ベクター精製市場 サイズ - 分析

ベクトル浄化市場は、評価されると推定される 2024年のUSD 336 Mn そして到達する予定 USD 1,300 Mn による 2031, 化合物年間成長率で成長 2024年から2031年にかけて21.3%のCAGR。

市場は、予測期間中に重要な成長を目撃する予定です。 遺伝子治療およびワクチン生産のための非常に純粋なベクトルのための成長した需要は市場を運転しています。 また、医薬品やバイオテクノロジー企業による研究開発投資の増加や、ベクター浄化のためのビッグデータや機械学習などの高度な技術の普及が更に市場成長を加速しています。 しかしながら、下流処理の複雑性やベクター精製技術に関連した高コストは、市場拡大を多少妨げる可能性があります。

市場規模(米ドル) Mn

CAGR21.5%

| 調査期間 | 2025-2032 |

| 推定の基準年 | 2024 |

| CAGR | 21.5% |

| 市場集中度 | High |

| 主要プレーヤー | アジレントテクノロジー, BIAの分離, バイオ・ロード研究所, メルク, サーモフィッシャー科学 その他 |

お知らせください!

ベクター精製市場 トレンド

市場ドライバー - 精製技術の進歩

技術的進歩は、ベクター浄化市場を強化する別の重要な要因です。 浄化技術は、より高い解像度の分離、より大きい選択性、およびウイルス粒子のより効率的なキャプチャを達成するために長い方法来ます。 臨床レベルのバイラルベクターのGMP製造を容易にする堅牢でスケーラブルなソリューションを開発するために、継続的な取り組みを行っています。 クロマトグラフィー媒体、最適化された緩衝システム、自動モジュラー機器へのアップグレードを含みます。

クロマトグラフィーは、ほとんどの産業規模の浄化のステップのための選択の方法を残します。 いくつかの企業は、特定のベクタータイプに適した新しい静止期の化学品を通してカラムのクロマトグラフィー技術を強化しています。 たとえば、ベッド吸着が高層AAVの準備を浄化するための有利なユニット操作として登場しました。 また、効率的なタンジェンシャル超/浸水用に設計された膜は、強化のための高められた使用を見つけることだけでなく、浄化されたウイルスの準備の緩衝を交換します。

設計された粒子は、ウイルスベクトルの選択的なキャプチャを達成するために、リグンドと競合しています。 これは、ナノボディ、オリゴナクレオチドアプタマーおよび他の親和性タグを含みます。 そのような類縁材料を統合するシステムは高い結合容量および容易な拡張性を提供します。 同様に、流動性のベッドのadsorbersを利用している連続的なクロマトグラフィーは高い動的結合容量の優秀な決断を達成できます。

Analytics は、リリーステストからリアルタイムのプロセス監視まで、より堅牢で自動化されるようにします。 機械学習と人工知能の展開は、クロマトグラフ法の開発と最適化を推進するのに役立ちます。 全体的に、精製技術の進歩は、現在のボトルネックに対処し、均一な品質を確保しながら収量とスループットを最大限に高めるのを支援しています。 これは、高機能ウイルスベクター浄化ソリューション市場での成長を亜鉛メッキします。

市場機会 - 新興市場の拡大

アジア・パシフィック地域は、バイオテクノロジーと製薬産業の急速な拡大により燃料を供給するベクター浄化市場にとって重要な機会として誕生しています。 中国、インド、韓国などの国々は、有利な政府政策と成長するインフラで支えられたバイオテクノロジーの研究と製造に大きな投資を目撃しています。 この領域は、遺伝子治療、ワクチン生産、およびその他の高度な治療に特に焦点を合わせ、バイオ医薬品イノベーションのためのグローバルハブになっています。 これらの産業が成長するにつれて、効率的でスケーラブルなベクター浄化技術に対する需要は、この領域で稼働している企業のための有利な市場を提示し、サージすることが期待されます。 慢性疾患の増大に伴い、中級の人口増加に伴い、先進的な治療の必要性を増幅し、アジア・パシフィックをベクターの浄化における将来の成長のための重要な地域にします。

主要プレーヤーが採用した主な勝利戦略 ベクター精製市場

大手のプレーヤーは、研究機関や病院と戦略的なパートナーシップを結び、ベクター浄化における新しい技術と専門知識へのアクセス権を獲得しています。 例えば、2017年、Merck KGaAはGeneWerkと提携し、Plasmidの生産と遺伝子ベクトル浄化の専門知識を活用しています。 このパートナーシップは、Merckがウイルスベクトル製造能力を拡大するのに役立ちます。

