Vulvar Cancer Drugs Market Size - Analysis

Market Size in USD Bn

CAGR8.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.7% |

| Market Concentration | Medium |

| Major Players | Massachusetts General Hospital, Merck Sharp & Dohme LLC, Shanghai Bovax Biotechnology Co. Ltd., Chongqing Bovax Biopharmaceutical Co. Ltd., Xencor Inc. and Among Others |

please let us know !

Vulvar Cancer Drugs Market Trends

With increasing awareness about women's health issues, more women are becoming wary of symptoms related to vulvar cancer. Various nonprofit organizations and women support groups have risen awareness about vulvar cancer through social media campaigns and community programs. They emphasize the need for regular vulvar examinations especially for older women who are at higher risk of developing the disease. This has encouraged more women to seek medical advice if they experience any unusual changes or symptoms in the vulvar area.

The out-of-pocket spending for patients has reduced significantly giving them confidence to undergo recommended vulvar examinations and avail quality care without financial constraints if a cancer is detected. The favorable policies of both government and private health insurers regarding cancer treatments have accelerated the uptake of modern vulvar cancer drugs in many countries.

Market Driver - Technological Advancements and New Drug Developments

Besides, advanced techniques like nanomedicine, 3D bioprinting and artificial intelligence are speeding up drug discovery processes. A few vulvar cancer drugs developed using these innovative approaches have demonstrated encouraging results in clinical trials. They have more selective mechanisms of action and milder side effects compared to conventional chemotherapy drugs.

Market Challenge - High Cost of Treatment and Limited Reimbursement Options

Furthermore, vulvar cancer has a relatively low incidence rate which affects only around 1 in every 1,000 women. This translates to a small patient pool for drug manufacturers to recover their high investment costs. Reimbursement policies and funding mechanisms also vary widely across different countries and regions.

The emergence of novel therapies and shift towards personalized medicine is a major opportunity area in the vulvar cancer drugs market. Currently, majority of treatment options are restricted to surgery along with chemotherapy and radiation which have limited success rates for advanced stages of the disease. However, with advancements in disease understanding through genomics and biomarker research, pharmaceutical companies are developing targeted therapies against specific mutations.

Additionally, the growing role of companion diagnostics is enabling identification of patient subgroups most likely to respond to a particular regimen. Such an approach can optimize treatment costs and resource allocation. Overall, the development of innovative therapeutic concepts represents a huge opportunity for market growth over the coming decade.

Prescribers preferences of Vulvar Cancer Drugs Market

Vulvar cancer is generally treated based on the stage of disease. For early stage (I/IIA), surgeons typically perform wide local excision with sentinel lymph node biopsy. If nodes are positive, follow-up groin lymphadenectomy may be recommended. For more advanced (IIB-IVA) disease, the current standard of care is radical local resection with bilateral inguinofemoral lymphadenectomy.

For recurrent or persistent disease after first-line treatment, second-line chemotherapy offers an option based on previous response and tolerance. Drugs like doxorubicin (Eg. Adriamycin) or gemcitabine (Eg. Gemzar) are utilized. A newer molecule, liposomal doxorubicin (Eg. Doxil), may provide more favorable tolerability.

Treatment Option Analysis of Vulvar Cancer Drugs Market

Early stage: For stage I-II cancers, surgery is the primary treatment. The aim is to remove the tumor with adequate margins. Radical local excisions or wider local excisions may be done depending on the size and extent of tumor. Occasionally, lymph node evaluation may also be performed. For larger lesions, radical vulvectomy can be considered which removes the entire vulva. This is often followed by radiation therapy to prevent recurrence.

Recurrent disease: For recurrent tumors after primary treatment, further surgery and/or radiation are considered based on previous treatment received, severity of recurrence, and patient's general condition. For advanced recurrent tumors not suitable for local treatment, palliative chemotherapy using drugs such as cisplatin, paclitaxel or docetaxel may provide symptomatic relief and improve quality of life.

Key winning strategies adopted by key players of Vulvar Cancer Drugs Market

Focus on developing innovative targeted therapies: Many top players like Merck & Co., Almirall, and AstraZeneca have focused on developing novel targeted therapies that have the potential to transform treatment for vulvar cancer. For example, in 2019 Merck received FDA approval for KEYTRUDA (pembrolizumab), an anti-PD-1 therapy, for treatment of recurrent locally advanced or metastatic vulvar cancer.

