Sterilization Services Market Size - Analysis

The sterilization services market is estimated to be valued at USD 5.98 Bn in 2025 and is expected to reach USD 9.48 Bn by 2032. It is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2025 to 2032. Sterilization services play a key role in preventing the spread of infections in healthcare settings by treating medical equipment and facilities to eliminate transmissible agents.

Market Size in USD Bn

CAGR6.8%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.8% |

| Market Concentration | Medium |

| Major Players | Steris Corporation, Stryker Corporation, 3M Company, Ecolab Inc., Sterigenics International LLC and Among Others |

please let us know !

Sterilization Services Market Trends

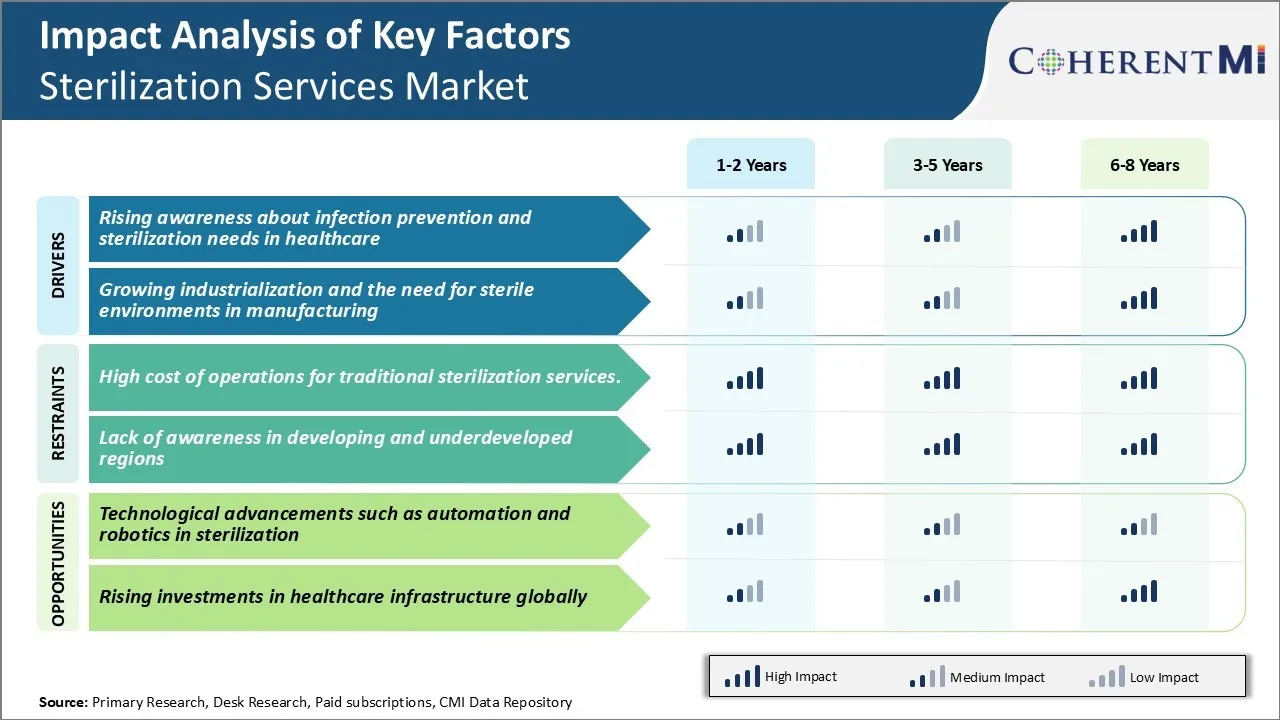

Market Driver - Rising Awareness About Infection Prevention and Sterilization Needs in Healthcare

As per CDC reports, over 2 million patients in the US contract an infection while receiving care in hospitals annually. This has emphasized the need to follow rigorous decontamination protocols of medical devices, instruments and other equipment used on patients.

Hospitals and other healthcare providers have been proactive in training their teams about adhering to sterilization standards and protocols. Regulatory bodies have imposed strict rules around reprocessing of reusable medical devices which needs to be followed by all parties involved. This includes precise documentation of sterilization process and batch traceability.

