Single Use Downstream Bioprocessing Market Size - Analysis

The single use downstream bioprocessing market is estimated to be valued at USD 1.74 Bn in 2025 and is expected to reach USD 4.71 Bn by 2032, growing at a compound annual growth rate (CAGR) of 15.3% from 2025 to 2032.

Market Size in USD Bn

CAGR15.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 15.3% |

| Market Concentration | High |

| Major Players | 3M, Agilitech, CPC (Colder Products Company), Cytiva Lifesciences, Pall Corporation and Among Others |

please let us know !

Single Use Downstream Bioprocessing Market Trends

The biopharmaceutical industry has seen considerable growth in the last decade with the development and commercialization of many novel biologics and biotherapeutics. This has put tremendous pressure on manufacturers to ramp up production capacities to meet rising demands. At the same time, regulatory expectations around process validation and safety have also increased substantially. Traditional stainless steel-based manufacturing infrastructure is complex and capital intensive to expand. It also requires considerable lead time for designing, installing and validating new production lines.

Adoption is also driven by the fact that single-use systems reduce the risk of product cross-contamination. Since each production campaign utilizes a new sterile consumable set, there is no risk of carry-over from previous product runs. This makes single-use more suitable for facilities producing multiple drug substances in a given manufacturing suite. Overall equipment and facility footprints are compact compared to traditional processes. Single-use systems are also gaining preference for continuous manufacturing due to the ease of assembling fluid transfer connections.

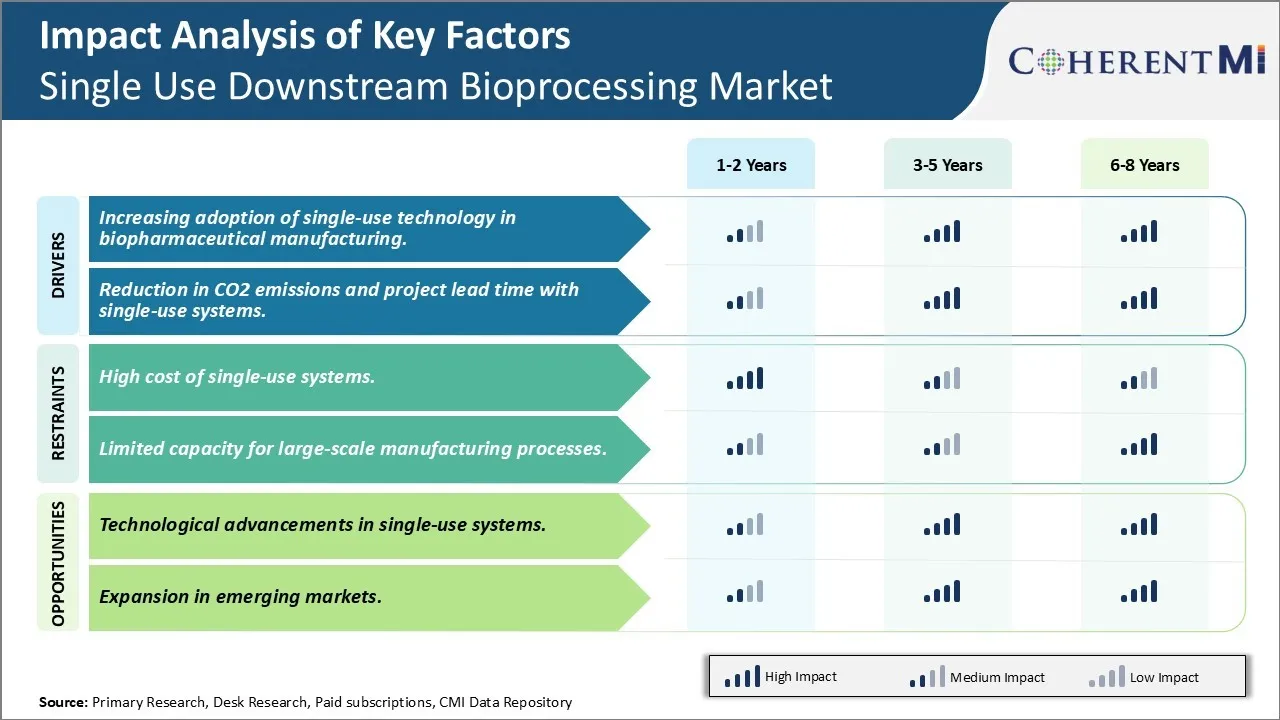

Market Driver - Reduction in CO2 emissions and project lead time with single-use systems

In addition, project lead times for capacity additions using single-use are considerably shorter. With pre-assembled and pre-qualified disposable components, production lines can be rapidly configured on demand. There is no extensive plant equipment fabrication or lengthy on-site qualification phases. Installation and commissioning times are optimized through modular approaches. Also, since single-use systems avoid cross-contamination issues, changeover times between product batches and campaign configurations are minimal. This efficient implementation and flexibility allow manufacturers to quickly respond to changing market demands or re-purpose facilities. The reduced project cycle times in turn reduce CO2 emissions from construction activities at the site.