Focus on combination therapies: Given the complexity of treating vulvar cancer, players are pursuing combination regimens involving targeted therapies, chemotherapy and radiation. For example, ongoing Phase 2 trials are evaluating the combination of pembrolizumab with chemoradiation.

Segmental Analysis of Vulvar Cancer Drugs Market

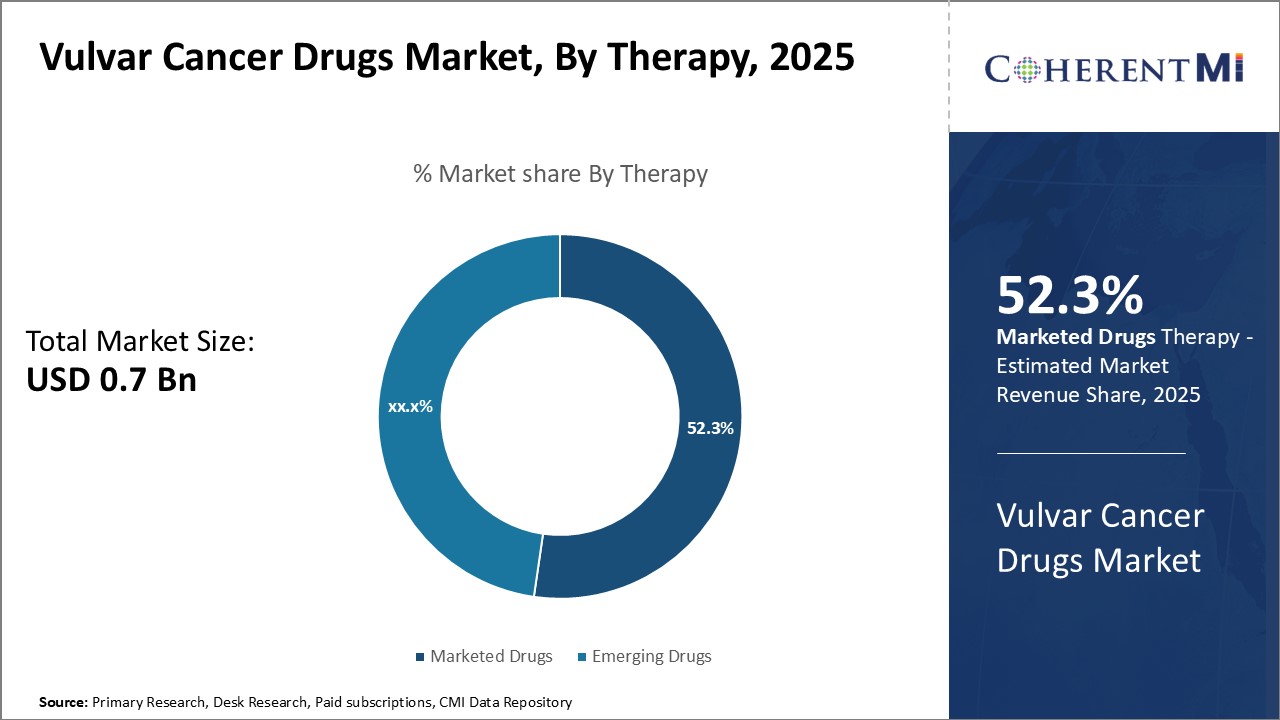

Insights, By Therapy: Rising Drug Approvals Drive Growth of Marketed Drugs Segment

Insights, By Therapy: Rising Drug Approvals Drive Growth of Marketed Drugs SegmentIn terms of therapy, marketed drugs are projected to hold 52.3% share of the market in 2025, owning to growing approval and adoption of innovative drugs for vulvar cancer treatment. Several pharmaceutical players have brought novel drugs to the market after demonstrating high efficacy and improved safety profiles through late-stage clinical trials.

While emerging drugs segment shows promise, marketed drugs have established brands and steady revenue streams due to their first-mover advantage. This segment is also boosted by growing awareness about vulvar cancer and emphasis on early diagnosis and management.

