Short-Acting Insulin Market Size - Analysis

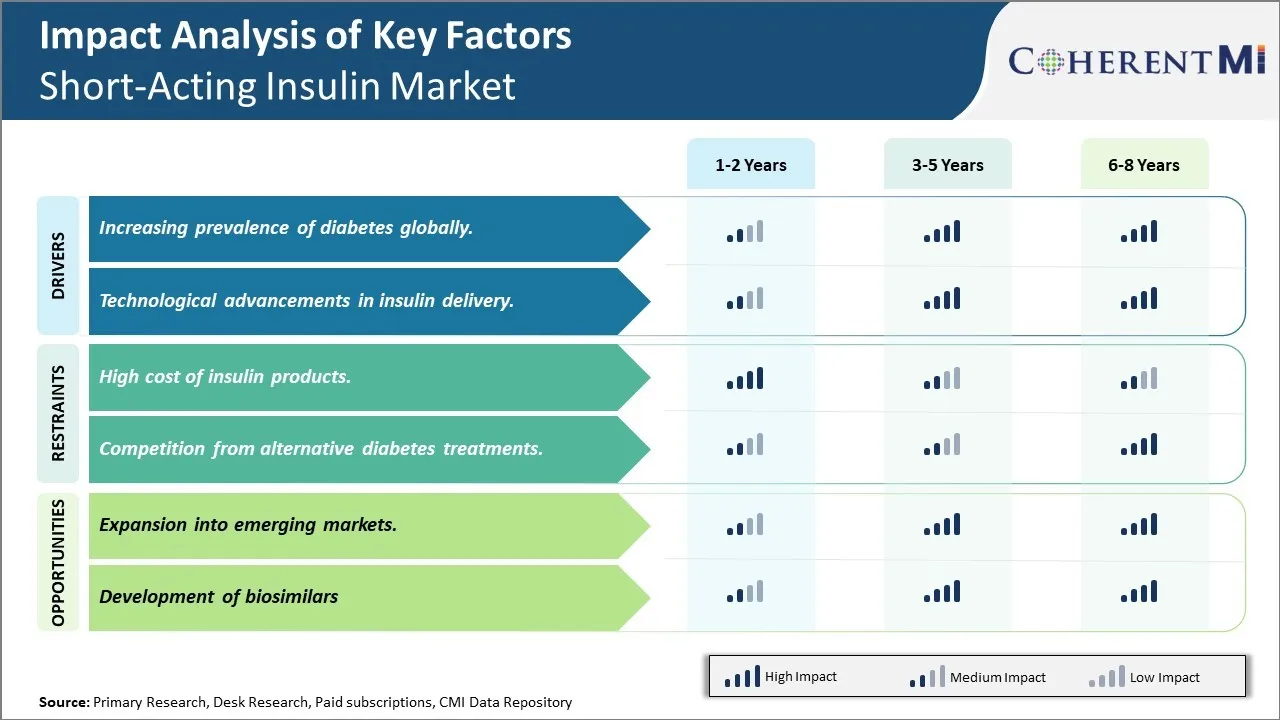

The short-acting insulin market is expected to witness substantial growth over the coming years. Key growth factors for the market include the rising incidence of diabetes, growing geriatric population, and increasing healthcare spending.

Market Size in USD Bn

CAGR5.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.3% |

| Market Concentration | High |

| Major Players | Eli Lilly and Company, Novo Nordisk, Sanofi, Biocon, Adocia and Among Others |

please let us know !

Short-Acting Insulin Market Trends

The prevalence of diabetes is growing at an alarming rate on a global scale. According to expert projections, by the year 2030 diabetes will affect around 552 million people worldwide, with developing nations shouldering much of this burden. As diabetes rates multiply across worldwide population, so does the demand for effective treatment and management regimens. Currently type 2 diabetes accounts for around 90% of all diabetes cases diagnosed globally. With largely sedentary modern lifestyles and worsening obesity epidemic trends, the number of type 2 diabetes patients has skyrocketed over the past few decades. As it is a chronic lifelong condition with no permanent cure available as yet, patients rely on long term medication to keep blood sugar levels in control.

