吸収性止血材市場 サイズ - 分析

吸収性ヘmostatsの市場は評価されると推定されます 2025年のUSD 3.06 Bn そして到達する予定 2032年までにUSD 4.82 Bn、 化合物年間成長率で成長 2025年から2032年までの6.7%のCAGR。 吸収性 hemostats はますます体内障を援助し、外科の後でボディによって吸収される能力に身に着けているヘルスケアの専門家によって採用されます。

市場規模(米ドル) Bn

CAGR6.7%

| 調査期間 | 2025-2032 |

| 推定の基準年 | 2024 |

| CAGR | 6.7% |

| 市場集中度 | High |

| 主要プレーヤー | B. ブラウン, バクスター, ジョンソン&ジョンソン, BDについて, キュラメディカル その他 |

お知らせください!

吸収性止血材市場 トレンド

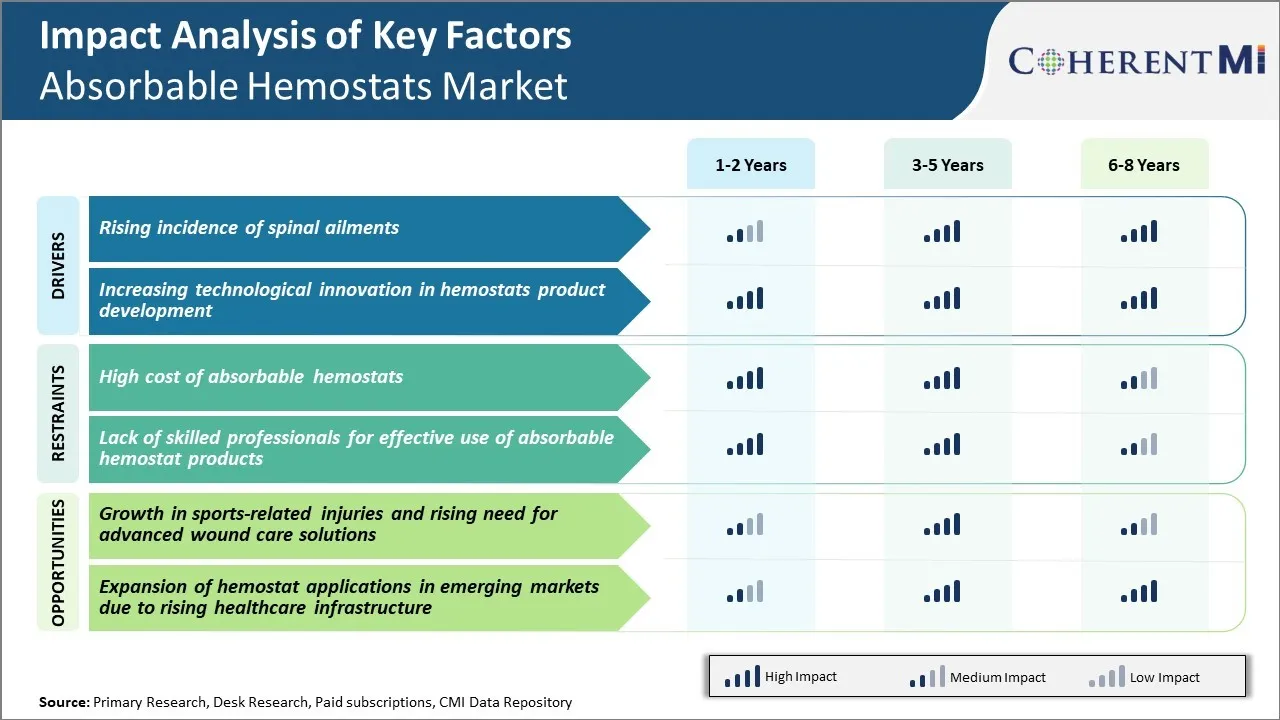

市場ドライバー - スピナルアイルメントのライジングインシデント

過去10年間に様々なタイプの背骨の病気に大きな上昇がありました。 脊椎の問題は、姿勢や肥満が原因で、滑りやすいディスク、損傷ディスク、または椎骨折などのより重要な条件に起因するマイナーな背痛から及ぶ可能性があります。 先進国の人口増加も、再生脊椎疾患の高症例にも貢献しています。 延伸されたライフスタイル関連の病気と身体活動の欠如は、脊椎障害により多くの傾向を増やしました。 数日間から数ヶ月まで続く可能性のあるいくつかの点で、アメリカ人のほぼ80%が痛みを経験します。

