | 6.9% |

| 市場集中度 | High |

| 主要プレーヤー | Aptarファーマ(AptarGroup), 西製薬サービス, Datwylerのシーリング解決(Datwylerのグループ), Lonstroff (住友ゴム工業), Ompi(ステバナトグループ) その他 |

お知らせください!

医薬品キャップおよびクロージャー市場 トレンド

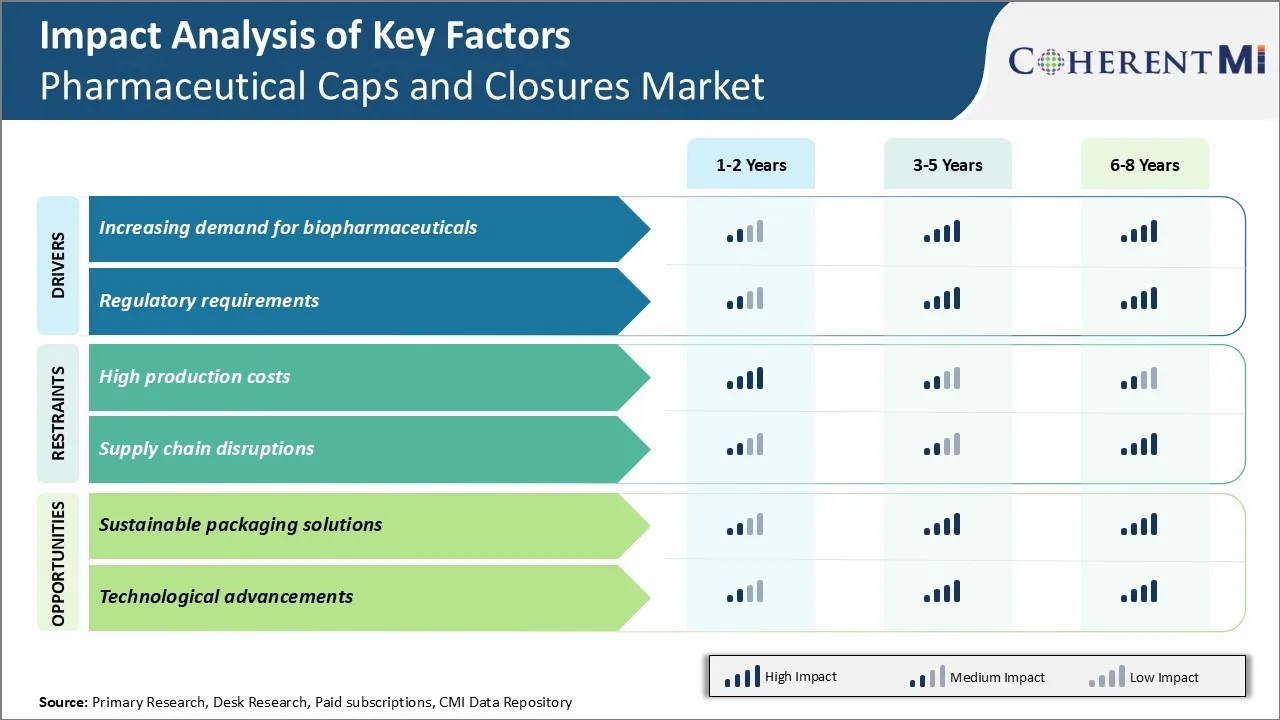

市場ドライバー - バイオ医薬品の需要増加

生きた細胞から得られるワクチンや治療などのバイオ医薬品は、医薬品のキャップやクロージャの需要が高まっています。 これらのバイオロジカル薬は、サプライチェーン全体での完全性と有効性を維持するために、洗練されたパッケージングソリューションを必要としています。 従来の小分子薬と比較して、バイオ医薬品は複雑で、温度変化に敏感です。 それらは汚染を防ぎ、交通機関および貯蔵の間にプロダクト viabilityを保障するために安全、タンパー明白なおよび密閉包装を必要とします。

