埋め込み型心臓モニター市場 サイズ - 分析

市場規模(米ドル) Bn

CAGR5.13%

| 調査期間 | 2024 - 2031 |

| 推定の基準年 | 2023 |

| CAGR | 5.13% |

| 市場集中度 | High |

| 主要プレーヤー | メドトロニック, アボット, バイオTelemetry, ボストン科学株式会社, バイオトロニックSE&Co. KG その他 |

お知らせください!

埋め込み型心臓モニター市場 トレンド

市場ドライバー - 心臓血管疾患に有利な胃の人口を上昇させる

高度な年齢は、心臓血管疾患の発症のための主要な非修飾リスク要因の一つです。 動脈硬化などの老化に関連する生理学的変化, 心臓筋肉の質量の減少, 心血管調節における変化は、心血管系が弱く、時間をかけて病気に敏感になります. 現在、開発途上国における総人口の約8~10%を占める65歳以上の方 しかし、この人口統計は急速に成長し、国連の推定によると2050年までに2倍に計画されています。

発展途上国はまた、生活の期待と出生率の減少のために、幾何学の人口シェアで一貫した上昇を経験しています。 人口の高齢者セグメントは、高血圧、糖尿病、COPD、心臓不整脈などの老化と一般的に関連する医療疾患のより高い負担に直面しています。 年齢層の成人が2〜3倍の確率で、若い人口と比較して有利な出産率が2倍になる。 若年で問題が起こらない可能性があるマイナーな心臓不整脈でさえ、高齢化や高齢化に伴う他の合併症の高リスクを引き起こす可能性があります。 そのため、心臓のリズムの継続的なモニタリングは、胃の患者にとって大きな重要性を期待しています。

移植可能な心臓モニターは、高齢者における長期心臓監視のための広範な採用を発見しました。 ユーザーの日常的な活動に干渉することなく、長期にわたって心臓のリズムを継続的に追跡する能力は、シニア患者にとって重要な利点を持っています。 これらのデバイスを介して不整脈の早期検出は、悪影響を防ぐために、タイムリーな臨床介入を導き、医療管理を最適化するのに役立ちます。 今後10年間で予想される世界的なgeriatricの人口統計で着実に上昇すると、特に高齢者の人口に合わせたインプラント可能なモニターなどの心臓モニタリングソリューションの要件は、加速されたペースで上昇する可能性があります。

市場機会 - ICM の製品発売と技術の進歩の成長

インプラント可能な心臓モニター市場は、これらの医療機器の継続的な製品起動と技術の進歩によって駆動される強力な成長機会を持っています。 ここ数年で、新しいICM製品を紹介するメーカーと、機能と機能性が強化された大きなイノベーションが誕生しました。 多くの新しいデバイスは、心臓情報を保存し、無線データ伝送機能を改善し、より小さなサイズの小型化を実現しました。 一部の製品は、人工知能ベースのアルゴリズムを統合し、心臓の不整脈をよりよく分析します。 このようなイノベーションは、インプラント可能な心臓モニターが、医師や患者の間で生みやすい診断ツールとして人気を博しています。 さらに、大手医療機器メーカーが研究開発に引き続き投資を続け、遠隔患者モニタリングや統合心臓治療の配信などの機能を備えたより先進的なICMは今後数年で開始することが期待されています。 これらの継続的な製品改良と新製品は、より多くのユーザーを引き付け、長期にわたって拡大してインプラント可能な心臓モニター市場を支援します。

主要プレーヤーが採用した主な勝利戦略 埋め込み型心臓モニター市場

先進的な機能を持つ革新的な製品の開発は、市場リーダーにとって勝ち抜かれた戦略でした。 たとえば、Medtronicは2017年にReveal LINQインサート可能な心臓モニターを発売しました。 磁気共鳴のイメージ投射との小型そして両立性は代わりの重要な利点を提供しました。 Medtronicが主要な市場シェアを獲得するのに役立ちました。

イノベーティブな新興企業が新しいテクノロジーを取り入れた大きなプレイヤーを支援しました。 たとえば、2018年にAbbottはSt. Jude Medicalを買収し、確認診断システムを含む、インサート可能な心臓モニターの広範なポートフォリオを獲得しました。 さまざまな患者様のニーズに応えるAbbottの製品提供および能力を拡大しました。

攻撃的なマーケティングキャンペーンは、リモート監視の利点とこれらのデバイスの利便性が増加した患者の受け入れを強調しています。 たとえば、Medtronicは2018年だけでReveal LINQの広告に95万ドルを費やしました。 この強力なプロモーションは、米国のような主要市場での製品を増加させました。

