Body Control Module Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Body Control Module Market is segmented By Functionality (High-End, Low-End), By Vehicle Energy Source (Hardware, Software), By Vehicle Type (Light-du....

Body Control Module Market Size

Market Size in USD Bn

CAGR3.02%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 3.02% |

| Market Concentration | High |

| Major Players | Continental AG, Robert Bosch GmbH, Denso Corporation, Delphi Automotive PLC, Mitsubishi Electric Corporation and Among Others. |

please let us know !

Body Control Module Market Analysis

The body control module market is estimated to be valued at USD 34.79 Bn in 2024 and is expected to reach USD 42.85 Bn by 2031. It is expected to grow at a compound annual growth rate (CAGR) of 3.02% from 2024 to 2031. The body control module market is witnessing positive trends as automakers are focusing on incorporating more electronic features in vehicles to improve driver experience.

Body Control Module Market Trends

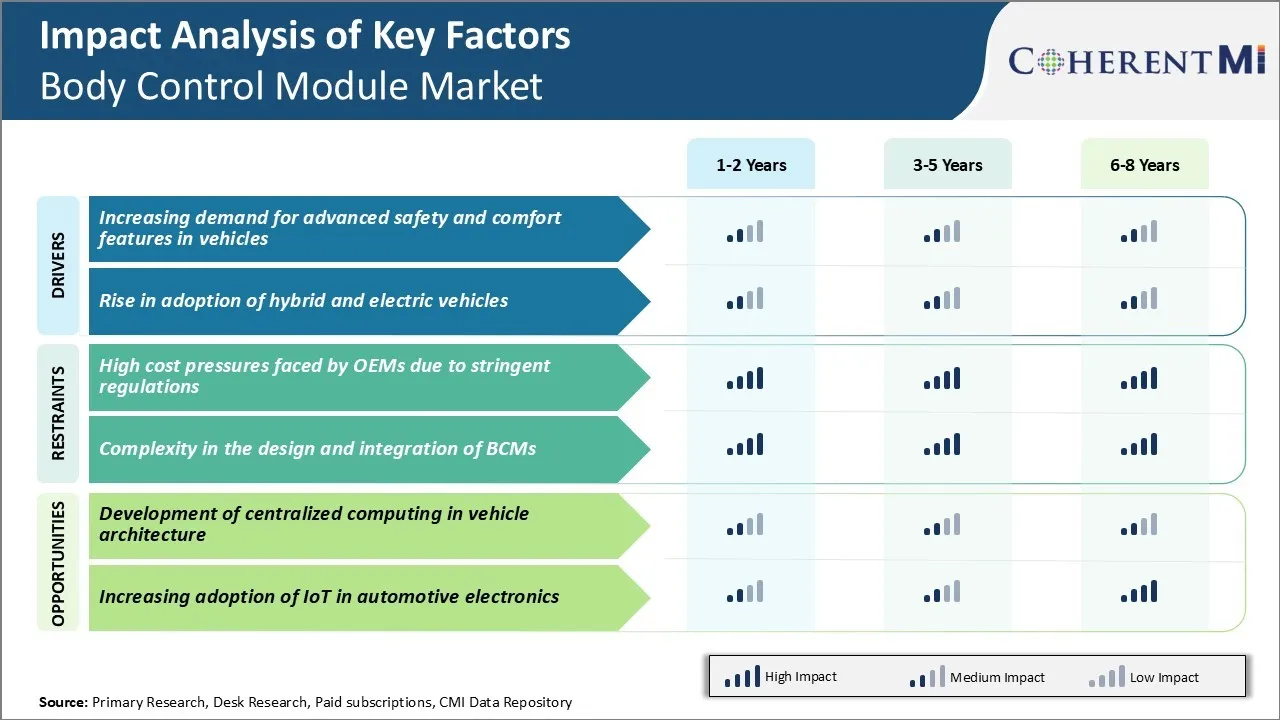

Market Driver - Increasing Demand for Advanced Safety and Comfort Features in Vehicles

With rising disposable income and increasing technological advancement, consumers are demanding vehicles that offer enhanced safety, comfort, and convenience features. Automakers are recognizing this trend and are rushing to incorporate the latest driver-assist technologies in their vehicles. The body control module plays a crucial role in supporting these advanced features. Features like adaptive cruise control, lane keep assist, blind spot monitoring, and automatic emergency braking are increasingly being adopted to minimize risks of accidents.

