Train Battery Market Size - Analysis

The train battery market is estimated to be valued at USD 321.6 Mn in 2025 and is expected to reach USD 569.3 Mn by 2032, growing at a compound annual growth rate (CAGR) of 8.5% from 2025 to 2032. The train battery market is witnessing positive trends owing to growing emphasis on development of energy efficient transport solutions.

Market Size in USD Mn

CAGR8.5%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.5% |

| Market Concentration | Medium |

| Major Players | AEG Power Solutions, Amara Raja Group, East Penn Manufacturing Company, ENERSYS, EXIDE INDUSTRIES LTD. and Among Others |

please let us know !

Train Battery Market Trends

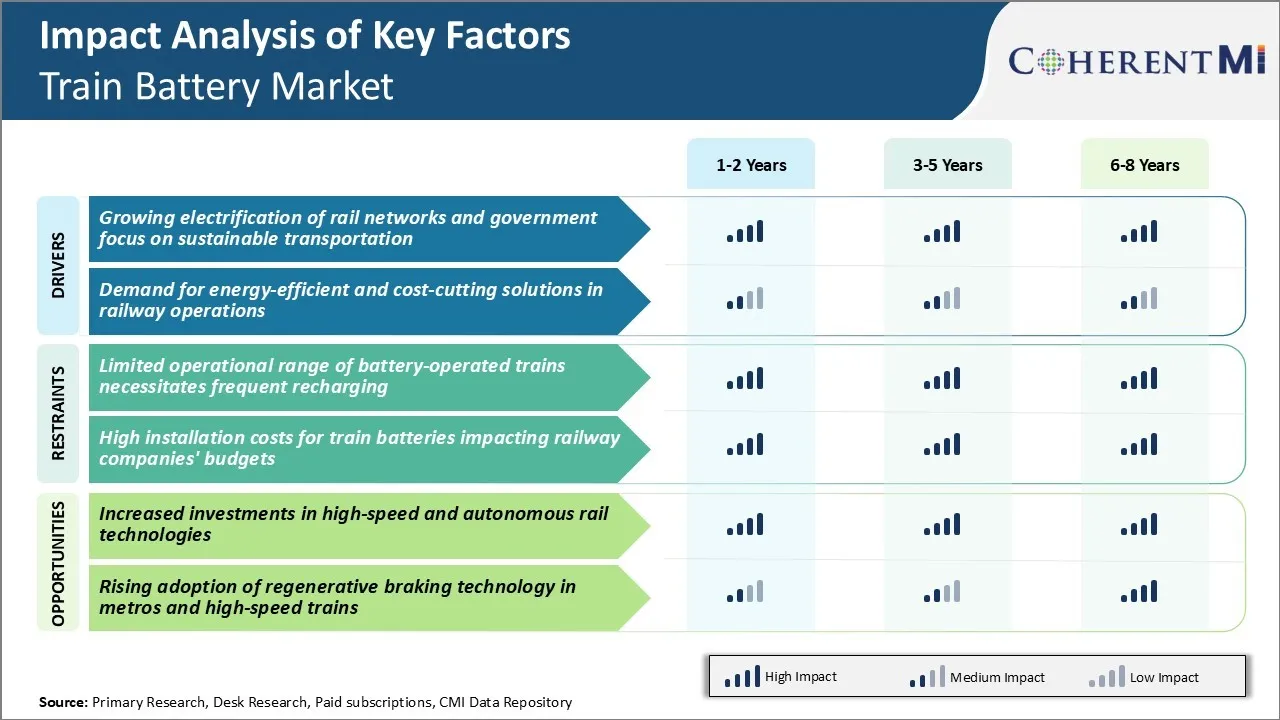

Market Driver - Growing Electrification of Rail Networks and Government Focus on Sustainable Transportation

Global shift towards more environmentally-friendly modes of transportation has been pushing rail electrification at an unprecedented rate. Governments across major economies have declared ambitious targets and roadmaps to electrify large sections of their rail infrastructure by using train batteries.

