HUD ヘルメット市場 規模およびシェア分析 - 成長トレンドおよび予測 (2024 - 2031)

HUDヘルメット市場は、接続性(テザー、埋め込み)、エンドユーザー(自動車(乗用車、商用車)、オートバイ、航空宇宙(軍用航空、民間航空)、ディスプレイ(OLED、LCOS、LCD、LED)、テクノロジ...

HUD ヘルメット市場 サイズ - 分析

HUDのヘルメットの市場は評価されると推定されます 米ドル 219.95 Mn で 2024 そして到達する予定 米ドル 1,389.1 によって Mn 2031、混合の年次成長率で育つ (CAGR) 2024年~2031年30.12%お問い合わせ 自転車や軍部隊の安全性と状況意識の向上に対する需要の増加は、HUDヘルメットの需要を運転しています。

市場規模(米ドル) Mn

CAGR30.12%

| 調査期間 | 2024 - 2031 |

| 推定の基準年 | 2023 |

| CAGR | 30.12% |

| 市場集中度 | High |

| 主要プレーヤー | ディグレンズ株式会社, 株式会社NUVIZ, 株式会社ジャパンディスプレイ, BMWの モーターラッド, 株式会社 商栄アジア その他 |

お知らせください!

HUD ヘルメット市場 トレンド

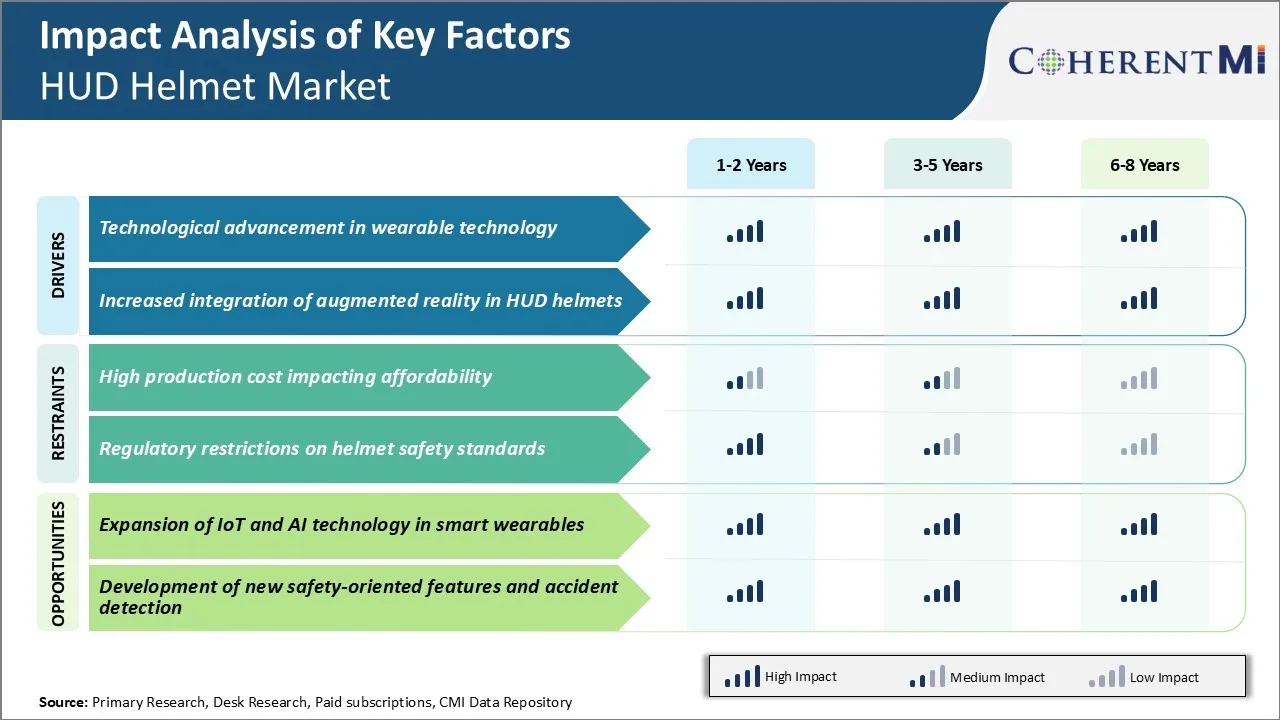

マーケットドライバー - ウェアラブルテクノロジーの技術開発

ウェアラブルな技術は急速な strides を作るために、ヘッドアップ ディスプレイ(HUD)のヘルメットは確かに増加する機能からより高度の機能性を密集した身につけられるフォーマットに寄与しています。 ディスプレイ技術、加工力、電池寿命、接続性、センサーなどの分野において、HUDヘルメットを活用できる大きな進歩を遂げています。