At the same time, consumers are also demanding more infotainment and comfort features inside the cabin. Connected car technologies that provide navigation, entertainment, and remote access are becoming mainstream. With safety and well-being of occupants becoming a top priority, the demand for sophisticated driver-assist and connected car technologies is expected to surge tremendously. This will significantly drive the need for advanced body control modules with powerful central computing capabilities, eventually driving growth of the body control module market.

Market Driver - Rise of Electric Vehicles

Another key factor promoting the body control module market is the rapidly growing electric vehicle industry. Both hybrids and fully electric vehicles rely on sophisticated power management systems to efficiently operate the high-voltage batteries and electric powertrains.

Body control module plays a central role in overseeing and controlling the high-voltage systems. It monitors battery charge levels, supervises power transfer between the electric motor and batteries and ensures safety in operation of these high-voltage components.

Moreover, EVs require advanced temperature control functionalities for thermal management of their battery packs. The body control module is important for integration of the climate control system with the battery pack to regulate its temperature for optimal performance and extended life. With stringent emission norms and favorable government policies, automakers are heavily investing in electric drivetrains.

More automakers are also introducing hybrid variants of their popular models to transition to sustainable mobility. Rise in hybrids and EVs spells greater potential for optimized body control module market to efficiently manage the complex electric powertrain systems.

Market Challenge - High Cost Pressures Faced by OEMs

The body control module market faces significant cost pressures due to stringent regulations imposed by various governments and regulatory bodies. Traditional independent systems architecture with multiple standalone modules has become highly complex and expensive to manage with the integration of advanced driver-assistance and electric vehicle technologies.

Meeting stringent vehicle safety, emission, and fuel economy norms requires heavy investment in R&D and upgrading existing module designs. This increases part costs for OEMs who are already battling rising material and technology costs. Consolidating functionalities on a single centralized computer-like module could help reduce wiring harness size and complexity substantially.

However, modifying existing vehicle architectures poses integration challenges. OEMs also need to consider longer development cycles to validate functionality and safety of new designs. With mounting pressures to deliver affordable green vehicles, controlling system costs without compromising quality remains a major issue for the body control module market.

Market Opportunity - Development of Centralized Computing in Vehicle Architecture

The growing adoption of centralized computing platform presents significant opportunities for the body control module market. A centralized system-on-chip based architecture allows seamless integration of advanced driver-assistance, connectivity, and electrical powertrain functions. It facilitates flexible over-the-air updates and upgrades of electronic control units during the vehicle lifecycle. This could help OEMs rollout new features faster and realize deferred revenues from software/service subscriptions.

Manufacturers are also exploring domain controller concept to partition complex automotive applications and workloads. A centralized high-performance body control module has potential to serve as the main domain controller integrating capabilities from various domains including chassis, body, cockpit and safety. This provides opportunities for module suppliers to offer software-defined products and platform solutions leveraging automotive-grade system-on-chips. It may also encourage new technology partnerships and evolving business models in the automotive electronics industry.

Key winning strategies adopted by key players of Body Control Module Market

Strategy 1: Focus on product innovation and development of new features

Continental AG adopted this strategy successfully by introducing advanced body control modules with advanced driver assistance system (ADAS) features like automated parking, blind spot monitoring, lane departure warning, etc.

Strategy 2: Strategic partnerships and collaborations

Delphi Automotive formed strategic partnerships with leading automakers like GM, Ford, Honda in 2010-2012 to be their primary supplier of body control modules. By 2018, Delphi had partnerships with 12 of the top 15 automakers globally.

Strategy 3: Focus on emerging markets with high growth potential

Bosch tailored its body control module technologies and products specifically for the Chinese and Indian markets from 2013 onwards.

Strategy 4: Pursue mergers and acquisitions for technology and talent

In 2015, Lear Corporation strengthened its capabilities through the acquisition of Guilford Mills Automotive Interiors, a leading manufacturer of door panels. This expanded Lear's integrated interior systems capabilities and also brought additional talent and R&D resources.

