United States Chlorine Market Size - Analysis

The United States Chlorine Market is estimated to be valued at USD 2.87 Bn in 2025 and is expected to reach USD 4.43 Bn by 2032, growing at a CAGR of 6.4% from 2025 to 2032.

The market is driven by strong demand from water treatment plants and as a raw material for many downstream chemicals.

Market Size in USD Bn

CAGR6.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.4% |

| Market Concentration | Medium |

| Major Players | Olin Corporation, Occidental Petroleum Corporation, Westlake Corporation, Hydrite Chemical Co., Air Liquide USA Inc. and Among Others |

please let us know !

United States Chlorine Market Trends

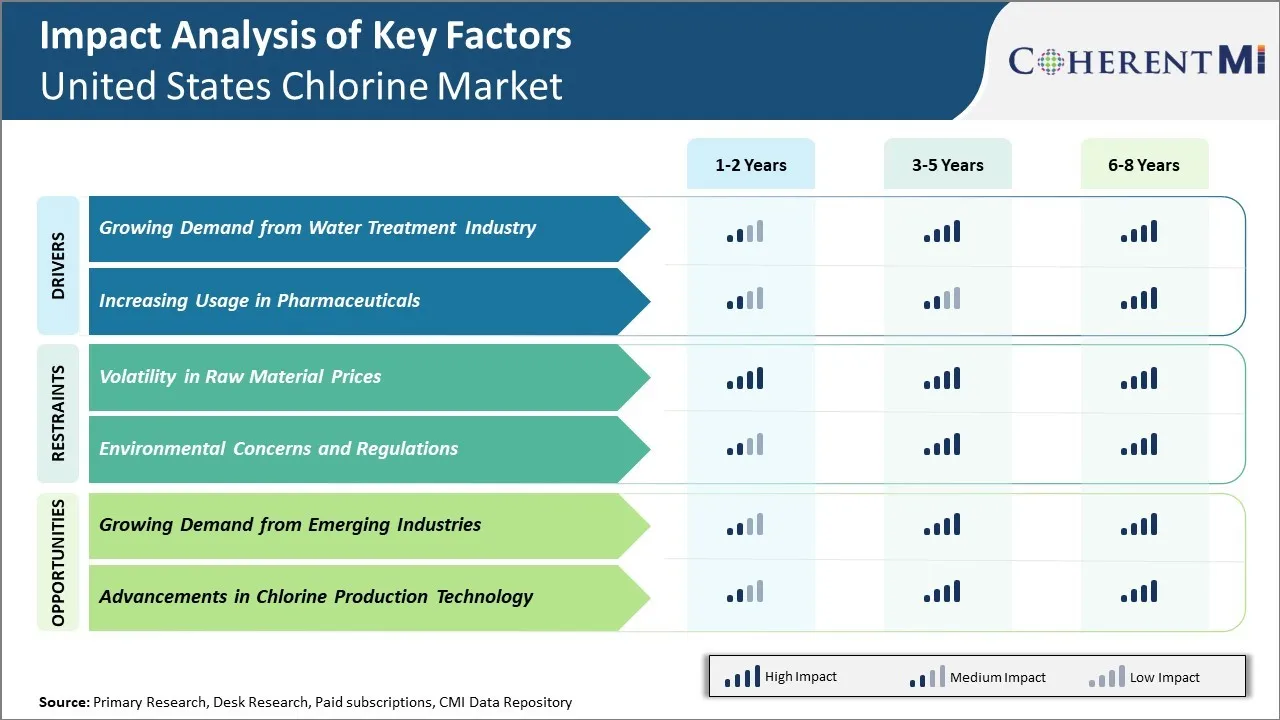

Market Driver – Growing Demand from Water Treatment Industry

The water treatment industry in the United States has been expanding rapidly over the past few years to meet the growing needs of water purification and disinfection. As the population increases and concerns over water safety rises, there has been a major drive towards advanced water treatment processes that utilize chlorine on a large scale.

Chlorine plays a key role in purifying water sources and ensuring safe drinking water by eliminating harmful microorganisms. Most municipal water facilities and wastewater treatment plants today heavily rely on chlorine for primary disinfection. Furthermore, industrial operations such as food and beverage production that use large amounts of water also chlorinate on-site to avoid contamination. The renovation and capacity expansion of existing treatment infrastructure as well as construction of new plants across the country has significantly contributed to higher chlorine consumption.

For example, according to data published by the US Environmental Protection Agency in 2022, over 91% of community water systems reported using chlorine for disinfection. Around 15% of these systems also upgraded their chlorination equipment or made process modifications to improve disinfection methods between 2020-2022. This clearly shows the continuing preference for chlorine-based disinfection and increasing investment in water treatment technologies using chlorine.

