X-linked Hypophosphatemia Market Size - Analysis

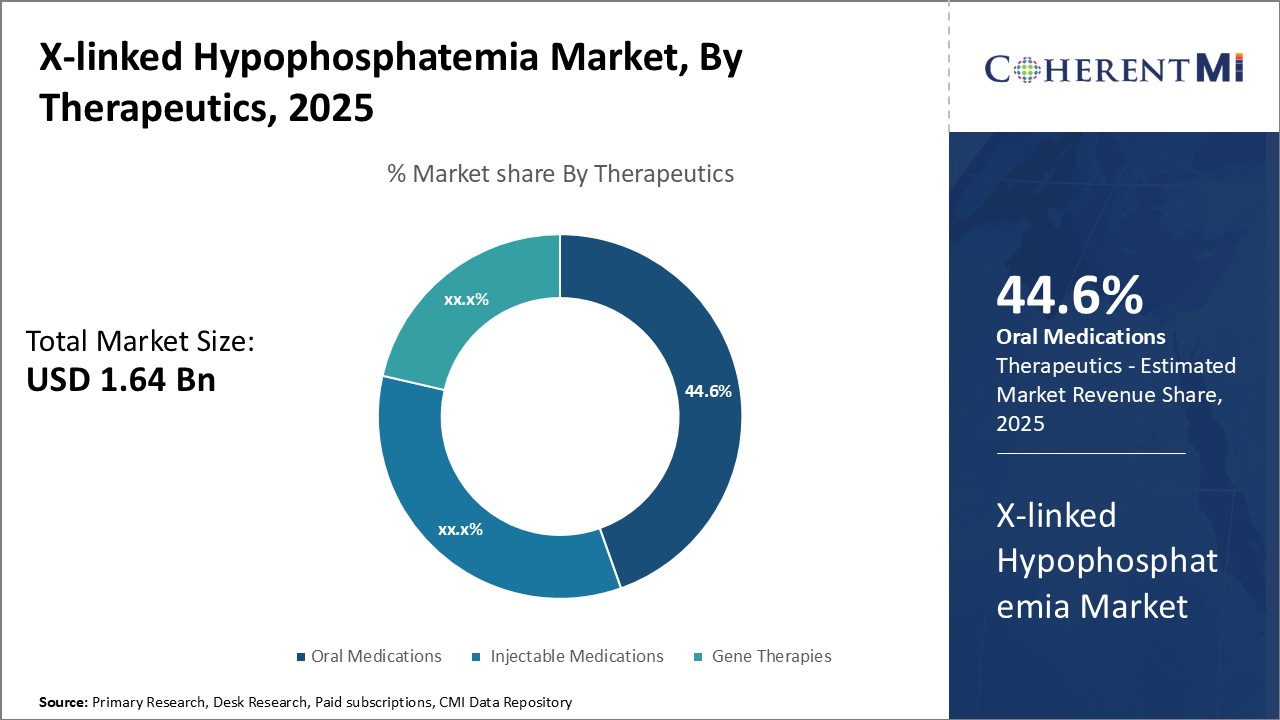

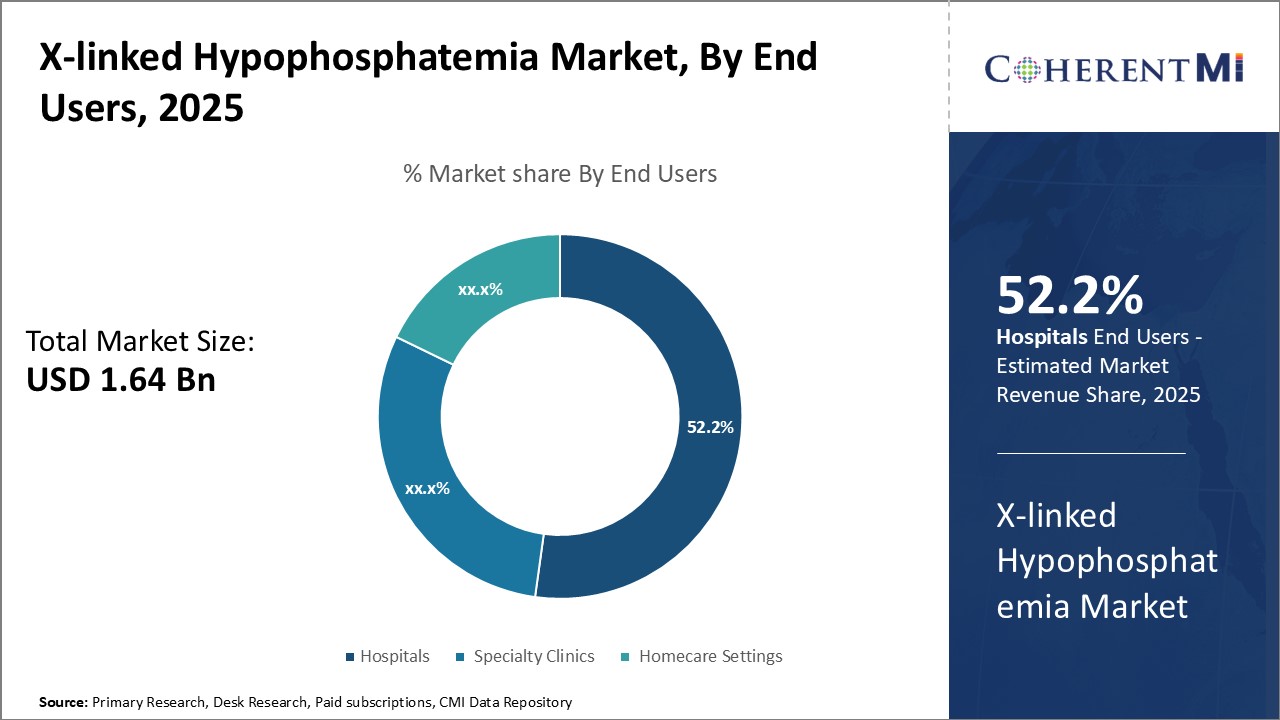

The X-linked hypophosphatemia market is estimated to be valued at USD 1.64 Bn in 2025 and is expected to reach USD 3.12 Bn by 2032, growing at a compound annual growth rate (CAGR) of 9.6% from 2025 to 2032.

Market Size in USD Bn

CAGR9.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 9.6% |

| Market Concentration | High |

| Major Players | Ultragenyx Pharmaceutical, Kyowa Kirin, Ascendis Pharma, Pfizer, Chiesi Farmaceutici and Among Others |

please let us know !