Technological innovation in insulin therapy has progressed at a rapid pace over the past couple of decades, led by advancement like insulin pens, insulin pumps and newly invented smart insulin delivery systems. One of the key areas of innovation is in developing more user-friendly devices that can mimic the natural insulin release patterns of pancreas more closely. Short acting insulin analogs are integral components of such advanced insulin delivery mechanisms, allowing for tighter glucose control through precise, on-demand insulin dosing.

Market Challenge - High cost of insulin products

One major opportunity area for the short-acting insulin market is the expansion into emerging economies. It is estimated that over 80% of people with diabetes worldwide live in low and middle-income countries. The rising prevalence of diabetes in emerging nations like India, Brazil, China and others present a substantial patient population needing treatment. However, access to insulin in these regions has remained low due to various factors such as low healthcare infrastructure and low affordability. If insulin manufacturers can make suitable pricing and distribution strategy changes to cater to these markets, it can drive significant revenue growth. Some strategies that can be adopted are developing low-cost vial and cartridge insulin products, improving supply chain logistics to remote areas, establishing partnerships with local healthcare providers and government bodies for volume-based pricing. By tapping into the commercial potential in emerging markets, companies can boost overall sales volumes and also fulfill their role in enhancing public health.

Key winning strategies adopted by key players of Short-Acting Insulin Market

Companies have focused on developing next-generation fast-acting insulin analogs with improved pharmacokinetic and pharmacodynamic properties. For example, in 2019, Eli Lilly launched Insulin Lispro, an ultra-rapid acting insulin analog that starts working faster than other short-acting insulins. Clinical trials showed it controls blood sugar levels more effectively post-meals. This helped Eli Lilly gain market share as Insulin Lispro set a new benchmark for fast-acting insulin therapy.

Companies have focused on expanding availability of their insulin brands in high growth regions. For example, in 2018 Sanofi launched its Lyxumia insulin pen in key Latin American markets like Brazil, Mexico after gaining regulatory approvals. This helped Sanofi gain 8% value share in Latin America's insulin market within a year by addressing local needs of flexibity and affordability.