Market Driver – Increasing Usage in Pharmaceuticals

The usage of chlorine in the pharmaceutical industry has seen significant rise in the United States and is one of the key factors boosting the growth of the chlorine market. Chlorine and its derivatives such as ethylene dichloride, vinyl chloride monomer and others are extensively used across different domains in the pharmaceutical industry for manufacturing of several essential drugs and medicines.

Chlorine is used as an antimicrobial agent and disinfectant in medical facilities. According to the data published by the Centers for Disease Control and Prevention in 2021, healthcare associated infections are on the rise and an estimated 4.8% of hospitalized patients at any time will contract at least one infection. The growing focus on sanitization and disinfection amidst the ongoing pandemic is likely to augment the demand for chlorine in the healthcare sector for sterilizing medical devices, hard surfaces and equipment. In addition, chlorine derivatives act as essential intermediates in the production of various antibiotics, vaccines and other therapeutic drugs. The active pharmaceutical ingredients manufactured utilizing chlorine and its byproducts are widely adopted for treating cardiovascular, respiratory, neurological and infectious diseases.

Market Challenge – Volatility in Raw Material Prices

The volatility in raw material prices has negatively impacted the growth of the United States chlorine market in recent times. Chlorine is a key feedstock or raw material that is used across many major end-use industries like water treatment, pharmaceuticals, paper, construction, etc. However, the prices of chlorine raw materials like salt, hydrogen, and electricity have witnessed significant fluctuations over the past couple of years.

Salt is the primary raw material used in the production of chlorine and it accounts for nearly 35-40% of the total production cost. Salt prices in the United States increased sharply from $80 per ton in 2020 to nearly $120 per ton in early 2022 due to disruptions caused by severe winter storms and higher global demand (U.S. Geological Survey, 2022). Similarly, hydrogen which is used along with salt for chlorine production through electrolysis has also seen strong price escalation over the past year due to shortage of natural gas globally. Electricity costs have surged across many American states due to power outages and shutdown of coal-fired plants further driving up production costs for chlorine producers.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Opportunity – Growing Demand from Emerging Industries

The United States chlorine market is poised to benefit greatly from growing demand emanating from emerging industries in the coming years. One of the key industries driving increased chlorine consumption is water treatment. With rising concerns around water scarcity and quality, especially in the western states facing drought conditions, extensive investment is being made towards desalination and wastewater recycling infrastructure. Chlorine and its derivatives form an indispensable part of municipal water treatment processes to ensure safety.

According to data from the United Nations, over 80% of wastewater in America flows untreated into the environment presenting a major health concern. To address this issue, the US government has allocated funds towards building new wastewater treatment plants across 25 states under the Bipartisan Infrastructure Law. These plants will incorporate advanced treatment technologies relying on chlorine for disinfection. Similarly, desalination is gathering steam in California to augment water supplies. The state currently has over $4.5 billion in pipeline for seawater desalination projects by 2023. All such facilities will create a sustained need for chlorine and its compounds.