X-linked Hypophosphatemia Market Trends

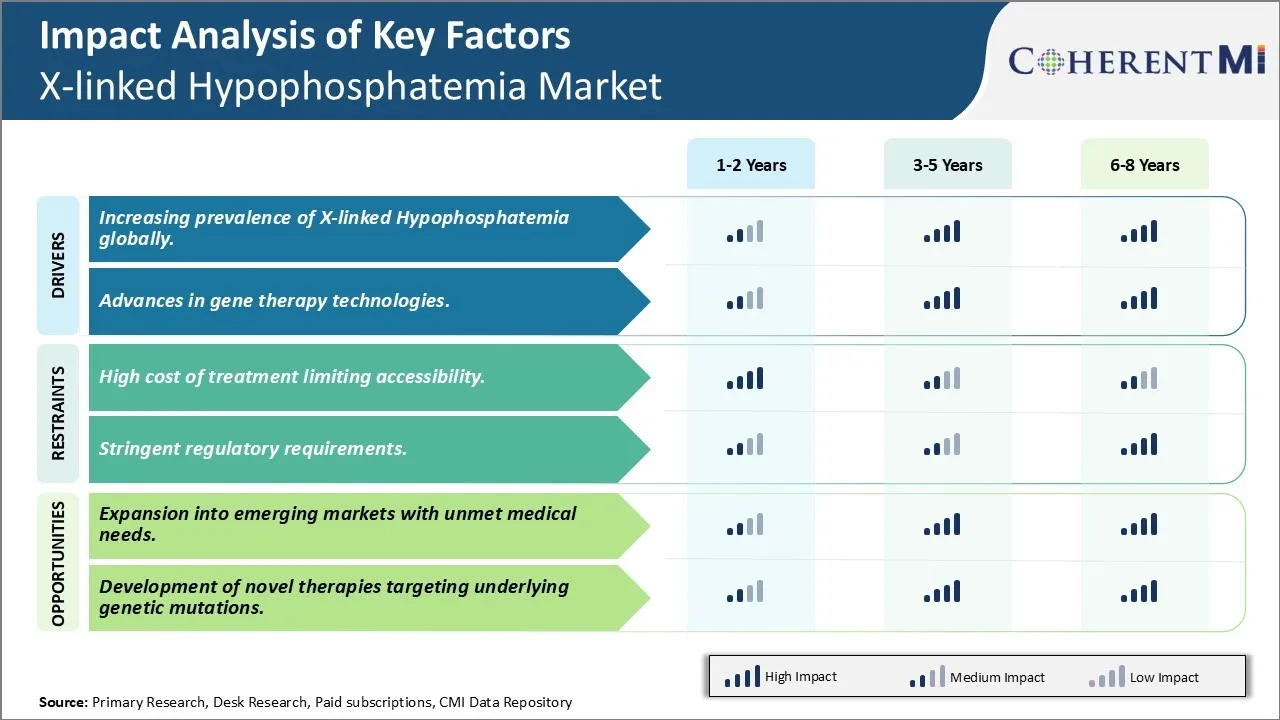

One of the major factors driving the growth of the X-linked Hypophosphatemia market is the increasing prevalence of the condition worldwide. X-linked Hypophosphatemia is a genetic disorder characterized by abnormally low levels of phosphorus in the blood and bones. The exact prevalence of XLH is unknown, however estimates suggest it affects approximately 1 in 20,000 individuals globally. Some studies have found a higher prevalence in certain populations such as 1 in 12,000 live male births in Denmark.

All of these factors indicate the patient pool for XLH is expanding rapidly. As a result, demand for effective treatment options and management of the condition is surging. Traditional therapies like phosphate and vitamin D supplements have been the mainstay of XLH treatment but newer biologic therapies targeting the underlying cause are gaining popularity. Their ability to more comprehensively address symptoms and long term complications of XLH makes them an attractive proposition for both patients and physicians alike, driving higher adoption and uptake. The growing prevalence and identification of more XLH cases presents a sizable opportunity for drugs and therapies in this market.

Market Driver - Advances in gene therapy technologies

Over the past decade, there have been major breakthroughs in the development of various gene therapy delivery systems like viral vectors, non-viral gene transfer methods and gene editing tools like CRISPR that have enabled more targeted and effective genetic manipulation. Clinical trials on various monogenic diseases have proven gene therapies can provide long term therapeutic benefits with a single dose treatment versus the need for repeated drug administration in traditional therapies. This makes them highly appealing to patients coping with a lifelong condition like XLH.

Market Challenge - High cost of treatment limiting accessibility

One key opportunity for players in the XLH market is the potential for expansion into emerging economies which have large patient populations with significant unmet medical needs. Many Asian and Latin American countries have a high prevalence of XLH due to genetic factors but lack proper diagnosis rates and access to treatment. This represents a large untapped market base. Pharmaceutical companies could look at obtaining regulatory approvals and establishing supply chains and distribution networks in these regions. Partnering with local healthcare providers and patient advocacy groups would help in screening, identification and