Wear Parts Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Wear Parts Market is segmented By Type (Metal Wear Parts, Ceramic Wear Parts, Polymer Wear Parts, Composite Wear Parts), By Application (Mining, Machi....

Wear Parts Market Size

Market Size in USD Bn

CAGR5.3%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.3% |

| Market Concentration | High |

| Major Players | Sandvik AB, Metso Outotec Corporation, Caterpillar Inc., ESCO Group LLC, Kennametal Inc. and Among Others. |

please let us know !

Wear Parts Market Analysis

The wear parts market is estimated to be valued at USD 685.73 Bn in 2024 and is expected to reach USD 984.65 Bn by 2031, growing at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2031. The wear parts market is expected to witness positive growth over the forecast period with the rise in infrastructure development and construction activities.

Wear Parts Market Trends

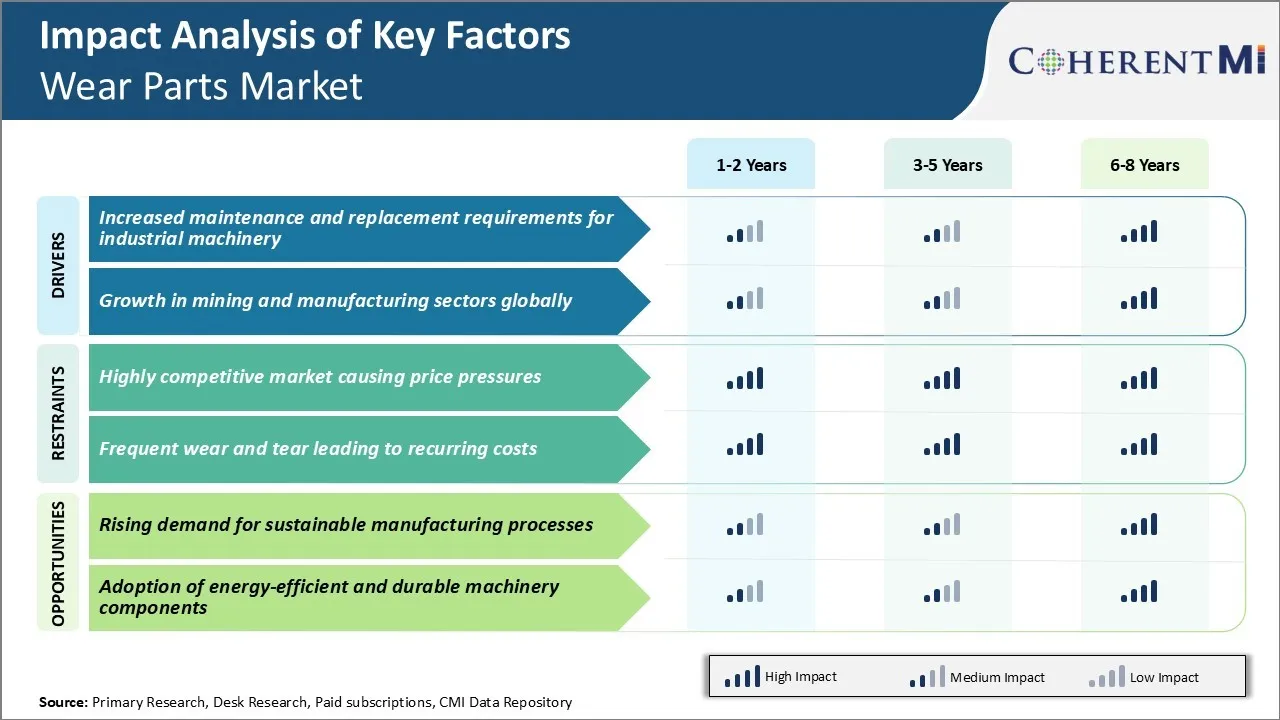

Market Driver - Increased Maintenance and Replacement Requirements for Industrial Machinery

As industrialization is spreading across the globe, the installation and usage of various types of industrial machinery has risen significantly in different sectors. These heavy-duty machines are subjected to high wear and tear due to their constant and continuous operation in tough working environments. This triggers demand in the wear parts market.

