United States Pharmaceuticals Market Size - Analysis

Pharmaceuticals refer to prescription and over-the-counter drugs used for diagnosis, treatment, cure, mitigation, or prevention of diseases in humans or animals. The market is driven by rising prevalence of chronic diseases, new drug launches, and increasing healthcare expenditure.

- Increasing Prevalence of Chronic Diseases: The rising prevalence of chronic diseases such as cancer, cardiovascular diseases, diabetes is a major factor driving growth in the United States pharmaceuticals market. The population afflicted with chronic diseases is growing steadily owing to sedentary lifestyles, unhealthy diets, higher stress levels, and an aging population. Pharmaceutical drugs are required on a continuous basis to manage chronic diseases. New drug development is focused on addressing unmet needs for chronic disease treatment. For instance, according to the National Center for Biotechnology Information the bradycardia incidences were majorly reported during COVID-19 in 2021, when remdesvir was administered in patients suffering from coronavirus. According to World Heath Federation report, in 2021, 1 billion people across the globe suffered from bradycardia in 2020.

- Favorable Regulatory and Reimbursement Scenario: The regulatory framework provided by the US FDA facilitates accelerated review and approval of novel drugs and therapies for patients. Initiatives such as the fast track, breakthrough therapy, accelerated approval, and priority review designations expedite the development and review of drugs for serious illnesses. Further, the reimbursement policies offer coverage for a majority of prescription drug costs under Medicare Part D plans, Medicaid, and private insurers. This provides accessibility and affordability for pharmaceuticals. According to the U.S. Food and Drug Administration (USFDA), any drug that is safe and effective for direct consumer use based on mentioned label instructions and warnings are considered to be over the counter or nonprescription drugs. There are two regulatory pathways for OTC drugs to get approval from the USFDA, which include OTC New Drug Application (NDA) and OTC Drug Monograph. Standards for safety and efficacy, Good Manufacturing Practices (inspections), and Labeling under 21 CFR 201.66 are required to be done for OTC products.

United States Pharmaceuticals Market Opportunities:

- Growing Adoption of Personalized Medicine: Advances in genomics, biomarkers and companion diagnostics are enabling more targeted therapies catered to patients based on their genetic makeup and molecular profiles. Personalized medicine can help avoid trial-and-error prescription and improve outcomes through optimal treatments tailored to the individual. Precision oncology is at the forefront of this opportunity.

- Rising Demand for Cell and Gene Therapies: Cell and gene therapies offer tremendous potential for curing rare genetic disorders and cancers by modifying the body’s own cells or introducing healthy genes. CAR T-cell therapies for blood cancers have already been approved. Significant investment and R&D is focused on next-generation cell & gene therapies to treat a wide range of diseases. Their transformative potential presents a big opportunity.

- Probablity of Drug Abuse: U.S. over-the-counter drugs market is expected to be hampered due to the lack of stringent regulations and enforcements by the regulatory authorities. This is expected to restrain the growth of the market over the forecast period. For instance, according to DrugAbuse.gov: 2020, approximately 3.1 million young people aged 12 to 25 have used a nonprescription cough and cold medication to get high. Moreover, in the U.S., in the year 2020, there were around 2.1 million hospital visits related to drug abuse, 27.1% involved the nonmedical use of pharmaceuticals (OTC medications). Furthermore, according to the National Institute on Drug Abuse, in the U.S., around 3.4% high school seniors had been misusing cough medicine in 2018. Thus, the high probability of drug abuse is expected to hamper the growth of the market over the forecast period.

Market Size in USD Bn

CAGR8.8%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.8% |

| Larget Market | Northeast |

| Market Concentration | High |

| Major Players | Johnson and Johnson Inc., Pfizer Inc., AbbVie Inc., Merck KGaA, Bristol-Myers Squibb Company and Among Others |

please let us know !