処理の高度化により、HUD ヘルメットが改善されたグラフィックスのレンダリング、画像認識機能、応答時間を利用できるようにします。 より強力なオンボードプロセッサとグラフィックスカードで、ヘルメットは、リアルタイムのビューの上にターンバイターンをオーバーレイしたり、オンラインマップデータを統合したりすることができます。

HUDヘルメットの接続が改善され、リアルタイムのデータストリーミングなどの機会を利用することができます。 例えば、4G LTEコネクティビティを統合することで、イベントのヘルプで他のモーターサイクリストや緊急サービスとの双方向通信が可能になります。 GPS衛星やオンラインマップからのデータストリームもヘルメットバイザーに映るターンバイターンナビゲーションのユーティリティを強化します。

このような技術の進歩は、今後数年間にHUDヘルメット市場の前例のない成長を阻止することが期待されます。

市場ドライバ - HUDヘルメットで拡張現実の統合を強化

拡張現実は、HUDのヘルメット体験を真に変えることを約束するエリアです。 今日のヘルメットは、速度やターンバイターンなどの限られた情報の基本的なオーバーレイのみを提供します。 しかし、AR技術が成熟するにつれて、ヘルメットはよりデジタルで豊かな道路のビジョンでライダーを没入する能力を得るでしょう。 洗練されたカメラとライブビデオフィードと強力なオンボードプロセッサと組み合わせることで、ヘルメットはリアルタイムでロードスケープをスキャンできます。

AR技術の進歩が進むにつれて、可能性は指数関数的に成長します。 AI/機械学習、空間マッピング、センサー融合技術を用いた先進的なオブジェクト認識などのコンセプトは、今日の想像を超えるAR体験を届けることを約束します。 デジタル・オーバーレイ・インフォメーションのインターフェイスは、よりニュアンスされ、文脈理解に基づいて微調整されます。

究極的には、ARを搭載したHUDヘルメットを通して、現実と仮想世界がシームレスに織り込まれているライダーにとって、これまでにない没入を実現します。 技術的な課題は残っていますが、ARインテグレーションによる変革的なライダーアシスタンスのための将来の可能性は途方もなく説得力があります。

市場課題 - 高生産コストの影響を受ける可能性

HUDヘルメット市場が直面する主要な課題の1つは、一般的な消費者のためのこれらのヘルメットの手頃な価格に影響を与える高生産コストに関連しています。 統合されたHUD、マイクロプロセッサ、ジェスチャーコントロール、コネクティビティモジュールなどの高度な技術機能を組み込むことで、製造費用を大幅に削減できます。

更に、安全・耐久性に最適化された特殊材料や部品の使用も材料の手札を駆動します。 これらすべての要因は、HUD ヘルメット市場の成長を妨げることができる統合技術なしで従来のヘルメットと比較して、HUD ヘルメットが大幅に高価になります。

たとえば、プレミアムHUDヘルメットの一部が2000ドル以上の価格で、販売の可能性を制限しています。 特に価格に敏感で価値意識の高い市場において、高コストのポーズの手頃な価格の課題。 消費者は通常のヘルメットのために$ 200-500を支払うために使用され、HUDのヘルメットの盗難価格タグは、多くの潜在的な買い手のための決定者として機能します。

市場機会 - スマートウェアラブルにおけるIoTとAI技術の拡大

HUDヘルメット市場の主な機会の1つは、スマートウェアラブルデバイスにおけるモノのインターネット(IoT)と人工知能(AI)の機能の拡大アプリケーションです。

マイクロチップ技術の継続的な進歩により、ワイヤレス接続、センサー、コンピューティングパワーの統合は、ヘルメットフォームファクターでもより実現可能になりました。 これは、統合ディスプレイを超えて行く「スマート」HUDヘルメットの開発を可能にします。 ヘルメットは、リモート監視、フリート管理、予測保守機能を有効にするため、IoTモジュールでアップグレードできます。

さらに、AIと機械学習アルゴリズムを統合することで、パーソナライズされたコンテキストエクスペリエンスをライダーに提供します。 従来の製品の機能を超えてユーザーエクスペリエンスを強化することにより、IoTとAIに基づくそのようなスマート機能がHUDヘルメット市場で新しい成長アベニューを開きます。

主要プレーヤーが採用した主な勝利戦略 HUD ヘルメット市場

技術の革新の焦点: : : BIKEDynamics、Skully、NUVIZなどのプレイヤーが採用した主要な戦略は、新しい技術の継続的な投資と発展を続けています。 たとえば、BIKEDynamicsは、2018年にRIDE HUDヘルメットを発売し、高度な光学システムに焦点を当てました。

