Seasonal Allergic Rhinitis Market Size - Analysis

Market Size in USD Bn

CAGR3.1%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 3.1% |

| Market Concentration | Medium |

| Major Players | Regeneron Pharmaceuticals, Revolo Biotherapeutics, Allergy Therapeutics, Emergo Therapeutics, ALKAbello and Among Others |

please let us know !

Seasonal Allergic Rhinitis Market Trends

Air pollution and climate change are among the major triggers for seasonal allergies in the recent years. They have been aggravated due to industrialization and increased vehicular emissions. Smaller particulate matter can remain suspended in the air for long durations and carry pollen and mold spores deeper inside the respiratory tract. This is expected to globally impact the geographic and demographic profiles of seasonal allergic rhinitis in the future.

The treatment demand is being fueled not just by rising disease prevalence but also a shift toward more effective therapeutics requiring medical supervision. Over-the-counter products are also innovating with newer delivery forms like sublingual strips and sprays targeting specific allergen types. Overall, factors like climate change and air pollution seem to be driving a long-term increase in the severity and incidence of seasonal allergic rhinitis cases.

Market Driver - Growing Awareness and Diagnosis Leading to Higher Demand for Treatment

Furthermore, online health forums provide a valuable platform for patients to share real-life experiences which helps easier self-identification of the condition. Search queries related to seasonal allergies have surged manifold over the past decade reflecting the increased self-directed research. symptomatic patients are more willing to visit ENT specialists as they perceive availability of safe and convenient medications delivering fast relief from sneezing, congestion and other discomforts.

Market Challenge - Variability in Treatment Response Among Patients

The varying responsiveness makes it difficult for physicians to determine the most suitable treatment regimen for a particular patient. This uncertainty in treatment outcome leads to decreased patient compliance and increased trial and error experimentation with multiple drugs before an effective treatment is found. The variability in clinical presentation and heredity factors that drive allergic reaction also contribute to the unpredictable nature of treatment response. Overall, the lack of consistency in symptom relief across the patient population poses significant difficulties in effectively managing the condition and contributes to decreased treatment satisfaction.

Market Opportunity - Development of Novel Therapies that Offer Better Symptom Relief

Similarly, biologics inhibiting key inflammatory pathways are being investigated for their robust symptom relief. With further research and clinical validation, such novel treatment approaches can translate into increased patient adherence and compliance by offering more effective, convenient and consistent relief from symptoms caused by seasonal allergies.

Prescribers preferences of Seasonal Allergic Rhinitis Market

Seasonal Allergic Rhinitis (SAR), commonly known as hay fever, involves an allergic response to airborne allergens such as pollen. Treatment is focused on relieving symptoms which include sneezing, a runny nose, nasal congestion, and itchy, watery eyes.

If OTC or low-dose prescription antihistamines do not provide enough relief, intranasal corticosteroids are often prescribed. These work well at reducing nasal congestion when used preventatively before and during peak pollen seasons. Common brand names include fluticasone propionate (Flonase) and mometasone furoate (Nasonex).

The timing and duration of symptoms, severity of signs and symptoms, and patient response to previous treatments all factor into a prescriber's medication selection for SAR. Monitoring compliance and potential side effects also influences future prescribing decisions.

Treatment Option Analysis of Seasonal Allergic Rhinitis Market

SAR has several treatment options depending on the severity of symptoms. Mild cases can often be controlled with OTC medications. Common OTC options include antihistamines such as loratadine (Claritin) and cetirizine (Zyrtec). These drugs work by blocking the effects of histamines, which are chemicals released during an allergic reaction and cause sneezing, itching, and runny nose.

For those with severe SAR that is not well-managed by antihistamines alone, allergy shots (immunotherapy) are highly effective over three to five years of treatment. Allergy shots work to desensitize a patient's immune system and provide long-term relief by treating the root cause of the allergy. Ocular (eye) and nasal corticosteroids such as fluticasone (Flonase) or mometasone (Nasonex) may also be prescribed for short-term relief of severe symptoms. Surgery is not usually necessary for SAR but may be considered in rare cases that are resistant to medical therapy.

