Pyoderma Gangrenosum Treatment Market Size - Analysis

Pyoderma gangrenosum (PG) is a rare ulcerative disorder often associated with systemic diseases such as rheumatoid arthritis, inflammatory bowel disease, and malignancies. Diagnosis is complex and involves ruling out other causes of ulcers. Treatment typically includes immunosuppressive agents like corticosteroids and cyclosporine. It is challenging to treat due to its association with systemic conditions and immune dysregulation. Emerging biologic therapies like Vilobelimab, which target specific cytokine pathways, offer hope for more effective treatments. Collaborative efforts between research institutions and the pharmaceutical industry are crucial in developing these therapies. The trend in the Pyoderma Gangrenosum treatment market involves a rising demand for biologic therapies for the treatment of pyoderma gangrenosum. Biologics such as anti-TNF-alpha inhibitors and IL-1 inhibitors are becoming the primary treatment options due to their effectiveness against moderate to severe cases. Moreover, the development of new biologics with novel mechanisms of action will further boost the treatment landscape in coming years.

Market Size in USD Bn

CAGR7.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 7.3% |

| Market Concentration | Medium |

| Major Players | Merck & Co Inc, Takeda Pharmaceutical, GSK Plc, Swedish Orphan, Biovitrium AB and Among Others |

please let us know !