脊椎手術は、毎年大幅な増加を見てきました。 脊椎の注入、減圧手術などのような侵襲的または最小限の侵襲的な手順を必要とする従来のオープン脊椎手術であっても、すべての血の損失の特定の量を含みます。 吸収性 hemostats は出血を制御するためにそのような複雑な脊柱の外科で広く使用され、血および液体を吸収し、凝固を促進します。 酸化セルロース、ゼラチンのマトリックスのトロンビンの混合物等のようなさまざまな形態は出血および外科条件の重症度によって好まれます

さらに、繊細な神経を巻き込んだ脊椎手術がより高度になり、血液の損失が最小限に抑えられ、視認性が向上するにつれて、そのような高い摂取量の成功が重要になります。 これは、背骨セグメントにおける技術的に高度なヘmostatsのための重要な需要を駆動します。

市場ドライバ - Hemostats製品開発における技術革新を強化

医療技術業界は、特にヘmostats ドメインで技術革新の急速なペースを目撃してきました。 数多くのスタートアップや大手企業が研究開発に注力し、次世代の静止製品を開発しています。 個々のエージェントの限界をブリッジするコンビネーションスタイルの開発に注力しています。 また、より高速な展開とクローティング能力が導入されているヘモスタット。

例えば、血栓またはゼラチンで酸化再生成セルロースの組み合わせは、デュアルアクションヘmostasisとシーラント効果を提供し、手術室で時間を減らすことで有利になります。 同様に、抗菌特性を統合するヘmostatsは、特に脊椎および脳の外科で術後の感染症を削減するのに役立つ新しいentrantsです。

同時に、再生可能な合成ポリマーベースのヘモスタットの開発は、新しいアベニューを開きます。 天然の代理店ベースのオプションと比較して、合成物は、病気の伝達などの問題から解放される以外に性能と吸収特性の一貫性を提供します。

材料科学およびポリマー工学の進歩は専門にされた外科条件のために完全に適した仕立ての合成物の設計を可能にしました。 例えば、解剖領域ごとにカスタマイズした3Dプリントヘmostatsは新しい開発です。 Hemostatsのナノテクノロジーおよび薬剤のローディング機能は新しい治療の可能性の鍵を開ける他の革新です。

このレポートの詳細については、 無料サンプルコピーをダウンロード

このレポートの詳細については、 無料サンプルコピーをダウンロード

市場課題 - 吸収性ヘmostatsの高いコスト

現在、吸収性ヘmostats市場で直面している主要な課題の1つは、これらの製品の高コストです。 吸収性ヘモスタットは、酸化セルロース、多糖類、およびゼラチンなどの高度な技術と材料を使用して製造され、体内で迅速な凝固と吸収を可能にします。

しかし、これらの高度な製造プロセスと材料は、かなりの価格で来ます。 例えば、SurgicelやGelita-Celなどの主要な吸収性ヘモスタットは1ユニットあたり150-200ドル前後のコストです。 この高コストは、多くの定期的な手術手順での使用を禁止し、主により大きく複雑な手術に採用を制限する吸収性ヘmostatsをします。

高コストも、これらの製品の浸透を価格に敏感な開発市場で制限します。 この課題に対処するためには、メーカーは、効率性を損なうことなくコストダウンを可能にするイノベーションに焦点を当てる必要があります。 これは、代替原料を探求し、生産ワークフローを合理化し、設計を標準化することができます。 高コストの障壁を克服することは、吸収性ヘmostats市場の完全な成長の可能性を実現するために重要になります。

市場機会 - スポーツ関連の傷害および高度の傷の心配の解決のための上昇の必要性の成長

吸収性ヘmostats市場の主要な機会の1つは、世界的なスポーツ関連の傷害の着実な上昇です。 より多くの人々はさまざまなレクリエーションと競争のスポーツを占めています。 しかし、これは筋肉の涙、骨の骨の骨折、および外科的介入を必要とするレースレーションのような怪我の増加にもつながっています。

