Optical Sensor Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

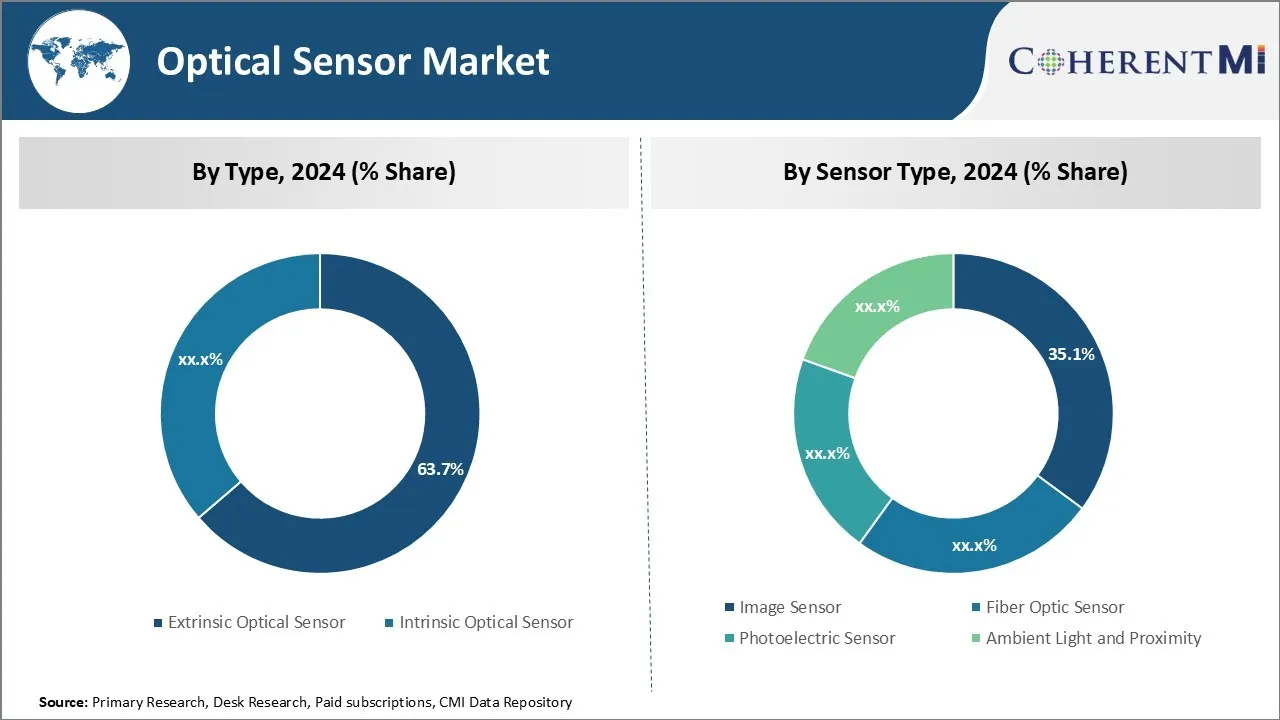

Optical Sensor Market is segmented By Type (Extrinsic Optical Sensor, Intrinsic Optical Sensor), By Sensor Type (Image Sensor, Fiber Optic Sensor, Pho....

Optical Sensor Market Size

Market Size in USD Bn

CAGR9.9%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 9.9% |

| Market Concentration | High |

| Major Players | Hamamatsu Photonics, ON Semiconductor, Sony Corporation, STMicroelectronics, Texas Instruments and Among Others. |

please let us know !

Optical Sensor Market Analysis

The optical sensor market is estimated to be valued at USD 26.69 Billion in 2024 and is expected to reach USD 51.67 Billion by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 9.9% from 2024 to 2031. The optical sensor market is expected to witness significant growth attributing to advancements in nanophotonics and microelectromechanical systems (MEMS) technologies.