Key winning strategies adopted by key players of Seasonal Allergic Rhinitis Market

Product innovation and expansion: Leading pharmaceutical companies like Pfizer, GlaxoSmithKline, and Sanofi have consistently invested in R&D to develop novel drugs for seasonal allergic rhinitis. For example, in 2018 Pfizer launched a sublingual allergy immunotherapy tablet called Oralair for grass pollen allergy. Clinical trials found it significantly reduced symptoms versus a placebo. These novel oral drugs provide an alternative to conventional intranasal sprays, improving patient compliance.

Geographic expansion: As seasonal allergies are prevalent globally, companies have expanded into new markets. For example, after 25 years of providing allergy immunotherapy in Japan, ALK received approval for its first sublingual tablet in 2017. It has since grown its Japanese revenues by 23%.

Segmental Analysis of Seasonal Allergic Rhinitis Market

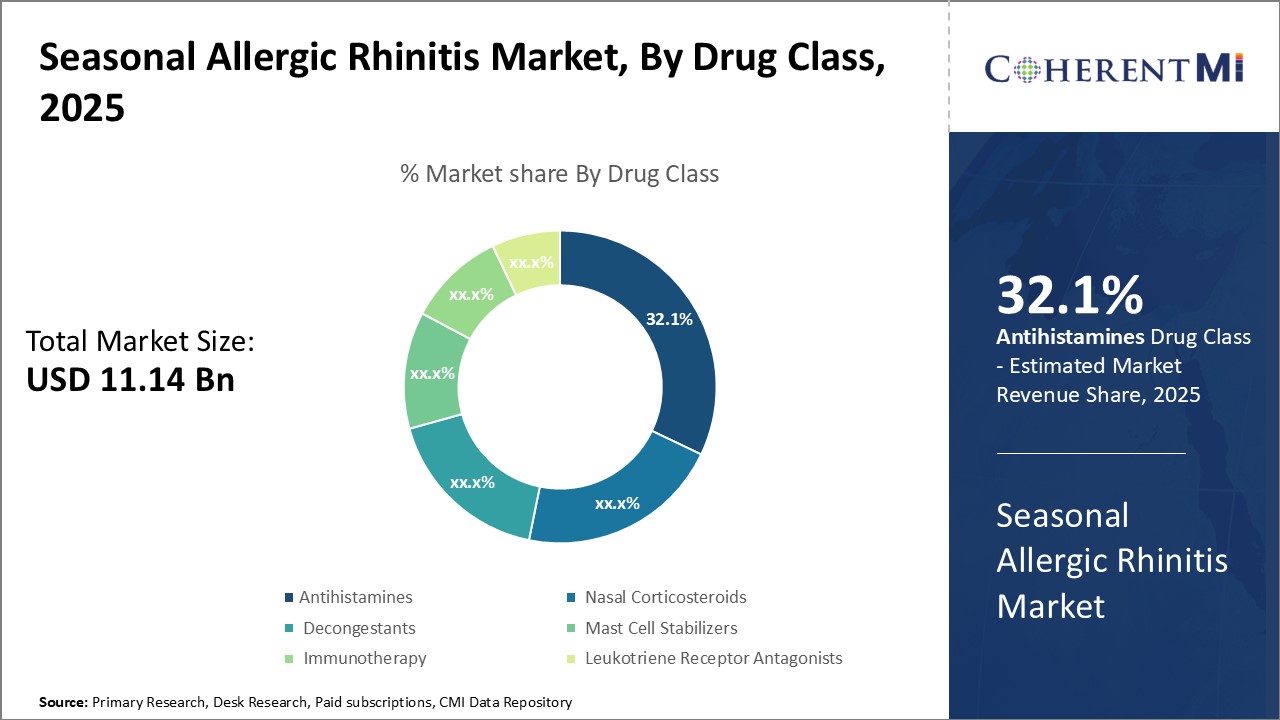

Insights, By Drug Class - Antihistamines Grab Highest Market Share with Growing Patient Preference and Effectiveness in Symptom Relief