Pyoderma Gangrenosum Treatment Market Trends

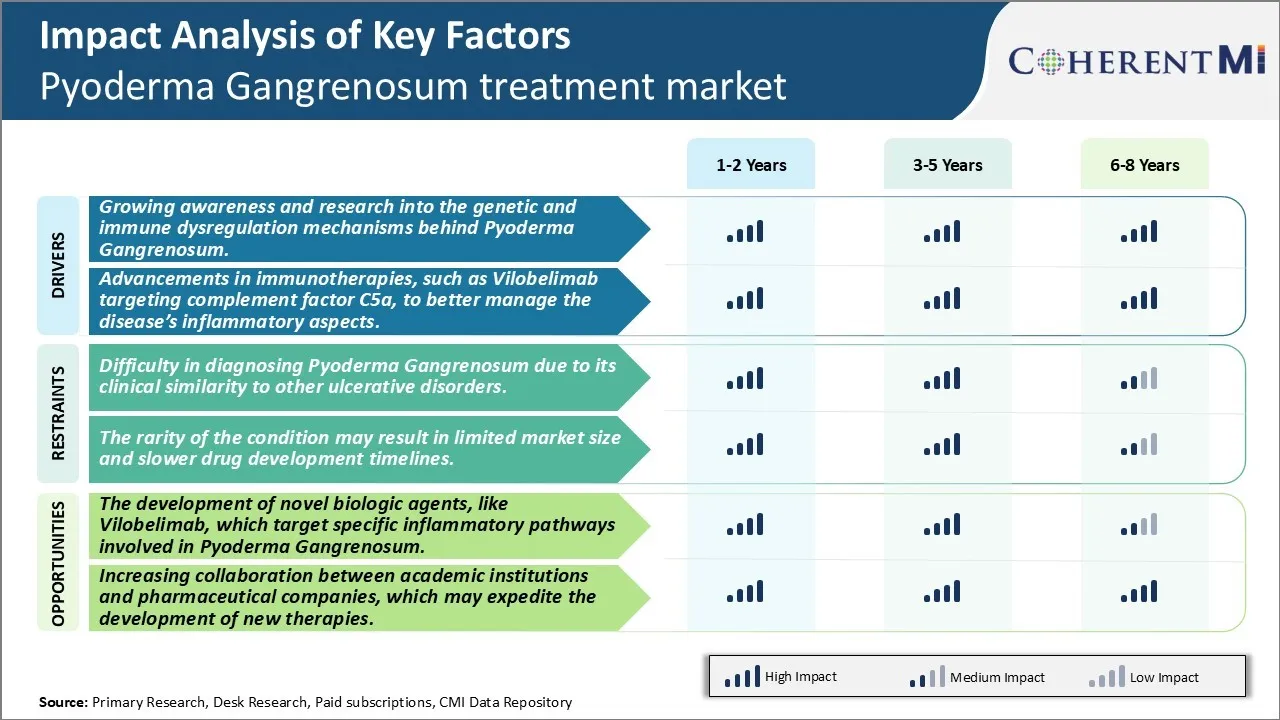

There is rapidly growing awareness about Pyoderma Gangrenosum (PG) among both medical professionals and general public. PG was once considered as rare and poorly understood condition but now it is recognized as a distinctive autoinflammatory disease. Considerable research efforts are underway in recent years to unravel the genetic and immune factors behind PG pathogenesis. While the exact causes remain unknown, it is increasingly evident that dysregulation of immune system plays a key role. A complex interplay of genetic, immunological and environmental triggers are believed to precipitate the uncontrolled inflammatory process in skin and other tissues in affected individuals.

Market Driver - Advancements in Immunotherapies, Such as Vilobelimab Targeting Complement Factor C5a, to Better Manage the Disease’s Inflammatory Aspects.

Clinical trials of Vilobelimab have generated encouraging results in PG patients with preliminary signs of safety and efficacy. Compared to placebo, Vilobelimab treatment demonstrated significantly faster wound healing, less need for adjunctive corticosteroids and better control of systemic symptoms. Ongoing phase 3 studies are further validating these initial findings across larger cohorts. If approved, Vilobelimab may offer an optimized treatment approach achieving remission through targeted blockade of specific inflammatory mediators involved in PG etiology. It represents a paradigm shift from broad based immunosuppression to precision targeting of aberrant complement activation driving tissue damage. Development is also underway to define subsets of patients most likely to benefit through identification of biomarkers. Overall, targeted C5a inhibition holds promise as a major advance to better control the inflammatory aspects while limiting toxicity - offering PG patients an improved therapeutic option.

Market Challenge - Difficulty in Diagnosing Pyoderma Gangrenosum Due to its Clinical Similarity to Other Ulcerative Disorders.

Recent advances in understanding the pathophysiology of PG have led to the development of novel biologic therapies that specifically target the deregulated immune pathways underlying the condition. Vilobelimab is a first-in-class biologic that blocks the C5a receptor, a key component of the terminal complement pathway responsible for inflammatory cell recruitment and activation in PG lesions. In clinical trials, Vilobelimab has demonstrated promising efficacy in inducing remission of ulcers in patients with both mild-to-moderate and severe PG. If approved, Vilobelimab will provide clinicians an optimized treatment option with a better safety profile compared to standard immunosuppressants. The availability of targeted biologic therapies like Vilobelimab that address the precise pathological drivers of PG offers a major market opportunity for growth. It provides an opportunity to reshape the treatment landscape, change prescribing patterns, and improve patient outcomes. Overall, the development of novel targeted therapeutics presents a significant commercial potential for companies in the Pyoderma Gangrenosum treatment market.

Prescribers preferences of Pyoderma Gangrenosum Treatment Market

Pyoderma Gangrenosum (PG) is an immune-mediated, neutrophilic dermatosis that typically causes recurring ulcerative lesions. Treatment involves a step-wise approach based on severity and extent of disease. For mild, localized PG, topical corticosteroids such as clobetasol propionate (Temovate) are usually first-line. If lesions progress or become widespread, systemic corticosteroids are prescribed. Oral prednisone is commonly used initially at doses of 0.5-1mg/kg/day. Brands include Deltasone.

Prescribers' preferences are influenced by several factors. Severity, extent and location of lesions guide choices between topical vs. systemic drugs. Risk-benefit analysis also plays a role, with less toxic options preferred for milder forms. Co-morbid conditions may prompt usage of certain drugs over others due to side effect profiles. Overall, a step-wise escalation from topicals to immunosuppressants to biologics remains the standard approach for most practitioners.

Treatment Option Analysis of Pyoderma Gangrenosum Treatment Market

Pyoderma Gangrenosum (PG) has four stages - papular, vesicular, ulcerative, and necrotic. The preferred treatment depends on the stage.

The ulcerative stage often requires immunosuppressants in addition to systemic steroids. Common choices include cyclosporine, tacrolimus, mycophenolate mofetil and azathioprine. These treatments suppress the overreactive immune response causing the ulcers. Cyclosporine is frequently the first choice due to its rapid efficacy.

