Electric Generator Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Electric Generator Market is segmented By Fuel Type (Diesel Generators, Gas Generators, CKD Generators), By Application (Stand By, Peak Shaving, Conti....

Electric Generator Market Size

Market Size in USD Bn

CAGR6.59%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.59% |

| Market Concentration | High |

| Major Players | Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Siemens AG, Kohler Co. and Among Others. |

please let us know !

Electric Generator Market Analysis

The electric generator market is estimated to be valued at USD 32.38 Bn in 2024 and is expected to reach USD 50.60 Bn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 6.59% from 2024 to 2031. The electric generator market is set to expand steadily due to rising demand for uninterrupted and backup power from both residential and commercial users.

Electric Generator Market Trends

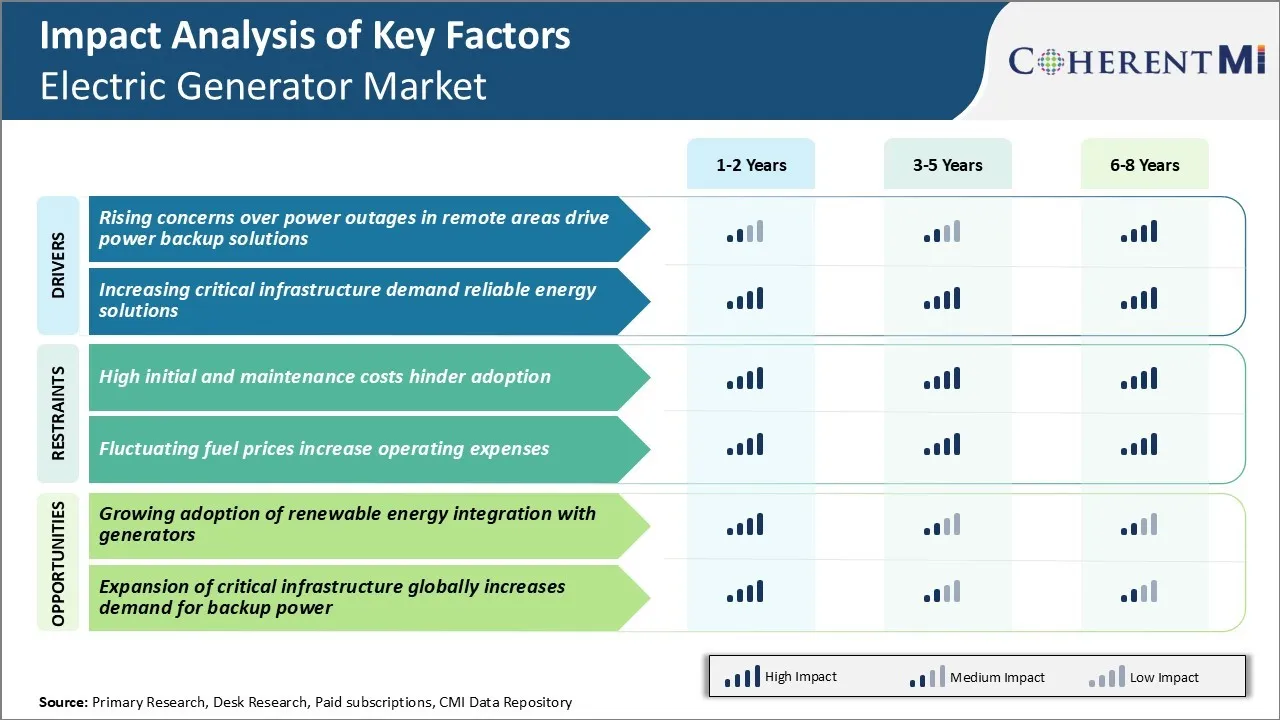

Market Driver - Rising Concerns over Power Outages in Remote Areas Drive Power Backup Solutions

As power demands continue rising across the globe, ensuring reliable access to electricity has become increasingly important. Remote and rural areas, in particular, are more prone to experiencing power outages due to their isolation from main power grids.

To address this issue, backup power generators have emerged as an essential solution. Smaller generators suitable for homes and small enterprises have gained widespread acceptance in off-grid areas. Larger generators are also being widely adopted to power entire remote communities and villages.