One of the major challenges for the single use downstream bioprocessing market is the high costs associated with single-use systems. While single-use technologies offer advantages such as decreased risk of cross-contamination, faster setup times and reduced validation requirements, the per-run costs of single-use systems are still significantly higher than the costs of conventional stainless steel-based systems. This is majorly due to the high material costs involved in producing single-use components which are intended for a single-use. Despite efforts of major players to develop more economically viable single-use solutions through innovations in material choices, joint ventures and economies of scale of production, the costs associated with single-use manufacturing infrastructure like bags, tubing, connectors, single-use sensors etc. continue to remain higher than conventional systems. This high-cost challenge acts as a deterrent for biopharmaceutical manufacturers, especially those producing biosimilars and generic drugs, to switch to single-use technologies from conventional systems. Overcoming this cost challenge through further technological advancements and economies of scale is critical for the wider adoption of single-use systems and future growth of this market.

Market Opportunity - Technological advancements in single-use systems

Such technological upgrades enable single-use systems to take on more complex manufacturing tasks like purification of multiple products. This expanding scope of application increases the appeal of single-use systems even for large-scale manufacturing facilities. Further innovations can be expected in areas like integrated automation, data analytics solutions and smart single-use technologies in coming years. These advancements will help boost the adoption of versatile and competitive single-use technologies for various bioprocessing needs.

Key winning strategies adopted by key players of Single Use Downstream Bioprocessing Market

Ge Healthcare was one of the early adopters of single-use technologies in the bioprocessing space in the early 2000s. They introduced flexible single-use biocontainers and assembled systems for concentration/diafiltration that helped customers transition from stainless steel to flexible film bags. This early mover advantage helped GE capture a significant market share.

In 2017, Sartorius launched its single-use bioprocessing platform called Stedim Biotech FlexFactory. It offers modular, workflow-oriented platforms that combine upstream and downstream single-use equipment like bioreactors, mixer, filtration and storage solutions. The integrated platforms helped streamline processes and significantly reduced operational costs.

In 2020, Merck KGaA partnered with Cytiva (formerly GE Healthcare Life Sciences) to develop single-use solutions optimized for Merck's processes. Through early collaboration, Cytiva could tailor its platforms as emerging customer needs evolve. Such strategic partnerships help companies gain product development insights.