For all stages, wound care is pivotal. Debridement to remove dead tissue, followed by dressings to keep wounds moist and prevent infection, optimizes treatment outcomes. Combination therapies utilizing tailored immunosuppressants, biologics and wound management based on disease stage are most effective for PG.

Key winning strategies adopted by key players of Pyoderma Gangrenosum Treatment Market

Focus on Biologic Therapies: Biologic therapies, such as TNF inhibitors (e.g., infliximab and adalimumab) and IL-17 inhibitors, are increasingly being used for managing refractory cases of pyoderma gangrenosum. These biologics have shown promise in improving healing rates for patients with severe conditions where traditional immunosuppressants fail. Companies like AbbVie, Pfizer, and Janssen Pharmaceuticals are investing in developing advanced biologics to offer more targeted treatments, thereby addressing the unmet medical needs in this market

Collaboration: Collaboration with academic institutions and research centers has become common, allowing companies to combine resources for more effective R&D.

Segmental Analysis of Pyoderma Gangrenosum Treatment Market

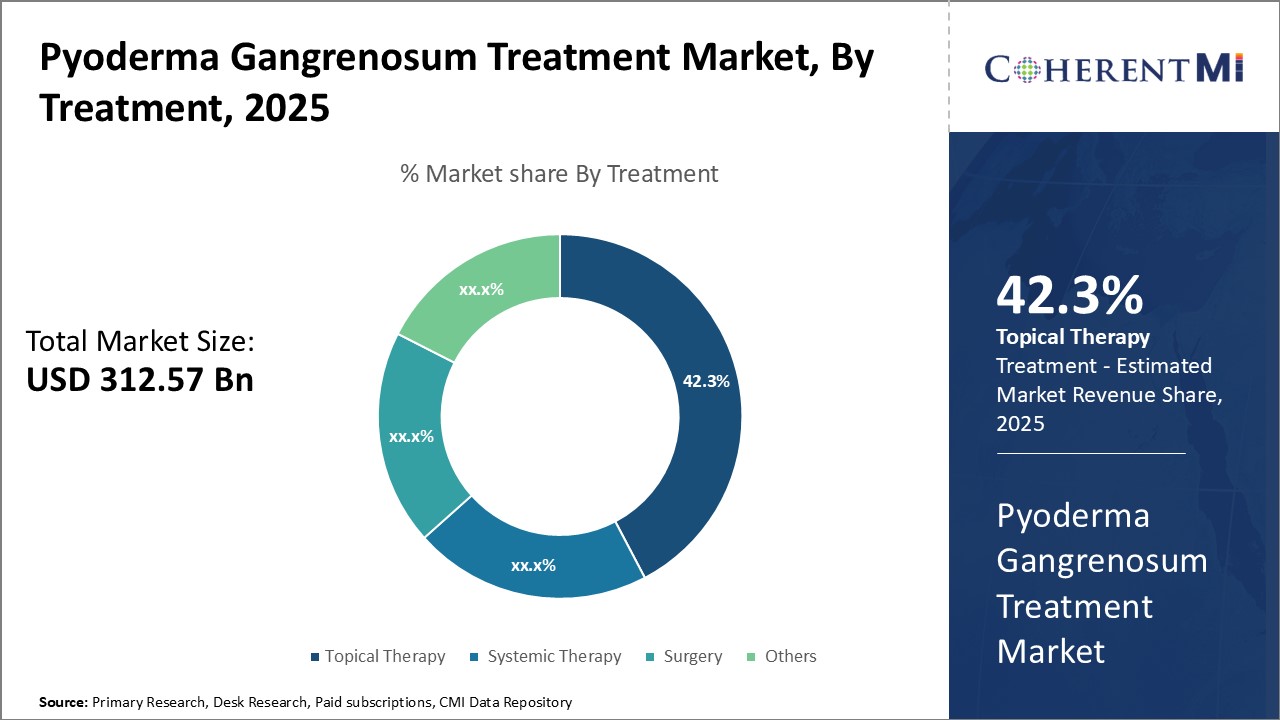

Insights, By Treatment, Accessibility and Targeted Approach drive Topical Therapy's Dominance.