Most companies now focus on predictive maintenance and condition monitoring of their industrial assets to reduce unexpected breakdowns. Repairing or replacing components have become more difficult and require specialized skills. At the same time, the demand for achieving higher productivity targets puts additional stress on the equipment resulting in faster degradation of parts.

Furthermore, different regions and countries are witnessing increased investments in infrastructure and industry. This has massively boosted the demand for construction and earthmoving equipment, power generation machineries, material handling systems, production plants, and other heavy-duty applications. Considering their intensive usage, the maintenance cycle and spare part replacement needs have also gone up substantially.

Market Driver - Growth in Mining and Manufacturing Sectors Globally

The mining and manufacturing sectors have always been at the forefront of industrial growth and have played a pivotal role in shaping economies worldwide. Both sectors heavily rely on extensive use of large mining and industrial equipment to extract and process raw materials efficiently.

Countries like China, India, Indonesia, Brazil, and Australia are witnessing massive capital investments in coal, iron-ore, and other mining projects. Similarly, major manufacturing hubs like the USA, Germany, Japan, and others are continuously augmenting their production capacities to tap new opportunities in different sectors. All these developments have directly aided the sales volume of critical mining and industrial equipment such as excavators, draglines, bulldozers, conveyor systems, milling machines, and other metalworking tools.

Additionally, advanced technologies like automation, robotics, IoT, and AI are being extensively adopted across mining and manufacturing facilities to boost throughput, enhance productivity, and reduce costs. Their sophisticated machineries also involve complex maintenance requirements where specialized wear parts and skills are necessary. All these factors collectively accentuate the importance of sourcing high-quality replacement parts from reliable suppliers.

Market Challenge - Highly Competitive Market Causing Price Pressures

The global wear parts market has become increasingly competitive over the past decade as many new players have entered this industry looking to capitalize on the projected growth opportunities. The rise in competition has put significant pressure on price margins for existing wear parts manufacturers. Players in the wear parts market now need to maintain razor-thin profit margins while attempting to undercut their rivals' prices to win new business.

Additionally, overcapacities have arisen in the industry as manufacturers have aggressively expanded their operations to boost market share. This imbalance of supply and demand has pushed prices down further. If the current trend continues unabated, there are fears some companies may be forced to exit the wear parts market if they are unable to cut costs significantly or demand does not increase rapidly enough to absorb the excess capacity.

Market Opportunity - Rising Demand for Sustainable Manufacturing Processes

One area that represents tremendous opportunity for companies in the wear parts market is the rising global demand for more sustainably manufactured products. There is a growing expectation across end-use sectors for components and wear parts that impose less environmental burden right through the manufacturing process and subsequent lifecycle. Organizations are under increasing pressure from stakeholders to reduce their carbon footprint and switch to greener alternatives.

As a result, the market for wear parts produced through sustainable technologies and renewable resources is expanding rapidly. Forward-thinking wear parts manufacturers can position themselves to tap into this need by investing in eco-friendly production methods. Adopting approaches like reducing waste, harnessing clean energy, implementing closed-loop material recycling systems, and utilizing biomaterials present wide scope for innovation and business advantage.

Companies adopting early could see themselves well-placed to meet the more stringent environmental standards. They take a lion’s share in the wear parts market from latecomers through their greener corporate credentials.

Key winning strategies adopted by key players of Wear Parts Market

Focus on product innovation through R&D: In 2020, Metso introduced its Metso Life concept wear parts which use advanced composite materials to last 4-5 times longer than traditional wear parts. This has helped mining companies reduce operational costs significantly.

Establish long-term partnerships: In 2018 Sandvik signed a 5-year global supply agreement with BHP to deliver mill liners, feed chutes and other crusher wear parts for all their mining sites globally. This strategically positions them ahead of competition.

Leverage digital technologies: Multotec's TONTRAK system tracks wear life of various components in real-time using analytics. This helped Vale, a major mining company, reduce downtime by 20% and save over $5 million annually on wear costs.

Focus on acquisitions for portfolio expansion: In 2021 Weir Group acquired assets of Atlas Copco's drill rig service business to strengthen their position in drill and blast tools segment.

