Automotive Cabin Air Filter Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Automotive Cabin Air Filter Market is segmented By Vehicle (Mid-Sized Passenger Car, , Compact Passenger Car, Premium Passenger Car, Luxury Passenger ....

Automotive Cabin Air Filter Market Size

Market Size in USD Bn

CAGR6.26%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.26% |

| Market Concentration | High |

| Major Players | Ahlstrom-Munksjo Oyj, DENSO Corp., Donaldson Co. Inc., Freudenberg SE, General Motors Co. and Among Others. |

please let us know !

Automotive Cabin Air Filter Market Analysis

The automotive cabin air filter market is estimated to be valued at USD 5.26 Bn in 2024 and is expected to reach USD 8.05 Bn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 6.26% from 2024 to 2031. Automotive cabin air filter market is expected to witness significant growth with rising demand for enhanced vehicle safety and performance features that improve air quality inside vehicles.

Automotive Cabin Air Filter Market Trends

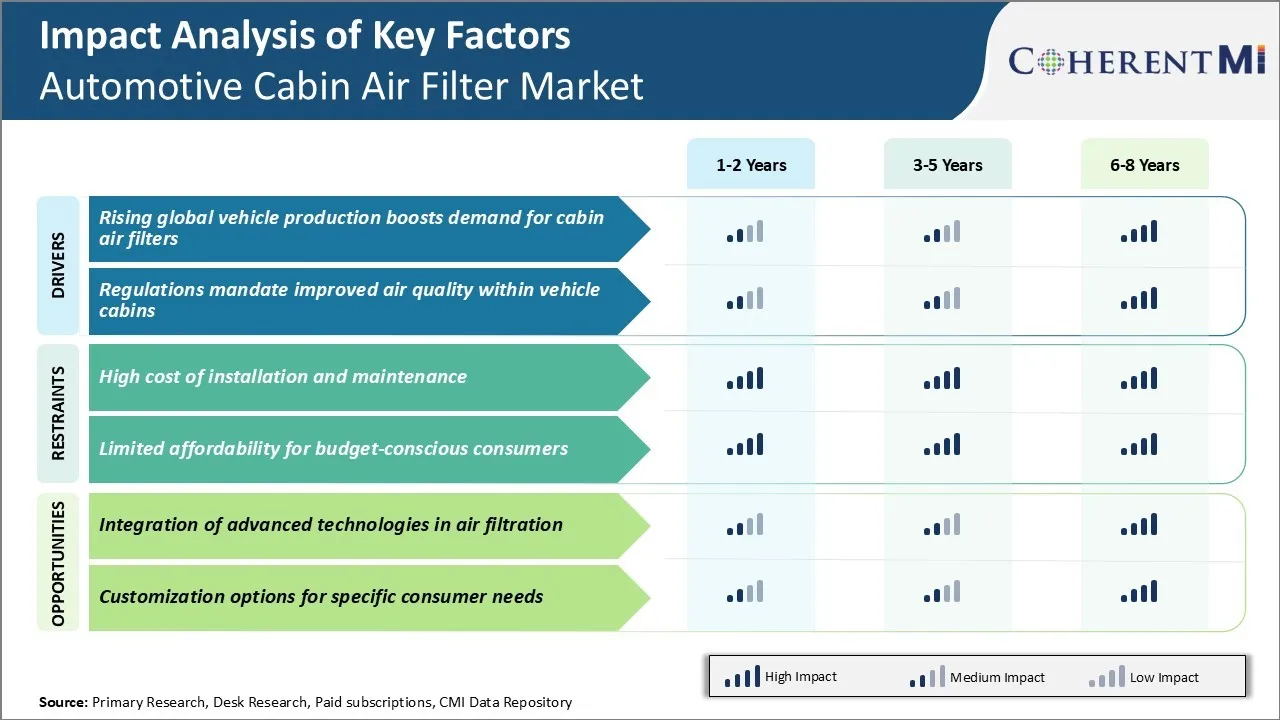

Market Driver - Rising Global Vehicle Production Boosts Demand for cabin air filters

According to various industry estimates, the global automobile sector saw record vehicle production numbers last year with over 95 million units rolling out of factories worldwide. This growth has largely been fueled by strong economic conditions and purchase incentives in key automobile markets.

The heightened production activity has indirectly benefited cabin air filter manufacturers. Automakers are equipping more of their newer models with automotive cabin air filters as standard to offer improved in-cabin air quality and comfort to buyers. With leading brands aiming to export their vehicles to stringent emission standards jurisdictions, they are also installing sophisticated filtration systems.

The aftermarket is another contributor, driving demand as old filters need routine replacement after a certain period of usage or mileage. Aftersales and maintenance centers attached to automaker dealerships or independent workshops form an integral purchasing node. Overall, the automotive cabin air filter market is expected to track and benefit from the continued rise in global automobile production volumes going forward.

