United States Infant Nutrition Market Size - Analysis

The United States Infant Nutrition Market is estimated to be valued at USD 14.60 Bn in 2025 and is expected to reach USD 21.52 Bn by 2032, growing at a CAGR of 5.7% from 2025 to 2032.

Market Size in USD Bn

CAGR5.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.7% |

| Market Concentration | High |

| Major Players | Abbott Nutrition, Mead Johnson Nutrition, Nestle USA, Perrigo Company, Danone S.A. and Among Others |

please let us know !

United States Infant Nutrition Market Trends

The demand for organic and natural products has seen significant rise over the past few years in the United States. An increasing number of health conscious parents are looking to offer their infants foods made from organic and natural ingredients without any synthetic preservatives, pesticides, hormones, or antibiotics. This growing preference for clean label products is directly benefiting the infant nutrition market. According to the USDA, sales of organic food products increased by over 14% between 2019 and 2020. Awareness around the potential health risks associated with chemicals used in conventional infant foods is a major factor influencing parental choices. More parents want products that are gentler on sensitive infant digestive systems and offer optimal nutrition.

Increasing awareness around nutrition and health among parents in the United States is a major driver propelling the growth of the nation's infant nutrition market. More and more mothers are conscious about providing their babies with balanced and nutritious first foods which are essential for proper development in early years. The Centers for Disease Control and Prevention recommends exclusively breastfeeding infants for the first 6 months which has boosted the sales of breastmilk alternatives.

High production costs pose a major challenge restraining the growth of United States infant nutrition market. Producing infant formula requires stringent processes to ensure highest quality and safety standards as it caters to the nutrition of fragile newborns. Strict regulatory frameworks mandate compliance to quality certifications involving complex manufacturing procedures and protocols. This increases production costs substantially.

The cost burden is passed on to consumers making infant formula less affordable for many American households. According to the 2020 Census Bureau data, the poverty rate in United States stood at 11.4% with millions of families struggling to make ends meet especially during the pandemic.

The Covid-19 pandemic has accelerated the shift towards online shopping in the United States as people have been staying indoors amidst lockdowns and social distancing norms. This presents a huge growth opportunity for players in the infant nutrition market to capitalize on the growing demand for online sales through strategic partnerships and enhancing their direct-to-customer capabilities.

Furthermore, the growing popularity of subscription models for regular purchases of items like diapers and formula boxes through auto-delivery has seen a massive boost during this time. This ensures uninterrupted supply and saves customers’ time from frequent grocery visits. Several major players have partnered with online retailers to set up dedicated storefronts and launch subscription programs over the past year.