車両メーカーと提携: : : 大手オートバイや自動車OEMとのパートナーシップを結集しました。 2020年、NUVIZはBMWと提携し、3D HUD技術をBMW Motorradのヘルメットに直接統合しました。 数値は、BMW取引後の年で35%増となりました。

ライダーの安全特徴に焦点を合わせて下さい: Skullyのようなプレイヤーは、ライダーの安全を直接改善するハッド機能に焦点を合わせ、成功を収めました。 たとえば、Skully AR-1 は、HUD を通じて提示された衝突検出やハザードアラートなどの高度なドライバー支援機能を導入しました。

ブランド認知の構築: HUDヘルメット市場における初期のリーダーは、ブランドマーケティングやPRキャンペーンに大きく投資しました。 バイクダイナミクス HUDヘルメットのコンセプトを、発売した時により広い聴衆に紹介した「HUD」キャンペーンです。

セグメント分析 HUD ヘルメット市場

洞察力、接続性によって: 技術の進歩は調整された区分の成長を運転します

テザードセグメントは、2024年にHUDヘルメット市場の55.4%のシェアを保持し、継続的な技術の進歩に向けています。 テザードヘルメットは、スマートフォンやバイクなどの外部機器への有線接続を可能にするため、より一般的に使用されています。

より速い充満を提供し、より高い決断の表示を支えるUSB-Cのような改善された接続規格の製造業者は絶えず調整されたヘルメットの設計を高めます。 高度なケーブルと高帯域幅チップセットの使用は、ナビゲーションの指示、通話通知、音楽のスムーズなリアルタイムストリーミングを保証します。

セグメント成長を燃料化する重要な要因は、高度な接続プロトコルの統合です。 多くのテザーヘルメットは、無線能力を拡張するWiFi、Bluetooth、独自の通信規格などの技術をサポートしています。 別の主要なドライバは、ユーザーフレンドリーなインターフェイスの実装です。 テザーされたヘルメットは、音声コマンドや物理的なボタンをシームレスに制御するために、シンプルで直感的なメニューを提供しています。 HUDヘルメット市場における重要なトレンドを牽引する見込みです。

エンドユーザーによるインサイト:自動車需要はエンドユーザーセグメントを支配します

自動車用エンドユーザーセグメントは、2024年にHUDヘルメット市場で48.7%のシェアを保持しています。 これは主にオートバイの使用量を増加させることによって運転されます。 主要な要因は、特に手頃な価格の個人的な輸送として役立つ開発国で、世界的なオートバイの売上高のボリュームが上昇しています。 さらに、モーターサイクルは、需要を刺激する多くの国でレクリエーション活動やアドベンチャースポーツとして人気を集めています。 HUDヘルメット市場でのセグメントを組み込んだ、プレミアム・高性能のオートバイの生産を増加させる。

車の設計および技術の援助の区分の成長に広いヘルメットの統合。 多くの新製品のオートバイモデルは、マウントポイント、パワーポート、HUDヘルメット用に最適化されたワイヤレス接続標準を含みます。 これは、オートバイのインフォテイメント、ナビゲーション、診断システムとヘルメット機能のシームレスなペアリングを実現します。 高度な統合により、ターンバイターンの方向、安全アラート、Bluetoothのペアリングなどの機能により、ヘルメットディスプレイを車両データと同期することができます。 別のシステムと比較して、ライダーの状況認識と安全性を大幅に向上させます。

洞察力、技術によって:優秀な表示質はOLEDの区分の優位性を現れます

ディスプレイ技術の中で、OLEDは、比類のない画質のためにHUDヘルメット市場でのシェアのバルクのためのアカウントをヘルメットします。 OLED または有機発光ダイオードは、HUD ヘルメットのような目のアプリケーションの近くにコンパクトに適している新しい発光技術です。

メーカーは、OLEDの無限のコントラスト比のポテンシャルを最大限に活用し、HUD画像の鮮明で鮮やかな色を実現しています。 太字で飽和した色合いとブラックスは、小さなフォントやグラフィックがライダーの視野に直接レンダリングされる可能性を向上させます。 途中で安全にナビゲーションの指示や機器の読み込みをスキャンするのに非常に重要です。 さらに、OLEDは最小限の電力を消費し、時間をかけてイメージ劣化することなくヘルメットの振動要求に耐えるのに十分な堅牢です。

高度なOLED製造の専門知識は、堅牢でコスト競争力のある大量生産を保証します。 提供され、進行中の技術的な進歩が比類のない視覚的経験を、OLED の区分は維持するために置きました。 HUDヘルメット市場の成長見通しを予測します。

追加の洞察 HUD ヘルメット市場

- アジア・パシフィック・マーケット・ドミナンス:2023年にHUDヘルメット市場で最も高いシェアを占めるアジア太平洋地域は、先進技術と都市化の急速な採用をしています。