Segmental Analysis of Single Use Downstream Bioprocessing Market

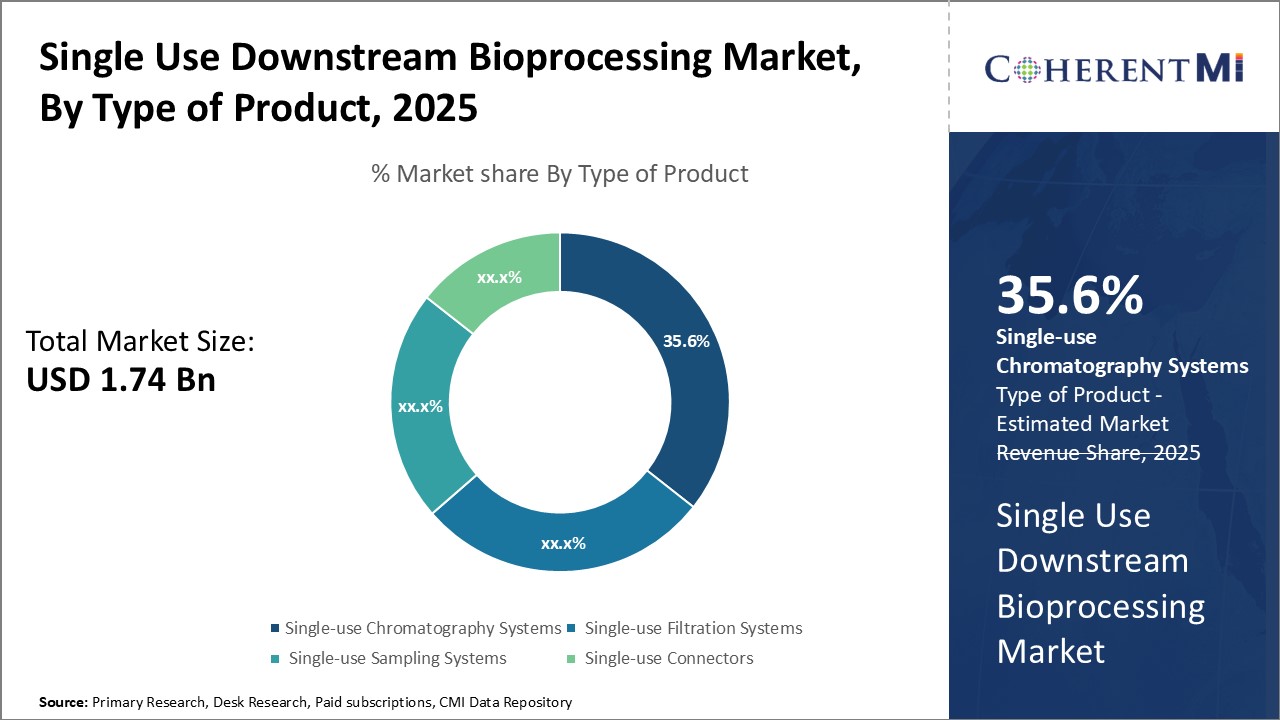

Insights, By Type of Product: Advantages of flexibility and cost-effectiveness drive growth of single-use chromatography systems

Insights, By Type of Product: Advantages of flexibility and cost-effectiveness drive growth of single-use chromatography systemsSingle-use chromatography systems sub-segment have emerged as the dominant product type with a market share of 35.6% in the single use downstream bioprocessing market owing to their flexibility and lower costs compared to traditional stainless-steel systems. These single-use systems allow biopharmaceutical manufacturers to rapidly configure chromatography steps during process development and drug production without the need for costly capital equipment investment or cleaning validation requirements between product changeovers.

In addition to flexibility advantages, single-use chromatography aids in cost savings through elimination of validation, cleaning, and cleaning agent costs typically associated with stainless steel systems. Single-use products are disposed after one-time use, negating the need for cleaning and re-qualification of expensive durable equipment for each new product. This saves considerably on operational expenses related to cleaning validation and reduces process water, utility, and cleaning solution consumption. Overall, the flexibility and total cost of ownership benefits have made single-use chromatography an invaluable technology for biomanufacturers across various scales of operation.

