TCR Therapy Market Size - Analysis

The TCR Therapy Market is estimated to be valued at USD 0.06 Bn in 2025 and is expected to reach USD 1.09 Bn by 2032, growing at a compound annual growth rate (CAGR) of 51.3% from 2025 to 2032. The market is poised to grow significantly over the next seven years owing to rising cancer incidences and strong pipeline of TCR cell therapies entering clinical trials for various cancer indications.

The trend in the TCR Therapy market has been positive over the past few years as technological advancements are helping researchers develop more effective TCR cell therapies. Many biopharma companies have ramped up research efforts to discover novel TCRs that can target solid tumors which has expanded the market potential. Successful clinical trial results and new regulatory approvals are positioning TCR cell therapies as an exciting area in immuno-oncology.

Market Size in USD Bn

CAGR51.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 51.3% |

| Market Concentration | High |

| Major Players | Adaptimmune Therapeutics, Alaunos Therapeutics, GlaxoSmithKline, Immunocore, Intellia Therapeutics and Among Others |

please let us know !

TCR Therapy Market Trends

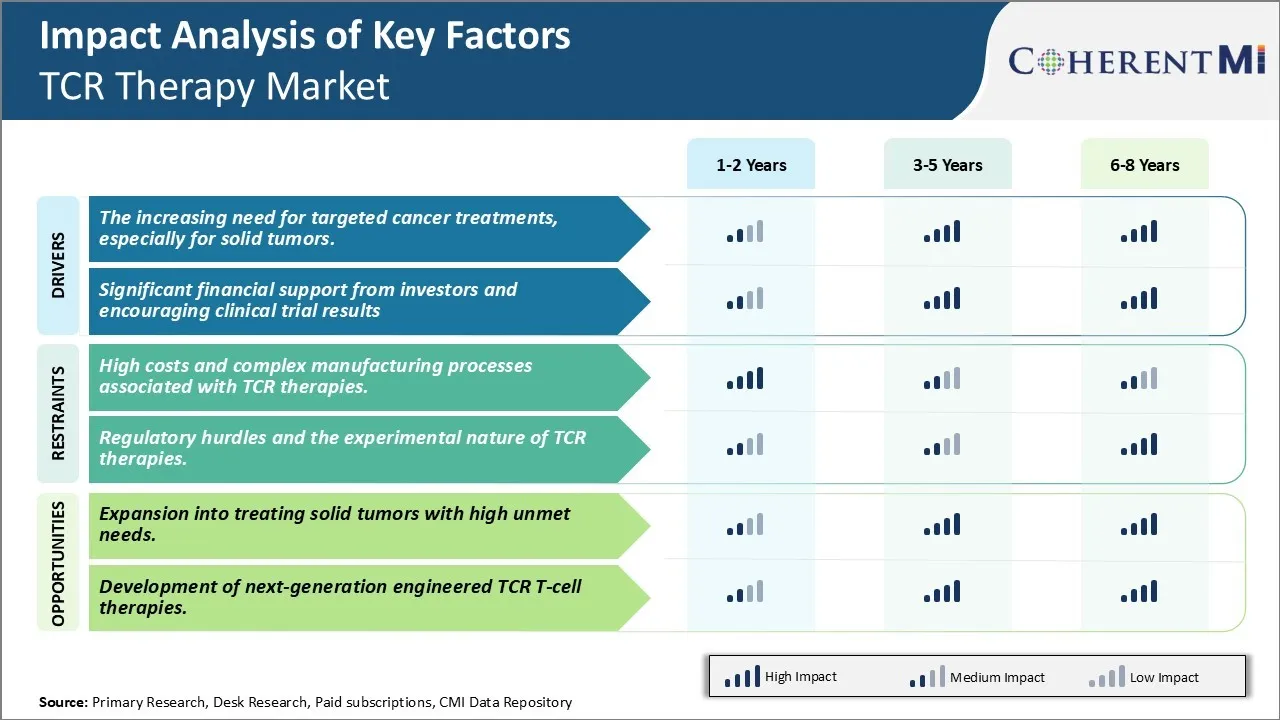

Market Driver - The increasing need for targeted cancer treatments, especially for solid tumors.

There has been growing demand for more targeted and personalized treatment options for cancer patients in recent years. While traditional treatment forms such as chemotherapy have been effective in managing some cancers, they often lack specificity which results in damage to healthy cells as well. This can lead to severe side effects and reduce the quality of life for patients. The success of immuno-oncology therapies in hematological cancers has further fueled interest in developing similar targeted therapies for solid tumors. However, solid tumors pose a unique challenge due to their complex tumor microenvironment which shields cancer cells and suppresses immune response.

