Rechargeable Batteries Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Rechargeable Batteries Market is segmented By Battery Type (Lithium-ion Batteries, Lead-acid Batteries, NiMH Batteries, NiCd Batteries, Others), By Ap....

Rechargeable Batteries Market Size

Market Size in USD Bn

CAGR5.88%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.88% |

| Market Concentration | High |

| Major Players | Samsung SDI Co., Ltd., Panasonic Corporation, Sony Corporation of America, LG Energy Solution Ltd., Contemporary Amperex Technology Co., Limited (CATL) and Among Others. |

please let us know !

Rechargeable Batteries Market Analysis

The rechargeable batteries market is estimated to be valued at USD 123.81 Bn in 2024 and is expected to reach USD 184.65 Bn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 5.88% from 2024 to 2031.

The rechargeable batteries market is expected to witness positive growth trends due to factors such as rising demand for electric vehicles, increasing adoption of smartphones and tablets, growing focus on renewable energy sources, and improving charging infrastructure.

Rechargeable Batteries Market Trends

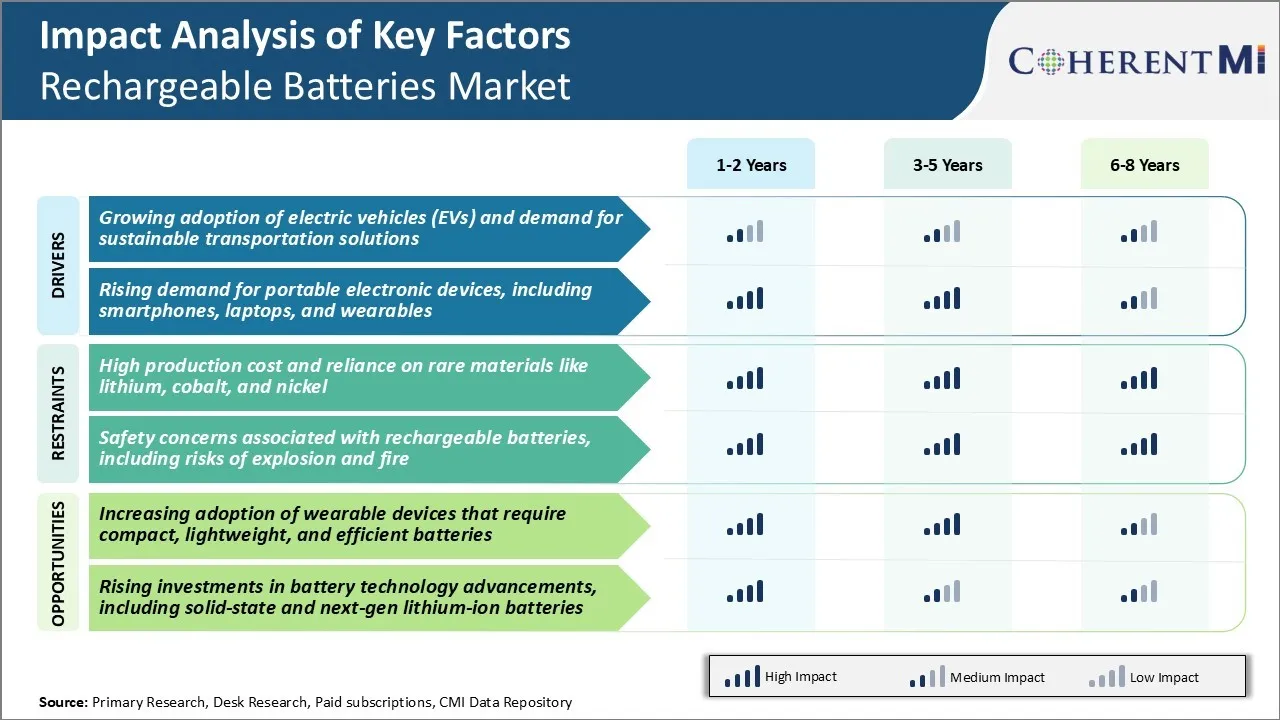

Market Driver - Growing Adoption of Electric Vehicles (EVs) and Demand for Sustainable Transportation Solutions

The transportation sector is witnessing a growing trend towards more sustainable solutions with increasing concerns around climate change and environmental pollution. EVs have emerged as one of the most viable alternatives to fuel-based vehicles providing a cleaner mode of transportation. Governments in many countries are also providing significant incentives and subsidies to promote the mass adoption of EVs.