バイオトロニックのようなメーカーは、価格に敏感な開発市場を貫通するために低コストのデバイスを開発することに焦点を当てました. 2015年に発売されたEverionラインは、ラテンアメリカやアジアパシフィックなどの地域における市場シェアを30%削減しました。

病院、保健システム、受給者と提携し、再燃を促進し、アクセシビリティの向上に貢献しました。 例えば、米国大病院や保険会社とのAbbottの提携により、患者様にとってより手頃な価格のモニターを確認しました。

セグメント分析 埋め込み型心臓モニター市場

洞察、エンドユーザーによる:市場で最大のシェアのための病院およびクリニックのサブセグメントアカウント

エンドユーザー、病院およびクリニックでは、インプラント可能な心臓では48.3%の最大のシェアのためのサブセグメントアカウントが市場を監視しています。 彼らは、複雑な整形外科手術のための専用の電気生理学部門と設備の整形心臓カテーテルラボを採用しています。 ほとんどの装置注入およびプログラミングは専門にされた訓練、生殖不能の手術室および現地のフォローアップ サポートのための条件を与えられた病院で行います。 多くの患者は、特に高リスク症例または新しいデバイスインサートのために、構造化された治療環境と病院で利用可能な周囲のクロック監視を好む。 クリニックは、定期的なフォローアップ、プログラミングの調整、イメージング研究、および排出後の追加のケアを提供することで、この役割を補完します。 彼らは、まだ専門知識を提供しながら、病院からいくつかの責任をオフロードするために役立つ. 遠隔患者の監視機能は、病院の受診に対するクリニック設定のケアの側面を容易にするために統合されています。 さらに、病院は、インフラやリソースのオンハンドによる新しいインプラント可能な心臓モニター技術の臨床試験で患者のより大きな数を登録することができます。 多くの国での払い戻し構造は、主に病院で覆われている手順と長期デバイスコストも支持しています。 専門的心臓サービスにおける中央機能全体で、現在の主なエンドユーザーセグメントとして病院を維持します。

追加の洞察 埋め込み型心臓モニター市場

世界的なインプラント可能な心臓モニター市場は、老化人口や肥満などのライフスタイル要因によって駆動される、有利な強迫の上昇による成長のために表彰されます。 市場は、診断精度を向上させるAIの強化を含む監視技術の進歩からも恩恵を受けています。 北米は、心臓病の発生率が高く、キープレーヤーの強い存在による優勢地域です。 市場拡大は、継続的な革新と病院とホーム設定の両方で監視デバイスの採用の増加によって強化されます。

競合の概要 埋め込み型心臓モニター市場

インプラント可能な心臓モニター市場で動作する主要なプレーヤーには、Medtronic、Abbott、BioTelemetry、Boston Scientific Corporation、Biotronik SE&Co. KG、SHL本部、ScottCare Corporation、Medicomp Inc.、Angel Medical Systems、Inc.、Edwards Lifescience Corporation、Cardiac Cath Lab of Phoenix、Koninklijke Philips N.V.、Nihon Kohden Corporation、LivaNova PLCなどがあります。

埋め込み型心臓モニター市場 リーダー

- メドトロニック

- アボット

- バイオTelemetry

- ボストン科学株式会社

- バイオトロニックSE&Co. KG

埋め込み型心臓モニター市場 - 競合関係

埋め込み型心臓モニター市場

(大手プレーヤーが支配)

(多くのプレーヤーが参入し、競争が激しい。)

最近の動向 埋め込み型心臓モニター市場

- 2022年8月、ハイドックスメディカルは、AI対応のインプラント用心臓デバイス向けシンガポールでの商用化承認を受け取り、診断機能を強化し、精度を監視します。

- 2021年7月、MedtronicはLINQ IIと2つのAccuRhythm AIアルゴリズムのためのFDAの整理を、中心のリズム データ収集の正確さを改善し、よりよい診断を援助しました。

- 2020年7月では、Medtronicは、LINQ II ICMデバイス用のFDAクリアランスとCEマークを保護し、改善されたデバイス長寿と検出精度のために指摘し、患者モニタリングの重要なステップをマークしました。

埋め込み型心臓モニター市場 セグメンテーション

- 用途別

- ハリスミア

- アトリアルフィブリレーション

- その他

- エンドユーザーによる

- 病院・クリニック

- ホーム 設定

- Ambulatory 外科センター

- その他a

購入オプションを検討しますか?このレポートの個々のセクション?