T cell receptor therapy is emerging as a promising platform that can address this unmet need. By engineering a patient's own T cells to target specific tumor antigens on cancer cells, it enables a living drug that can infiltrate solid tumors and induce response in a highly localized manner. This personalized approach could help avoid collateral damage to healthy tissue unlike traditional treatments.

Many academic institutes and biotech companies are actively conducting research to identify tumor antigens unique to different solid tumor types. Early clinical trial results of TCR therapies in cancers like melanoma, synovial sarcoma and others have demonstrated feasibility of achieving response even in advanced solid tumors. Patients who have exhausted standard therapies are eager to try out novel targeted treatments with the potential of improved outcomes and lowered side effects.

Significant financial support from investors and encouraging clinical trial results

The encouraging clinical efficacy demonstrated by initial TCR therapy products have captured the interest of both private and public sector investors. Venture capital and biotech companies find the platform technologically innovative with potential for significant commercial success. The National Cancer Institute in US has also increased funding for academic research on designing novel TCRs against various solid and liquid tumors. Such financial support has enabled expansion of clinical trials and establishment of manufacturing infrastructure to develop these living drugs. The field is rapidly progressing from small early stage trials to mid-size studies evaluating multiple TCR therapies together.

Positive results from some of these combination clinical trials testing safety and efficacy has boosted further confidence among investors. For instance, one trial presented complete remission in several lymphoma patients when TCR therapy was given along with checkpoint inhibitors. No significant toxicities were reported even with the combined regimen.

Such demonstrations of the ability to augment immuno-oncology therapies without compromising safety has attracted increasing VC funding. It is expected that with continued success, large pharmaceutical partners may also enter into licensing deals and take the lead in late stage trials and commercialization in the future. The unique mechanism of action and encouraging clinical signs so far provide optimism for TCR therapy to emerge as a mainstream treatment approach.

Market Challenge - High costs and complex manufacturing processes associated with TCR therapies.

One of the major challenges currently facing the TCR therapy market is the high costs and complex manufacturing processes associated with developing these therapies. TCR therapies are considered advanced cell therapies which involve extracting T cells from a patient's blood, modifying them genetically to express a novel TCR, and expanding these cells ex vivo before infusing them back into the patient. This multi-step process requires specialized facilities, trained personnel, and reliable production techniques which add significantly to the costs.

Manufacturing one batch of these personalized therapies often runs into millions of dollars. Additionally, manufacturing times are long, often taking several weeks. This high cost and complexity makes TCR therapies inaccessible to large portions of the patient population currently. For the market to grow, manufacturers will need to significantly drive down costs through process improvements, automation, and economies of scale. Research into alternate manufacturing strategies like universal TCR therapies may also help address this challenge to some degree.

Market opportunity - Expansion into treating solid tumors with high unmet needs.

One major opportunity area for the TCR therapy market lies in the expansion of application into treating solid tumors. Currently, most clinical research and approvals for TCR therapies are limited to hematological cancers like lymphoma and leukemia. However, solid tumors represent a much larger market size worldwide with high unmet medical needs. Examples include cancers of the lung, breast, prostate etc.

TCR therapies hold promise for treating solid tumors as well, provided researchers can overcome challenges like low immunogenicity of solid tumors, heterogeneity of antigens expressed, immunosuppressive tumor microenvironment etc. Early clinical trials targeting antigens in solid tumors like MAGE-A3 in lung cancer have shown positive results. As more targets are identified and means to overcome barriers discovered, TCR therapies may become an important treatment option for solid tumors in the future.

Key winning strategies adopted by key players of TCR Therapy Market

Strategic collaborations and partnerships: One of the most effective strategies adopted by companies has been collaborating with other players to advance TCR therapy research and development. For example, in 2021 Gilead Sciences partnered with iTeos Therapeutics to develop novel TCR therapies. Such partnerships allow companies to share resources, expertise and risks associated with developing these complex therapies.

Focus on developing therapies targeting solid tumors: While initial TCR therapies mainly targeted hematological cancers, leaders in the field like Gilead have shifted focus towards developing therapies for solid tumors which have a much larger patient pool. For example, Gilead's KTE-X19 therapy showed promising results in myeloma and is now being tested in non-Hodgkin's lymphoma patients. This strategic focus if successful will capture a bigger market share.

Acquisitions to gain expertise/IP: To enhance internal capabilities, companies have acquired other players. For instance, Novartis acquired Cell Therapy business of Celyad in 2020 to enhance its cell and gene therapy portfolio. This gave Novartis access to Celyad's TCR platform and pipeline assets which has helped expedite its TCR programs.