企業は、製品ポートフォリオを強化するために、補完的な技術で小規模なプレーヤーを獲得しています。 2019年、米系分子検査サービス会社Cognate BioServicesを取得。 この買収は、コグロンの組換えAAV(rAAV)とレンチル技術を用いたLonzaのウイルスベクトル開発と製造能力を拡大しました。

プレイヤーは、高度なベクトル精製ソリューションを開発するために研究開発に継続的に投資します。 たとえば、サーモフィッシャーは、2020年に研究開発に500万ドルを投資し、新しいクロマトグラフィー製品とウイルスベクターの浄化のための単一使用技術を起動しました。 EXPERION自動電気泳動システムは、研究者がベクトル浄化プロセスを開発し、最適化するのに役立ちます。

大手企業は、新しい施設を通じて、新興アジア・中南米市場に進出しました。 2018-19年に中国とプエルトリコにSartoriusが生産拠点をオープンし、遺伝子と細胞療法の研究を成長させることにより、ウイルスベクターの需要が高まっています。 この効果的なローカリゼーション戦略は、サルトリアスが重要な市場シェアを獲得するのに役立ちました。

セグメント分析 ベクター精製市場

洞察、浄化の技術のタイプによって: クロマトグラフィーの高い解像度とスケーラビリティ

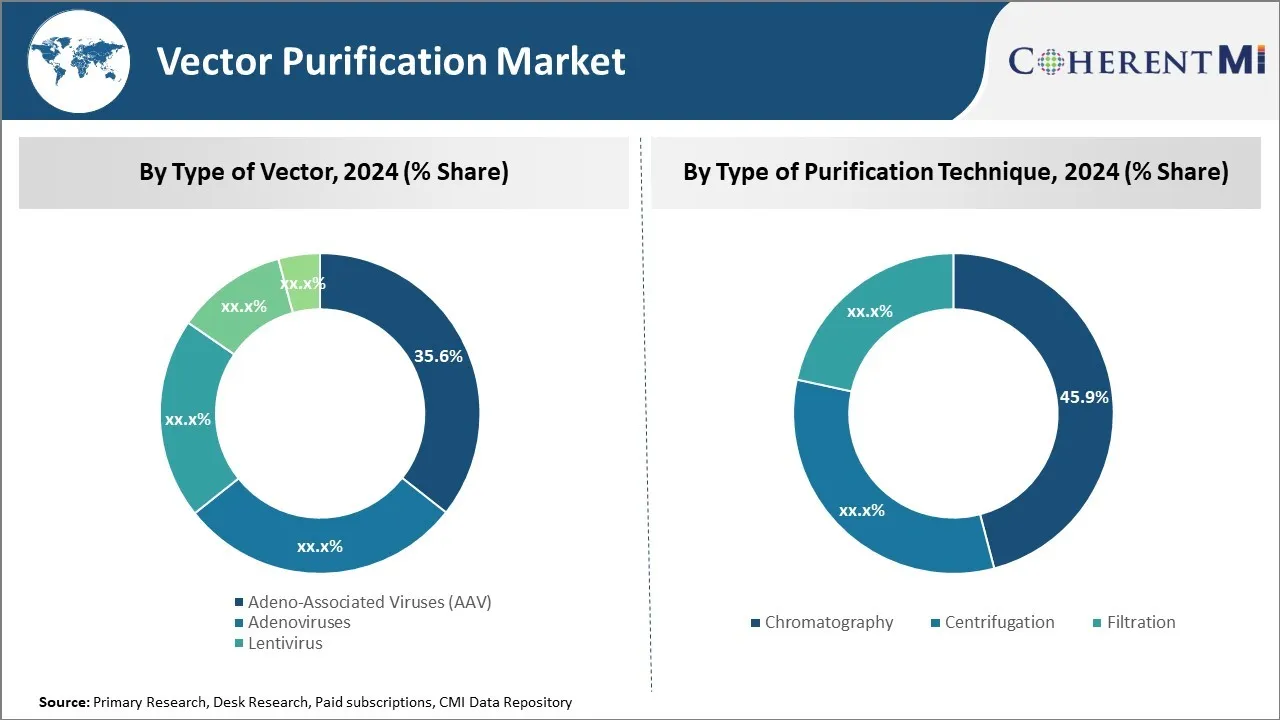

精製技術の種類では、クロマトグラフィーサブセグメントは、高分解能とスケーラビリティにより、市場で最高45.9%のシェアに貢献します。 クロマトグラフィーは、生産細胞培養からAAVのようなウイルスベクトルを浄化するために使用される主な方法になりました。 化学的および物理的性質に基づく高解像分離を可能にします。 イオン交換、サイズ排除、アフィニティなどのさまざまなクロマトグラフィーモダリティは、個別または組み合わせて、ターゲットのウイルス粒子を不純物から選択的に捕獲します。

