US Quick E-Commerce (Quick Commerce) Market Size - Analysis

The US Quick E-Commerce (Quick Commerce) Market is segmented by business model, product type, order size, delivery time, and location. By business model, the market is segmented into dark stores, hybrid stores, partner stores, micro fulfillment centers, local retail stores, warehouses, and others. Dark stores are expected to dominate the market over the forecast period. Dark stores are small warehouses optimized for online order fulfillment and located in prime areas near customers. The low overhead cost and proximity to customers make dark stores an efficient model for Quick Commerce.

US Quick E-Commerce (Quick Commerce) Market Drivers:

- Busy Modern Lifestyles and Need for Convenience: The busy, on-the-go lifestyles of today's consumers are a major driver of the Quick Commerce market. Long working hours, hectic schedules, and time-crunched urban dwellers have led to demand for services that offer speed and convenience. Quick Commerce taps into this by providing near-instant delivery of everyday items, saving customers' time. Working parents, millennials, and other time-pressed consumers are willing to pay premium prices for the convenience of getting groceries, meals, and other necessities delivered rapidly. Quick Commerce brings convenience to the doorstep, catering perfectly to busy lifestyles. According to a survey by the United States Department of Labor in 2021, American workers spent an average of 1.3 hours per day on essential shopping and errands. However, many cited lack of time as a major barrier that prevented them from completing these tasks efficiently. Quick e-commerce helps address this issue by making routine chores significantly more convenient. This resonates strongly with current lifestyles and impacts growth positively.

- High Smartphone and Internet Penetration: Widespread smartphone and internet access has been pivotal to the rise of Quick Commerce. Apps enable easy ordering and tracking, while extensive smartphone penetration allows on-demand services to reach a wide audience. High-speed mobile internet has also enabled complex Quick Commerce logistics operations. Further, digital fluency of younger demographics has pushed adoption. With smartphones ubiquitous, Quick Commerce companies can conveniently connect with and serve consumers. According to data from the US Census Bureau, over 89% of Americans now own a smartphone. Additionally, the Pew Research Center found that around 85% of adults use the internet.

- Expansion into New Geographies: Quick Commerce currently focuses on major metro cities but has ample room to expand into suburban neighborhoods and smaller cities. Building out networks in these untapped geographies can unlock new demand and growth. Many consumers outside urban cores also face constraints on time, mobility or access. Quick Commerce can fill gaps in convenience and coverage. Partnerships with local stores and networks of flexible drivers enable geographic expansion. For instance, DoorDash is now spreading into small towns, while GoPuff targets college campuses. Tapping underserved territories can aid growth for Quick Commerce firms. According to data from the US Census Bureau, secondary city regions surrounding major metro areas accounted for 65% of national population growth from 2010-2020.

- New Product Categories: Most Quick Commerce firms started with a limited range of products such as snacks, drinks and essentials. Expanding into new categories like pharmacy, electronics, luxury goods or alcohol can provide growth channels. Customers appreciate the convenience of on-demand delivery across a wider range of products. Quick Commerce companies are building assortments with items beyond basics that can drive higher order values. Some firms also leverage partnerships; for example, Uber Eats enables Quick Commerce for flower delivery through partnerships with florists. Wider assortments ensure customers can fulfill more needs rapidly.

US Quick E-Commerce (Quick Commerce) Market Restraints:

- Intense Competition and Discount Wars: The quick delivery space has witnessed heightened competition with aggressive discounting and promotional offers. Multiple well-funded startups have jumped in, while food and grocery delivery majors are expanding into the segment. The competition has led to discount wars to grab market share. However, excessive discounts and promotions can erode profitability. Many players have sought rapid growth over sustainable unit economics. Retaining customers also becomes harder relying on discounts versus great service. The intense competition has also led to escalating customer acquisition costs for Quick Commerce firms.

- High Operational Costs and Complex Logistics: The logistics networks and warehousing facilities required to enable Quick Commerce involve steep operational expenditures. Real estate and labor costs can be challenging to balance. High delivery frequency leads to disproportionate workforce and infrastructure costs. Complex routing, inventory and warehouse management also add overheads. Lack of economies of scale in hyper-local logistics also creates constraints. Many startups have struggled with high operational costs. Also, loss rates of perishable items and returned goods further undermine profits. Managing the complex logistics at scale remains an operational challenge.