Trains powered by electricity result in close to zero direct emissions and are much more energy efficient compared to diesel locomotives. Several countries in Europe have long electrified their mainline networks to a large extent. However, even these nations are now looking to electrify smaller branch lines and regional networks, which will further boost demand for train batteries.

In recent years, many developing economies in Asia and Latin America have also significantly ramped up investments to expand electrified rail corridors through the use of train batteries. This is evident from China's bold nationwide plan to achieve 100% electrification by 2050. India too has unveiled mega plans such as the dedicated freight corridors and high-speed rail projects, where electrification is a key design aspect.

This is expected to boost growth of the train battery market around the world, in the coming years.

Market Driver - Demand for Energy-efficient and Cost-cutting Solutions in Railway Operations

Rail operators across the world are under constant pressure to improve operating efficiencies and optimize maintenance costs. Additionally, the maintenance requirements of diesel engines are considerably higher compared to electric traction systems. Train batteries that can provide 'last mile' connectivity beyond electrified tracks or provide supplementary power are ideal solutions to improve energy efficiency of line operations.

Many railroad companies have started pilot trials of train battery technology on shunting locomotives, maintenance cars, and passenger coaches. The ability of lithium-ion train batteries to deliver high energy density in a lightweight package makes them very suitable for retrofitting in existing rail assets.

Train batteries also enable greater flexibility of train movements that were earlier restricted by geographical constraints of electrified sections. As more innovative battery-electric solutions prove their reliability and cost-effectiveness in real-world railway applications, their adoption will sharply accelerate train battery market in the foreseeable future.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Limited Operational Range of Battery-Operated Trains

One of the key challenges currently facing the train battery market is the limited operational range of battery-powered trains between charges. Traditional lithium-ion battery technology provides trains with a range of only 100-200 kilometers before the batteries need to be recharged. This poses logistical difficulties as it necessitates frequent recharging stops during operations, disrupting schedules.

Additionally, the substantial weight of the large battery packs required to achieve even this limited range significantly cuts into the payload capacity of trains.

Train battery technology will need to be considerably advanced to achieve higher energy densities and specific energies. This can help in providing battery-powered trains with operational ranges comparable to diesel counterparts, which can travel over 1000 kilometers on a single fuel tank. Thereby, achieving long operational range with the use of train batteries can limit growth of the train battery market.

Market Opportunity - Increased Investments in High-Speed and Autonomous Rail Technologies

Governments and private investors around the world are increasingly committing large amounts of capital into the development of advanced high-speed and autonomous rail infrastructure projects. Such modern rail systems provide a massive potential for train battery market.

Cutting-edge high-speed trains capable of traveling at over 300 km/h will depend on lightweight yet powerful battery packs. Autonomous subway networks and freight rail lines also present opportunities for train battery suppliers to electrify train fleets of the future.

With projected investments in rail projects exceeding $2 trillion over the next decade, the demand for train batteries optimized for rail applications is expected to grow tremendously. This growing funding environment enhances the business case for battery manufacturers to intensify R&D to develop trains batteries meeting the stringent performance requirements of next-generation transportation technologies.

Key winning strategies adopted by key players of Train Battery Market

Focus on advanced technologies: Train batteries require high performance to provide backup power during operations. For example, in 2020, Hitachi announced a lithium-ion battery utilizing new materials that can fast charge within 10 minutes, doubling the energy density of conventional train batteries.

Strategic partnerships and collaborations: Players have partnered with OEMs and rail operators to gain deep customer insights and co-develop customized solutions. In 2017, GS Yuasa partnered with Siemens to develop an energy storage system for Germany's first battery-powered multiple-unit train.

Global expansion through acquisitions: Large manufacturers have expanded globally through strategic acquisitions. In 2018, Hitachi acquired Ansaldo STS, providing access to over 60 countries and expanding its global rail foothold.

Focus on sustainability and recyclability: Companies have emphasized sustainability to align with industry and passenger expectations. For example, Hitachi invested in closed loop recycling facilities that recover over 95% materials from spent batteries.