enrollment of patients. Introducing more affordable generic formulations tailored for these markets also provides an opportunity to expand accessibility. With rising incomes and awareness, demand is expected to grow rapidly over the coming years. Companies addressing the treatment gap in emerging nations stand to benefit significantly from first-mover advantage in these expanding XLH markets of the future.

Prescribers preferences of X-linked Hypophosphatemia Market

X-linked hypophosphatemia is typically treated via a stepwise approach based on the stage and severity of symptoms. In mild early-stage disease, diet and lifestyle modifications may be sufficient to manage phosphate levels. For more significant symptoms, prescription medication becomes necessary. The first-line treatment is usually an oral phosphate supplement to increase phosphate levels in the blood. If this is not effective, combination therapy with a vitamin D analog such as calcitriol may be prescribed.

Treatment Option Analysis of X-linked Hypophosphatemia Market

X-linked hypophosphatemia (XLH) is typically treated based on disease severity and stage. For mild cases, the first-line treatment is oral phosphate supplementation and active vitamin D therapy. Common phosphate supplements used include PhosLo and PhosPhoSol which provide the recommended daily intake amount. Vitamin D therapies help regulate phosphorus levels and include calcitriol (Rocaltrol) and alphacalcidol (Calcichew).

Surgical options such as corrective osteotomies may be considered for bowing deformities of the lower extremities in older children and adults. However, drug therapies are now preferred first due to less invasive nature and ability to address systemic effects beyond just musculoskeletal symptoms. Regular monitoring through laboratory tests and physical exams allows doctors to properly titrate treatments based on the individual's response and disease progression over time. A multidisciplinary care team helps maximize Treatment outcomes at each stage of XLH.

Key winning strategies adopted by key players of X-linked Hypophosphatemia Market

Launching new and improved treatment options has been a very effective strategy for companies in this market. For example, in 2017, Kyowa Hakko Kirin launched the powder version of the only approved drug for XLH, Burosumab (Crysvita). This new formulation solved issues associated with stability and storage of the drug. It received positive nod from regulatory authorities and physicians, aiding strong uptake. Such product innovations help companies expand their market share by addressing unmet needs.