- Counterbalance: Consider outsourcing certain operations or tasks to specialized third-party providers. This can often reduce costs and simplify logistics by leveraging expertise and resources from external sources. Work on optimizing the supply chain by reducing redundancies, renegotiating contracts, consolidating suppliers, or exploring alternative sourcing options. This can help in simplifying logistics and potentially cutting costs.

Market Size in USD Bn

CAGR8%

| Study Period | 2023 - 2030 |

| Base Year of Estimation | 2022 |

| CAGR | 8% |

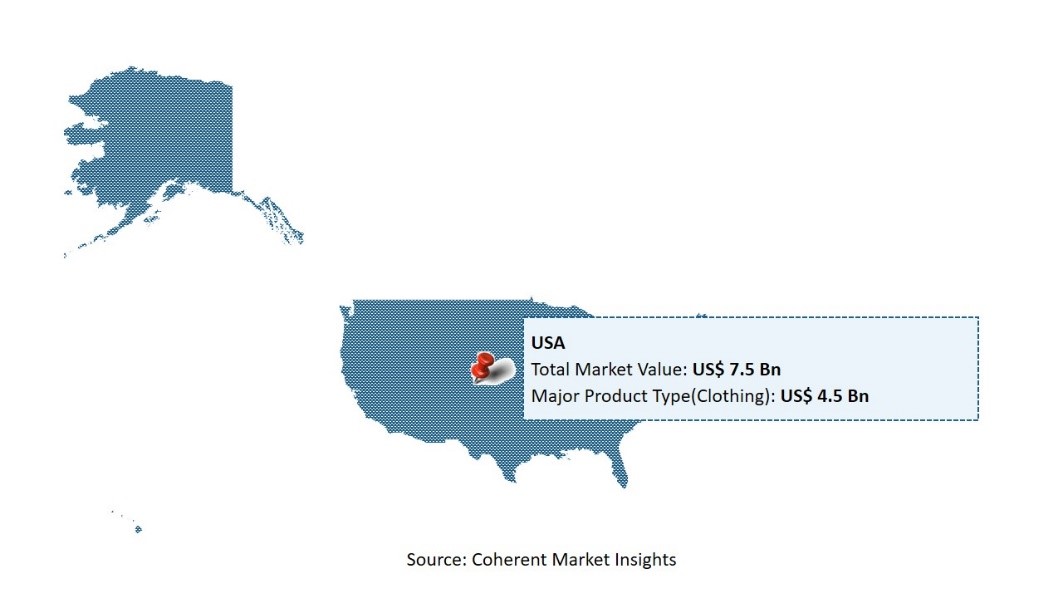

| Larget Market | U.S. |

| Market Concentration | High |

| Major Players | GoPuff, DoorDash, Uber, Instacart, Postmates and Among Others |

please let us know !

US Quick E-Commerce (Quick Commerce) Market Trends

- Quick Grocery Taking Share from Traditional Channels: One major ongoing trend is the rapid shift of grocery shopping towards Quick Commerce channels providing greater convenience. Traditional grocery stores with long lines and restricted hours are losing share to apps enabling effortless shopping and 15-minute delivery. According to surveys, nearly 60% of consumers have purchased groceries online for rapid fulfillment, signaling the growth of quick grocery commerce. Areas like produce, dairy and fresh foods are shifting online due to convenience. The pandemic has also accelerated adoption of quick grocery services out of safety concerns. According to the latest quarterly report published by the US Census Bureau in December 2022, e-commerce sales as a percentage of total retail sales jumped to 14.3% in the third quarter from 13.0% in the previous quarter.