Even governments and policymakers are promoting the deployment of generators as a means to extend electrification to far-flung regions. Several rural electrification programs subsidize the procurement and installation of backup systems. As a result of growing reliability concerns as well as support measures, the electric generator market catering to remote and off-grid applications is thriving.

Both individual consumers and infrastructure owners are increasingly recognizing the value of backup power in mitigating disruption risks. This rising preference for backup solutions is a key driver propelling the electric generator market forward.

Market Driver - Increasing Critical Infrastructure Demand Reliable Energy Solutions

In today's world, reliable power is no longer a luxury but rather an imperative for development across sectors. Society has become overwhelmingly dependent on a constant electricity supply to function smoothly. This reality has placed significant focus on ensuring robust and resilient energy infrastructure nationwide. Especially as infrastructure responsible for essential services like healthcare, banking, transport, and communications require uninterrupted access to power.

To meet this growing need for highly reliable energy, facilities housing critical infrastructure are heavily investing in backup power solutions. Regulators in many countries now mandate minimum backup power capacity for critical facilities. Non-compliance can invite heavy penalties. To adhere to such norms, infrastructure owners have little choice but to procure robust electric generator sets. It is a major factor sustaining vital electricity supply and propelling the electric generator market.

Market Challenge - High Initial and Maintenance Costs Hinder Adoption

The high initial capital outlay required for purchasing electric generators poses as a major challenge in the electric generator market. This is true, especially in developing regions and rural areas with limited access to reliable grid electricity. Standby electric generators can range from a few thousand dollars for smaller home backup units to tens of thousands of dollars for large industrial generators. The high upfront costs deter many potential customers and make electric generators an unaffordable option for low-income households and businesses.

Furthermore, the ongoing operating and maintenance costs associated with fuel, repairs, and regular servicing of generators also places a financial burden on customers over the productive lifespan of the equipment. With tight budget constraints, customers are hesitant to make such a sizable long-term investment, hampering penetration levels.

Additionally, lack of financing options in certain markets further exacerbates the affordability challenge. To address this barrier, manufacturers may need to explore strategies like subsidized financing, rental options, bundled service contracts etc. to make generators more cost-effective.

Market Opportunity - Growing Adoption of Renewable Energy Integration with Generators

The rising push for clean and sustainable energy coupled with favorable policy incentives has boosted investments in renewable energy sources like solar and wind power in recent years. However, intermittency remains a key issue with these variable energy sources. This is where backup electric generators play an important supporting role by ensuring reliable power supply when renewable power generation is inadequate.

When paired with battery storage technologies, generators can provide extended backup during periods of low solar or wind resource availability. Their integration with renewable energy systems enables higher penetrations of clean energy while also delivering critical power resilience. This has driven increased uptake of generator-renewable hybrid solutions across both residential and commercial-industrial sectors.

Additionally, the use of generators to power microgrids further scales up opportunities in off-grid rural electrification applications utilizing decentralized renewable resources. Going forward, the synergies between electric generators and variable renewables will be a significant tailwind for continued expansion of the electric generator market.

Key winning strategies adopted by key players of Electric Generator Market

Focus on product innovation- Product innovation has been one of the most widely adopted strategies by generators manufacturers to gain competitive advantage. For example, in 2020, Generac Holdings introduced PWRcell, a home standby generator system integrated with wall-mounted and floor-standing lithium-ion batteries to provide emergency backup power even during power outages. This innovative product helped Generac strengthen its leadership position in home standby electric generators market.

Expand through strategic acquisitions - Acquisitions have allowed generators companies to broaden their product portfolio and geographical footprint. In 2022, Caterpillar acquired Ottobock for $2.1 billion, adding Ottobock's hydraulics and electronics capabilities to its offerings.

Focus on after-sales services and customer support - Strong after-sales service and customer support network helps vendors retain and attract more customers.

Increased investments in emerging markets - As demand for electric generators grows rapidly in Asian and African countries, leading companies started investing heavily in developing robust distribution and customer support channels in these regions over the last 5 years.