スポーツ医学はスポーツ関連の傷および傷害に対処することに焦点を合わせる専門にされた臨床規準として出ました。 高度な創傷ケアソリューションの需要は、アスリートの迅速な回復を支援するために、この分野で重要な成長を目撃しています。 体内の残留物を残すことなく、クイッククローティングと癒しを促進する吸収可能なヘモスタットは、従来のガウゼとスポーツ医学用途のための布創傷ドレッシングよりも明確な利点を持っています。 最小限の侵襲手術の有効性は、アップテイクを後押ししています。

定期的な運動による生活習慣病予防が優先されるとともに、特殊スポーツ傷害管理の要求や、吸収性ヘモスタットなどの創傷ケアソリューションは、今後数年間で増加し続けることが期待されます。

主要プレーヤーが採用した主な勝利戦略 吸収性止血材市場

製品イノベーション: 新しく、革新的な吸収性ヘmostatsプロダクトを開発することは市場のプレーヤーによって採用される重要な作戦です。 例えば、2018年に、BaxterはGAVELの外科密封剤、外科の間に適当な出血に穏やかに制御するように設計されている吸収性のhemostatic代理店を進水させました。 それは一般的な、血管および心血管のプロシージャの広い範囲の使用のために承認される最初の吸収性のヘmostatでした。 この革新的な製品は、バクスターゲイン市場シェアを助けました。

買収について: : : 他の企業が新しい技術や市場へのアクセス権を獲得するために成功した戦略をしています。 2019年、ジョンソン・アンド・ジョンソンは、ロボット支援手術における姿勢を強化するためにオーリス・ヘルスを買収しました。 SURGICEL製品が成長する分野に参入するようなJ&Jの吸収性ヘmostatsを与えました。

パートナーシップ: 他のプレイヤーとのパートナーシップを確立することで、製品の提供と強みを補完します。 例えば、2017年にApollo Endosurgery社と提携し、お客様に吸収性ヘmostatsを含む手術製品の包括的なポートフォリオを提供しています。 2020年、C.R. BardはEthiconと提携し、SPONGOSTANのような吸収性ヘmostatへのアクセスを拡大しました。

市場拡大: : : トッププレイヤーは、コラボレーション、買収、新製品の発売により、新興地域に集中しています。 たとえば、2015年、バクスターは、インドのTachoSilを含むTachoSilを含むClaris注射器と合弁会社を設立しました。