Segmental Analysis of Short-Acting Insulin Market

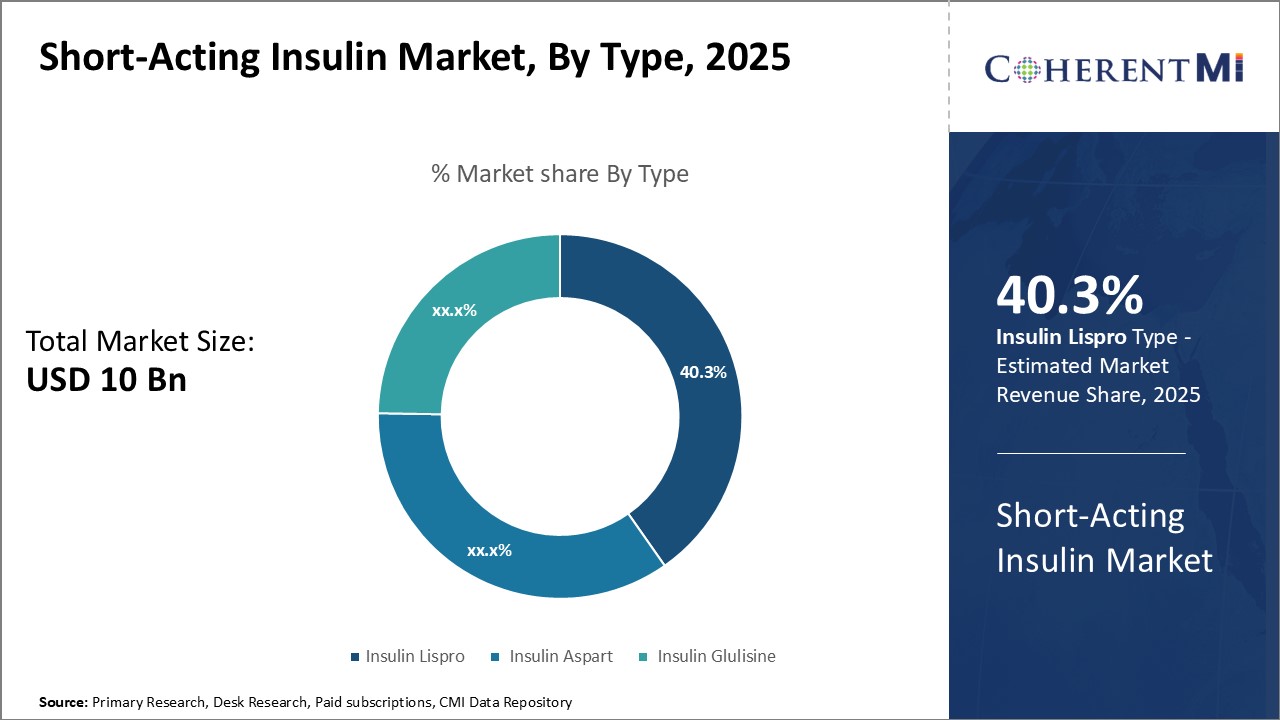

Insights, By Type: In terms of type, insulin lispro sub-segment contributes the highest share of the market owing to its rapid action profile

Insights, By Type: In terms of type, insulin lispro sub-segment contributes the highest share of the market owing to its rapid action profileInsulin lispro sub-segment accounts for the largest share of 40.25 in the short-acting insulin market due to its rapid action profile. Insulin lispro is the first commercially available rapid-acting insulin analogue. It was developed by substituting the amino acid proline with lysine at position B28. This single amino acid substitution results in quicker absorption and faster onset of action as compared to regular human insulin. Insulin lispro has an onset of action within 15 minutes and achieves maximum effectiveness in 30-90 minutes. Its effect lasts for 2-4 hours which makes it an ideal short-acting insulin option for patients to use before meals. The rapid action profile of Insulin Lispro more closely mimics the natural secretion of insulin by the pancreas in response to a meal. This provides better glycemic control to patients with diabetes. Moreover, Insulin Lispro is widely available as an affordable biosimilar and has gained broad acceptance among physicians as the standard of care for pre-meal insulin treatment. Its early establishment and preferential adoption by healthcare providers and insurance companies has enabled this segment to capture the largest share in the market over the years.