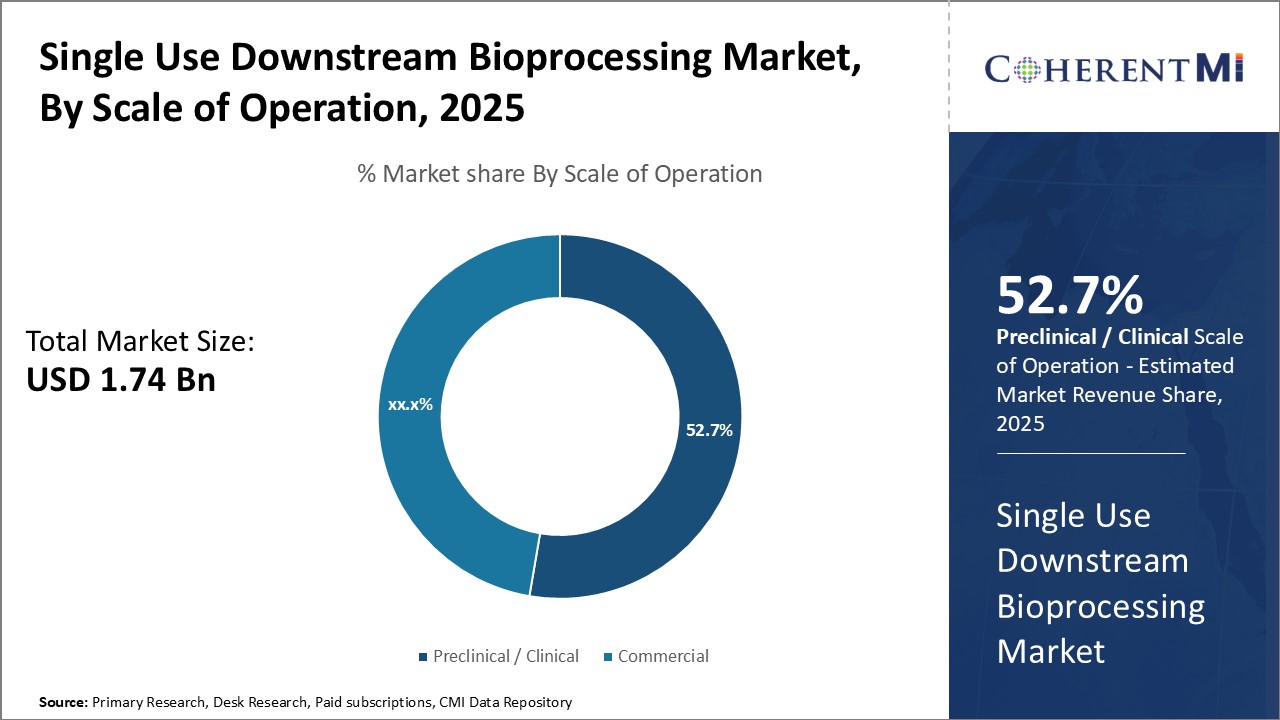

The preclinical/clinical sub-segment commands the largest share of 52.7% in the single use downstream bioprocessing market for scale of operation. During drug development phases, processes are dynamically optimized, and sample volumes are relatively small. Thus, the flexibility and disposable nature of single-use systems allow for faster design-build-test-learn cycles that are critical to advancing candidate molecules through preclinical and clinical testing.

Additionally, single-use technologies meet stringent purity standards for products intended for first-in-human studies through their disposable nature. This mitigates risks of residues, leachable, extractables or cross-contamination issues associated with traditional stainless-steel equipment during safety-critical early development phases. Overall, the adaptability, cleanliness and compact design of single-use downstream systems have made them indispensable for optimizing bioprocessing workflows during preclinical and clinical drug development.

Additional Insights of Single Use Downstream Bioprocessing Market

- The adoption of single-use technologies in bioprocessing has grown due to their benefits, such as reduced contamination risks and increased productivity. These technologies are pivotal in addressing the growing demand for biologics, driven by the increasing number of FDA-approved biologics and ongoing clinical trials. Companies are focusing on developing and automating single-use systems to enhance efficiency, which is expected to drive market growth significantly in the coming years.

Competitive overview of Single Use Downstream Bioprocessing Market

The major players operating in the single use downstream bioprocessing market include 3M, Agilitech, CPC (Colder Products Company), Cytiva Lifesciences, Pall Corporation, Pneumatic Scale Angelus, and Thermo Fisher Scientific.

Single Use Downstream Bioprocessing Market Leaders

- 3M

- Agilitech

- CPC (Colder Products Company)

- Cytiva Lifesciences

- Pall Corporation

Single Use Downstream Bioprocessing Market - Competitive Rivalry

Single Use Downstream Bioprocessing Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Single Use Downstream Bioprocessing Market

- In June 2023, Waters expanded collaboration with Sartorius to deliver comprehensive bioanalytics for downstream biomanufacturing.

- In June 2023, Cytiva added Culture Bio’s 250 mL bioreactor vessel to its portfolio to tackle scaling bottlenecks.

Single Use Downstream Bioprocessing Market Segmentation

- By Type of Product

- Single-use Chromatography Systems

- Single-use Filtration Systems

- Single-use Sampling Systems

- Single-use Connectors

- By Scale of Operation

- Preclinical / Clinical

- Commercial

Would you like to explore the option of buying individual sections of this report?

Nikhilesh Ravindra Patel is a Senior Consultant with over 8 years of consulting experience. He excels in market estimations, market insights, and identifying trends and opportunities. His deep understanding of the market dynamics and ability to pinpoint growth areas make him an invaluable asset in guiding clients toward informed business decisions. He plays a instrumental role in providing market intelligence, business intelligence, and competitive intelligence services through the reports.

Frequently Asked Questions :

How big is the Single Use Downstream Bioprocessing Market?

The Single Use Downstream Bioprocessing Market is estimated to be valued at USD 1.74 in 2025 and is expected to reach USD 4.71 Billion by 2032.

What are the major factors driving the single use downstream bioprocessing market growth?

The increasing adoption of single-use technology in biopharmaceutical manufacturing and reduction in co2 emissions and project lead time with single-use systems are the major factors driving the single use downstream bioprocessing market.

Which is the leading type of product in the single use downstream bioprocessing market?

The leading type of product segment is single-use chromatography systems.

Which are the major players operating in the single use downstream bioprocessing market?

3M, Agilitech, CPC (Colder Products Company), Cytiva Lifesciences, Pall Corporation, Pneumatic Scale Angelus, and Thermo Fisher Scientific are the major players.

What will be the CAGR of the single use downstream bioprocessing market?

The CAGR of the single use downstream bioprocessing market is projected to be 15.3% from 2025-2032.