クロマトグラフィー操作は、バイオリアクターのボリュームを増加させることで、タンデムですぐにスケールアップすることができます。 複数の列は、シリーズまたは並列構成でリンクして、産業レベルへのスループットを高めることができます。 生産性と再現性をさらに高めるオートメーション。 その分析機能は、メーカーが純度、アイデンティティ、効力などの重要な製品特性を確認できるように、重要な品質管理を提供します。

遺伝子および細胞療法は、後期臨床試験および商品化に加速するので、堅牢でスケーラブルな下流浄化がさらに向上します。 クロマトグラフィーは、継続的な最適化を通じて、これらのエスカレート要求を満たすために一意に適しています。 蓄積されたプロセスおよび装置の知識の富はクロマトグラフィーのコラムを救命振動ベクトルの広範な製造に必要な信頼性および柔軟性作ります。 さらなる規制遵守と商業的生存率は、クロマトグラフィーによる浄化に依存します。

追加の洞察 ベクター精製市場

- ベクトル浄化市場は、特に遺伝子および細胞療法の上昇の採用によるウイルスベクトルの需要の増加によって運転されます。 市場は、浄化プロセスのコストと技術的な複雑さに関する課題に直面しています。 しかし、浄化技術の進歩と、ウイルス性ベクターベースの治療のための臨床試験の増加は、重要な市場成長を促進することが期待されます。

競合の概要 ベクター精製市場

ベクトル浄化市場で動作する主要なプレーヤーは、サーモフィス科学、メルク、アジレント技術、BIA分離、バイオ レーダー研究所、サイティバ(旧GEライフサイエンス)、サルトリアス、タカラバイオおよびバイオビジョンが含まれます。

ベクター精製市場 リーダー

- アジレントテクノロジー

- BIAの分離

- バイオ・ロード研究所

- メルク

- サーモフィッシャー科学

ベクター精製市場 - 競合関係

ベクター精製市場

(大手プレーヤーが支配)

(多くのプレーヤーが参入し、競争が激しい。)

最近の動向 ベクター精製市場

- 2023年7月、バイオヴィアンは、フィンランドのトゥルクで製造施設を拡大し、アデノビアルとアデノ・アソシエーテッド・ウイルス治療のために50万ドルを投資しました。

- 2023年6月、Texcellは、バイオ医薬品および医療機器のウイルスの安全性を向上させるために、北米で試験施設を開設しました。

ベクター精製市場 セグメンテーション

- ベクトルの種類

- アデノ・アソシエイト・ウイルス(AAV)

- アデノウイルス

- レンティウイルス

- レトロウイルス

- その他

- 浄化技術の種類別

- クロマトグラフィー

- 遠心分離機

- ろ過

購入オプションを検討しますか?このレポートの個々のセクション?

Vipul Patil は、製薬業界で 6 年間の経験を積んだダイナミックな経営コンサルタントです。分析力と戦略的洞察力に優れた Vipul は、製薬会社と提携して業務効率の向上、より広範な拡大、収益性の高い市場での流通の複雑さへの対応に成功しています。

よくある質問 :

ベクトル浄化市場の成長を妨げる重要な要因は何ですか?

ウイルスベクターの大規模な浄化における浄化プロセスと技術的な課題に関連した高いコストは、ベクター浄化市場の成長を妨げる主要な要因です。

ベクター精製市場成長を促進する主要な要因は何ですか?

遺伝子および細胞療法の採用が増加し、歩留まりおよび効率を高める浄化技術の進歩がベクトル浄化の市場を運転する主要な要因によるウイルスのベクトルのための増加された要求はあります。

ベクトル浄化市場におけるベクトルのリーディングタイプは?

ベクトルセグメントのリーディングタイプは、アドノ・アソシエーションウイルス(AAV)です。

ベクトル浄化市場で動作する主要な選手は?

サーモフィッシャー科学、メルク、アジレントテクノロジーズ、BIA分離、バイオ・レーダー研究所、サイティバ(旧GEライフサイエンス)、サルトリアス、タカラバイオ、バイオビジョンが主要なプレーヤーです。

ベクトル浄化市場のCAGRは何ですか?

ベクトル浄化市場のCAGRは、2024-2031から21.3%になるように計画されています。