Segmental Analysis of United States Infant Nutrition Market

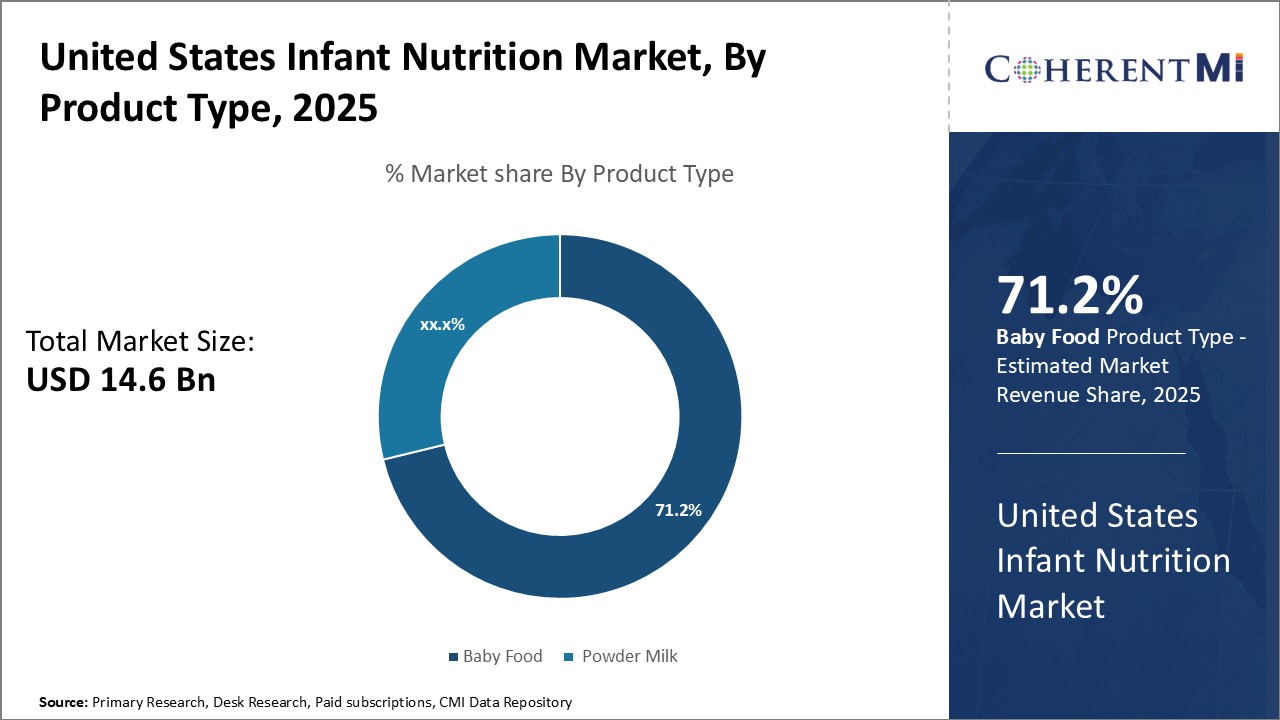

Insights, By Product Type: Health Benefits of Powder Milk

Insights, By Product Type: Health Benefits of Powder MilkIn terms of product type, powder milk sub-segment contributes the highest share of 71.2% in the market owning to perceived health benefits.

Additionally, powder milk formulations are developed using stringent guidelines and quality standards ensuring hygiene and safety. This gives parents a sense of assurance about the quality and purity of nutrients presents in powder milk. The drying process employed in manufacturing powder milk is also believed to retain all nutritional qualities better than alternative forms of milk. These perceived health advantages have resulted in higher consumption and demand for powder milk among American parents fulfilling their needs for the best infant nutrition options. Various milk formula brands promoting powder milk as the most 'complete nutrition' comparable to breastmilk have further boosted its acceptance over other segments.