Early clinical success to attract investors: Obtaining proof-of-concept clinical data for TCR therapies is challenging but provides significant competitive advantage. Bluebird Bio saw its market value rise after announcing positive data for BB2121 in multiple myeloma patients in 2018. Early clinical validation helps attract more fundraising to advance programs.

Segmental Analysis of TCR Therapy Market

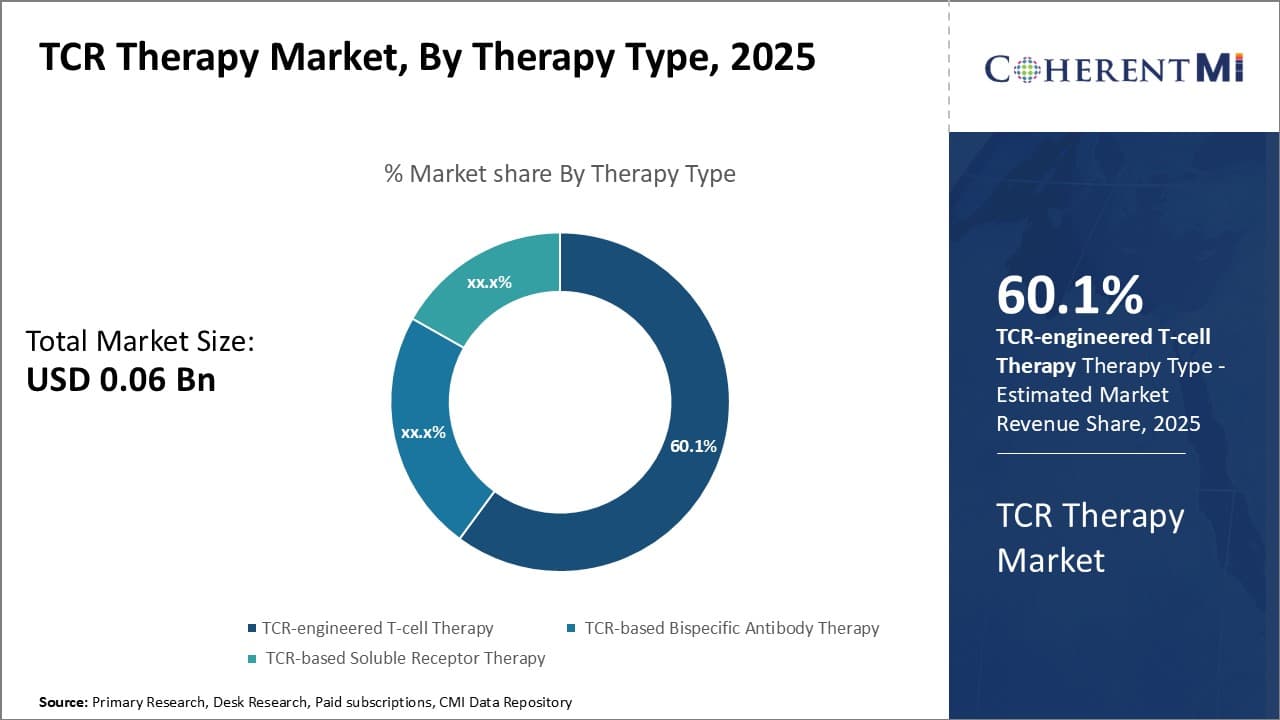

By Therapy Type - Emerging Advancement in CAR-T Cell Engineering is Driving TCR-engineered T-cell Therapy Growth

By Therapy Type - Emerging Advancement in CAR-T Cell Engineering is Driving TCR-engineered T-cell Therapy Growth

In terms of By Therapy Type:, TCR-engineered T-cell Therapy contributes the highest share of the market owning to continuous improvements in T-cell engineering technologies. TCR-engineered T-cell therapy involves extracting T cells from the patient's blood and modifying them to fight against the cancer cells.

While safety and efficacy concerns had initially slowed down the adoption of this therapy, however, recent breakthroughs in identification of disease-specific T-cell receptors and personalized manufacturing processes have enabled researchers to design more potent and safer TCR-engineered T cells. In addition, adopting viral and non-viral vector gene delivery methods to insert the desired TCR genes into T cells have optimized costs and reduced therapy development timelines. Growing expertise among biopharma companies to leverage innovations such as TCR gene knockout and gene editing is also adding new dimensions to this therapy segment. Overall, further advancements in CAR engineering coupled with expanding clinical evidence are expected to drive higher uptake of TCR-engineered T-cell therapy going forward.