セグメント分析 吸収性止血材市場

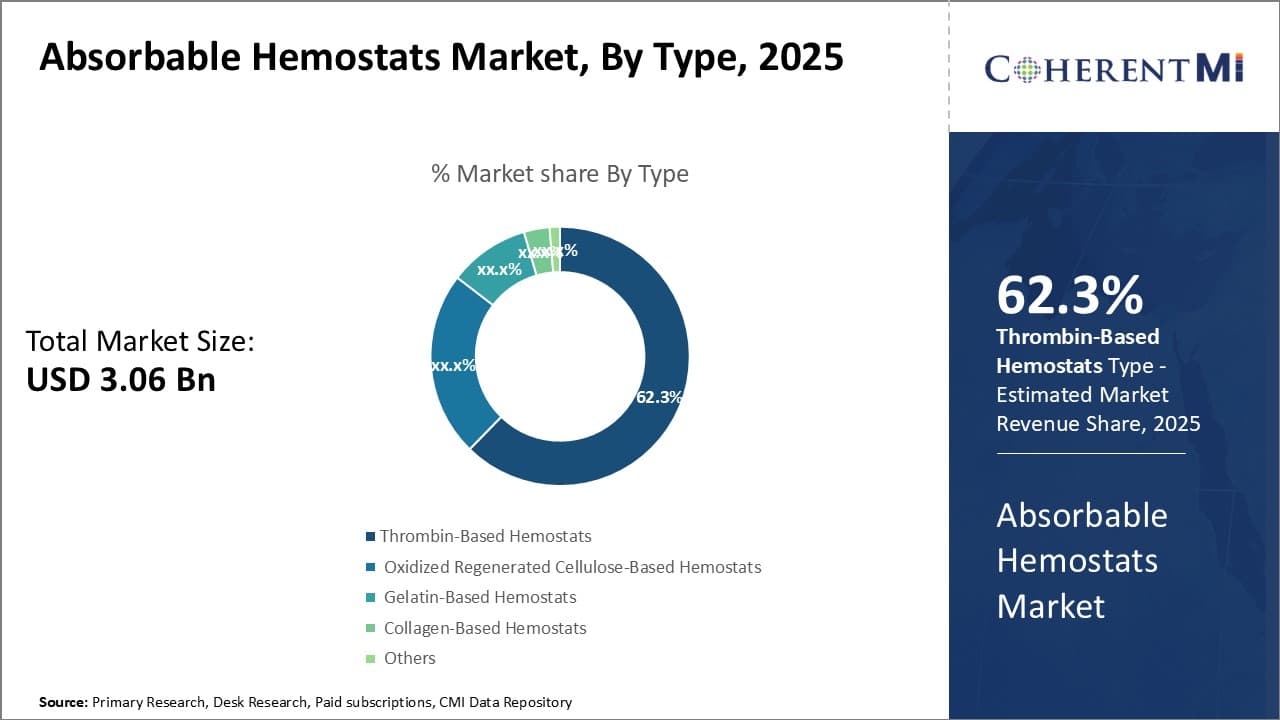

このレポートの詳細については、 無料サンプルコピーをダウンロード洞察, タイプで: 汎用性と広い応用性は、トロンボーンベースのヘモスタットの成長を駆動

このレポートの詳細については、 無料サンプルコピーをダウンロード洞察, タイプで: 汎用性と広い応用性は、トロンボーンベースのヘモスタットの成長を駆動

タイプの面では、トロンビンベースのヘモスタットは、その汎用性と幅広いアプリケーションを所有する市場の最高のシェアに貢献します。 トロンボーンベースのヘモスタットは血栓を活性化し、血栓を形成するためにフィブリノゲンの変換を援助することによって働きます。 アクションのこのメカニズムは、手術の種類を渡るさまざまな手順のために、それらに効果的な止血剤を作ります。 彼らはほとんどの組織タイプと互換性があり、アプリケーションの前に複雑な準備手順を必要としません。 また、タンパク質をベースにし、身体のポストサージリーに劣化・吸収を最小限に抑えます。

トロンボーンベースのヘmostatsは、心臓血管、神経外科、整形外科、およびその迅速で効果的なhemostasisによる外傷の手順で広く使用されています。 心血管外科では、それらは血管のastomosesおよび動脈のcannulationの場所からの出血を制御するのを助けます。 神経外科では、過剰な腫れを促進することなく、脳の問題のほとんどを達成するために好まれています。 彼らの可鍛性製剤は、関節のための最小侵襲的な整形外科手術で簡単に適用することができます。

トラウマの場合、トロンビンベースのヘリモスタティックパッドとパウダーは、出血の創傷やレースの迅速ヘリシスを提供します。 骨組みベースのヘmostatsの汎用性は、手術の専門性だけでなく、さまざまな組織タイプとの互換性の点で、吸収性ヘmostats市場でのリーディングタイプとなっています。

