United States Container Glass Market Size - Analysis

The container glass market in the U.S. is a significant part of the broader glass packaging industry. It involves the production and distribution of glass containers that are used for packaging various products, including beverages, food, pharmaceuticals, and cosmetics. Container glass is widely used for packaging various products due to its transparency, impermeability, and recyclability. It is commonly used for packaging beverages like beer, wine, and spirits, as well as food items such as sauces, condiments, and preserves.

United States Container Glass Market- Drivers

- Sustainable packaging trends: Increasing awareness and demand for sustainable packaging solutions have driven interest in glass containers. Glass is highly recyclable and considered environmentally friendly, thus appealing to consumers and companies who are aiming to reduce their environmental impact.

- Preference for premium packaging: Glass is often associated with premium and high-quality packaging. In industries, such as beverages (especially wine and spirits), premium packaging can influence consumer perception and purchasing decisions, thereby contributing to the demand for glass containers.

- Craft beverage boom: The growth of the craft beverage industry, including craft beer, wine, and spirits, has positively impacted the container glass market. Craft producers often choose glass bottles for their products, thereby contributing to increased demand.

- Innovation in design and shape: Glass manufacturers continue to innovate in terms of bottle design, shape, and aesthetics. Unique and eye-catching packaging designs help products to stand out on store shelves, thus attracting consumer attention and influencing purchasing decisions.

- Recycling initiatives: The emphasis on recycling and circular economy practices benefits the glass industry. Glass is infinitely recyclable without loss of quality, and companies by using recycled glass (cullet) in their manufacturing processes contribute to sustainability goals.

United States Container Glass Market- Opportunities

- Health and wellness products: Position glass containers are ideal for health and wellness products, such as organic juices, health drinks, and nutritional supplements. Glass is inert and does not react with the contents, thus making it suitable for these applications.

- Global expansion: By leveraging the reputation of U.S.-manufactured glass containers, there may be potential for growth in international markets with a focus on quality packaging.

- Digitalization and smart packaging: Integrating technologies like Quick Response codes or Radio Frequency Identification Code into glass packaging can provide interactive and informational experiences for consumers. Emphasizing the use of recycled glass (cullet) in manufacturing processes will aid in aligning with sustainability goals and may provide cost advantages.

United States Container Glass Market- Restraints

- Competition from alternative materials: Glass faces competition from alternative packaging materials, such as plastic and aluminum. Each material has its own set of advantages and disadvantages, and the choice often depends on factors like cost, weight, and environmental considerations

- Transportation costs and weight: Glass containers are heavier as compared to some alternative materials, thus leading to higher transportation costs. The weight of glass can contribute to increased fuel consumption during transportation, thereby impacting both economic and environmental aspects.

- Environmental impact of production: While glass is highly recyclable, the production process itself can have a significant environmental impact. Energy-intensive manufacturing processes contribute to greenhouse gas emissions, and efforts to reduce this impact may face constraints.

- Fragility and breakage: The fragility of glass is a well-known constraint. Glass containers can break during handling, transportation, or storage, thereby leading to potential losses for manufacturers and retailers.

- Counterbalance: The glass containers need to be handled with utmost care to minimize the risk of its breakage during handling and transportation.

- Cost of recycling and cullet quality: The cost of collecting and recycling glass, as well as the quality of recycled glass (cullet), can be a challenge. Contamination of glass waste or issues that are related to the collection and recycling infrastructure can impact the quality of cullet.

- Limited use in flexible packaging: Glass is rigid and not well-suited for flexible packaging formats, which are gaining popularity in certain industries. This limitation may restrict its use in products where flexible packaging is preferred.

United States Container Glass Market-Analyst Viewpoint

The Southeast region dominates container glass production led by states like Georgia and Texas with their industrial infrastructure and proximity to raw materials. However, the West Coast is emerging as the fastest growing market. States like California and Washington are hubs of food processing and witness strong demand from local craft breweries and wineries. While the Northeast market is mature, manufacturers are enhancing capabilities to tap rising health drink demand.

Market Size in USD Bn

CAGR4.1%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 4.1% |

| Larget Market | United States |

| Market Concentration | High |

| Major Players | Owens-Illinois, Inc. (OI), Ardagh Group, Verallia, Anchor Glass Container Corporation, Vitro Packaging and Among Others |

please let us know !

United States Container Glass Market Trends

Light weighting technology: Light weighting initiatives involve the use of advanced manufacturing technologies to reduce the weight of glass containers. This not only improves the environmental footprint but also addresses concerns about transportation costs.

Craft beverage packaging: The rise of craft beverages, including craft beer, wine, and spirits, has led to increased demand for distinctive glass packaging. Craft producers often seek customized and unique bottle designs to stand out in a competitive market.