The declining battery costs and improving charging options are also making EVs more affordable and practical for everyday use. Various companies are introducing wireless and rapid charging stations to make it more convenient for EV owners. With traditional automakers as well as new entrants aggressively pushing EVs, the global EV fleet is expected to grow sharply in the coming years. This is likely to propel the demand for advanced rechargeable batteries that can meet the high energy density and power requirements of EVs.

Market Driver - Rising Demand for Portable Electronic Devices, including Smartphones, Laptops, and Wearables

Continual upgrades in features and functions as well as falling prices have led to phenomenal growth in the global sales of smartphones. Power-hungry high-resolution displays, multi-camera setups, processor upgrades, and 5G capabilities are driving the demand for high-density batteries. Rechargeable batteries that can support longer usage hours on a single charge are high in demand. Laptops and tablets are also advancing with processing power and connectivity capabilities, necessitating rechargeable batteries that deliver higher capacity and faster charging.

The growing popularity of wearable devices such as smartwatches, fitness trackers, smart glasses, and wireless earbuds have created new avenues for rechargeable batteries. However, the miniature form factors of wearables pose unique engineering challenges for batteries to deliver adequate runtime without compromising comfort or aesthetics. In order to power the myriad classes of portable devices effectively, manufacturers in the rechargeable batteries market are consistently innovating with new chemistries, designs, and charging solutions to meet evolving consumer demands. This augurs well for the future prospects of the rechargeable batteries market.

Market Challenge - High Production Cost and Reliance on Rare Materials

One of the key challenges faced by the rechargeable batteries market is the high production costs associated with these batteries. Producing rechargeable batteries at scale requires significant investments in manufacturing plants and equipment. This leads to high fixed costs for battery manufacturers.

The mining and processing of these materials is an expensive process. The prices of these raw materials also fluctuate frequently depending on global supply and demand forces. Any shortage or price spike of these critical materials can adversely impact production costs for battery makers. The reliance on rare materials also raises sustainability and geopolitical concerns. Many of these materials are sourced from unstable regions raising supply security risks.

The energy intensive mining and refining processes also have negative environmental impacts. Unless production costs come down significantly or battery designs transition to more sustainable and affordable materials, high costs will continue to restrain widespread mass adoption of rechargeable batteries.

Market Opportunity - Increasing Adoption of Wearable Devices

One of the major opportunities for the rechargeable batteries market is the increasing adoption of wearable devices that require compact, lightweight, and efficient batteries. The market for wearable devices such as smartwatches, fitness trackers, smart glasses, healthcare monitors and others is growing rapidly. All these devices need miniature power sources to function without hampering portability and form factor.

Rechargeable lithium ion batteries have become the technology of choice for wearable devices owing to their high energy density and long battery life. As more consumers adopt cutting-edge wearable devices, the demand for powerful yet small-sized rechargeable batteries will continue expanding.

Battery makers can capitalize on this opportunity by developing specialized battery chemistries, form factors, and charging solutions tailored for the unique power needs of the wearables industry. The wearables sector provides a major growth avenue for battery players as it acts as an ambassador for other portable consumer electronics that runs on battery power.

Key winning strategies adopted by key players of Rechargeable Batteries Market

Strategic Partnerships and Collaborations: One of the main strategies adopted by leading battery manufacturers has been forming strategic partnerships with OEMs and other players in the value chain. For example, in 2018, Samsung SDI partnered with BYD to mass produce cylindrical lithium-ion battery cells for electric vehicles.

R&D Investments in New Technologies: Heavy investments in R&D have allowed some players to launch cutting-edge battery technologies and gain a foothold in lucrative market segments. For example, in 2015, Tesla spent $1800 million in R&D to develop its proprietary lithium-ion cell chemistries and manufacturing processes for energy storage.

Capacity and Facility Expansions: Leading players have strategically expanded production capacities through new plants and facilities globally to cater to growing demand. For instance, Samsung SDI setup new plants in Hungary, China, and the U.S since 2010 to quadruple its production capacity to 60GWh by 2020.

Geographic Expansions: Companies have also looked at expanding into lucrative foreign markets through acquisitions, joint-ventures and greenfield projects.