Optical Sensor Market Trends

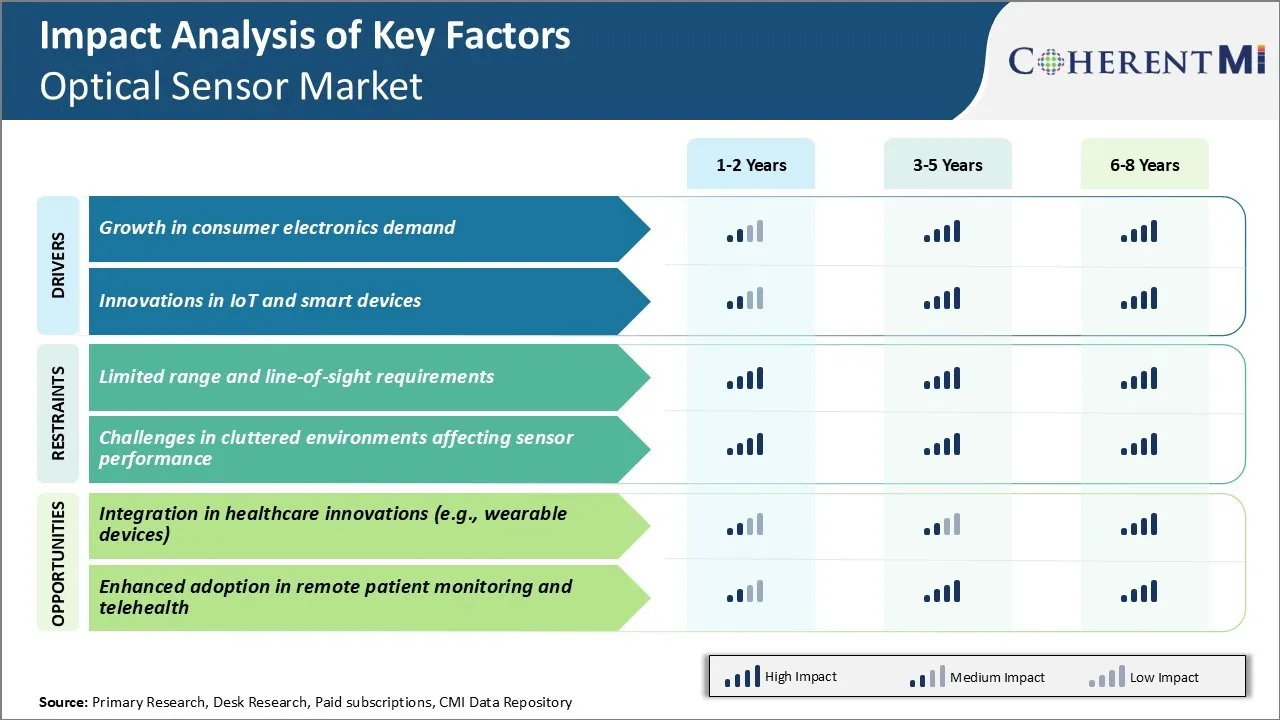

Market Driver - Growth in Consumer Electronics Demand

The evolving consumer electronics landscape has undoubtedly been one of the major factors propelling the optical sensor market in recent times. People worldwide are increasingly embracing these smart devices as an essential part of their lives. Thereby, the appetite for innovative devices with more intelligent and interactive capabilities pushes manufacturers to include more sophisticated optical sensors.

Today's smartphones are packed with not just one but multiple cameras, with megapixel counts rising continuously to satisfy photo and video enthusiasts. Advanced optical systems inside allow these mini computers to perform tasks similar to professional DSLR cameras such as Portrait mode, Night mode, HDR functionality and so on. This remains an important factor driving growth of the optical sensor market.

Wearables makers also focus on integrating superior ambient light, gestures, heart rate, and other biosensors into watches, bands, and virtual/augmented reality headsets. Growing dependency of major OEMs on optical sensors to enable immersive experiences is stimulating continuous R&D investments and spurring higher sensor adoption in the optical sensor market.

Market Driver - Innovations in IoT and Smart Devices

IoT has been revolutionizing various industries by facilitating the seamless connection of physical and virtual world through sensors and devices. Technologies such as RFID, thermal sensors, biometric, and proximity sensors are expanding the IoT ecosystem. Hence, optical sensors are uniquely poised to take it to the next level by enabling real-time data insights and intuitive human-device interactions. Leading tech firms are fast introducing clever innovations powered by innovative optical sensor modules which can benefit diverse applications across industries.

Advanced motion detectors, doorbell cameras, smart-mirrors with embedded cameras and sensors allow for hands-free controls and enhanced security. Technologies assisting in object identification, inspection, robotic guidance are key application areas in the optical sensor market.

Interestingly, wearable augmented reality glasses with embedded eye tracking sensors can unlock immersive mixed reality experiences across education, healthcare and more. Overall, potential of novel technologies in reshaping the IoT narrative through intelligent context-aware devices seems immense and promises to drive optical sensor market.