このレポートの詳細については、 無料サンプルコピーをダウンロード

このレポートの詳細については、 無料サンプルコピーをダウンロード

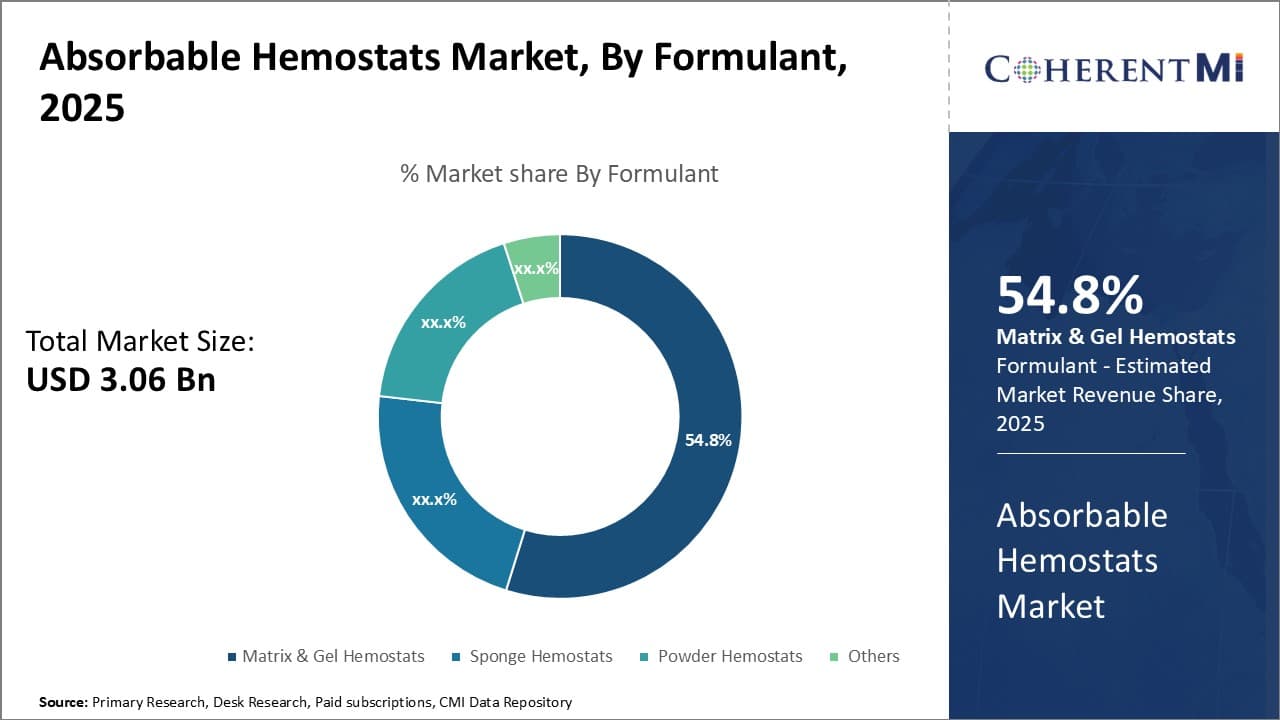

洞察力、フォーミュラントによる:マトリックスとゲルヘモスタットの優れた性能

式的な面で, マトリックス & ゲル Hemostats は、他の処方よりも優れた性能特性を借りて市場の最高のシェアに貢献します. マトリクスとゲルのヘモスタットは、機械的に創傷のキャビティを満たし、ヘmostasisを確立するアプリケーションに相互接続されたネットワークを形成します。 可能なゲルかマトリックスである、それらは不規則なティッシュの表面および解剖学の欠陥によく合わせます。

スポンジおよび粉の公式、マトリックスおよびゲルのhemostatsと比較されて出血の場所のより強く、より速い機械圧縮を排出します。 この圧縮は、クローティングプロセスの延長期間にわたって維持されます。 また、近代的な行列とゲルヘmostatsは、血小板凝集を加速するためにトロンビンのような生物活性剤を追加しました。 いくつかの高度な処方は、自然治癒が起こるまで、ヘmostasis を維持するために徐々に凝固因子を解放します。

マトリクスとゲルのヘモスタットの均一な分布特性により、内部の圧縮力に依存するスポンジと比較して、より信頼性の高いヘmostasisを可能にします。 それらはまた緩い粉および微粒より外科場所へのより少ない破壊的です。 ユーザーフレンドリーな処方、マトリックスおよびゲルのヘmostatsが最小限に侵襲的な内視鏡処置でアップテークを増加させ、堅いゲルの公式が限られたスペースで十分な圧縮を達成しました。 全体的に、優秀な性能の属性はマトリックス及びゲルのヘmostatsの吸収性ヘmostatsの市場の一流のformntのタイプをしました。

アプリケーションによる洞察: 神経外科症例の複雑さとボリュームは、その株式をブースト

応用面では、神経外科は市場の最も高いシェアに貢献します。 神経手術の手順は、神経組織の繊細な性質に非常に複雑である傾向があります。 血管や脳神経などの敏感な構造の近くに位置する病変の遠足または修復の間に安全な hemostasis を達成することは極めて重要です。