At the same time, advancements in medical technologies have led to significant rise in complex surgical procedures involving reusable equipment. Key and heat-sensitive devices necessitate special sterilization methods like low-temperature sterilization which were not commonly used earlier. All these factors have paved way for increased outsourcing of sterilization services by hospitals to specialist sterilization companies with advanced technical skills and infrastructure. This trend is expected to drive the sterilization services market.

Market Driver - Growing Industrialization and the Need for Sterile Environments in Manufacturing

With rapid industrialization worldwide, end-user industries requiring sterile manufacturing environments such as pharmaceutical, medical devices and food processing have witnessed significant rise. These sectors involve production of products intended for internal consumption or direct application on humans and animals. Hence, implementation of sterilization practices during various stages of manufacturing from raw material to finished goods is crucial to ensure protection from microbial and particulate contamination.

Stringent international quality regulations especially in developed markets mandate stringent sterilization validation protocols for manufacturing facilities. Regulatory inspections focus on evaluating effectiveness of decontamination methods and processes.

Additionally, ‘sterile to sterile’ packaging requirements necessitate sterilizing filled containers before dispatch. However, maintaining in-house sterilization equipment involves high operating costs. Many companies thus outsource terminal sterilization and packaging of finished medical devices, implants and consumables to specialized sterilization service providers. This offers advantages like flexible sterilization capacity, lower costs and freeing manufacturing lines for continuous production. All these factors are expected to significantly expand the sterilization services market globally.

Market Challenge - High Cost of Operations for Traditional Sterilization Services

The high cost of operations remains one of the biggest challenges currently facing the sterilization services market. Traditional sterilization methods such as steam sterilization are still widely used, however they require large capital investments in expensive sterilization equipment, specialized facilities, extensive training for operators, and rigorous ongoing quality control processes.

Additionally, the throughput of traditional sterilization technologies can be slow. The lengthy sterilization cycles take time and limit the volume of items that can be processed. These operational expenses put pressure on the margins of sterilization services providers and end up getting passed on to customers through higher service fees. The high costs make it difficult for companies offering traditional sterilization services to scale and expand to new markets.

Market Opportunity - Technological Advancements Such as Automation and Robotics in Sterilization

Recent years have seen exciting technological advancements with the potential to significantly impact the sterilization services market. Automation and robotics are increasingly being adopted to boost efficiencies in sterilization workflows. Automated guided vehicles can transport items through sterilization lines autonomously without human drivers.

Vision systems and scanning technologies allow for automated verification of sterilization indicators. Robotic arms are also allowing for more precise, consistent, and controlled loading and unloading of sterilizers. Artificial intelligence is enabling real-time monitoring and process optimization. These technologies reduce labor requirements and prevent errors from manual handling. They also enable tighter process controls and consistency in sterilization results.

With lower costs, higher volumes, and more flexibility, these automated solutions are poised to transform traditional operation models. Their adoption opens up opportunities for new consolidation and expansion strategies across geographies for businesses in the sterilization services market.

Key winning strategies adopted by key players of Sterilization Services Market

Strategic expansions to gain market share: Players have aggressively expanded their sterilization service networks through acquisitions and partnerships to access new regions and customers.

Focus on niche & complex equipment sterilization: Given the rise in complex medical devices, players have focused on developing expertise in sterilizing difficult equipment. For example, Getinge invests heavily in R&D to sterilize complex endoscopes and implants.

Adopting new sterilization technologies: Players have invested in new sterilization technologies like vaporized hydrogen peroxide, gamma irradiation, e-beam etc. to handle different device types.

Growing focus on validation & compliance: Given increased regulatory focus, players emphasized strict validation, record-keeping and quality systems. For example, in 2020, Sotera Health launched ComplianceEase tool to streamline quality documentation for customers.

