Ozone Generator Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Ozone Generator Market is segmented By Technology (Corona Discharge, Cold Plasma, Electrolysis, Ultraviolet), By End Use (Municipal, Industrial, Comme....

Ozone Generator Market Size

Market Size in USD Bn

CAGR8.26%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.26% |

| Market Concentration | High |

| Major Players | Xylem Inc., Mitsubishi Electric Corporation, Suez SA, Toshiba Corporation, Ebara Corporation and Among Others. |

please let us know !

Ozone Generator Market Analysis

The ozone generator market is estimated to be valued at USD 1.311 Bn in 2024 and is expected to reach USD 2.285 Bn by 2031. It is estimated to grow at a compound annual growth rate (CAGR) of 8.26% from 2024 to 2031. The ozone generator market is expected to expand at a significant growth rate due to rising demand for clean water and increasing industrial applications.

Ozone Generator Market Trends

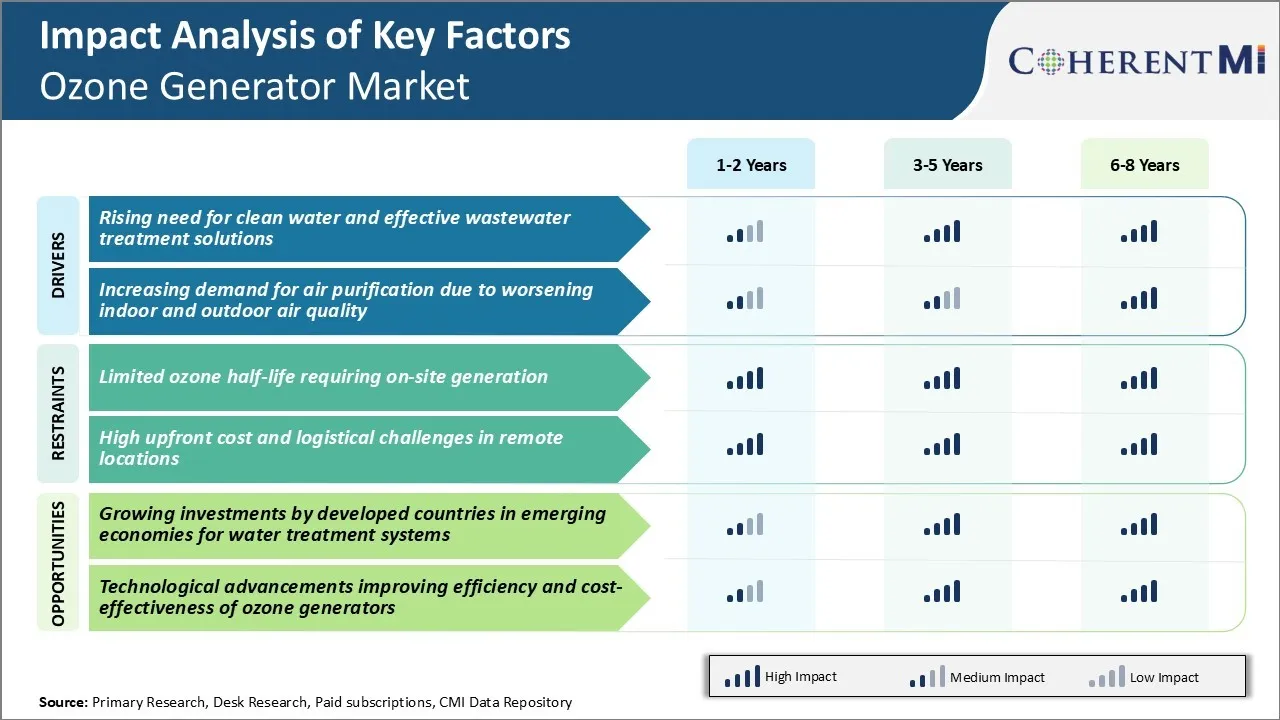

Market Driver - Rising Need for Clean Water and Effective Wastewater Treatment Solutions

The global demand for clean and purified water is continuously rising due to increasing population and industrialization. Conventional water treatment methods using filtration, chlorination etc. have limitations in removing certain toxic organic compounds and resistant microbes.

Ozone is a powerful oxidizing agent that can effectively kill bacteria, viruses, and other pathogens within seconds. Industries such as food & beverage, pharmaceuticals, and semiconductor manufacturing that require highly purified water are utilizing ozone generation systems to attain zero liquid discharge. Rapid expansion of these industries will further augment demand in the ozone generator market.

Ozone technology fits well in such applications due to its high oxidation and disinfection efficacy, leaving no toxic residues. This is driving its adoption among municipal utilities and power producers that withdraw large volumes of water for non-potable industrial processes. Thereby, this is expected to remain a major driver for growth of the ozone generator market.