United States Pharmaceuticals Market Trends

- Rising Popularity of OTC Medicines: The OTC drugs market has witnessed substantial growth in recent years driven by healthcare consumerism, self-medication, and availability of Rx-to-OTC switches. Increased access to information and awareness about side effects is boosting adoption of OTC drugs. Availability of OTC drugs improves patient access while reducing pressure on the healthcare system. The switch from Rx to OTC refers to the transfer of proven prescription drugs to non-prescription drugs. Due to the switch, many people can conveniently buy and use a wider range of analgesics, antihistamines, heartburn reducers, nicotine replacement products and cough, cold and flu products without consulting a doctor. For instance, in 2020, the U.S. Food and Drug Administration (U.S. FDA) converted GlaxoSmithKline’s Voltaren Arthritis Pain (diclofenac sodium topical gel, 1%), Alcon’s Pataday Twice Daily Relief (olopatadine HCl ophthalmic solution/drops, 0.1%), and Once Daily Relief (olopatadine HCl ophthalmic solution/drops, 0.2%), to OTC drugs

- Northeast: The Northeast region is the largest pharmaceutical market in the US, with a market share of over 40%. The region is home to some of the largest and most affluent cities in the US, as well as a number of major pharmaceutical companies.

- West: The West region is the second-largest pharmaceutical market in the US, with a market share of over 30%. The region is home to a number of large and growing cities, as well as a number of biotech companies.

- South: The South region is the third-largest pharmaceutical market in the US, with a market share of over 15%. The region is home to a number of large and growing cities, as well as a number of pharmaceutical companies.

- Midwest: The Midwest region is the smallest pharmaceutical market in the US, with a market share of under 15%. The region is home to a number of large and growing cities, but it also has a number of rural areas.

Segmental Analysis of United States Pharmaceuticals Market

Competitive overview of United States Pharmaceuticals Market

Major Players operating in the United States Pharmaceuticals Market include Johnson and Johnson Inc., Pfizer Inc., AbbVie Inc., Merck KGaA, Bristol-Myers Squibb Company, Amgen Inc., Eli Lilly and Company, Novartis AG, Gilead Sciences, Inc. , F. Hoffmann-La Roche Ltd, Sanofi, AstraZeneca, GSK plc., Bayer AG, Boehringer Ingelheim International GmbH, Teva Pharmaceutical Industries Ltd., Abbott and Biogen

United States Pharmaceuticals Market Leaders

- Johnson and Johnson Inc.

- Pfizer Inc.

- AbbVie Inc.

- Merck KGaA

- Bristol-Myers Squibb Company

United States Pharmaceuticals Market - Competitive Rivalry

United States Pharmaceuticals Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in United States Pharmaceuticals Market

New product launches:

- In July 2020, Novartis AG, a pharmaceutical company launched a portfolio of 15 generics and OTC medicines from the Sandoz division in order to treat patients with COVID-19 patients. The OTC products includes for the treatment of gastro-intestinal illness, acute respiratory symptoms, pneumonia as well as septic shock.

- In March 2020, , U.S. Food and Drug Administration (FDA) approved GlaxoSmithKline’s Advil Dual Action, the first OTC formulation combining ibuprofen and acetaminophen, for pain relief.

Acquisition and partnerships:

- In August 2022, the Novartis AG company, pharmaceutical company, divested Sandoz, its generics and biosimilars division into a new publicly traded standalone company, by way of a 100% spin-off. The independent Sandoz would have a US American Depositary Receipt (ADR) programme in addition to having its headquarters in Switzerland and being listed on the SIX Swiss Exchange

- On October 08, 2022, GlaxoSmithKline Plc., pharmaceutical and biotechnology company, announced three collaboration agreement with Tempus, library of clinical & molecular data and an operating system. The collaboration agreement will allow to increase the pace of clinical trials which may help in launching more products in the market, including OTC products.