Segmental Analysis of Sterilization Services Market

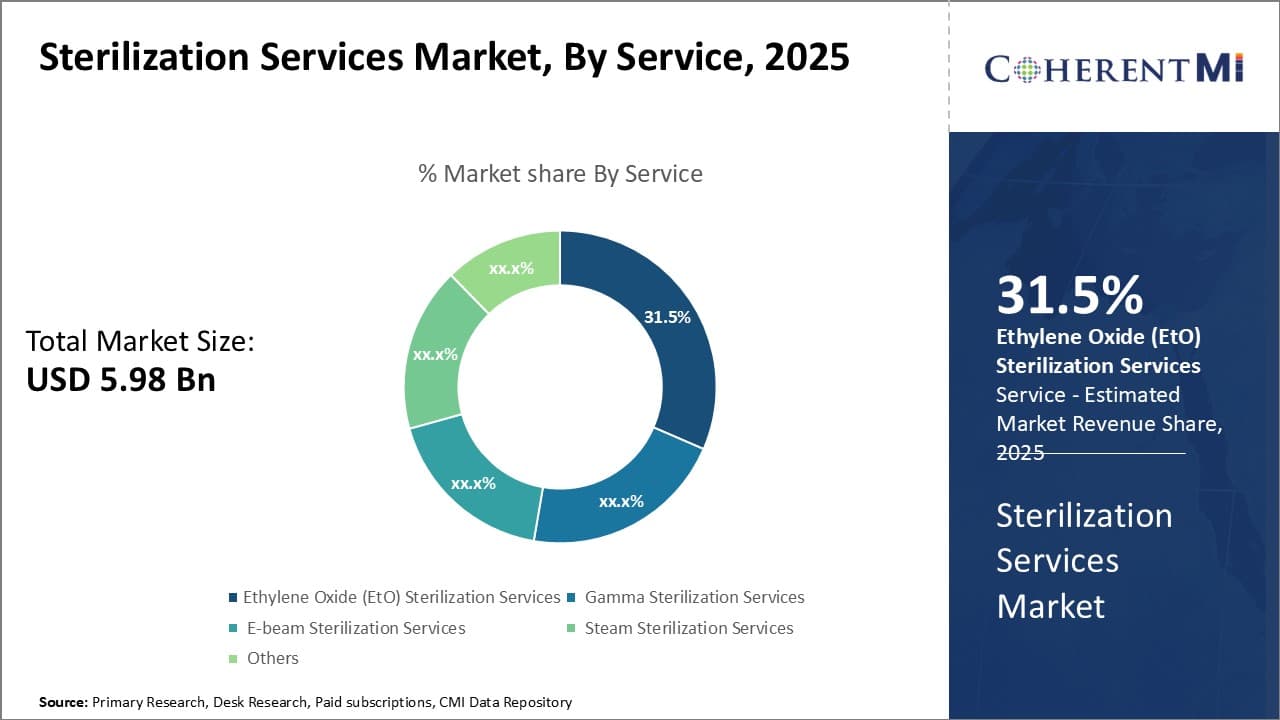

Insights, By Service: Technological Advancements Drive Growth of Ethylene Oxide (EtO) Sterilization Services

In terms of service, ethylene oxide (EtO) sterilization services contributes 31.5% share of the sterilization services market in 2025. This is owing to technological advancements increasing its adoption. Ethylene Oxide is highly effective at sterilizing medical devices due to its unmatched penetration and broad material compatibility. Advances such as automated loading systems and enhanced process monitoring & controls have made EtO sterilization more efficient and reproducible compared to older methods.

As medical devices become more advanced, the need for reliable low-temperature sterilization rises. EtO's unique combination of sporicidal activity, material compatibility and speed has made it a sterilization process of choice for many temperature-sensitive products. Continued technological upgrades to EtO sterilization facilities will further drive its prominence in coming years.