Segmental Analysis of Rechargeable Batteries Market

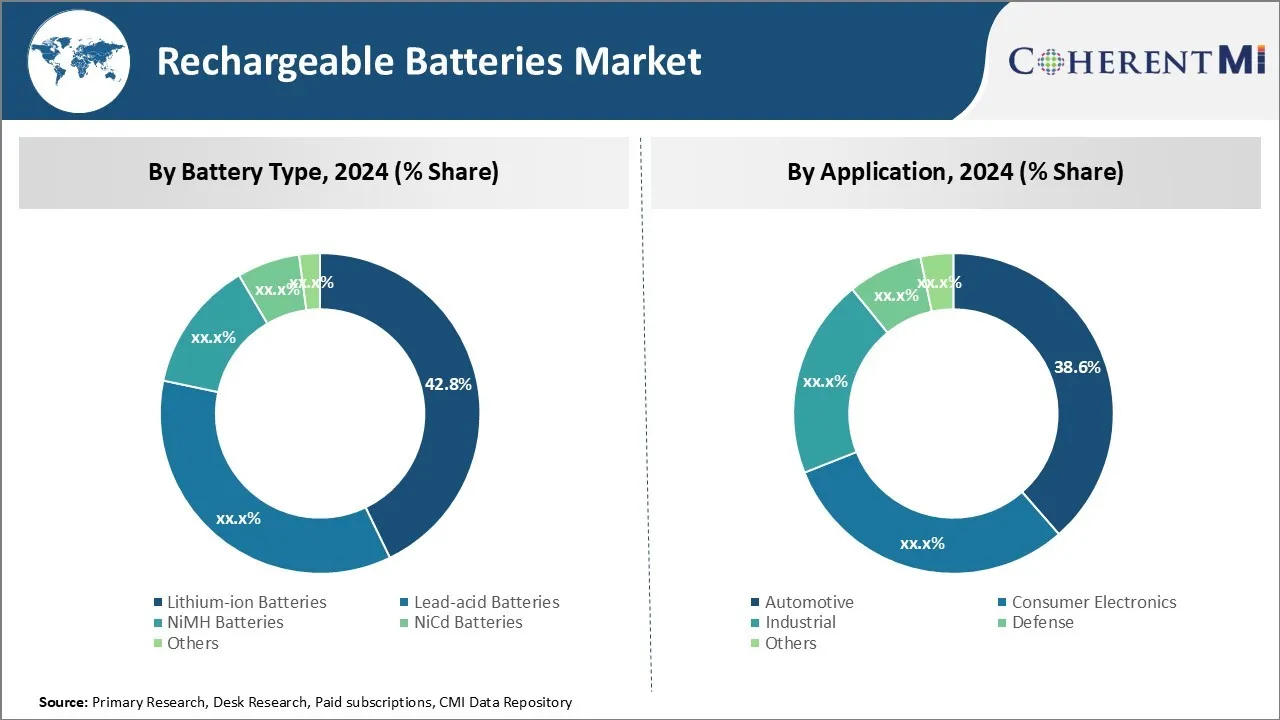

Insights, By Battery Type: Lithium-ion Batteries Demonstrate Superior Energy Density and Life Cycle

Lithium-ion batteries have emerged as the premier battery technology in the rechargeable batteries market. They account for 42.8% market share in 2024, due to their lightweight and high energy density characteristics. Weighing significantly less than other battery chemistries, lithium-ion batteries allow for the design of slimmer and lighter electronic devices. Their high energy density means they can power devices for longer periods compared to lead-acid or NiMH batteries of similar size.

Perhaps most importantly, lithium-ion batteries exhibit very low rates of self-discharge and can maintain their charge over longer periods without requiring recharging. This extends the lifespan of devices between charges. Their cycle life is also excellent - lithium-ion batteries retain a high percentage of their charge capacity even after hundreds of charge-discharge cycles.

Major tech companies exclusively use lithium-ion in smartphones and laptops due to weight and power constraints. Automakers are similarly moving to lithium-ion for electric powertrains where energy density determines driving range.

Insights, By Application: Growth in Electric Vehicles and Hybridization of Powertrains Boosts Adoption in Automotive Sector

The automotive segment accounts for 38.6% of current demand in the rechargeable batteries market, led by strong demand from the electric vehicle (EV) and hybrid vehicle (HV) sectors. As automakers respond to increasingly stringent emission regulations and consumer demand for green vehicles, EVs and HVs are experiencing rapid uptake worldwide.

Many countries now offer purchase incentives for EVs and HVs to encourage their adoption. Electric vehicles in particular require huge battery packs - often over 60kWh capacity - to achieve driving ranges comparable to combustion engines. Meanwhile, hybrid electric vehicles pairing internal combustion engines with electric motors are viewed as a transitional technology towards fully-electric drivetrains.