Market Challenge - Limited Range and Line-of-Sight Requirements

One of the major challenges currently faced by the optical sensor market is the limited range and line-of-sight requirements of optical sensors. Most optical sensors require direct line-of-sight visibility to objects in order to detect and analyze them accurately. This line-of-sight requirement poses practical difficulties in applications where the sensor and target objects may not always be within each other's field of view, like in underground facilities, enclosed structures, heavy industrial settings etc.

The sensing range of optical sensors is also relatively short compared to alternatives like radar and ultrasonic sensors. Operating over longer ranges in poor visibility conditions reduces the sensors' performance. Additionally, factors like ambient light, dust, fog, and other atmospheric conditions can disrupt the line-of-sight and easily degrade the sensing capabilities.

Addressing these range and line-of-sight limitations through technological innovations to enhance performance in difficult environments is a major challenge for the optical sensor market. Overcoming these constraints will be key to driving broader adoption across more application spaces.

Market Opportunity - Integration in Healthcare Innovations (e.g., Wearable Devices)

One of the major opportunities for the optical sensor market lies in their growing integration into innovative healthcare technologies. An emerging area is wearable medical devices and remote patient monitoring solutions. Optical sensors are increasingly being used in wearables due to their small size, lightweight nature and low power requirements. Examples include wearable pulse oximeters and heart rate monitors. Their non-contact operation also makes them well-suited for continuous, non-invasive measurements on patients.

Key players in the optical sensor market are also developing more sophisticated wearable diagnostic tools incorporating optical sensors for applications like glucose monitoring, blood pressure monitoring etc. This allows continuous at-home patient monitoring and early disease detection.

With the rise of telehealth, remote patient monitoring through wearable optical sensors has vast opportunities in the coming years. If challenges around range, visibility and miniaturization can be successfully addressed, optical sensors are poised to revolutionize preventive healthcare and deliver higher quality care through technological innovations.

Key winning strategies adopted by key players of Optical Sensor Market

Focus on innovation and new product development - Players have heavily invested in R&D to develop new and advanced optical sensor technologies. For example, Hamamatsu Photonics introduced new CMOS image sensors with high sensitivity, speed and resolution in 2018. These sensors found applications in industrial machines, security cameras and medical devices. Their innovative sensors helped capture new customer segments.

Strategic partnerships and collaborations - Companies partnered with OEMs, technology providers and system integrators to integrate their optical sensors into larger systems and solutions. For instance, in 2017 ROHM partnered with Datalogic to develop barcode scanners for retail stores using ROHM's CMOS image sensors.

Acquisitions for technology leadership - Large players acquired innovative startups to gain access to new technologies and capabilities.

Aggressive geographic expansion - Players saw growth opportunities in developing markets and expanded their sales and distribution footprint globally. For example, Vishay launched new sales offices across Asia Pacific and Latin America between 2015-18 totap into increasing demand from automotive, industrial and consumer sectors.

Focus on low-power applications - Companies developed new optical sensor products optimized for battery operated devices.

Segmental Analysis of Optical Sensor Market

Insights, By Type: Adaptable and Efficient Designs Drive Extrinsic Optical Sensor Market Growth

In terms of type, extrinsic optical sensor contributes 63.7% share of the optical sensor market owning to their highly adaptable and efficient designs. Extrinsic sensors can easily be integrated into existing systems with minimal modifications needed, allowing for a quick implementation process.

Their flexible nature also means they can be designed to monitor a wide range of parameters including pressure, temperature, flow, and displacement. This universality makes them applicable to diverse industrial, medical and other applications.

Additionally, extrinsic sensors offer design advantages over intrinsic sensors such as increased durability from external sensing elements. Their modular designs simplify the manufacturing process and allow components to be easily replaced if needed. This enhances the lifetime and cost-effectiveness of extrinsic optical sensors.

Insights, By Sensor Type: Image Sensors Lead through Refined Precision and Analysis Capabilities

In terms of By Sensor Type, Image Sensor contributes 35.1% share of the optical sensor market in 2024, due to their refined precision and advanced analytical abilities. Image sensors allow objects and environments to be digitally captured, recorded and analyzed with a high degree of accuracy. Their ability to process large amounts of visual data has been key to enabling sophisticated machine vision systems.