- Specialized Local Retail Partnerships Emerging: Quick Commerce firms have recognized the value of partnerships with local neighborhood stores, enabling hyper-local goods to be rapidly delivered while also benefitting retail partners through increased digital reach. Small local stores provide specialized products from food to pharmacy goods that appeal to customers seeking variety. Partnerships allow Quick Commerce platforms to expand inventories without overhead. For mom-and-pop stores struggling with foot traffic losses, such partnerships provide a lifeline while serving their community. This growing local retail-delivery symbiosis provides a new framework. According to the National Association of Convenience Stores, there are over 150,000 C-stores nationwide located in urban areas, suburbs and rural towns. Leveraging this extensive retail infrastructure means Quick Commerce platforms can achieve wider coverage without investing in as many of their own micro-fulfillment centers. The partnership allows Gorillas to enter new markets faster while generating added foot traffic and revenue for the C-stores.

Figure. US Quick E-Commerce (Quick Commerce) Market Size (US$ Bn)

Competitive overview of US Quick E-Commerce (Quick Commerce) Market

GoPuff, DoorDash, Uber, Instacart, Postmates, GrocerKey, Jokr, Buyk, Fridge No More, Gorillas, Getir, Zapp, Delivery.com, Mercato, Weezy, Gopuff, Flink, Jiffy, Buyk, Ultrafast

US Quick E-Commerce (Quick Commerce) Market Leaders

- GoPuff

- DoorDash

- Uber

- Instacart

- Postmates

US Quick E-Commerce (Quick Commerce) Market - Competitive Rivalry

US Quick E-Commerce (Quick Commerce) Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in US Quick E-Commerce (Quick Commerce) Market

New product launches

- In March 2022, DoorDash launched ultra-fast grocery delivery in 15 minutes or less in metropolitan cities through its DashMart service. This leverages DoorDash's extensive logistics infrastructure to meet consumer demand for speed and convenience.

- In May 2021, Uber launched grocery delivery in the US within 30 minutes or less through Uber Eats. This taps into Uber's network of drivers for quick delivery from grocery and convenience stores.

- In June 2022, Instacart announced the launch of Instacart Platform Enterprise, enabling retailers to develop their own branded Quick Commerce solutions. This provides technology and infrastructure for grocers looking to enter Quick Commerce.

Acquisition and partnerships

- In April 2022, DoorDash acquired Wolt in a $8.1 billion deal to expand its international presence into Europe and other markets. This strengthened DoorDash's Quick Commerce capabilities.

- In August 2021, Uber acquired Drizly for $1.1 billion to bolster its delivery offerings with on-demand alcohol delivery. Drizly's retail partnerships expanded Uber's Quick Commerce reach.

US Quick E-Commerce (Quick Commerce) Market Segmentation

- By Product Type

- Clothing

- Stationary

- By Delivery Mode

- Online

- ash on Delivery

Would you like to explore the option of buyingindividual sections of this report?

Monica Shevgan has 9+ years of experience in market research and business consulting driving client-centric product delivery of the Information and Communication Technology (ICT) team, enhancing client experiences, and shaping business strategy for optimal outcomes. Passionate about client success.

Frequently Asked Questions :

What are the key factors hampering growth of the US Quick E-Commerce (Quick Commerce) Market?

Key factors hampering growth include low profit margins, heavy competition, high operational costs, poor unit economics, lack of customer loyalty, regulatory restrictions, and sustainability concerns.

What are the major factors driving the US Quick E-Commerce (Quick Commerce) Market growth?

Major growth factors include busy modern lifestyles, rising smartphone penetration, demand for instant delivery, high urban population density, innovations in logistics, and venture capital investments.

Which is the leading component segment in the US Quick E-Commerce (Quick Commerce) Market?

The grocery segment is expected to dominate the US Quick E-Commerce (Quick Commerce) Market owing to rising demand for quick delivery of fresh foods and daily essentials.

Which are the major players operating in the US Quick E-Commerce (Quick Commerce) Market?

Major players include GoPuff, DoorDash, Uber, Instacart, Postmates, Fridge No More, Buyk, Gorillas, Jokr, and Getir among others.

What will be the CAGR of US Quick E-Commerce (Quick Commerce) Market?

The US Quick E-Commerce (Quick Commerce) Market is projected to grow at a CAGR of 8% from 2023 to 2030.

What are the drivers of the US Quick E-Commerce (Quick Commerce) Market?

Key drivers include increasing urbanization, busy modern lifestyles, growing smartphone and internet penetration, demand for convenience, innovations in logistics and technology, and high disposable incomes.