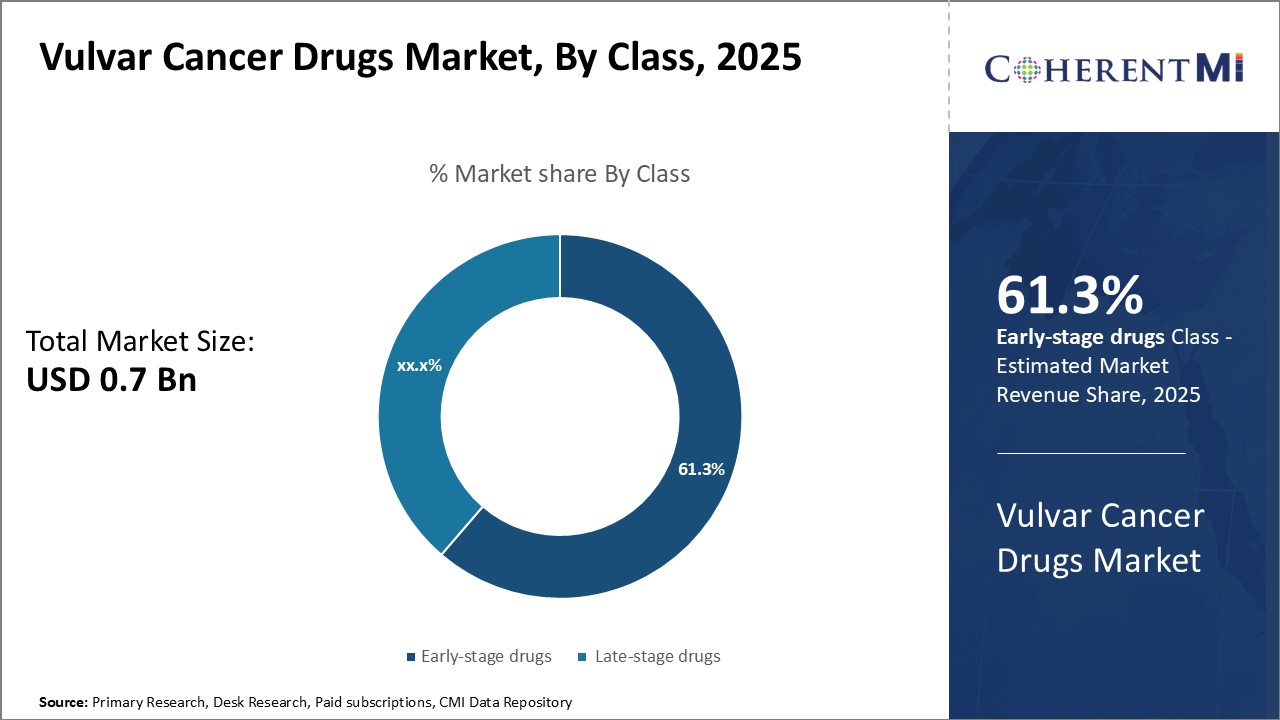

Among the segments classified by class, early-stage drugs segment is expected to account for 61.3% share of the market in 2025, owing to significant investments channelized towards developing new novel treatment options. Pharmaceutical companies and biotech firms are actively investing in early clinical research to explore safer and more targeted drugs. A flush pipeline of early-stage drugs in Phases I and II are under investigation for activity against specific gene mutations and pathways linked to tumor growth.

Additional Insights of Vulvar Cancer Drugs Market

- Emerging Therapies: Several late-stage drugs are in the pipeline, aiming to provide more effective and targeted treatments for Vulvar Cancer patients.

- Patient Pool Data: The United States has the highest Vulvar Cancer prevalence among the 7MM countries.

Competitive overview of Vulvar Cancer Drugs Market

The major players operating in the vulvar cancer drugs market include Massachusetts General Hospital, Merck Sharp & Dohme LLC, Shanghai Bovax Biotechnology Co. Ltd., Chongqing Bovax Biopharmaceutical Co. Ltd., Xencor Inc., ICON plc., GI Innovation Inc., HRYZ Biotech Co., and Travera Inc.

Vulvar Cancer Drugs Market Leaders

- Massachusetts General Hospital

- Merck Sharp & Dohme LLC

- Shanghai Bovax Biotechnology Co. Ltd.

- Chongqing Bovax Biopharmaceutical Co. Ltd.

- Xencor Inc.

Vulvar Cancer Drugs Market - Competitive Rivalry

Vulvar Cancer Drugs Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Vulvar Cancer Drugs Market

- In May 2024, Xencor Inc. announced a collaboration with ICON plc to develop a next-generation drug targeting early-stage Vulvar Cancer. This partnership is expected to accelerate drug discovery and enhance patient outcomes through innovative therapeutic approaches.

- In July 2024, Massachusetts General Hospital launched a new clinical trial focusing on improving radiation therapy outcomes in Vulvar Cancer patients. The trial aims to reduce side effects and improve quality of life for patients, potentially reshaping treatment protocols.