Manisha Vibhute は、市場調査とコンサルティングで 5 年以上の経験を持つコンサルタントです。市場動向を深く理解している Manisha は、クライアントが効果的な市場アクセス戦略を策定できるよう支援しています。彼女は、医療機器会社が価格設定、償還、規制の経路をうまく利用して、製品の発売を成功に導くお手伝いをしています。

よくある質問 :

インプラント可能な心臓モニター市場の成長を妨げる重要な要因は何ですか?

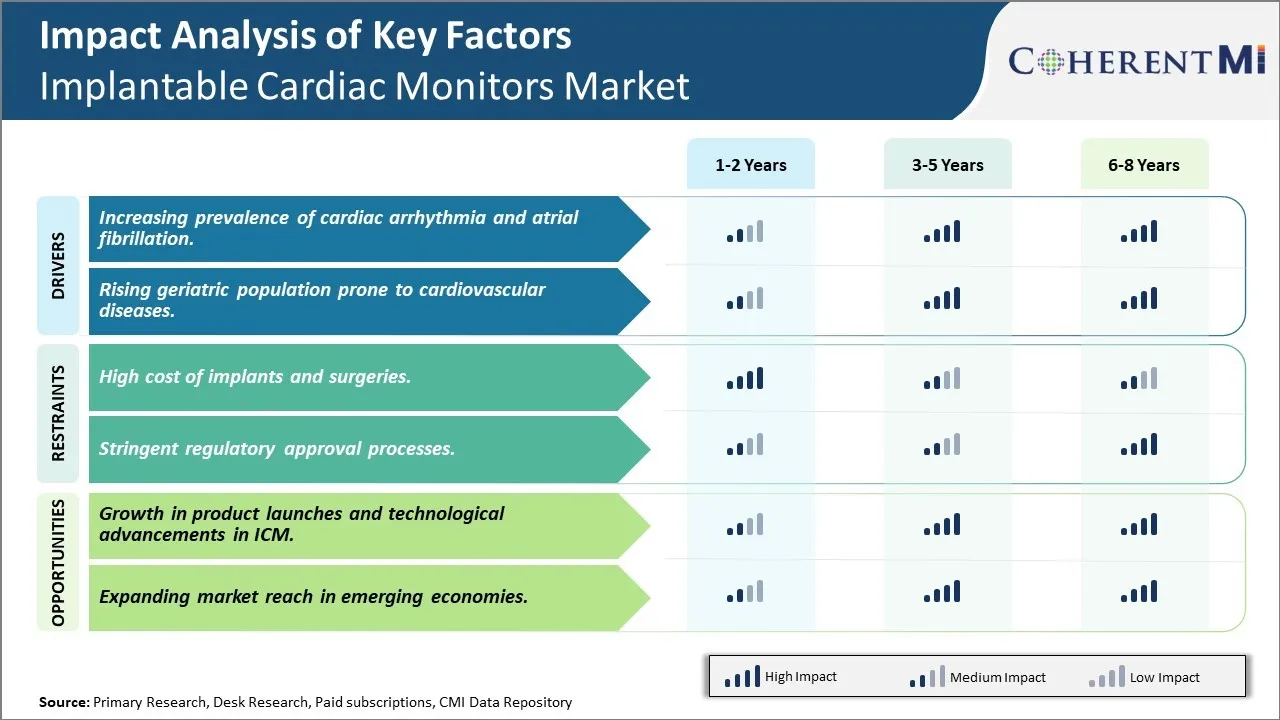

インプラントおよび手術および厳格な規制当局の承認プロセスの高コストは、インプラント可能な心臓モニター市場の成長を妨げる主要な要因です。

注射可能な心臓を運転する主要な要因は市場成長を監視しますか?

心臓不整脈および陰謀の増大率および心血管疾患への増加のgeriatric集団傾向は、インプラント可能な心臓モニター市場を運転する主要な要因です。

インプラント可能な心臓モニター市場における主要なアプリケーションは?

主要なアプリケーションセグメントは不整脈です。

移植可能な心臓モニター市場で動作する主要なプレーヤーはどれですか?

Medtronic、Abbott、BioTelemetry、Boston Scientific Corporation、Biotronik SE&Co. KG、SHL本社、ScottCare Corporation、Medicomp Inc.、Angel Medical Systems、Inc.、Edwards Lifescience Corporation、Cardiac Cath Lab of Phoenix、Koninklijke Philips N.V.、Nihon Kohden Corporation、LivaNova PLCは主要なプレーヤーです。

インプラント可能な心臓モニター市場のCATGは何ですか?

移植可能な心臓モニターのCATGは、2024-2031から5.1%になるように計画されています。