Going forward, the transformation of vehicle fleets towards electrification and investment in charging infrastructure will be a major multi-year trend supporting automotive demand. As battery costs decrease further and EV driving ranges extend, battery-electric platforms may eventually eclipse hybrids as well. The automotive segment is thus expected to remain the primary growth driver in the overall rechargeable batteries market.

Additional Insights of Rechargeable Batteries Market

- Tata Group’s Investment: $1.6 billion in India for EV battery production (June 2023).

- Toyota's Subsidy: Received $853 million from Japan for next-gen lithium-ion batteries (June 2023).

- Lithium-ion Batteries: Account for higher charge cycles (5000 cycles compared to 1200 for lead-acid).

- Environmental Benefits: Rechargeable batteries are 90% recyclable, producing 28% less toxic waste than disposable ones.

- Regional Insights: Asia-Pacific dominates the global rechargeable batteries market due to low labor costs, raw material availability, and government support. China's produced 77% of the global battery supply in 2022.

Competitive overview of Rechargeable Batteries Market

The major players operating in the rechargeable batteries market include Samsung SDI Co., Ltd., Panasonic Corporation, Sony Corporation of America, LG Energy Solution Ltd., Contemporary Amperex Technology Co., Limited (CATL), Energizer Holdings, Inc., GPB International Limited, Camelion Batterien GmbH, Hitachi Chemical Co., Ltd., Tesla, Inc., Fedco Batteries, Illinois Capacitor, Optimum Nano Energy Co. Ltd, Spectrum Brands, INC, Johnson Controls International plc, BYD Company Ltd., and Toshiba Corporation.

Rechargeable Batteries Market Leaders

- Samsung SDI Co., Ltd.

- Panasonic Corporation

- Sony Corporation of America

- LG Energy Solution Ltd.

- Contemporary Amperex Technology Co., Limited (CATL)

Rechargeable Batteries Market - Competitive Rivalry, 2024

Rechargeable Batteries Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Rechargeable Batteries Market

- In September 2023, LG Energy Solution entered a strategic alliance with a leading automotive manufacturer to jointly develop high-capacity EV batteries. The partnership leverages LG’s R&D expertise, accelerates time-to-market for advanced batteries, and enhances both companies’ competitiveness in the burgeoning EV industry and rechargeable batteries market.

- In July 2023, Panasonic expanded its EV battery manufacturing capacity by commissioning a new production facility in the United States. This strategic move enhances its supply chain resilience, shortens delivery times, and supports increasing demand from automotive OEMs, bolstering its competitive position in the rechargeable batteries market.

- In May 2023, Samsung SDI unveiled a next-generation solid-state battery prototype with superior energy density and safety attributes. This innovation aims to extend electric vehicle ranges, improve charging efficiency, and strengthen Samsung SDI’s foothold in the premium EV rechargeable batteries market.

Rechargeable Batteries Market Segmentation

- By Battery Type

- Lithium-ion Batteries

- Lead-acid Batteries

- NiMH Batteries

- NiCd Batteries

- Others

- By Application

- Automotive

- Consumer Electronics

- Industrial

- Defense

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the rechargeable batteries market?

The rechargeable batteries market is estimated to be valued at USD 123.81 Bn in 2024 and is expected to reach USD 184.65 Bn by 2031.

What are the key factors hampering the growth of the rechargeable batteries market?

High production cost and reliance on rare materials like lithium, cobalt, and nicke,l and safety concerns associated with rechargeable batteries, including risks of explosion and fire, are the major factors hampering the growth of the rechargeable batteries market.

What are the major factors driving the rechargeable batteries market growth?

Growing adoption of EVs, high demand for sustainable transportation solutions, and rising demand for portable electronic devices, including smartphones, laptops, and wearables, are the major factors driving the rechargeable batteries market.

Which is the leading battery type in the rechargeable batteries market?

The leading battery type segment is lithium-ion batteries.

Which are the major players operating in the rechargeable batteries market?

Samsung SDI Co., Ltd., Panasonic Corporation, Sony Corporation of America, LG Energy Solution Ltd., Contemporary Amperex Technology Co., Limited (CATL), Energizer Holdings, Inc., GPB International Limited, Camelion Batterien GmbH, Hitachi Chemical Co., Ltd., Tesla, Inc., Fedco Batteries, Illinois Capacitor, Optimum Nano Energy Co. Ltd, Spectrum Brands, INC, Johnson Controls International plc, BYD Company Ltd., and Toshiba Corporation are the major players.

What will be the CAGR of the rechargeable batteries market?

The CAGR of the rechargeable batteries market is projected to be 5.88% from 2024-2031.