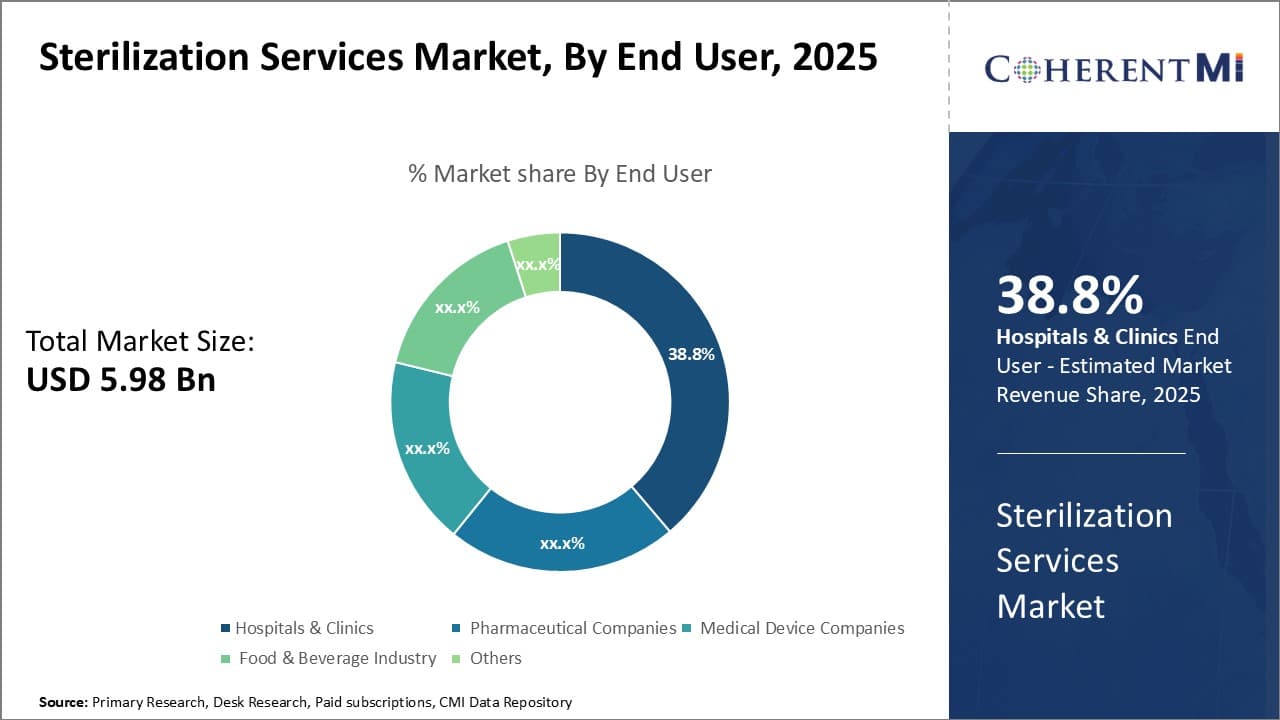

Insights, By End User: Hospitals Drive Demand for High-Volume Sterilization

Insights, By End User: Hospitals Drive Demand for High-Volume Sterilization

In terms of end user, hospitals & clinics contributes 38.8% share of the sterilization services market in 2025. This is owing to high sterilization volume needs. Hospitals utilize a vast range and quantity of sterilized medical supplies and devices for surgical procedures, wound care and other interventions every day. This consistently high volume drives demand for sterilization on an industrial scale rather than small individual loads.

A steady supply of sterilized products is also critical for healthcare facilities to avoid treatment delays or stock-outs. Their need for streamlined, high-output sterilization processes on a daily basis makes outsourcing to specialized sterilization service providers the most feasible option. This perpetual high-volume demand from hospitals anchors the growth of commercial sterilization services market.

Insights, By Mode of Delivery: Practice of Outsourcing On-Site Procedures Boosts Growth

In terms of mode of delivery, on-site sterilization contributes the highest share of the sterilization services market owing to the increased practice of outsourcing on-premise sterilization procedures. While off-site sterilization allows sending loads off complex, many facilities still prefer critical supplies and tools to be sterilized within their premises for quality assurance, faster turnarounds and biosecurity.