Segmental Analysis of United States Chlorine Market

To learn more about this report, Download Free Sample Copy

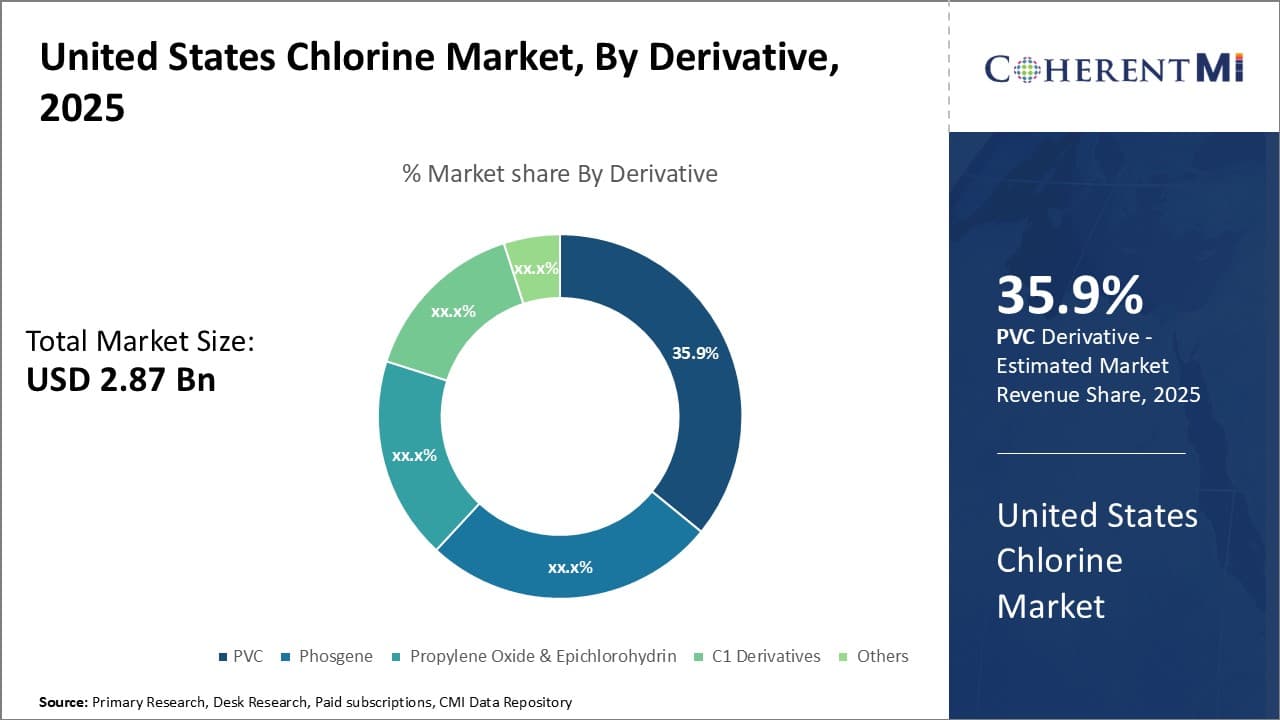

Insights, By Derivative: PVC Demand Drives Growth in the Chlorine Derivatives Segment

To learn more about this report, Download Free Sample Copy

Insights, By Derivative: PVC Demand Drives Growth in the Chlorine Derivatives Segment

Within the derivatives segment of the United States chlorine market, PVC is by far the largest and most influential with a market share of 35.9%. PVC demand is primarily driven by its widespread use in construction applications such as vinyl siding, pipes, profiles and fittings. The US construction industry has experienced steady growth in recent years, buoyed by factors such as population increase, economic expansion, and recovering housing starts post-recession. As long as construction activity remains vibrant, PVC consumption will continue increasing to meet the needs of builders and contractors.

Another key market for PVC is the automotive sector. Both new vehicle manufacturing and aftermarket parts require various vinyl components that provide benefits like durability, versatility and impact resistance. As Americans purchase more vehicles and keep their existing cars longer on the road, more PVC is incorporated into door panels, dashboards, upholstery, wiring insulation and other interior and exterior trim pieces. Strong auto sales volumes therefore translate directly into increased PVC demand.

Looking ahead, the emergence of more specialized PVC applications also positions the material for ongoing market share growth. Advanced formulations now allow PVC to replace traditional materials in demanding markets like medical devices, healthcare facilities, wire and cable.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