Launching drugs in new international markets where they receive orphan drug designation and pricing benefits has paid off well. For example, Kyowa Kirin expanded Crysvita's availability from Japan, US to EU in 2019. This enabled it to tap into the sizeable European patient pool and boosted product sales manifold. Other players like Ultragenyx are also pursuing regulatory approvals in multiple regions for long term growth.

Segmental Analysis of X-linked Hypophosphatemia Market

Insights, By Therapeutics: Convenience and effectiveness of oral medications

Insights, By Therapeutics: Convenience and effectiveness of oral medicationsIn terms of therapeutics, oral medications sub-segment contributes the highest share of 445.6% in the X-linked hypophosphatemia market owing to their convenience and effectiveness. Being available in the form of tablets and capsules, oral medications offer patients an easy to use and pain-free treatment option for managing their hypophosphatemia symptoms. The avoidance of frequent hospital visits for intravenous administration of drugs significantly improves patient compliance with oral medications.

Overall, the non-invasive nature and flexible dosing of oral medications have enabled them to gain higher patient acceptance compared to other drug types. This has solidified oral medications' dominance in the X-linked Hypophosphatemia therapeutic segment over time.

Among the various end-users, hospitals account for the largest share of 52.2% in the X-linked hypophosphatemia market. This can be attributed to their central role in initial diagnosis and ongoing management of the disorder. As hypophosphatemia symptoms often require specialized tests and multidisciplinary care, hospitals serve as the preferred access points for most patients.

The availability of inpatient and outpatient treatment options also allow for closer monitoring during critical phases. Hospitals have the infrastructure and resources to regularly evaluate treatment responses, especially during periods when medications may need adjustments or replacements. Over time, as patients' health stabilizes, care can be transitioned to specialty clinics or home-based settings. However, most patients continue relying on hospitals for periodic follow-ups or management of complications and co-morbidities. This cements hospitals' prominence in the overall hypophosphatemia treatment landscape.

Additional Insights of X-linked Hypophosphatemia Market

- The X-linked Hypophosphatemia market is poised for significant growth over the coming years, driven by advancements in gene therapy and increasing disease prevalence. The current treatment landscape includes a mix of traditional therapies and innovative approaches, with a focus on improving patient quality of life.

Competitive overview of X-linked Hypophosphatemia Market

The major players operating in the X-linked hypophosphatemia market include Ultragenyx Pharmaceutical, Kyowa Kirin, Ascendis Pharma, Pfizer, Chiesi Farmaceutici, Radius Health, and Novo Nordisk.

X-linked Hypophosphatemia Market Leaders

- Ultragenyx Pharmaceutical

- Kyowa Kirin

- Ascendis Pharma

- Pfizer

- Chiesi Farmaceutici

X-linked Hypophosphatemia Market - Competitive Rivalry

X-linked Hypophosphatemia Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in X-linked Hypophosphatemia Market

- In March 2024, Ultragenyx Pharmaceutical announced the expansion of its gene therapy pipeline with the acquisition of a new technology platform that is expected to enhance the treatment of X-linked Hypophosphatemia. This strategic move is anticipated to strengthen the company’s market position and drive future growth.

- In July 2023, Kyowa Kirin successfully completed Phase III clinical trials for a new oral formulation, showing significant improvement in patient outcomes. The company plans to file for regulatory approval in early 2024.

X-linked Hypophosphatemia Market Segmentation

- By Therapeutics

- Oral Medications

- Injectable Medications

- Gene Therapies

- By End Users

- Hospitals

- Specialty Clinics

- Homecare Settings

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Frequently Asked Questions :

How big is the X-linked Hypophosphatemia Market?

The X-linked Hypophosphatemia Market is estimated to be valued at USD 1.64 in 2025 and is expected to reach USD 3.12 Billion by 2032.

What are the major factors driving the X-linked hypophosphatemia market growth?

The increasing prevalence of x-linked hypophosphatemia globally and advances in gene therapy technologies are the major factors driving the X-linked hypophosphatemia market.

Which are the leading therapeutics in the X-linked hypophosphatemia market?

The leading therapeutics segment is oral medications.

Which are the major players operating in the X-linked hypophosphatemia market?

Ultragenyx Pharmaceutical, Kyowa Kirin, Ascendis Pharma, Pfizer, Chiesi Farmaceutici, Radius Health, and Novo Nordisk are the major players.

What will be the CAGR of the X-linked hypophosphatemia market?

The CAGR of the X-linked hypophosphatemia market is projected to be 9.6% from 2025-2032.