However, maintaining expensive on-premise sterilization equipment and recruiting well-trained technicians requires sizable investment of funds and workforce. More hospitals and manufacturers are leveraging third-party sterilization experts who can build and manage dedicated on-campus sterilization facilities. Reliance on external specialists also ensures on-site processes adhere to evolving compliance norms. The outsourcing model has thus boosted adoption of on-premise sterilization services substantially.

Additional Insights of Sterilization Services Market

- Healthcare-Associated Infections (HAIs): Globally, around 7% of hospitalized patients in developed countries acquire at least one healthcare-associated infection. This statistic emphasizes the critical need for robust sterilization protocols.

- Emerging Regions: The Asia Pacific region is projected to witness the fastest growth rate, attributed to improving healthcare infrastructure, rising awareness of infection control, and the influx of foreign direct investments.

- S. sterilization services market is predicted to grow at a CAGR of 8.05% from 2024 to 2034, reaching USD 3.38 billion by 2034.

- Asia-Pacific is the fastest-growing region in the global sterilization services market due to industrialization and increasing healthcare needs.

Competitive overview of Sterilization Services Market

The major players operating in the sterilization services market include Steris Corporation, Stryker Corporation, 3M Company, Ecolab Inc., Sterigenics International LLC, Cretex Companies, Noxilizer Inc., Beta-Gamma-Service GmbH & Co. Kg, Cosmed Group Inc., Medline Industries Inc., Anderson Products Inc., and Doyen Medipharm

Sterilization Services Market Leaders

- Steris Corporation

- Stryker Corporation

- 3M Company

- Ecolab Inc.

- Sterigenics International LLC

Sterilization Services Market - Competitive Rivalry

Sterilization Services Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Sterilization Services Market

- In October 2024, Konoike Transport announced the conversion of their Indian group company into a management company and the acquisition of shares in an Indian surgical instrument and equipment sterilization company.

- In September 2024, BGS Beta-Gamma-Service GmbH & Co. KG announced plans to open a new e-beam irradiation facility in the United States. The facility, located in Imperial, Pennsylvania, near Pittsburgh International Airport, is scheduled to begin operations in mid-2025.

- In May 2024, Crothall Healthcare and Ascendco Health announced a partnership to enhance surgical instrument tracking and improve sterile processing quality in healthcare facilities across the United States.

- In April 2024, Noxilizer Inc. expanded its nitrogen dioxide (NO₂) contract sterilization services at its headquarters in Hanover, Maryland, USA. This expansion was driven by increased demand for NO₂ sterilization, particularly for pre-filled syringes and drug-device combination products.

Sterilization Services Market Segmentation

- By Service

- Ethylene Oxide (EtO) Sterilization Services

- Gamma Sterilization Services

- E-beam Sterilization Services

- Steam Sterilization Services

- Others

- By End User

- Hospitals & Clinics

- Pharmaceutical Companies

- Medical Device Companies

- Food & Beverage Industry

- Others

- By Mode of Delivery

- On-Site

- Off-Site

Would you like to explore the option of buying individual sections of this report?

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

Frequently Asked Questions :

How big is the sterilization services market?

The sterilization services market is estimated to be valued at USD 5.98 Bn in 2025 and is expected to reach USD 9.48 Bn by 2032.

What are the key factors hampering the growth of the sterilization services market?

High cost of operations for traditional sterilization services. and lack of awareness in developing and underdeveloped regions are the major factors hampering the growth of the sterilization services market.

What are the major factors driving the sterilization services market growth?

Rising awareness about infection prevention and sterilization needs in healthcare and the need for sterile environments in manufacturing are the major factors driving the sterilization services market.

Which is the leading service in the sterilization services market?

The leading service segment is ethylene oxide (EtO) sterilization services.

Which are the major players operating in the sterilization services market?

Steris Corporation, Stryker Corporation, 3M Company, Ecolab Inc., Sterigenics International LLC, Cretex Companies, Noxilizer Inc., Beta-Gamma-Service GmbH & Co. Kg, Cosmed Group Inc., Medline Industries Inc., Anderson Products Inc., and Doyen Medipharm are the major players.

What will be the CAGR of the sterilization services market?

The CAGR of the sterilization services market is projected to be 6.8% from 2025-2032.