キャップやクロージャは、効果的な保護と生物学的医薬品の簡単な識別を提供する上で重要な役割を果たしています。 湿気の障壁が付いている高度の容器の閉鎖システム、酸素の口径測定器およびdesiccantsは生物医薬品包装のためにますます普及しています。 ゴムのような専門材料から成っている漏出防止およびタンパー防止びんの帽子、ガラスびんのシールおよびストッパーは温度感受性の生物的の封入、完全性および安定性を保障します。 いくつかのバイオ医薬品製品はまた、カスタマイズされた閉鎖またはストッパーを利用する充填された注射器のような配達装置を必要とします。

パーソナライズされた薬の上昇はまた、モノクローナル抗体、組換えタンパク質、幹細胞療法などの標的生物学的薬の需要を燃やしました。 このようなニッチバイオ医薬品を包装するメーカーは、取り扱いを強化し、再封を可能にする革新的な閉鎖設計に依存しています。 これは、用量の破壊と生殖能力の維持を可能にします。 更に、自己管理の高めのために承認される生物的薬として、容易に開いた、容易な閉鎖の閉鎖が付いているユーザー フレンドリーの子供抵抗力があるおよびシニア フレンドリーの包装はprominenceを得ます。

バイオ医薬品業界は、従来の小分子薬、医薬品キャップ、クロージャメーカーと比較して、より高いペースで成長することが期待されているため、バイオ医薬品製品全体の全域に適した高度なソリューションを開発しています。 カスタマイズしたタンパー証拠、耐漏性シール、使いやすさなどの特徴は、将来の大きな分子薬の上昇カテゴリの成功したパッケージにとって不可欠です。

市場ドライバー - 規制要件

医薬品包装を取り巻く厳しい規制は、常にキャップやクロージャのイノベーションと開発を主導しています。 しかし、規制の風景は、グローバル化と安全面に取り組む新しいガイドラインでより複雑になりました。 製造業者は、米国、欧州、アジアなどの主要な市場のcGMP規格に準拠し、製品の品質を確保し、国際サプライチェーン全体での偽造を防ぐ必要があります。

また、医薬品包装の厳しい材料の仕様や試験基準を規定しています。 ライナーやシールなどのコンポーネントの修飾は、洗練された分析方法とFDAに準拠した原材料のみを使用するためにクロージャメーカーの課題を含みます。 トレーサビリティは、全世界で実施されているシリアライズおよび集計要件で重要になっています。 キャップとクロージャは、数値コードや2Dデータマトリクスバーコードなどの技術を使用して、最も低い分布レベルで薬を一意に識別しなければなりません。

投薬の間違いおよび誤用への土台の焦点はユーザー フレンドリーで、高齢者に優しい包装の設計のための新しいmandatesに導きました。 小児耐性パッケージは、より多くの薬のカテゴリのために規制され、使いやすいと開放の容易さのための国際規格を更新し、革新的なソリューションを促しています。 さらに、製品ライフサイクル全体で環境フットプリントを削減した「グリーン」と「持続可能な包装材料」に関する規制が強調されています。 生分解性ポリマーと再生可能な材料は、地面を得る。

欧州におけるFalsified Medicine指令のような今後の規制は、医薬品包装の高度な認証技術も含まれています。 規制は、世界各地で動的に進化し、新しい医療課題と整列するにつれて、医薬品キャップやクロージャ業界は、一貫して製品、製造技術、品質システムをアップグレードし、コンプライアンスを維持しなければなりません。 これらのドライブは革新を続けました。