Segmental Analysis of United States Container Glass Market

Competitive overview of United States Container Glass Market

Owens-Illinois, Inc. (OI), Ardagh Group, Verallia, Anchor Glass Container Corporation, Vitro Packaging, Ardagh Glass Packaging

United States Container Glass Market Leaders

- Owens-Illinois, Inc. (OI)

- Ardagh Group

- Verallia

- Anchor Glass Container Corporation

- Vitro Packaging

United States Container Glass Market - Competitive Rivalry

United States Container Glass Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in United States Container Glass Market

New Product Launches

- August 2023: O-I Glass, a prominent manufacturer of glass packaging for the food and beverage industry, introduced its innovative "Cento per Cento Sicily" bottles. These bottles showcase a distinct circular economy concept through a custom bottom logo. The entire production of these bottles takes place at O-I's facility in Marsala, Italy. Crafted from a minimum of 90% recycled glass, locally sourced from Sicily, these containers are not only eco-friendly but also remarkably lightweight, weighing a mere 410 grams. This design ensures optimal energy efficiency during the manufacturing process.

- August 2023: Revino, U.S.-based recycling company, launched its pioneering end-to-end refillable glass bottle reuse system for addressing the pressing need for sustainability in the wine sector

Acquisition and partnerships

- In March 2022 - Berlin Packaging, the global hybrid packaging supplier acquired the United Bottles & Packaging, a North America-based distributor of high-quality glass bottles and closures for the food and beverage end markets.

United States Container Glass Market Segmentation

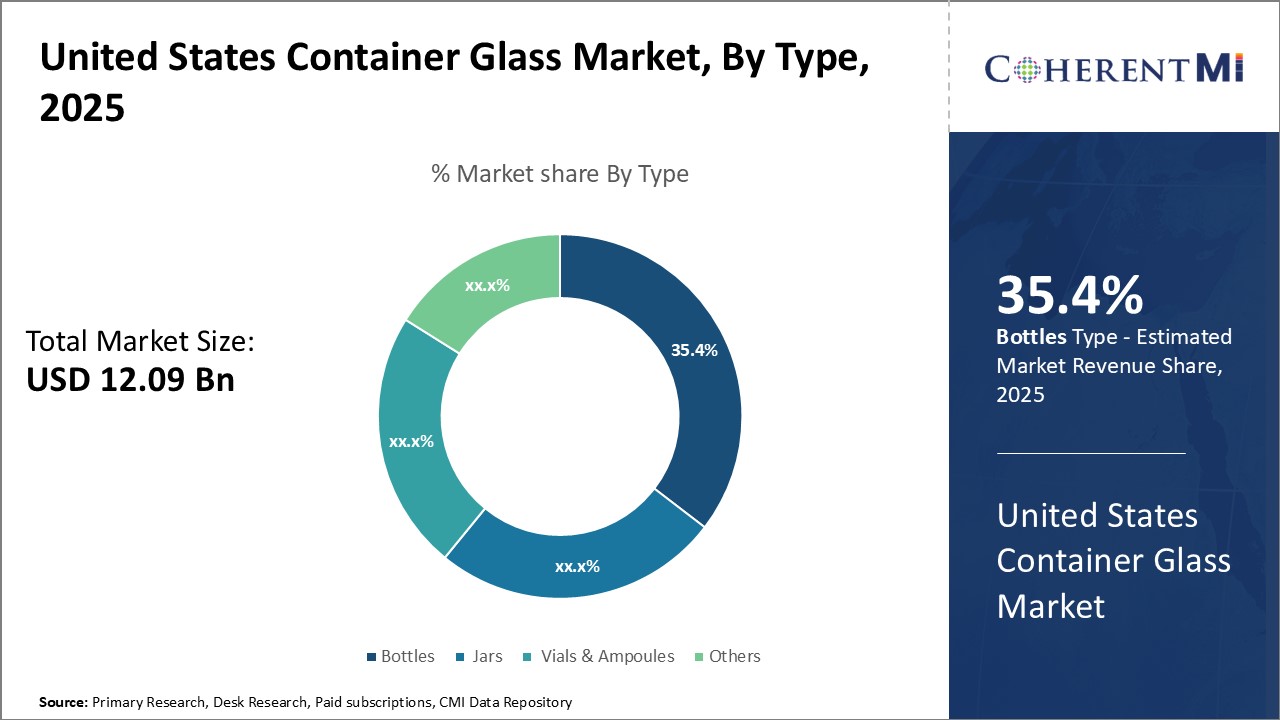

- By Type

- Bottles

- Jars Vials & Ampoules

- Others (Candle Glass Container, etc.)

- By Application

- Cosmetic & Perfumes

- Pharmaceuticals

- Food Packaging

- Beverage Packaging and Other (Chemicals, etc.)

Would you like to explore the option of buying individual sections of this report?

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Frequently Asked Questions :

How big is the United States Container Glass Market?

The United States Container Glass Market is estimated to be valued at USD 12.09 in 2025 and is expected to reach USD 16.02 Billion by 2032.

What are the major factors driving the United States container glass market?

Sustainable packaging trends, preference for premium packaging, craft beverage boom, innovation in design and shape, and recycling initiatives are the major factors driving the United States container glass market.

Which is the leading component segment in the United States container glass market?

The leading component segment in the United States container glass market is bottles under by type.

Which are the major players operating in the United States container glass market?

The major players operating in the United States container glass market are The Owens-Illinois, Inc. (OI), Ardagh Group, Verallia, Anchor Glass Container Corporation, Vitro Packaging, Ardagh Glass Packaging - North America, and Glass Container Manufacturer's Institute (GCMI) Member Companies.

What will be the CAGR of United States container glass market?

The CAGR of the U.S. container glass market is 4.1%.