Segmental Analysis of Train Battery Market

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

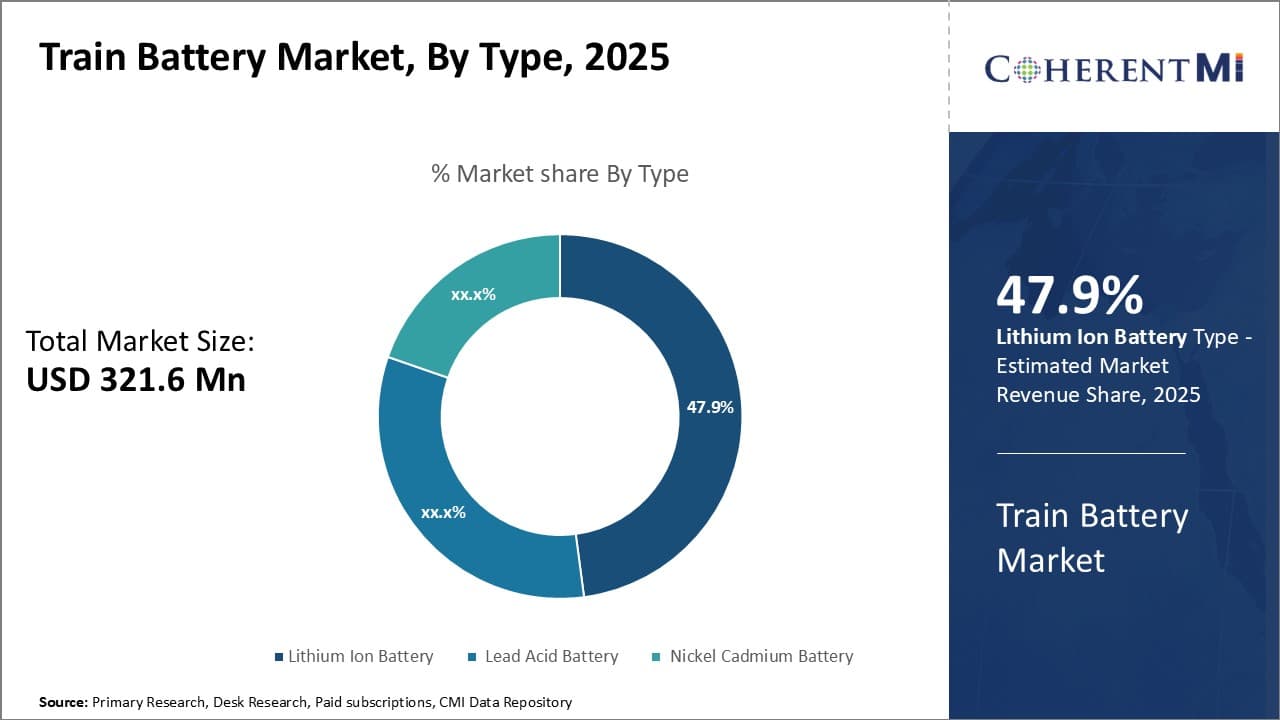

Insights, By Type: Lithium-Ion Train Battery - The Rise of Lithium-Ion Technology

In terms of type, lithium-ion train battery contributes 47.9% share of the train battery market in 2025, owning to its inherent advantages over other chemistries. Lithium-ion train batteries offer higher energy density compared to lead-acid and nickel-cadmium batteries, which allows for longer runtimes on a single charge.

Lithium-ion train batteries also exhibit very low self-discharge, retaining their charge for months when not in use. This makes them suitable for standby applications to power emergency systems on trains even during long term storage.

From a maintenance perspective, lithium-ion train batteries require little servicing or water top ups like lead-acid batteries. They also have a longer 3,000 to 5,000 cycle lifespan that lowers long term cost of ownership. As lithium battery cell and pack technology continues to advance each year, costs are declining steadily while energy and power performance increases. This improving value proposition is driving global adoption of this chemistry across the train battery market.