市場課題 - 高生産コスト

医薬品キャップやクロージャ市場は、高い生産コストに関して重要な課題に直面しています。 医薬品キャップやクロージャの製造には、製品や公共の安全を確保するために、厳格な品質管理措置と良好な製造慣行の遵守が必要です。 豊富な試験・認証・専門機械を含みます。 その結果、生産は長くなり、通常のプラスチック包装と比較して高いコストを伴います。 また、アルミニウムなどの金属などの材料は経費に加算されます。 ガンマ照射などの滅菌に関する規制の期待は、コストを引き上げます。 個々の医薬品やバイオロジスティックス企業は、色、サイズなどの条件でパッケージのカスタマイズされた要件を会議し、スケールの経済にも影響を与えます。 これらの要因は、メーカーが低価格を維持し、ブリスターパックなどの代替品と競争することが困難になります。 高コストは、市場の成長のためのロードブロックを、特に価格に敏感でコストを削減し、医療市場を開発する。

市場機会 - 持続可能なパッケージングソリューション

医薬品キャップとクロージャ市場は、持続可能なパッケージングソリューションの開発に大きなチャンスを見出しています。 環境保全に重点を置いたグローバルに重点を置き、製薬メーカーは、グリーン技術とリサイクル性を重視しています。 閉鎖メーカーのケータリングカスタマイズされた持続可能な製品提供は、競争力のある利点を得ることができます。 たとえば、石油のソース依存性を低下させる材料を活用したり、リサイクルされたコンテンツから医薬品の生産者や消費者をアピールする材料を活用しています。 最小限のプラスチック使用、再生利用できるアルミニウム帽子等のような環境に優しい特徴を組み込む解決。 また企業の要求に応じます。 工場内の再生可能エネルギー源への移行により、持続可能性の資格をさらに高めます。 効率的な保護特性を持つキャップと閉鎖がカーボンフットプリントを下げると、医療廃棄物の環境影響を削減する懸念のある医療プロバイダーや患者にアピールします。 成長する需要を経験し、彼らのリーダーシップをセメントでセメントで造る市場プレーヤーのための革新的な持続可能な包装の提示の有利な機会に焦点を合わせて下さい。

主要プレーヤーが採用した主な勝利戦略 医薬品キャップおよびクロージャー市場

ウェスト・ファーマ・サービス、カプゲル(ロンザ)、アプタルグループなどのプレイヤーは、継続的な投資を通じて大きな成功を収め、イノベーションに注力しています。 例えば、 2018年に吸入された呼吸薬および2017年に容易な開いたガラスのためのウエストはスマートな線量の技術を進水させました。 これらの新製品の提供により、市場シェアを獲得しました。

プレイヤーは特定の顧客の必要性に従って高度にカスタマイズされた解決を提供します。 例えば、Capsugelは2015年に薬剤の原料の精密な適量と満たされたVcapsカスタマイズされたカプセルを進水させました。 お客様のご要望にお応えいたします。 オファーをカスタマイズする能力は、大きな契約を獲得しました。

戦略的M&Aにより、プレイヤーは能力とフットプリントを拡大することができます。 2016年、西日本では、ポリマー素材やクロージャの拡大に貢献した大協精工を買収。 この買収は、日本薬局市場での地位を強化しました。 同様に、Capsugelは、2017年にLonzaによって統合された解決のpowerhouseを作成するために得られました。

合弁事業、新工場、買収などを通じて、アジア、ラテンアメリカ、中東などの新興市場で戦略的に拡大。 たとえば、2018年、カプシュゲルは中国の新しい施設で操業を開始しました。 成長を続ける高成長市場への注力は、売上規模を上げています。

プレーヤーは、継続的なアップグレードと品質認証を通じて、進化する世界的な医薬品規制の遵守を保証します。 品質とコンプライアンスへのコミットメントは、クライアントが安心し、ビジネスを繰り返すのを助けます。