Market Driver - Increasing Demand for Air Purification due to Worsening Indoor and Outdoor Air Quality

Air pollution has become a pressing public health issue, aggravated by industrial emissions, vehicle exhaust and construction activities in urban conglomerations. Poor ambient air quality takes a huge toll due to rising incidence of respiratory and cardiovascular illnesses. Strict standards and guidelines have been implemented to curb air toxins and promote a hygienic living environment.

Growing health consciousness and awareness about impacts of poor indoor air quality have spurred demand for advanced residential purification systems. Ozone generators that work on the principle of photo-catalytic oxidation are a preferred technology. Some key attributes driving their adoption over other technologies include stronger disinfecting action, fast response time and lack of usage of filters or chemicals.

Apart from households, commercial buildings like malls, theaters and hospitals that house large public gatherings are also installing zonal ozone-based air purifiers. Hence, the residential as well as commercial sectors are expected to contribute to opportunities in the ozone generator market.

Market Challenge - Limited Ozone Half-life Requiring On-site Generation

One of the key challenges faced by the ozone generator market is the limited half-life of ozone, which requires on-site generation of ozone. Ozone is an unstable gas that decomposes rapidly, with a half-life of only around 20-30 minutes. This short window necessitates generation of ozone near its point of application. Transportation of ozone over long distances is not feasible due to losses during transit.

As a result, companies distributing ozone generators need to ensure local production facilities as well as a strong distribution network to provide timely deliveries to customers located across a region. Setting up multiple local production units and maintaining an efficient supply chain network entails sizable infrastructure investments.

It also leads to higher operational costs associated with managing inventories and logistics across multiple locations. Further, any disruption in the supply chain can impact timely deliveries and satisfy customer needs, thereby affecting brand image and revenues.

Market Opportunity - Growing Investments by Developed Countries in Emerging Economies for Water Treatment Systems

One of the major market opportunities for ozone generators lies in the growing investments by developed nations and multilateral organizations in building water treatment infrastructure in emerging economies. Access to clean drinking water remains a major issue in several developing countries of Asia, Africa, and Latin America due to rapid urbanization and industrialization outpacing the development of water supply networks.

Several developed countries and entities like the World Bank have initiated large programs to support investments in water treatment systems, desalination plants, and wastewater recycling facilities across developing regions. This offers significant opportunities for ozone generator suppliers to provide equipment for disinfection in these upcoming projects.

The ozone generator market is also aided by favourable government regulations and incentives promoting the adoption of ozone-based advanced oxidation technologies for water treatment in emerging nations.

Key winning strategies adopted by key players of Ozone Generator Market

Focus on innovation and new product development: Players like Ozonia, Mitsubishi Electric, Primozone, and DEL have achieved significant success by continuously investing in R&D to develop innovative and advanced ozone generator technologies.

Strategic partnerships and collaborations: Leading companies form strategic partnerships with EPC firms, system integrators, and end-use industries to gain access to new customer segments. For instance, in 2020 Mitsubishi Electric partnered with Texel Ozone, an expert in ozone technologies, to leverage each other's strengths and better service the food and pharmaceutical industries in the US.

Aggressive marketing campaigns: Companies spend heavily on marketing campaigns to create brand recognition and educate potential customers about ozone generator applications and benefits.

Focus on emerging economies: With growing ozone generator demand from sectors like food processing in developing nations, key players are investing in distribution channels and manufacturing facilities there.

Segmental Analysis of Ozone Generator Market

Insights, By Technology: Superior Ozone Generation Capabilities Drive Corona Discharge Adoption

In terms of technology, corona discharge contributes 45.3% share of the ozone generator market in 2024. This is owing to its superior ozone generation capabilities. Corona discharge technology utilizes high voltage electrical discharges to convert oxygen into ozone.

Compared to other technologies like cold plasma or electrolysis, corona discharge requires a smaller form factor to produce equivalent amounts of ozone. This compact size and high concentration of ozone generation have made corona discharge the technology of choice for applications that demand high throughput.

An additional advantage of corona discharge is its operating efficiency. Once activated, corona discharge generators can continuously produce ozone with minimal drop-off in output over time as long as a steady supply of air and electricity is maintained.

More efficient power supplies could improve ozone yield and reduce energy requirements. This will expand the usable applications and drive greater adoption of corona discharge ozone generators across various industrial operations and municipal treatment facilities.

Insights, By End Use: Municipal Demand Drives Highest Market Share for Wastewater Treatment Applications

In terms of end use, the municipal segment contributes 38.7% share of the ozone generator market in 2024. This is due to the widespread use of ozone technology for wastewater treatment. Municipal wastewater facilities employ ozone to remove toxins, contaminants, pollutants, and excess organic matter from wastewater before returning it to the environment or reuse applications.

Compared to alternatives like chlorination, ozone treatment provides superior disinfection without producing harmful byproducts. It is highly effective at neutralizing bacteria, viruses and other microbes that typically exist in high concentrations in municipal wastewater.