To learn more about this report, Download Free Sample Copy

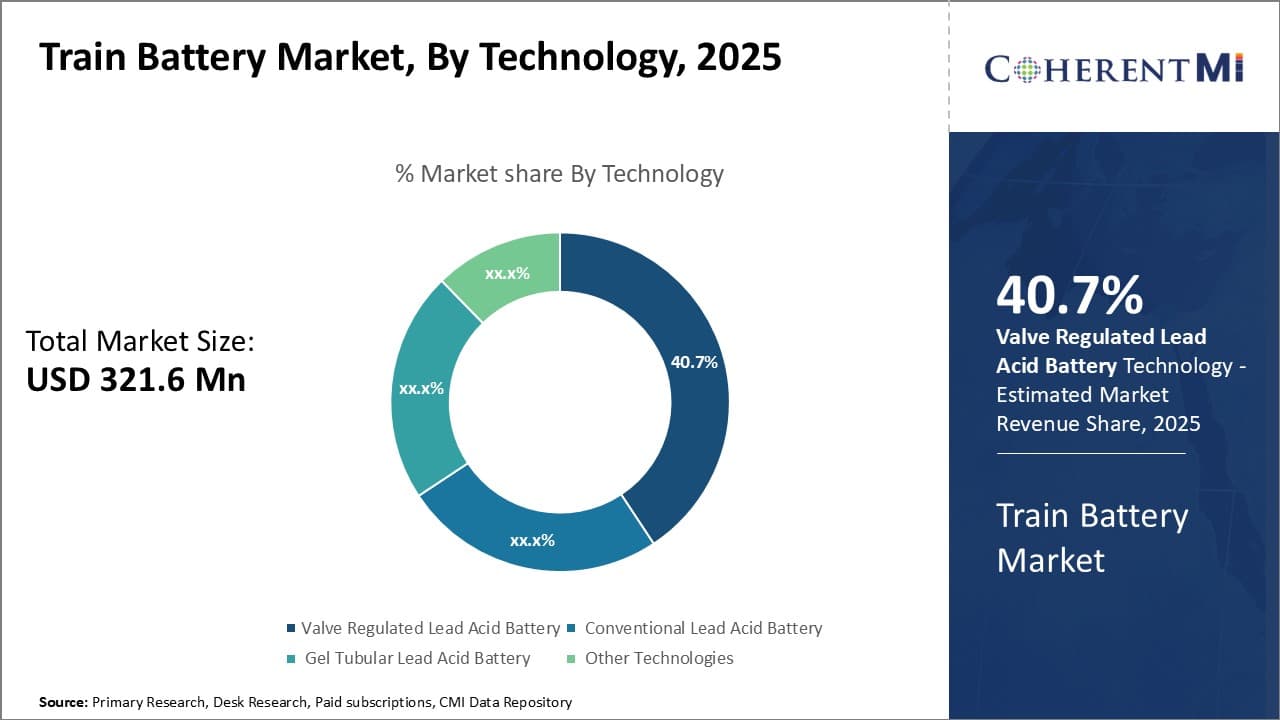

Insights, By Technology: Valve Regulation Enhances Lead-Acid Deployment

To learn more about this report, Download Free Sample Copy

Insights, By Technology: Valve Regulation Enhances Lead-Acid Deployment

In terms of technology, valve regulated lead acid (VRLA) batteries contribute 40.7% share of the train battery market in 2025, due to key advantages over conventional flooded lead-acid designs. VRLA batteries, also known as sealed or maintenance-free batteries, offer improved safety thanks to their sealed construction with no exposures to liquids. This makes them ideal for below deck installation in passenger trains where space is tight.

Unlike conventional lead-acid batteries, VRLA designs have no risk of acid or hydrogen gas leaks which can cause corrosion or explosions in enclosed spaces. They are also more tolerant to vibrations experienced on moving trains. VRLA batteries also self-regulate pressure through static vent valves, preventing the need for water top ups usually required with flooded lead-acid batteries.