Segmental Analysis of Body Control Module Market

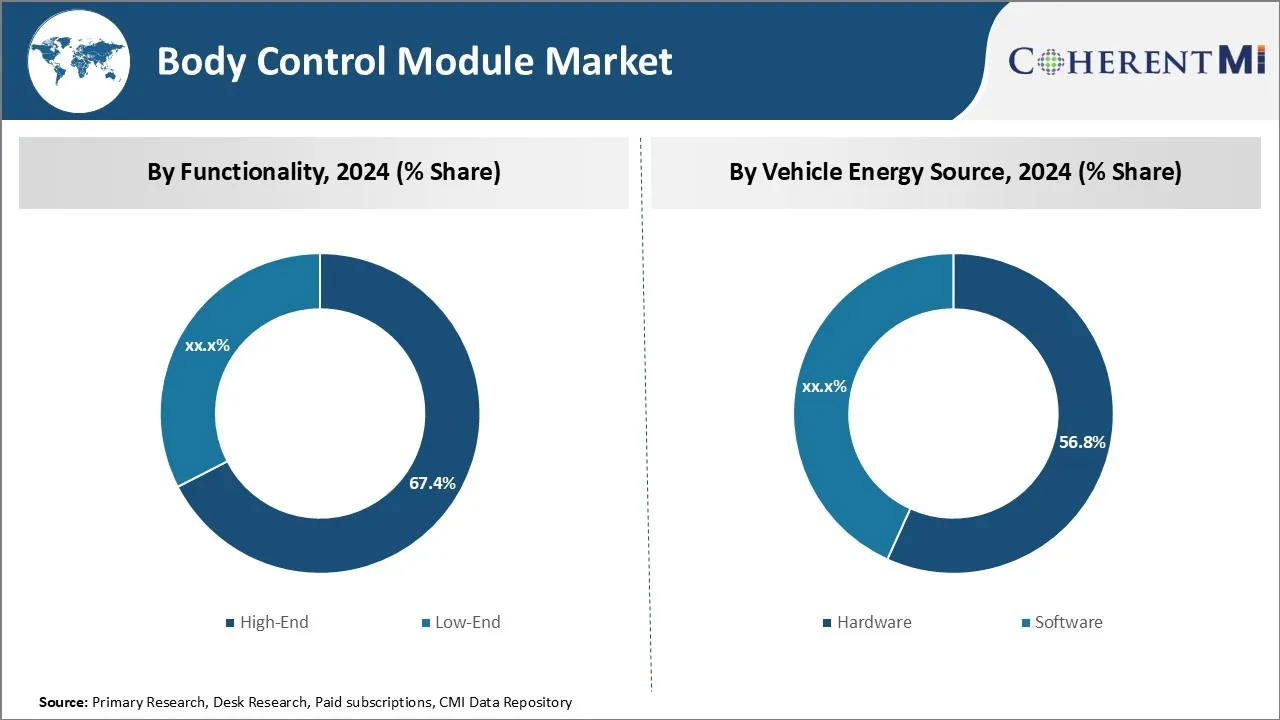

Insights, By Functionality: Consumers' Rising Preference for Premium Features Drives Demand

In terms of functionality, high-end body control modules contribute 67.4% share of the body control module market in 2024. High-end BCMs enable a wide range of sophisticated driver assistance, infotainment and connectivity systems that enhance comfort and convenience. As disposable incomes rise globally, more consumers are willing to pay extra for vehicles equipped with advanced technology.

Many luxury and premium brands have made high-tech features standard even on their entry-level models. This is increasing the penetration of high-end body control modules down the vehicle segments. The rising demand for integrated connectivity is a major driver.

Further, advanced driver assistance systems that promise enhanced safety are also vital selling points for luxury brands. Overall, as technology becomes more pervasive across brands and segments, high-end body control modules will continue finding more applications. The body control module market is projected to ride the tailwinds of buyers' unrelenting appetite for the newest innovations and seamless experiences on the move.