Segmental Analysis of Wear Parts Market

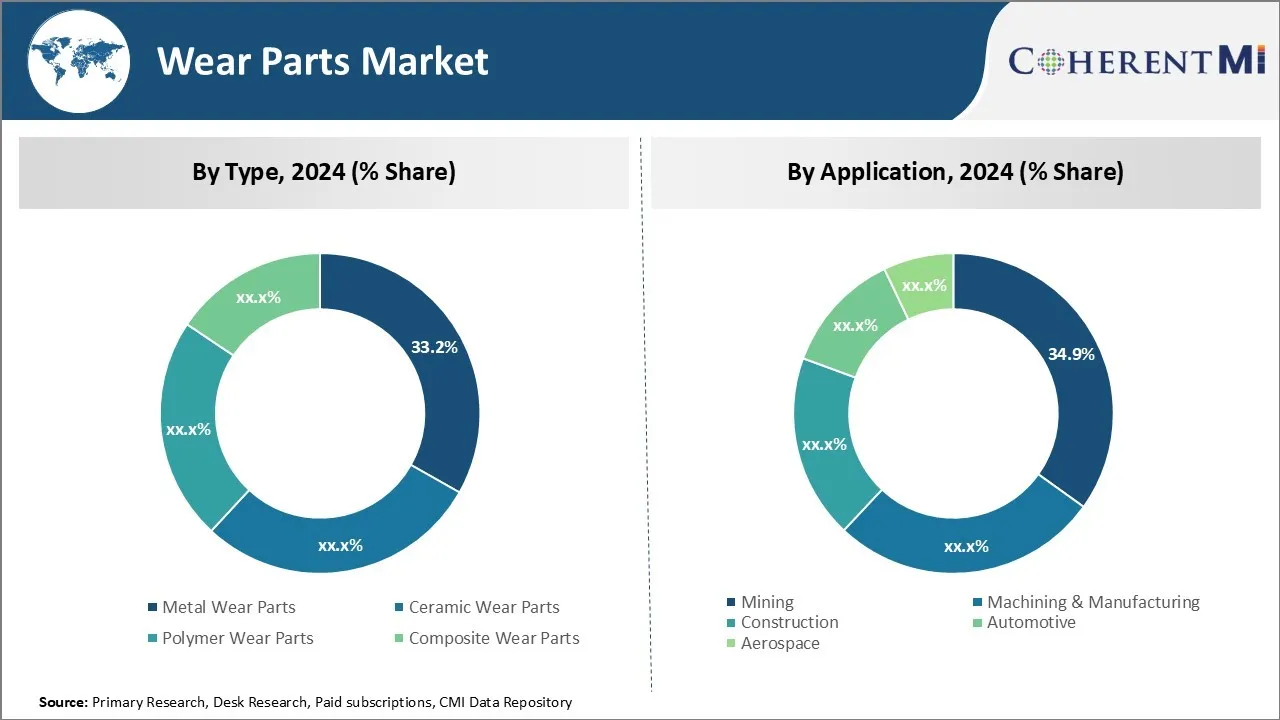

Insights, By Type: Metal Wear Parts: Driving Growth Through Durability and Reliability

Metal wear parts contribute 33.2% share of the wear parts market in 2024, due to their exceptional durability and reliability in heavy-duty applications. Metal parts are designed for longevity, with service lives often extending 10 years or more. Their low maintenance needs save customers downtime and replacement costs compared to less durable alternatives. Metals can be heat treated and alloyed to achieve even greater strength, hardness, and corrosion resistance tailored for specific application requirements. Repairs to metal parts are also simple through procedures like patching, hard facing, or welding.

Metal fabricators have extensive experience and production capabilities for complex metal wear part designs. Computer-aided manufacturing allows precision machining, while casting creates intricate internal passages. Metal parts are commonly customized through heat treatment, coating, or cladding processes to optimize performance. Comprehensive services from design through installation help minimize customer total costs of ownership.

Insights, By Application: Mining: Top Revenue Driver Through Severe Operating Conditions

The mining industry contributes 34.9% share of the wear parts market in 2024, due to the exceptionally punishing operating environment in mines. Wear parts for mining equipment like excavators, haul trucks, and drills endure round-the-clock usage in abrasive rock and ore. Component failures can halt operations, so mine operators prioritize ultra-durable solutions to maximize equipment uptime. Tungsten carbide, ceramic, and metal composite materials best suit the destructive mining environment through their self-lubricating properties, ultra-hardness, and corrosion resistance.