Advancements in absorbent glass mat (AGM) and gel electrolyte technologies used in VRLA batteries have improved cycle life capabilities to compete with traditional designs. As a mature and lower cost technology, VRLA batteries continue seeing widespread use where high safety and low maintenance are priorities for rail operators.

Insights, By Application: Maximizing Payload Through Passenger Focus

In terms of application, passenger trains contribute the highest share of the train battery market driven by their unique power and runtime needs. Passenger carriages require larger battery banks to smoothly start heavy loaded trains and generate onboard electricity for robust HVAC, lighting, infotainment and other luxury amenities expected by travelers. Maximizing available interior space for seating also means efficient compact battery designs are critical.

Reliability is paramount as interruptions negatively impact customer satisfaction. To ensure trains remain on schedule, high reserve capacities and rapid recharges are standard. The large number of trips daily and long operational life also means reduced maintenance requirements and total cost of ownership over decades of service life are high priorities.

As passenger traffic continues to rise globally with improving economies, new train models are emerging with even more advanced amenities. This spurs demand for higher power density battery solutions to re-charge faster without compromising passenger capacity. It has led manufacturers to adopt next-generation lithium titanate oxide and lithium ferro phosphate chemistries tailored for this growing segment in the train battery market.

Additional Insights of Train Battery Market

- North America leads the train battery market with a 40% share as of 2023. This is driven by the increased adoption of electric and hybrid train systems in the region.

- By application, metros hold a significant market share (41%), owing to rapid urbanization and expanded railway networks, particularly in Asia Pacific countries like China and Japan.

- Battery Electric Railcar for Freight Train: In April 2024, Intramotev launched a battery-electric railcar for freight trains, the first of its kind in the U.S. This innovation signals a shift towards sustainable freight transportation.

- AI-Based Battery Management: In August 2024, Electra Vehicles introduced EVE-Ai, a software that enhances EV battery performance through AI, improving accuracy in range calculations and providing predictive maintenance alerts.

Competitive overview of Train Battery Market

The major players operating in the train battery market include AEG Power Solutions, Amara Raja Group, East Penn Manufacturing Company, ENERSYS, EXIDE INDUSTRIES LTD., First National Battery, Furukawa Electric Co., Ltd., GS Yuasa International Ltd., Hitachi Rail Limited, HOPPECKE Carl Zoellner & Sohn GmbH, Fengri Power & Electric Co., Limited, Power & Industrial Battery Systems GmbH, Saft2022, SEC Battery, and Shuangdeng Group Co, Ltd.

Train Battery Market Leaders

- AEG Power Solutions

- Amara Raja Group

- East Penn Manufacturing Company

- ENERSYS

- EXIDE INDUSTRIES LTD.

Recent Developments in Train Battery Market

- In July 2024, Alstom announced its plans to start producing batteries for hybrid and metro trains in India, targeting completion by 2025. This initiative is part of Alstom's broader strategy to enhance regional production capabilities and reduce dependency on imported batteries.

- In April 2024, Siemens Mobility launched its Mireo Plus B battery hybrid trains in Germany, specifically in the Ortenau region. The Mireo Plus B trains are designed to operate on both electrified and non-electrified tracks, which allows them to be deployed in areas lacking overhead power lines.

- In August 2023, Alstom and Verkehrsverbund Mittelsachsen (VMS) launched a battery-powered electric train in Chemnitz, Germany. This initiative represents a significant advancement towards adopting clean energy in regional rail networks. A total of eleven Coradia Continental battery-electric trains have been ordered, which are expected to enter service in 2024 on the Chemnitz-Leipzig line, replacing existing diesel trains.

Train Battery Market Segmentation

- By Type

- Lithium Ion Battery

- Lead Acid Battery

- Nickel Cadmium Battery

- By Technology

- Valve Regulated Lead Acid Battery

- Conventional Lead Acid Battery

- Gel Tubular Lead Acid Battery

- Other Technologies

- By Application

- Passenger Trains

- Freight Trains

- High-Speed Trains

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.