セグメント分析 医薬品キャップおよびクロージャー市場

洞察、包装容器のタイプによって: バイアルの高いユーザビリティとコスト効率性

包装容器の種類に関しては、バイアルサブセグメントは、その高いユーザビリティと費用効果の高い市場における47.3%の最高のシェアに貢献します。 びんの包装の容器の区分は汎用性および費用の利点による薬剤の帽子そして閉鎖の市場の最も大きい共有を保持します。 びんは包装の液体、クリームおよび同じようなプロダクトのために広く利用された細いガラスかプラスチックびんです。 それらはワクチン、静脈内薬、目/耳の低下および他の小さい容積の液体の公式のような薬物のために非常に適しています。

ウイルスは湿気、ガスおよび汚染物質に対して信頼できる障壁の保護を提供します。 シームレスな構造により、外部粒子の侵入やコンテンツの漏洩を防ぎます。 これは、敏感な薬を包装するための理想的なバイアルになります。 バイアルの円筒形状は、最小スペース内の最大記憶容量を可能にします。 破損のリスクを伴わずに簡単に搬送・保存できます。

また、瓶やカートリッジなどの他の容器と比較して、ガラスびんの製造は比較的少ない材料が必要です。 生産コストを削減する。 ウイルスは、特に小さい薬量のためのコスト効率の高いソリューションを提供しています。 量産加工も簡単に自動化できます。 液体薬の種類に対するバイアルの適応性とともにこれらのコストメリットは、代替パッケージタイプよりも高い利用率を発揮します。

バイアル設計のシンプルさは、容易な取り扱いと分配を容易にします。 バイアルコンテンツの管理には、シリンジやドロップパーなどの追加デバイスは必要ありません。 これは、特に自己治療製品のための管理を容易にします。 全体的に、バイアルは、非常に機能的で手頃な価格のパッケージングオプションとして際立っています。そのため、最大の需要を占めています。

洞察、閉鎖の種類によって: シールの改ざん防止および漏れ防止特性

シールサブセグメントは、その改ざん防止および漏洩防止特性に対するクロージャセグメントで25.7%の最高シェアに貢献します。 シールクロージャタイプは、その改ざん防止および漏洩防止能力に起因する医薬品キャップおよびクロージャセグメントにおける重要な市場シェア優位性をお楽しみください。 シールは付着力かヒート シーリング ホイルが薬剤の容器の入り口をしっかり閉めるのに使用されています。

シールは外部の汚染および漏出からプロダクトを保護する信頼できる気密のシールを作成します。 それらは密封された容器に湿気、酸素または微生物の記入項目を防ぎます。 これは、パッケージ薬の安全性、殺菌性、長期的安定性を維持するのに役立ちます。 タンパー防止シールは、製品の信頼性と完全性を顧客に保証します。

また、前回の開口部の標識を手軽に検査できます。 これはトレーサビリティを可能にし、薬のミックスアップを回避するのに役立ちます。 シンプルな構造と応用プロセスにより、より高い生産率と、複雑な閉鎖タイプと比較してコストを削減できます。 フィルムのコーティングの技術はシールの障壁機能を高めます。

シールは、バイアル、アンプル、シリンジ、ボトルなど、さまざまな容器にパッケージ化された多様な薬処方の用途で非常に多様です。 シールの自己接着性は、他の閉鎖装置を必要としない直接塗布を可能にします。 異なる容器形状とサイズへの適合性は、アドレス指定可能な市場を拡大します。 すべてのこれらの利点は製薬産業の他の閉鎖のタイプ上のシールのためのより高い市場の好みを運転します。

追加の洞察 医薬品キャップおよびクロージャー市場

- 医薬品キャップとクロージャ市場は、バイオ医薬品業界におけるより安全で信頼性の高いパッケージングソリューションの需要によって駆動される重要な成長を受けています。 また、市場は、より専門的なパッケージングソリューションを必要とするパーソナライズされた薬へのシフトの影響を受けています。 製造業の自動化や持続可能なパッケージングソリューションなどの新興トレンドも市場の未来を形作ります。 主要なプレーヤーは、彼らの競争力を維持するために、製品ポートフォリオと地理的なリーチを拡大することに焦点を当てています。