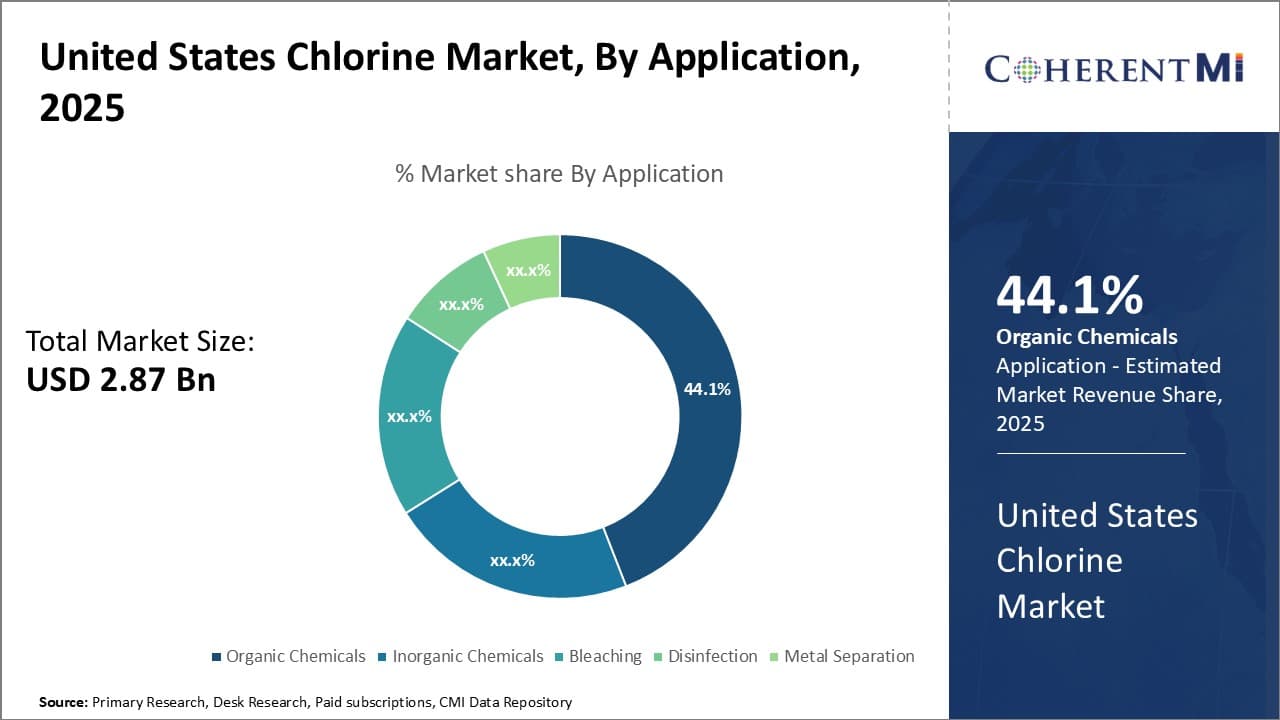

Insights, By Application: Organic Chemicals Sector Stimulates Strong Demand in Application Segment

Within the application segments of the US chlorine market, organic chemicals dominate with a market share of 44.1%. Chlorine is critically important as a feedstock and intermediate in producing a wide variety of end products. It serves as the basis for major commodity organic chemicals such as ethylene dichloride (EDC), vinyl chloride monomer (VCM) and polyvinyl chloride (PVC). These building blocks then go on to manufacture important plastics, polymers and resins with widespread industrial and consumer applications.

The outsized role of chlorine in foundational organic chemicals underscores why market fluctuations closely track trends in related sectors. For instance, when PVC and derivative plastic demand increases due to construction activity or automotive production, chlorine consumption rises in tandem as a PVC precursor. Similarly, expansions in ethylene and propylene derivatives like ethylene glycol directly stimulate higher chlorine feedstock requirements.

Outside of basic building block intermediates, chlorine also finds growing use in more specialized organic syntheses. Pharmaceutical, agrochemical and water treatment sectors increasingly utilize chlorinated compounds and rely on chlorine as a critical process material. As environmental regulations tighten and populations age, these high-value end markets are positioned for gains – pulling further chlorine volume along with their success.

Competitive overview of United States Chlorine Market

The major players operating in the United States Chlorine Market include Olin Corporation, Occidental Petroleum Corporation, Westlake Corporation, Hydrite Chemical Co., Air Liquide USA Inc., ERCO Worldwide, Formosa Plastics Corporation, Georgia Gulf Corporation, Kuehne Chemical Corporation, and Titanium Metals Corporation.

United States Chlorine Market Leaders

- Olin Corporation

- Occidental Petroleum Corporation

- Westlake Corporation

- Hydrite Chemical Co.

- Air Liquide USA Inc.

Recent Developments in United States Chlorine Market

- In August 2022, Olin Corporation, a leading manufacturer of chlorine in the U.S., announced plans to expand its chlorine production capacity at its facility in Freeport, Texas. The expansion is expected to increase the company's chlorine production by 200,000 tons per year, meeting the growing demand for chlorine in various industries.

- In October 2021, Occidental Petroleum Corporation, another major player in the U.S. chlorine market, acquired chlor-alkali assets from Mexichem, a Mexican chemical company. The acquisition included a chlor-alkali plant in Ingleside, Texas, which is expected to strengthen Occidental's position in the U.S. chlorine market.

- In June 2022, Westlake Corporation, a leading producer of chlorine in the U.S., announced plans to invest $2.5 billion in a new chlor-alkali facility in Petrokimia, Indonesia.

United States Chlorine Market Segmentation

- By Derivative

- PVC

- Phosgene

- Propylene Oxide & Epichlorohydrin

- C1 Derivatives

- Others (HCl, TiO2, etc.)

- By Application

- Organic Chemicals

- Inorganic Chemicals

- Bleaching

- Disinfection

- Metal Separation

Would you like to explore the option of buying individual sections of this report?

Vidyesh Swar is a seasoned Consultant with a diverse background in market research and business consulting. With over 6 years of experience, Vidyesh has established a strong reputation for his proficiency in market estimations, supplier landscape analysis, and market share assessments for tailored research solution. Using his deep industry knowledge and analytical skills, he provides valuable insights and strategic recommendations, enabling clients to make informed decisions and navigate complex business landscapes.