Insights, By Vehicle Energy Source: Hardware Components Account for the Bulk of Spending

In terms of vehicle energy source, the hardware segment contributes 58.6% share of the body control module market in 2024. This is owing to the multitude of physical components required. A typical body control module consists of integrated circuits, microprocessors, memory chips, power management chips and other discrete components packaged on a printed circuit board. It also interfaces with a vast network of vehicle sensors and actuators using dedicated wiring harnesses.

Given the complex array of mechanical and electrical parts involved, hardware accounts for the major portion of BCM production costs. Original equipment manufacturers prefer working with experienced Tier 1 suppliers who can ensure robust design, stringent quality control, and economies of large-scale manufacturing for hardware. Software development has lower barriers to entry and higher room for iteration, but automakers still demand functionality, reliability, and long-term support from trusted partners here as well.

Insights, By Vehicle Type: Growing electrified fleet drives BCM innovation in light commercial vehicles

In terms of vehicle type, the light-duty vehicles segment contributes the highest share currently driven by rising electrification of commercial fleets. Light commercial vehicles consisting of vans and pickup trucks are increasingly pursuing dual-fuel or all-electric powertrains to reduce operating costs and meet emission regulations. However, integrating high-voltage components and managing hybrid/electric systems requires sophisticated new body control module functionality.

Vehicle electrification is driving more distributed electrical architectures with additional body control modules to supervise subsystems like battery management, motors and generator control units. Advanced algorithms are needed for energy recuperation, thermal management and route-optimization based on state of charge.

Autonomous light vehicles being tested require next-level computational power and sensor fusion from body control modules. As light-duty commercial electric vehicles scale up globally with rising urbanization and delivery operations, their specialized control and connectivity needs will propel innovations in the body control modules market.

Additional Insights of Body Control Module Market

- Increased demand for small and reliable body control modules due to growing electronic content in vehicles.

- Asia Pacific region leads the global body module control market in production and adoption due to rapid advancements in automotive technology.

- Embedded software market for automotive applications expected to reach $233 billion by 2023.

- Light-duty vehicles are anticipated to dominate due to efficiency and regulatory compliance.

Competitive overview of Body Control Module Market

The major players operating in the body control module market include Continental AG, Robert Bosch GmbH, Denso Corporation, Delphi Automotive PLC, Mitsubishi Electric Corporation, Hella GmbH & Co. KGaA, Mouser Electronics, Infineon Technologies AG, Harman International, Tata Elxsi, and Renesas Electronics Corporation.

Body Control Module Market Leaders

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Delphi Automotive PLC

- Mitsubishi Electric Corporation

Body Control Module Market - Competitive Rivalry, 2024

Body Control Module Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Body Control Module Market

- In June 2024, Magna announced its first contract to supply a reconfigurable seating system to a Chinese Original Equipment Manufacturer (OEM). This innovative system features fully rotating front seats on nearly two-meter-long rails, allowing for flexible in-cabin layouts.

Body Control Module Market Segmentation

- By Functionality

- High-End

- Low-End

- By Vehicle Energy Source

- Hardware

- Software

- By Vehicle Type

- Light-duty Vehicles

- Heavy Vehicles

- By MCU Bit Size

- 8-bit

- 16-bit

- 32-bit

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the body control module market?

The body control module market is estimated to be valued at USD 34.79 Bn in 2024 and is expected to reach USD 42.85 Bn by 2031.

What are the key factors hampering the growth of the body control module market?

High cost pressures faced by OEMs due to stringent regulations and complexity in the design and integration of body control modules are the major factors hampering the growth of the body control module market.

What are the major factors driving the body control module market growth?

Increasing demand for advanced safety and comfort features in vehicles and rise in adoption of hybrid and electric vehicles are the major factors driving the body control module market.

Which is the leading functionality in the body control module market?

The leading functionality segment is high-end.

Which are the major players operating in the body control module market?

Continental AG, Robert Bosch GmbH, Denso Corporation, Delphi Automotive PLC, Mitsubishi Electric Corporation, Hella GmbH & Co. KGaA, Mouser Electronics, Infineon Technologies AG, Harman International, Tata Elxsi, and Renesas Electronics Corporation are the major players.

What will be the CAGR of the body control module market?

The CAGR of the body control module market is projected to be 3.02% from 2024-2031.