Market Driver - Regulations Mandate Improved Air Quality within Vehicle Cabins

Governments and regulatory bodies across major economies have been strengthening norms regarding vehicular emissions and air pollution in recent times. With growing public concern over the health impacts of harmful automotive emissions, tighter restrictions are being placed on air pollutants released from vehicles. While emission standards primarily focus on tailpipe exhaust, various agencies are now evaluating the air quality inside passenger compartments as well. This has provided a boost to the automotive cabin air filter market.

The U.S. Environment Protection Agency and the California Air Resource Board have guidelines regarding maximum permissible levels of particulate matter and other pollutants that can enter vehicle interiors. The European Union too has laid down Air Quality regulations for commercial as well as private vehicles. Similar norms are enforced in countries like China, Japan and India to curb air pollution. Automakers are installing high-grade cabin air filters and efficient HVAC systems to comply with these emission certifications. Original equipment provided to car manufacturers needs to meet the stringent filtration efficiency criteria set by regulators, which will bolster major activities in the automotive cabin air filter market.

Market Challenge - High Cost of Installation and Maintenance

One of the key challenges faced by the automotive cabin air filter market is the high cost associated with installation and maintenance of cabin air filters. Replacing cabin air filters is generally required every 15,000-20,000 miles which amounts to spending $50-100 each time for parts and labor. Considering most people drive around 15,000 miles annually, the maintenance cost adds up significantly over the lifetime of the vehicle.

Additionally, accessing the filter compartment often requires dismantling portions of the dashboard or glove box, making the installation process labor intensive. As a result, many vehicle owners choose to ignore the recommended replacement cycles in order to save on costs. This reduction in timely maintenance and replacement of filters negatively impacts air quality inside vehicles and reduces the effectiveness of the filter.

To address this challenge, OEMs in the automotive cabin air filter market need to develop cheaper and easier to access filter designs. They also need to focus on reducing labor costs during installation and encourage more frequent replacement of filters.

Market Opportunity – Growth Potential in Integration of Advanced Technologies

The integration of advanced technologies presents a major opportunity for growth in the automotive cabin air filter market. With rising consumer awareness about in-vehicle air quality and health effects of pollutants, there is a growing demand for features like particulate sensors and automatic filter replacement indicators.

Manufacturers can capitalize on this by developing electronically indexed filters integrated with predictive maintenance systems. The filters can track runtime as well as particulate detection and alert drivers on mobile apps when replacement is due. This helps promote timely filter changes in a cost-effective manner without needing to track mileage.

Furthermore, technologies like active carbon and HEPA filters that offer improved filtration efficacy can command a premium. Companies in the automotive cabin air filter market focus on offering such advanced filtering solutions factory-fitted or as an accessory. This way, they can tap into consumers willing to pay more for superior in-cabin air quality and features ensuring health and well-being.

Key winning strategies adopted by key players of Automotive Cabin Air Filter Market

Focus on technology innovation: Cabin air filters play a crucial role in maintaining good indoor air quality in vehicles. Major players like MAHLE and MANN+HUMMEL have focused on continuous innovation to develop advanced filtration technologies that can capture even smaller airborne particles.

Expand product portfolio: Leading companies offer a diverse portfolio of cabin air filters catering to different vehicle models and types. For instance, Donaldson expanded its range and launched cabin air filters suitable for hybrid and electric vehicles in 2016-17. A broad portfolio helps players target a bigger share of the automotive cabin air filter market.

Emphasis on recyclability and sustainability: Cabin air quality players have started focusing more on recycling used filters and reducing environmental footprint. Honeywell launched fully recyclable cabin air filters made from non-woven polyester in 2018. Similarly, MANN+HUMMEL uses recycled content in its filters and focuses on eco-friendly packaging.

Strategic acquisitions: Major acquisitions have helped market players consolidate their presence across regions. For example, in 2014, Donaldson acquired engine and cabin air filter manufacturer, Protec to expand its presence in Europe.

Segmental Analysis of Automotive Cabin Air Filter Market

Insights, By Vehicle: Mid-Sized Passenger Car Offer Convenience and Practicality

In terms of vehicle, mid-sized passenger car contributes 28.5% share of the automotive cabin air filter market in 2024, owning to its convenience and practicality. Mid-sized passenger cars offer a good balance of interior space and fuel efficiency, making them suitable for average-sized families. They provide sufficient legroom and headroom for adults without being too large or costly. Mid-sized cars also perform well on both highway drives and city commutes.

Additionally, the operating costs of mid-sized cars tend to be lower than full-sized vehicles due to better fuel economy ratings. Overall, mid-sized passenger cars strike the right balance of functionality, practicality and affordability, attributes which have propelled this segment to the top of the automotive cabin air filter market.