Many patients experiencing mild to moderate symptoms tend to opt for oral antihistamines as their first line of treatment due to convenient oral dosage forms. A wide range of innovative formulations such as non-drowsy, rapid relief and long-lasting versions have enabled antihistamines to address patient needs for all-day symptom management without compromising on daily activities. This has positioned antihistamines as a preferred management strategy for active individuals. Despite being available over-the-counter, antihistamines are inexpensive and therefore preferred by price-conscious customers.

Additional Insights of Seasonal Allergic Rhinitis Market

- Industrialized countries around the world have witnessed a significant increase in the prevalence of allergic respiratory diseases including seasonal allergic rhinitis.

- In January 2022, RYALTRIS (Glenmark Pharmaceuticals) received a approval by the US FDA for treating seasonal allergic rhinitis in adults and pediatric patients aged 12 and above.

- In April 2021, RAGWITEK (ALKAbello), received approval by the US FDA for the treatment of allergic rhinitis caused by short ragweed pollen.

- In December 2019, XOLAIR (Novartis Pharmaceuticals), received approval in Japan for treating severe Japanese cedar pollinosis.

- According to National Center for Health Statistics, adults aged 45-64 were more susceptible to seasonal allergies, as compared to adults aged 18-44 years and adults over 65 years, in 2021

Competitive overview of Seasonal Allergic Rhinitis Market

The major players operating in the Seasonal allergic rhinitis market include Regeneron Pharmaceuticals, Revolo Biotherapeutics, Allergy Therapeutics, Emergo Therapeutics, and ALKAbello.

Seasonal Allergic Rhinitis Market Leaders

- Regeneron Pharmaceuticals

- Revolo Biotherapeutics

- Allergy Therapeutics

- Emergo Therapeutics

- ALKAbello

Seasonal Allergic Rhinitis Market - Competitive Rivalry

Seasonal Allergic Rhinitis Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Seasonal Allergic Rhinitis Market

- In January 2022, RYALTRIS (Glenmark Pharmaceuticals) received a approval by the US FDA for treating seasonal allergic rhinitis in adults and pediatric patients aged 12 and above.

- In April 2021, RAGWITEK (ALKAbello), received approval by the US FDA for the treatment of allergic rhinitis caused by short ragweed pollen.

- In December 2019, XOLAIR (Novartis Pharmaceuticals), received approval in Japan for treating severe Japanese cedar pollinosis.

Seasonal Allergic Rhinitis Market Segmentation

- By Drug Class

- Antihistamines

- Nasal Corticosteroids

- Decongestants

- Mast Cell Stabilizers

- Immunotherapy

- Leukotriene Receptor Antagonists

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Frequently Asked Questions :

How big is the Seasonal Allergic Rhinitis Market?

The Seasonal Allergic Rhinitis Market is estimated to be valued at USD 11.14 in 2025 and is expected to reach USD 13.79 Billion by 2032.

What are the major factors driving the seasonal allergic rhinitis market growth?

The increasing prevalence of allergies due to factors like climate change and pollution and growing awareness and diagnosis leading to higher demand for treatment are the major factor driving the seasonal allergic rhinitis market.

Which is the leading drug class in the seasonal allergic rhinitis market?

The leading drug class segment is Antihistamines.

Which are the major players operating in the seasonal allergic rhinitis market?

Regeneron Pharmaceuticals, Revolo Biotherapeutics, Allergy Therapeutics, Emergo Therapeutics, and ALKAbello are the major players.

What will be the CAGR of the seasonal allergic rhinitis market?

The CAGR of the seasonal allergic rhinitis market is projected to be 3.1% from 2025-2032.