Vulvar Cancer Drugs Market Segmentation

- By Therapy

- Marketed Drugs

- Emerging Drugs

- By Class

- Early-stage drugs

- Late-stage drugs

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Frequently Asked Questions :

How big is the vulvar cancer drugs market?

The vulvar cancer drugs market is estimated to be valued at USD 0.70 Bn in 2025 and is expected to reach USD 1.26 Bn by 2032.

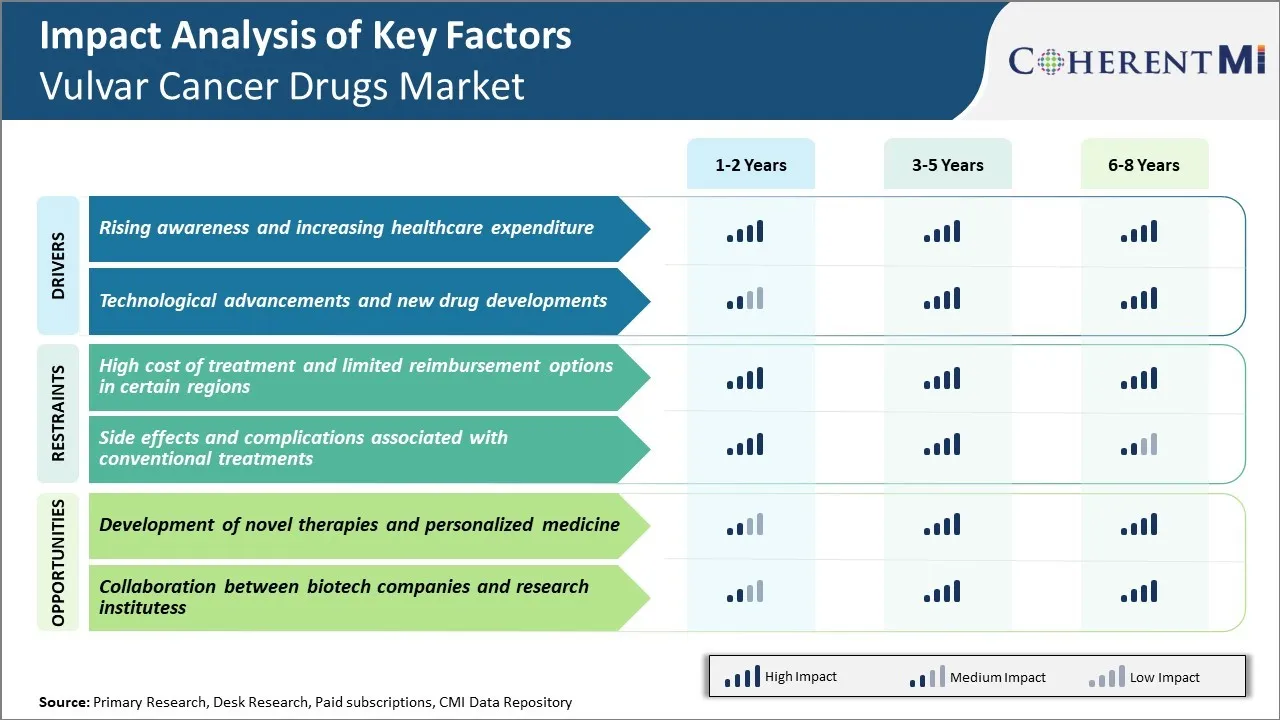

What are the key factors hampering the growth of the vulvar cancer drugs market?

The high cost of treatment and limited reimbursement options in certain regions and side effects and complications associated with conventional treatments are the major factors hampering the growth of the vulvar cancer drugs market.

What are the major factors driving the vulvar cancer drugs market growth?

The rising awareness and increasing healthcare expenditure and technological advancements and new drug developments are the major factors driving the vulvar cancer drugs market.

Which is the leading therapy in the vulvar cancer drugs market?

The leading therapy segment is marketed drugs.

Which are the major players operating in the vulvar cancer drugs market?

The major players operating in the vulvar cancer drugs market include Massachusetts General Hospital, Merck Sharp & Dohme LLC, Shanghai Bovax Biotechnology Co. Ltd., Chongqing Bovax Biopharmaceutical Co. Ltd., Xencor Inc., ICON plc.,

GI Innovation Inc., HRYZ Biotech Co., and Travera Inc.

What will be the CAGR of the vulvar cancer drugs market?

The CAGR of the vulvar cancer drugs market is projected to be 8.7% from 2025-2032.