Insights, By Sales Channel: Original Equipment Dominance

In terms of sales channel, OEMs (original equipment manufacturers) contributes 45.6% share of the automotive cabin air filter market in 2024, due to their original equipment dominance. Automotive cabin air filters are typically included as standard features in new vehicles and replaced as part of routine maintenance schedules. As the entities that originally build and distribute new cars, OEMs are able to leverage their relationships with automakers to ensure their filters are installed at the source.

Having the filters pre-installed allows OEMs to capture this reliable revenue stream. While the aftermarket sees competition from alternate suppliers, OEMs maintain control over filters for the lifespan of each vehicle sold. Their first-to-market access and integration within production lines gives OEMs an inherent advantage over other sales channels in this segment.

Insights, By Filter Medium: Synthetic Filters Exhibit High Performance

In terms of filter medium, synthetic filters contributes the highest share of the automotive cabin air filter market due to their superior filtration performance. Synthetic materials like polyester are highly effective at trapping unwanted exhaust particles and allergens without restricting airflow. They are designed using advanced microfiber weaves that can capture ultra-fine dust and pollen down to a few microns in size.

Synthetic constituents also promote longer filter life through their durability against abrasion, chemicals and moisture. Coupled with an appropriate density, synthetic compositions maximize a filter's cleaning ability while remaining cost-effective. Their filtration consistency delivers clean interior air for vehicle occupants. As a result of such optimal function, synthetic filters have become the preferred automotive cabin air filter compared to alternatives like cellulose.

Additional Insights of Automotive Cabin Air Filter Market

- Asia Pacific leads in size in global automotive cabin air filter market due to the growing demand for electric vehicles. Asia Pacific's market share in 2023 was USD 2.72 billion, projected to reach USD 5.03 billion by 2033.

- North America focuses on regulations to combat vehicle emissions, leading to innovation in air filters. This is projected to impact upcoming trends in the automotive cabin air filter market.

- The market's growth is fueled by advancements in air quality technology, rising consumer awareness, and governmental mandates for reduced emissions.

- Major players in the automotive cabin air filter market are innovating to meet evolving consumer preferences and regulatory standards.

Competitive overview of Automotive Cabin Air Filter Market

The major players operating in the automotive cabin air filter market include Ahlstrom-Munksjo Oyj, DENSO Corp., Donaldson Co. Inc., Freudenberg SE, General Motors Co., MAHLE GmbH, MANN+HUMMEL, Parker Hannifin Corp., Robert Bosch GmbH, and Sogefi Spa.

Automotive Cabin Air Filter Market Leaders

- Ahlstrom-Munksjo Oyj

- DENSO Corp.

- Donaldson Co. Inc.

- Freudenberg SE

- General Motors Co.

Automotive Cabin Air Filter Market - Competitive Rivalry, 2024

Automotive Cabin Air Filter Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Automotive Cabin Air Filter Market

- In January 2024, BOSCH launched the FILTER+PRO cabin filter with advanced allergen filtration technology. The FILTER+pro features advanced allergen filtration technology, effectively combating allergens, pollen, fine dust, harmful gases, bacteria, viruses, and mold.

- In December 2023, Uno Minda, a leading Tier 1 supplier of proprietary automotive solutions, introduced a range of automotive filters for commercial vehicles in the Indian aftermarket. This product line, developed in collaboration with Japan's Roki Co. Ltd., includes air, oil, and fuel filters.

Automotive Cabin Air Filter Market Segmentation

- By Vehicle

- Mid-Sized Passenger Car

- Compact Passenger Car

- Premium Passenger Car

- Luxury Passenger Car

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Others

- By Sales Channel

- OEMs (Original Equipment Manufacturers)

- OESs (Original Equipment Suppliers)

- IAM (Identify and Access Management)

- By Filter Medium

- Synthetic Filters

- Cellulose Filters

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the automotive cabin air filter market?

The automotive cabin air filter market is estimated to be valued at USD 5.26 Bn in 2024 and is expected to reach USD 8.05 Bn by 2031.

What are the key factors hampering the growth of the automotive cabin air filter market?

High cost of installation and maintenance and limited affordability for budget-conscious consumers are the major factors hampering the growth of the automotive cabin air filter market.

What are the major factors driving the automotive cabin air filter market growth?

Rising global vehicle production boosts demand for cabin air filters and regulations mandate improved air quality within vehicle cabins are the major factors driving the automotive cabin air filter market.

Which is the leading vehicle in the automotive cabin air filter market?

The leading vehicle segment is mid-sized passenger car.

Which are the major players operating in the automotive cabin air filter market?

Ahlstrom-Munksjo Oyj, DENSO Corp., Donaldson Co. Inc., Freudenberg SE, General Motors Co., MAHLE GmbH, MANN+HUMMEL, Parker Hannifin Corp., Robert Bosch GmbH, and Sogefi Spa are the major players.

What will be the CAGR of the automotive cabin air filter market?

The CAGR of the automotive cabin air filter market is projected to be 6.26% from 2024-2031.