Another factor driving municipal demand is population growth. As more individuals and industries contribute to wastewater volumes in cities and suburbs, treatment facilities must boost capacity and processing efficiency to handle increasing loads.

Government regulations further stimulate the municipal segment’s share in the ozone generator market. Subsidization programs that help fund infrastructure upgrades also benefit adoption of ozone generators within the municipal sector.

Insights, By Application: Wastewater Treatment Applications Dominate Due to Ozone's Disinfection Capabilities

In terms of application, wastewater treatment contributes the highest share to the Ozone Generator market owing to ozone's highly effective disinfection properties. Ozone is a potent oxidizer capable of inactivating all microorganisms encountered in wastewater, from bacteria and viruses to protozoan oocysts and cysts. Ozone also excels at removing contaminants that may interfere with or pass through conventional treatment systems.

Beyond disinfection capabilities, ozone promotes flocculation and coagulation of solids for easier removal through downstream processes like sedimentation. This benefits wastewater facilities seeking simplified sludge handling. Ozone also reduces odors from facilities by eliminating foul smelling molecules.

Going forward, stringent regulations and the constant influx of new contaminants into wastewater are expected to further increase reliance on ozone for treatment. This will drive continuous growth in ozone generator installations across the high-value wastewater treatment application segment.

Additional Insights of Ozone Generator Market

- North America held over 33% share of the ozone generator market in 2023 due to advanced water treatment and air purification infrastructure.

- Asia-Pacific is projected to grow rapidly in the global ozone generator market due to industrialization, water pollution concerns, and increasing adoption of ozone technology.

- Europe sees significant growth in the global ozone generator market driven by strict environmental regulations and a focus on sustainable water and air treatment solutions.

- Ozone is 3,000 times more effective than chlorine for disinfection (Water Pollution Control Federation).

- WHO estimates that 3 in 10 people globally face a shortage of clean drinking water. The U.S. faces 23,000 to 75,000 sanitary sewer overflows annually.

Competitive overview of Ozone Generator Market

The major players operating in the ozone generator market include Xylem Inc., Mitsubishi Electric Corporation, Suez SA, Toshiba Corporation, Ebara Corporation, Ozonetech Systems OTS AB, Absolute Systems Inc., DEL Ozone, Primozone Production AB, Daikin Industries, Ltd., Ozonia (Suez Water Technologies & Solutions), Oxyzone, MKS Instruments, Inc., Biotek Environmental Science Ltd., and International Ozone Technologies Group, Inc.

Ozone Generator Market Leaders

- Xylem Inc.

- Mitsubishi Electric Corporation

- Suez SA

- Toshiba Corporation

- Ebara Corporation

Ozone Generator Market - Competitive Rivalry, 2024

Ozone Generator Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Ozone Generator Market

- In May 2023, Xylem Inc., a leading global water technology company, completed its acquisition of Evoqua Water Technologies Corp., a provider of mission-critical water treatment solutions and services, in an all-stock transaction valued at approximately $7.5 billion.

- In April 2023, Fresh Mouth introduced an innovative device that functions both as an ozone generator and a hydrogenated water producer, aiming to enhance oral hygiene by effectively eliminating bacteria.

Ozone Generator Market Segmentation

- By Technology

- Corona Discharge

- Cold Plasma

- Electrolysis

- Ultraviolet

- By End Use

- Municipal

- Industrial

- Commercial

- Residential

- By Application

- Wastewater Treatment

- Air Treatment

- Laboratory & Medical Equipment

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the ozone generator market?

The ozone generator market is estimated to be valued at USD 1.311 Bn in 2024 and is expected to reach USD 2.285 Bn by 2031.

What are the key factors hampering the growth of the ozone generator market?

Limited ozone half-life requiring on-site generation and high upfront cost and logistical challenges in remote locations are the major factors hampering the growth of the ozone generator market.

What are the major factors driving the ozone generator market growth?

Rising need for clean water and effective wastewater treatment solutions and increasing demand for air purification due to worsening indoor and outdoor air quality are the major factors driving the ozone generator market.

Which is the leading technology in the ozone generator market?

The leading technology segment is corona discharge.

Which are the major players operating in the ozone generator market?

Xylem Inc., Mitsubishi Electric Corporation, Suez SA, Toshiba Corporation, Ebara Corporation, Ozonetech Systems OTS AB, Absolute Systems Inc., DEL Ozone, Primozone Production AB, Daikin Industries, Ltd., Ozonia (Suez Water Technologies & Solutions), Oxyzone, MKS Instruments, Inc., Biotek Environmental Science Ltd., and International Ozone Technologies Group, Inc. are the major players.

What will be the CAGR of the ozone generator market?

The CAGR of the ozone generator market is projected to be 8.26% from 2024-2031.