Segmental Analysis of Electric Generator Market

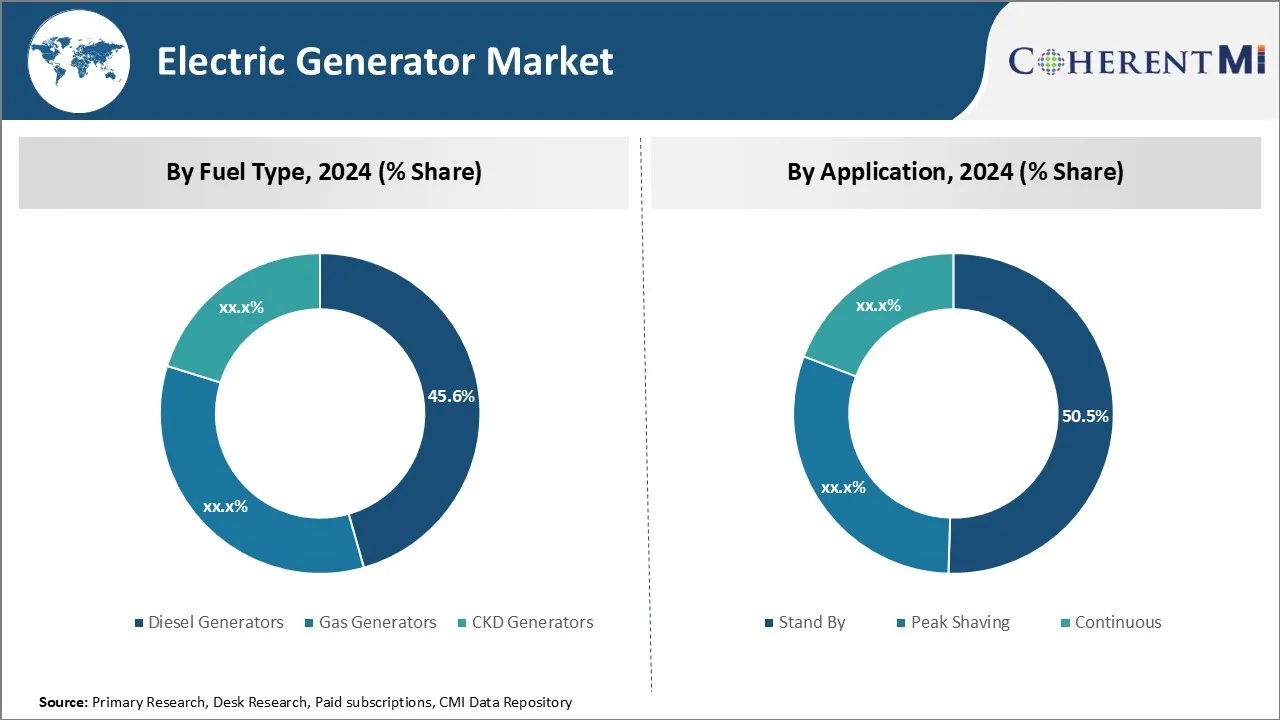

Insights, By Fuel Type: Reliability and Adaptability Drives Diesel Generators' Market Dominance

In terms of fuel type, diesel generators contributes 45.6% share of the electric generator market in 2024. This is owning to their reliability and adaptability. Diesel is a stable fuel that is less prone to supply disruptions compared to natural gas. This provides diesel generators an upper hand in delivering uninterrupted power even in areas without a stable gas supply infrastructure. Their ability to run for extended hours without refueling through on-board diesel tanks also makes them a viable backup power solution for remote locations and off-grid sites.

Additionally, diesel generators offer higher power densities than other fuel types, enabling them to provide power efficiently even for large industrial and commercial facilities. They are also relatively inexpensive to install due to widespread availability of diesel across the world. The consistency in diesel fuel quality allows diesel generators to seamlessly run on any grade of diesel, providing extensive operational flexibility.

Insights, By Application: Dependability drives popularity of standby generators

In terms of application, stand by contributes 50.5% share of the electric generator market in 2024. This is due to the critical dependability they offer. Standby generators are automatic home or commercial backup power systems primarily used to ensure power during outages. They provide peace of mind against disruption of essential services.

Standby generators instantly take over in the event of a power failure, avoiding downtime and protecting sensitive equipment and operations from power fluctuations. Their ability to maintain steady and stable voltage output within seconds of a utility failure makes them highly reliable for mission critical or time sensitive applications across various industries.