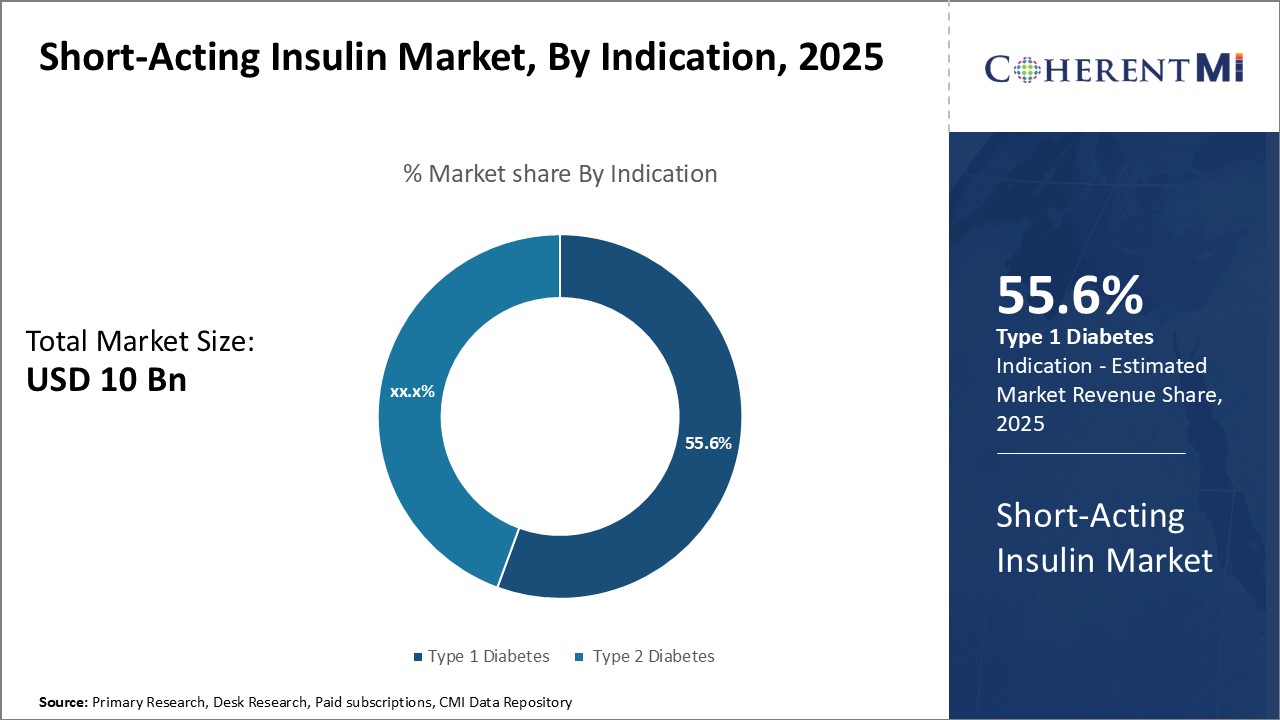

The type 1 diabetes sub-segment holds the highest market share of 55.6% among indications in the short-acting insulin market. Type 1 diabetes, previously known as juvenile diabetes, is an autoimmune condition in which the body's immune system destroys the insulin-producing beta cells in the pancreas. Patients with type 1 diabetes do not produce any insulin internally and are completely dependent on lifelong external insulin administration. Short-acting insulin products are critical for Type 1 diabetes patients as they need to inject them before each meal to regulate post-prandial blood glucose levels. The nature of the condition makes insulin treatment a medical necessity for individuals with type 1 diabetes. Additionally, incidence and prevalence of type 1 diabetes is rising globally, driving increased demand for fast-acting insulin analogues among this patient segment. Early initiation and lifelong reliance on insulin therapy ensures a consistent patient base captured by this indication in the short-acting insulin market.

Additional Insights of Short-Acting Insulin Market

The short-acting insulin market is experiencing steady growth driven by the rising prevalence of diabetes, particularly in Asia-Pacific. Companies are focusing on innovations in delivery systems and biosimilar development to gain a competitive edge. The market is characterized by significant competition among major players, with a strong emphasis on research and development to introduce more effective and patient-friendly products.

Competitive overview of Short-Acting Insulin Market

The major players operating in the short-acting insulin market include Novo Nordisk, Sanofi, Eli Lilly and Company, Biocon and Adocia.

Short-Acting Insulin Market Leaders

- Eli Lilly and Company

- Novo Nordisk

- Sanofi

- Biocon

- Adocia

Short-Acting Insulin Market - Competitive Rivalry

Short-Acting Insulin Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Short-Acting Insulin Market

- In June 2023, Novo Nordisk launched an advanced insulin delivery device aimed at improving patient adherence.

- In April 2024, Eli Lilly and Company partnered with a digital health company to enhance diabetes management through AI-based solutions.

Short-Acting Insulin Market Segmentation

- By Type

- Insulin Lispro

- Insulin Aspart

- Insulin Glulisine

- By Indication

- Type 1 Diabetes

- Type 2 Diabetes

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Frequently Asked Questions :

How big is the Short-Acting Insulin Market?

The Short-Acting Insulin Market is estimated to be valued at USD 10.00 in 2025 and is expected to reach USD 14.35 Billion by 2032.

What are the major factors driving the short-acting insulin market growth?

The increasing prevalence of diabetes globally and technological advancements in insulin delivery are the major factors driving the short-acting insulin market.

Which is the leading type in the short-acting insulin market?

The leading type segment is insulin lispro.

Which are the major players operating in the short-acting insulin market?

Novo Nordisk, Sanofi, Eli Lilly and Company, Biocon, and Adocia are the major players.

What will be the CAGR of the short-acting insulin market?

The CAGR of the short-acting insulin market is projected to be 5.3% from 2025-2032.