Insights, By Treatment, Accessibility and Targeted Approach drive Topical Therapy's Dominance.By Treatment, topical therapy is expected to contribute 42.3% market share in 2025 owing to its accessibility and targeted approach. As topical treatments are applied directly to the affected skin areas, they allow for focused and localized drug delivery. This ensures maximum concentration of active ingredients at the site of action and minimal systemic exposure. Hence, topical therapy options have fewer side effects compared to oral or injectable alternatives. Their convenience of external application without medical supervision also makes them an attractively accessible first-line treatment option for patients. Additionally, the wide availability of over-the-counter topical corticosteroids provides effective symptom relief at an affordable cost, further cementing topical therapy's popularity.

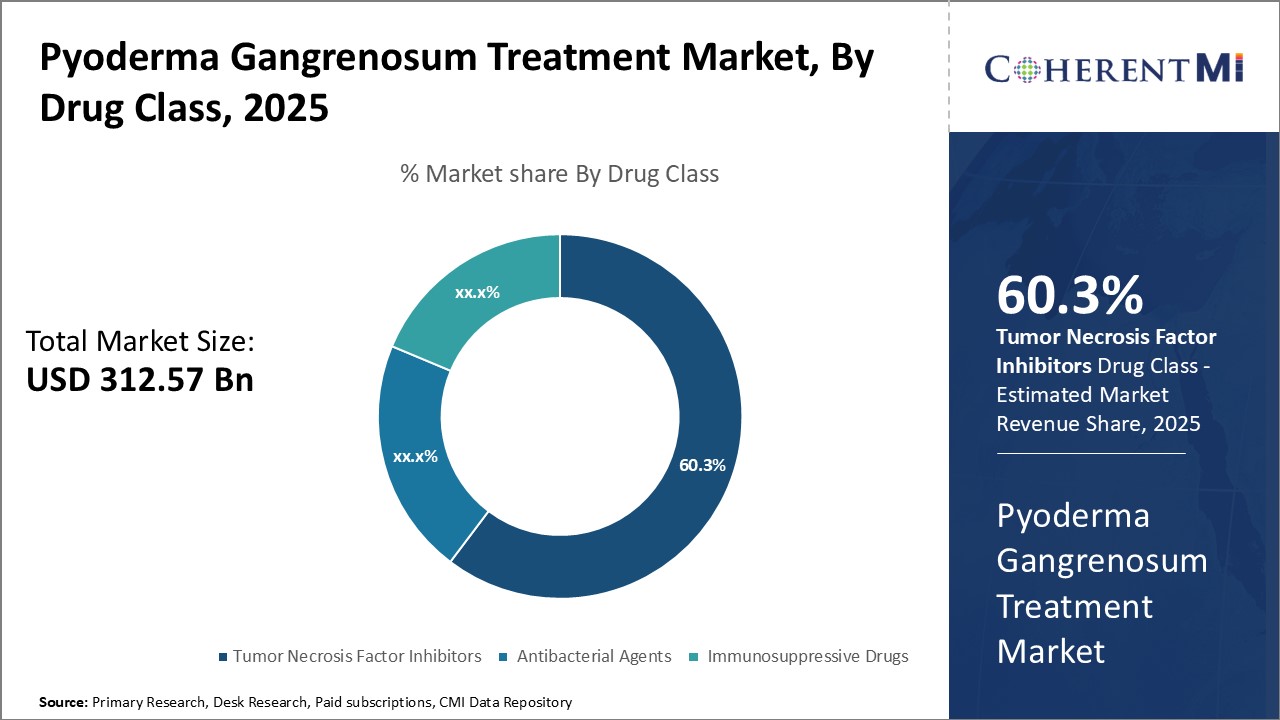

By Drug Class, tumor necrosis factor inhibitors is expected to contribute 60.3% market share owing to its potent immunosuppressive property. By blocking Tumor Necrosis Factor-α, a pro-inflammatory cytokine implied in the pathogenesis of Pyoderma Gangrenosum, TNF inhibitors achieve effective suppression of the overactive immune response involved. This translates to rapid clinical improvement and remission of symptoms for most patients. With a strong mechanism of action targeting the underlying disease process, TNF inhibitors have emerged as first-line biologics for moderate to severe cases of Pyoderma Gangrenosum. Their high therapeutic effectiveness despite less frequent dosing reinforcing their popularity over other drug classes.