- Dominant機能として運行: 運行機能はGPS技術の高められた統合によるHUDのヘルメットで最も普及しています。

- 軍の採用: 防衛力はますますHUDのヘルメットを採用し、兵士やパイロットに重要な情報を提供し、ミッションの効率性と安全性を向上させます。

- 自動車統合: 高級車メーカーは、HUDヘルメットの互換性を車と統合し、没入型運転体験を提供します。

- 消費者の関心:調査は、オートバイのライダーの60%以上が強化された安全のためのHUDヘルメット技術に興味があることを示しています。 過去3年間にHUD技術のスタートアップにおけるベンチャーキャピタル投資が25%増加しました。

競合の概要 HUD ヘルメット市場

HUDのヘルメット市場で動作する主要なプレーヤーには、Dig Lens Inc.、NUVIZ Inc.、日本ディスプレイ株式会社、BMW Motorrad、SHOEI ASIA CO.、Ltd、インテリジェント・クラニウム・ヘルメット LLC、JARVISH Inc.、BAE Systems、Elbit Systems Ltd.、Garmin Ltd.、デンソー株式会社などがあります。

HUD ヘルメット市場 リーダー

- ディグレンズ株式会社

- 株式会社NUVIZ

- 株式会社ジャパンディスプレイ

- BMWの モーターラッド

- 株式会社 商栄アジア

HUD ヘルメット市場 - 競合関係

HUD ヘルメット市場

(大手プレーヤーが支配)

(多くのプレーヤーが参入し、競争が激しい。)

最近の動向 HUD ヘルメット市場

- 2024年5月 スペース XはスペーススーツのためのHUDのヘルメットを進水させ、ユーザがリアルタイムデータにアクセスできるようにします。 このHUDは、圧力、温度、相対湿度などの適合メトリックにリアルタイムのデータを提供し、宇宙歩道の状況意識を高めます。

- 2024年2月、エンジニアリング・ティルバンガントフラム(CET)の大学は、バイクライダーの安全と飲酒運転を強化するスマートヘルメットの特許を付与しました。 ヘルメットは、ヘルメットを着用し、アルコールを検出すると自動的にエンジンをシャットダウンするときに、オートバイが起動することができることを確実にします。これにより、車両の運転から無毒な個人を防ぐことができます。

- 2023年7月、TilsberkはSygicと協力して、ライダーをナビゲーションでサポートするHUDヘルメットを作成しました。 この革新的なデバイスは、速度制限、電流速度、近距離、移動時間と距離などの重要な情報を、ライダーの視野に直接作成します。

HUD ヘルメット市場 セグメンテーション

- 接続性によって

- テザード

- 組み込み

- エンドユーザ

- 自動車産業

- 乗客車

- 商用車

- オートバイ

- エアロスペース

- 軍の航空

- 民間航空

- 自動車産業

- ディスプレイ

- ソリューション

- リコール

- LCD及びLED

- テクノロジー

- 慣習的な HUD

- 拡張現実 HUD

購入オプションを検討しますか?このレポートの個々のセクション?

Sakshi Suryawanshi は、市場調査とコンサルティングで 6 年間の豊富な経験を持つリサーチ コンサルタントです。彼女は、市場予測、競合分析、特許分析に精通しています。Sakshi は、市場動向の特定と競合環境の評価に優れており、戦略的な意思決定を促進する実用的な洞察を提供します。彼女の専門知識は、企業が複雑な市場動向をナビゲートし、効果的に目標を達成するのに役立ちます。

よくある質問 :

HUDヘルメット市場はどれくらいの大きさですか?

HUDのヘルメット市場は2024年のUSD 219.95 Mnで評価され、USD 1,389.1に達すると予想されます によって 2031.

HUDヘルメット市場の成長を妨げる重要な要因は何ですか?

ヘルメットの安全基準の耐久性と規制制限に影響を与える高生産コストは、HUDヘルメット市場の成長を妨げる主要な要因です。

HUDヘルメット市場成長を牽引する主要な要因は何ですか?

ウェアラブル技術の技術開発とHUDヘルメットの拡張現実の統合の増加は、HUDヘルメット市場を牽引する主要な要因です。

HUDヘルメット市場における主要な接続は?

主要な接続セグメントは調整されます。

HUDヘルメット市場での主な選手は?

Dig Lens Inc.、株式会社NUVIZ、日本ディスプレイ、BMW Motorrad、SHOEI ASIA CO.、株式会社インテリジェント・クラニウム・ヘルメット LLC、JARVISH Inc、BAE Systems、Elbit Systems Ltd、Garmin Ltd、デンソー 主要選手です。

HUDヘルメット市場のCATGは何ですか?

HUD ヘルメット市場は 2024-2031 から 30.12% になるように計画されています。