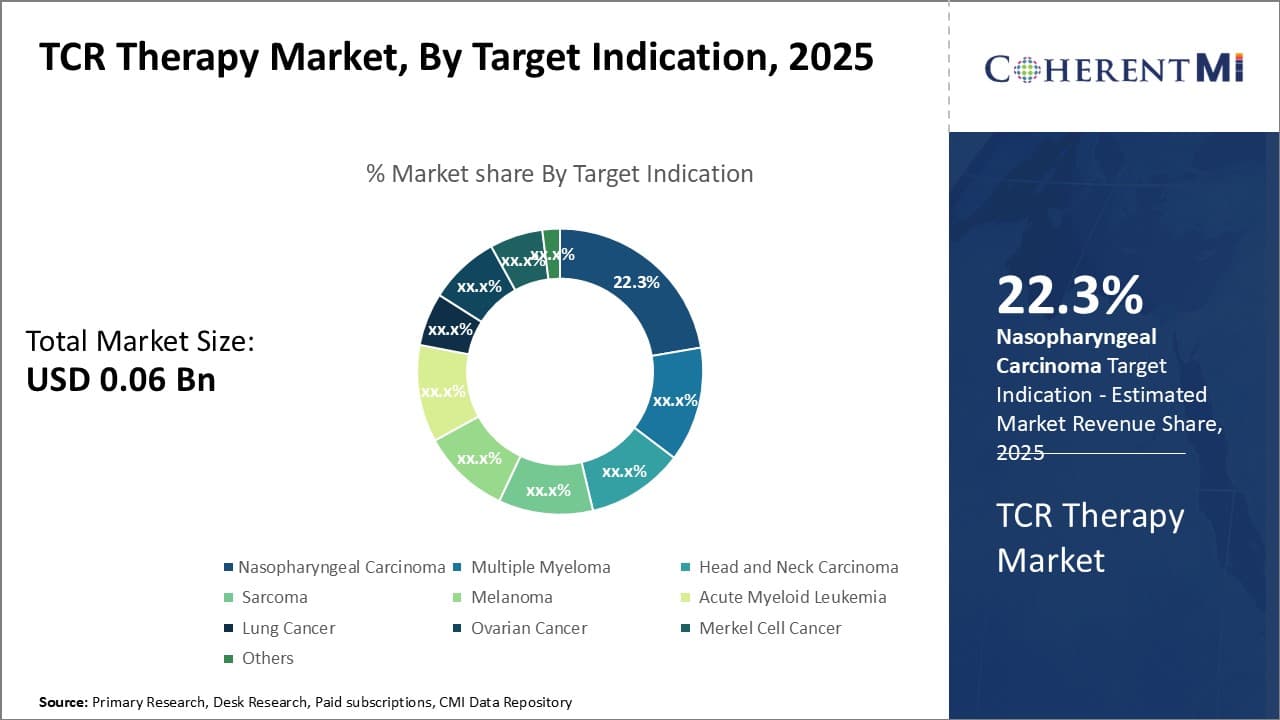

By Target Indication,- Rising disease incidence contributing to Nasopharyngeal Carcinoma segment growth

In terms of By Target Indication, Nasopharyngeal Carcinoma contributes the highest share of the market owing to significantly rising incidence rates globally. Nasopharyngeal carcinoma starts in the nasopharynx, which is the upper part of the throat behind the nose.

Countries such as China, Hong Kong, Japan, and Singapore have witnessed a spike in nasopharyngeal carcinoma cases, predominantly due to Epstein–Barr virus infection which is known to increase the risk. As cases rise, demand for effective targeted therapies is also increasing. Biopharma companies are thus prioritizing the development of TCR therapies against nasopharyngeal carcinoma to address this unmet need. Additionally, growing awareness about risk factors and early symptoms of nasopharyngeal carcinoma is enabling early diagnosis and further driving the segment size.

By Target Antigen - Rich pipeline and clinical evidence supporting NY-ESO-1 antigen segment

In terms of By Target Antigen the TCR Therapy Market is segmented into NY-ESO-1, EBV, gp100, Others. Among these segments NY-ESO-1 contributes the highest share of the market owning to a robust clinical pipeline and emerging proof of concept with this antigen. NY-ESO-1 is one of the most immunogenic cancer testis antigens with elevated expression in multiple solid tumors as well as hematologic cancers.

Several pharmaceutical companies have demonstrated encouraging clinical outcomes for NY-ESO-1 targeted TCR therapies in melanoma, synovial sarcoma and myeloma. This clinical validation has boosted investments towards expanding these therapies to target additional cancer indications. Furthermore, being an attractive universal antigen expressed across diverse cancer types supports the development of off-the-shelf allogenic TCR therapies targeting NY-ESO-1. Thus, a vibrant research landscape and clinical translation make NY-ESO-1 the leading segment currently.