同時に、過剰な腫れと瘢痕形成は、脳の手術で避けなければなりません。 吸収性ヘモスタットの代理店は従ってティッシュの炎症を増加させることなしで血の損失を最小にする必須のadjunctsです。 さらに、神経疾患や生命の期待が世界的に上昇するにつれて、脳と脊椎手術の症例の量と複雑性が急速に増加しています。

周囲の組織を乱すことなく、しっかりとまだ不規則な神経アーキテクチャに合致する高度なゲルとマトリックス処方は、広範な取込みを参照してください。 トロンボーンベースのヘmostatsは、無害に分解しながら、触媒的に凝固を加速するだけでなく、広範な神経外科的アプリケーションを持っています。

これらの利点を考えると、吸収性ヘmostatsは、神経腫瘍学、神経血管、内因性神経外科および外傷の手順における高度な出血管理技術の重要なコンポーネントになりました。 他のアプリケーション領域と比較して神経外科専門の増殖の高度化および容積は高い市場シェアを運転します。

追加の洞察 吸収性止血材市場

- 筋骨格条件の上昇, 特に腰痛, に影響します。 1.71 グローバルに億人 (2021).

- 道路のクラッシュや落下による脊髄損傷の増加に伴い、年間250,000〜500,000の症例が世界的に増加しています。

- ゼラチンベースのヘモスタットは、血液と流体の40倍の体重を吸収する能力のために有効であり、200%のバイボで拡大し、それらを外科的ヘmostasisで優れた選択肢を作る。

競合の概要 吸収性止血材市場

吸収性ヘモスタット市場で運営されている主要なプレーヤーには、B。Braun、Baxter、Johnson& ジョンソン、BD、キュラメディカル、ジェリタメディカル、キュラサンAG、メリルライフサイエンス、Zhonghui Shengxi、北京Datsing Bio-Tech、Guizhou Jin Jiu Biotech、北京Taikesiman、Foryou Medical、Saikesaisi Holdingsグループ、Biotemed、hangkclean demostemed、 LLC、Stryker、およびSamyang Holdings Corporation。

吸収性止血材市場 リーダー

- B. ブラウン

- バクスター

- ジョンソン&ジョンソン

- BDについて

- キュラメディカル

最近の動向 吸収性止血材市場

- 2020年3月、Ethiconはオーストラリア、ニュージーランド、タイのSUGICEL® POWDERのABSORBABLE HEMOSTATを発売し、手術中の効率的な出血制御を補助しました。 Ethicon、ジョンソン&ジョンソンメディカルデバイス企業、戦略的にオーストラリア、ニュージーランド、タイでこの製品を導入しました。 製品は、特に伝統的なヘmostasisメソッドが不十分な状況で、より効率的に出血を制御するのを助けるように設計されています。 シンガポールや香港などの地域に既に導入され、日本、マレーシアなどアジア・太平洋諸国に導入されました。

- 2018年1月、Ethiconは、サージオンが破壊的な出血を制御するのを助けるために米国でSurgiceL®の粉末ABSORBABLE HEMOSTATを発売しました。

吸収性止血材市場 セグメンテーション

- タイプ別

- トロンボーンベースのヘmostats

- 酸化再生セルロースベースのヘmostats

- ゼラチンベースのヘmostats

- コラーゲンベースのヘmostats

- その他

- フォーミュラン

- マトリックス&ゲルヘモスタット

- スポンジヘmostats

- 粉 Hemostats

- その他

- 用途別

- 神経外科

- 整形外科手術

- 一般手術

- 再建手術

- その他

- エンドユーザーによる

- 病院・クリニック

- Ambulatory 外科センター

- その他

購入オプションを検討しますか?このレポートの個々のセクション?

Manisha Vibhute は、市場調査とコンサルティングで 5 年以上の経験を持つコンサルタントです。市場動向を深く理解している Manisha は、クライアントが効果的な市場アクセス戦略を策定できるよう支援しています。彼女は、医療機器会社が価格設定、償還、規制の経路をうまく利用して、製品の発売を成功に導くお手伝いをしています。