Reputable wear parts suppliers thoroughly test products through simulation of real-world mining conditions. Applications engineering ensures optimal material specification, geometry, heat treatment, and coatings for a mining OEM's specific duty cycles and material characteristics. On-site field support shortens replacement times to keep mines running. As mining scale and throughput increase to satisfy rising commodity demand, the need grows for reliable solutions to combat equipment downtime from premature wear parts.

Additional Insights of Wear Parts Market

- The adoption of wear parts in the renewable energy sector is increasing, particularly in wind turbines where durability is crucial.

- 3D printing technology is being utilized to produce customized wear parts, reducing production time and costs.

- Asia-Pacific Region Dominance: The region accounts for over 35% of the global wear parts market, driven by industrial growth.

- Shift Towards Automation: There's a significant investment in automated machinery requiring specialized wear parts.

- Steel wear parts are less durable than ceramics but are widely used due to their versatility. Tungsten carbide parts last 10 times longer than steel, highlighting cost-effectiveness.

Competitive overview of Wear Parts Market

The major players operating in the wear parts market include Sandvik AB, Metso Outotec Corporation, Caterpillar Inc., ESCO Group LLC, Kennametal Inc., Hitachi Construction Machinery Co., Ltd., Komatsu Ltd., Atlas Copco AB, Castolin Eutectic, Pilot Precision, Hensley Industries, Redexim, Spokane Industries, Pacific Coast Borax Company, Miller Carbide, and Columbia Steel.

Wear Parts Market Leaders

- Sandvik AB

- Metso Outotec Corporation

- Caterpillar Inc.

- ESCO Group LLC

- Kennametal Inc.

Wear Parts Market - Competitive Rivalry, 2024

Wear Parts Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Wear Parts Market

- On July 1, 2024, Sandvik completed the acquisition of a majority stake in Suzhou Ahno Precision Cutting Tool Technology Co., Ltd., a leading China-based company. This acquisition aimed to enhance Sandvik's product portfolio and strengthen its market position in Asia.

- In November 2023, Metso introduced Skega™ Life, an innovative rubber material for mill linings, offering up to 25% longer wear life compared to their previous premium rubber, Skega™ Classic. This advancement is designed to enhance sustainability and safety, optimize throughput, and increase uptime due to improved wear resistance and reduced maintenance needs.

- In March 2023, Caterpillar Inc. showcased its latest products, services, and technologies at the CONEXPO-CON/AGG event in Las Vegas, Nevada. The company highlighted advancements in services, technology, and sustainability, including the unveiling of the Cat C13D engine platform designed for heavy-duty off-highway applications.

Wear Parts Market Segmentation

- By Type

- Metal Wear Parts

- Ceramic Wear Parts

- Polymer Wear Parts

- Composite Wear Parts

- By Application

- Mining

- Machining & Manufacturing

- Construction

- Automotive

- Aerospace

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the wear parts market?

The wear parts market is estimated to be valued at USD 685.73 Bn in 2024 and is expected to reach USD 984.65 Bn by 2031.

What are the key factors hampering the growth of the wear parts market?

Highly competitive market causing price pressures and frequent wear & tear leading to recurring costs are the major factors hampering the growth of the wear parts market.

What are the major factors driving the wear parts market growth?

Increased maintenance and replacement requirements for industrial machinery and growth in mining and manufacturing sectors globally are the major factors driving the wear parts market.

Which is the leading type in the wear parts market?

The leading type segment is metal wear parts.

Which are the major players operating in the wear parts market?

Sandvik AB, Metso Outotec Corporation, Caterpillar Inc., ESCO Group LLC, Kennametal Inc., Hitachi Construction Machinery Co., Ltd., Komatsu Ltd., Atlas Copco AB, Castolin Eutectic, Pilot Precision, Hensley Industries, Redexim, Spokane Industries, Pacific Coast Borax Company, Miller Carbide, and Columbia Steel are the major players.

What will be the CAGR of the wear parts market?

The CAGR of the wear parts market is projected to be 5.3% from 2024-2031.