Additional Insights of TCR Therapy Market

- The TCR therapy market is poised for significant growth, driven by the need for effective cancer treatments, especially for solid tumors, which represent a substantial unmet medical need. The market is currently valued at US$ 0.04 billion in 2023 and is projected to grow at a staggering CAGR of 51.1% over the next decade.

- The market is still in its nascent stage, but advancements in TCR technologies, particularly those targeting solid tumors, are expected to revolutionize the field. The increasing involvement of big pharmaceutical companies, coupled with substantial financial backing from investors, underscores the market's potential. However, the field remains experimental, with high costs and complex manufacturing processes posing significant challenges. Nonetheless, the potential for TCR therapies to address unmet needs in cancer treatment makes this an exciting area of development with a promising future.

Competitive overview of TCR Therapy Market

The major players operating in the TCR Therapy Market include RootPath, Kite Pharma, Guangzhou Xiangxue Pharmaceutical Co. Ltd, Eureka Therapeutics, Bristol-Myers Squibb Company, Gilead Sciences, Inc., Novartis AG, Johnson & Johnson, CARsgen Therapeutics Holdings Limited, IASO Biotherapeutics, JW (Cayman) Therapeutics Co. Ltd, CRISPR Therapeutics, Allogene Therapeutics and Cartesian Therapeutics, Inc.

TCR Therapy Market Leaders

- Adaptimmune Therapeutics

- Alaunos Therapeutics

- GlaxoSmithKline

- Immunocore

- Intellia Therapeutics

TCR Therapy Market - Competitive Rivalry

TCR Therapy Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in TCR Therapy Market

- On August 2024, The FDA has approved Tecelra (afamitresgene autoleucel), a gene therapy for adults with unresectable or metastatic synovial sarcoma who have previously received chemotherapy, are positive for specific HLA antigens, and whose tumors express the MAGE-A4 antigen, as confirmed by FDA-authorized diagnostic devices.

- In November 2022, AstraZeneca has announced the acquisition of Neogene Therapeutics, a clinical-stage biotech company specializing in next-generation T-cell receptor therapies (TCR-Ts) for targeting solid tumors. This acquisition aims to enhance AstraZeneca's efforts to bring advanced cell therapies to cancer patients.

- On 08 August 2024. Medigene AG and WuXi Biologics have entered into a three-year strategic partnership to co-develop T cell receptor-guided T Cell Engagers (TCR-TCEs) for treating challenging tumors. The collaboration leverages Medigene’s TCR expertise and WuXi Biologics’ TCE and bispecific antibody platforms, including WuXiBody

TCR Therapy Market Segmentation

- By Therapy Type:

- TCR-engineered T-cell Therapy

- TCR-based Bispecific Antibody Therapy

- TCR-based Soluble Receptor Therapy

- By Target Indication

- Nasopharyngeal Carcinoma

- Multiple Myeloma

- Head and Neck Carcinoma

- Sarcoma

- Melanoma

- Acute Myeloid Leukemia

- Lung Cancer

- Ovarian Cancer

- Merkel Cell Cancer

- Others

- By Target Antigen

- NY-ESO-1

- EBV

- gp100

- Others

- By End-User

- Hospitals and Cancer Centers

- Academic and Research Institutes

- Contract Manufacturing Organizations (CMOs)

- Others

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Frequently Asked Questions :

How big is the TCR Therapy Market?

The TCR Therapy Market is estimated to be valued at USD 0.06 in 2025 and is expected to reach USD 1.09 Billion by 2032.

What are the major factors driving the TCR Therapy Market growth?

The the increasing need for targeted cancer treatments, especially for solid tumors. and significant financial support from investors and encouraging clinical trial results are the major factor driving the TCR Therapy Market.

Which is the leading Therapy Type: in the TCR Therapy Market?

The leading Therapy Type: segment is TCR-engineered T-cell Therapy.

Which are the major players operating in the TCR Therapy Market?

RootPath, Kite Pharma, Guangzhou Xiangxue Pharmaceutical Co. Ltd, Eureka Therapeutics, Bristol-Myers Squibb Company, Gilead Sciences, Inc., Novartis AG, Johnson & Johnson, CARsgen Therapeutics Holdings Limited, IASO Biotherapeutics, JW (Cayman) Therapeutics Co. Ltd, CRISPR Therapeutics, Allogene Therapeutics, Cartesian Therapeutics, Inc. are the major players.

What will be the CAGR of the TCR Therapy Market?

The CAGR of the TCR Therapy Market is projected to be 51.3% from 2025-2032.