Insights, By Dosage, Injection Administration maximizes Compliance in Pyoderma Gangrenosum Treatment.

Additional Insights of Pyoderma Gangrenosum Treatment Market

Pyoderma gangrenosum (PG) is a challenging and rare disorder that affects the skin, leading to painful ulcers that can be difficult to treat. It is often linked to systemic conditions like rheumatoid arthritis and inflammatory bowel disease, making it a complex condition to manage. Treatments have traditionally focused on systemic immunosuppression, using drugs like corticosteroids to control inflammation. However, new therapies like Vilobelimab by InflaRx represent a major advancement in the field. By targeting specific inflammatory pathways—such as complement factor C5a—these therapies aim to control tissue damage and reduce ulcer progression more effectively than traditional treatments. The disease’s rarity means clinical trials for new drugs are critical, and the collaboration between academics and pharmaceutical companies will play a key role in advancing the standard of care for PG.

Competitive overview of Pyoderma Gangrenosum Treatment Market

The major players operating in the Pyoderma Gangrenosum treatment market include Merck & Co Inc, Takeda Pharmaceutical, GSK Plc, Swedish Orphan, Biovitrium AB, Lupin, Dr. Reddy's Laboratories, Alexion Pharmaceuticals, AbbVie Inc, Amgen Inc and Pfizer Inc.

Pyoderma Gangrenosum Treatment Market Leaders

- Merck & Co Inc

- Takeda Pharmaceutical

- GSK Plc

- Swedish Orphan

- Biovitrium AB

Pyoderma Gangrenosum Treatment Market - Competitive Rivalry

Pyoderma Gangrenosum Treatment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Pyoderma Gangrenosum Treatment Market

InflaRx is advancing its monoclonal antibody Vilobelimab (Phase III), which selectively blocks complement factor C5a. This drug shows promise in controlling inflammation-driven tissue damage without affecting the membrane attack complex, which remains crucial for immune defense. This Phase III development holds potential to address unmet needs in the treatment of Pyoderma Gangrenosum (PG).

Pyoderma Gangrenosum Treatment Market Segmentation

- By Treatment

- Topical Therapy

- Systemic Therapy

- Surgery

- Others

- By Drug Class

- Tumor Necrosis Factor Inhibitors

- Antibacterial Agents

- Immunosuppressive Drugs

- By Dosage

- Injection

- Tablets

- Ointments

- By Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

- By Symptoms

- Pain

- Fever

- Tenderness

- Blisters

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Frequently Asked Questions :

How Big is the Pyoderma Gangrenosum treatment market?

The Global Pyoderma Gangrenosum treatment market is estimated to be valued at USD 312.57 Bn in 2025 and is expected to reach USD 511.85 Bn by 2032.

What will be the CAGR of the Pyoderma Gangrenosum treatment market?

The CAGR of the Pyoderma Gangrenosum treatment market is projected to be 7.1% from 2024 to 2031.

What are the major factors driving the Pyoderma Gangrenosum treatment market growth?

The growing awareness and research into the genetic and immune dysregulation mechanisms behind pyoderma gangrenosum, advancements in immunotherapies, such as Vilobelimab targeting complement factor c5a, to better manage the disease’s inflammatory aspects, are the major factors driving the Pyoderma Gangrenosum treatment market.

What are the key factors hampering the growth of the Pyoderma Gangrenosum treatment market?

The difficulty in diagnosing pyoderma gangrenosum due to its clinical similarity to other ulcerative disorders. The rarity of the condition may result in limited market size and slower drug development timelines. These are the major factors hampering the growth of the Pyoderma Gangrenosum treatment market.

Which is the leading Treatment in the Pyoderma Gangrenosum treatment market?

Topical Therapy is the leading Treatment segment.

Which are the major players operating in the Pyoderma Gangrenosum treatment market?

Merck & Co Inc, Takeda Pharmaceutical, GSK Plc, Swedish Orphan, Biovitrium AB, Lupin, Dr. Reddy's Laboratories, Alexion Pharmaceuticals, AbbVie Inc, Amgen Inc, Pfizer Inc are the major players.