Advances in pixel density and sensor resolution are also expanding the precision and diagnostic capabilities of image sensors. Areas like medical imaging, autonomous vehicles, facial recognition and industrial inspection have greatly benefited from these enhancements. The integration of image processing chips onto the sensor die has further accelerated analysis speeds. Growing computational power will continue propelling the analytical prowess of image sensors.

Insights, By Application: Quality Control Demand Boosts Industrial Optical Sensors

In terms of application, industrial contributes the highest share of the optical sensor market driven by the need for quality control and manufacturing oversight. Optical sensors play a critical role in automated inspection and detection on production lines. Their non-contact capabilities allow for contaminant and defect analysis without disrupting material flows. This has been important for maintaining product quality standards.

Additionally, optical sensors help enable predictive maintenance by continuously monitoring industrial machinery for signs of wear. Their deployment in robotic quality assurance systems has also grown to reduce reliance on human inspection. With further automation expected, demand from the industrial sector will continue as optical sensors take on expanded quality control responsibilities.

Additional Insights of Optical Sensor Market

- Optical sensors are pivotal across various applications due to their ability to enhance functionality in consumer electronics, healthcare, and industrial automation. The growing integration in IoT and autonomous technologies demonstrates their expanding scope. Challenges like line-of-sight limitations are being addressed through technological advancements, paving the way for broader adoption.

- Consumer Electronics Dominance: Optical sensors dominate this segment due to applications in smartphones and tablets, emphasizing adaptive brightness, facial recognition, and advanced imaging.

- Medical Expansion: The increasing reliance on optical sensors in healthcare, particularly for remote monitoring and diagnostics, highlights their critical role in patient care.

- In 2023, the Asia Pacific region accounted for around 44% share of the global optical sensor market. The Asia-Pacific region's dominance underscores the strategic importance of regional manufacturing hubs.

Competitive overview of Optical Sensor Market

The major players operating in the optical sensor market include Hamamatsu Photonics, ON Semiconductor, Sony Corporation, STMicroelectronics, Texas Instruments, Vishay Intertechnology, Analog Devices, Rockwell Automation, Teledyne Technologies, and ams AG.

Optical Sensor Market Leaders

- Hamamatsu Photonics

- ON Semiconductor

- Sony Corporation

- STMicroelectronics

- Texas Instruments

Optical Sensor Market - Competitive Rivalry, 2024

Optical Sensor Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Optical Sensor Market

- In October 2022, Lumotive and Gpixel introduced the M30 Reference Design Platform, combining Lumotive's Light Control Metasurface (LCM™) beam steering chips with Gpixel's CMOS image sensors. This platform aims to accelerate the adoption of advanced 3D lidar sensors in mobility and industrial sectors, including applications like autonomous robotics.

- In July 2022, Sony announced the IMX675, a CMOS image sensor for security cameras, offering simultaneous full-pixel image capture and rapid area-specific output. This sensor features approximately 5.12 megapixels and introduces Dual Speed Streaming technology, enabling simultaneous full-pixel image capture at up to 40 frames per second and high-speed output of user-defined regions of interest.

Optical Sensor Market Segmentation

- By Type

- Extrinsic Optical Sensor

- Intrinsic Optical Sensor

- By Sensor Type

- Image Sensor

- Fiber Optic Sensor

- Photoelectric Sensor

- Ambient Light and Proximity

- By Application

- Industrial

- Medical

- Biometric

- Automotive

- Consumer Electronics

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the optical sensor market?

The optical sensor market is estimated to be valued at USD 26.69 Billion in 2024 and is expected to reach USD 51.67 Billion by 2031.

What are the key factors hampering the growth of the optical sensor market?

Limited range and line-of-sight requirements and challenges in cluttered environments affecting sensor performance are the major factors hampering the growth of the optical sensor market.

What are the major factors driving the optical sensor market growth?

Growth in consumer electronics demand and innovations in IoT and smart devices are the major factors driving the optical sensor market.

Which is the leading type in the optical sensor market?

The leading type segment is extrinsic optical sensor.

Which are the major players operating in the optical sensor market?

Hamamatsu Photonics, ON Semiconductor, Sony Corporation, STMicroelectronics, Texas Instruments, Vishay Intertechnology, Analog Devices, Rockwell Automation, Teledyne Technologies, and ams AG are the major players.

What will be the CAGR of the optical sensor market?

The CAGR of the optical sensor market is projected to be 9.9% from 2024-2031.