Insights, By End Use: Continuous Usage Drives Commercial Sector's Lead

In terms of end use, commercial sector contributes the highest share of the electric generator market owing to round-the-clock power needs. Commercial buildings such as retail outlets, offices, schools and hospitals require continuous electricity supply to support round-the-clock operations.

While these facilities also utilize generators for backup during outages, a large portion of commercial generators are used on a regular basis to supplement power from the local grid. This helps commercial establishments avoid power cuts and fluctuations caused by overloaded grids or planned maintenance work.

It also enables them to reduce dependency on expensive commercial tariffs. The high power consumption and consistent operational needs of commercial sector facilities drive the segment's lead in the electric generator market.

Additional Insights of Electric Generator Market

- Increasing deployment of generators for construction sites and mining operations where grid power is absent.

- Growth in renewable energy targets (e.g., India's plan for 500 GW capacity by 2030 and Europe's target of 45% renewable energy by 2030).

- North America held the largest share of the electric generator market in 2023.

- Europe is projected to grow at the fastest rate in the global electric generator market during the forecast period.

- Construction and mining sectors drive generator adoption in Asia-Pacific.

Competitive overview of Electric Generator Market

The major players operating in the electric generator market include Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Siemens AG, Kohler Co., Rolls-Royce Holdings plc, Atlas Copco AB, Honda Motor Co., Ltd., Mitsubishi Heavy Industries, Ltd., Wartsila Corporation, Yanmar Holdings Co., Ltd., Kirloskar Electric Company, Briggs & Stratton Corporation, Kubota Corporation, Mahindra Powerol, and Wuxi Kipor Power Co., Ltd.

Electric Generator Market Leaders

- Caterpillar Inc.

- Cummins Inc.

- Generac Holdings Inc.

- Siemens AG

- Kohler Co.

Electric Generator Market - Competitive Rivalry, 2024

Electric Generator Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Electric Generator Market

- In July 2024, Kohler introduced ultra-low-noise generators designed for urban environments. This innovation reduces sound pollution, meets stricter city regulations, and appeals to commercial and residential customers demanding quieter, more community-friendly solutions.

- In February 2024, Cummins announced a strategic collaboration with a leading energy storage provider. This partnership integrates battery systems with Cummins generators, enabling seamless microgrid solutions that bolster sustainability and reliability in remote industrial applications.

- In November 2023, Siemens launched a new digital platform for large-scale commercial and industrial electric generators. The platform enhances predictive maintenance, reduces downtime, and lowers operational costs, strengthening Siemens’ position as a technology leader in the electric generator market.

- In August 2023, Caterpillar introduced a new line of hybrid diesel-gas generator sets in North America. This development aims to reduce emissions, improve fuel efficiency, and offer flexible power solutions, enhancing Caterpillar’s presence and environmental credentials in the electric generator market.

Electric Generator Market Segmentation

- By Fuel Type

- Diesel Generators

- Gas Generators

- CKD Generators

- By Application

- Stand By

- Peak Shaving

- Continuous

- By End Use

- Commercial

- Industrial

- Residential

- Mining, Oil & Gas

- Construction

- Marine

- Manufacturing

- Pharmaceuticals

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the electric generator market?

The electric generator market is estimated to be valued at USD 32.38 Bn in 2024 and is expected to reach USD 50.60 Bn by 2031.

What are the key factors hampering the growth of the electric generator market?

The high initial and maintenance costs hinder adoption and fluctuating fuel prices increase operating expenses are the major factor hampering the growth of the electric generator market.

What are the major factors driving the electric generator market growth?

The rising concerns over power outages in remote areas drive power backup solutions and increasing critical infrastructure demand reliable energy solutions are the major factor driving the electric generator market.

Which is the leading fuel type in the electric generator market?

The leading fuel type segment is diesel generators.

Which are the major players operating in the electric generator market?

Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Siemens AG, Kohler Co., Rolls-Royce Holdings plc, Atlas Copco AB, Honda Motor Co., Ltd., Mitsubishi Heavy Industries, Ltd., Wartsila Corporation, Yanmar Holdings Co., Ltd., Kirloskar Electric Company, Briggs & Stratton Corporation, Kubota Corporation, Mahindra Powerol, and Wuxi Kipor Power Co., Ltd. are the major players.

What will be the CAGR of the electric generator market?

The CAGR of the electric generator market is projected to be 6.59% from 2024-2031.