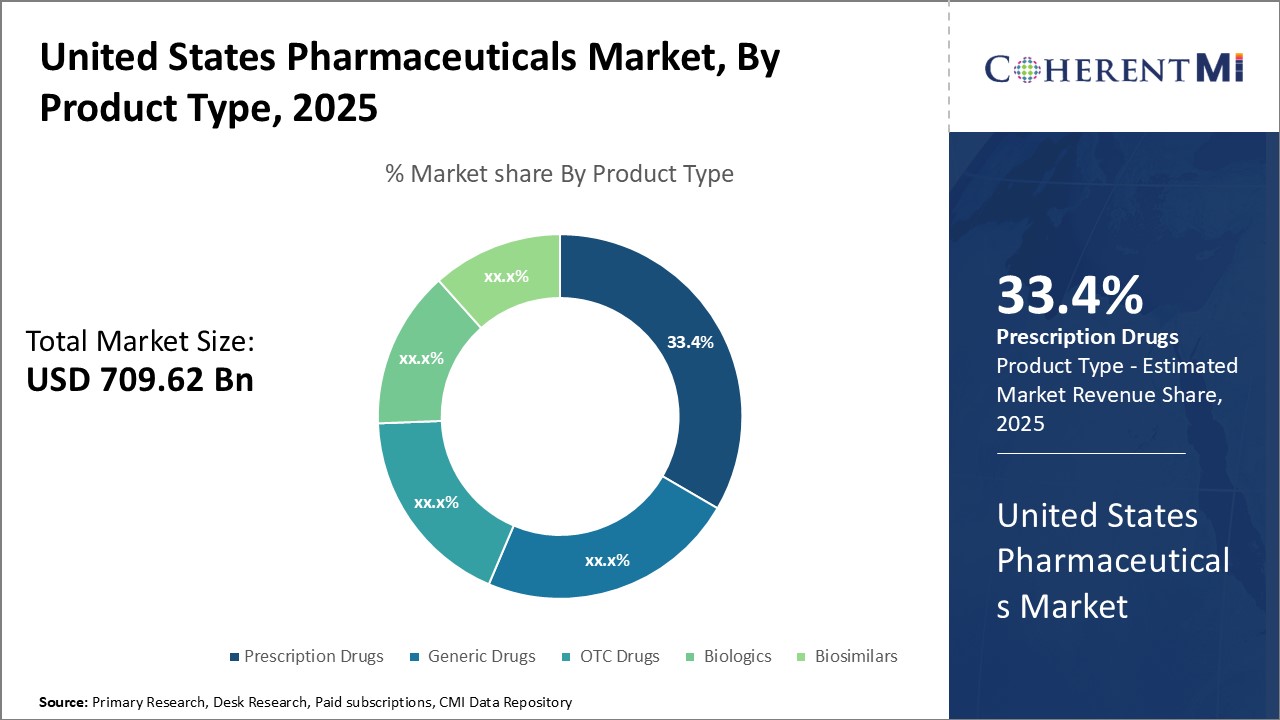

United States Pharmaceuticals Market Segmentation

- By Product Type

-

- Prescription Drugs

- Generic Drugs

- OTC Drugs

- Biologics

- Biosimilars

- By Therapy Area

-

- Oncology

- Diabetes

- Autoimmune Diseases

- Neurological Disorders

- Cardiovascular

- Infectious Diseases

- Others (Respiratory, Gastrointestinal, etc.)

- By Distribution Channel

-

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

- By Route of Administration

-

- Oral

- Parenteral

- Topical

- Others

- By End-User

-

- Hospitals

- Clinics

- Homecare

- Others

- By Geography

-

- Northeast

- West

- South

- Midwest

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Frequently Asked Questions :

How big is the United States Pharmaceuticals Market?

The United States Pharmaceuticals Market is estimated to be valued at USD 709.6 in 2025 and is expected to reach USD 1280.6 Billion by 2032.

What are the major factors driving the United States Pharmaceuticals Market growth?

Rising prevalence of chronic diseases, favorable regulatory policies, rising healthcare spending, growth in biologics and biosimilars.

Which is the leading component segment in the United States Pharmaceuticals Market?

The leading component segment is the prescription drugs segment.

Which are the major players operating in the United States Pharmaceuticals Market?

Johnson & Johnson, Pfizer, AbbVie, Merck, Bristol-Myers Squibb, Amgen, Eli Lilly, Novartis, etc.

Which region will lead the United States Pharmaceuticals Market?

Northeast is expected to lead the United States Pharmaceuticals Market.

What will be the CAGR of United States Pharmaceuticals Market?

The CAGR of United States Pharmaceuticals Market is projected to be 8.8% from 2025-2032.