競合の概要 医薬品キャップおよびクロージャー市場

医薬品キャップおよびクロージャ市場で動作する主要なプレーヤーには、Aptar Pharma(AptarGroup)、West Pharmaceutical Services、Datwyler Sealing Solutions(Datwyler Group)、Lonstroff(Sumitomo Rubber Industries)、Ompi(Stevanato Group)、Daikyoセイコー、Hebei First Rubber Medical Technology、江蘇Hualan New Pharmaceutical Materialsなどがあります。

医薬品キャップおよびクロージャー市場 リーダー

- Aptarファーマ(AptarGroup)

- 西製薬サービス

- Datwylerのシーリング解決(Datwylerのグループ)

- Lonstroff (住友ゴム工業)

- Ompi(ステバナトグループ)

医薬品キャップおよびクロージャー市場 - 競合関係

医薬品キャップおよびクロージャー市場

(大手プレーヤーが支配)

(多くのプレーヤーが参入し、競争が激しい。)

最近の動向 医薬品キャップおよびクロージャー市場

- 2023年6月、Aptar Pharmaは、高効力薬用に設計された新しいエラストマー閉鎖を発売し、薬物の安全性を高め、汚染リスクを軽減します。

- 2023年5月、西製薬は、前殺菌閉鎖の需要増加を満たすために、北米での生産能力を拡大しました。

- 2023年4月、Datwylerは、バイオロジックの持続可能なパッケージングソリューションを開発するための戦略的パートナーシップを締結しました。

医薬品キャップおよびクロージャー市場 セグメンテーション

- 包装容器のタイプによって

- バイアル

- シリンジ

- カートリッジ

- 閉鎖の種類によって

- シール

- ストッパー

- キャップ

- プランジャー

- バレル

- 針の盾

購入オプションを検討しますか?このレポートの個々のセクション?

Ghanshyam Shrivastava - 経営コンサルティングとリサーチの分野で 20 年以上の経験を持つ Ghanshyam Shrivastava は、プリンシパル コンサルタントとして、生物製剤とバイオシミラーに関する幅広い専門知識を持っています。彼の主な専門知識は、市場参入と拡大戦略、競合情報、さまざまな治療カテゴリと API に使用されるさまざまな医薬品の多様なポートフォリオにわたる戦略的変革などの分野にあります。彼は、クライアントが直面する主要な課題を特定し、戦略的意思決定能力を強化するための堅牢なソリューションを提供することに優れています。彼の市場に関する包括的な理解は、リサーチ レポートとビジネス上の意思決定に貴重な貢献をします。

Ghanshyam は、業界カンファレンスで人気の高い講演者であり、製薬業界に関するさまざまな出版物に寄稿しています。

よくある質問 :

医薬品キャップおよび閉鎖市場の成長を妨げる重要な要因は何ですか。

高生産コストとサプライチェーンの混乱は、医薬品キャップやクロージャ市場の成長を妨げる主要な要因です。

医薬品キャップやクロージャの市場成長を促進する主要な要因は何ですか?

バイオ医薬品および規制要件の需要の増加は、医薬品キャップとクロージャ市場を運転する主要な要因です。

医薬品キャップやクロージャ市場における包装容器のリーディングタイプは?

包装容器の区分の一流のタイプはガラスびんです。

医薬品キャップやクロージャ市場で動作する主要な選手は?

Aptar Pharma(AptarGroup)、West Pharmaceutical Services、Datwyler Sealing Solutions(Datwyler Group)、Lonstroff(Sumitomoゴム工業)、Ompi(Stevanato Group)、Daikyo Cosmo、Hebei First Rubber Medical Technology、江蘇Hualan New Pharmaceutical Materialsは主要なプレーヤーです。

医薬品キャップとクロージャの市場は?

医薬品キャップおよびクロージャ市場におけるCAGRは、2024-2031年から6.7%となると予想されます。