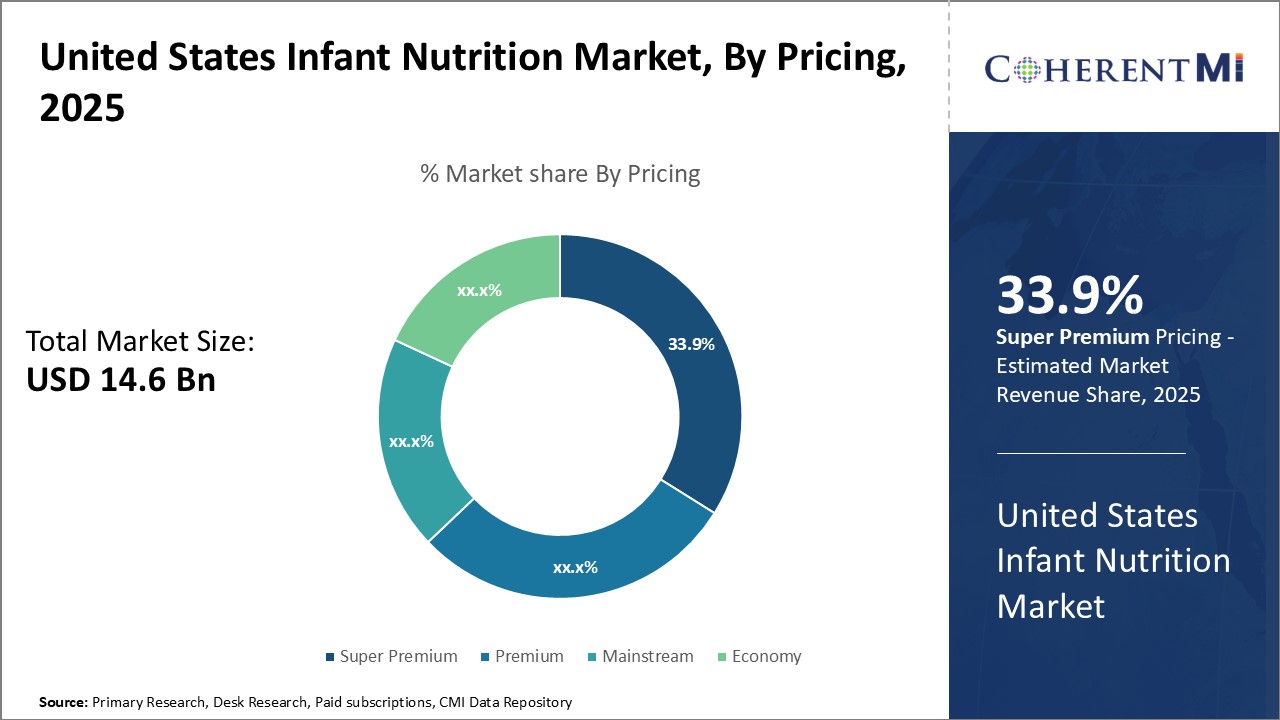

Within the pricing segmentation of the United States infant nutrition market, the super-premium sub-segment contributing highest share of 33.9% is driven by parents' willingness to pay premium prices for higher nutrition and premium brands. Parents perceive super premium products to offer finest quality ingredients, advanced formulations tailored to specific needs and superior nutritional value justified by their higher costs.

Affluent American parents moreover consider super premium buys as 'investments' towards securing their babies' long-term health and development. Brands resonating these aspirations and values have succeeded in this competitive segment. Sustainability initiatives and emphasis on organic, non-GMO ingredients further augment the 'superiority aura' of premium products driving repeat purchases by quality-conscious customers. Thus, the perception of 'you get what you pay for' drives sustained demand for high-priced yet exclusive super premium variants within the United States infant nutrition sector.

Competitive overview of United States Infant Nutrition Market

The major players operating in the United States Infant Nutrition Market include Abbott Nutrition, Mead Johnson Nutrition, Nestle USA, Perrigo Company, Danone S.A., Reckitt Benckiser (Mead Johnson & Company, LLC), Bellamy's Organic, Biostime, DMK Baby GmbH, and Ausnutria.

United States Infant Nutrition Market Leaders

- Abbott Nutrition

- Mead Johnson Nutrition

- Nestle USA

- Perrigo Company

- Danone S.A.

United States Infant Nutrition Market - Competitive Rivalry

United States Infant Nutrition Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in United States Infant Nutrition Market

- In January 2024, Nestle introduced a new line of infant formula products in the United States, featuring advanced nutritional profiles and improved taste.

- In October 2022, Abbott Laboratories announced plans to expand its infant nutrition operations in the United States, including the construction of a new manufacturing facility and the introduction of new products.

- In July 2022, Danone S.A launched a new line of organic infant formula products in the United States, catering to the growing demand for organic and natural products.

United States Infant Nutrition Market Segmentation

- By Product Type

- Baby Food

- Powder Milk

- By Pricing

- Super Premium

- Premium

- Mainstream

- Economy

Would you like to explore the option of buying individual sections of this report?

Shivam Bhutani has 6 years of experience in market research and strategy consulting. He is a Market Research Consultant with strong analytical background. He is currently an MBA candidate specializing in Business Analytics from BITS Pilani.

He is adept at navigating diverse roles from sales and marketing to research and strategy consulting. He excels in market estimation, competitive intelligence, pricing strategy, and primary research. He is skilled at analysing large datasets to provide precise insights, helping clients in achieving strategic transformation across various industries. He is skilled in leveraging data visualization techniques to drive innovation and enhance business processes.

Frequently Asked Questions :

How big is the United States Infant Nutrition Market?

The United States Infant Nutrition Market is estimated to be valued at USD 14.60 in 2025 and is expected to reach USD 21.52 Billion by 2032.

What are the major factors driving the United States Infant Nutrition Market growth?

The growing demand for organic and natural products and increasing awareness of nutrition and health are the major factors driving the United States Infant Nutrition Market.

Which is the leading Product Type in the United States Infant Nutrition Market?

The leading Product Type segment is Powder Milk.

Which are the major players operating in the United States Infant Nutrition Market?

Abbott Nutrition, Mead Johnson Nutrition, Nestle USA, Perrigo Company, Danone S.A., Reckitt Benckiser (Mead Johnson & Company, LLC), Bellamy's Organic, Biostime, DMK Baby GmbH, and Ausnutria are the major players.

What will be the CAGR of the United States Infant Nutrition Market?

The CAGR of the United States Infant Nutrition Market is projected to be 5.7% from 2025-2032.